AMSC Bundle

Can AMSC Revolutionize the Energy Sector?

AMSC, a key player in power systems and grid solutions, is navigating the dynamic energy sector with a laser focus on growth. From its inception in 1987, AMSC has evolved significantly, shifting its strategic focus to grid resilience and renewable energy integration, particularly in the burgeoning wind energy market. This evolution highlights the company's adaptability and its commitment to addressing the growing global demand for sustainable and reliable power solutions.

This AMSC SWOT Analysis offers a comprehensive look at the company's strengths and weaknesses, as well as the opportunities and threats it faces. Understanding the AMSC growth strategy is crucial for investors and analysts alike, as it directly impacts the AMSC future prospects and overall AMSC company analysis. Furthermore, we will delve into AMSC's market position, examining its financial performance and the drivers behind its revenue growth within the renewable energy sector, alongside its technology advancements and strategic partnerships.

How Is AMSC Expanding Its Reach?

The expansion initiatives undertaken by AMSC are central to its AMSC growth strategy. These initiatives are designed to capitalize on the increasing global demand for grid resilience and renewable energy integration, driving the company's AMSC future prospects. The company's approach involves a multi-faceted strategy, including entering new markets, diversifying its product offerings, and forming strategic partnerships to strengthen its market position.

A significant aspect of AMSC's expansion strategy involves continued penetration into the wind energy market. This is achieved primarily through its D-VAR® and NEPSI solutions. These solutions are designed to improve grid stability and power quality for wind farms. The company is actively seeking opportunities in both established and emerging wind energy markets, focusing on regions with substantial renewable energy infrastructure development. This strategic focus is crucial for enhancing its AMSC financial performance.

Furthermore, AMSC is broadening its product categories beyond traditional power quality solutions. This includes the development of more comprehensive grid hardening technologies, such as advanced fault current limiters and other grid-enhancing devices. These innovations are aimed at addressing the challenges associated with aging grid infrastructure and the integration of distributed energy resources. This diversification is a key element of the AMSC company analysis.

AMSC is expanding its presence in the wind energy market by leveraging its D-VAR® and NEPSI solutions. These solutions are designed to enhance grid stability and power quality. This strategy is critical for capitalizing on the growth in the AMSC wind energy market.

The company is diversifying its product offerings to include more grid-hardening technologies. This includes advanced fault current limiters and other grid-enhancing devices. This diversification helps mitigate reliance on any single market and aligns with evolving industry requirements.

AMSC is actively pursuing strategic partnerships to accelerate its growth and market reach. These partnerships are essential for expanding its customer base and enhancing its technological capabilities. These partnerships are vital for AMSC strategic partnerships.

AMSC is expanding its geographic footprint by targeting both established and emerging markets. This includes regions with significant renewable energy infrastructure development. International expansion is a key driver of the company's AMSC revenue growth drivers.

AMSC's expansion initiatives are designed to drive growth and capitalize on market opportunities. These initiatives include strategic market entry, product diversification, and the formation of strategic partnerships. The company's focus on AMSC sustainable energy solutions is a core element of its strategy.

- Penetration into the wind energy market with D-VAR® and NEPSI solutions.

- Expansion into grid hardening technologies, including fault current limiters.

- Securing new contracts and projects in various global markets.

- Focus on regions experiencing significant renewable energy infrastructure development.

The company's diversification extends into naval defense applications, as demonstrated by its Ship Protection System (SPS) and degaussing systems. This strategic move diversifies revenue streams beyond the energy sector, mitigating risks associated with market fluctuations. Recent contract wins for its D-VAR® systems in global markets highlight successful international expansion efforts. For more insights into how AMSC approaches its market, consider reading the Marketing Strategy of AMSC. These initiatives are driven by the need to access new customer segments, reduce reliance on any single market, and stay ahead of evolving industry requirements. This approach is critical for its AMSC investment potential.

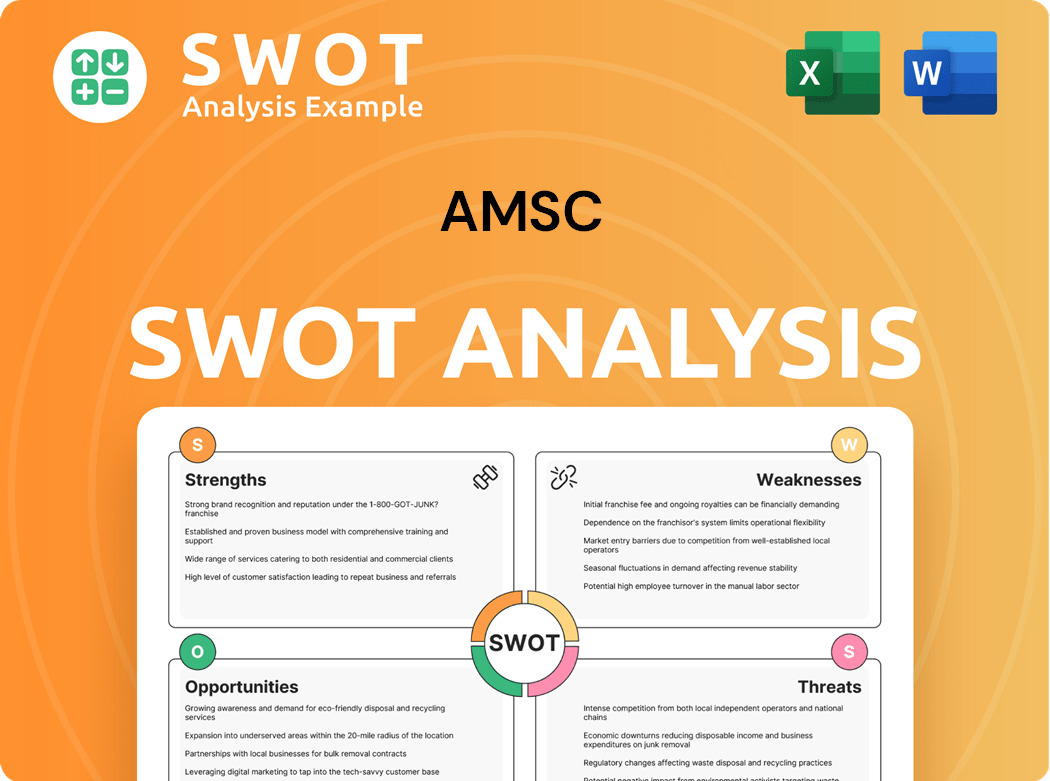

AMSC SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does AMSC Invest in Innovation?

The innovation and technology strategy of AMSC is a cornerstone of its sustained growth, heavily reliant on substantial investments in research and development. This approach allows the company to develop and deploy advanced solutions, particularly in grid resilience and renewable energy sectors. Continuous improvement of products like D-VAR® and NEPSI ensures that AMSC remains at the forefront of power quality and grid stabilization technologies.

A key element of AMSC's strategy involves in-house development complemented by strategic collaborations. The company's focus on digital transformation is evident through the integration of advanced controls and data analytics into its power systems, which enhances operational efficiency and enables predictive maintenance for customers. Sustainability is also central to AMSC’s mission, with its products directly supporting the integration of renewable energy sources and improving grid efficiency.

The company's commitment to innovation is further highlighted by its patent portfolio, particularly in areas like fault current limiting and power electronics. These technological advancements underscore AMSC's leadership in critical fields, directly contributing to its growth objectives and reinforcing its position as a technological leader in the power systems industry. For a deeper understanding of how AMSC generates revenue, consider exploring Revenue Streams & Business Model of AMSC.

AMSC dedicates a significant portion of its resources to research and development. These investments are crucial for maintaining its competitive edge and driving future growth. The company's focus on innovation is directly linked to its financial performance and market position.

The continuous improvement of products such as D-VAR® and NEPSI is a core element of AMSC's strategy. These products are designed to meet the evolving needs of the power industry. This helps to drive AMSC's revenue growth drivers.

AMSC is embracing digital transformation by integrating advanced controls and data analytics into its power systems. This enhances operational efficiency and enables predictive maintenance. This technology advancement is a key aspect of AMSC's strategy.

Sustainability is a key focus for AMSC, with its products directly supporting the integration of renewable energy sources. This approach helps reduce the carbon footprint of power generation and transmission. This aligns with the company's long-term growth potential in the sustainable energy solutions market.

AMSC's innovation strategy includes strategic collaborations to enhance its capabilities and market reach. These partnerships are crucial for expanding its presence in the wind energy market and grid modernization projects. Details on specific recent partnerships are not extensively publicized.

AMSC's patent portfolio, particularly in fault current limiting and power electronics, highlights its technological leadership. These patents protect its innovations and contribute to its competitive advantage. This supports the company's market share analysis and overall AMSC company analysis.

AMSC's technology advancements are pivotal in addressing the challenges of the power systems industry, influencing its AMSC growth strategy and future prospects. These advancements include:

- D-VAR® and NEPSI Product Enhancements: Continuous upgrades to these product lines ensure they remain competitive in power quality and grid stabilization.

- Integration of Data Analytics: The use of data analytics for predictive maintenance and operational efficiency improves customer satisfaction and reduces downtime.

- Focus on Renewable Energy Integration: AMSC's products directly support the integration of renewable energy sources, which is crucial for sustainable energy solutions.

- Patent Protection: A strong patent portfolio in critical areas like fault current limiting and power electronics protects AMSC's innovations.

AMSC PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is AMSC’s Growth Forecast?

The financial outlook for AMSC, focusing on its growth strategy and future prospects, appears promising. The company is strategically positioned within the growing renewable energy and grid resilience markets. This positioning is crucial for driving AMSC's financial performance and market position.

AMSC's revenue targets and profit margins are significantly influenced by its ability to secure new projects and expand its product offerings. Recent financial reports show a clear focus on improving profitability and achieving sustainable growth. The company's commitment to innovation and strategic acquisitions, such as the 2022 acquisition of NEPSI, further supports its long-term growth potential.

In the third quarter of fiscal year 2024, AMSC reported total revenues of $29.2 million, a rise from $20.9 million in the prior quarter and $22.2 million in the same quarter last year. The company also reported a net loss of $2.5 million, or $0.09 per share, for the third quarter of fiscal year 2024, an improvement from a net loss of $4.7 million, or $0.17 per share, in the prior quarter. Looking ahead, AMSC anticipates revenues for the fourth quarter of fiscal year 2024 to be in the range of $29 million to $33 million.

AMSC's financial performance is closely tied to the global push for clean energy and grid modernization, which are expected to drive demand for its solutions. The company's quarterly earnings report provides insights into its revenue growth drivers and operational efficiency. For detailed insights, consider reviewing the Owners & Shareholders of AMSC article.

AMSC's market position is strengthened by its technology advancements and strategic partnerships. The company's business model analysis reveals a focus on innovation and capturing market share in critical infrastructure sectors. This strategic approach is crucial for navigating the competitive landscape.

Key revenue growth drivers for AMSC include its involvement in wind energy market projects and grid modernization projects. These projects are supported by the increasing demand for sustainable energy solutions. The company's ability to secure and execute these projects significantly impacts its long-term growth potential.

AMSC faces challenges and opportunities in the renewable energy sector. These include the need to adapt to evolving market dynamics and capitalize on technological advancements. The company's investment in R&D and strategic acquisitions demonstrates its commitment to addressing these challenges.

The investment potential of AMSC is influenced by its stock price forecast and its ability to execute its growth strategy. The company's quarterly earnings reports and investor relations activities provide valuable information for assessing its financial health. The company's focus on sustainable energy solutions further enhances its investment appeal.

AMSC's long-term growth potential is supported by its strategic positioning in the renewable energy market and its commitment to innovation. The company's sustainable energy solutions and focus on grid modernization projects are key factors in its future prospects. The company's financial ambitions are closely tied to the global push for clean energy.

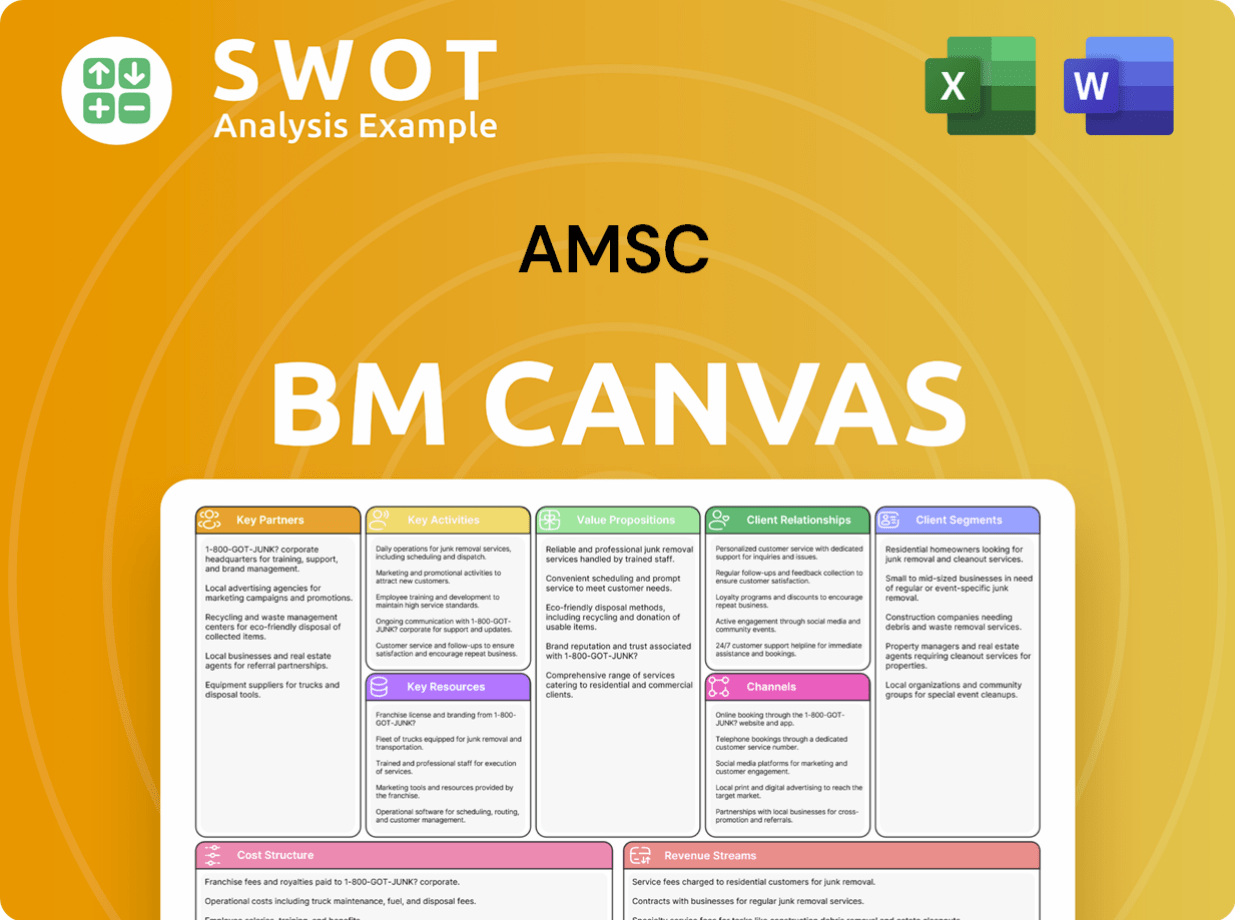

AMSC Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow AMSC’s Growth?

The path of the company, while promising, is not without its potential pitfalls. The company's AMSC growth strategy faces various strategic and operational risks. Market competition and the cyclical nature of certain markets present significant challenges to AMSC financial performance.

Regulatory changes, especially concerning energy policies and grid standards, could necessitate adjustments to product development and market strategies. Supply chain issues, including the availability and cost of critical components, could disrupt manufacturing and project timelines. The company's reliance on advanced technologies also exposes it to the risk of technological disruption.

Internally, resource constraints, such as the availability of skilled engineering talent, could hinder innovation and project execution. The company actively mitigates these risks through diversification of its product portfolio and customer base, reducing dependence on any single market or technology. The company also utilizes risk management frameworks to assess and prepare for potential disruptions.

The power systems and grid solutions sectors are highly competitive, with both established players and emerging innovators vying for market share. This intense competition can impact the AMSC market position and profitability. Successful navigation requires continuous innovation and strategic differentiation.

The wind energy market, a key area for the company, is subject to cyclical fluctuations. These cycles can lead to revenue volatility, affecting AMSC quarterly earnings report and overall financial performance. Diversification and strategic planning are crucial to managing these risks.

Changes in energy policies and grid standards can necessitate significant adjustments to product development and market strategies. Adapting to these changes requires agility and a proactive approach to ensure compliance and maintain a competitive edge. These changes directly impact AMSC renewable energy projects.

The availability and cost of critical components can disrupt manufacturing and project timelines. These disruptions can directly affect profitability. Mitigating these risks involves robust supply chain management and strategic partnerships to ensure a stable supply of necessary components.

The company's reliance on advanced technologies exposes it to the risk of technological disruption from competitors developing superior or more cost-effective solutions. Continuous innovation and investment in research and development are essential to maintain a competitive advantage and drive AMSC technology advancements.

The availability of skilled engineering talent can hinder the pace of innovation and project execution. Addressing these constraints requires effective talent management strategies, including recruitment, training, and retention programs. This impacts AMSC long-term growth potential.

Increasing cybersecurity threats to critical infrastructure could impact the demand for secure power systems. The company must continuously adapt its offerings to address these evolving threats. This is a crucial factor in AMSC grid modernization projects.

The accelerating pace of energy transition requires continuous adaptation of the company's offerings. Staying ahead in this rapidly evolving market demands a focus on innovation and strategic partnerships. This influences AMSC sustainable energy solutions.

AMSC Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of AMSC Company?

- What is Competitive Landscape of AMSC Company?

- How Does AMSC Company Work?

- What is Sales and Marketing Strategy of AMSC Company?

- What is Brief History of AMSC Company?

- Who Owns AMSC Company?

- What is Customer Demographics and Target Market of AMSC Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.