ASR Bundle

Can ASR Company Continue its Dominance in the Dutch Insurance Market?

ASR Nederland N.V. has strategically navigated the complex financial services landscape, most notably with its acquisition of Aegon Nederland in 2024. This pivotal move significantly reshaped ASR's market position, highlighting its commitment to strategic expansion and market leadership. Understanding the ASR SWOT Analysis is crucial to grasping the company's trajectory.

From its humble beginnings in 1710, ASR has evolved into a key player, offering a wide array of insurance and financial products. Today, the company's growth strategy is centered on sustainable practices and technological innovation. This exploration will delve into ASR's future prospects, examining its expansion plans, technological advancements, and the competitive landscape within the Dutch financial sector, providing a comprehensive ASR market analysis.

How Is ASR Expanding Its Reach?

The expansion initiatives of ASR Nederland are primarily focused on strengthening its position within the Dutch market. This approach prioritizes optimizing current business lines rather than pursuing aggressive international expansion. The company's strategic moves are designed to enhance its market share and operational efficiency.

A significant aspect of ASR's growth strategy involves mergers and acquisitions, most notably the acquisition of Aegon Nederland, finalized in 2024. This acquisition has significantly boosted ASR's market share across various insurance sectors, including life insurance, pensions, and non-life insurance. The integration of Aegon Nederland is expected to yield substantial synergies, a key element of ASR's future prospects.

Beyond acquisitions, ASR is also concentrating on organic growth within its existing markets, focusing on innovation and customer-centric solutions. This includes developing new products and services tailored to evolving customer needs, particularly in areas like sustainable investments and personalized insurance solutions. This approach supports the long-term growth potential of the ASR company.

The acquisition of Aegon Nederland, completed in 2024, was a pivotal move. This strategic acquisition has significantly strengthened ASR's market position. It has created a stronger, more competitive entity within the Dutch insurance market.

ASR aims to achieve approximately €175 million in pre-tax synergies by 2026 from the integration of Aegon Nederland. These synergies will come from streamlined operations and optimized product offerings. This integration is a key part of the ASR company's strategic planning process.

ASR is investing in organic growth through product innovation and enhanced customer service. This includes developing new products tailored to customer needs, especially in sustainable investments. The company is also expanding its distribution channels, including digital platforms.

ASR is committed to sustainable and responsible business practices. This commitment serves as a key differentiator, attracting environmentally conscious customers. This focus aligns with broader societal trends and enhances the ASR company's competitive advantages.

ASR's expansion strategy is multifaceted, focusing on both inorganic and organic growth. The acquisition of Aegon Nederland is a cornerstone of this strategy, significantly increasing ASR's market share. The company is also focused on developing innovative products and services.

- Mergers and Acquisitions: Strategic acquisitions to expand market share.

- Product Innovation: Developing new products, particularly in sustainable investments.

- Distribution Channels: Expanding digital platforms to reach a wider audience.

- Sustainable Practices: Focusing on responsible business to attract environmentally conscious customers.

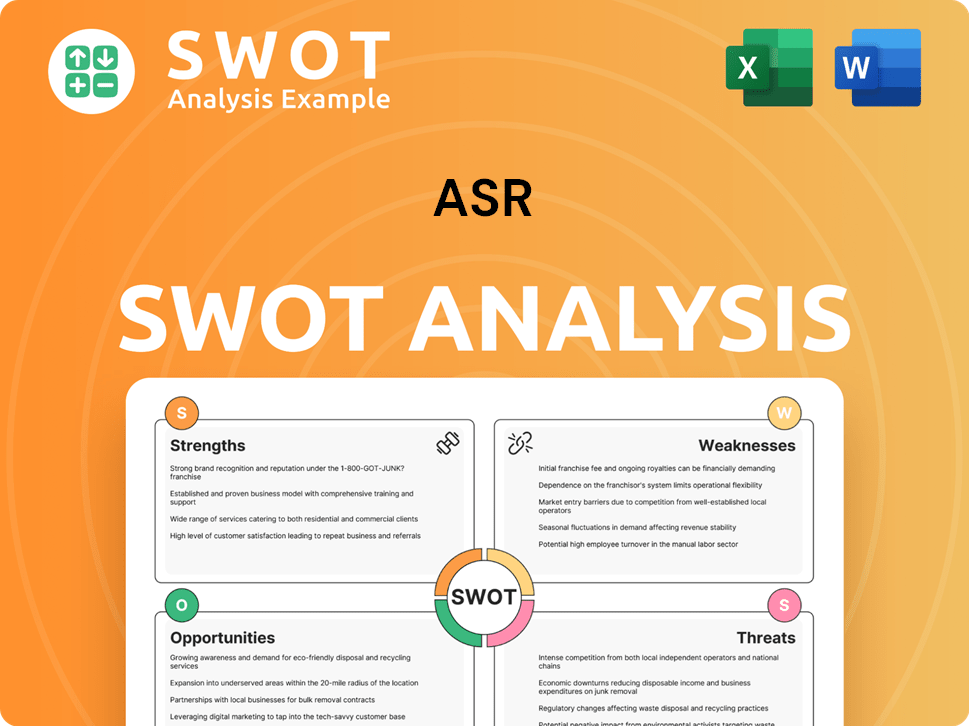

ASR SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does ASR Invest in Innovation?

The ASR company focuses heavily on innovation and technology as key drivers for its growth strategy. This approach is designed to enhance customer experience, streamline operations, and boost overall efficiency. By embracing digital transformation, data analytics, and customer-centric solutions, ASR aims to solidify its position in the market and capitalize on emerging opportunities.

A core element of ASR's strategy involves continuous investment in its digital platforms. This includes developing user-friendly online portals for policy management, claims processing, and easy access to product information. The goal is to make insurance services more accessible and convenient for customers, thereby improving customer satisfaction and loyalty. This commitment to digital enhancement is a key aspect of ASR's long-term vision.

Furthermore, ASR leverages data analytics and artificial intelligence (AI) to gain deeper insights into customer behavior and optimize its operations. This data-driven approach supports more accurate underwriting, fraud detection, and targeted marketing campaigns. While specific details about patents or industry awards are not widely publicized, ASR's commitment to digital transformation indicates a continuous effort to integrate advanced technologies into its core business processes.

ASR is actively enhancing its digital platforms to improve customer experience. This includes developing user-friendly online portals for policy management and claims processing. These initiatives aim to make insurance services more accessible and convenient.

The company utilizes data analytics and AI to gain deeper insights into customer behavior and optimize risk assessment. This supports more accurate underwriting and targeted marketing efforts. This approach is crucial for personalized product offerings.

ASR is exploring and investing in green financial products and responsible investment solutions. This aligns with the growing market demand for environmentally and socially conscious offerings. Sustainability is a key focus for future growth.

ASR prioritizes customer-centric solutions to enhance satisfaction and loyalty. This includes personalized product offerings and improved accessibility. The focus is on meeting evolving customer needs.

Streamlining operations is a key objective, achieved through digital transformation and data-driven insights. This leads to increased efficiency and reduced costs. The company aims for continuous improvement.

Data analytics and AI are used to improve risk assessment accuracy and detect fraud. This ensures the company's financial stability. These measures are crucial for long-term sustainability.

The ASR company's approach to innovation is multifaceted, focusing on digital transformation, data analytics, and sustainability. These strategies are designed to drive the ASR future prospects and maintain a competitive edge in the ASR market analysis.

- Digital Platforms: Continuous enhancement of online portals for policy management and claims processing.

- Data Analytics and AI: Leveraging data insights for personalized product offerings and optimized risk assessment.

- Sustainability: Investing in green financial products and responsible investment solutions.

- Customer Experience: Prioritizing user-friendly interfaces and accessible services to improve customer satisfaction.

- Operational Efficiency: Streamlining processes through technology to reduce costs and improve service delivery.

For a deeper understanding of the company's history and evolution, you can read a Brief History of ASR.

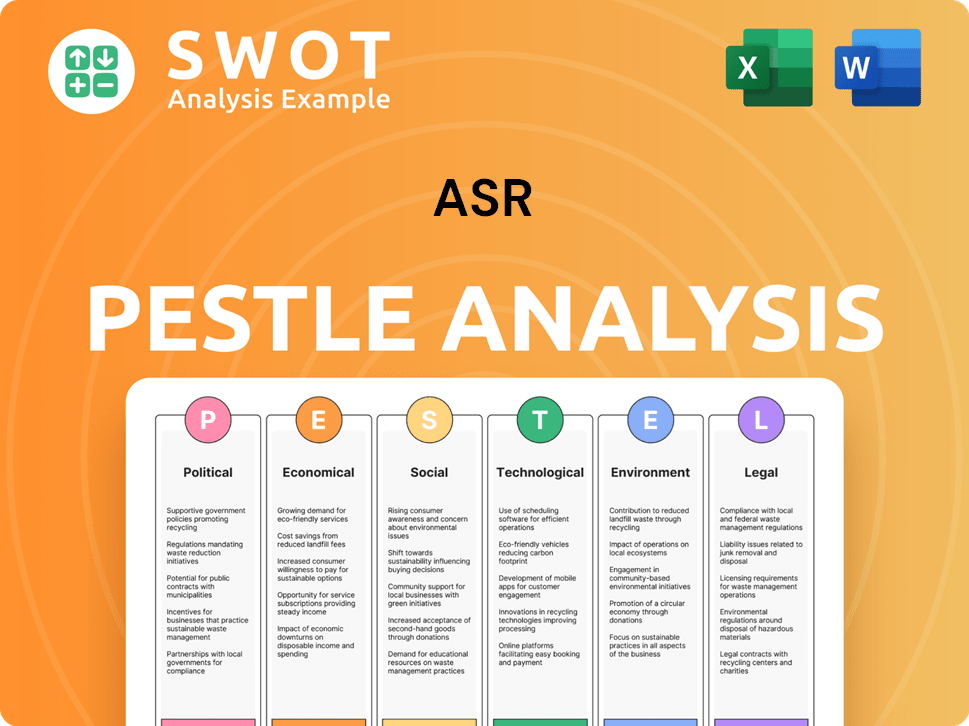

ASR PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is ASR’s Growth Forecast?

The financial outlook for the ASR company is centered on strong capital generation, dividend growth, and the successful integration of Aegon Nederland. Following the acquisition, the company has set ambitious targets for its future financial performance. This strategic focus is expected to drive significant value for shareholders and solidify its position in the market.

ASR's commitment to returning value to shareholders is reflected in its dividend policy. The company aims for an annual dividend per share growth of 8% through 2026. This commitment underscores the company's confidence in its financial strength and its ability to generate sustainable returns.

The company's financial health is also demonstrated by its Solvency II ratio, which stood at a robust 199% at the end of 2023. This strong capital position provides a solid foundation for future growth and resilience. For more details on the company's financial structure, you can read about the Revenue Streams & Business Model of ASR.

ASR aims to achieve an operating capital generation of over €950 million in 2024. The company expects to grow this to over €1 billion by 2026. These targets highlight the company's focus on generating strong cash flows.

The company plans to increase its dividend per share by 8% annually through 2026. This strategy reflects ASR's commitment to rewarding shareholders. This also shows confidence in its financial outlook.

ASR reported a net result of €1,006 million for the full year 2023. This strong performance, prior to the full impact of the Aegon integration, demonstrates the company's underlying profitability and operational efficiency. This is a key indicator of the company's financial health.

The Solvency II ratio was at a robust 199% at the end of 2023. This ratio, well above regulatory requirements, indicates a strong capital position. This provides a buffer against potential risks and supports future growth initiatives.

ASR's long-term financial goals are supported by operational efficiency, disciplined capital allocation, and sustainable growth. These factors are key to achieving its ambitious financial targets. The successful integration of Aegon and continued strong performance are critical for reaching these goals.

- Focus on operational efficiency to improve profitability.

- Disciplined capital allocation to maximize returns.

- Sustainable growth within the core Dutch market.

- Successful integration of Aegon to realize synergies.

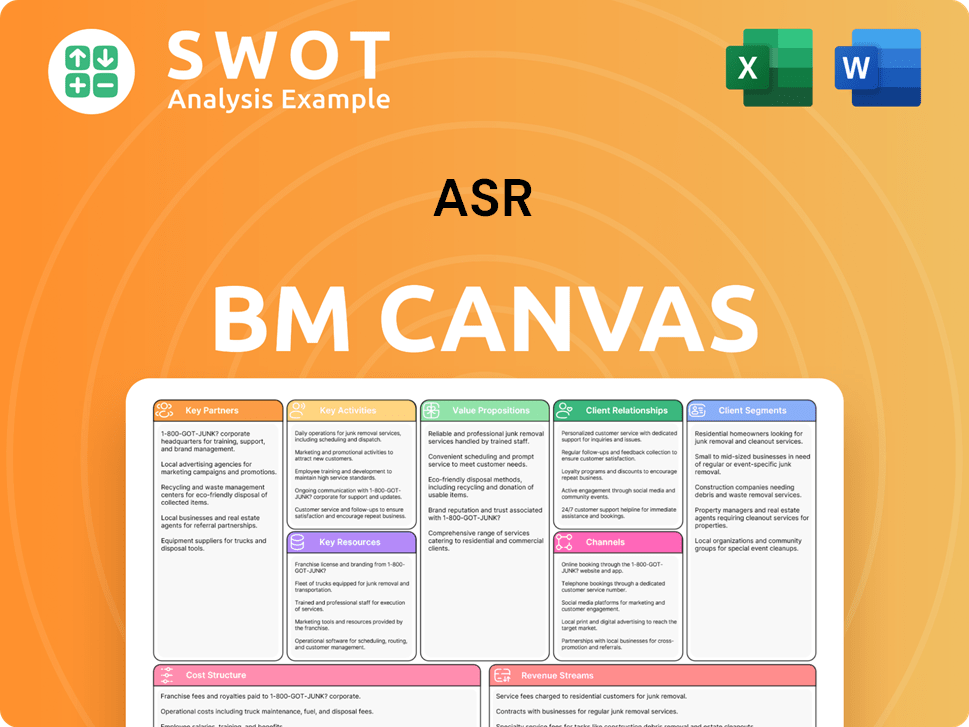

ASR Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow ASR’s Growth?

The ASR company, despite its robust position and strategic initiatives, faces several potential risks that could influence its future. These challenges span market competition, regulatory changes, technological disruptions, and internal resource constraints. Understanding these risks is crucial for assessing the long-term viability of the ASR company's growth strategy and its future prospects.

Intense competition in the Dutch insurance sector, coupled with the rapid pace of technological advancements, creates a dynamic environment. The company must continually adapt to maintain its market share and profitability. Furthermore, compliance with evolving regulations and the successful integration of acquisitions present ongoing operational challenges that require careful management.

The ASR company's ability to navigate these obstacles will significantly determine its success. A thorough ASR market analysis reveals the complexities of the insurance industry, where strategic foresight and adaptability are essential for sustained growth. Examining the ASR business model and ASR industry trends provides insights into how the company can mitigate risks and capitalize on opportunities.

The Dutch insurance market is highly competitive, with both established players and emerging fintech companies vying for market share. This competition can lead to price wars and pressure on profit margins. The ASR company needs to differentiate itself through innovative products and superior customer service to maintain its competitive edge. For a deeper understanding, explore the Competitors Landscape of ASR.

Regulatory changes, particularly those related to Solvency II, data privacy (like GDPR), and sustainable finance, pose significant challenges. Compliance requires continuous investment in systems and expertise. Non-compliance can result in substantial penalties and reputational damage, impacting the ASR company's financial performance. The company must proactively adapt to these evolving regulatory landscapes.

Technological advancements, while offering opportunities for innovation, also present a risk of disruption from insurtech startups. The ASR company must continuously invest in digital transformation to stay competitive. This involves adapting to new technologies and potentially acquiring or partnering with innovative companies. According to recent reports, insurtech investments reached over $14 billion globally in 2024.

Although less direct, supply chain issues in the broader economy can affect investment returns and policyholder's ability to pay premiums. Economic downturns or disruptions can indirectly impact the ASR company's financial stability. The company needs to maintain a diversified investment portfolio and develop robust risk management strategies to mitigate these risks. Economic forecasts for the Netherlands in 2025 predict moderate growth, but with potential volatility.

Attracting and retaining top talent, especially in specialized areas like data science and AI, can be challenging. The ASR company must offer competitive compensation and benefits to secure skilled professionals. Furthermore, effective talent management and succession planning are crucial for long-term success. The demand for data scientists in the Netherlands is expected to increase by approximately 15% by 2025.

The successful integration of acquisitions, such as Aegon Nederland, carries operational risks related to merging systems, cultures, and processes. The ASR company must ensure a smooth transition to realize projected synergies. This requires careful planning and execution to avoid disruptions. Integration costs can range from 5% to 10% of the acquisition value, as reported in 2024.

The ASR company employs several strategies to mitigate these risks. These include a diversified product portfolio, robust risk management frameworks, and scenario planning to assess the potential impact of adverse events. The company's focus on sustainable practices also helps in navigating evolving regulatory landscapes. The company's risk management framework is regularly updated, with reviews conducted at least quarterly, as per 2024 reports.

Effective strategic planning is critical to address these challenges. This involves continuous monitoring of the market, regulatory environment, and technological advancements. The ASR company's strategic planning process includes regular reviews of its business model and competitive positioning, with adjustments made as needed. The company's strategic plan is updated annually, with mid-year reviews to address any emerging risks. The Dutch insurance market is expected to grow by approximately 2% annually through 2026, according to recent forecasts.

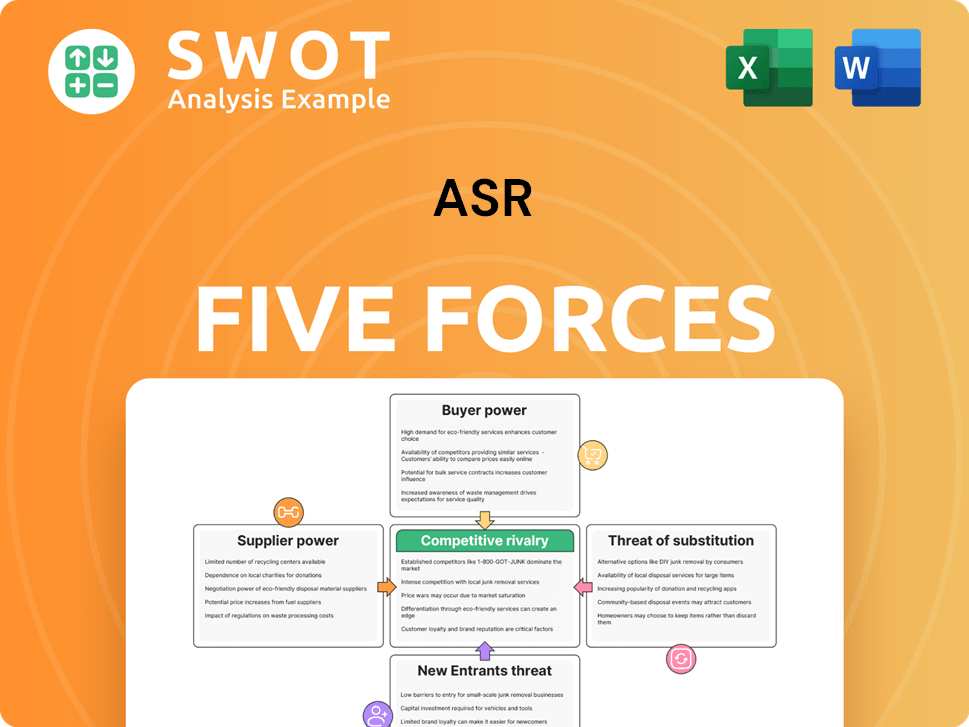

ASR Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.