AMSC Bundle

How Does the AMSC Company Power the Future?

American Superconductor (AMSC) is reshaping the global energy landscape with cutting-edge power solutions, driving efficiency and reliability across the grid. Witnessing a remarkable 53% revenue surge in fiscal year 2024, AMSC demonstrates its crucial role in meeting escalating energy demands. But how does this AMSC SWOT Analysis reveal the inner workings of this energy innovator?

AMSC's impact extends from wind energy to grid solutions, offering vital support for renewable energy integration and modernizing aging infrastructure. Understanding the AMSC company's operations is essential for anyone tracking technological advancements and investment opportunities in the evolving energy sector. This detailed analysis will explore how AMSC generates value, its strategic initiatives, and its position in a competitive market, providing insights into what American Superconductor does.

What Are the Key Operations Driving AMSC’s Success?

The American Superconductor (AMSC) company operates primarily in two key segments: Grid and Wind. These segments are designed to provide solutions for the efficient and reliable transmission and distribution of power, as well as support the wind energy sector. AMSC's core business revolves around leveraging its proprietary technologies to enhance grid stability and improve the performance of wind turbines.

In Q4 FY2024, the Grid segment accounted for a significant portion of AMSC's revenue, approximately 84% of the total. This segment focuses on providing electric utilities and renewable energy developers with advanced solutions. The Wind segment, which contributed 16% of the total revenue in Q4 FY2024, supports wind turbine manufacturers with electrical control systems and engineering services.

AMSC's value proposition lies in its ability to offer innovative solutions that address critical challenges in the energy sector. The company's technologies aim to reduce power losses, improve grid performance, and optimize renewable energy generation. AMSC's commitment to innovation and its strategic acquisitions, such as NWL, Inc., further strengthen its market position and expand its product offerings.

AMSC's Grid segment provides solutions like D-VAR and NEPSI systems to improve grid stability and power quality. These solutions involve extensive engineering and project management tailored to specific customer needs. Critical Power Solutions, such as PQ-IVR and D-VAR VVO systems, offer modular STATCOMs for industrial applications.

The Wind segment supports wind turbine manufacturers with advanced electrical control systems and engineering services. This involves close collaboration on design and efficient supply chain management to reduce the cost of wind energy. AMSC's technologies help optimize wind turbine performance.

AMSC's core technologies include advanced power electronics and superconductor-based systems. These technologies enable high-density current transmission with minimal losses, enhancing grid efficiency and reliability. The acquisition of NWL, Inc. expanded AMSC's product offerings into industrial and military power supplies.

- Enhanced grid performance through D-VAR and NEPSI systems.

- Reduced power losses and improved efficiency.

- Improved operational safety for naval fleets.

- Optimized renewable energy generation through advanced control systems.

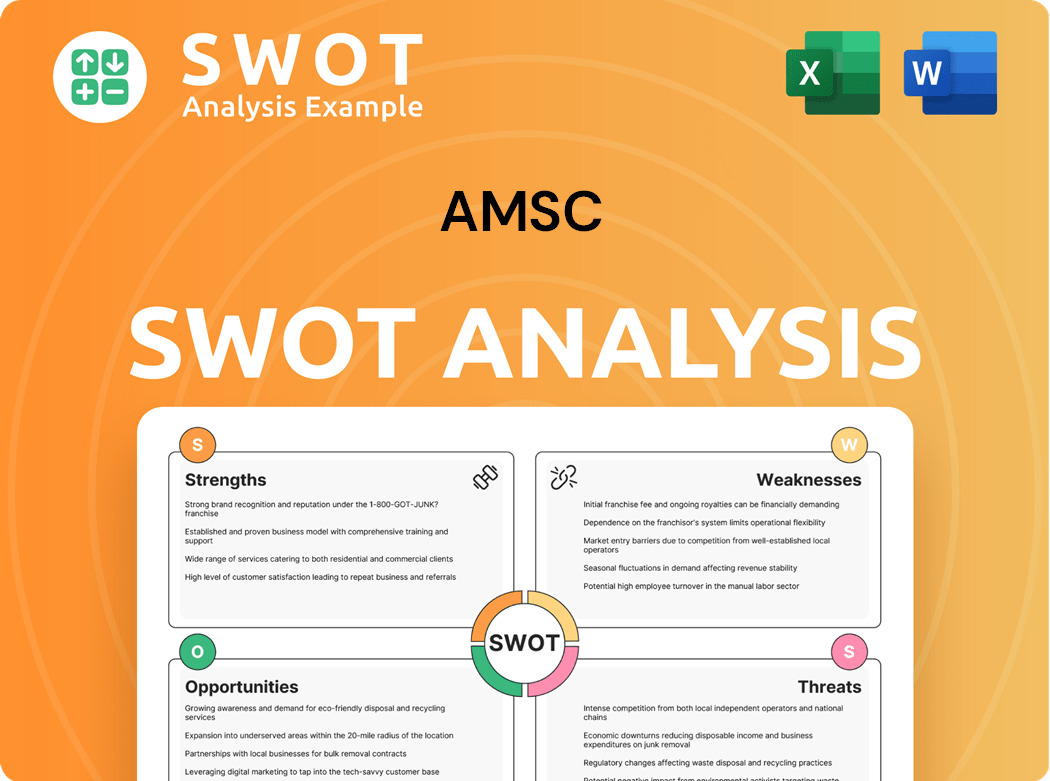

AMSC SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does AMSC Make Money?

The revenue streams and monetization strategies of the American Superconductor (AMSC) company are primarily centered around its advanced power systems and related services. AMSC's business model is diversified across two main segments: Grid and Wind. The Grid segment focuses on solutions for grid resilience and power quality, while the Wind segment provides electrical control systems and components for wind turbines.

For fiscal year 2024, AMSC reported total revenue of $222.8 million, a significant increase of 53% compared to $145.6 million in fiscal year 2023. The Grid segment was the major revenue driver, accounting for 84% of the total revenue in Q4 FY2024. The Wind segment contributed 16% of the total revenue during the same period.

AMSC projects revenues to be between $64.0 million and $68.0 million for the first quarter ending June 30, 2025. The monetization strategies for its grid solutions are largely project-based, reflecting the customization of systems like D-VAR and Resilient Electric Grid (REG) systems. In the wind sector, revenue comes from electrical control systems, components, and licensing agreements for wind turbine designs. The acquisition of NWL, Inc. has been a key factor in recent revenue growth, expanding AMSC's reach into industrial and military power supplies.

AMSC's financial performance shows a strong operational base. The company has maintained consistent positive operating cash flow for seven consecutive quarters, with $28.3 million reported for the full fiscal year 2024. This indicates effective financial management and a stable operational foundation. The company's approach involves expanding its product portfolio and market presence, as noted by CEO Daniel McGahn, suggesting a strategy to deepen penetration within its target sectors.

- The Grid segment accounted for 84% of total revenue in Q4 FY2024, driven by solutions like D-VAR and NEPSI systems.

- The Wind segment contributed 16% of the total revenue in Q4 FY2024.

- AMSC's focus on expanding its product portfolio and market presence suggests a strategy of deepening penetration within its target sectors.

- The acquisition of NWL, Inc. has been a significant factor in recent revenue growth, expanding AMSC's reach into industrial and military power supplies.

AMSC PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped AMSC’s Business Model?

The AMSC company has achieved several key milestones that have significantly influenced its operational and financial results. A notable strategic move was the acquisition of NWL, Inc. in August 2024, which immediately boosted revenue and expanded market reach into the industrial and military power supply sectors. This acquisition is set to strengthen AMSC's presence in the military, particularly with the U.S. Navy and Department of Defense.

The company has demonstrated strong financial performance, reporting its third consecutive quarter of GAAP profitability and its seventh consecutive quarter of non-GAAP profitability in Q4 FY2024. Total revenue for fiscal year 2024 increased by 53% year-over-year to $222.8 million, with Q4 FY2024 revenue reaching $66.7 million, up nearly 60% year-over-year. AMSC also secured $75 million in new orders in Q4 FY2024, bringing total year-end orders to a recent record of nearly $320 million, and its 12-month backlog grew to over $200 million.

Despite facing operational challenges like supply chain disruptions and reliance on key customers, AMSC continues to focus on innovation and growth, emphasizing its commitment to developing advanced power solutions. Its competitive advantages stem from its technology leadership in power electronics and superconductor-based systems, offering unique solutions for grid stability and renewable energy integration. The company's D-VAR and NEPSI solutions are key differentiators, providing megawatt-scale power resiliency. To learn more about the company's ownership, you can check out Owners & Shareholders of AMSC.

The acquisition of NWL, Inc. in August 2024 was a pivotal strategic move that immediately contributed to revenue growth. AMSC has achieved its third consecutive quarter of GAAP profitability and seventh consecutive quarter of non-GAAP profitability in Q4 FY2024.

The acquisition of NWL, Inc. expanded AMSC's market reach into industrial and military power supply sectors. The company is focusing on innovation and growth, particularly in developing advanced power solutions to address market demands.

Technology leadership in power electronics and superconductor-based systems provides unique solutions for grid stability. D-VAR and NEPSI solutions are key differentiators, offering megawatt-scale power resiliency.

Total revenue for fiscal year 2024 increased by 53% year-over-year to $222.8 million. Q4 FY2024 revenue reached $66.7 million, up nearly 60% year-over-year. The company secured $75 million in new orders in Q4 FY2024.

Operational challenges include potential supply chain disruptions and reliance on a few key customers. Despite these, AMSC focuses on innovation and growth, particularly in grid solutions and renewable energy. The company is adapting to new trends, such as the increasing demand for grid resiliency and investments in domestic semiconductor manufacturing.

- Supply chain management is crucial to mitigate risks.

- Diversifying customer base can reduce dependence on a single customer.

- Innovation in grid solutions and renewable energy is a key focus.

- Adaptation to market trends like data centers and semiconductor manufacturing is important.

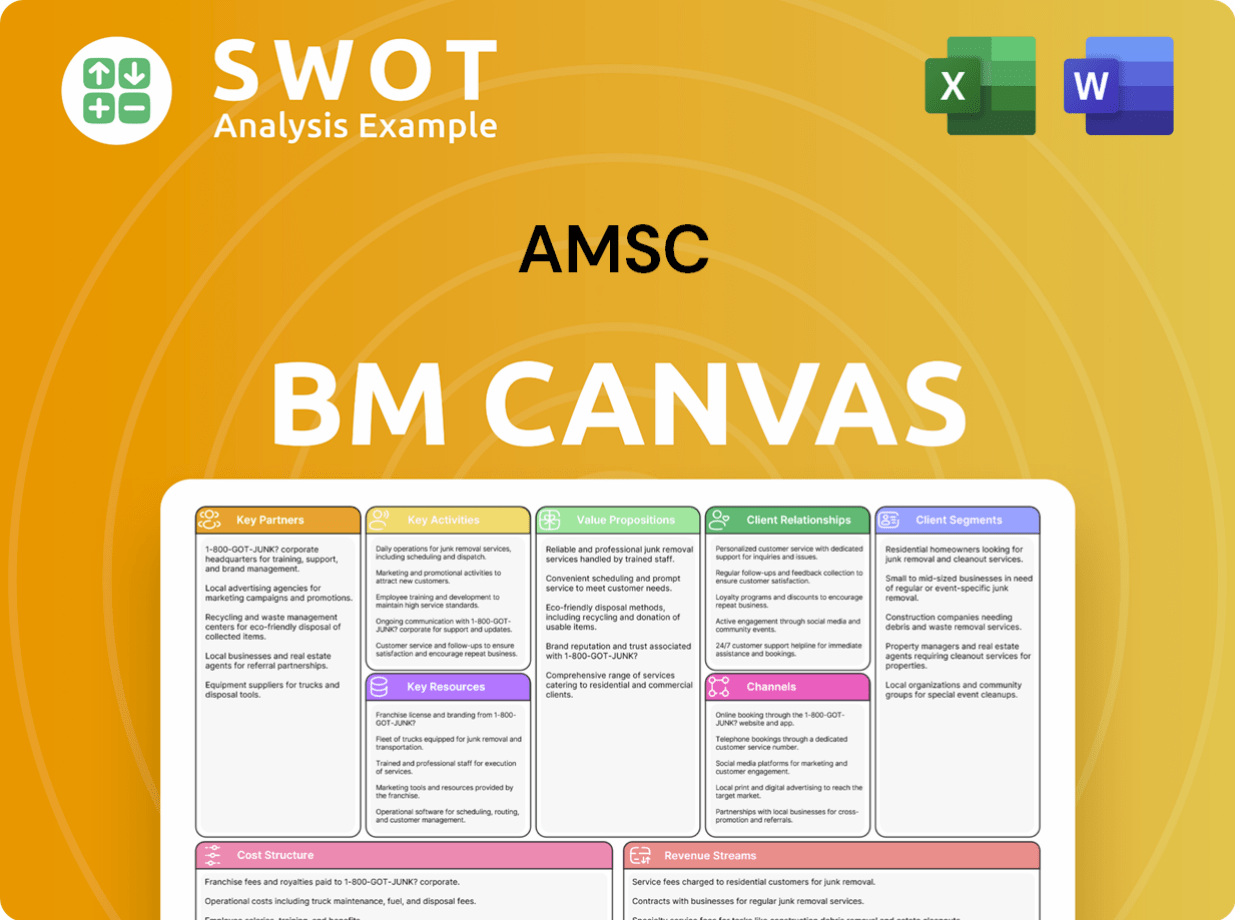

AMSC Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is AMSC Positioning Itself for Continued Success?

The AMSC company holds a distinct position in the power systems and grid solutions sector. It specializes in advanced power electronics and superconducting technology. While not as large as companies like Siemens Gamesa or General Electric, AMSC's focused approach allows for deep expertise in grid modernization, renewable energy integration, and critical power solutions.

Key risks for AMSC include supply chain disruptions, intellectual property infringement, and reliance on key customers, particularly in the wind business. Macroeconomic pressures like inflation and interest rate fluctuations, along with regulatory changes, could impact profitability. Dependence on government contract funding also presents a risk.

AMSC's specialization in advanced power electronics and superconducting technology sets it apart. The company focuses on grid modernization, renewable energy integration, and critical power solutions. The fiscal year 2024 revenue was $222.8 million, with a significant increase in orders.

Potential risks include supply chain disruptions and intellectual property infringement. Reliance on key customers, particularly in the wind business, is a concern. Macroeconomic pressures and regulatory changes also pose challenges.

AMSC is positioned to benefit from the reshoring of domestic industrial production. Increased demand for grid resiliency in the renewable energy sector and investments in domestic semiconductor manufacturing are also tailwinds. For Q1 FY2025, revenue is projected between $64 million and $68 million.

Analysts forecast a 49% revenue growth for AMSC in fiscal year 2025. The company aims to sustain and expand profitability through innovation in Resilient Electric Grid (REG) systems and ship protection technologies. The order backlog was nearly $320 million at the end of fiscal 2024.

AMSC is broadening its offerings and entering new sectors to strengthen customer relationships. The company's focus on innovation in REG systems and ship protection technologies contributes to a more resilient and sustainable energy infrastructure. The company's net income is expected to exceed $1 million in Q1 FY2025.

- Broadening offerings to enter new sectors.

- Strengthening customer relationships.

- Continued innovation in REG systems.

- Focus on ship protection technologies.

AMSC Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of AMSC Company?

- What is Competitive Landscape of AMSC Company?

- What is Growth Strategy and Future Prospects of AMSC Company?

- What is Sales and Marketing Strategy of AMSC Company?

- What is Brief History of AMSC Company?

- Who Owns AMSC Company?

- What is Customer Demographics and Target Market of AMSC Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.