Argan Bundle

How Does Argan Inc. Thrive in a Competitive Market?

The energy and infrastructure sectors are battlegrounds of innovation and rivalry, demanding strategic agility. Understanding the competitive landscape is crucial for any company aiming for sustained success. This analysis dissects the environment surrounding Argan Inc., a key player in engineering, procurement, and construction services.

From its inception in 1991 as Thermacore, Inc., Argan Inc. has evolved significantly, now providing vital services to power generation and telecommunications infrastructure. This evolution necessitates a deep dive into its Argan SWOT Analysis and the competitive dynamics it faces. This exploration will reveal the key players, market strategies, and factors driving Argan's position within the competitive landscape of the Argan oil company and the broader infrastructure market, offering critical insights for investors and industry observers alike. A thorough Argan oil market analysis is essential.

Where Does Argan’ Stand in the Current Market?

The company, specializing in power generation and renewable energy infrastructure, holds a significant position, particularly within the United States. Its core operations center around providing comprehensive engineering, procurement, and construction (EPC) services. This includes everything from initial design and engineering to construction, commissioning, and ongoing maintenance for power plants and renewable energy projects.

The value proposition of the company lies in its ability to deliver end-to-end solutions. This approach allows clients to have a single point of contact, streamlining project management and potentially reducing costs. Furthermore, its expertise in both traditional and renewable energy sectors positions it well to meet the evolving demands of the energy market.

Geographically, the company's strongest presence is in North America, where it serves a diverse clientele. The company's strategic shift towards renewable energy infrastructure reflects an effort to capitalize on the growing green energy market while maintaining its established expertise in traditional power. The Owners & Shareholders of Argan have been instrumental in guiding this strategic diversification.

While specific market share figures for 2024-2025 are proprietary, the company is a leading provider of EPC services for natural gas-fired power plants. It is also increasingly active in the renewable energy sector, including solar and wind projects.

The company's Q3 2024 earnings report showed revenues of $170.8 million. The company also has a backlog of projects totaling approximately $728 million, indicating a robust pipeline of future work and a strong financial standing.

The company's primary market is North America. Its presence in international markets is comparatively weaker, representing a potential area for future expansion.

Its primary product lines encompass comprehensive EPC solutions, from initial design and engineering to construction, commissioning, and ongoing maintenance.

The company's market position is shaped by its EPC service offerings and its adaptation to market demands. The company has strategically shifted towards renewable energy infrastructure. This diversification reflects a move to capitalize on the growing green energy market while maintaining its established expertise in traditional power.

- Strong presence in the North American power infrastructure sector.

- Growing involvement in renewable energy projects (solar and wind).

- Focus on comprehensive EPC solutions.

- Financial stability with a substantial project backlog.

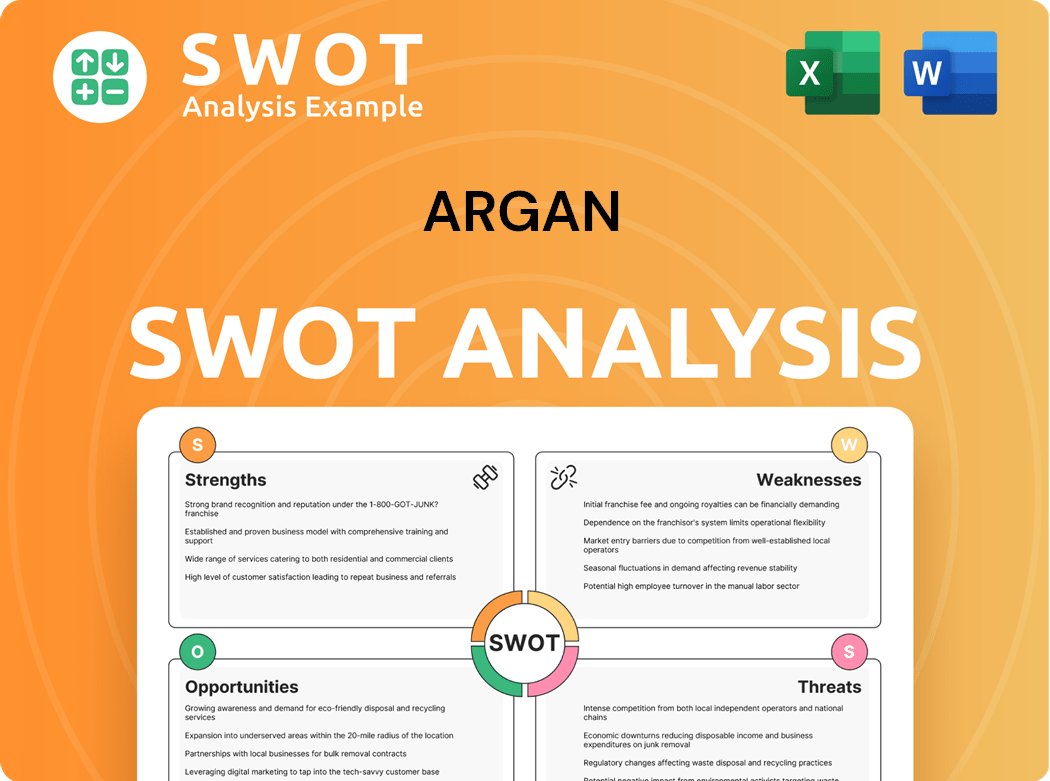

Argan SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Argan?

The competitive landscape for Argan Inc. is complex, involving both direct and indirect competitors across the engineering, construction, and infrastructure services sectors. The company faces challenges from large, diversified firms and specialized players, particularly in the power generation and renewable energy markets. Understanding this landscape is crucial for Argan's strategic positioning and future growth.

Direct competitors include major engineering and construction companies with extensive resources and global reach. Indirect competition comes from firms offering specific services within the EPC value chain, such as engineering consultants and equipment suppliers. The dynamics of the market are also shaped by mergers, acquisitions, and the emergence of new entrants, particularly in the rapidly evolving renewable energy sector.

The Argan oil market analysis reveals a dynamic environment where companies must adapt to maintain a competitive edge. Factors such as technological advancements, regulatory changes, and economic conditions influence the competitive dynamics.

These are large, diversified engineering and construction firms that directly compete with Argan in the power generation and renewable energy EPC space.

A global giant with extensive experience in various sectors, including power. Fluor can leverage its massive scale and financial resources to bid on large, complex projects.

A privately held engineering and construction behemoth offering comprehensive EPC services across numerous industries, including power. Bechtel has a strong global footprint.

Known for its heavy civil construction and power projects, particularly in North America. Kiewit often competes directly with Argan for domestic power plant construction contracts.

These companies focus on specific renewable energy segments, such as solar or wind farm construction, and compete through specialized expertise and niche market relationships.

Has a significant renewable energy portfolio and competes in the renewable energy sector.

A major player in wind and solar EPC, now part of Quanta Services. This acquisition created a larger, more integrated competitor.

Argan oil competitors are impacted by industry trends. The Argan oil industry is influenced by factors such as sustainability concerns, government incentives, and technological advancements, which drive demand and shape the competitive dynamics. The Argan oil market size and growth are also key indicators of the competitive environment.

Indirect competitors include firms offering only parts of the EPC value chain, such as engineering consulting firms or equipment suppliers. New entrants in the renewable energy sector can also disrupt the market. Understanding the competitive landscape argan is crucial for strategic planning.

- Engineering consulting firms that may partner with other construction entities.

- Equipment suppliers who may collaborate with construction companies.

- New entrants, particularly in the rapidly evolving renewable energy sector, can disrupt the market.

- Mergers and acquisitions, such as Quanta Services' acquisition of Blattner Energy, create larger, more integrated competitors.

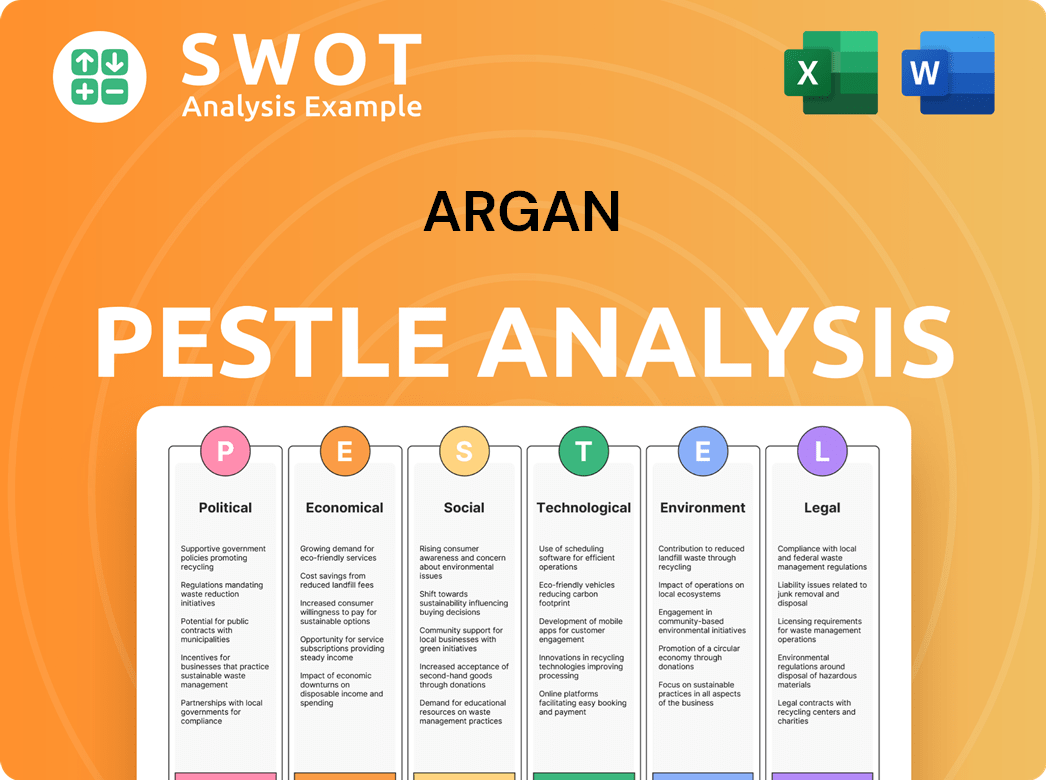

Argan PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Argan a Competitive Edge Over Its Rivals?

Understanding the competitive advantages of a company like Argan Inc. is crucial for anyone analyzing the Argan oil industry. These advantages are what set it apart in the competitive landscape argan and help it maintain its position. A detailed look at these strengths can provide valuable insights for investors, competitors, and market analysts alike. This analysis helps in evaluating the company's potential for growth and its ability to withstand market pressures.

Argan Inc. has carved a niche for itself, particularly in the Engineering, Procurement, and Construction (EPC) sector. This specialization allows it to offer tailored solutions and often achieve higher project completion rates. The company's agility as a mid-sized player also contributes to its competitive edge, enabling quicker decision-making compared to larger competitors. This responsiveness is a key factor in client satisfaction and project success.

A strong balance sheet and consistent profitability provide a competitive edge, enabling Argan Inc. to self-fund projects and navigate economic downturns more effectively. The company's accumulated experience and refined processes in project management and construction methodologies act as a form of intellectual property, difficult for competitors to replicate quickly. These factors combined contribute to a robust operational efficiency and a solid market position, making it a key player in the Argan oil market analysis.

Argan Inc. excels in the EPC of natural gas-fired power plants, a sector demanding precision and efficiency. This specialization allows them to offer tailored solutions and often achieve higher project completion rates. Their deep understanding of the power and energy sectors is a significant advantage, contributing to their strong reputation.

Gemma Power Systems, a wholly-owned subsidiary, is a key asset. It is known for delivering complex power projects on schedule and within budget. This contributes significantly to Argan's brand equity and reputation, solidifying its market position and client trust.

As a mid-sized player, Argan Inc. can make quicker decisions and adopt more flexible project approaches. This agility is particularly appealing to clients seeking efficient and responsive partners. This responsiveness often results in faster project timelines and improved client satisfaction.

A strong balance sheet and consistent profitability provide a competitive edge, enabling self-funded projects and resilience during economic downturns. This financial stability allows for investment in new technologies and sustained operational capabilities. This financial health is critical in a competitive market.

Argan Inc.'s competitive advantages are multi-faceted, encompassing specialized expertise, project execution capabilities, and financial strength. These factors contribute to a strong market position and the ability to secure and deliver complex projects. Their focus on efficiency and client satisfaction further enhances their competitive edge.

- Specialized Expertise: Deep understanding of EPC for natural gas-fired power plants.

- Gemma Power Systems: Proven ability to deliver complex projects on time and within budget.

- Agility: Quicker decision-making and flexible project approaches compared to larger competitors.

- Financial Strength: Strong balance sheet enabling self-funded projects and investment in new technologies.

- Operational Efficiency: Effective supply chain management and strong vendor relationships.

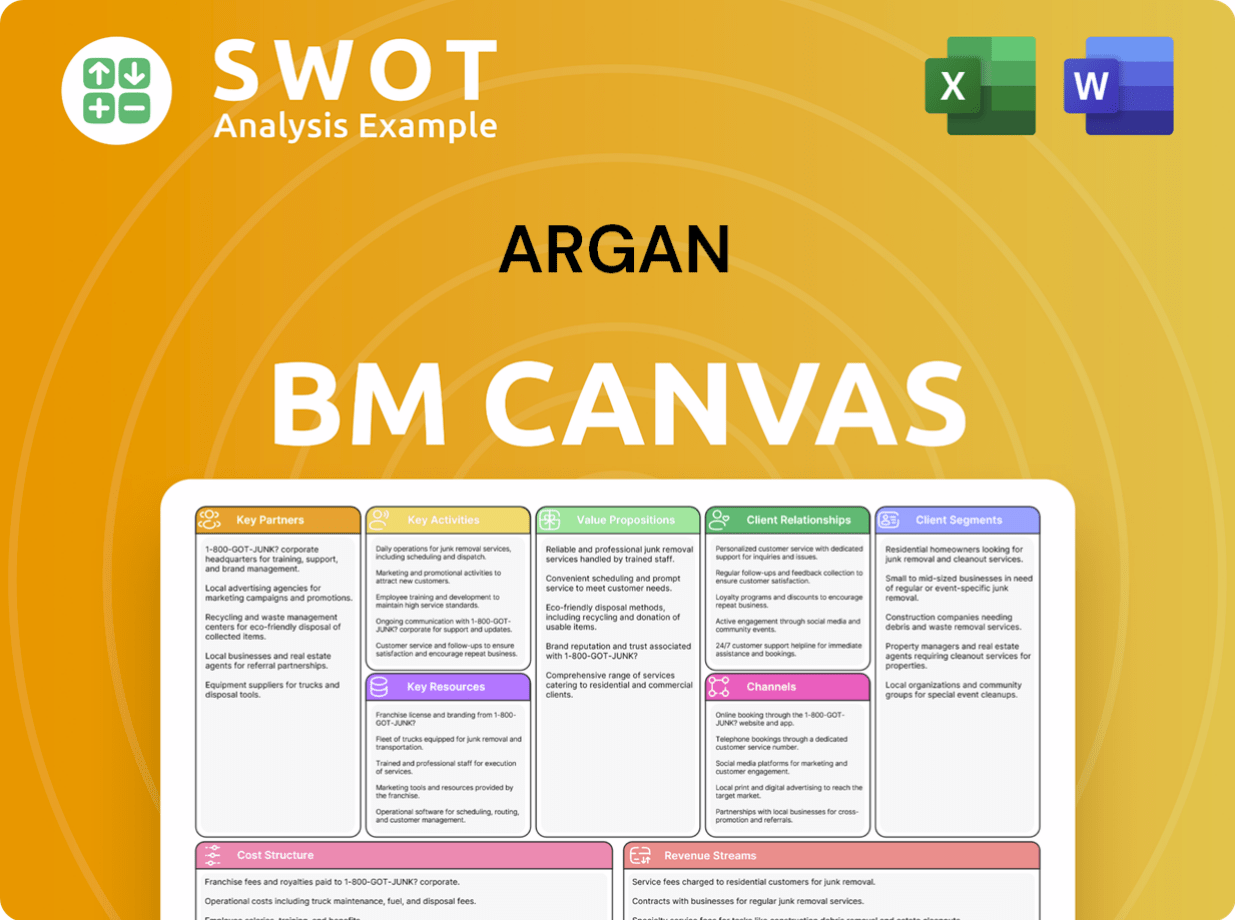

Argan Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Argan’s Competitive Landscape?

The competitive landscape for Argan Inc. is significantly influenced by evolving industry trends, particularly the global shift towards renewable energy. This transition presents both opportunities and challenges, requiring strategic adaptation. The company's historical focus on natural gas-fired power plants necessitates a proactive approach to renewable energy investments. Regulatory changes, such as stricter emissions standards, further drive this shift.

Technological advancements in energy storage and smart grids will continue to reshape the market. This creates new service offerings and potential threats from innovative competitors. Geopolitical factors and energy price fluctuations add uncertainty to investment decisions. Argan must navigate these dynamics to maintain its competitive edge.

The renewable energy sector is experiencing rapid growth, driven by climate change concerns and falling technology costs. Government incentives and increasing consumer demand for sustainable products are also contributing factors. These trends are reshaping the Marketing Strategy of Argan.

Intense price competition in the EPC sector and the need to attract skilled labor pose significant challenges. Managing supply chain disruptions for critical components in renewable energy projects is crucial. The decline in demand for conventional power plants could impact the company's core business if the transition to renewables isn't managed effectively.

Expanding the renewable energy portfolio, especially in utility-scale solar and offshore wind, presents significant growth opportunities. Leveraging expertise in telecommunications infrastructure can provide diversification and stable revenue. Strategic partnerships with technology providers could unlock new markets.

Argan's competitive position will likely evolve towards a balanced portfolio of conventional and renewable energy projects. A strong emphasis on efficiency and adaptability is essential to remain resilient in the dynamic energy landscape. This involves strategic investments and continuous innovation.

The Argan oil industry faces evolving challenges and opportunities. The company needs to align its strategies with the current market trends. The Argan oil market analysis indicates a growing demand for sustainable energy solutions.

- Diversify into renewable energy sources to mitigate risks.

- Invest in technological advancements for greater efficiency.

- Form strategic partnerships to expand market reach.

- Adapt to changing regulations and market dynamics.

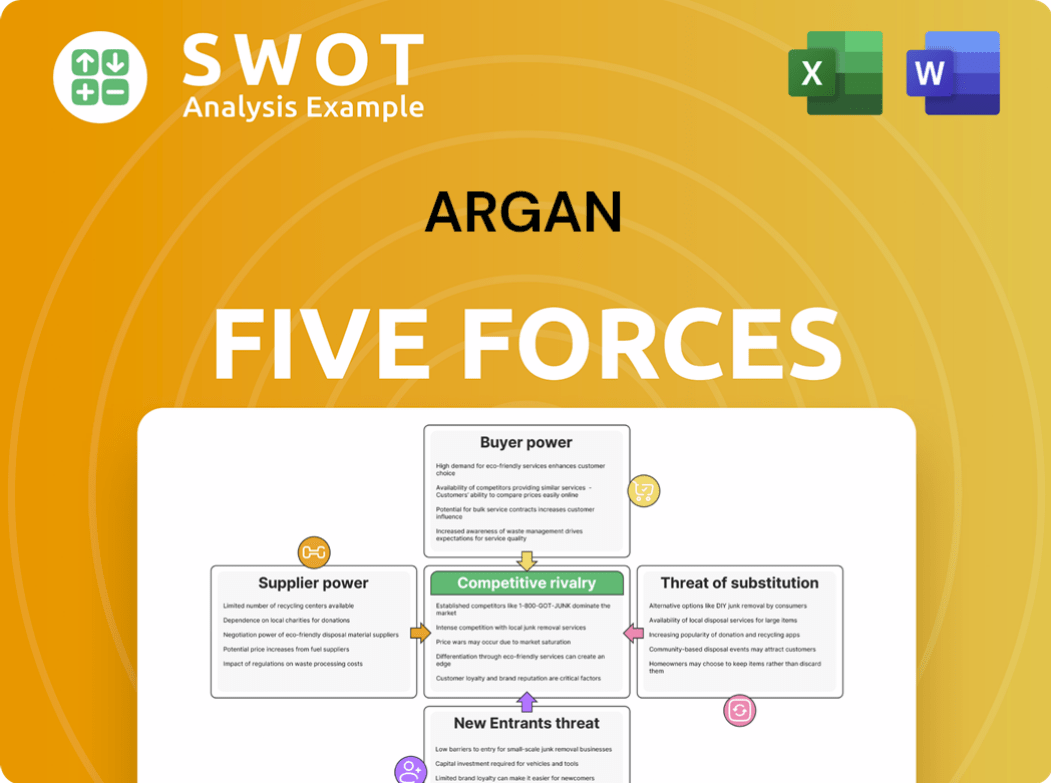

Argan Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Argan Company?

- What is Growth Strategy and Future Prospects of Argan Company?

- How Does Argan Company Work?

- What is Sales and Marketing Strategy of Argan Company?

- What is Brief History of Argan Company?

- Who Owns Argan Company?

- What is Customer Demographics and Target Market of Argan Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.