ASR Bundle

Who Really Owns ASR Company?

Understanding a company's ownership is crucial for investors and stakeholders alike. The ASR SWOT Analysis is a great tool to understand the company. ASR Nederland N.V., a leading Dutch insurer, offers a compelling case study in this regard. From its origins as a state-owned entity to its current public status, the evolution of ASR's ownership reveals much about its strategic direction and market position.

This exploration into ASR company ownership will uncover the intricacies of its shareholder base, including key institutional investors and public shareholders. We'll examine how the ASR business has been shaped by its ownership structure, looking at the ASR parent company and its impact on the company's trajectory. Discover the ASR company ownership details and how it influences the firm's performance and future strategies, answering questions like "Who owns ASR" and "Who are the major shareholders of ASR."

Who Founded ASR?

The history of ASR company ownership is multifaceted, evolving from a collection of insurance predecessors rather than a single founding entity. The company's origins can be traced back to the early 18th and 19th centuries, with various insurance businesses merging over time. Understanding who owns ASR requires examining this complex historical context, which is key to grasping the ASR company ownership structure.

ASR's formation in 2000 as Fortis ASR involved the merger of Fortis AMEV and the ASR Group. This consolidation marked a significant shift in the ASR business. The early ownership structure was primarily within the Fortis framework. The Dutch government's intervention during the 2008 financial crisis dramatically altered the company's ownership, making the state the primary shareholder.

The absence of specific individual founders and initial equity splits at the 2000 merger is due to the nature of the company's creation, which was a consolidation of existing insurance entities. This makes tracing the ASR company ownership history a bit complex. The focus shifts to the larger financial groups and, later, the Dutch State's role in ASR company ownership.

Key predecessors include N.V. Maatschappij van Assurantie, Discontering en Beleening der Stad Rotterdam (1720) and Levensverzekering Maatschappij Utrecht (De Utrecht, 1833).

Formed in 2000 through the merger of Fortis AMEV and the ASR Group.

Initially part of the Fortis concern; later, the Dutch State acquired all Dutch entities of Fortis Holding in 2008.

The Dutch government's acquisition made ASR a state-owned entity.

ASR was listed on Euronext Amsterdam in 2016, with the Dutch State selling a majority of its shares.

ASR is now a publicly traded company, with the Dutch State still holding a significant stake.

Understanding ASR shareholders involves examining the company's history. The Dutch State played a crucial role in the company's ownership, especially during the financial crisis. Today, ASR is a public company. The Dutch State remains a major shareholder, although the company is listed on Euronext Amsterdam. For more insights into the ASR business model, you can explore the Revenue Streams & Business Model of ASR.

- 2000: Formation of Fortis ASR.

- 2008: Dutch State acquires ASR.

- 2016: Initial Public Offering (IPO) on Euronext Amsterdam.

- Current: ASR is a publicly traded company with the Dutch State as a major shareholder.

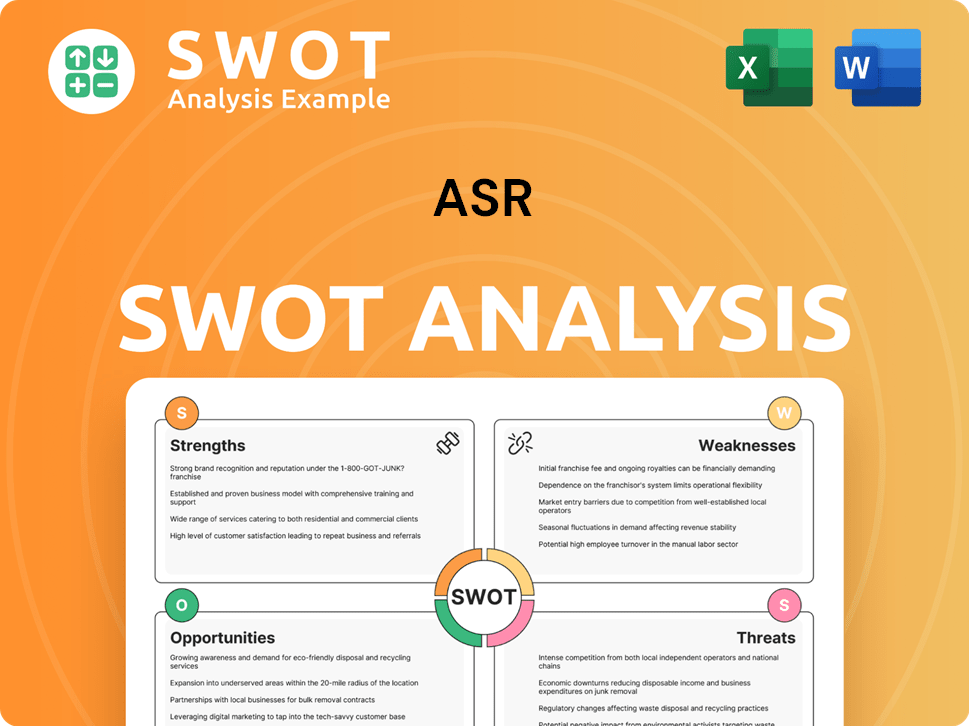

ASR SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has ASR’s Ownership Changed Over Time?

The evolution of the ASR company ownership structure reflects a significant shift from state control to a publicly traded entity. Initially, the Dutch government fully owned ASR Nederland after acquiring Fortis's Dutch operations in 2008. This ownership model persisted until the company's Initial Public Offering (IPO), marking a pivotal change in its financial and operational landscape.

The IPO of ASR Nederland on June 10, 2016, on Euronext Amsterdam, was a landmark event. The offering price was €19.50 per share, raising approximately €1.2 billion. This initial public offering allowed the company to broaden its investor base and access capital markets more effectively. The transition to a public company has enabled ASR to pursue strategic acquisitions and expand its market presence, as seen with the acquisition of Aegon's Dutch insurance business in 2020. For more details on the company's strategic direction, you can read about the Growth Strategy of ASR.

| Event | Date | Details |

|---|---|---|

| Dutch Government Acquisition of Fortis | 2008 | ASR Nederland becomes fully state-owned. |

| Initial Public Offering (IPO) | June 10, 2016 | ASR goes public on Euronext Amsterdam, raising approximately €1.2 billion. |

| Acquisition of Aegon's Dutch Insurance Business | 2020 | ASR expands its market presence. |

As of the latest reports, ASR company ownership is primarily characterized by a mix of institutional investors and a significant free float. The Dutch Government held 30.0% as of Q3 2023. Key institutional shareholders as of late 2023 and early 2025 include AEGON Investment Management BV (29.95% as of December 31, 2024), Norges Bank Investment Management (5.06% as of December 31, 2024), BlackRock, Inc. (4.24% as of May 21, 2025), and The Vanguard Group, Inc. (2.53% as of June 4, 2025). The free float accounted for approximately 43.5% of ASR's total share capital as of October 2023. The company's market capitalization reached approximately €4.2 billion in October 2023, and approximately €12.057 billion as of May 19, 2025.

The ownership structure of ASR has evolved significantly, transitioning from state ownership to a publicly listed company.

- The Dutch government initially owned ASR.

- The IPO in 2016 brought in significant capital and shifted the ownership landscape.

- Institutional investors now hold substantial stakes in ASR.

- The free float represents a significant portion of the shares available for trading.

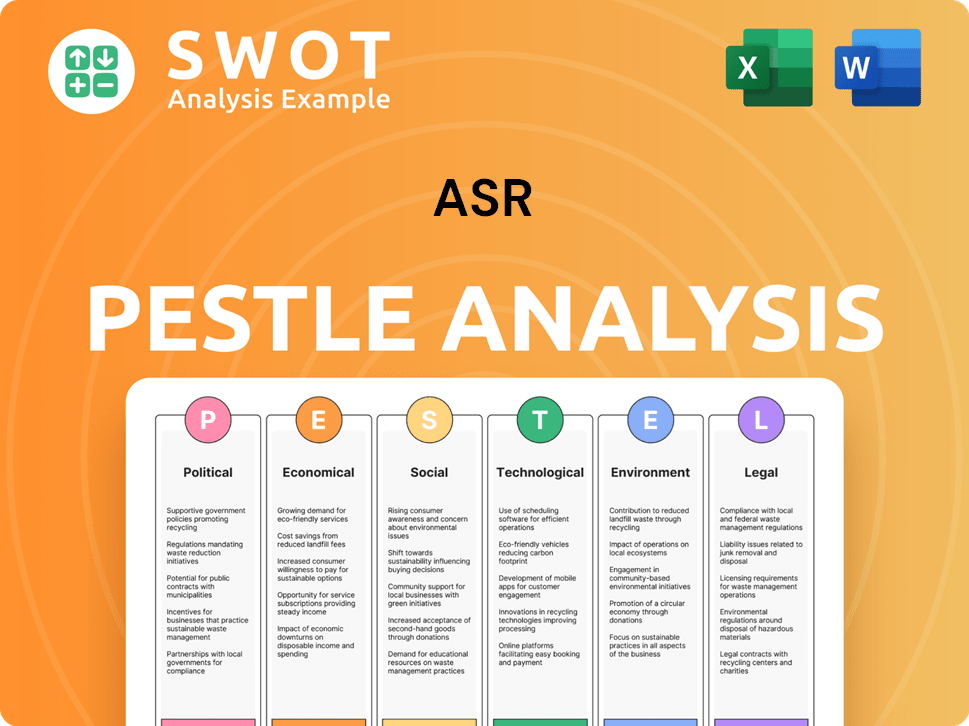

ASR PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on ASR’s Board?

The governance structure of ASR Nederland N.V. features a two-tier board system. This includes an Executive Board (EB), responsible for the company's strategy and results, and a Supervisory Board (SB), which oversees the EB and advises on company policies. In 2023, a Management Board (MB) was introduced to manage day-to-day operations and implement the business strategy. This structure ensures a clear separation of duties and oversight.

The Supervisory Board includes members with significant experience in financial services, aligning with the interests of ASR shareholders. Following Aegon's acquisition by ASR, Aegon gained the right to nominate two additional members to the Supervisory Board. One of these members must be female and independent, and the other can be Aegon's CEO or CFO, demonstrating a direct link between a major shareholder and board representation. This structure ensures that major stakeholders have a voice in the company's governance.

| Board Level | Responsibilities | Key Features |

|---|---|---|

| Executive Board (EB) | Corporate targets, strategy, and results | Responsible for the company's overall performance. |

| Supervisory Board (SB) | Advises the EB, supervises policies, and oversees general affairs | Acts as the employer of the Executive Board. |

| Management Board (MB) | Manages day-to-day business and implements the business strategy | Established in 2023 to streamline operations. |

The voting structure at ASR is designed to support long-term investors. ASR Nederland follows the Dutch Corporate Governance Code, promoting transparency and good governance. The company's articles of association and governance practices are in line with Dutch regulations, including formal procedures for board appointments. The 'Stichting Continuïteit ASR Nederland' (Continuity Foundation) was established to protect the interests of a.s.r. and its stakeholders. For insights into the competitive landscape, consider exploring the Competitors Landscape of ASR.

ASR operates under a two-tier board system with an Executive Board and a Supervisory Board. Aegon, a major shareholder, has the right to nominate two members to the Supervisory Board. The company adheres to the Dutch Corporate Governance Code, ensuring transparency.

- The Executive Board focuses on strategy and results.

- The Supervisory Board oversees the Executive Board.

- Aegon's influence is reflected in board representation.

- The Continuity Foundation protects stakeholder interests.

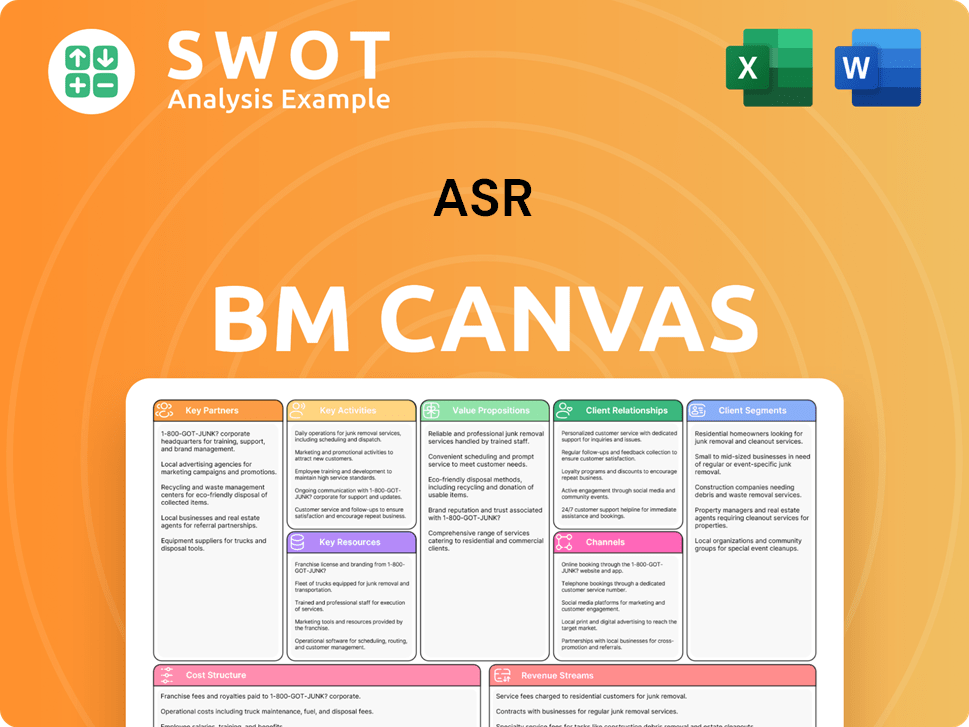

ASR Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped ASR’s Ownership Landscape?

Over the past few years, significant developments have reshaped the ownership landscape of ASR Nederland N.V. A major transaction occurred on July 4, 2023, with the acquisition of Aegon Nederland N.V. from Aegon Europe Holding BV for €4.6 billion. This acquisition significantly boosted ASR's non-life insurance segment. As a result of this deal, Aegon now has the right to nominate two members to ASR's Supervisory Board. These changes reflect strategic moves aimed at strengthening market position and operational capabilities. The ASR company ownership structure has been evolving due to these strategic decisions.

In addition to acquisitions, ASR has engaged in share buyback programs. A €100 million share buyback program was completed in December 2024, funded by the sale of Knab to BAWAG. Another program, announced on February 19, 2025, repurchased 2,403,923 shares at an average price of €52.00 per share, concluding on May 6, 2025, with a total value of €125 million. As of May 7, 2025, the company has 211,326,978 shares issued, with 4,699,914 shares held in treasury. ASR plans to seek approval from the General Meeting of Shareholders in 2026 to cancel the repurchased shares. These actions demonstrate a commitment to enhancing shareholder value. These moves impact the ASR shareholders and the overall ASR business.

| Metric | Value | Date |

|---|---|---|

| Market Capitalization | €12.057 billion | May 19, 2025 |

| Operating Result | €1,428 million | 2024 |

| Solvency II Ratio | 198% | December 31, 2024 |

| Dividend per Share (Proposed) | €3.12 | 2024 |

Industry trends also show an increased interest from institutional investors in ASR, with their ownership rising to approximately 56%. The company's stock price has shown resilience, with an approximate year-to-date growth of 15.3% as of October 2023. ASR's operating result increased by €455 million to €1,428 million in 2024. The Solvency II ratio as of December 31, 2024, was 198%, up from 176% in 2023. The proposed dividend for 2024 increased by 8% to €3.12 per share. These financial indicators highlight ASR's strong performance and strategic financial management. For more details on the company's performance, you can check out this article on ASR company ownership.

Acquisition of Aegon Nederland N.V. expanded ASR's customer base and non-life insurance segment.

Share buyback programs of €100 million (completed December 2024) and €125 million (completed May 6, 2025) reflect commitment to shareholder value.

Institutional investor ownership has risen to approximately 56%, indicating confidence in ASR's business model.

Strong financial results with an increased operating result of €1,428 million in 2024 and a Solvency II ratio of 198% as of December 31, 2024.

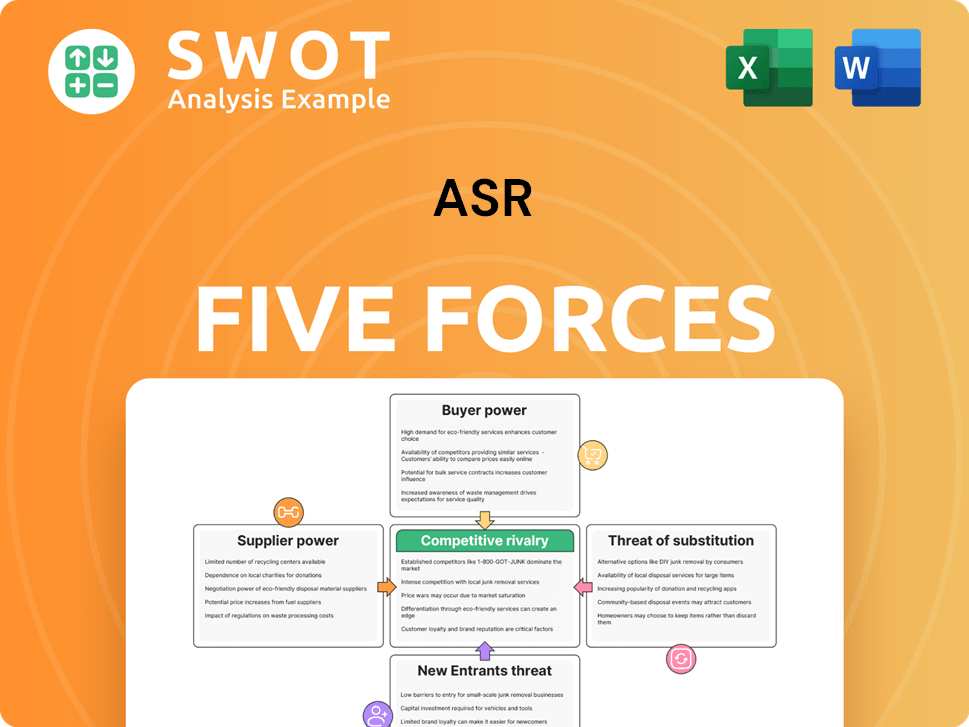

ASR Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of ASR Company?

- What is Competitive Landscape of ASR Company?

- What is Growth Strategy and Future Prospects of ASR Company?

- How Does ASR Company Work?

- What is Sales and Marketing Strategy of ASR Company?

- What is Brief History of ASR Company?

- What is Customer Demographics and Target Market of ASR Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.