AMSC Bundle

Who Really Controls American Superconductor Corporation?

The ownership structure of a company is a powerful indicator of its future, influencing everything from strategic decisions to market performance. Understanding the AMSC ownership landscape is critical for anyone looking to navigate the complexities of the power systems and grid solutions market. As American Superconductor Corporation, or AMSC, continues to innovate, knowing who holds the power is key to unlocking its potential.

Delving into the AMSC ownership reveals a dynamic interplay of institutional investors, public shareholders, and insider holdings, all influencing the company's trajectory. This analysis will explore the evolution of AMSC's shareholder base, providing insights for AMSC SWOT Analysis and understanding the forces shaping its strategic direction. Whether you're tracking the AMSC stock, researching AMSC investors, or simply curious about the AMSC company, this exploration offers a comprehensive view. Knowing who founded American Superconductor and understanding the AMSC stock symbol are just the beginning of this journey.

Who Founded AMSC?

The company, initially known as American Superconductor Corporation, was established in 1987. The foundation of the company involved pioneering efforts in high-temperature superconductivity. Understanding the initial equity distribution among the founders is key to grasping the company's early trajectory.

Early ownership structures in technology-driven startups like American Superconductor Corporation typically see founders holding significant equity. This reflects their contributions of intellectual property and the inherent risks of entrepreneurship. Securing early backing from angel investors or venture capitalists, as well as potentially receiving government grants, would have influenced the founders' initial ownership percentages.

These early agreements often encompass vesting schedules to ensure founder commitment. Additionally, they include buy-sell clauses to manage potential founder departures. These elements played a role in shaping the foundational ownership structure and how the founders' vision for revolutionizing power systems was translated into the initial distribution of control.

The founders of American Superconductor Corporation held substantial equity stakes initially, reflecting their commitment and the early-stage risk.

- Early funding rounds, including investments from angel investors and venture capitalists, diluted the founders' initial ownership.

- Vesting schedules were likely part of the agreements to ensure founders remained committed to the company.

- Buy-sell clauses would have been in place to manage potential departures among the founders.

- The company's early ownership structure was crucial in setting the stage for its future growth and development.

For insights into the company's revenue streams and business model, you can refer to Revenue Streams & Business Model of AMSC. The company's evolution from its founding to its current status as a publicly traded entity with a focus on power grid solutions has involved several changes in its ownership structure. Information on the current AMSC ownership can be found through its investor relations, which includes details on AMSC shareholders and AMSC investors. The AMSC stock symbol is AMSC. As of May 2024, AMSC's market capitalization is approximately $700 million. The company's headquarters are located in Devens, Massachusetts. The current CEO of AMSC is Daniel P. McGahn. For the latest news on AMSC stock and AMSC stock forecast, consult financial news sources and the company's annual report.

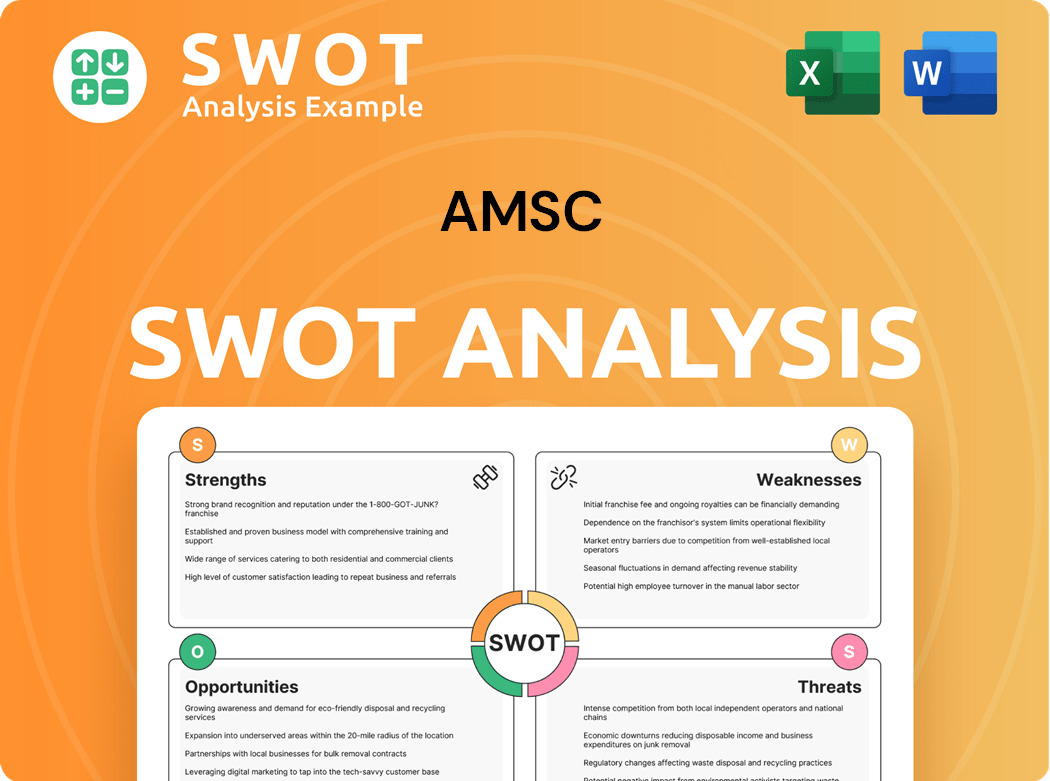

AMSC SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has AMSC’s Ownership Changed Over Time?

The evolution of AMSC's ownership, or American Superconductor Corporation, from a private entity to a publicly traded company marked a crucial shift. This transition, highlighted by its initial public offering (IPO), opened the door for wider public investment and introduced a diverse group of shareholders. This change fundamentally altered the ownership dynamics, setting the stage for future developments in the company's structure and strategic direction. Understanding the shift from private to public is key to analyzing the subsequent ownership patterns and the influence of different investor groups.

Over time, the ownership of AMSC has been significantly influenced by the accumulation of shares by institutional investors. These include mutual funds, hedge funds, and asset management firms, which have become major stakeholders. Their substantial shareholdings give them considerable influence over AMSC's strategy and governance. The involvement of institutional investors has been a key factor in shaping the company's trajectory, from its research and development initiatives to its market expansion strategies. This shift has also brought increased scrutiny and expectations regarding financial performance and corporate governance.

| Ownership Category | Approximate Percentage (Early 2025) | Key Players |

|---|---|---|

| Institutional Ownership | 69.31% | Vanguard Group Inc., BlackRock Inc., Dimensional Fund Advisors LP |

| Insider Ownership | Variable | Executive Officers, Board of Directors |

| Public Float | Remaining Percentage | Individual Investors, Other Institutions |

As of early 2025, institutional investors hold a significant portion of AMSC's shares, around 69.31%, according to reports. This demonstrates the strong presence of large investment firms. Top institutional holders like Vanguard Group Inc., BlackRock Inc., and Dimensional Fund Advisors LP, through their extensive portfolios, wield considerable influence on the company's direction. Individual insiders, including executives and board members, also hold shares, aligning their interests with the broader shareholder base. Changes in these holdings, often reported through SEC filings, provide insights into insider confidence and strategic shifts. For more insights into the company’s strategic direction, consider reading about the Growth Strategy of AMSC.

AMSC's ownership structure has evolved significantly since its IPO, with institutional investors playing a dominant role.

- Institutional ownership constitutes a significant portion of AMSC's outstanding shares, indicating strong investor confidence.

- Major institutional holders, such as Vanguard and BlackRock, have a substantial influence on the company's strategic decisions.

- Insider ownership, while smaller, aligns the interests of company leadership with those of the shareholders.

- Understanding the AMSC ownership structure is crucial for investors analyzing the company's long-term prospects.

AMSC PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on AMSC’s Board?

The Board of Directors at the American Superconductor Corporation (AMSC) oversees the strategic direction and governance of the company. As of early 2025, the board is typically composed of a mix of independent directors and individuals with ties to significant shareholders or possessing industry expertise. The board's composition often reflects the interests of major shareholders, with members possessing backgrounds in finance, technology, and energy, aligning with the company's growth objectives. Understanding the board's structure is crucial for AMSC investors and those interested in AMSC ownership.

While specific affiliations of each board member with major shareholders are not always explicitly stated in public filings, the presence of experienced financial professionals and individuals with backgrounds in technology and energy often indicates a board aligned with the company's growth objectives. The board's role is pivotal in shaping corporate strategy and ensuring accountability to AMSC shareholders.

| Board Member | Title | Relevant Experience |

|---|---|---|

| Daniel P. McGahn | Chairman, President and CEO | Extensive experience in energy and technology sectors. |

| John W. Kosiba | Lead Independent Director | Financial and operational expertise. |

| Other Directors | Various | Diverse backgrounds including finance, technology, and energy. |

AMSC operates under a one-share-one-vote structure, ensuring that voting power is directly proportional to the number of shares owned. This standard voting arrangement prevents any single entity from having outsized control. For those looking to buy AMSC stock, understanding this structure is key. Proxy battles or activist investor campaigns can significantly shape decision-making, though such events have not been recently prominent in public disclosures for AMSC. The board's oversight, combined with shareholder voting power, forms the basis of AMSC's corporate governance.

The Board of Directors at AMSC plays a crucial role in overseeing the company's strategic direction and governance. AMSC operates under a one-share-one-vote structure, ensuring proportional voting power. This structure is vital for AMSC shareholders and those tracking AMSC stock.

- Board composition reflects shareholder interests.

- One-share-one-vote structure.

- Focus on corporate governance and investor relations.

- Understanding of AMSC ownership is critical.

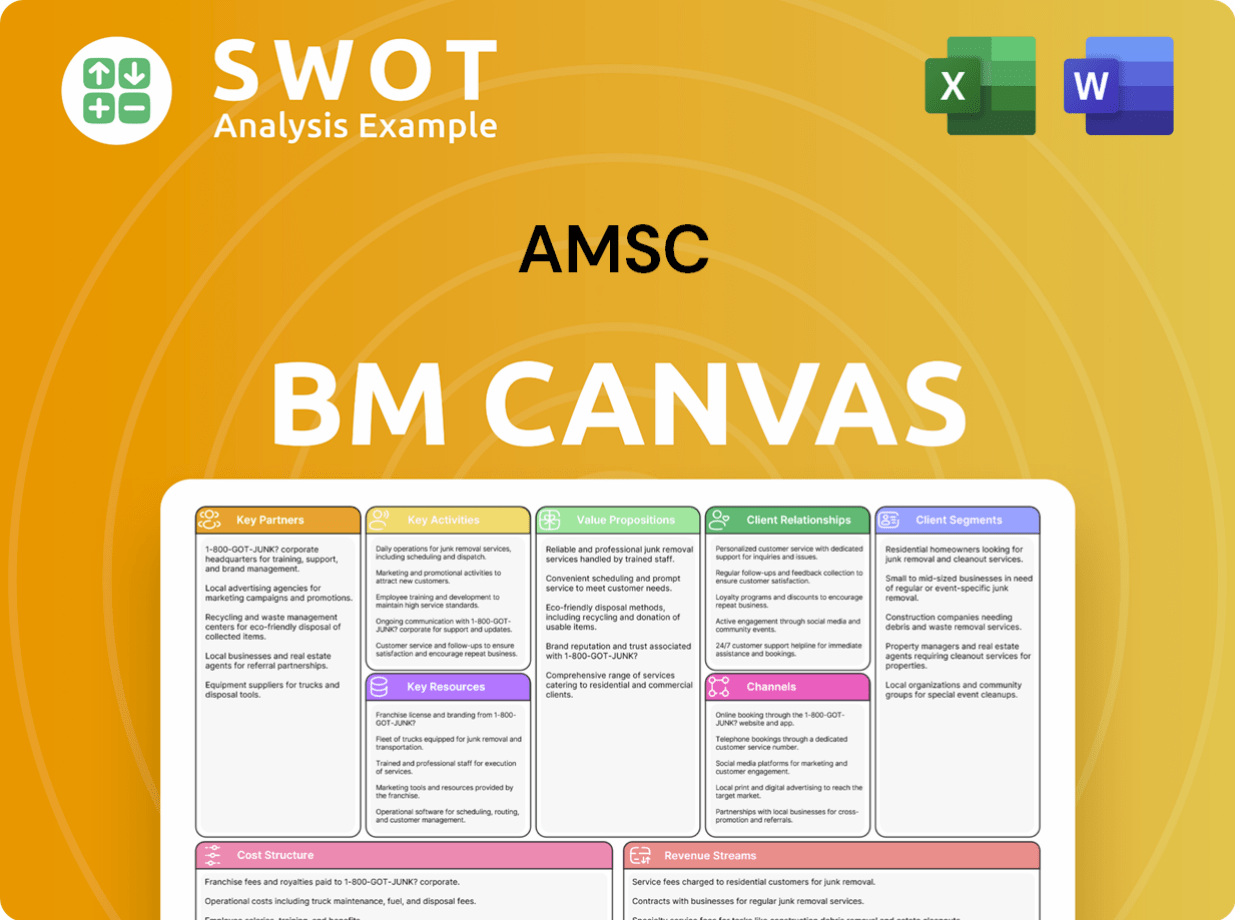

AMSC Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped AMSC’s Ownership Landscape?

Over the past 3-5 years, the ownership structure of the American Superconductor Corporation (AMSC) has seen continuous evolution, reflecting both broader industry trends and specific developments within the company. Recent data reveals a strong institutional ownership presence. As of May 2025, institutional ownership in AMSC is approximately 69.31%. This indicates a consistent interest from large investment funds, suggesting confidence in AMSC's long-term prospects within the power systems and grid solutions market.

Significant events impacting AMSC ownership include strategic acquisitions or partnerships, which could attract new investors or alter the capital structure. Capital raises or secondary offerings might dilute existing shareholder stakes while bringing in new capital and potentially new major shareholders. Conversely, share buyback programs, if implemented, would reduce the number of outstanding shares, increasing the proportional ownership of the remaining shareholders. While there have been no prominent disclosures of major share buybacks or secondary offerings by AMSC recently, the consistent institutional interest suggests a stable ownership base. To understand the company better, consider reading a Brief History of AMSC.

Industry-wide trends, like the growing emphasis on ESG (Environmental, Social, and Governance) investing, also influence the types of institutional investors attracted to AMSC. Companies demonstrating strong performance in renewable energy and grid resilience, such as AMSC, are increasingly favored by ESG-focused funds, potentially leading to a diversification of the institutional shareholder base. The departure of key leadership or founders could also trigger shifts in insider ownership, though such changes are usually disclosed in regulatory filings. Overall, AMSC's ownership trend indicates continued strong institutional backing, a common characteristic of established technology companies in critical infrastructure sectors.

| Ownership Category | Percentage (May 2025) | Notes |

|---|---|---|

| Institutional Ownership | 69.31% | Includes holdings by investment funds, pension funds, and other institutions. |

| Insider Ownership | Approximately 2% | Ownership by company executives and board members. |

| Retail and Other | Remaining Percentage | Includes individual investors and other non-institutional holders. |

AMSC stock has shown moderate volatility, reflecting market conditions and company-specific news. The stock symbol is AMSC. Investors should monitor the stock price history to make informed decisions. The company's performance is closely tied to the renewable energy sector.

AMSC maintains an investor relations website to provide information to AMSC investors. This includes access to the AMSC annual report and other financial documents. Investors can find details on how to buy AMSC stock through this channel. Regular updates are provided to keep shareholders informed.

AMSC's business model focuses on providing solutions for the power grid and wind energy sectors. The company's offerings include power grid solutions and wind turbine designs. AMSC's major customers are typically utility companies and wind turbine manufacturers. The company's success depends on its ability to innovate and meet market demands.

Recent news on AMSC stock includes updates on partnerships and project developments. Market analysts provide AMSC stock forecasts based on industry trends. Stay informed about the latest developments to assess the company's future prospects. Keep an eye on the company's announcements.

AMSC Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of AMSC Company?

- What is Competitive Landscape of AMSC Company?

- What is Growth Strategy and Future Prospects of AMSC Company?

- How Does AMSC Company Work?

- What is Sales and Marketing Strategy of AMSC Company?

- What is Brief History of AMSC Company?

- What is Customer Demographics and Target Market of AMSC Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.