ASR Bundle

Unveiling ASR Nederland N.V.: How Does It Thrive?

ASR Nederland N.V. is a cornerstone of the Dutch financial landscape, impacting individuals and businesses alike. Its commitment to sustainability and responsible practices has cemented its reputation as a leader in insurance, pensions, and mortgages. This exploration unveils the operational strategies and revenue models that fuel ASR's success, providing crucial insights for investors and industry watchers.

For those seeking a deeper understanding, this analysis goes beyond surface-level observations. We'll dissect ASR's core operations, revealing its value propositions and monetization strategies. This examination will provide a clear picture of how the ASR SWOT Analysis company maintains its market leadership and drives financial success, offering actionable insights for informed decision-making in the financial sector.

What Are the Key Operations Driving ASR’s Success?

The core operations of ASR Nederland N.V. are centered around providing financial products like insurance, pensions, and mortgages. They serve individuals, small businesses, and large corporations within the Netherlands. Their value proposition lies in delivering comprehensive financial solutions tailored to their customers' needs.

Key operational processes include underwriting risk, managing investments, and offering customer-centric services. This involves actuarial analysis for accurate policy pricing, investment management for returns, and efficient claims processing. ASR's operational backbone is significantly enhanced by technology, especially digital platforms designed to improve customer experience and streamline internal procedures.

Sales channels include independent advisors, direct online sales, and partnerships to ensure broad market reach. Customer service is a key differentiator, emphasizing personalized support and efficient inquiry resolution. ASR's supply chain is primarily financial, dealing with capital sourcing and investment portfolio management. Partnerships with financial advisors and brokers are crucial for distribution, while collaborations with technology providers enhance digital capabilities.

ASR employs sophisticated actuarial analysis to assess and price insurance policies accurately. This involves evaluating various risk factors to determine premiums. Risk management is crucial for maintaining financial stability and ensuring long-term profitability.

The company manages a diverse investment portfolio to grow policyholder funds and generate returns. This includes strategic asset allocation and active portfolio management. Investment decisions are guided by financial goals and risk tolerance, with a focus on long-term value creation.

ASR emphasizes personalized support and efficient resolution of customer inquiries. This includes providing timely and accurate information, handling claims promptly, and addressing customer concerns. Customer service is a key differentiator, fostering customer loyalty and satisfaction.

Investment in digital platforms enhances customer experience and streamlines internal processes. This includes online portals, mobile apps, and automated systems for policy management and claims processing. ASR technology improves efficiency and accessibility for customers.

ASR integrates sustainable and responsible practices into its core strategy, including investment policies that prioritize environmental, social, and governance (ESG) factors. This commitment extends to product development, offering sustainable investment options for pension funds. This approach aligns with growing consumer demand and helps mitigate long-term risks.

- Investments in renewable energy and green bonds differentiate ASR from competitors.

- ASR's focus on sustainability translates into customer benefits through financially sound and ethically aligned products.

- ESG factors are heavily weighted in investment decisions.

- This focus on sustainability not only aligns with growing consumer demand but also helps mitigate long-term risks.

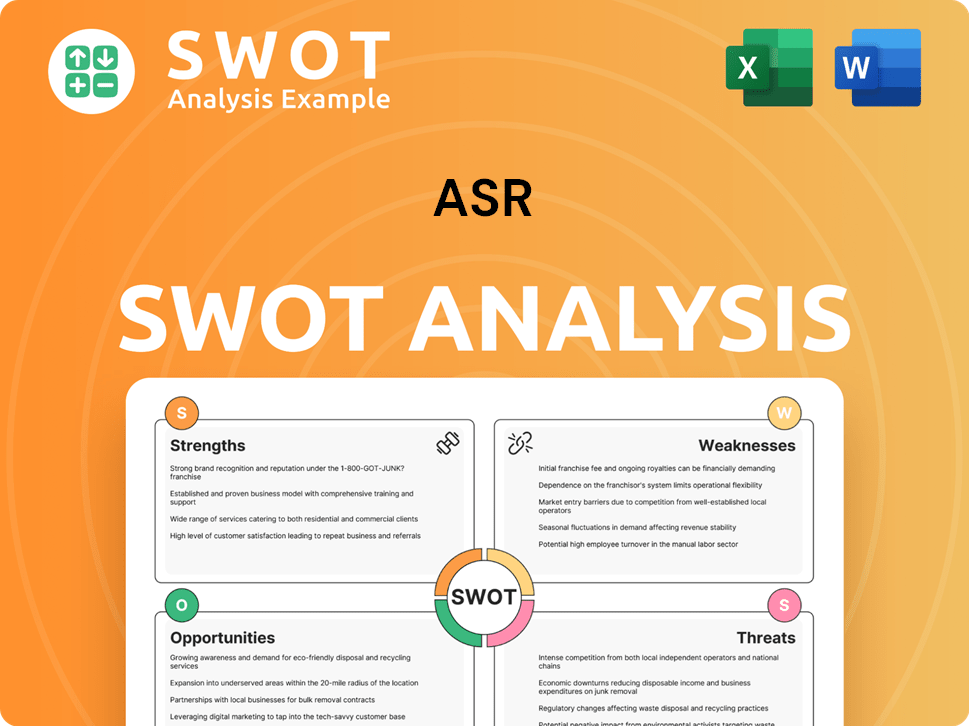

ASR SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does ASR Make Money?

ASR Nederland N.V. generates revenue through insurance premiums, asset management fees, and interest income from mortgage lending. Its primary revenue stream is gross written premiums from insurance segments, including life, non-life, and health insurance. Pension business and mortgage lending also contribute significantly to its financial performance.

The company's monetization strategies include tiered pricing for insurance products, bundling services, and offering investment options within pension products. ASR also focuses on increasing fee-based income and integrating sustainability-linked products to diversify revenue streams and attract specific market segments.

For the full year 2023, ASR reported gross written premiums of €7.9 billion. The mortgage portfolio grew to €16.9 billion by the end of 2023, highlighting the scale of its financial operations.

ASR's revenue model is diversified across several key areas, ensuring a robust financial structure. The primary revenue sources include insurance premiums, asset management fees, and interest income from mortgage lending. These streams are crucial for the company's financial health and growth.

- Insurance Premiums: This is the largest revenue source, driven by life, non-life, and health insurance policies.

- Asset Management Fees: Earned from managing pension funds and administering pension schemes.

- Interest Income: Generated from its mortgage portfolio, which continues to expand.

- Other Income: Includes fees from financial services and cross-selling opportunities.

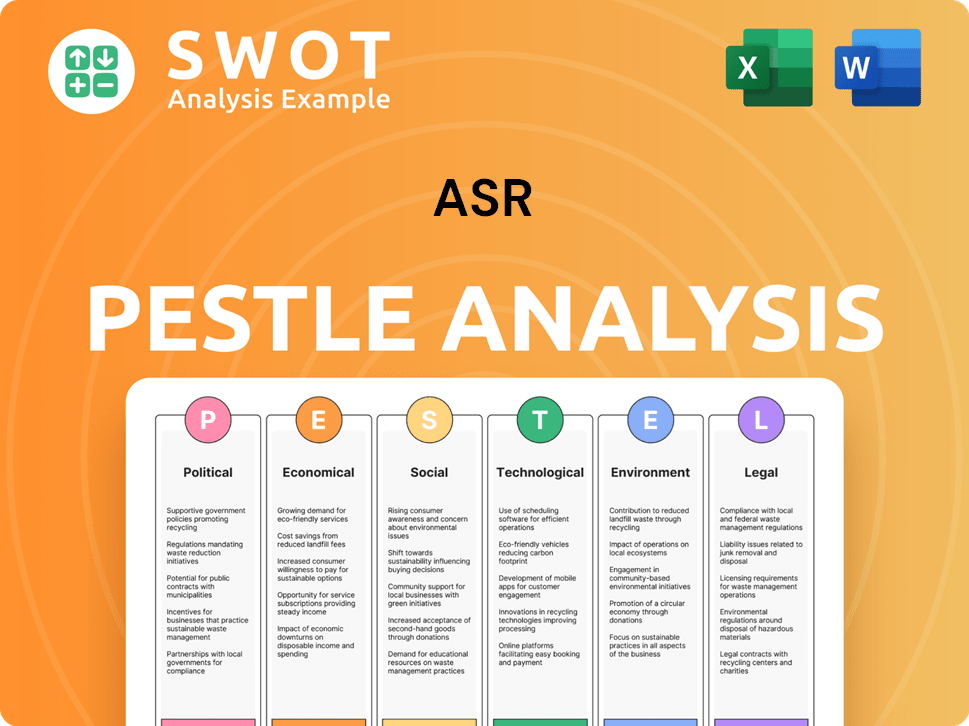

ASR PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped ASR’s Business Model?

The evolution of ASR Nederland N.V. showcases significant milestones, strategic initiatives, and competitive advantages that have shaped its market position. A key strategic move was the acquisition of Aegon Nederland's insurance activities in 2023, a transformative deal valued at €4.9 billion. This acquisition significantly expanded ASR's market share and product portfolio, particularly in life and non-life insurance, making it a major player in the Dutch insurance market.

ASR's consistent focus on integrating sustainable practices into its core business has led to recognition as a leader in ESG within the insurance sector. The company has also adapted to operational challenges, such as volatile financial markets and evolving regulatory landscapes, by maintaining strong solvency ratios and adjusting its investment strategies. These actions demonstrate ASR's resilience and proactive approach to managing risks and opportunities.

The company's competitive advantages stem from its strong brand recognition, robust capital position, and broad distribution network. Additionally, ASR's commitment to sustainability provides a unique edge, attracting environmentally and socially conscious customers and investors. These factors collectively enable ASR to sustain its business model in a competitive and dynamic industry, positioning it for continued growth and success.

The acquisition of Aegon Nederland's insurance activities in 2023 for €4.9 billion was a pivotal moment. This move expanded ASR's market share and product offerings significantly. Another key milestone is its leadership in ESG within the insurance sector.

ASR focuses on integrating sustainable practices into its core business. The company adapts to market changes by maintaining strong solvency ratios. It also invests in digitalization to enhance customer experience and operational efficiency.

ASR benefits from strong brand recognition and trust in the Dutch market. It has a robust capital position and a broad distribution network. The company's commitment to sustainability attracts environmentally conscious customers.

ASR invests in digitalization, including AI for claims processing. It uses data analytics for personalized product offerings. This ongoing adaptation helps ASR remain competitive.

The acquisition of Aegon Nederland significantly boosted ASR's market share. ASR's focus on sustainability has improved its ESG ratings, attracting investors. The company's strong solvency ratios and strategic investments have helped it navigate market volatility.

- €4.9 billion: The value of the Aegon Nederland acquisition.

- Strong Solvency Ratios: Maintained to manage financial risks.

- ESG Leadership: Recognized for sustainable practices.

- Digital Investments: Focus on AI and data analytics.

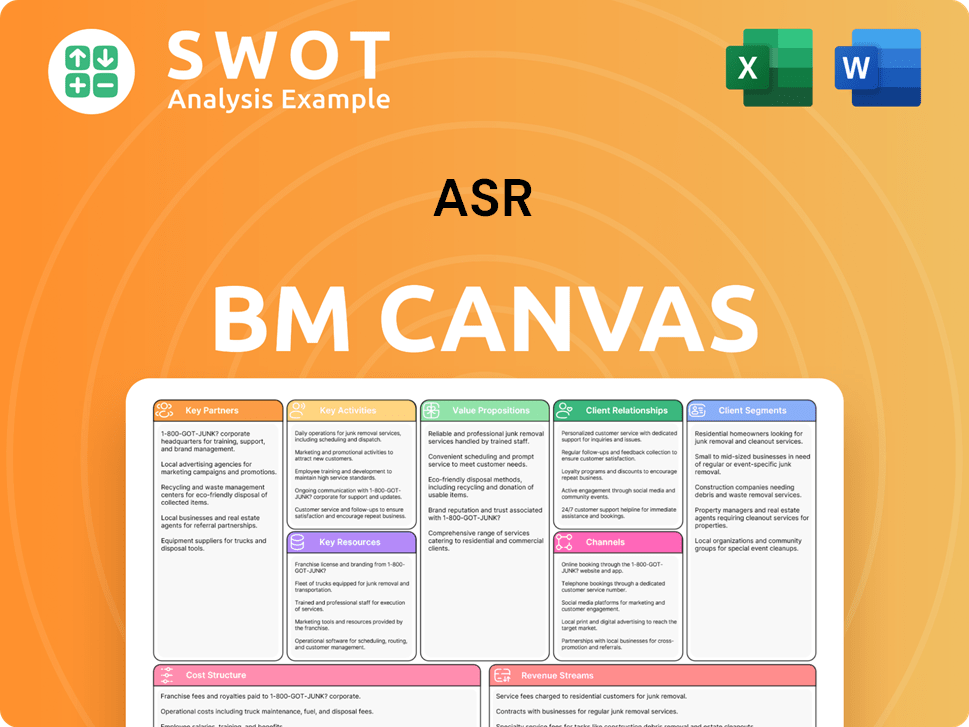

ASR Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is ASR Positioning Itself for Continued Success?

ASR Nederland N.V. maintains a strong position in the Dutch insurance and financial services sector. It is consistently among the top insurers, known for its market share and brand recognition. The acquisition of Aegon Nederland's insurance activities significantly boosted its customer base and premium income, cementing its status as a major player in both life and non-life insurance.

However, ASR faces several risks, including regulatory changes, competition from insurtech startups, and the need to adapt to technological disruptions and changing consumer preferences. Economic downturns and interest rate fluctuations also pose challenges. Despite these risks, ASR is focused on growth through digitalization and sustainability, aiming to reinforce its market leadership in the Netherlands.

ASR holds a prominent position in the Dutch insurance market, ranking among the top insurers. Its acquisition of Aegon Nederland strengthened its market share. The company emphasizes customer loyalty and sustainable practices, resonating well with consumers.

Key risks include regulatory changes and competition from insurtech startups. Technological advancements, such as AI, require continuous investment. Economic fluctuations and evolving consumer preferences also present challenges.

ASR plans to sustain revenue through organic growth, strategic acquisitions, and digitalization. The company aims to leverage its scale and enhance digital customer journeys. ASR is focused on ESG principles and long-term value creation.

Enhancing digital customer experiences is a key focus. Optimizing product portfolios to meet evolving needs is also crucial. Further embedding ESG principles across all business lines is part of the strategy.

ASR is focused on sustainable growth through various initiatives. The company aims to leverage its strong capital position and sustainable profile. For more details, explore the Growth Strategy of ASR.

- Continued organic growth and strategic acquisitions are planned.

- Digitalization and sustainability are key drivers.

- Emphasis on long-term value creation for shareholders.

- Commitment to maintaining a strong societal impact.

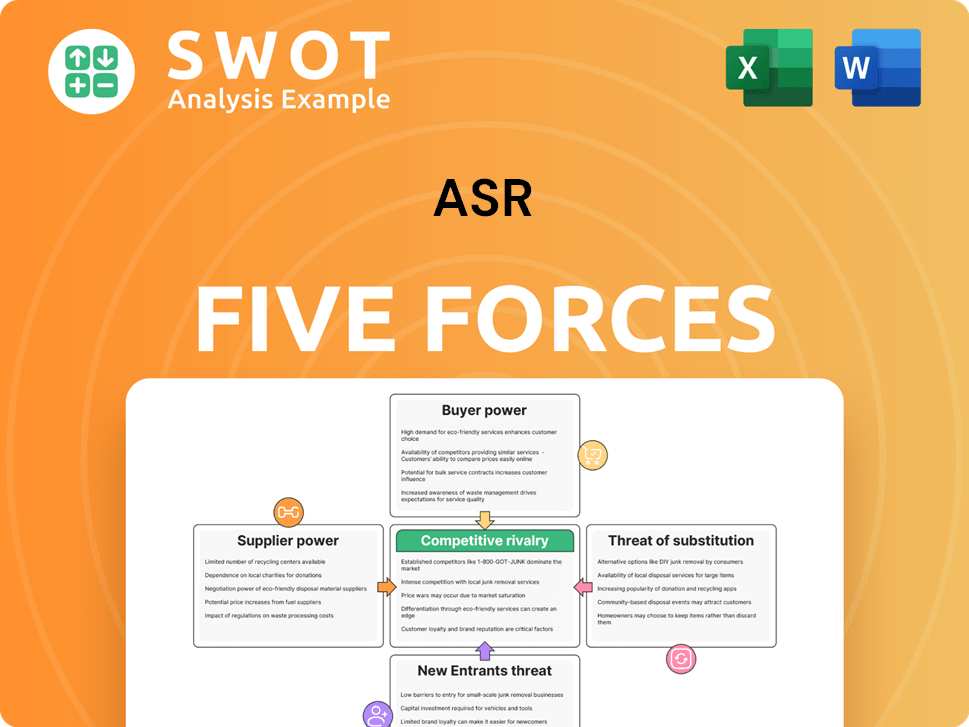

ASR Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of ASR Company?

- What is Competitive Landscape of ASR Company?

- What is Growth Strategy and Future Prospects of ASR Company?

- What is Sales and Marketing Strategy of ASR Company?

- What is Brief History of ASR Company?

- Who Owns ASR Company?

- What is Customer Demographics and Target Market of ASR Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.