ASR Bundle

Who are ASR's Customers?

Understanding the ASR SWOT Analysis is crucial for any company aiming for sustained success, and ASR Nederland N.V. is no exception. The acquisition of Aegon's Dutch operations in 2022 was a pivotal move that reshaped its market position, making it the second-largest insurer in the Netherlands. This strategic expansion highlights the critical need to understand the evolving landscape of its customer base.

To effectively serve its diverse customer base, ASR must deeply understand its customer demographics and target market. This includes detailed market segmentation and thorough audience analysis to tailor its products and services. Analyzing the ASR business through the lens of its customer profile, from individual needs to corporate demands, is essential for strategic planning. This article will delve into the specifics of ASR company customer behavior analysis and how it strategically identifies and serves its target audience, answering questions like "What are the customer demographics for ASR company?" and "How to identify the target market for ASR?".

Who Are ASR’s Main Customers?

Understanding the customer demographics and target market is crucial for the success of the ASR company. ASR Nederland N.V. caters to a diverse customer base, primarily within the Netherlands, encompassing consumers (B2C), businesses (B2B), and employers. This broad reach allows ASR to offer a wide range of services and products tailored to different needs. The company's market segmentation strategy is key to effectively reaching and serving its varied customer groups.

The primary customer segments of ASR are organized across its Non-life, Life, Asset Management, and Distribution and Services segments. The Non-life segment, which accounted for 57% of the revenue in 2024, provides property damage, civil liability, disability, and health insurance. The Life segment, contributing 43% of revenue in 2024, focuses on life insurance, pensions, and mortgages. This structure reflects ASR's strategic approach to meeting the diverse financial needs of its customers.

ASR's focus on customer demographics and target market is evident in its specialized offerings and market positioning. The company's strategic decisions, such as the acquisition of Aegon NL, have expanded its customer base and strengthened its market position. This focus on customer needs and market dynamics ensures that ASR continues to provide relevant and valuable services.

The Non-life segment offers property damage, civil liability, disability, and health insurance. In 2024, this segment generated 57% of ASR's revenue. ASR's market share in the disability market was 39.8% in 2023, up from 39.4% in 2022, based on gross written premiums. This segment includes customers seeking protection against various risks.

The Life segment focuses on life insurance, pensions, and mortgages, contributing 43% of the revenue in 2024. This segment caters to customers planning for their long-term financial security. ASR's offerings in this segment are designed to provide comprehensive financial solutions.

ASR targets customers seeking quality health insurance through its 'a.s.r. Ik kies zelf' label, which utilizes direct online channels. The 'a.s.r.' label is aimed at entrepreneurs, SMEs, and self-employed individuals, primarily distributed through intermediaries. As of year-end 2024, ASR Health Basic had 616,896 insured persons.

The acquisition of Aegon NL significantly expanded ASR's customer base, strengthening its position as the second-largest Dutch insurer. This strategic move enhanced its pension and disability business. Organic Capital Creation increased to €1,193 million in 2024, partly due to the Aegon Nederland contribution, reflecting ASR's growth strategy.

ASR's customer base is segmented across Non-life, Life, Asset Management, and Distribution and Services. The company's focus on specific customer needs is evident through its health insurance offerings, such as 'a.s.r. Ik kies zelf' and 'a.s.r.', which target different segments. ASR's strategic acquisitions, like Aegon NL, have expanded its reach and strengthened its market position.

- Non-life customers include those seeking property, liability, and health insurance.

- Life customers focus on life insurance, pensions, and mortgages.

- Health insurance targets customers through direct and intermediary channels.

- The acquisition of Aegon NL significantly boosted customer numbers and market share.

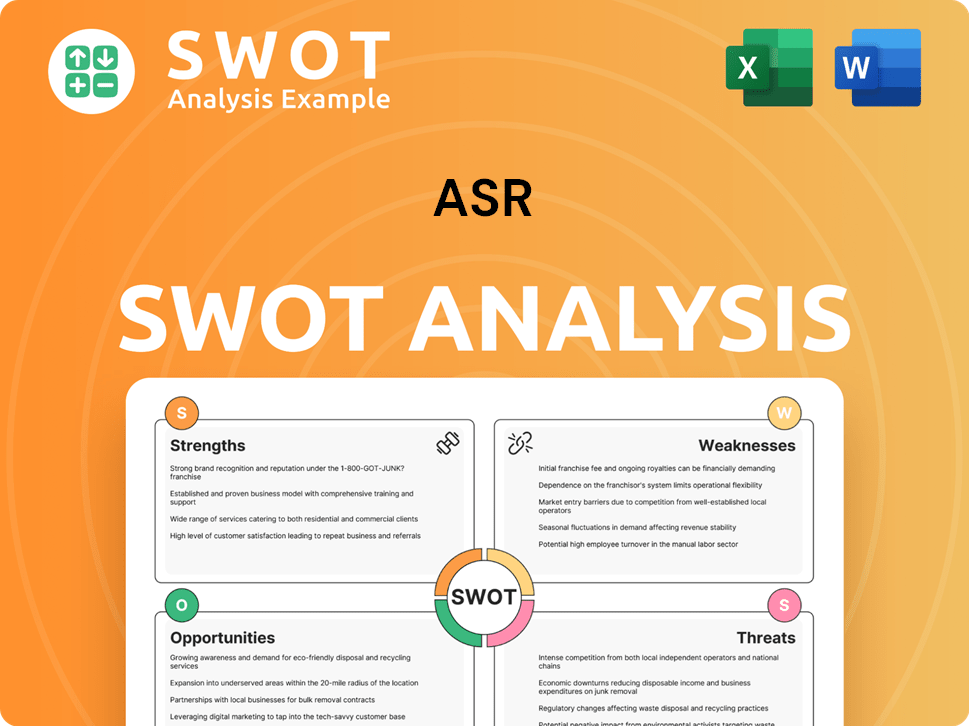

ASR SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do ASR’s Customers Want?

Understanding the customer needs and preferences is crucial for the success of any business, including the ASR company. The core of ASR's customer base is driven by the fundamental need for financial security and stability. This need translates into a demand for reliable insurance, pension plans, and mortgage products designed to protect against life's uncertainties and facilitate future planning. The ASR company's ability to meet these needs directly influences its market position and customer loyalty.

Customers of the ASR company evaluate offerings based on several key decision-making criteria. These include the features of the products, the quality of the service provided, and the reputation of the insurer. Aspects like sustainability and responsible business practices are also significant. ASR focuses on addressing common customer pain points, such as managing risks, ensuring income during periods of disability, and planning for retirement. This approach ensures that the ASR company remains relevant and responsive to its customers' evolving needs.

Market trends and customer feedback significantly influence the ASR company's product development and marketing strategies. The growing awareness of financial security and an aging population in the Netherlands drive increased demand for life insurance and pension products. For example, the demand for personalized and preventative health plans is growing, prompting insurers like ASR to innovate their product offerings. The ASR company tailors its marketing and product features to specific segments, such as offering the 'a.s.r. Ik kies zelf' health insurance label for online-savvy customers and distributing the 'a.s.r.' label through intermediaries for entrepreneurs and SMEs.

The ASR company focuses on providing financial security to its customers. This includes offering comprehensive protection through insurance, pensions, and mortgages. The company emphasizes product features, service quality, and sustainability in its offerings. The ASR company addresses customer pain points like risk management and retirement planning.

- Financial Security: Customers prioritize financial stability, seeking protection for various life events.

- Product Features: Customers assess offerings based on their features and benefits.

- Service Quality: High-quality service is a key factor in customer satisfaction.

- Sustainability: ASR's reputation for responsible business practices influences customer decisions.

- Risk Management: Customers seek solutions to manage risks and uncertainties.

The ASR company's approach to the market is also influenced by its commitment to sustainability. It supports sustainable living through its offerings, providing information and products with sustainable features, and offering mortgages that incentivize energy-saving measures in homes. This aligns with the increasing consumer demand for environmentally conscious products and services. To learn more about the ASR company's overall business model and revenue streams, you can read more in this article: Revenue Streams & Business Model of ASR.

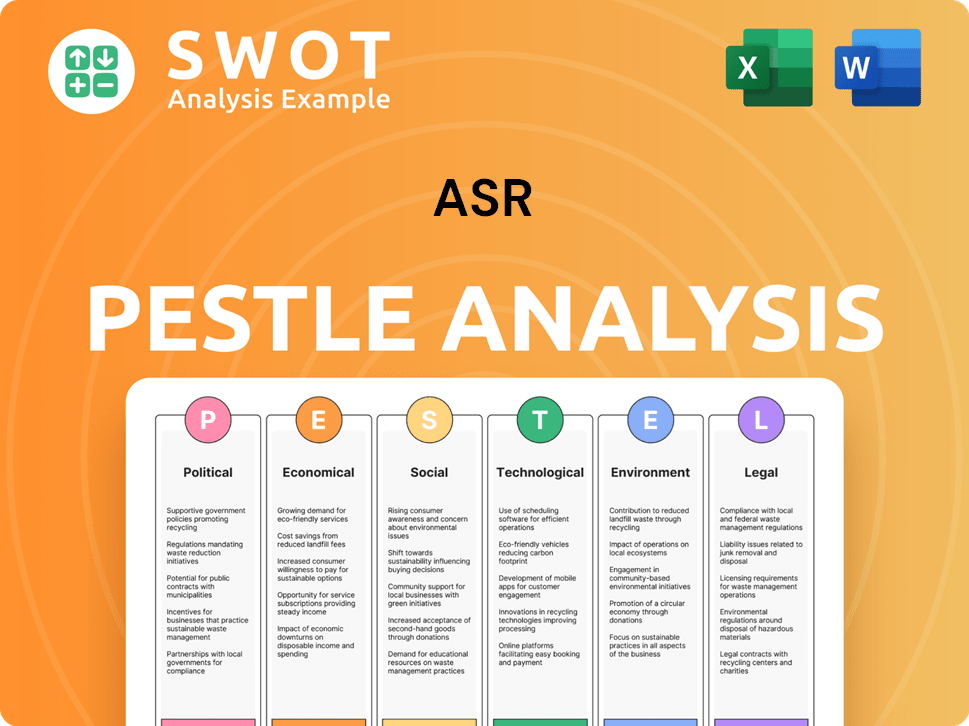

ASR PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does ASR operate?

The geographical market presence of the ASR company is primarily concentrated within the Netherlands. This focus is a key element of its business strategy, where it has established a significant market share. This strong position was further solidified by the acquisition of Aegon's Dutch operations.

ASR's strategic emphasis on the Dutch market places it as the second-largest insurer in the Netherlands, just behind NN Group. ASR has a leading presence in the pension and disability sectors, demonstrating its strong foothold in the region. This domestic focus allows ASR to tailor its products and services to the specific needs of the Dutch consumer base.

The Dutch insurance market, where ASR operates, is experiencing moderate growth. This growth is influenced by factors such as economic stability, the ongoing digital transformation, and shifts in consumer behavior. ASR's localized approach, including its health insurance brands and focus on sustainability, is designed to resonate with the specific values and preferences of the Dutch market. You can learn more about Growth Strategy of ASR.

The Dutch insurance market is highly concentrated, with the top three players holding over two-thirds of the market share. This concentration indicates a competitive landscape where established companies like ASR have a significant advantage. Understanding this market dynamic is crucial for ASR's strategic planning.

ASR's property portfolio is focused on 'approximately 15 top retail cities' and the 'strongest demographic and economic regions in the Netherlands.' This localized approach to real estate investments aligns with its customer base and supports its market segmentation strategy. This targeted approach allows for more effective resource allocation.

ASR localizes its offerings and marketing to succeed in this diverse market. For instance, its health insurance brands, 'a.s.r.' and 'a.s.r. Ik kies zelf,' cater to different customer preferences and distribution channels within the Netherlands. This customer-centric strategy is key to maintaining and growing its market share.

ASR's commitment to sustainable business practices and climate goals, as outlined in its 2024 annual report and climate transition plan, resonates within the Dutch market. In 2024, ASR's investment portfolio saw its carbon footprint decrease by 5 percentage points, and impact investments reached 8.7% of the portfolio. These efforts align with the growing emphasis on sustainability.

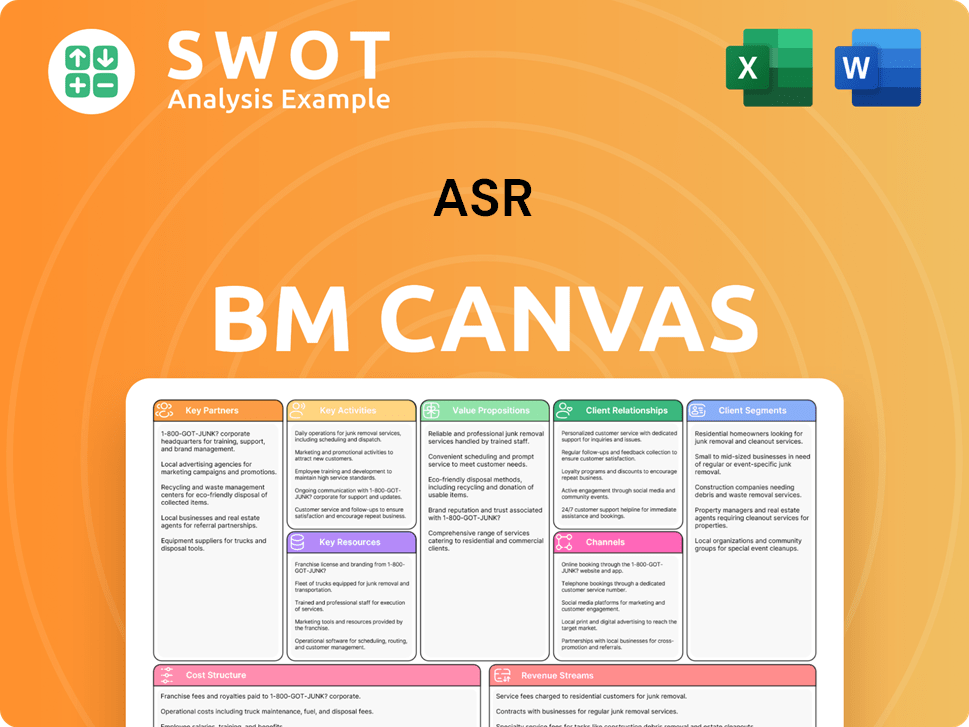

ASR Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does ASR Win & Keep Customers?

The customer acquisition and retention strategies of ASR Nederland N.V. are designed to reach a diverse customer base through multiple channels. This approach includes digital platforms, traditional methods, and intermediaries to ensure broad market coverage. A key element of this strategy involves integrating acquisitions, such as the Aegon NL portfolio, which has significantly boosted premium growth in both Non-life and Life segments. These efforts are further supported by a focus on customer satisfaction and sustainable practices to foster long-term relationships.

ASR’s customer acquisition strategies are multi-faceted, utilizing both direct and intermediary channels. For instance, health insurance products are distributed through direct online channels like 'a.s.r. Ik kies zelf' and intermediary channels, including 'a.s.r. label' for entrepreneurs and SMEs. The integration of Aegon NL's portfolio has been a significant driver, contributing to substantial growth in premiums. Furthermore, ASR's commitment to customer satisfaction and sustainable business practices is crucial for attracting and retaining customers, aligning with societal demands.

Retention strategies at ASR are centered on customer satisfaction, measured by the Net Promoter Score (NPS-c). While the NPS-c score of 39 in 2024 was slightly lower than the 41 recorded in 2023, ASR aims to achieve a target of 50. To improve customer experience, ASR is implementing further digitalization and AI in its customer service, expanding 'Mijn a.s.r.' and digitalizing claims handling. The company's focus on sustainable practices and preventing illness also contributes to customer loyalty and long-term relationships. This comprehensive approach aims to build strong customer relationships and ensure sustainable growth.

ASR utilizes direct online channels, such as 'a.s.r. Ik kies zelf,' to acquire customers. These digital platforms offer direct access to products and services, streamlining the customer experience. The focus on digital channels allows for efficient customer acquisition and targeted marketing campaigns.

ASR also employs intermediary channels, including 'a.s.r. label' for entrepreneurs and SMEs. These channels leverage partnerships to reach specific customer segments. This approach broadens ASR's market reach and provides tailored solutions for different customer needs.

ASR focuses on customer satisfaction, using the Net Promoter Score (NPS-c) to measure it. While the 2024 NPS-c score was 39, the company aims for a target of 50. Improving customer experience is a key part of ASR's retention strategy.

ASR is implementing digitalization and AI in customer service to improve overall experience. This includes expanding 'Mijn a.s.r.' and digitalizing claims handling. These initiatives aim to streamline processes and enhance customer interactions.

ASR emphasizes sustainable and responsible business practices to attract and retain customers. This commitment aligns with the growing societal demand for sustainability. ASR's sustainable reputation score increased to 39% in 2024, meeting its target range of 38-43%.

- Sustainability: ASR’s focus on sustainability enhances its brand image and attracts customers.

- Preventative Measures: ASR’s products and services aim to prevent illness, absenteeism, and disability, fostering customer loyalty.

- Market Segmentation: ASR's strategies are tailored to different customer segments, ensuring effective market penetration.

- Customer Experience: Digitalization and AI are used to improve customer service and experience.

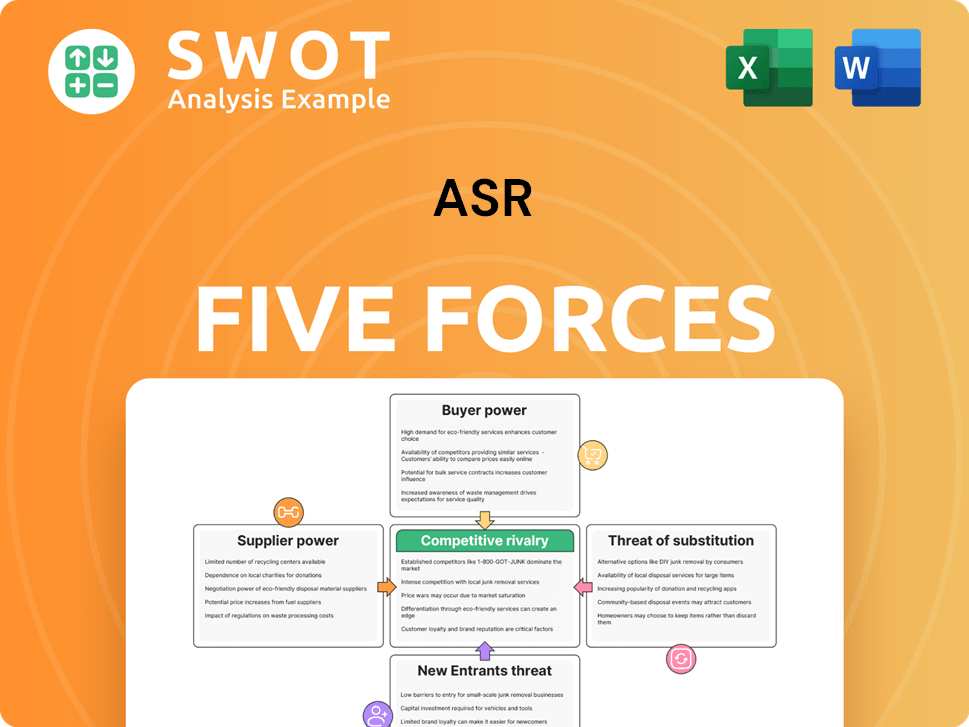

ASR Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.