Procter & Gamble SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Procter & Gamble Bundle

What is included in the product

Offers a full breakdown of Procter & Gamble’s strategic business environment.

Perfect for summarizing complex insights in a digestible strategic view.

Preview Before You Purchase

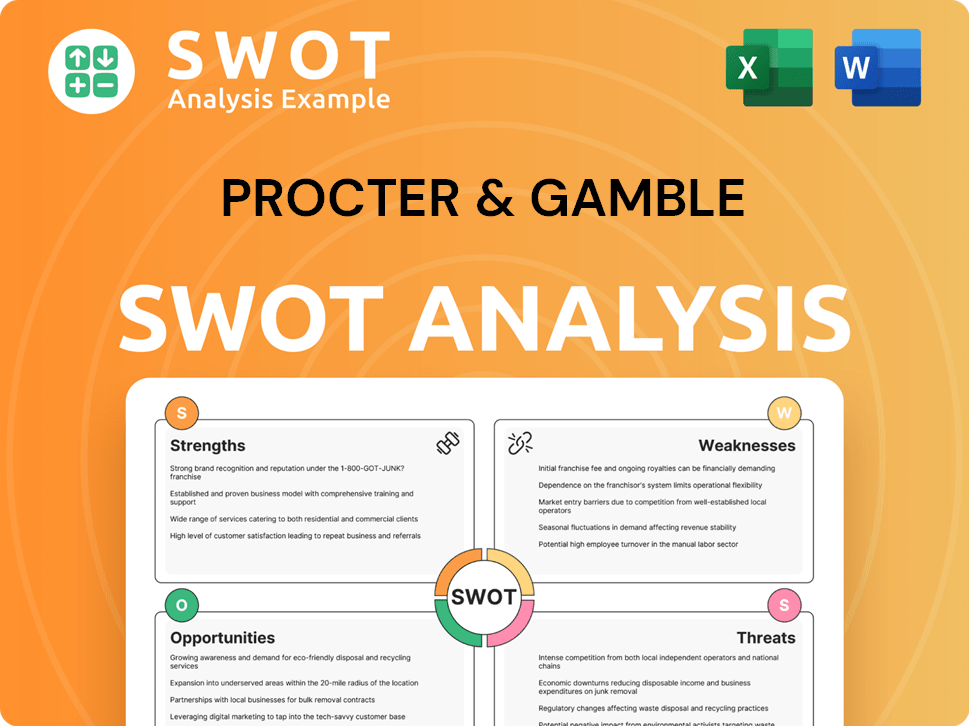

Procter & Gamble SWOT Analysis

Preview what you'll get! This is the same detailed Procter & Gamble SWOT analysis you'll download upon purchase. See P&G's strengths, weaknesses, opportunities, and threats outlined professionally. The entire document's contents are available after completing your order. Gain immediate access to the full report.

SWOT Analysis Template

Procter & Gamble boasts iconic brands and global reach, yet faces evolving consumer demands and competitive pressures. A quick look reveals strengths like strong brand equity and innovation, but also vulnerabilities like reliance on retail channels. Exploring its growth drivers highlights emerging market opportunities and a focus on sustainability, while the threats section identifies challenges from competition. Understand P&G’s complete business picture with our detailed SWOT analysis.

Unlock the full SWOT report to gain detailed strategic insights, editable tools, and a high-level summary in Excel. Perfect for smart, fast decision-making.

Strengths

Procter & Gamble (P&G) boasts a powerful portfolio of well-known brands like Tide and Pampers. This brand strength cultivates customer loyalty, which is crucial. In 2024, P&G's net sales reached approximately $82 billion, demonstrating the value of its brand recognition. This strong brand equity enables P&G to command premium pricing.

P&G's global presence spans over 180 countries, a massive reach. This extensive network ensures products are accessible worldwide. In fiscal year 2024, P&G's net sales were $82 billion, driven by its global reach. This distribution network provides a key advantage in market penetration.

Procter & Gamble (P&G) has a strong commitment to innovation. P&G invests heavily in R&D, with about $2.3 billion spent in fiscal year 2024. This fuels new product launches and improvements. Innovation allows P&G to adapt to changing consumer preferences, helping it maintain its market leadership. This focus ensures P&G's products remain competitive.

Financial Stability and Shareholder Value

Procter & Gamble (P&G) boasts a solid financial foundation and a strong commitment to shareholder value. The company has a history of delivering robust financial results, marked by consistent earnings growth and substantial cash flow generation. P&G actively returns value to shareholders through dependable dividend payments and share buybacks. For instance, in 2024, P&G increased its dividend for the 68th consecutive year.

- Consistent Dividend Payouts

- Share Repurchases

- Strong Cash Flow Generation

- Historical Financial Performance

Supply Chain Efficiency and Resilience

Procter & Gamble (P&G) boasts a supply chain known for its efficiency and resilience. They are actively enhancing capacity planning, agility, and data transparency. P&G's supply chain has shown its ability to adapt, even during disruptions like cyberattacks. This is reflected in its strong operational performance and ability to maintain product availability.

- P&G's supply chain is a key competitive advantage.

- They have invested heavily in technology and processes.

- Resilience is a core focus, ensuring business continuity.

P&G's established brands foster customer loyalty. Its 2024 net sales were ~$82B. Strong brands allow premium pricing. This highlights their financial power.

| Strength | Description | Data Point (2024) |

|---|---|---|

| Brand Equity | Strong, recognized brands. | $82B in net sales |

| Global Reach | Presence in over 180 countries. | Extensive Distribution Network. |

| Innovation | High R&D spending to stay competitive. | ~$2.3B spent on R&D |

Weaknesses

Procter & Gamble heavily relies on mature markets, with North America and Western Europe contributing significantly to its revenue. This dependence makes P&G vulnerable to economic downturns. For instance, in fiscal year 2024, North America accounted for roughly 40% of P&G's sales. Stagnation in these regions directly impacts P&G's overall growth trajectory. Slower growth in these key areas can limit the company's expansion potential.

Procter & Gamble's main focus on consumer goods creates significant market dependence. This reliance can amplify risks tied to consumer behavior shifts or economic downturns. Limited diversification means P&G's financial performance heavily hinges on the consumer goods sector's health. For instance, in 2024, over 90% of P&G's revenue came from this sector. This concentration poses a notable weakness in its SWOT analysis.

Procter & Gamble faces the challenge of imitable products, as many items in its portfolio can be readily copied by rivals. This vulnerability can lead to market share erosion, particularly if competitors offer similar products at reduced prices. For example, in 2024, several generic brands gained ground in the laundry detergent market, directly impacting P&G's Tide. This highlights the ongoing pressure to innovate and differentiate to maintain a competitive edge. The constant threat of imitation necessitates continuous investment in research and development.

Challenges in Adapting to Rapidly Changing Consumer Demand

Procter & Gamble (P&G) faces challenges in adapting to rapidly changing consumer demand. The consumer goods market sees frequent shifts in preferences, which can impact P&G's relevance. Slow responses to these changes may cause P&G to lose market share. In 2024, P&G's organic sales growth was approximately 3%, reflecting these challenges.

- Changing consumer preferences can lead to product obsolescence.

- Delayed innovation can hurt P&G's competitiveness.

- Supply chain adjustments are needed to meet new demands.

- Marketing strategies must quickly adapt to new trends.

Increasing Competition from Smaller, Agile Brands

Procter & Gamble (P&G) contends with rising competition. Smaller brands are rapidly adjusting to shifting consumer tastes. These agile competitors use direct-to-consumer strategies effectively. P&G must innovate to maintain market share. P&G's sales in 2024 were approximately $82 billion, a slight increase from the previous year, indicating the impact of competition.

- Smaller brands' agility allows quick adaptation to trends.

- Direct-to-consumer models offer competitive pricing and reach.

- P&G needs continuous innovation to stay ahead.

- P&G's market share faces pressure from these competitors.

Procter & Gamble’s heavy reliance on mature markets like North America and Western Europe exposes it to economic slowdowns. Dependence on consumer goods concentrates risk, making it vulnerable to market shifts. In 2024, over 90% of revenue came from this sector. P&G's products are easily imitated, potentially eroding market share if not consistently innovating.

| Weakness | Description | Impact |

|---|---|---|

| Market Concentration | Reliance on consumer goods (90%+ of revenue) | Vulnerable to sector downturns or changing consumer behavior |

| Imitable Products | Products readily copied by competitors | Erosion of market share if not innovating and differentiating |

| Slow Adaptation | Potential for delayed reactions to shifting consumer trends | Loss of market share to more agile competitors, approximately 3% organic sales growth in 2024 |

Opportunities

Emerging markets offer substantial growth for P&G. The company can broaden its reach, tapping into regions with high growth. For example, P&G saw a 6% organic sales increase in developing markets in fiscal year 2024. This expansion helps diversify revenue streams. Growth in these markets is crucial for future success.

P&G can boost its e-commerce presence, capitalizing on rising online shopping. This includes increased digital transformation investments. In fiscal year 2024, e-commerce sales grew, contributing significantly to overall revenue. This also enhances marketing and supply chain efficiency.

Procter & Gamble (P&G) can capitalize on product innovation. It can create new products. This boosts revenue. In Q1 FY24, P&G's organic sales grew by 4%. Innovation is key for growth.

Growing Demand for Sustainable Products

Procter & Gamble (P&G) faces a growing demand for sustainable products, presenting a significant opportunity. Consumers increasingly favor eco-friendly options, creating a market for P&G to innovate. This shift allows P&G to develop and promote sustainable offerings, potentially attracting new customers. P&G can capitalize on this trend, improving its brand image and market position.

- In 2024, the global green products market was valued at $300 billion.

- P&G has set goals to reduce its carbon footprint by 50% by 2030.

- Sales of sustainable products are growing at 10% annually.

Strategic Partnerships and Collaborations

Procter & Gamble (P&G) can capitalize on strategic partnerships, such as collaborations focused on sustainability and supply chain improvements. These alliances allow P&G to access external expertise, fostering innovation and tackling intricate challenges. For instance, P&G partnered with TerraCycle in 2024 to boost recycling programs. Such moves align with consumer demand for eco-friendly products. These partnerships also enhance operational efficiency.

- P&G's 2024 sustainability partnerships included collaborations to reduce plastic waste.

- Supply chain optimization through partnerships aims to cut costs by 5-7% by 2025.

- Innovation partnerships have led to a 10% increase in new product launches in 2024.

Procter & Gamble can seize growth in emerging markets, capitalizing on increased consumer demand. E-commerce presents a major avenue to boost sales, as online shopping rises. Innovation in sustainable products allows for a greener brand image and a wider market reach. Strategic partnerships can optimize supply chains, lowering costs and fueling product development.

| Opportunity | Details | Data (2024/2025) |

|---|---|---|

| Emerging Markets Growth | Expansion into developing economies. | 6% organic sales growth in developing markets (FY24). |

| E-commerce Expansion | Boost online presence and digital transformation. | E-commerce sales contribute significantly to revenue. |

| Product Innovation | New product development. | Q1 FY24: 4% organic sales growth. |

| Sustainability | Meet consumer demand for eco-friendly goods. | Global green market valued at $300B. |

| Strategic Partnerships | Collaboration on sustainability, supply chain, and innovation. | Supply chain cost reduction: 5-7% by 2025. |

Threats

Procter & Gamble (P&G) faces fierce competition from global giants and local brands. This rivalry can trigger price wars, squeezing profit margins, a critical factor for investors. For instance, in 2024, P&G's net sales increased by only 3% due to competitive pressures. This environment necessitates constant innovation and efficiency to maintain profitability. These pressures are especially notable in emerging markets, where competition is particularly intense.

P&G faces global economic threats. Inflation and potential recessions could hurt sales. Currency fluctuations, like the 2024 impact, can lower profits. In Q1 2024, currency negatively affected sales by 2%. These economic shifts pose risks.

P&G faces threats from rising commodity costs, including raw materials, energy, and transportation. These fluctuations can directly increase input costs, impacting profitability. For instance, in 2024, the cost of key materials like pulp and resin saw price volatility. If unmanaged, rising costs squeeze profit margins. In Q1 2024, P&G reported a slight decrease in gross margin due to increased costs.

Changing Consumer Preferences and Trends

Shifting consumer preferences are a significant threat to Procter & Gamble. Consumers increasingly favor smaller brands and private labels, focusing on value. P&G needs to adapt to maintain its market share. The company's organic sales growth in fiscal year 2024 was approximately 3%, indicating a need for agility.

- Increased competition from niche brands.

- Rising demand for sustainable products.

- Economic downturns impacting consumer spending.

Supply Chain Disruptions and Geopolitical Tensions

Procter & Gamble faces threats from supply chain disruptions and geopolitical tensions, which can significantly impact its operations. Global supply chains are vulnerable to disruptions due to geopolitical instability and cyberattacks, potentially affecting product availability. These disruptions may lead to increased operational costs, impacting profitability. For example, in 2023, supply chain issues contributed to a 2% increase in costs.

- Geopolitical tensions can lead to trade restrictions.

- Cyberattacks can disrupt distribution networks.

- Supply chain disruptions can raise production costs.

- These issues can affect product availability.

P&G confronts intense market competition that can decrease profitability. Economic instability and currency fluctuations pose substantial risks. Supply chain disruptions, as experienced in 2023, continue to pressure operational costs and product availability.

| Threats | Impact | Financial Data (2024/2025) |

|---|---|---|

| Competition | Price wars, margin squeeze | Net sales growth 3% (2024) |

| Economic Instability | Sales decline, currency impact | Q1 2024 currency impact -2% |

| Supply Chain | Increased costs, disruptions | 2% cost increase (2023) |

SWOT Analysis Data Sources

This SWOT analysis draws on financial reports, market analysis, expert opinions, and competitive data, for accuracy and reliability.