Assurant Bundle

How Well Do You Know the History of Assurant?

Ever wondered about the origins of a global risk management leader? Assurant, a name synonymous with protection, has a fascinating past that's key to understanding its present-day dominance. From its roots in 1892 to its current status as a Fortune 500 company, the Assurant SWOT Analysis reveals a story of strategic evolution and resilience.

This brief history of Assurant explores the company's remarkable journey, from its humble beginnings as the La Crosse Mutual Aid Association to its expansion into a global provider of Assurant insurance and Assurant financial solutions. Discover the key milestones and strategic decisions that have shaped the Assurant company, providing valuable insights into its growth, acquisitions, and impact on the industry. Explore the Assurant timeline and understand how Assurant has adapted and innovated to meet the evolving needs of its customers and stakeholders.

What is the Assurant Founding Story?

The Assurant history begins in June 1892 with the formation of the La Crosse Mutual Aid Association in La Crosse, Wisconsin. This marked the genesis of what would become a significant player in the insurance and financial services sector. The early focus was on providing financial security to individuals and families, addressing the economic uncertainties of the late 19th century.

The initial aim was to offer reliable and accessible financial protection, especially for the working class. This was achieved through a mutual aid model, where members contributed to a common fund to support each other during times of need, primarily through life insurance. This cooperative approach was designed to offer its members peace of mind and security.

The company's early funding likely came from initial member contributions, a common practice for mutual associations back then. The cultural and economic context of the time, marked by industrialization and a growing awareness of financial insecurity, significantly influenced the company's creation. Mutual aid societies provided a crucial safety net before the widespread availability of commercial insurance.

Assurant SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Assurant?

The early growth of the Assurant company involved strategic moves that expanded its offerings and reach. This growth began with mergers and continued with relocations and diversification into new insurance areas. These early decisions set the stage for the company's future expansion and its transformation into a major player in the insurance industry. This Assurant company overview will help you understand its evolution.

In 1904, the La Crosse Mutual Aid Association merged with the Wisconsin Life Insurance Company, establishing the La Crosse Life Insurance Company. This merger was a crucial step in broadening its insurance offerings. The company's early focus was on life insurance, laying the groundwork for future diversification. These initial steps were fundamental to the Assurant's early strategy of consolidating and expanding its market presence.

A significant transformation occurred in 1909 when the company moved its headquarters to Milwaukee, Wisconsin, and rebranded as the Time Insurance Company. This relocation to a larger economic hub facilitated further growth and expansion. The new location provided access to a broader market and resources, which were essential for its development. This move was a key part of the Assurant timeline.

During the mid-20th century, Time Insurance Company expanded beyond traditional life insurance, venturing into accident and health insurance. This strategic shift allowed the company to tap into emerging market needs. By diversifying its offerings, the company aimed to broaden its client base and reduce its reliance on a single insurance type. This diversification was a key part of the Assurant insurance strategy.

The latter half of the 20th century saw a series of acquisitions that significantly shaped Assurant's future. In 1977, the acquisition of the American Bankers Insurance Group marked its entry into the property and casualty insurance market. Further expansion continued with the acquisition of Fortis, Inc.'s U.S. insurance businesses in 2001, which brought a substantial portfolio of specialty protection products. These acquisitions were instrumental in transforming the company from a regional insurer to a national, and eventually global, provider of diversified risk management solutions.

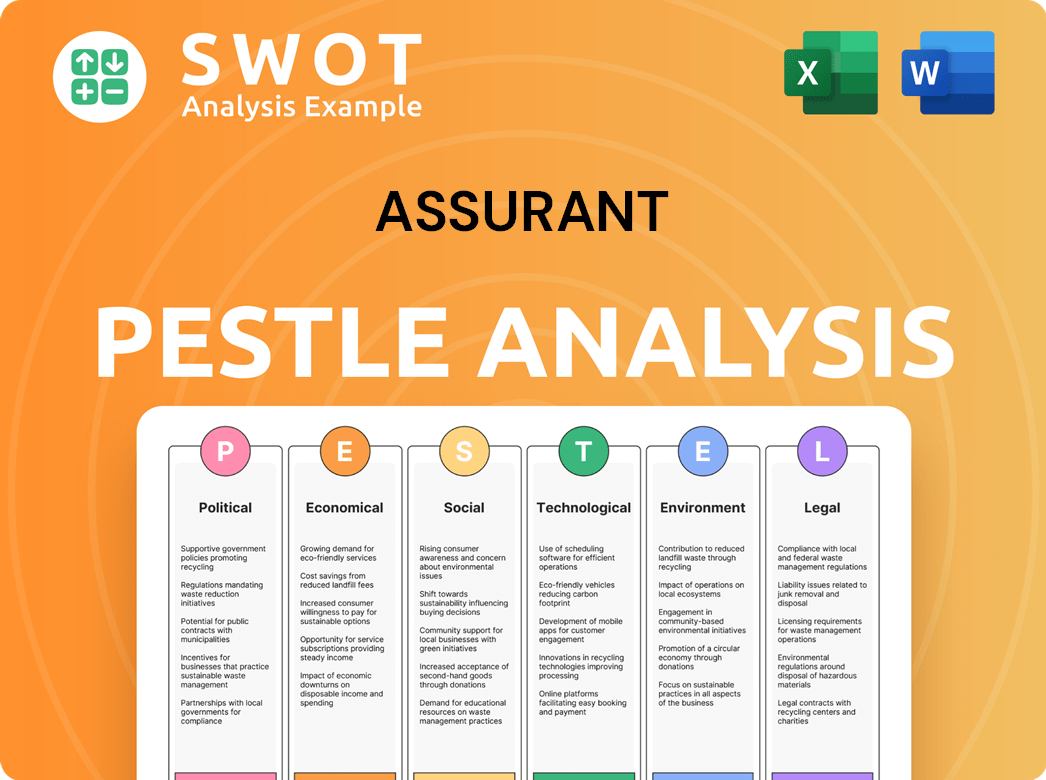

Assurant PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Assurant history?

The Assurant company's history is a journey marked by significant achievements and strategic adaptations. From its roots to its current position, Assurant has demonstrated resilience and a capacity to evolve within the dynamic financial services sector. Examining the Assurant company's background gives insights into its growth and influence.

| Year | Milestone |

|---|---|

| 1896 | Founded as the C.L. Brown Insurance Agency, marking the initial entry into the insurance market. |

| 1950s | Expanded into the mobile home insurance market, a key step in diversifying its offerings. |

| 1960s | Entered the credit insurance sector, broadening its financial protection services. |

| 2004 | Assurant becomes a publicly traded company, listed on the New York Stock Exchange. |

| 2018 | Sold its mortgage solutions business to focus on its global lifestyle and housing segments. |

| 2023 | Assurant reported revenue of approximately $9.8 billion, reflecting its substantial market presence. |

Assurant has consistently embraced innovation to stay ahead in the insurance and financial services sectors. A key focus has been the development of specialized protection products, particularly in the rapidly expanding mobile device market. The company has also invested heavily in technology-driven solutions to streamline claims processing and enhance customer service, improving operational efficiency.

Assurant has been a pioneer in mobile device protection, offering comprehensive coverage for smartphones and other devices. This area has seen significant growth, aligning with the increasing reliance on mobile technology.

The company has implemented advanced technology to automate and expedite claims processing, improving customer satisfaction. This includes the use of AI and data analytics to assess claims more efficiently.

Assurant has enhanced its customer service through digital platforms, providing online access and support. This includes mobile apps and web portals for policy management and claims submission.

Assurant has formed strategic partnerships with leading mobile carriers and retailers to offer protection plans. These collaborations expand market reach and customer access.

The company uses data analytics to assess risk and tailor insurance products to specific customer needs. This improves pricing accuracy and risk management.

Assurant has expanded its operations into new geographic markets, diversifying its revenue streams. This includes growth in Latin America and Europe.

Despite its successes, Assurant has faced significant challenges throughout its history. The 2008 financial crisis presented considerable headwinds, requiring strategic adjustments to investment portfolios and risk management practices. The insurance industry's competitive nature demands continuous innovation and adaptation to stay relevant.

Assurant has navigated economic downturns, which can impact its investment portfolio and customer demand. The company has had to adjust its strategies to mitigate these risks.

The company has adapted to evolving regulatory landscapes, ensuring compliance with changing insurance laws. This requires ongoing monitoring and adjustments to business practices.

The insurance industry is highly competitive, necessitating continuous innovation and differentiation. Assurant faces competition from both established players and emerging InsurTech companies.

Assurant has undertaken strategic divestitures of non-core assets to focus on key growth areas. This allows the company to streamline operations and allocate resources more effectively.

The company has adapted to technological disruptions, including the rise of digital insurance platforms. This requires investments in technology and digital capabilities.

Assurant has responded to changing consumer preferences, such as the demand for more personalized insurance products. This involves offering flexible and customizable coverage options.

Assurant Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Assurant?

The journey of the Assurant company, a prominent player in the insurance and financial services sector, is marked by strategic shifts and significant milestones. From its humble beginnings in the late 19th century to its current status as a publicly traded entity, Assurant's history showcases its ability to adapt and evolve within the dynamic financial landscape. This Marketing Strategy of Assurant article will walk you through the key events that shaped the company into what it is today.

| Year | Key Event |

|---|---|

| 1892 | La Crosse Mutual Aid Association was founded in La Crosse, Wisconsin. |

| 1904 | Merged with Wisconsin Life Insurance Company, forming La Crosse Life Insurance Company. |

| 1909 | Relocated to Milwaukee and rebranded as Time Insurance Company. |

| 1977 | Acquired American Bankers Insurance Group, entering the specialized property and casualty market. |

| 2001 | Acquired Fortis, Inc.'s U.S. insurance businesses, expanding into specialty protection. |

| 2004 | Officially rebranded as Assurant, Inc. and became publicly traded on the NYSE. |

| 2015 | Divested its health insurance business to focus on specialty protection. |

| 2018 | Sold its mortgage solutions business to concentrate on global lifestyle and housing. |

| 2020s | Continued focus on mobile protection, extended service contracts, and global expansion. |

| 2024 | Announced its commitment to achieving net-zero greenhouse gas emissions by 2040. |

Assurant is currently concentrating on its global lifestyle and housing segments. This includes mobile device protection, extended service contracts, and lender-placed insurance. The company is strategically positioned to benefit from the increasing global demand for connected living and the protection of consumer goods.

In the first quarter of 2025, Assurant reported a net operating income of $197 million. This strong financial performance indicates a positive outlook for future growth. The company's financial health supports its expansion plans and investments in digital solutions.

Assurant is committed to innovation in digital solutions and maintaining strong client relationships. These aspects are expected to be key drivers of success in the future. The company's focus on technology and customer service will likely enhance its market position.

Assurant's future trajectory remains aligned with its founding vision of providing essential protection. The company continuously adapts to the evolving technological and consumer landscape. This adaptability ensures that Assurant remains relevant and competitive in the long term.

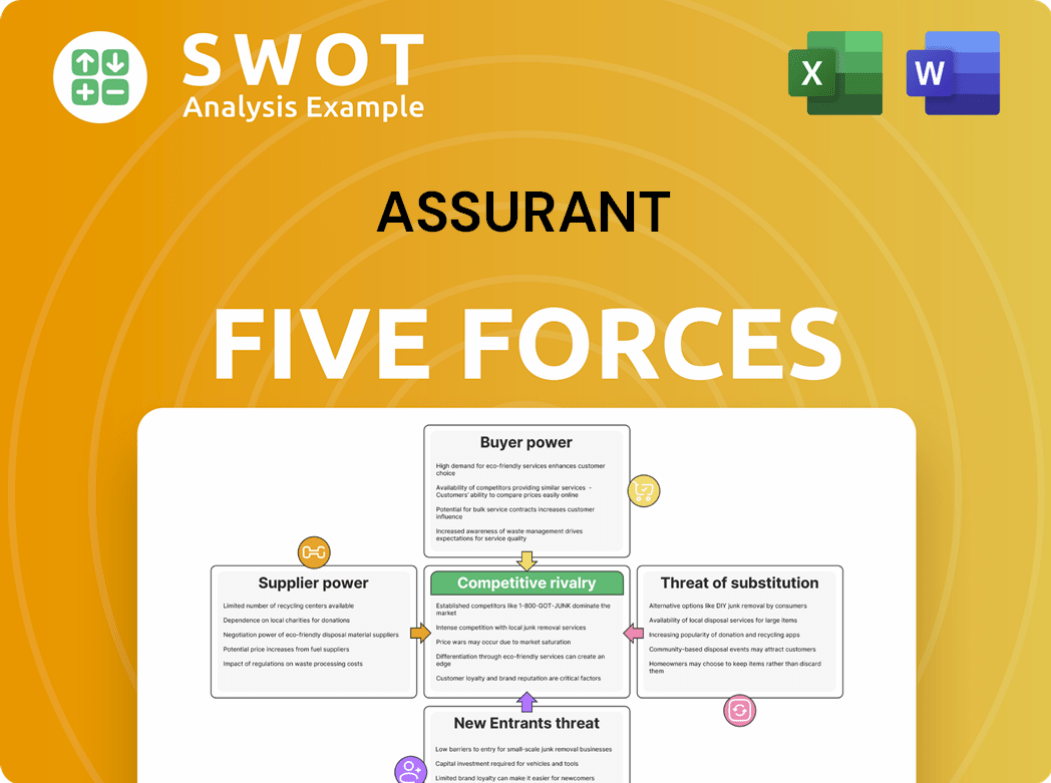

Assurant Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Assurant Company?

- What is Growth Strategy and Future Prospects of Assurant Company?

- How Does Assurant Company Work?

- What is Sales and Marketing Strategy of Assurant Company?

- What is Brief History of Assurant Company?

- Who Owns Assurant Company?

- What is Customer Demographics and Target Market of Assurant Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.