AMSC Bundle

How has the AMSC company evolved?

Born from cutting-edge materials science research, the American Superconductor Corporation, or AMSC, embarked on a mission to revolutionize power delivery. Founded in 1987, its journey from a Massachusetts-based startup to a global technology innovator is a compelling story of innovation and resilience. Discover the AMSC history and its impact on the energy landscape.

This exploration into the brief AMSC history will uncover the pivotal moments that shaped the company. From its early focus on high-temperature superconductor wires to its current status as a provider of AMSC products for grid modernization and AMSC renewable energy solutions, understand the strategic decisions and technological advancements that have defined AMSC's trajectory in the AMSC wind energy sector.

What is the AMSC Founding Story?

The

AMSC company

story began on April 9, 1987. It was the brainchild of a team of MIT-affiliated visionaries. They were Gregory J. Yurek, Yet-Ming Chiang, David A. Rudman, and John B. Vander Sande.The

AMSC history

is rooted in the pioneering days of high-temperature superconductivity. The founders saw a chance to create materials that could transmit electricity far more efficiently than conventional copper wires. Gregory J. Yurek, a professor and material scientist at MIT, is credited with starting the company from his kitchen.Their initial business plan focused on producing high-temperature superconductor (HTS) wires. They also aimed to develop HTS-based motors and generators. A key early goal was to produce commercially viable superconducting cables. These cables were designed to reduce energy losses in electrical transmission. Early funding was secured through venture capital, with approximately $4.5 million raised before the initial public offering. This capital was essential for research, development, and the initial manufacturing of their HTS wires.

Here's a snapshot of the early days of

American Superconductor Corporation

.- Founded: April 9, 1987

- Founders: Gregory J. Yurek, Yet-Ming Chiang, David A. Rudman, and John B. Vander Sande

- Initial Focus: High-temperature superconductor (HTS) wires, motors, and generators

- Early Funding: Approximately $4.5 million in venture capital

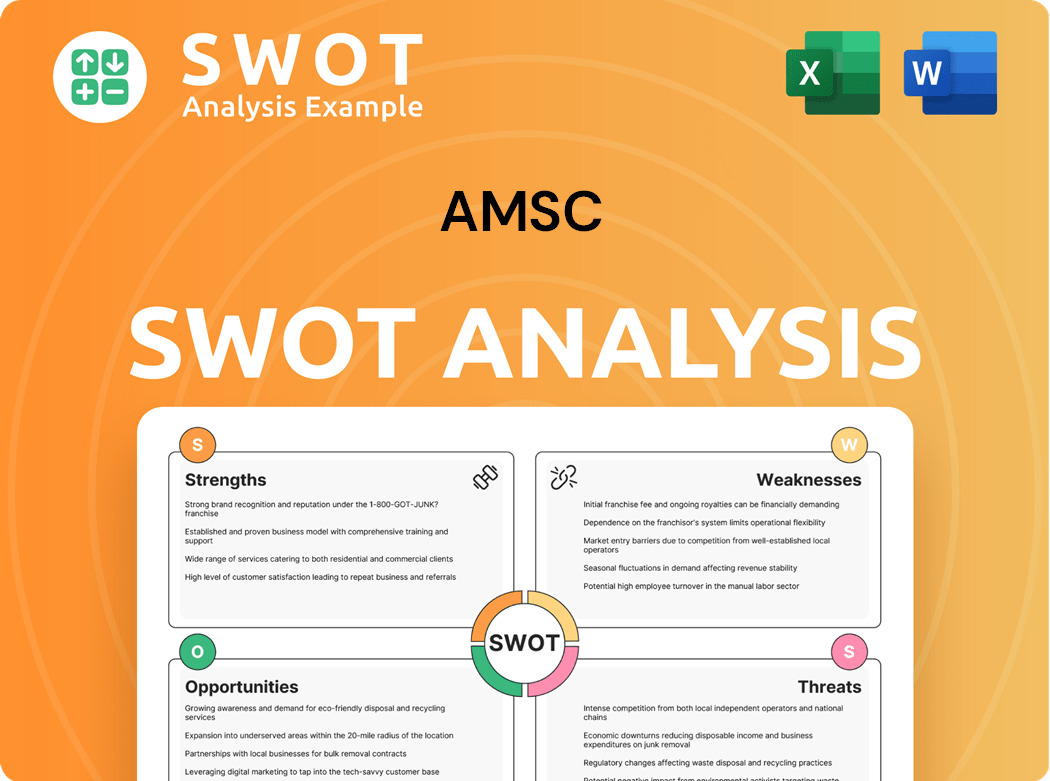

AMSC SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of AMSC?

The early growth of the AMSC company was marked by its Initial Public Offering (IPO) in 1991, which raised $36 million. This capital was crucial for research, development, and scaling manufacturing operations. Over the following years, the company strategically diversified its portfolio, expanding into new sectors and markets.

The IPO on NASDAQ in 1991 provided crucial funding. This initial funding of $36 million was instrumental in the early stages of the

The acquisition of Windtec GmbH in 2007 was a pivotal moment. This strategic move marked AMSC's entry into the

AMSC expanded its geographical footprint significantly. Operations were established in Asia, Australia, Europe, and North America. This expansion increased the company's market reach and diversified its customer base.

In August 2024, the acquisition of NWL Inc. for $56.4 million was finalized. This added approximately $55 million in annual revenue. Q2 fiscal year 2024 revenues surged by 60% year-over-year to $54.5 million, largely due to the NWL acquisition and increased shipments of new energy power systems. As of December 31, 2024, AMSC's cash, cash equivalents, and restricted cash totaled $80.0 million.

AMSC PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in AMSC history?

The AMSC history is marked by significant achievements in the power systems and renewable energy sectors. The company has consistently pushed the boundaries of technology, leading to advancements in grid solutions and superconductor applications. These milestones underscore AMSC's commitment to innovation and its impact on the energy industry.

| Year | Milestone |

|---|---|

| 1987 | Founded as American Superconductor Corporation, focusing on superconductor technology. |

| 2000s | Expanded into wind energy and grid solutions, developing AMSC wind turbine technology and power grid technology. |

| 2010s | Navigated the Sinovel crisis and restructured its business model, diversifying its market focus. |

| 2017 | Announced plans to reduce operating costs and optimize manufacturing capacity through strategic shifts. |

| 2024 | Achieved profitability for the third consecutive quarter in Q4, with net income exceeding $1.2 million. |

AMSC has been at the forefront of innovation, especially in the realm of power systems. Its Resilient Electric Grid (REG) systems and ship protection technologies are notable examples of its expertise.

AMSC's Resilient Electric Grid (REG) systems enhance grid reliability and efficiency. These systems are vital for modernizing power networks and integrating renewable energy sources.

AMSC's technologies protect ships, leveraging its superconductor and power electronics knowledge. These technologies improve the safety and operational capabilities of maritime vessels.

The company holds patents for its electronic control systems, which are integral to its grid solutions. These systems boost the performance of both renewable and conventional power systems.

AMSC's software-driven grid solutions enhance grid management and optimization. These solutions are key to improving the efficiency and reliability of power networks.

AMSC utilizes advanced materials in its applications, improving the performance of its AMSC products. These materials are crucial for the company's innovations in power systems.

AMSC's solutions are designed to facilitate the integration of renewable energy sources. The company's technology supports the global transition to sustainable energy.

Despite its successes, the

The Sinovel crisis exposed vulnerabilities related to customer concentration and intellectual property. This event prompted a strategic shift towards diversification.

Historically, AMSC has encountered operating losses, impacting its financial performance. The company has worked to improve its financial stability.

AMSC has often required additional capital to fund its operations and expansion. Securing capital has been a recurring challenge.

The company has faced relatively high operational costs, affecting its profitability. Efforts to streamline operations have been crucial.

AMSC has been affected by market fluctuations in the renewable energy sector. Adapting to market changes is key to its success.

The company faces competition in the power systems and renewable energy markets. Staying competitive requires continuous innovation and strategic positioning.

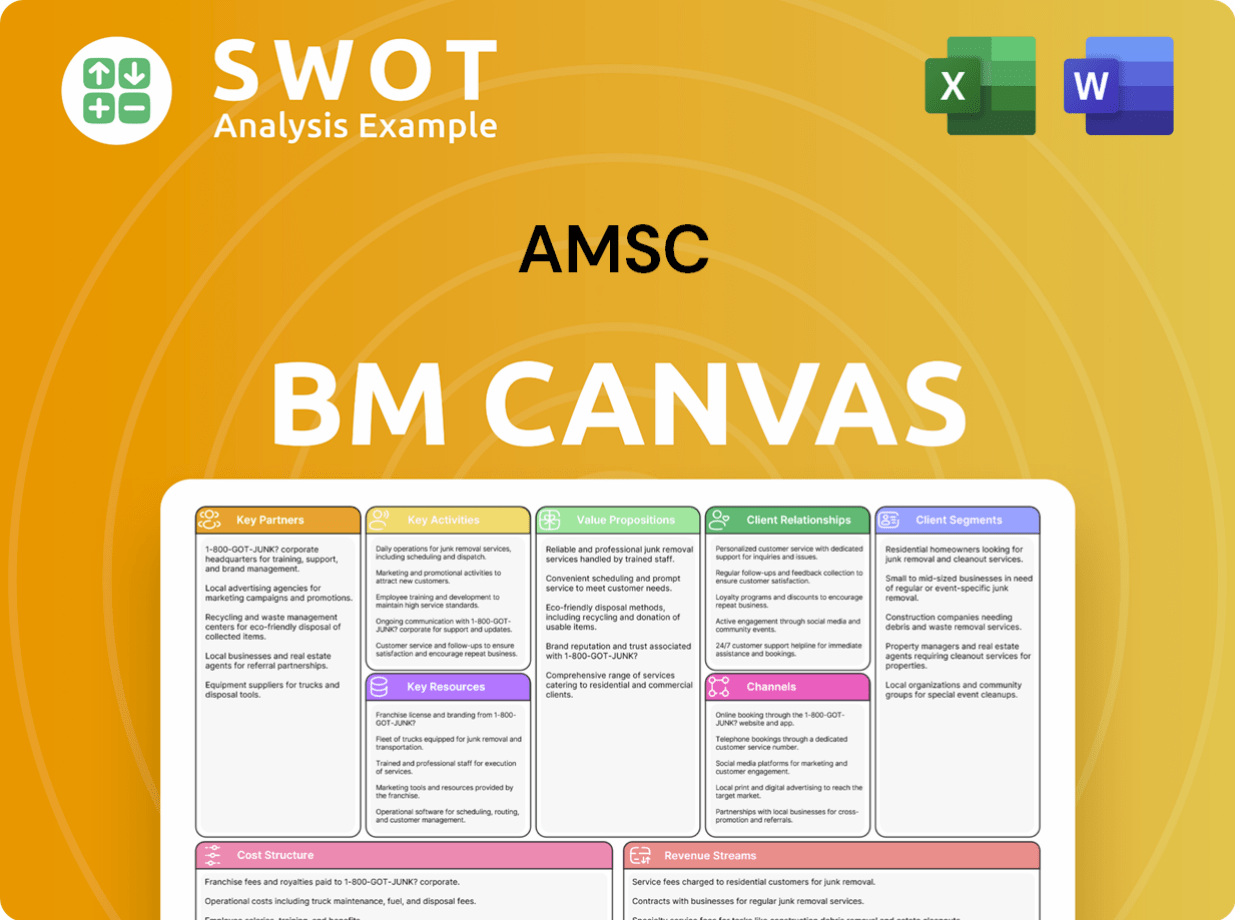

AMSC Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for AMSC?

The AMSC company, also known as American Superconductor Corporation, has a rich

| Year | Key Event |

|---|---|

| April 9, 1987 | AMSC (American Superconductor Corporation) is founded in Westborough, Massachusetts. |

| 1991 | AMSC completes its Initial Public Offering (IPO) on NASDAQ, raising $36 million. |

| 2006 | Daniel McGahn joins AMSC to expand into new markets. |

| 2007 | AMSC acquires Windtec GmbH, diversifying into the renewable energy sector. |

| 2009 | Daniel McGahn is promoted to President and COO. |

| 2011 | The Sinovel crisis begins, leading to a strategic shift towards diversification. |

| March 24, 2015 | The company executes a 10-for-1 reverse stock split. |

| April 2017 | AMSC announces plans to reduce operating costs and optimize manufacturing capacity. |

| August 2024 | AMSC finalizes the acquisition of NWL Inc. for $56.4 million. |

| Q2 Fiscal Year 2024 (ending September 30, 2024) | Revenues increase by 60% year-over-year to $54.5 million; net income reaches $4.9 million. |

| Q3 Fiscal Year 2024 (ending December 31, 2024) | Revenues reach $61.4 million, a 56% increase year-over-year; net income is $2.5 million. |

| Q4 Fiscal Year 2024 (ending March 31, 2025) | Revenues are $66.7 million, up 59% year-over-year; net income is $1.2 million, marking the third consecutive quarter of profitability. |

| Fiscal Year 2024 (ending March 31, 2025) | Full fiscal year revenue reaches $222.8 million, a 53% increase year-over-year; net income is $6.0 million. |

| Q1 Fiscal Year 2025 (ending June 30, 2025) | AMSC projects revenues between $64.0 million and $68.0 million, with net income expected to exceed $1.0 million. |

AMSC is focused on grid modernization and renewable energy expansion. The company anticipates significant growth in various sectors, including potential triple-digit million dollar orders in the semiconductor sector. The CEO, Daniel McGahn, emphasizes innovation and growth for a better future.

Analyst predictions forecast a significant revenue growth of 49% in fiscal year 2025. AMSC's strong order backlog, which was nearly $320 million at the end of fiscal year 2024, supports this growth. The company’s Q1 Fiscal Year 2025 projects revenues between $64.0 million and $68.0 million.

AMSC's long-term strategy includes broadening its offerings, entering new sectors, and strengthening customer relationships. The company is committed to delivering smarter, cleaner, and more efficient energy solutions globally. This approach aligns with the company's founding vision.

Fiscal Year 2024 (ending March 31, 2025) saw full fiscal year revenue reach $222.8 million, a 53% increase year-over-year, with a net income of $6.0 million. Q4 Fiscal Year 2024 (ending March 31, 2025) revenues were $66.7 million, up 59% year-over-year.

AMSC Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of AMSC Company?

- What is Growth Strategy and Future Prospects of AMSC Company?

- How Does AMSC Company Work?

- What is Sales and Marketing Strategy of AMSC Company?

- What is Brief History of AMSC Company?

- Who Owns AMSC Company?

- What is Customer Demographics and Target Market of AMSC Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.