Procter & Gamble Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Procter & Gamble Bundle

What is included in the product

Detailed analysis of each competitive force, supported by industry data and strategic commentary.

Quickly compare different scenarios: competitor moves, new regulations, or tech changes.

What You See Is What You Get

Procter & Gamble Porter's Five Forces Analysis

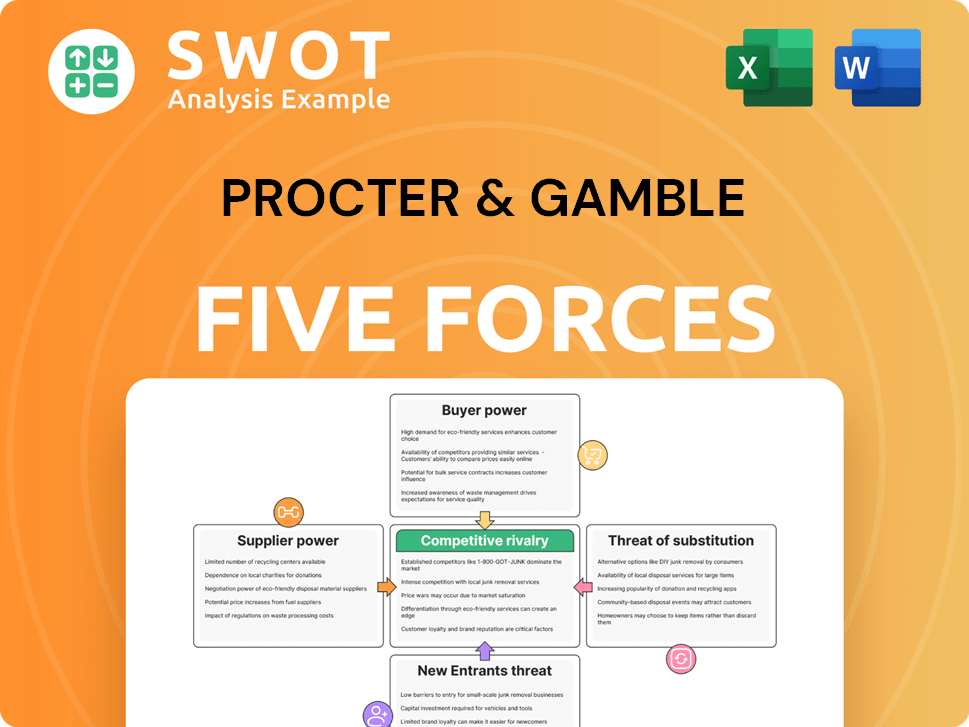

The provided analysis of Procter & Gamble employs Porter's Five Forces, evaluating industry rivalry, supplier power, buyer power, threat of substitutes, and threat of new entrants.

This analysis assesses P&G's competitive landscape, detailing its strengths, weaknesses, opportunities, and threats (SWOT).

It provides actionable insights into P&G's market position and strategic implications for its future.

The document presented is the complete Porter's Five Forces analysis you will receive—ready for immediate download.

No changes, no edits, the document you see is exactly what you’ll get after purchase—fully formatted and ready to use.

Porter's Five Forces Analysis Template

Procter & Gamble (P&G) navigates a dynamic consumer goods landscape. Its buyer power is significant due to consumer choice. Rivalry is high, fueled by strong competitors. Threats of new entrants are moderate, with established brands. Substitute products pose a persistent challenge. Supplier power is moderate due to diversified sourcing.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Procter & Gamble’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

P&G's supplier diversity program is a key strategy to manage supplier power. In 2023, P&G spent over $4 billion with diverse suppliers. This approach ensures a more resilient supply chain, reducing dependence on any single supplier. By fostering relationships with diverse businesses, P&G also promotes economic empowerment.

Procter & Gamble's (P&G) global sourcing network, encompassing roughly 50,000 suppliers across 175 countries, significantly reduces supplier bargaining power. This extensive network allows P&G to negotiate favorable terms. In 2024, P&G's procurement spending reached billions of dollars. This scale allows for advantageous pricing and supply terms.

Procter & Gamble (P&G) wields significant negotiation leverage with suppliers. P&G uses long-term supply contracts with fixed pricing. Annual contract talks include price adjustments. In 2024, P&G's cost of goods sold was about $42 billion, showing its purchasing power's impact. This strategy ensures stable supply and effective cost management.

Supplier Partnerships

Procter & Gamble (P&G) strategically cultivates supplier partnerships to mitigate supplier power. P&G's investments in supplier collaboration and innovation totaled $1.2 billion in 2023, indicating a commitment to long-term relationships. These partnerships typically span 7-10 years, fostering collaborative innovation and a high supplier sustainability compliance rate. This approach enhances efficiency and sustainability across its supply chain.

- P&G's supplier partnerships average 7-10 years.

- 2023 supplier collaboration and innovation investment: $1.2 billion.

- Focus on collaborative innovation projects.

- High supplier sustainability compliance rate.

Mitigation Strategies

Procter & Gamble (P&G) actively manages supplier power through strategic initiatives. A key approach involves decreasing reliance on single-source suppliers. In 2023, P&G diversified its supplier base, reducing dependencies by 15%. This strategy enhances supply chain stability and negotiation leverage.

- Geographic Diversification: P&G sources materials from multiple countries.

- Alternative Suppliers: 3-5 alternative suppliers per critical material.

- Risk Reduction: Mitigates supply disruptions and price hikes.

- Supply Chain Resilience: Strengthens overall operational robustness.

Procter & Gamble (P&G) actively manages supplier power via a global network and long-term contracts. In 2024, P&G's procurement spending hit billions, giving it strong negotiation leverage. The firm's investments in supplier collaboration reached $1.2 billion in 2023, fostering innovation.

| Metric | Value | Year |

|---|---|---|

| Procurement Spending | Billions | 2024 |

| Supplier Collaboration Investment | $1.2 Billion | 2023 |

| Diverse Supplier Spend | $4 Billion+ | 2023 |

Customers Bargaining Power

Customers of Procter & Gamble (P&G) often face low switching costs because of the readily available alternatives in the consumer goods market. This ease of switching gives customers considerable power, forcing P&G to offer competitive pricing and maintain product quality. For instance, P&G's 2024 annual report highlights the importance of brand loyalty in a market where competitors are just a click away, affecting pricing strategies. P&G continuously innovates to retain customers.

Strong brand loyalty reduces customer bargaining power for Procter & Gamble. Consumers often accept higher prices for P&G's well-known brands. For instance, P&G's net sales in 2023 reached $82 billion. Brand equity maintenance is critical to retain this advantage.

E-commerce significantly boosts customer bargaining power by widening product choices and price comparisons. Online retail accounted for 22% of P&G's total sales in 2023, highlighting its influence. Customers gain more control through readily available product information and purchasing options. This increased transparency and competition put pressure on P&G to maintain competitive pricing and value.

Promotional Sensitivity

Procter & Gamble faces significant customer bargaining power due to promotional sensitivity. Customers are highly responsive to deals, with approximately 54% actively seeking discounts. This behavior boosts buyer power, allowing easy brand switching based on promotions. P&G must strategically balance promotions to maintain sales and profitability.

- 54% of consumers actively seek deals and promotions, increasing their bargaining power.

- Promotional strategies significantly impact P&G's sales volume and profitability.

- Customers' ability to switch brands based on offers highlights their power.

Retailer Influence

Large retailers significantly influence P&G's financial results. Walmart, a major customer, represented 12.5% of P&G's sales in 2023, demonstrating substantial purchasing power. This leverage allows these retailers to negotiate advantageous terms, impacting profit margins. P&G must carefully manage these relationships to ensure distribution and profitability.

- Walmart's Impact: 12.5% of P&G's 2023 revenue.

- Negotiated Terms: Retailers can secure favorable pricing.

- Margin Pressure: Reduced profitability for P&G.

- Relationship Management: Key for distribution and profit.

Customer bargaining power significantly impacts P&G due to readily available alternatives and promotional sensitivity. E-commerce amplifies this power by enabling easy price comparisons and widening product choices. Retail giants like Walmart, representing 12.5% of P&G's 2023 sales, wield considerable influence over pricing and terms.

| Factor | Impact | Data |

|---|---|---|

| Switching Costs | Low | Availability of Substitutes |

| E-commerce | High Bargaining | 22% of 2023 Sales |

| Retailer Power | Significant | Walmart: 12.5% of 2023 Sales |

Rivalry Among Competitors

Procter & Gamble (P&G) faces intense competition from rivals like Unilever and Colgate-Palmolive. These companies compete across numerous categories, increasing rivalry. P&G must innovate to keep its market share. In 2024, P&G's net sales were approximately $82 billion, showing its size in the market.

As of Q4 2024, P&G's 13.72% market share underscores its dominance, though strong rivals exist. Unilever and Colgate-Palmolive, with substantial shares, intensify competition. P&G must strategically defend its position. Market dynamics require continuous adaptation and innovation to stay ahead.

Procter & Gamble (P&G) vigorously invests in product innovation to stay ahead. In 2023, P&G spent $2.1 billion on R&D. This investment fueled the launch of 47 new products. Continuous innovation helps P&G differentiate its offerings. It also allows P&G to meet changing consumer demands.

Multi-Brand Strategy

Procter & Gamble's (P&G) multi-brand strategy is a key competitive tactic. This allows P&G to capture a wide range of consumers. This strategy allows them to compete across different market segments. Managing these brands demands strong marketing and brand management skills. P&G's net sales for fiscal year 2024 were $82.2 billion.

- Offers products at various price points.

- Targets diverse consumer preferences.

- Requires strong brand management.

- Aims for market share growth.

Consumer Behavior

Consumer behavior significantly shapes competitive dynamics. Shifts in consumer preferences, driven by income and price sensitivity, demand that P&G adjusts its strategies. Adapting pricing and product offerings to consumer trends is crucial for sustained success. Understanding these trends helps P&G stay competitive.

- In 2024, P&G's focus on value and premium products reflects consumer demand.

- Price sensitivity is evident, with consumers seeking affordable options.

- P&G's ability to innovate and cater to diverse needs is key.

- Market research shows changing preferences in household care.

Procter & Gamble (P&G) faces intense competition from rivals like Unilever and Colgate-Palmolive, impacting its market share. In 2024, P&G's net sales were about $82 billion, reflecting its substantial size. P&G's multi-brand strategy helps it compete effectively.

| Aspect | Details | Impact |

|---|---|---|

| Key Rivals | Unilever, Colgate-Palmolive | High competition |

| 2024 Net Sales | $82 Billion | Market Presence |

| Strategy | Multi-brand approach | Wide consumer reach |

SSubstitutes Threaten

The threat of substitutes for Procter & Gamble is low. Consumers face limited alternatives for many P&G products. Finding natural substitutes for items like shampoo is challenging. This scarcity helps P&G maintain market share. In 2024, P&G's net sales were approximately $82 billion, reflecting its strong brand presence.

The surge in private label brands presents a notable threat within P&G's competitive landscape. These alternatives, frequently priced lower, appeal to cost-conscious shoppers. In 2024, private label sales grew, impacting established brands. To maintain its position, P&G must highlight the superior value and quality of its products, perhaps through targeted marketing and innovation.

The increasing demand for natural and organic products poses a significant substitution threat to Procter & Gamble. The global natural and organic personal care market is expected to hit $33.38 billion by 2030. To stay competitive, P&G must innovate and provide sustainable alternatives to meet consumer preferences. This strategic shift is crucial for maintaining market share.

Low Variety

The threat from substitutes for Procter & Gamble (P&G) is relatively low due to limited variety. Homemade or natural alternatives, such as DIY cleaning products, often have fewer options. This contrasts with P&G's vast portfolio of branded products. The range of substitutes is restricted, making them less appealing overall.

- P&G's portfolio includes over 75 brands, with many sub-brands, offering consumers numerous choices.

- The global household and personal care market, where P&G operates, reached approximately $700 billion in 2024.

- Homemade alternatives may lack the performance and convenience of P&G's scientifically-formulated products.

Subscription Services

The rise of subscription services poses a threat to Procter & Gamble. These services provide personalized personal care products directly to consumers. This shift towards convenience challenges P&G's traditional retail model. P&G must adapt to stay competitive.

- Subscription box sales grew, with the personal care segment showing strong gains in 2024.

- Companies like Dollar Shave Club, a subscription service, were acquired for billions, indicating market value.

- P&G is investing in e-commerce and direct-to-consumer channels to counter subscription model.

The threat of substitutes varies for P&G. Private-label brands and DIY options are challenges. The demand for natural products necessitates innovation. P&G needs to adapt to maintain its market share.

| Substitute Type | Market Impact (2024) | P&G Response |

|---|---|---|

| Private Label | Increased sales, pricing pressure | Highlight product value, marketing |

| Natural/Organic | Market growing (est. $33.38B by 2030) | Sustainable innovation |

| Subscription Services | Growing segment | Invest in e-commerce and direct-to-consumer |

Entrants Threaten

New entrants into P&G's market face high initial capital requirements, essential for product development, manufacturing, and marketing. P&G's substantial R&D investment of $2.1 billion in 2023 highlights the financial hurdle. Capital expenditures reached $4.3 billion, creating significant barriers for potential competitors. These investments secure P&G's market position.

Procter & Gamble (P&G) leverages substantial economies of scale, manufacturing goods in vast quantities to reduce expenses. New competitors find it difficult to replicate P&G's production efficiency and cost advantages. Building comparable economies of scale demands considerable time and capital. In 2024, P&G's net sales were approximately $82 billion, reflecting its scale.

Procter & Gamble's (P&G) strong brand portfolio, including names like Tide and Pampers, presents a significant barrier. New entrants struggle to compete with P&G's established consumer trust. Building brand recognition requires substantial investment, as seen by P&G's $8.1 billion in advertising spending in 2023. This robust brand equity effectively deters new competitors.

Distribution Network

Procter & Gamble (P&G) wields a vast distribution network that's a tough barrier for newcomers. This network spans various global retail channels, making it challenging to replicate. New entrants struggle to match P&G's established channels, crucial for consumer reach. This advantage helps P&G maintain its market position.

- P&G's products are available in over 180 countries.

- The company manages a network of over 700 distribution centers globally.

- P&G spends billions annually on supply chain and distribution.

- In 2024, P&G's net sales reached approximately $82 billion.

Continuous Innovation

Procter & Gamble (P&G) faces the threat of new entrants, mitigated by its continuous innovation. P&G's significant investment in research and development (R&D) helps it stay ahead of consumer trends. This ongoing innovation makes it harder for new competitors to compete effectively. Sustained R&D spending is crucial for maintaining a competitive edge in the market.

- P&G spent approximately $2.2 billion on R&D in fiscal year 2023.

- This investment supports the development of new products and improvements to existing ones.

- Innovation helps P&G maintain its brand loyalty and market share.

- New entrants often struggle to match this level of innovation and investment.

New entrants face high barriers due to P&G's capital needs, economies of scale, strong brands, and distribution networks. P&G's 2023 R&D spend was $2.1B, while ad spend hit $8.1B. These factors make it tough for new competitors to enter the market.

| Barrier | Description | Financial Impact (2023-2024) |

|---|---|---|

| Capital Requirements | High initial investment for product dev, mfg, and marketing | R&D: $2.1B (2023), CapEx: $4.3B (2023), Sales: ~$82B (2024) |

| Economies of Scale | Vast production volume reduces costs | Net Sales: ~$82B (2024), Global distribution network |

| Brand Equity | Strong brands like Tide and Pampers build trust | Advertising Spend: $8.1B (2023), Strong brand recognition |

Porter's Five Forces Analysis Data Sources

We analyze P&G using SEC filings, market research reports, and financial news, offering robust industry and competitor understanding.