ASR Bundle

What's the Story Behind ASR Company's Success?

Delve into the fascinating ASR SWOT Analysis and uncover the remarkable journey of ASR Company, a financial powerhouse with roots stretching back centuries. From its humble beginnings in 1720 as Stad Rotterdam, a pioneer in European insurance, to its modern-day prominence, ASR's story is one of resilience, adaptation, and strategic growth. Explore the key milestones and pivotal moments that shaped this leading Dutch insurer.

The ASR Company's ASR history is a testament to its ability to navigate economic shifts and market changes. The transformation from its early focus on fire and maritime insurance to a comprehensive financial services provider reflects its commitment to meeting evolving customer needs. Understanding the ASR Company's evolution offers valuable insights for investors and business strategists alike, highlighting the importance of adaptability and long-term vision in the financial sector.

What is the ASR Founding Story?

The ASR Company's story is a blend of historical insurance firms, with its roots tracing back to 1720. This early beginning set the stage for a company that would evolve through mergers and acquisitions, eventually becoming a significant player in the Dutch financial sector. Understanding the ASR history involves recognizing the consolidation of various entities over time, shaping its current structure and focus.

The journey of ASR Nederland N.V. is a story of adaptation and resilience. From its early days as an insurance provider to its transformation during the 2008 financial crisis, the company has demonstrated a capacity to navigate significant challenges. The company's evolution highlights its commitment to serving the Dutch market and its ability to adapt to changing economic landscapes.

The company's formation reflects a strategic consolidation of resources and expertise, positioning it for growth and sustainability in the financial services industry. The company's history is a testament to the enduring nature of financial institutions and their ability to evolve with the times.

The foundational narrative of ASR Nederland N.V. begins with the establishment of N.V. Maatschappij van Assurantie, Discontering en Beleening der Stad Rotterdam in 1720. This early entity, 'Stad Rotterdam,' was created to offer financial protection against risks, primarily fire and maritime incidents. Over the centuries, other insurance companies emerged, contributing to the formation of the modern ASR.

- Woudsend Insurance, established in 1816, began as a mutual fire insurance company.

- 'Let op uw Einde,' a funeral expenses fund, was founded in Utrecht on December 6, 1847, by D. Stolwerk and W.P. Ingenegeren.

- De Utrecht, a predecessor to AMEV, was established in 1883.

The immediate precursor to the current ASR Nederland was formed in 1997 through the merger of Stad Rotterdam Verzekeringen and ETI Amersfoortse insurance companies. The name ASR was derived from the initials of Amersfoort and Stad Rotterdam. In 2000, Fortis AMEV and ASR Group (comprising De Amersfoortse, Stad Rotterdam Verzekeringen, and Woudsend Verzekeringen) merged, forming Fortis ASR. The original business model focused on a range of insurance products, including life, non-life, and pension insurance, along with asset management services.

- The merger in 2000 marked a significant consolidation of established insurance legacies.

- The merged entities offered a diversified range of insurance products.

- Asset management services were also a key part of the business model.

In 2008, the Dutch government intervened during the 2007–2008 financial crisis, acquiring the Dutch insurance operations of Fortis, including Fortis ASR. This intervention led to the spin-off of Fortis Insurance Nederland N.V. and its re-establishment as ASR Nederland N.V. on November 21, 2008. This marked a new chapter for the company, allowing it to focus on its core insurance and financial services in the Netherlands. Read more about the Target Market of ASR.

- The government's acquisition was a response to the financial crisis.

- ASR Nederland N.V. was re-established as an independent entity.

- The re-establishment allowed a focus on core insurance and financial services.

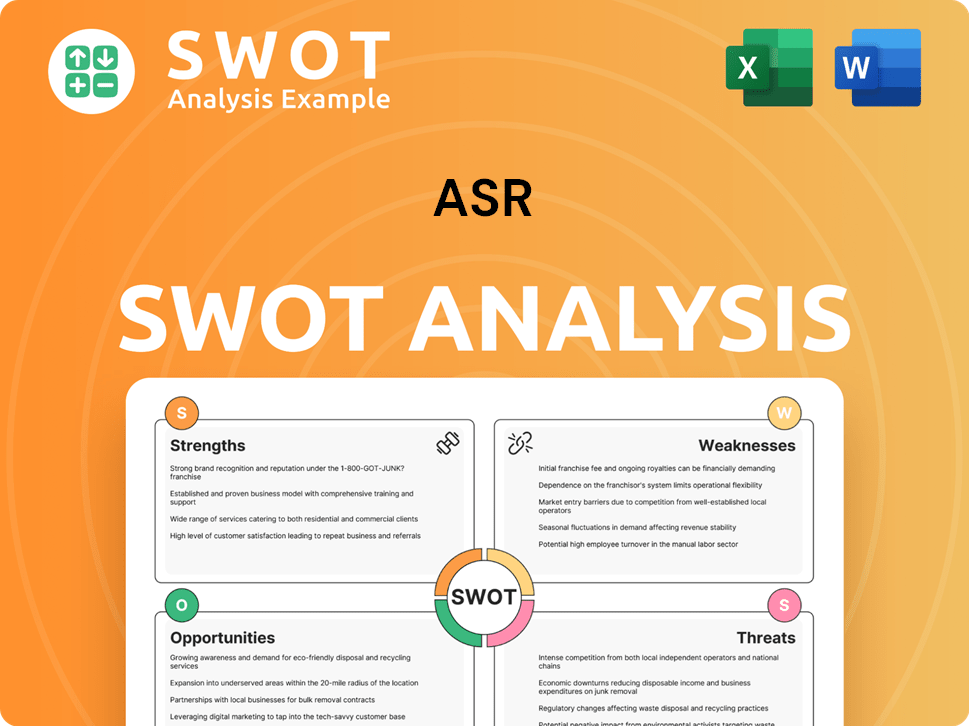

ASR SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of ASR?

The early growth and expansion of ASR Nederland, particularly after its government acquisition in 2008, focused on strategic consolidation and market penetration within the Netherlands. ASR has consistently aimed to strengthen its position in the Dutch insurance market. The company strategically diversified its revenue streams across non-life and life insurance, pensions, and mortgages.

ASR Nederland's growth strategy included organic growth and strategic acquisitions. Several brands were added to its portfolio over the years, such as Europeesche Verzekeringen, De Amersfoortse, Ardanta, Falcon Leven, and Ditzo, which were integrated into the broader ASR Group. The company's focus was on expanding its market presence and customer base.

In 2016, ASR Nederland went public through an Initial Public Offering (IPO) on Euronext Amsterdam. This IPO raised approximately €1.2 billion, significantly increasing its visibility and capital for further expansion. The IPO also led to its inclusion in the AEX index, enhancing its market position.

A major strategic move was the acquisition of Aegon's Dutch insurance business in 2020, which was completed in 2023. This acquisition significantly enhanced ASR's non-life insurance segment and expanded its customer base by approximately 6.5 million customers. The integration is expected to be completed by 2026.

The acquisition of Aegon contributed to a substantial increase in ASR's operating result, which rose by €455 million to €1,428 million in 2024 (compared to €973 million in 2023). In 2023, ASR reported a gross premium income of €8.825 billion and net income of €1.117 billion. The company's Return on Equity (ROE) for 2023 was 16%.

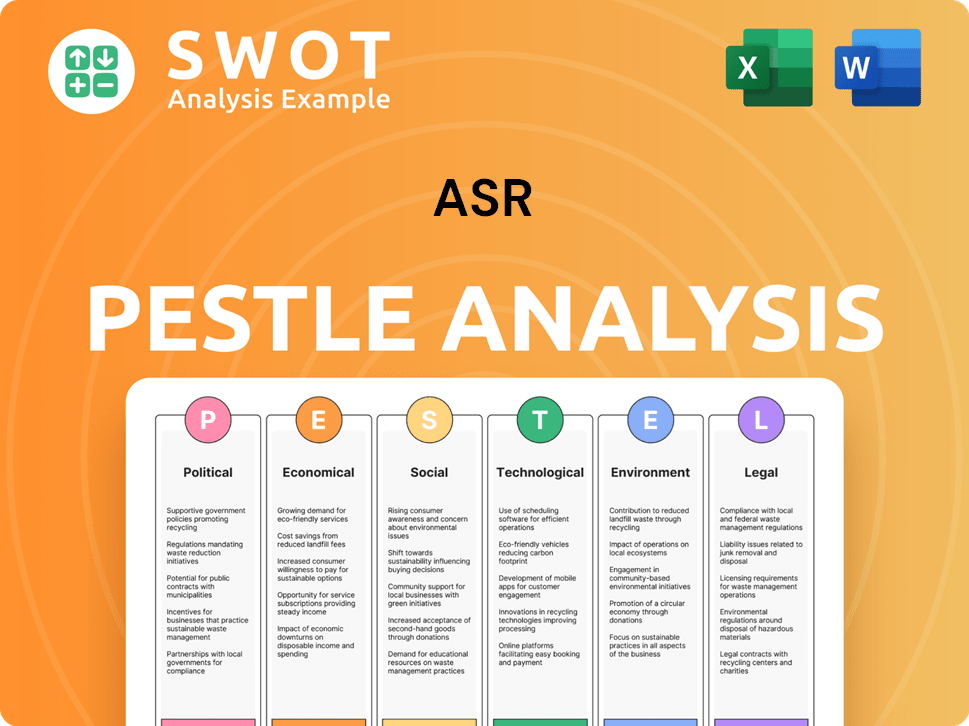

ASR PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in ASR history?

The history of ASR Nederland is marked by significant achievements, particularly in sustainability and strategic expansions. The company has consistently demonstrated its commitment to environmental and social responsibility, earning recognition in leading sustainability indexes and setting ambitious goals for reducing its carbon footprint and increasing impact investments.

| Year | Milestone |

|---|---|

| 2024 | ASR was included in the Dow Jones Sustainability World Index (DJSI World Index) for five consecutive years and in the Dow Jones Sustainability Europe Index (DJSI Europe Index) for four consecutive years, ranking ninth and fifth respectively. |

| 2024 | ASR achieved a score of 82 points out of 100 in the DJSI assessment, demonstrating strong performance across environmental, social, and governance parameters. |

| 2023 | ASR acquired Aegon Nederland, strengthening its market position and aiming for significant cost synergies. |

| 2025 | ASR concluded a final settlement related to past collective proceedings concerning certain Aegon products. |

ASR has embraced technological advancements and digital transformation to enhance its operations and market position. In 2023, the company acquired a digital insurance startup, signaling its commitment to digital strategies and anticipating increased annual premiums.

ASR acquired a digital insurance startup in 2023, which is expected to generate an additional €50 million in annual premiums starting in 2024. This move highlights ASR's focus on enhancing its digital capabilities and expanding its market reach through technology.

The company's main office in Utrecht, which opened in 1974, underwent a major overhaul between 2012 and 2015 to become one of the most sustainable offices in the Netherlands, achieving BREEAM 'Outstanding' certification. ASR aims to reduce carbon emissions from its own operations by 50% by the end of 2025 (compared to 2018).

Despite its successes, ASR has faced challenges, including economic downturns and intense competition within the insurance sector. The company also deals with market volatility and indirect political pressures, particularly in its health insurance business.

The 2007-2008 financial crisis significantly impacted ASR, leading to its acquisition by the Dutch government in 2008. Fluctuations in equity, fixed income, and property markets also affect ASR's profitability and capital position.

The insurance sector is highly competitive, with ASR operating alongside major players like NN Group and Achmea. The health insurance business, which constituted about 20% of its premiums as of 2023, has experienced volatility due to indirect political pressure and intense competition.

ASR has undertaken strategic pivots to navigate market dynamics, such as the acquisition of Aegon Nederland in 2023. The integration of Aegon Nederland's business is expected to be completed by 2026.

ASR's Solvency II ratio increased to 198% as of December 31, 2024, up from 176% in 2023, providing ample flexibility for future endeavors. To learn more about ASR's financial performance, you can explore Revenue Streams & Business Model of ASR.

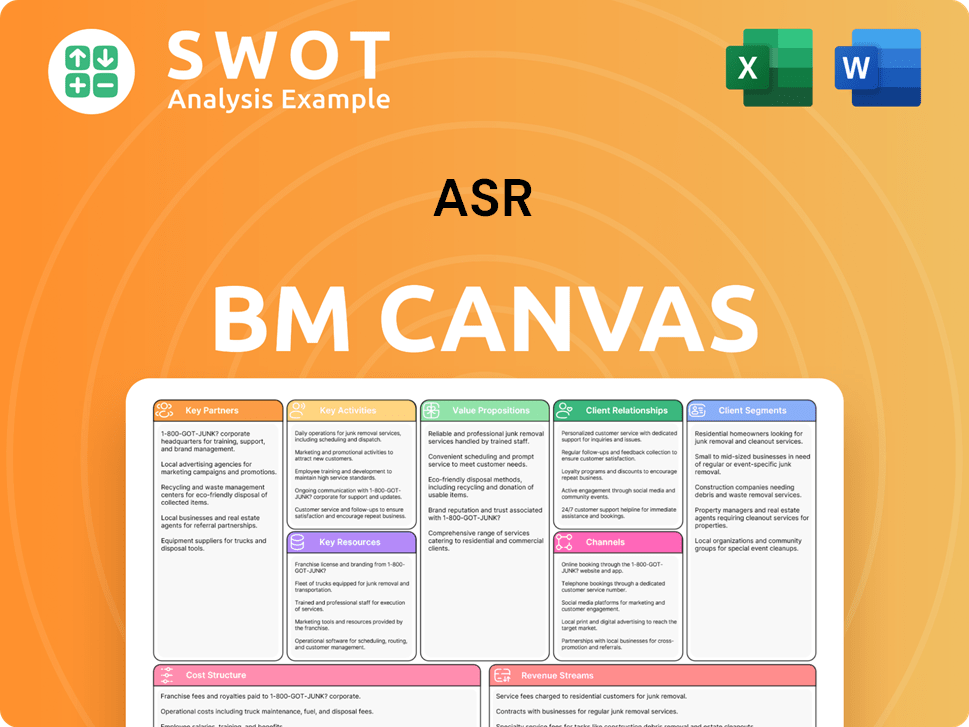

ASR Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for ASR?

The journey of ASR Nederland, a leading Dutch insurance company, is marked by significant milestones and strategic transformations. From its roots in 1720 to its current status as a publicly listed company, ASR has consistently adapted to market changes while focusing on sustainable growth and innovation. This evolution reflects not only its commitment to financial performance but also its dedication to corporate social responsibility, as highlighted in its recent sustainability initiatives. For a deeper understanding of the company's core principles, explore the Mission, Vision & Core Values of ASR.

| Year | Key Event |

|---|---|

| 1720 | Establishment of N.V. Maatschappij van Assurantie, Discontering en Beleening der Stad Rotterdam, the earliest predecessor of ASR. |

| 1997 | Formation of the original ASR insurance company through the merger of Stad Rotterdam Verzekeringen and ETI Amersfoortse insurance companies. |

| 2000 | Formation of Fortis ASR through the merger of Fortis AMEV and ASR Group. |

| 2008 | Dutch government acquires Fortis's Dutch insurance business, including Fortis ASR, leading to the re-establishment of ASR Nederland N.V. as an independent entity. |

| 2012-2015 | Major overhaul of ASR's Utrecht head office to become one of the most sustainable offices in the Netherlands. |

| 2016 | ASR Nederland goes public through an IPO on Euronext Amsterdam, raising approximately €1.2 billion and joining the AEX index. |

| 2020 | ASR Nederland acquires the Dutch insurance business of Aegon. |

| 2023 | Completion of the acquisition of Aegon's Dutch operations. |

| 2024 | ASR publishes its 2024 annual report, including a new chapter on sustainability efforts in line with CSRD, and introduces a climate transition plan. ASR reports a net income of €946 million for the full year ended December 31, 2024. |

| 2024 (December) | ASR Nederland is included in the Dow Jones Sustainability World Index for the fifth consecutive year. |

| 2025 (May) | Shareholders approve the distribution of a dividend of €3.12 per share for the financial year 2024. |

ASR aims to maintain a Solvency II ratio above 160%, with the ratio at 198% as of May 2025. The company targets organic capital creation (OCC) of €1.35 billion in 2026. Operating return on equity is targeted to exceed 12%.

ASR is focused on becoming a leading insurer in the Netherlands, particularly in pensions and mortgages. The integration of Aegon Nederland is expected to yield run-rate cost synergies of €215 million in 2026. A progressive dividend policy with mid-to-high single-digit percentage growth is planned through 2026.

A reduction of carbon footprint by 25% is targeted by 2030. Impact investments are planned to reach 10% of the investment portfolio by 2027. ASR is committed to responsible investment and has introduced a climate transition plan in March 2025.

Analysts forecast an annual earnings growth of 4.4%, with EPS expected to grow by 8.2% per annum. While revenue is forecast to decline at 6.4% per annum over the next three years, strategic initiatives are expected to drive profitable growth. The company aims for a Net Promoter Score (NPS-i) increase of +4 points in 2026 and employee engagement greater than 85 in 2026.

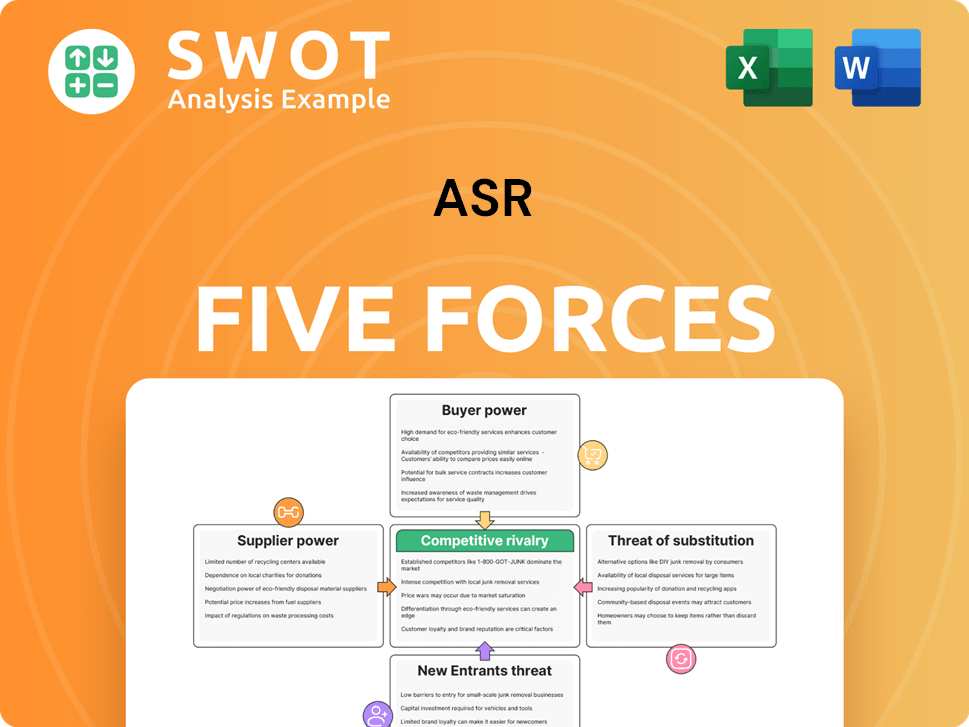

ASR Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of ASR Company?

- What is Growth Strategy and Future Prospects of ASR Company?

- How Does ASR Company Work?

- What is Sales and Marketing Strategy of ASR Company?

- What is Brief History of ASR Company?

- Who Owns ASR Company?

- What is Customer Demographics and Target Market of ASR Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.