Argan Bundle

How Did Argan Company Rise to Prominence?

Founded in 2003, Argan Inc. has become a major force in the construction and engineering sector, particularly in power generation and renewable energy. From humble beginnings with $30 million in annual revenues, the company has experienced remarkable growth, expanding its services and significantly increasing its market capitalization. Today, Argan is a key player in building essential energy and telecommunications infrastructure, demonstrating its strategic foresight and adaptability.

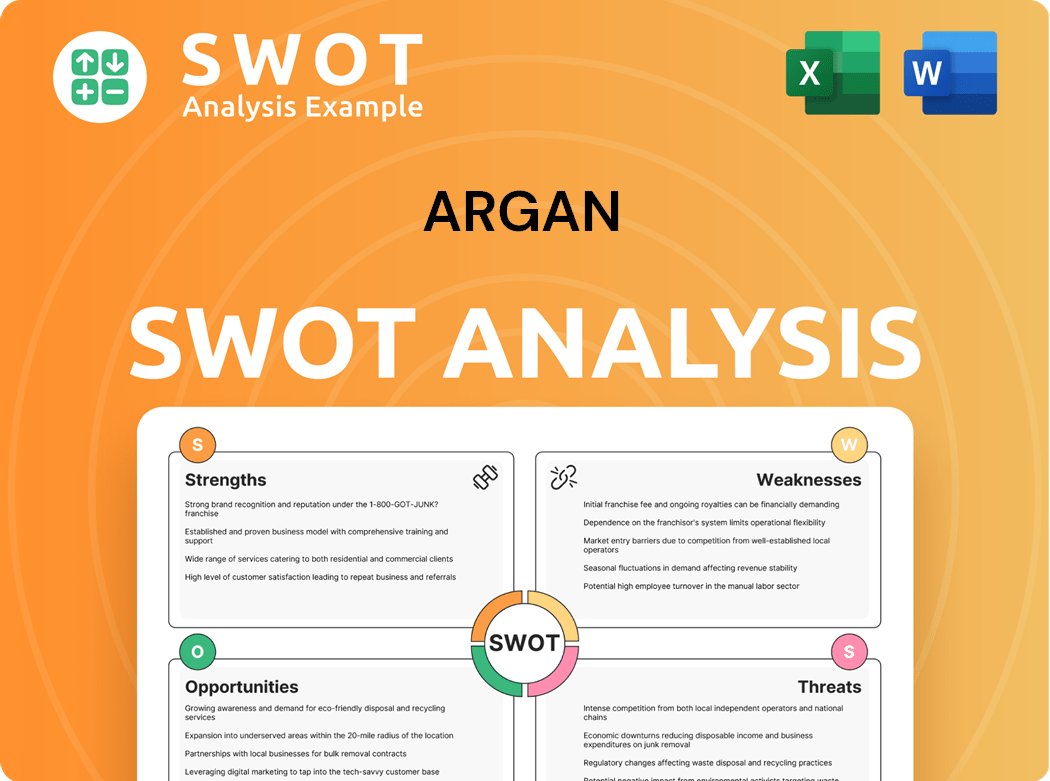

Argan Company's journey began with a focus on engineering, procurement, and construction (EPC) services, quickly establishing itself in the evolving energy market. The company's success is evident in its impressive project backlog, reaching a record $1.9 billion by April 30, 2025. For a deeper dive into Argan's strategic positioning, consider the Argan SWOT Analysis, which highlights the company's strengths, weaknesses, opportunities, and threats. This growth reflects Argan's commitment to innovation and its ability to capitalize on opportunities in the energy sector, showcasing its impact on the industry.

What is the Argan Founding Story?

The story of Argan Inc. began in 2003, when Rainer H. Bosselmann established the company. He led the company as Chairman and Chief Executive Officer until August 2022. From its inception, the company has been a notable player in the construction and related services sector.

Initially based in Rockville, Maryland, Argan operated there for over two decades. The company's headquarters moved to Arlington, Virginia, in March 2025. While the specific motivations behind the company's founding remain less publicized, Bosselmann's leadership was key in transforming Argan into an international business.

Argan's initial focus was on offering construction and related services, mainly to the power industry. A significant moment in its early development was the acquisition of Gemma Power Systems (GPS) in December 2006. This acquisition expanded Argan's scope, allowing it to design, build, and commission large-scale energy projects. This included combined-cycle facilities, simple-cycle peaking plants, and renewable energy sources like biomass, solar, and wind farms. This acquisition was instrumental in shaping Argan's core offerings and establishing its presence in the power sector.

Argan's journey is marked by strategic decisions and expansions.

- 2003: Rainer H. Bosselmann founds Argan Inc.

- 2006: Acquisition of Gemma Power Systems (GPS), expanding capabilities in the power sector.

- March 2025: Corporate headquarters relocated to Arlington, Virginia.

For additional insights into the company's strategic growth, you can explore the Growth Strategy of Argan.

Argan SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Argan?

The early growth of the company was significantly shaped by strategic acquisitions and a focus on expanding its service offerings. A key move was the acquisition of Gemma Power Systems (GPS) in December 2006, which became a cornerstone for its power industry services. The company's early milestones included constructing various power plants, covering both traditional and renewable energy projects.

In the initial six months ending July 31, 2009, total revenues reached $128.6 million, with Gemma contributing over 91%. By the first quarter ending April 30, 2009, net revenues were $63.1 million, where Gemma accounted for 92% of the total. The company also expanded its services to include industrial construction and telecommunications infrastructure.

In fiscal year 2025 (ending January 31, 2025), consolidated revenues increased by 52% to $874.2 million. The Power Industry Services segment saw a 66% increase in revenues to $693 million, representing 79% of consolidated revenues. The company's backlog reached $1.4 billion at January 31, 2025, an 80% increase from the previous year. For more details on their financial strategies, see Revenue Streams & Business Model of Argan.

The company's growth was supported by major capital raises and a disciplined capital allocation strategy. This included investments in organic growth and opportunistic share repurchases. Securing large projects, such as a 700 MW combined-cycle natural gas project and a 300 MW biofuel power plant, further propelled its expansion. In November 2024, the telecommunications segment hired a new CEO to focus on market expansion.

The company's ability to secure large projects, such as a 700 MW combined-cycle natural gas project in the U.S. and a 300 MW biofuel power plant in Ireland, further propelled its expansion. The company's focus on renewable energy projects and industrial construction services through The Roberts Company (TRC) and telecommunications infrastructure services via SMC Infrastructure Solutions was also a key factor.

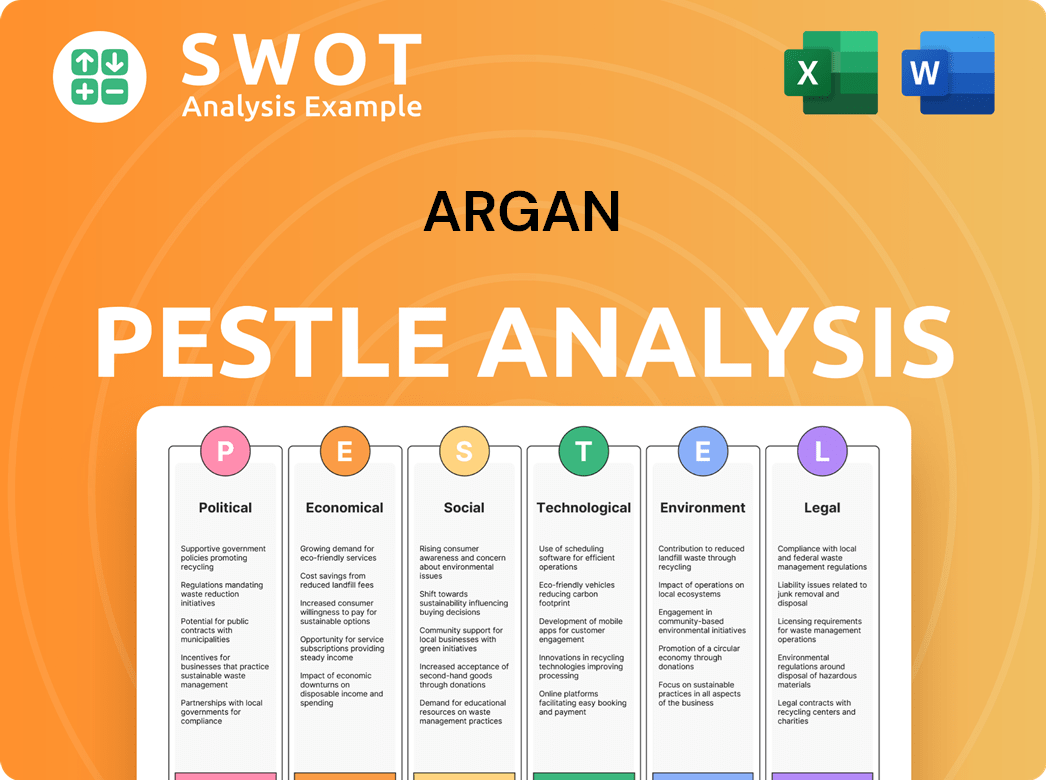

Argan PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Argan history?

The Argan Company has achieved significant milestones, especially in the power generation sector, demonstrating its expertise in constructing both natural gas-fired power plants and renewable energy facilities. This positions the company as 'energy-agnostic,' leading to a robust project backlog.

| Year | Milestone |

|---|---|

| 2025 | The project backlog reached a record $1.9 billion as of April 30, 2025, primarily driven by large-scale power projects. |

| 2025 | Gemma Renewable Power, an Argan subsidiary, was recognized with the 2025 Nexus Award for Partner of the Year. |

| 2025 | Relocated corporate headquarters from Rockville, Maryland, to Arlington, Virginia, in March 2025. |

The company's focus on constructing both natural gas and renewable energy facilities highlights its adaptability in the energy market. This approach has allowed the company to stay relevant and competitive in a changing industry, as detailed in Mission, Vision & Core Values of Argan.

The company's ability to build both natural gas and renewable energy projects is a key innovation. This diversification helps the company stay resilient in the face of changing market demands and energy policies.

The relocation of the corporate headquarters to Arlington, Virginia, is a strategic move. This change is designed to improve recruitment, enhance collaboration, and provide better access to major transportation hubs.

Leadership transitions, such as David H. Watson succeeding Rainer H. Bosselmann as President and CEO in August 2022, are part of the company's evolution. These changes are aimed at adapting to industry dynamics and ensuring operational excellence.

Despite its successes, Argan Company has faced challenges, including losses on certain projects and supply chain issues. These factors have impacted the company's financial performance and project timelines.

Gross profit was negatively impacted by a loss on the Kilroot project in fiscal year 2024 and the first quarter of fiscal year 2025. These financial setbacks highlight the risks associated with large-scale projects.

Supply chain issues have extended the timelines for completing gas-fired power plant projects. Project timelines have increased from 2.5-3 years to 3-4 years, impacting project delivery.

Reliance on the Power Services segment and customer concentration present risks that require careful management. This concentration can make the company vulnerable to changes in customer behavior or market conditions.

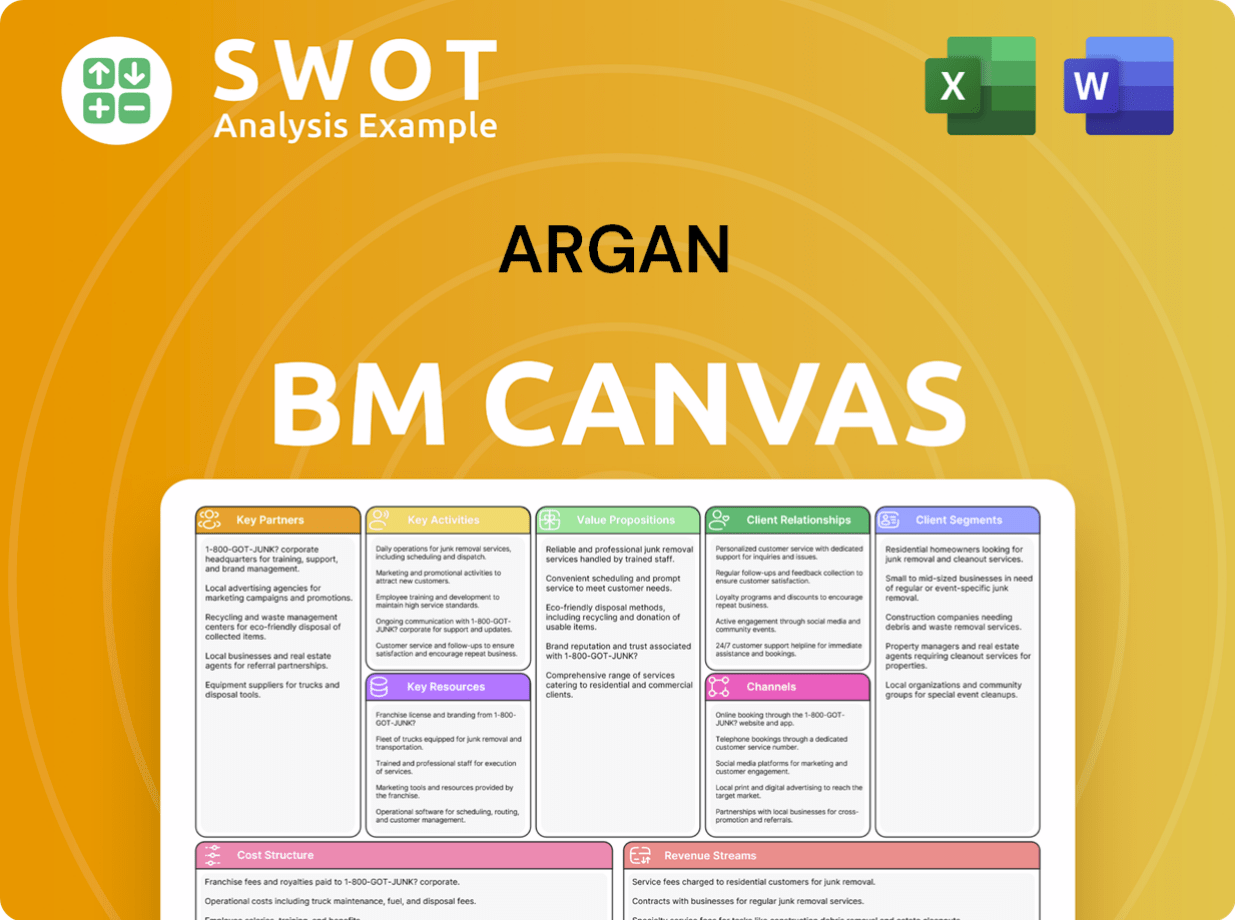

Argan Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Argan?

The Owners & Shareholders of Argan company has a history marked by strategic moves and growth in the energy infrastructure sector. Founded in 2003 by Rainer H. Bosselmann, the company expanded significantly with the 2006 acquisition of Gemma Power Systems. Key milestones include consistent revenue growth, the retirement of Bosselmann in August 2022, and the appointment of David H. Watson as President and CEO. Recent developments include a 25% dividend increase in September 2024, strong fiscal 2025 results with revenues up 52% to $874.2 million, and a project backlog reaching $1.4 billion. The company relocated its headquarters to Arlington, Virginia, in March 2025, and Gemma Renewable Power received the 2025 Nexus Award. Further, Argan announced an increase to its share repurchase program and declared a quarterly dividend of $0.375 per share in April 2025, with Sean Terrell assuming the CEO role at The Roberts Company in May 2025. The company reported a record backlog of $1.9 billion as of April 30, 2025, showcasing robust growth.

| Year | Key Event |

|---|---|

| 2003 | Argan Inc. was founded by Rainer H. Bosselmann. |

| December 2006 | Argan acquired Gemma Power Systems (GPS), expanding its power industry services. |

| 2009 | Argan's revenues showed consistent growth, with Gemma Power Systems contributing a substantial portion. |

| August 2022 | Rainer H. Bosselmann retired, and David H. Watson was appointed President and CEO. |

| September 2024 | Argan increased its quarterly dividend by 25% to $0.375 per common share. |

| December 2024 | Argan reported strong third-quarter fiscal 2025 results, with revenues up 57% to $257 million. |

| March 2025 | Argan relocated its corporate headquarters to Arlington, Virginia. |

| March 2025 | Argan reported fourth-quarter and fiscal year 2025 results, with consolidated revenues of $874.2 million for fiscal 2025, a 52% increase year-over-year. Project backlog reached $1.4 billion. |

| April 2025 | Argan's Gemma Renewable Power received the 2025 Nexus Award for Partner of the Year. |

| April 2025 | Argan announced an increase to its share repurchase program and declared a quarterly dividend of $0.375 per share. |

| May 2025 | Sean Terrell assumed the CEO role at The Roberts Company, an Argan subsidiary, as part of a succession plan. |

| June 2025 | Argan reported strong first-quarter fiscal 2026 results with consolidated revenue growth of 23% to $193.7 million, and a record backlog of $1.9 billion as of April 30, 2025. |

Argan anticipates substantial growth in power infrastructure projects over the next decade. Natural gas projects are expected to increase, aligning with rising power demand from data centers and electric vehicle adoption. The company's energy-agnostic capabilities and strong finances position it well for these trends.

Ongoing strategic initiatives include a focus on organic growth, maintaining the quarterly dividend, and considering mergers and acquisitions. These actions aim to complement existing skills and expand the company's geographic footprint, fostering continued growth in the energy sector.

Analysts forecast Argan's earnings to grow by 14% per year and revenue by 11.4% per year. The company's leadership emphasizes its successful project delivery record as a key advantage for continued backlog growth and financial strength.

Argan's key advantage lies in its reputation for on-time and on-budget project delivery, which supports its continued backlog growth. This track record is rooted in the company's founding vision of building essential energy infrastructure, ensuring its sustained market position.

Argan Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Argan Company?

- What is Growth Strategy and Future Prospects of Argan Company?

- How Does Argan Company Work?

- What is Sales and Marketing Strategy of Argan Company?

- What is Brief History of Argan Company?

- Who Owns Argan Company?

- What is Customer Demographics and Target Market of Argan Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.