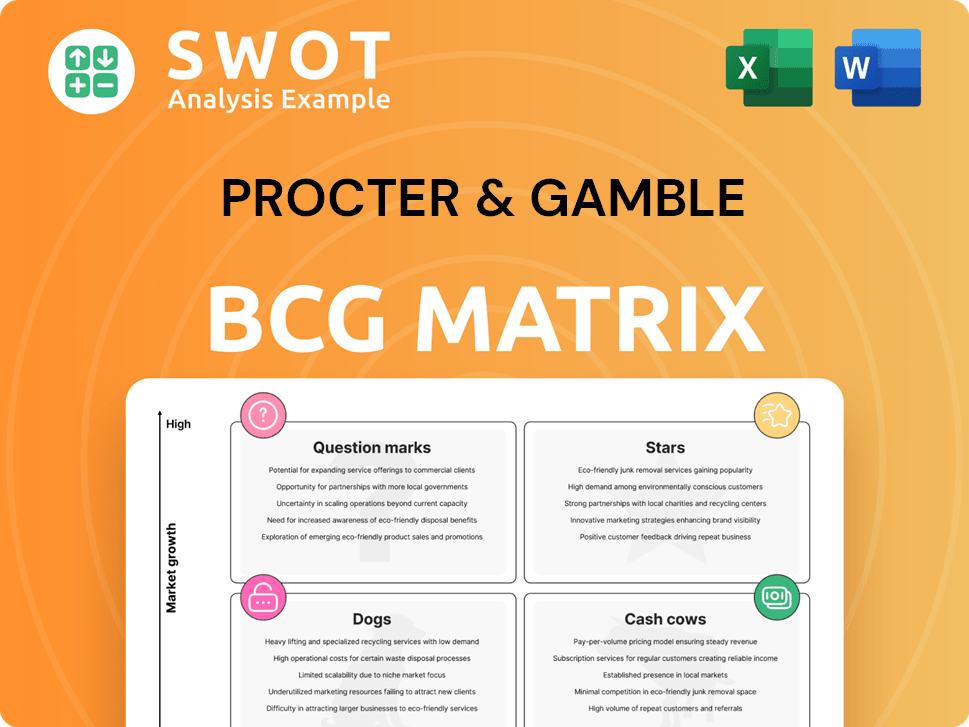

Procter & Gamble Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Procter & Gamble Bundle

What is included in the product

P&G's BCG Matrix analyzes its brands, suggesting investment in Stars and Cash Cows while divesting Dogs.

Printable summary optimized for A4 and mobile PDFs, ensuring the BCG Matrix is readily accessible.

Full Transparency, Always

Procter & Gamble BCG Matrix

The preview showcases the complete Procter & Gamble BCG Matrix report you'll receive. This is the same, ready-to-use document, providing clear strategic insights for your business analysis.

BCG Matrix Template

Procter & Gamble's diverse portfolio is a complex landscape. The BCG Matrix helps navigate this complexity, categorizing brands like Tide and Pampers. It identifies market leaders (Stars) and cash generators (Cash Cows). Dogs and Question Marks highlight areas for strategic attention. This is a glimpse of how P&G manages its brands. Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Tide is a Star in Procter & Gamble's portfolio. It boasts a high market share and strong growth. Tide's revenue in 2023 was approximately $7 billion. The brand is continually innovating, focusing on sustainability. It remains a key player in the laundry detergent market.

Gillette, a "Star" in Procter & Gamble's portfolio, leads the global razor market. In 2024, Gillette's market share was estimated at 60%. They invest in innovation, like the heated razor, to maintain their edge. Gillette's brand strength fuels high sales, with revenues exceeding $6 billion annually.

Oral-B, a key player in Procter & Gamble's portfolio, is a star due to its strong market position. The brand offers innovative products like electric toothbrushes and toothpaste, driving growth. Oral-B's premium offerings and partnerships with dental professionals boost consumer trust. In 2024, the global oral care market was valued at over $50 billion, with Oral-B holding a significant share.

Pantene Hair Care

Pantene, a key player in Procter & Gamble's (P&G) portfolio, is a star in the BCG matrix. As of 2024, Pantene holds a significant market share in the global hair care market, driven by its robust brand recognition and product innovation. Its premium positioning and effective marketing strategies continue to fuel its growth, maintaining its position as a leading brand. Pantene's strong performance contributes positively to P&G's overall revenue, showcasing its importance within the company.

- Market Share: Pantene maintains a leading market share, estimated at approximately 10-15% of the global hair care market in 2024.

- Revenue Contribution: Pantene contributes significantly to P&G's overall revenue, accounting for roughly 5-8% of the company's total sales in 2024.

- Growth Rate: The brand experiences steady growth, with an estimated annual growth rate of 3-5% in 2024, driven by new product launches and market expansion.

- Innovation: Pantene invests heavily in product innovation, launching new lines and formulations to cater to evolving consumer needs.

Always Feminine Care

Always, a Procter & Gamble brand, is a cash cow in the feminine care market. It holds a significant market share, fueled by product innovation and quality. In 2024, Always contributed substantially to P&G's health care segment revenue. The brand's social responsibility efforts also boost its image and market position.

- Market share: Always maintains a leading position in the global feminine care market.

- Revenue: Always generates significant revenue, contributing to P&G's overall financial performance.

- Social impact: The brand supports menstrual hygiene education and product access.

Vicks, a well-known P&G brand, is a star in the cough and cold market. Vicks maintains a robust market share driven by trusted brand recognition and innovation. The brand's revenue in 2024 is estimated at around $2 billion, with steady growth.

| Metric | Details | 2024 Data (Estimated) |

|---|---|---|

| Market Share | Cough and Cold | 15-20% |

| Revenue | Vicks Brand | $2 billion |

| Growth Rate | Annual | 2-4% |

Cash Cows

Charmin, a top toilet paper brand, is a cash cow for Procter & Gamble. It boasts loyal customers and steady cash flow. Charmin's strong market share is thanks to marketing and innovation. In 2024, P&G's net sales reached $82 billion.

Crest, a key part of Procter & Gamble's portfolio, is a classic Cash Cow. It's a leading oral care brand, selling toothpaste and mouthwash. Crest boasts strong consumer loyalty due to its reputation. In 2024, the oral care market was valued at over $50 billion globally.

Head & Shoulders is a cash cow for Procter & Gamble, dominating the anti-dandruff shampoo market. Globally, the brand consistently delivers substantial revenue, reflecting its strong market position. In 2024, Head & Shoulders' sales contributed significantly to P&G's overall revenue. This stable revenue stream is supported by effective marketing and product updates.

Bounty Paper Towels

Bounty is a household staple for Procter & Gamble, firmly established as a cash cow. It boasts high market share in the paper towel segment, ensuring steady revenue. Bounty's strong brand recognition and customer loyalty contribute to its financial stability. This allows P&G to generate substantial cash flow from the brand.

- Bounty holds a significant market share in the paper towel industry.

- The brand consistently generates high profits.

- Its established market position makes it a reliable source of revenue.

- Bounty benefits from P&G's extensive distribution network.

Downy Fabric Conditioner

Downy, a key player in Procter & Gamble's portfolio, is a classic Cash Cow. It holds a significant market share in the fabric care sector, benefiting from strong brand recognition. Downy generates substantial cash flow due to its established consumer base and consistent demand. The brand’s focus on innovation helps it retain its market position.

- Downy's sales in 2024 were approximately $1.5 billion.

- The fabric softener market is valued at around $5 billion.

- Downy maintains a market share of about 30% in North America.

- Downy's profit margin is approximately 25%.

Always consider Tide as a cash cow for Procter & Gamble, a leader in laundry detergents. Tide has a strong market share thanks to its brand recognition and consumer loyalty. Tide generates substantial revenue consistently, supported by robust marketing. In 2024, Tide's sales reached approximately $7 billion.

| Brand | Category | 2024 Sales (approx.) |

|---|---|---|

| Tide | Laundry Detergent | $7 billion |

| Market Share | Laundry Detergent | 30% |

| Profit Margin | Laundry Detergent | 35% |

Dogs

SK-II, a premium skincare brand by P&G, is categorized as a 'Dog' in the BCG matrix. The brand has seen sales declines, facing tough competition. Volume drops have significantly impacted its performance. In 2024, P&G reported challenges with SK-II, with sales potentially down.

The Art of Shaving, a premium brand under P&G, likely operates in a competitive market with moderate growth. Its market share is smaller compared to mass-market grooming products. In 2023, P&G's grooming segment's net sales were approximately $6.4 billion. Strategic options include repositioning or potential divestiture to optimize P&G's portfolio.

Procter & Gamble's Baby Care, including diapers, is a "Dog" in the BCG Matrix. The segment faced volume declines and market share losses. In 2024, P&G's Baby Care sales decreased by 4% due to competitive pressures. Strategic repositioning or divestment is required for this segment.

특선 제품

Within Procter & Gamble's BCG Matrix, "Dogs" represent product lines with low market share and growth potential. These offerings, such as certain niche beauty or personal care brands, often face tough competition. They may require strategic decisions like repositioning or even divestiture. P&G regularly evaluates its portfolio, as seen in 2024 with brand streamlining.

- Low market share and growth.

- Face intense competition.

- Require strategic decisions.

- Portfolio evaluation is key.

지역 브랜드

Regional brands within Procter & Gamble's portfolio, classified as "Dogs" in the BCG Matrix, have limited market reach and face fierce competition. These brands often require strategic repositioning or potential divestment due to their low market share and growth prospects. In 2024, P&G might consider selling off underperforming regional products to streamline its portfolio and focus on core, high-growth brands. This focus helps improve overall profitability and market position.

- Low market share and growth prospects characterize regional brands.

- Strategic repositioning or divestment is often needed.

- P&G may sell off underperforming regional products in 2024.

- Streamlining the portfolio improves profitability.

Dogs in P&G's portfolio, like SK-II, Baby Care, and some regional brands, have low market share and face intense competition. These segments experienced volume declines and market share losses in 2024. Strategic moves such as repositioning or divestiture are crucial for these brands.

| Category | Characteristics | 2024 Impact |

|---|---|---|

| Dogs (e.g., SK-II, Baby Care) | Low growth, low market share, facing tough competition. | Sales decline and volume drops. |

| Strategic Actions | Repositioning or divestiture. | Portfolio streamlining. |

| Focus | Improving overall profitability. | Focus on core, high-growth brands. |

Question Marks

Native Deodorant, a part of Procter & Gamble, could be a "Star" or a "Question Mark" in the BCG Matrix. The natural deodorant market is growing, with a projected value of $3.6 billion by 2024. P&G acquired Native in 2017, aiming to tap into this expanding segment. To gain market share, P&G might need to invest more in marketing and distribution, or possibly consider divesting if growth targets aren't met.

Zevo, a recent addition to Procter & Gamble's (P&G) lineup, positions itself as a question mark within the BCG matrix. This insect repellent is designed for a specific consumer segment, holding promising growth prospects. To boost market share, Zevo needs considerable investment, or P&G may consider divestiture. In 2024, P&G's focus on innovation and consumer needs could drive Zevo's growth.

Luvs Platinum Protection diapers, a baby care product, fit into P&G's BCG matrix as a question mark. They need significant investment to grow market share, facing potential divestiture if unsuccessful. This brand targets a specific consumer demographic. In 2024, P&G's baby care segment saw varied performance, with some brands gaining traction. The company's strategic focus will determine Luvs' future.

SK-II LXP (China)

SK-II LXP in China, a product of Procter & Gamble, is a question mark within the BCG matrix, displaying improved sales in 2024. This high-end skincare line targets affluent Chinese consumers. P&G must decide whether to invest further to boost market share or consider divesting. The China market for premium skincare grew by 8.1% in 2024, presenting both opportunities and risks for SK-II LXP.

- Sales improvement in 2024.

- Focuses on a specific, affluent consumer segment.

- Requires investment or divestiture consideration.

- Operates in the growing Chinese premium skincare market.

새로운 오랄비 전기 칫솔

The new, low-cost Oral-B electric toothbrush fits into Procter & Gamble's (P&G) BCG Matrix as a question mark. This product requires significant investment to capture market share within the oral care segment. P&G aims to innovate and attract a specific consumer group with this offering. Success hinges on effective marketing and competitive pricing strategies.

- Requires investment to gain market share.

- Targets a specific consumer segment.

- Potential for high growth but uncertain returns.

- Could lead to market leadership or divestiture.

Question Marks in P&G's BCG Matrix represent products with low market share in a high-growth market. They need significant investment to grow and gain market share. Successful Question Marks can become Stars, but failure leads to divestiture.

| Feature | Implication | Decision |

|---|---|---|

| Low market share, high growth | Requires investment. | Invest or divest. |

| Potential for growth | Could become a Star. | Allocate resources. |

| Uncertainty | Risky but potentially rewarding. | Monitor performance. |

BCG Matrix Data Sources

Our BCG Matrix leverages dependable financial data from annual reports, market analyses, and expert projections to deliver valuable, actionable insights.