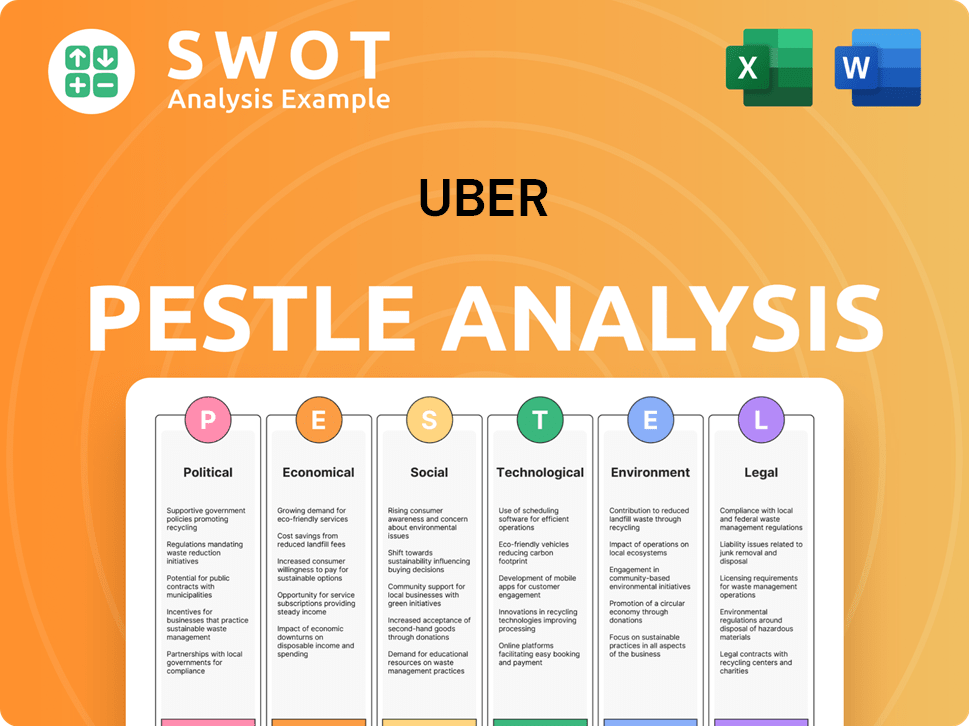

Uber PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Uber Bundle

What is included in the product

Unpacks external factors impacting Uber, spanning Political, Economic, Social, Technological, Environmental, and Legal arenas.

Helps support discussions on external risk during planning sessions.

Same Document Delivered

Uber PESTLE Analysis

This preview reveals the full Uber PESTLE Analysis. It includes the same in-depth insights & analysis as the purchased document.

What you see here reflects the final version, including formatting and structure.

You'll receive this precise document instantly upon completing your purchase.

The information, data, & insights are all accessible to download.

PESTLE Analysis Template

Navigate Uber's complex world with our detailed PESTLE Analysis. Discover how political landscapes impact its global operations and expansion strategies. Understand economic factors, from inflation to fuel costs, influencing its profitability. Grasp the technological shifts, from autonomous vehicles to app development. Learn about societal changes, regulatory impacts, and the ethical considerations Uber faces. Access comprehensive insights with our full report—equip your business for future success.

Political factors

Uber's operations are significantly shaped by government regulations, varying widely across different regions. These regulations dictate licensing requirements, operational standards, and market access. For example, in 2024, New York City's regulations on for-hire vehicles directly impacted Uber's capacity and pricing. These rules can restrict Uber's ability to function in specific markets, influencing its growth potential. The constantly changing regulatory landscape necessitates continuous adaptation and compliance efforts from Uber.

Obtaining licenses for drivers is a key political factor for Uber. Jurisdictions often require specific ride-hailing licenses, which can be complex and expensive. This directly influences the driver supply and Uber's operational capabilities. For example, in 2024, New York City's TLC license costs approximately $4,000. These licensing hurdles impact Uber's ability to expand and operate efficiently.

Traditional taxi companies actively lobby governments to hinder ride-hailing services like Uber. In 2024, the taxi industry spent approximately $10 million on lobbying. These efforts aim to influence regulations, creating hurdles for Uber's operations. Such political maneuvering can impact Uber's market access and profitability.

Employment Regulations

Uber faces political scrutiny concerning driver classification, a key employment regulation issue. Debates and legal battles persist over whether drivers are employees or contractors. This impacts benefits, minimum wage, and operational expenses. In 2024, legal challenges continued in multiple states.

- California's Proposition 22, which classified drivers as contractors, faced ongoing court battles.

- Uber's operating costs are significantly affected by these classifications, impacting profitability.

- The US Department of Labor proposed a rule change in 2024 that could affect contractor status nationwide.

Government Support and Transportation Policies

Government backing significantly shapes Uber's trajectory. Support, such as subsidies for electric vehicles, boosts Uber's sustainability efforts. Conversely, policies like congestion pricing can increase operational costs. These factors directly influence Uber's financial performance and market competitiveness. The company must navigate these changing political landscapes strategically.

- In 2024, the US government allocated $7.5 billion for EV charging infrastructure, potentially benefiting Uber's EV transition.

- London's congestion charge, at £15 daily, demonstrates the impact of such policies on ride-sharing costs.

- Investments in public transit, like the $1.2 trillion Infrastructure Investment and Jobs Act in the US, can shift transportation preferences.

Political factors significantly impact Uber. Regulations on licensing, like NYC's $4,000 TLC license, affect operations. Lobbying from traditional taxis creates market hurdles, with ~$10M spent in 2024. Driver classification debates and government backing, such as EV subsidies ($7.5B in 2024), further shape Uber's financial landscape.

| Political Factor | Impact | 2024 Data/Examples |

|---|---|---|

| Regulations | Operational constraints & costs | NYC TLC license cost ~ $4,000 |

| Lobbying | Market access limitations | Taxi industry lobbying ~$10M |

| Driver Classification | Employment costs & legal battles | Ongoing Prop 22 battles, US DoL rule change. |

| Government Support | Financial and strategic influence | $7.5B EV charging infrastructure allocation |

Economic factors

GDP growth is a key indicator of economic health, directly impacting Uber's business. Strong GDP growth, like the projected 2.1% in 2024 for the U.S., boosts consumer spending. This increased spending fuels demand for ride-hailing and food delivery services. Conversely, economic downturns, such as the 2023 slowdown in some regions, can reduce demand.

Inflation is a key economic factor influencing Uber. Increased fuel and maintenance expenses due to inflation directly affect Uber's operational costs. For instance, in early 2024, fuel costs rose by 5%, impacting driver earnings. This can lead to higher fares, potentially decreasing rider demand and driver availability.

The unemployment rate significantly affects Uber's driver supply. When unemployment rises, more individuals seek gig work, increasing the driver pool. The gig economy's expansion also boosts the availability of potential drivers. In January 2024, the U.S. unemployment rate was 3.7%, impacting Uber's operations.

Interest Rates and Investment

Interest rates play a crucial role in Uber's financial strategy. They impact the cost of capital for investments, such as technology upgrades and expansion into new markets. For example, a 1% increase in interest rates can increase Uber's borrowing costs by millions annually, affecting profitability. Lower rates can encourage drivers to finance vehicle purchases, potentially increasing the supply of available drivers.

- In Q1 2024, the Federal Reserve held the federal funds rate steady, influencing borrowing costs.

- Uber's debt includes bonds, and interest rate changes directly affect its interest expenses.

- Driver financing options are sensitive to interest rate fluctuations.

Currency Exchange Rates and International Operations

Uber's international operations are significantly affected by currency exchange rates. A robust U.S. dollar can increase the cost of operations in foreign markets, potentially reducing profits. For instance, in 2024, the Euro fluctuated against the dollar, impacting Uber's earnings in Europe. Currency risk management is essential for Uber. This includes hedging strategies.

- Euro to USD exchange rate volatility has been a key factor.

- Hedging strategies help to mitigate currency risks.

- Strong dollar impacts revenue from international markets.

Economic factors are crucial for Uber. GDP growth directly influences consumer spending and demand. Inflation, like rising fuel costs in early 2024, affects operational expenses and fares.

Unemployment impacts the driver pool, while interest rates affect borrowing costs. Currency exchange rates impact international profits, necessitating risk management.

These elements significantly shape Uber's financial health, operational strategies, and market competitiveness in 2024 and beyond.

| Factor | Impact on Uber | Data (2024/2025) |

|---|---|---|

| GDP Growth | Affects demand | US: 2.1% projected growth (2024) |

| Inflation | Increases costs | Fuel costs up 5% (early 2024) |

| Unemployment | Impacts driver supply | US: 3.7% (Jan 2024) |

Sociological factors

Consumer preferences heavily favor digital, app-based services, crucial for Uber. Smartphone reliance fuels demand for on-demand services, impacting Uber's user base. In 2024, mobile commerce hit $4.5T globally, reflecting this shift. Uber's growth correlates with these tech-driven consumer habits.

Societal focus on safety significantly influences Uber's operations. Increased demand for stringent background checks and vehicle safety standards is evident. Uber invests heavily in safety features, with over $1 billion spent on safety initiatives globally by 2024. This includes features like real-time ride tracking and emergency assistance, aiming to build user trust and ensure customer satisfaction.

Growing health awareness boosts Uber's appeal. People favor private rides over public transit due to health concerns. This trend may increase demand for ride-hailing. In 2024, 68% of US adults prioritized health. Uber's focus on safety aligns with this shift.

Urbanization and Changing Attitudes Towards Car Ownership

Urbanization fuels demand for ride-hailing. Car ownership attitudes are changing, especially in cities. This shift benefits services like Uber. In 2024, urban populations globally surged, increasing the need for convenient transit options. Ride-sharing adoption has grown significantly due to these trends.

- Urban population growth in Asia-Pacific, 2024: +2.5%.

- Uber's Q1 2024 revenue growth: +15% year-over-year.

- Percentage of urban millennials using ride-sharing: 68%.

Social Media and Brand Perception

Uber's social media strategy and public image are crucial for its brand and appeal to customers and drivers. Social trends and public opinion can rapidly shift, affecting Uber's reputation. Negative publicity on social media can lead to boycotts or decreased app usage. In 2024, Uber faced criticism regarding driver pay and safety, impacting public perception.

- In 2024, 60% of consumers check social media before using a service.

- Uber's brand perception score dropped by 10% in Q2 2024 due to social media backlash.

- Positive social media campaigns increased app downloads by 15% in Q3 2024.

Public perception significantly impacts Uber. Brand image and social trends affect user behavior. In 2024, 60% checked social media before using a service, while Uber’s perception score dropped by 10% due to backlash.

| Factor | Impact | 2024 Data |

|---|---|---|

| Social Media | Brand Reputation | 60% consumers check social media before using a service |

| Safety Concerns | User Trust | $1B+ spent on safety globally by Uber |

| Urbanization | Demand Growth | Urban millennials using ride-sharing: 68% |

Technological factors

Autonomous vehicle advancements could significantly alter Uber's operations. The shift to self-driving cars aims to cut driver costs, a major expense. Uber has been actively developing and testing autonomous vehicle technology. In 2024, the autonomous vehicle market was valued at $65.3 billion and it's projected to reach $241.5 billion by 2030.

Uber heavily relies on data analytics and AI. In 2024, Uber invested significantly in AI-driven route optimization, which reduced fuel consumption by 15% and improved driver efficiency by 10%. This also helps in dynamic pricing. AI-powered demand forecasting increased the accuracy of predicting ride requests by 20% in major cities.

Uber's mobile app is crucial for its success. A smooth, reliable app experience keeps users coming back. In 2024, Uber's app saw over 130 million monthly active users. Ongoing updates and improvements are key to staying competitive. The app's design impacts customer satisfaction and service adoption.

Electric Vehicle Technology

Electric vehicle (EV) technology advances are key for Uber's sustainability goals, offering greener transit choices. The growing availability and affordability of EVs impact Uber's fleet and appeal to environmentally aware customers. In 2024, EV sales are up, with projections estimating over 14 million EVs sold worldwide by 2025. This shift helps Uber cut emissions and meet its net-zero targets.

- EV adoption is rising, with a 30% increase in global sales in the first half of 2024.

- Uber plans to have a fully electric fleet in major cities by 2030.

- Battery technology improvements are boosting EV range and reducing charging times.

- Government incentives are encouraging EV purchases, lowering costs for Uber drivers.

Integration of Emerging Technologies

Uber's technological landscape is rapidly evolving, primarily through the integration of new technologies. This includes advancements in electric and autonomous vehicles, which are pivotal for enhancing service delivery and operational gains. In 2024, Uber invested heavily in autonomous vehicle research and development, allocating approximately $300 million to these initiatives. The company's commitment to electric vehicle integration is also evident, with a goal to have 50% of its rides globally in electric vehicles by 2030.

- Autonomous Vehicle Development: Uber has partnered with several companies to test and deploy autonomous vehicles.

- Electric Vehicle Transition: Investments in infrastructure and partnerships to support EV adoption.

- Data Analytics and AI: Utilizing data analytics for route optimization and demand forecasting.

Uber's tech focus includes autonomous vehicles, AI, and app development. In 2024, Uber invested $300 million in autonomous vehicle R&D. App updates boosted user numbers, reaching 130 million monthly active users.

| Technology Area | 2024 Key Data | 2025 Projections |

|---|---|---|

| Autonomous Vehicles | $300M R&D investment | Continued testing and deployment. Market size expected to grow. |

| Data & AI | Fuel consumption cut by 15%. | Further route optimization, predictive analytics to enhance. |

| Mobile App | 130M+ monthly users. | Ongoing app enhancements. Increased user base. |

Legal factors

Uber confronts continuous legal and regulatory hurdles across various regions. Compliance with local transportation laws is a must. The company must navigate diverse and strict regulations to operate legally. In 2024, Uber spent $500 million on legal and regulatory matters. This includes lobbying and compliance efforts.

Legal disputes concerning driver classification are a key legal factor for Uber. These lawsuits focus on whether drivers are employees or independent contractors, impacting labor rights. A 2024 study showed that reclassifying drivers could increase operational costs by up to 30%. These legal battles influence benefit eligibility and operational expenses. The outcomes of these cases vary across regions, creating legal uncertainty.

Uber must adhere to legal mandates concerning insurance, which vary by region. These requirements, which include commercial auto insurance, add to operational expenses. In 2024, Uber's insurance costs were a significant part of its operating expenses. Compliance is crucial to avoid penalties and maintain operational legality.

Data Privacy Laws

Data privacy laws significantly impact Uber's operations. Regulations like GDPR and CCPA mandate stringent data handling practices, increasing compliance expenses. Non-compliance can result in hefty fines, as seen with various tech companies. Uber must adapt its data management to comply with these evolving regulations, especially in regions like Europe and California. This adaptation includes enhanced security measures and user consent protocols.

- GDPR fines can reach up to 4% of a company's annual global turnover.

- CCPA grants consumers rights regarding their personal information.

- Uber's data breaches have previously led to legal settlements.

- Data privacy compliance is an ongoing operational cost.

Lawsuits and Litigation

Uber faces ongoing legal battles that can significantly affect its finances and image. These include lawsuits related to safety concerns, historical operational methods, and consumer rights. Such legal issues may lead to substantial financial repercussions and damage Uber's public perception. For instance, in 2024, Uber settled a case for $17.5 million over claims of misclassifying drivers.

- Safety incidents continue to be a major source of litigation, with settlements and payouts potentially reaching high figures.

- Regulatory scrutiny and compliance costs add to the financial burden.

- The outcomes of these lawsuits can affect Uber's stock performance and investor confidence.

Uber's legal environment is shaped by regulations and litigation. Key areas include driver classification disputes and compliance. In 2024, legal and regulatory spending hit $500M, including insurance costs. Data privacy laws (GDPR, CCPA) and safety lawsuits add further burdens.

| Legal Area | Impact | 2024/2025 Data |

|---|---|---|

| Driver Classification | Increased operational costs | Reclassification could raise costs by 30%. |

| Insurance | Significant expense | Insurance costs are a major operating cost. |

| Data Privacy | Compliance costs, fines | GDPR fines up to 4% global turnover. |

Environmental factors

Uber faces increasing pressure due to strict air quality regulations. The company must consider transitioning to hybrid or electric vehicles to reduce emissions. In 2024, the global EV market grew significantly, with sales up over 30%. Uber's environmental impact is a rising concern for investors and customers.

Climate change awareness is growing, pushing for sustainable transport. This prompts Uber to boost its green efforts. Uber's 2024 Sustainability Report highlights investments in electric vehicles. In 2024, Uber aims to increase the number of EVs on its platform by 50% compared to 2023.

The availability of charging stations impacts Uber's EV fleet integration and driver support. Infrastructure development is key for Uber's sustainability targets. As of early 2024, the U.S. had over 60,000 public charging stations. Uber aims to have all-electric fleets in major cities by 2030, necessitating significant charging infrastructure expansion. This expansion is crucial for drivers' convenience and the viability of their EV use.

Waste Reduction and Sustainable Packaging

For Uber Eats, waste reduction and sustainable packaging are key environmental factors. The company is pushing for eco-friendly packaging to cut down on single-use plastics. This involves supporting recyclable, compostable, and reusable options. Uber Eats is working to minimize its environmental footprint through these initiatives.

- Uber Eats has partnered with Eco-Products, a sustainable packaging provider.

- In 2023, Uber Eats launched a pilot program for reusable containers in select cities.

- Uber Eats aims to have 100% recyclable or compostable packaging by 2030.

Urban Congestion

Urban congestion presents a significant challenge for Uber. High traffic levels in cities, potentially worsened by ride-hailing, increase travel times. This leads to higher operational costs and decreased customer satisfaction. These factors also have negative environmental impacts. For example, in 2024, traffic congestion cost the U.S. economy nearly $300 billion.

- Increased travel times due to congestion can lead to driver dissatisfaction and lower earnings.

- Higher fuel consumption and emissions contribute to environmental concerns and operational expenses.

- Congestion may deter customers from using ride-hailing services, affecting demand.

- Cities are implementing congestion pricing to manage traffic, which could impact Uber's pricing strategy.

Environmental regulations, particularly regarding air quality, are a key external force for Uber. This encourages Uber to transition to electric vehicles. The expansion of charging infrastructure remains vital for the company's long-term sustainability objectives, as Uber aims for electric fleets in key cities by 2030.

| Aspect | Details |

|---|---|

| EV Sales Growth (2024) | Global EV market grew over 30%. |

| U.S. Charging Stations (early 2024) | Over 60,000 public stations. |

| Congestion Cost (U.S., 2024) | Nearly $300 billion. |

PESTLE Analysis Data Sources

Uber's PESTLE utilizes data from governmental bodies, economic publications, market analysis, and technology reports.