Procter & Gamble PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Procter & Gamble Bundle

What is included in the product

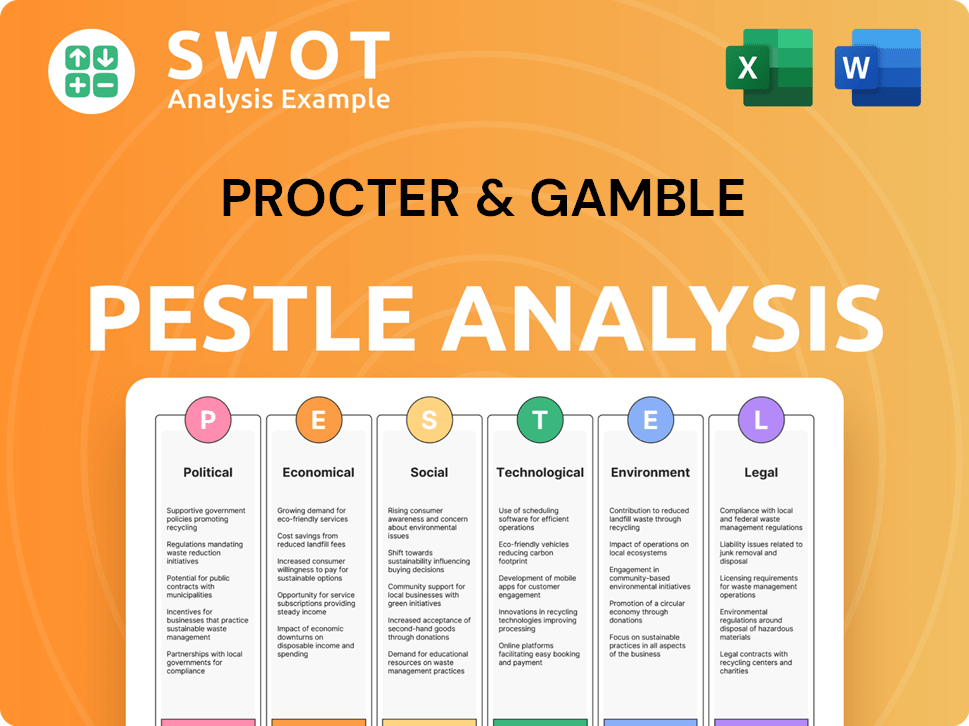

The P&G PESTLE analyzes external factors across Politics, Economics, Social, Technology, Environment, and Legal, providing valuable insights.

The PESTLE analysis allows stakeholders to clearly recognize opportunities or threats affecting the company.

Preview Before You Purchase

Procter & Gamble PESTLE Analysis

This P&G PESTLE Analysis preview showcases the complete document you'll receive. You’ll get this structured, ready-to-use analysis after purchase.

PESTLE Analysis Template

Procter & Gamble (P&G) faces complex external factors. Political shifts, like trade policies, impact their global operations. Economic trends, such as inflation, affect consumer spending on P&G's products. Social changes, including sustainability demands, influence product development and branding. Legal regulations concerning product safety and environmental compliance also play a crucial role. Uncover the full PESTLE breakdown impacting P&G. Get detailed insights and strategic analysis—buy now.

Political factors

Procter & Gamble's global footprint is heavily shaped by governmental regulations. These regulations, spanning product safety, labeling, and environmental standards, are critical. Compliance is vital for P&G to operate legally and maintain market access worldwide. For instance, in 2024, P&G spent $1.7 billion on regulatory compliance efforts globally, demonstrating the significance of these factors.

International trade policies significantly influence Procter & Gamble's operations. Tariffs and trade agreements impact the cost of raw materials and finished goods. For example, in 2024, P&G navigated fluctuating import duties across various markets. Trade policy shifts can alter product competitiveness; a 10% tariff hike can substantially affect profit margins.

P&G's global presence makes it vulnerable to geopolitical risks. Instability can disrupt supply chains and increase costs. For instance, the Russia-Ukraine war impacted P&G's operations. Currency fluctuations, like the 2024 movements, also affect financials. These factors necessitate careful risk management.

Governmental Support for E-commerce

Governmental backing for e-commerce significantly impacts P&G. Increased support can intensify competition from online retailers. However, it also creates chances for P&G to broaden its market reach and tap into the expanding online shopping trend. The global e-commerce market is projected to reach $8.1 trillion in 2024, offering substantial growth potential for P&G's online sales.

- E-commerce sales in North America reached $1.1 trillion in 2023, a key market for P&G.

- China's e-commerce market, a growing area for P&G, is estimated at $2.3 trillion.

- P&G's e-commerce sales grew by 11% in fiscal year 2023.

Governmental Support for Higher Energy Efficiency

Governmental support for higher energy efficiency presents P&G with chances to enhance its environmental impact and cut operational expenses. The U.S. government, for example, offers various tax credits and grants for energy-efficient projects. In 2024, the Inflation Reduction Act allocated billions for clean energy initiatives, which P&G could leverage. Accessing these programs can aid P&G in achieving its sustainability targets.

- Tax credits and grants for energy-efficient projects are available.

- The Inflation Reduction Act supports clean energy.

- These initiatives can help P&G meet its sustainability goals.

Political factors significantly shape P&G's operations. Governmental regulations cost P&G $1.7 billion in 2024. International trade, like tariffs, impacts profits. Geopolitical risks and e-commerce support also influence the company.

| Factor | Impact | Example (2024) |

|---|---|---|

| Regulations | Compliance Cost | $1.7B spent on regulatory efforts. |

| Trade Policies | Affects Costs & Competitiveness | Fluctuating import duties impacted operations. |

| Geopolitical Risk | Supply Chain Disruptions, Cost Increases | Russia-Ukraine war impacts and currency moves. |

Economic factors

Rising inflation and fluctuating commodity prices significantly impact P&G's profitability. In Q3 2024, P&G faced increased costs for raw materials. The company strategically adjusts prices and focuses on cost-saving measures to protect its margins. For instance, P&G implemented price increases in 2024 to offset rising expenses. They also invest in efficiency to manage costs.

Procter & Gamble's global presence makes it vulnerable to currency volatility. Adverse currency fluctuations can diminish reported revenue and profits. For example, in fiscal year 2024, currency negatively impacted P&G's sales by approximately 2%. This highlights the significant financial risk. Currency volatility remains a key factor.

Economic stability and consumer confidence are crucial for P&G's sales. Strong consumer confidence often boosts spending on P&G's products. In 2024, consumer confidence in the US varied, impacting sales. Economic uncertainties can reduce spending, affecting revenue.

Growth Rate of Developing Markets

Developing markets offer substantial growth potential for P&G. These regions, with rising disposable incomes, are key for expansion. P&G can target these consumers with its diverse product portfolio. For example, India's FMCG market is projected to reach $220 billion by 2025. This growth is driven by increased urbanization and a growing middle class.

- India's FMCG market is projected to reach $220 billion by 2025.

- Urbanization and a growing middle class drive growth.

Supply Chain Disruptions

Procter & Gamble's (P&G) intricate global supply chain faces vulnerabilities due to natural disasters, political unrest, and unexpected events. These disruptions can lead to shortages of raw materials and delays in delivering finished goods. For instance, the 2024-2025 period saw increased shipping costs, with a 15% rise in container prices from Asia. P&G's reliance on diverse suppliers helps mitigate risks, yet disruptions can still affect production and distribution. The company must balance cost efficiency with supply chain resilience.

- Shipping costs rose 15% in 2024 from Asia

- P&G utilizes a diversified supplier network

Inflation, raw material costs, and currency fluctuations are critical for P&G. Rising expenses prompted price adjustments and cost-saving efforts in 2024. Economic stability and consumer confidence influence sales and spending habits. Developing markets, like India, represent major growth opportunities.

| Factor | Impact | Data |

|---|---|---|

| Inflation | Increases costs | Raw material costs rose in Q3 2024 |

| Currency | Affects revenue | 2% negative impact in FY2024 |

| Consumer Confidence | Boosts Sales | US confidence varied in 2024 |

Sociological factors

Consumer preferences are dynamic, compelling P&G to adjust product development and marketing strategies. A rising preference for sustainable and eco-friendly products exists. Data from 2024 shows a 15% increase in demand for such goods. Consumers also favor high-quality and healthful products; in 2025, P&G plans to invest $2 billion in these areas.

Consumers increasingly favor sustainable, eco-friendly products. P&G responds by integrating sustainability into its practices. In 2024, 60% of consumers preferred sustainable brands. P&G aims for net-zero emissions by 2040, reflecting this trend. This influences product development, packaging, and manufacturing.

Consumers increasingly favor healthful products, a trend P&G must address. In 2024, the global health and wellness market reached $7 trillion, a 5-10% annual growth is expected. P&G's product innovation should prioritize health-conscious needs. Marketing strategies must highlight health benefits to resonate with consumers.

Declining Population Growth Rate in Developed Countries

A declining population growth rate in developed nations presents challenges for Procter & Gamble. This demographic shift could shrink the potential market size for P&G's products in these regions. The company faces pressure to maintain or grow its market share despite fewer potential consumers. P&G must adapt to this reality.

- In 2024, many developed countries face stagnant or negative population growth.

- P&G needs to focus on innovation and premium products to drive value.

- Acquiring brands with strong market positions can help maintain market share.

- Expansion into emerging markets offers growth opportunities.

Ethical and Social Responsibility Expectations

Consumers are increasingly holding companies like Procter & Gamble to higher standards of ethical and social responsibility. This encompasses expectations around diversity, inclusion, ethical sourcing, and fair labor practices. P&G faces pressure to actively engage in community initiatives. For instance, in 2024, P&G's "Always" brand continued its commitment to menstrual health education, reaching millions globally.

- P&G aims to achieve 100% responsibly sourced pulp and paper by 2025.

- The company has invested significantly in programs promoting gender equality and LGBTQ+ inclusion.

- P&G's 2024 sustainability report detailed its progress on reducing its environmental footprint.

Consumer attitudes shift towards ethical and social responsibility. This influences P&G's brand perception and product choices. In 2024, consumers prioritized ethical sourcing, diversity, and community engagement. P&G's initiatives include responsible sourcing targets and diversity programs.

| Factor | Details | Impact |

|---|---|---|

| Ethical Consumerism | Growing demand for ethical products, in 2024 ethical product sales grew by 20%. | P&G must prioritize ethical sourcing, transparency. |

| Social Responsibility | Focus on diversity, inclusion, and community programs. | Enhances brand image and attracts socially-conscious consumers. |

| Health & Wellness Trends | Consumers' growing emphasis on health-conscious products. | P&G must invest in healthier product development, marketing. |

Technological factors

The expanding online market for consumer goods offers P&G a major chance to grow and profit from online shopping. Digital marketing and e-commerce investments are key. In 2024, online sales grew by 12%, with P&G's e-commerce sales up 15%. This trend boosts P&G's global reach.

Business automation is key for P&G. They are using advanced analytics to streamline their supply chain. This boosts operational efficiency and cuts costs. P&G aims to automate processes to reduce waste. In 2024, P&G invested heavily in AI and automation to improve its manufacturing processes.

Technological advancements in fuel efficiency offer P&G a chance to cut logistics expenses and lessen its environmental impact. The U.S. Department of Transportation reported that freight transportation accounted for 8.9% of total U.S. greenhouse gas emissions in 2023. By adopting fuel-efficient vehicles and optimizing routes, P&G can significantly lower its carbon footprint. This could lead to improved brand perception among environmentally conscious consumers and potential cost savings.

Innovation and Product Development

Procter & Gamble (P&G) heavily invests in research and development to stay ahead. They constantly improve existing products and launch new ones in growing markets. P&G's R&D spending reached $2.2 billion in fiscal year 2024. This investment drives innovation and strengthens their product portfolio.

- R&D spending: $2.2B (FY2024)

- Focus: Enhancing existing products.

- Goal: Meet changing consumer needs.

- Strategy: Introduce new products.

Digital Transformation and Technology Adoption

Procter & Gamble (P&G) is deeply invested in digital transformation, leveraging technologies like AI, IoT, and cloud computing. This strategy aims to boost efficiency and competitive advantage. P&G's digital investments are substantial, with over $2 billion spent annually on technology and digital capabilities. This includes e-commerce, which accounted for approximately 17% of total sales in 2024.

- AI is used for supply chain optimization, predicting consumer demand, and personalized marketing.

- IoT enhances product tracking and consumer engagement through smart packaging.

- Cloud-based solutions improve data management and operational agility.

- Big data analytics provides insights into consumer behavior and market trends.

P&G leverages technology extensively. Key areas include digital marketing, which drove a 15% e-commerce sales increase in 2024. Investments in AI and automation boost supply chain efficiency, with R&D spending hitting $2.2B in fiscal 2024. Digital transformation, including AI, IoT, and cloud, is a major focus.

| Technology Aspect | Implementation | Impact |

|---|---|---|

| E-commerce | Online platforms, digital marketing | 15% sales growth in 2024 |

| AI & Automation | Supply chain, manufacturing | Cost reduction, efficiency gains |

| R&D | Product innovation | $2.2B (FY2024) investment |

Legal factors

Increasing product safety regulations are crucial for Procter & Gamble. P&G must comply with diverse safety standards globally. This compliance involves major investments in testing and adherence. For instance, in 2024, P&G spent $2.5 billion on R&D, partly for safety.

The expansion of environmental protection regulations poses both challenges and chances for P&G. Compliance might be expensive, but it encourages innovation in sustainable practices and products. Recent data indicates that P&G has increased its investment in eco-friendly packaging and renewable energy sources by 15% in 2024. This shift aligns with growing consumer demand for environmentally responsible products.

P&G faces increasing regulations regarding sustainability, including non-financial reporting and due diligence. These regulations impact P&G's operations, demanding strategic alignment. For instance, the EU's Corporate Sustainability Reporting Directive (CSRD) requires extensive ESG disclosures. In 2024, P&G is actively working to meet these new requirements.

International Trade Laws and Intellectual Property Rights

Procter & Gamble (P&G) must adhere to international trade laws and intellectual property rights, vital for its global presence. This includes protecting its brands and patents across various markets. P&G's legal team navigates complex international regulations to ensure compliance. In 2024, P&G spent approximately $3 billion on legal and regulatory compliance, reflecting the importance of these factors.

- Trademark protection is crucial, with P&G holding over 200,000 trademarks worldwide.

- International trade disputes can impact P&G's supply chain and profitability.

- The company actively combats counterfeiting to safeguard its brand reputation.

Privacy and Data Protection Regulations

P&G faces strict data privacy regulations. GDPR in the EU and similar laws globally impact how they handle consumer data. Non-compliance can lead to hefty fines. They must secure consumer data to maintain trust and avoid legal issues.

- GDPR fines can reach up to 4% of annual global turnover.

- P&G's marketing heavily relies on data analytics.

P&G's legal landscape includes safety rules and environmental sustainability mandates, demanding global compliance, with a 2024 R&D spend of $2.5 billion. They handle complex trade laws, IPR, and global data privacy rules, spending around $3 billion on legal compliance. Strict adherence is crucial to protect trademarks and avoid significant financial penalties from non-compliance, particularly concerning data privacy.

| Area | Details | Impact |

|---|---|---|

| Product Safety | Adherence to safety regulations, globally. | $2.5B R&D (2024) on compliance |

| Environmental | Eco-friendly packaging; CSRD | 15% investment rise (2024) |

| Intellectual Property | Trademark protection; brand defense | Legal & compliance spend: $3B (2024) |

Environmental factors

Growing opposition to forest conversion, especially for oil palm, affects P&G's raw material sourcing. The company is under pressure regarding deforestation impacts. P&G aims for responsible sourcing, with a goal to achieve 100% sustainably sourced palm oil by 2025. In 2024, they reported 99% traceability to palm oil mills.

Changing weather patterns, including more frequent extreme events, pose risks to P&G's agricultural supply chains. This can lead to higher costs and reduced availability of raw materials. P&G needs to build supply chain resilience, potentially by diversifying sourcing locations. For example, in 2024, adverse weather contributed to a 5% increase in agricultural commodity prices globally.

The growing supply of recyclable materials offers P&G a chance to boost its sustainability efforts. This helps meet consumer demand for eco-friendly products. In 2024, the global recycling rate for plastics was about 9%, showing room for growth. P&G aims to use more recycled materials in packaging, boosting its brand image.

Commitment to Reducing Greenhouse Gas Emissions

Procter & Gamble (P&G) is heavily invested in cutting greenhouse gas emissions. They aim to boost energy efficiency and switch to renewable electricity sources. P&G's commitment is evident in its sustainability reports and targets. For instance, P&G has reduced its manufacturing GHG emissions by 52% since 2010.

- 2024: P&G aims for net-zero emissions by 2040.

- Renewable energy usage is a key focus.

- Significant investments in sustainable practices are ongoing.

- Supply chain emissions are also targeted for reduction.

Water Scarcity and Water Conservation Efforts

Water scarcity poses a significant environmental risk for Procter & Gamble, affecting its production and supply chain globally. P&G addresses this through water conservation initiatives, aiming to minimize water use in its manufacturing processes and promote responsible water usage by consumers. The company also supports water restoration projects in regions facing water stress. For example, P&G's water conservation efforts have led to a reduction in water consumption per unit of production by 25% from 2010 to 2023.

- Water scarcity is a growing global issue, with over 2 billion people living in water-stressed countries.

- P&G aims to reduce water consumption in its operations and during product use.

- The company invests in water restoration projects to support water-stressed areas.

- P&G's goal is to achieve net-zero water impact by 2030.

P&G faces environmental risks and opportunities regarding deforestation and sustainable sourcing, with 99% traceability to palm oil mills reported in 2024. Extreme weather and rising commodity prices, up 5% in 2024, demand supply chain resilience and diversification efforts. The growing availability of recyclables and a focus on reduced greenhouse gas emissions (52% reduction since 2010) underscore their commitment.

| Environmental Factor | Impact | P&G Strategy |

|---|---|---|

| Deforestation | Raw material sourcing risks | 100% sustainably sourced palm oil by 2025. |

| Climate Change | Higher costs, reduced availability | Diversify sourcing, build resilience |

| Recycling | Enhance sustainability | Use more recycled materials in packaging |

PESTLE Analysis Data Sources

The P&G PESTLE utilizes data from economic databases, government reports, market analyses, and industry publications to ensure accuracy and relevant insights.