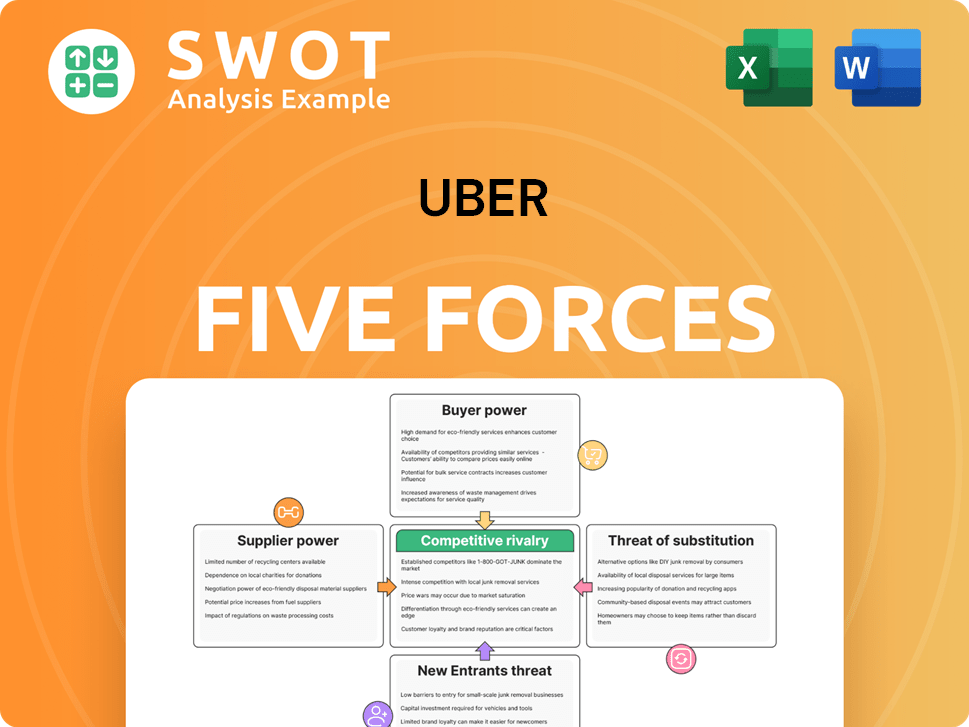

Uber Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Uber Bundle

What is included in the product

Tailored exclusively for Uber, analyzing its position within its competitive landscape.

Immediately visualize pressure points with a dynamic, interactive chart.

Full Version Awaits

Uber Porter's Five Forces Analysis

This Uber Porter's Five Forces analysis preview mirrors the final document. You're viewing the complete, ready-to-download analysis of Uber's competitive landscape. The content, format, and insights here are identical to the file you'll get. There are no hidden sections or alterations post-purchase. Your purchased document is immediately ready for your review and use.

Porter's Five Forces Analysis Template

Uber faces intense rivalry, especially from Lyft, driving down prices. The threat of new entrants, while high, is mitigated by network effects. Bargaining power of buyers (riders) is moderate due to readily available alternatives. Supplier power (drivers) is significant, impacting labor costs. Substitute products, like public transport, pose a moderate threat.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Uber’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Driver availability is crucial for Uber Porter's operations. Limited drivers during peak times boost their bargaining power. This can lead to higher fares, impacting Uber's profit. For example, in 2024, driver shortages in certain areas increased ride prices by about 15%.

Uber's reliance on independent contractor drivers significantly affects its supplier bargaining power. This model, though offering flexibility, limits Uber's control over pricing and service conditions. Drivers' ability to work for competitors reduces Uber's ability to dictate terms. In 2024, Uber faced challenges with driver earnings and labor costs, with driver pay being a major negotiation point. This dynamic impacts Uber's profitability.

The presence of alternative platforms like Lyft and local taxi services gives drivers leverage. In 2024, Lyft's revenue grew, indicating viable options. Drivers can use these alternatives to negotiate better pay. This competition influences Uber's profitability and operational decisions.

Operational Cost Impact

The bargaining power of suppliers, such as drivers, significantly impacts Uber's operational costs. Drivers' demands for better pay and improved conditions can strain Uber's profitability. In 2024, rising living costs in urban areas increased driver demands, posing challenges. Uber must balance driver satisfaction with financial sustainability, potentially affecting fare prices or profits.

- Driver payouts represented 70.8% of gross bookings in Q4 2023.

- Uber's net income in Q4 2023 was $1.43 billion.

- In 2024, Uber faced strikes and protests over pay and working conditions.

- Uber's revenue grew 15% year-over-year in Q4 2023.

Dynamic Pricing and Incentives

Uber employs dynamic pricing and incentives to manage driver supply and demand effectively. These strategies encourage drivers to work during peak times and in high-demand areas. By adjusting fares based on real-time conditions, Uber ensures driver availability and maintains service quality, reducing driver bargaining power. In 2024, Uber's revenue reached $37.86 billion, highlighting the effectiveness of such strategies.

- Dynamic pricing adjusts fares based on demand.

- Incentives motivate drivers during busy periods.

- Uber's 2024 revenue was $37.86 billion.

- These tactics mitigate driver bargaining power.

Driver bargaining power significantly impacts Uber. In Q4 2023, driver payouts were 70.8% of gross bookings. This affects profitability and operational costs.

Uber manages this through dynamic pricing and incentives. In 2024, Uber's revenue was $37.86 billion, showing strategy effectiveness.

Competition from Lyft and driver demands influence Uber's terms. In Q4 2023, Uber's net income was $1.43 billion. The balance between driver satisfaction and financial sustainability poses ongoing challenges.

| Metric | Q4 2023 | 2024 |

|---|---|---|

| Driver Payouts (% of Gross Bookings) | 70.8% | N/A |

| Net Income | $1.43B | N/A |

| Revenue | N/A | $37.86B |

Customers Bargaining Power

Customers are highly price-sensitive, significantly affecting Uber's fare structures and overall service demand. Riders frequently compare prices among ride-sharing services like Lyft and public transit, influencing Uber's pricing. This sensitivity necessitates competitive pricing to attract and retain customers, balancing acquisition with profitability. In 2024, Uber's revenue was around $37 billion, highlighting the impact of pricing strategies.

Switching costs for Uber's customers are low, allowing easy transitions to competitors. Riders can readily choose between Uber, Lyft, taxis, or public transit. The ease of switching boosts customer bargaining power. Uber must continuously improve service and pricing. In 2024, Lyft's market share was about 30% of the ride-sharing market, showing the impact of customer choice.

Loyalty programs and discounts can lower customer bargaining power. Uber's programs, like Uber One, offer incentives such as discounted rides and priority service. These initiatives increase customer loyalty. In 2024, Uber's revenue reached $37.86 billion, showing strong customer retention despite competition.

Service Alternatives

Customers wield significant bargaining power due to the abundance of transportation choices. Riders can easily switch between Uber, Lyft, taxis, buses, and even bikes. This competition pressures Uber to offer better pricing and service to stay competitive. In 2024, the global ride-hailing market was estimated at $110 billion, highlighting the vast alternatives available.

- Uber faces competition from various transportation modes.

- Riders can select from taxis, public transit, and micro-mobility options.

- Uber must excel in convenience, reliability, and user experience.

User Experience

User experience is crucial for Uber Porter's customer bargaining power. Uber's app functionality, with features like easy ride requests and cashless payments, greatly influences user preference. This seamless experience boosts customer satisfaction and loyalty, setting Uber apart. In 2024, Uber's app saw over 134 million monthly active users globally, highlighting its user-friendly appeal.

- App functionality impacts customer preference.

- Seamless experience enhances satisfaction.

- Uber's app had 134M+ monthly users in 2024.

- User experience sets Uber apart from competitors.

Customer bargaining power significantly impacts Uber's business. Riders easily compare prices among various transport options, increasing their leverage. Uber must offer competitive pricing and service to retain customers. In 2024, Uber's revenue was about $37 billion, reflecting customer influence on pricing.

| Aspect | Impact | 2024 Data |

|---|---|---|

| Price Sensitivity | High, influencing fare structures. | Uber Revenue: ~$37B |

| Switching Costs | Low, easy transitions to competitors. | Lyft Market Share: ~30% |

| Competition | Multiple transport options exist. | Global Ride-Hailing Market: ~$110B |

Rivalry Among Competitors

Uber enjoys a dominant market position. In March 2024, Uber controlled 76% of the U.S. ride-hailing market. This dominance allows Uber to use its size and brand to its advantage. Uber's strong presence supports its competitive edge, helping maintain its top spot.

Uber encounters fierce competition from rivals like Lyft and regional players. These competitors frequently engage in price wars and offer incentives to capture customer loyalty. In 2024, Lyft's revenue reached $4.4 billion, indicating a strong market presence. Uber must consistently innovate and improve its offerings to maintain its competitive edge.

Uber's diversification strategy, including Uber Eats and freight, intensifies competitive rivalry. This expansion into varied services generates multiple revenue streams, reducing dependence on ride-sharing. As of Q3 2023, Uber's revenue reached $9.29 billion, with Mobility and Delivery contributing significantly. Offering diverse services strengthens Uber's market position and attracts a wider customer base.

Innovation and Technology

Uber's hefty investments in technology and innovation significantly impact competitive rivalry. These investments aim to enhance both customer experiences and operational efficiency. The company's focus on advanced technologies, including autonomous vehicles and AI-driven solutions, sets it apart from rivals. Continuous innovation is vital for Uber to sustain its competitive advantage within the dynamic transportation sector.

- In 2024, Uber allocated billions to R&D, reflecting its commitment to technological advancements.

- Uber's AI-driven features have improved trip efficiency by up to 15% in select markets.

- The company's autonomous vehicle initiatives saw a 20% increase in testing miles by late 2024.

- These technological strides help in cost reduction.

Global Expansion

Uber's extensive global footprint, spanning over 900 cities, intensifies competitive rivalry. This widespread presence enables Uber to leverage economies of scale and brand recognition across diverse markets. However, it also exposes Uber to varying regulatory environments and local competitors. Adapting to these conditions is vital for maintaining its competitive edge.

- Uber operates in over 70 countries.

- In 2024, Uber's revenue reached $37.3 billion.

- Uber's market share varies significantly across different regions.

- Expansion into new markets requires substantial investment.

Competitive rivalry in the ride-hailing sector is intense. Uber faces strong competition, particularly from Lyft, leading to price wars. Uber's diversification, including Uber Eats, intensifies this rivalry by expanding its service offerings.

| Aspect | Details |

|---|---|

| Market Share (U.S. Ride-hailing, 2024) | Uber: 76%, Lyft: 24% |

| Lyft Revenue (2024) | $4.4 billion |

| Uber Revenue (Q3 2023) | $9.29 billion |

SSubstitutes Threaten

Alternative transportation options present a notable threat to Uber Porter. Traditional taxis, public transit (buses, trains), and micro-mobility (scooters, bikes) provide alternatives. The cost and convenience of these options directly affect Uber's demand. In 2024, public transit ridership increased by 15% in major cities, indicating a shift. This shift highlights the ongoing competition Uber faces.

Autonomous vehicle (AV) technology poses a growing threat to Uber. Companies like Waymo and Tesla are advancing self-driving capabilities. If AVs become widespread, they could diminish the need for ride-sharing. In 2024, the AV market is projected to reach $65 billion, highlighting the potential disruption.

The rise of remote work and virtual meetings poses a threat to Uber's Porter's Five Forces analysis. Consumer behavior changes, like increased remote work, could diminish the need for Uber's services. Data from 2024 shows a continued rise in remote work, with 30% of US workers working remotely. This shift could lower demand for rides to offices and business events.

Car Ownership

Car ownership poses a significant threat to Uber's ride-sharing services, acting as a direct substitute. The convenience of personal vehicles reduces reliance on Uber. The cost of car ownership, including insurance and fuel, impacts this substitution. Parking availability also affects the attractiveness of owning a car versus using Uber.

- In 2024, the average monthly cost of owning a car in the U.S. was around $800, including insurance, fuel, and maintenance.

- Approximately 85% of U.S. households own at least one vehicle, indicating the widespread availability of the substitute.

- Parking costs in major cities can add up, with average monthly parking fees ranging from $200 to $600, influencing the choice between car ownership and ride-sharing.

Walking and Cycling

Walking and cycling serve as strong substitutes for Uber Porter, especially for short trips. These modes are cheaper and eco-friendlier, attracting budget-conscious and health-focused users. In 2024, cycling saw a 10% rise in urban areas, showing this shift. The growth of bike lanes and pedestrian zones boosts their appeal.

- Cost Savings: Walking and cycling have zero direct costs compared to Uber.

- Environmental Impact: They produce no emissions, contrasting with Uber's carbon footprint.

- Health Benefits: Physical activity from walking and cycling improves health.

- Infrastructure: Availability of bike lanes and pedestrian infrastructure.

The threat of substitutes significantly impacts Uber. Car ownership, walking, cycling, and public transport provide competitive options. Each substitute affects Uber's demand and profitability.

| Substitute | Impact on Uber | 2024 Data |

|---|---|---|

| Car Ownership | Reduces demand | Avg. monthly cost ~$800 in US |

| Walking/Cycling | Competes for short trips | Cycling up 10% in urban areas |

| Public Transit | Offers a cheaper alternative | Ridership increased by 15% |

Entrants Threaten

The ride-sharing sector demands substantial capital for tech, infrastructure, and marketing, creating a high entry barrier. Building an app, setting up a reliable system, and recruiting drivers need significant funds. Uber's 2024 marketing expenses reached billions, showing the financial scale. High capital needs discourage new entrants.

Regulatory barriers, like licensing and insurance, hinder new ride-sharing entrants. Compliance with local rules and permits is time-consuming and expensive. For example, in 2024, Uber spent millions on regulatory compliance globally. These costs create a significant hurdle.

Uber's strong brand and vast network of drivers significantly deter new competitors. Its brand recognition and large customer base are major advantages. New entrants struggle to gain brand awareness and attract users. In 2024, Uber's revenue reached $37.28 billion, reflecting its market dominance. This makes it incredibly difficult for new companies to compete effectively.

Network Effects

The ride-sharing sector showcases robust network effects, enhancing platform value with user growth. Uber's vast network of drivers and riders provides a competitive edge, posing entry barriers. According to 2024 data, Uber's active drivers number in the millions globally, illustrating its network size. Establishing a comparable network demands considerable time and capital, deterring new rivals.

- Uber's global presence spans over 70 countries.

- The company's market capitalization reached approximately $140 billion in early 2024.

- Uber's revenue in 2023 was around $37 billion.

Technological Expertise

The ride-sharing sector is heavily reliant on technological prowess, necessitating ongoing investments in research and development to stay competitive. A robust, user-friendly platform demands substantial technological expertise, posing a significant barrier for new entrants. Uber, for instance, consistently updates its technology, as seen in its Q3 2023 report, which highlighted advancements in safety and efficiency features. New companies must match or exceed Uber's technological capabilities to gain market share.

- Technological advancements are crucial for success.

- Building and maintaining a platform is complex.

- New entrants must compete technologically.

- Uber's tech updates are continuous.

New ride-sharing firms face substantial barriers due to capital needs. Uber's 2024 marketing spend was billions, deterring new entrants. Regulatory hurdles, like licenses, also hinder them. Established brands and network effects further protect Uber.

| Barrier | Details | Impact on New Entrants |

|---|---|---|

| Capital Requirements | Marketing, tech, infrastructure | High upfront costs; discourages entry |

| Regulatory Hurdles | Licensing, compliance costs | Time-consuming and expensive |

| Brand and Network Effects | Uber's recognition, driver network | Difficult to compete; requires significant resources |

Porter's Five Forces Analysis Data Sources

We use Uber's financial reports, market research, and industry news to assess competition. These sources provide data for each of the forces.