AMSC Bundle

Who Buys AMSC's Power Solutions?

In the rapidly evolving energy sector, understanding the AMSC SWOT Analysis is crucial for any investor or strategist. AMSC, a leader in power systems, has seen its customer base transform. This shift reflects the dynamic nature of the energy market and the company's strategic adaptability.

This exploration into the customer demographics and target market of the AMSC company will provide a detailed customer profile, offering insights crucial for informed market analysis and effective business strategy. We'll examine the evolving needs of their customers, from wind energy to grid resilience, helping you understand the company's approach to serving these critical segments. Understanding the target market is key to grasping AMSC's success in fiscal year 2024 and its future trajectory.

Who Are AMSC’s Main Customers?

Understanding the Marketing Strategy of AMSC involves a deep dive into its customer demographics and target market. AMSC primarily operates in the business-to-business (B2B) sector, focusing on enhancing the performance and efficiency of electric power infrastructure. This strategic focus allows AMSC to target specific segments with tailored solutions, driving growth and market penetration.

The company's customer base is diverse, including electric utilities, wind turbine manufacturers, industrial facilities, and government entities. Each segment has unique needs, which AMSC addresses through its specialized products and services. This approach enables AMSC to maintain a strong market position and adapt to evolving industry demands. The company's ability to serve various sectors highlights its versatile business strategy.

AMSC's customer segmentation strategy is crucial for its success. By focusing on these key segments, AMSC can tailor its products and services to meet specific needs. This targeted approach allows for more effective marketing, sales, and customer relationship management, contributing to enhanced profitability and market share.

Electric utilities are a core customer segment for AMSC, seeking grid modernization solutions to improve reliability and integrate renewable energy. The global smart grid market was valued at approximately $29.9 billion in 2024, indicating a significant market opportunity for AMSC's offerings. AMSC provides technologies that help utilities manage and optimize power distribution.

Wind turbine manufacturers, such as Inox Wind Limited, rely on AMSC for electrical control systems (ECS) and wind turbine designs. The global wind turbine market was valued at around $80 billion in 2024. AMSC's solutions enhance the efficiency and performance of wind turbines, supporting the growth of renewable energy.

Industrial facilities represent a crucial customer base, requiring stable and high-quality power to reduce downtime and boost efficiency. Demand from this sector for grid solutions increased by 15% in 2024. AMSC's offerings help industrial clients maintain reliable power supplies, supporting their operational needs.

The government and defense sector, with the U.S. Navy as a key client, is vital for AMSC. U.S. defense spending is projected to exceed $886 billion in 2024. AMSC provides solutions for ship protection and advanced power systems, securing a stable revenue stream through defense contracts.

AMSC has strategically expanded its target segments through acquisitions and organic growth. The acquisition of NWL Inc. in August 2024 for $56.4 million bolstered its military and industrial power supply capabilities. This acquisition added $55 million in annual revenue, contributing to AMSC's financial performance.

- The New Energy Power Systems (NEPS) division has also seen organic growth, contributing to the company's profitability.

- AMSC achieved its third consecutive quarter of profitability and seventh consecutive quarter of positive operating cash flow in fiscal year 2024.

- Total year-end orders reached a record of nearly $320 million, reflecting robust demand and a diversified order pipeline.

- These achievements highlight the effectiveness of AMSC's customer segmentation and market strategies.

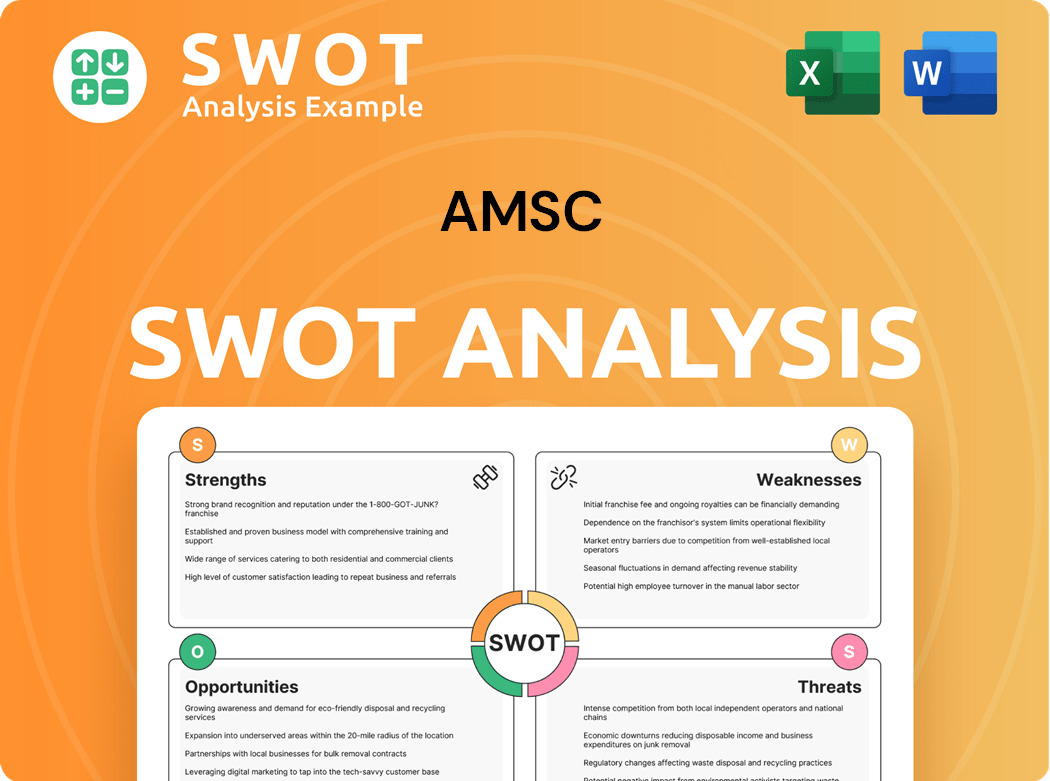

AMSC SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do AMSC’s Customers Want?

Understanding the customer needs and preferences is crucial for the success of the Growth Strategy of AMSC. The company's customer base spans various sectors, each with distinct requirements. This customer segmentation is driven by the need for reliable, efficient, and high-performing power solutions.

For electric utilities, the primary focus is on enhancing grid stability and integrating renewable energy sources. Wind turbine manufacturers prioritize solutions that reduce the cost of wind energy. Industrial customers, on the other hand, seek reliable power quality to minimize downtime. The U.S. Navy and other government entities require specialized, robust systems for naval fleets.

AMSC addresses these diverse needs through its Gridtec, Windtec, and Marinetec solutions. These offerings are designed to meet the specific demands of each customer segment, ensuring optimal performance and efficiency. Market trends and strategic acquisitions, like the NWL Inc. acquisition in August 2024, further enhance AMSC's ability to serve its target markets.

Electric utilities are a significant part of AMSC's customer demographics. They need advanced grid systems for enhancing grid stability. They are motivated by the need to optimize network reliability and integrate renewable energy sources.

Wind turbine manufacturers are another key segment. They prioritize solutions that reduce the cost of wind energy. They focus on improved turbine efficiency and streamlined deployment.

Industrial customers, including factories, require reliable power quality. They need to minimize downtime and maximize operational efficiency. Their preferences lean towards power quality technology for stable power delivery.

The government and defense sector, particularly the U.S. Navy, is a crucial market. They focus on increasing operational safety and enhancing power quality. They require highly specialized and robust systems.

Gridtec Solutions provide advanced grid systems and engineering services. They are designed to optimize network reliability and performance. These solutions directly address the needs of electric utilities.

Windtec Solutions offer electronic controls and designs. They are aimed at reducing the cost of wind energy. They align with manufacturers' efficiency goals.

Market analysis reveals the increasing demand for grid solutions. The demand for grid solutions from the industrial sector increased by 15% in 2024. Strategic acquisitions, such as NWL Inc. in August 2024, have bolstered AMSC's capabilities. This acquisition expanded its offerings in military and industrial power supply, improving its ability to meet the needs of its target market.

- The customer demographics of AMSC include electric utilities, wind turbine manufacturers, industrial customers, and the government/defense sector.

- AMSC's target market is defined by the specific needs of each sector, such as grid stability for utilities and cost reduction for wind energy companies.

- AMSC's solutions, including Gridtec, Windtec, and Marinetec, are tailored to meet these needs.

- Market trends and acquisitions like NWL Inc. are crucial in shaping AMSC's ability to serve its customer base effectively.

AMSC PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does AMSC operate?

The global geographical market presence of the AMSC company is substantial, with operations extending across Asia, Australia, Europe, and North America. The company's headquarters are located near Boston, Massachusetts, in the United States. Its solutions are deployed in power networks in over a dozen countries, supporting gigawatts of renewable energy worldwide. This broad reach highlights its commitment to serving diverse markets and its ability to adapt to regional demands.

North America, especially the U.S., is a critical market for AMSC, particularly due to its strong engagement with the U.S. Navy for ship protection systems and advanced power solutions. The acquisition of NWL Inc. in August 2024 further solidified AMSC's position in the military and industrial power supply sectors within the U.S. This strategic move enhanced its capabilities and market reach within a key geographical area.

While specific market share percentages by region aren't readily available, AMSC's financial performance indicates a robust and diversified market presence. For instance, fiscal year 2024 revenues reached $222.8 million, and the order pipeline was nearly $320 million, demonstrating strong market traction. The company actively localizes its offerings and partnerships to succeed in diverse markets. Its strategic growth initiatives for fiscal year 2025 include broadening its offerings and entering new sectors, suggesting continued expansion and adaptation to regional market dynamics.

AMSC's primary markets include North America, Asia, Australia, and Europe. These regions represent significant opportunities for its advanced power solutions and ship protection systems. The company's focus on these areas is supported by its financial results and strategic initiatives.

The U.S. is a crucial market for AMSC, particularly due to its work with the U.S. Navy and its acquisition of NWL Inc. in 2024. This focus strengthens its position in the military and industrial power supply sectors. The company’s presence in the U.S. is a key component of its business strategy.

AMSC's solutions are deployed in power networks across over a dozen countries, supporting gigawatts of renewable energy. This global deployment highlights the company's ability to serve diverse markets and its commitment to sustainable energy solutions. Its international presence is a key aspect of its market strategy.

In fiscal year 2024, AMSC reported revenues of $222.8 million. The company's robust order pipeline, valued at nearly $320 million, indicates strong market demand. These figures reflect the company’s financial health and its ability to secure significant contracts.

AMSC's strategic growth initiatives for fiscal year 2025 include broadening its offerings and entering new sectors. This expansion strategy aims to capitalize on emerging market opportunities and adapt to regional market dynamics. The company is actively pursuing growth in various areas.

AMSC actively localizes its offerings and partnerships to succeed in diverse markets. Collaborations with companies like Inox Wind Limited demonstrate its commitment to tailoring its solutions. This approach helps the company to meet the specific needs of various regions.

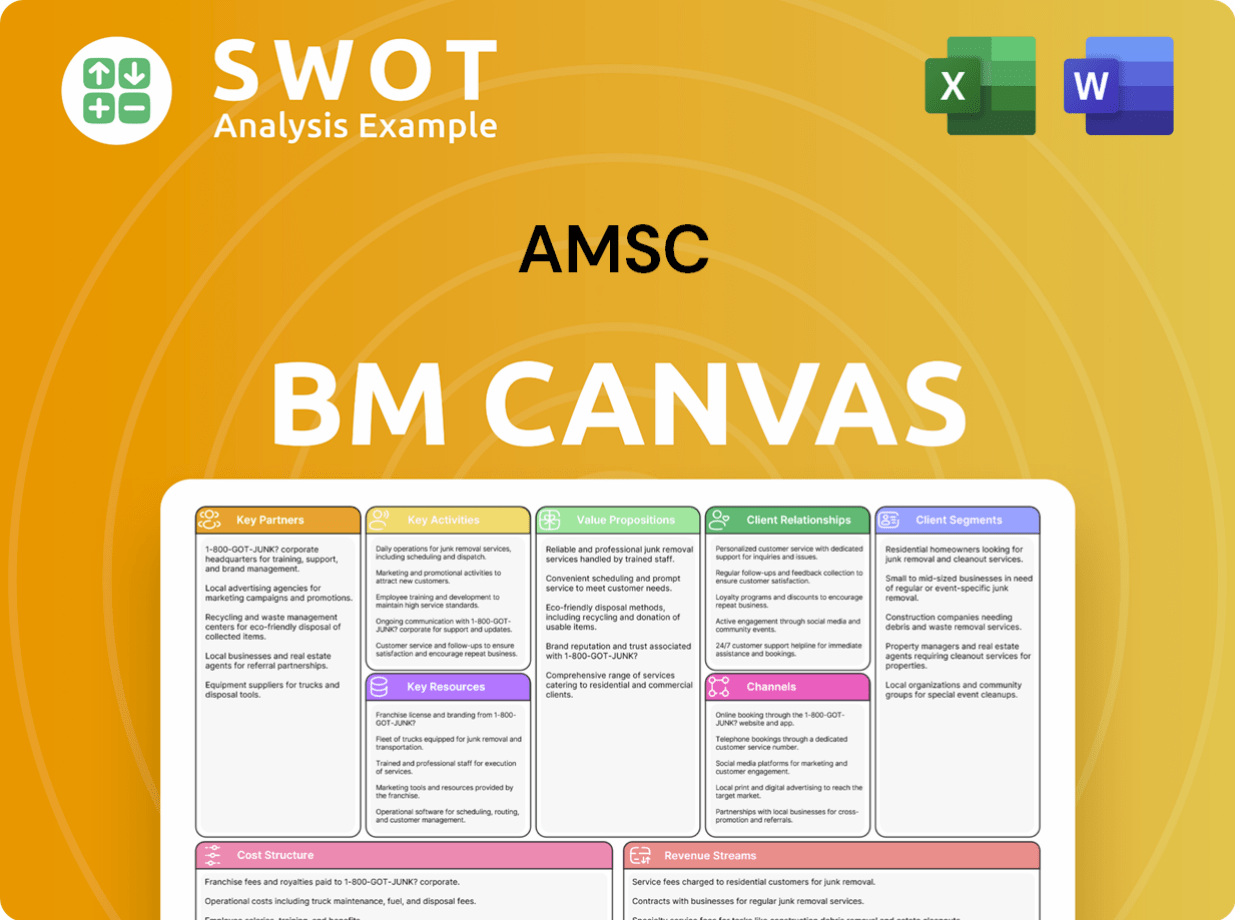

AMSC Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does AMSC Win & Keep Customers?

The company, with its focus on advanced power systems and grid solutions, employs a multi-faceted approach to customer acquisition and retention. This strategy centers on providing tangible benefits to energy providers and industrial manufacturers through its specialized technologies. The company's offerings, categorized under Gridtec™, Windtec™, and Marinetec™, aim to optimize performance, reliability, and efficiency, which are key drivers in attracting and retaining customers.

Customer acquisition is heavily influenced by demonstrating the value of its technology. For instance, the ability to reduce the cost of wind energy or enhance the operational safety of naval fleets showcases the direct benefits of using their products. Strategic partnerships are also crucial, enabling the company to combine its strengths with those of various entities, including utilities and research institutions. In fiscal year 2024, the company secured nearly $320 million in new orders, indicating strong customer demand and successful acquisition efforts.

Customer retention is fostered through long-term contracts and a focus on expanding offerings in growing end markets. The company's financial performance, including consistent positive operating cash flow, reaching $6.3 million in Q4 fiscal year 2024, reflects strong operational execution and customer satisfaction. Investor relations activities, such as regular financial results announcements, also contribute to transparency and build customer trust, supporting retention efforts.

Partnerships with entities like utilities, equipment manufacturers, and research institutions are vital for market access and product development. These collaborations allow the company to combine its strengths with those of other industry leaders. For example, the company secured $15 million in new orders in 2024 through partnerships with utility companies for Gridtec™ solutions.

The acquisition of NWL Inc. in August 2024, which added $55 million in annual revenue, is a key acquisition strategy. This move directly expands the company's customer base and offerings, particularly in military and industrial power supply capabilities. This acquisition is a significant step in expanding its market reach.

Long-term contracts with manufacturers and utilities are essential for ensuring a steady income stream and enduring business relationships. These agreements provide stability and contribute to customer retention. This approach is crucial for maintaining a consistent revenue flow.

The company's focus on strengthening customer relationships and expanding its offerings in growing end markets contributes to retention. This strategy helps to ensure sustained demand for their products and services. This focus is vital for long-term growth and stability.

The company's financial performance, including consistent positive operating cash flow, is crucial for customer retention. Investor relations activities, like regular financial results announcements, enhance transparency and build trust. This approach helps to maintain strong relationships with stakeholders.

- Positive operating cash flow for seven consecutive quarters, reaching $6.3 million in Q4 fiscal year 2024.

- Secured nearly $320 million in new orders in fiscal year 2024, indicating robust demand.

- The company's financial results announcements and conference calls support transparency.

Understanding the Brief History of AMSC helps to understand the company’s evolution and its strategies for acquiring and retaining customers.

AMSC Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of AMSC Company?

- What is Competitive Landscape of AMSC Company?

- What is Growth Strategy and Future Prospects of AMSC Company?

- How Does AMSC Company Work?

- What is Sales and Marketing Strategy of AMSC Company?

- What is Brief History of AMSC Company?

- Who Owns AMSC Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.