Assurant Bundle

How Does Assurant Navigate the Complex Insurance Market?

In a world of rapid technological change and shifting consumer demands, Assurant stands out as a key player in the risk management solutions sector. Its diverse offerings, spanning mobile device protection to lender-placed insurance, place it at the center of several critical industries. Understanding the Assurant SWOT Analysis is key to grasping its competitive position.

This report provides a comprehensive Assurant market analysis, examining its competitive landscape and identifying its main rivals. We'll explore the company's strengths and weaknesses within the insurance market, analyzing its competitive strategy and financial performance relative to its competitors. Understanding who Assurant's key competitors are and how it differentiates itself is crucial for anyone looking to understand the financial services industry.

Where Does Assurant’ Stand in the Current Market?

Assurant holds a strong market position within the specialty protection and risk management sectors. The company is a global leader, particularly in connected living, which includes mobile device protection and extended service contracts. Additionally, it is a leading provider of lender-placed insurance. As of 2023, Assurant serviced over 300 million mobile devices globally, showcasing its significant footprint in the mobile device protection market.

The company's core operations are structured around three main segments: Global Lifestyle, Global Housing, and Global Preneed. These segments allow Assurant to offer a diverse range of products, including mobile device protection, extended service contracts, lender-placed insurance, and preneed funeral insurance. This diversification helps to mitigate risks and capitalize on various market opportunities.

Assurant's value proposition lies in providing specialized insurance and protection products that meet the evolving needs of consumers and businesses. The company focuses on offering comprehensive solutions, leveraging digital platforms for efficient claims processing and customer service. This approach enhances customer experience and operational efficiency.

Assurant has a significant global presence, with operations in North America, Europe, Asia, and Latin America. Its market share is particularly notable in segments like lender-placed insurance, reflecting its established relationships with financial institutions. The company's ability to adapt to changing market dynamics and expand its offerings has solidified its position in the Target Market of Assurant.

Assurant's financial performance reflects its robust market standing. For the full year 2023, the company reported net operating income of $1.20 billion, demonstrating its financial health compared to industry averages. This strong financial performance is supported by a solid capital position and consistent profitability, which contribute to its competitive advantages.

The company is focused on digital transformation and expanding its offerings to meet the demands of an increasingly connected world. This includes significant investments in digital platforms for claims processing and customer service. Assurant continues to seek growth in emerging markets and through strategic partnerships to further solidify its global market position.

Assurant's primary product lines include Global Lifestyle (mobile, extended service contracts, and vehicle protection), Global Housing (lender-placed insurance, multifamily housing, and manufactured housing), and Global Preneed (preneed funeral insurance). These diverse offerings cater to a wide range of customer needs and contribute to the company's overall market position.

Assurant's competitive advantages stem from its specialized focus, global presence, and strong financial performance. The company's ability to innovate and adapt to changing market conditions is also crucial. These strengths enable Assurant to maintain a leading position in the insurance market.

- Strong market position in key segments.

- Global footprint with operations in multiple regions.

- Focus on digital transformation and customer service.

- Consistent financial performance and profitability.

Assurant SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Assurant?

The Assurant competitive landscape is shaped by a diverse group of companies across its various business segments. The company faces competition from both direct and indirect rivals in the insurance and extended service contract markets. These competitors challenge Assurant on various fronts, including pricing, service quality, and technological innovation.

Understanding Assurant's competitors is crucial for a thorough Assurant market analysis. The competitive dynamics are constantly evolving due to mergers, acquisitions, and the emergence of new players, especially in the insurtech space. Therefore, staying informed about the competitive environment is essential for assessing Assurant's position in the industry.

The Assurant industry is competitive and dynamic. The company competes with established insurance carriers, specialized warranty providers, and technology companies. These competitors offer similar products and services, putting pressure on Assurant to maintain its market share and profitability.

In the mobile device protection market, Assurant's key competitors include Asurion, Apple, and Samsung. These companies offer device protection plans and extended warranties, competing on service quality, network reach, and customer relationships.

In the lender-placed insurance market, Assurant competes with large property and casualty insurers such as QBE. These competitors focus on pricing, regulatory compliance, and efficient claims handling.

The vehicle protection market includes various warranty administrators and insurance companies. These competitors offer vehicle service contracts and extended warranties, competing on price, coverage, and service.

New entrants and emerging players in the insurtech space are disrupting the market. These companies leverage advanced analytics and digital platforms to offer personalized and efficient protection solutions, creating new challenges for established players like Assurant.

Mergers and alliances, such as partnerships between tech companies and insurers, continually reshape the competitive dynamics. These collaborations create new challenges and opportunities for Assurant, requiring the company to adapt and innovate.

Assurant faces competitive pressures from various sources, including pricing, service quality, and technological innovation. The company must continually improve its offerings to maintain its market share and profitability.

Assurant's competitive strategy overview involves focusing on its core strengths and adapting to market changes. The company leverages its established relationships, technological capabilities, and customer service to differentiate itself from competitors.

- Customer Base and Competitor Comparison: Assurant serves a diverse customer base, including consumers, businesses, and financial institutions. The company's ability to provide tailored solutions and excellent customer service is a key differentiator.

- Assurant's Financial Performance Compared to Competitors: Financial performance varies across segments. For example, in 2024, the global insurance market is projected to reach approximately $7 trillion.

- Assurant's Strengths and Weaknesses Analysis: Strengths include a diversified business model and strong customer relationships. Weaknesses may include exposure to market fluctuations and competition from larger players.

- Assurant's Recent Acquisitions and Their Impact on Competition: Acquisitions can strengthen Assurant's market position and expand its capabilities. These moves often aim to enhance the company's competitive edge.

- Assurant's Innovation in the Insurance Market Compared to Rivals: Assurant invests in technology and innovation to improve its products and services. This includes using data analytics and digital platforms to enhance customer experience and operational efficiency.

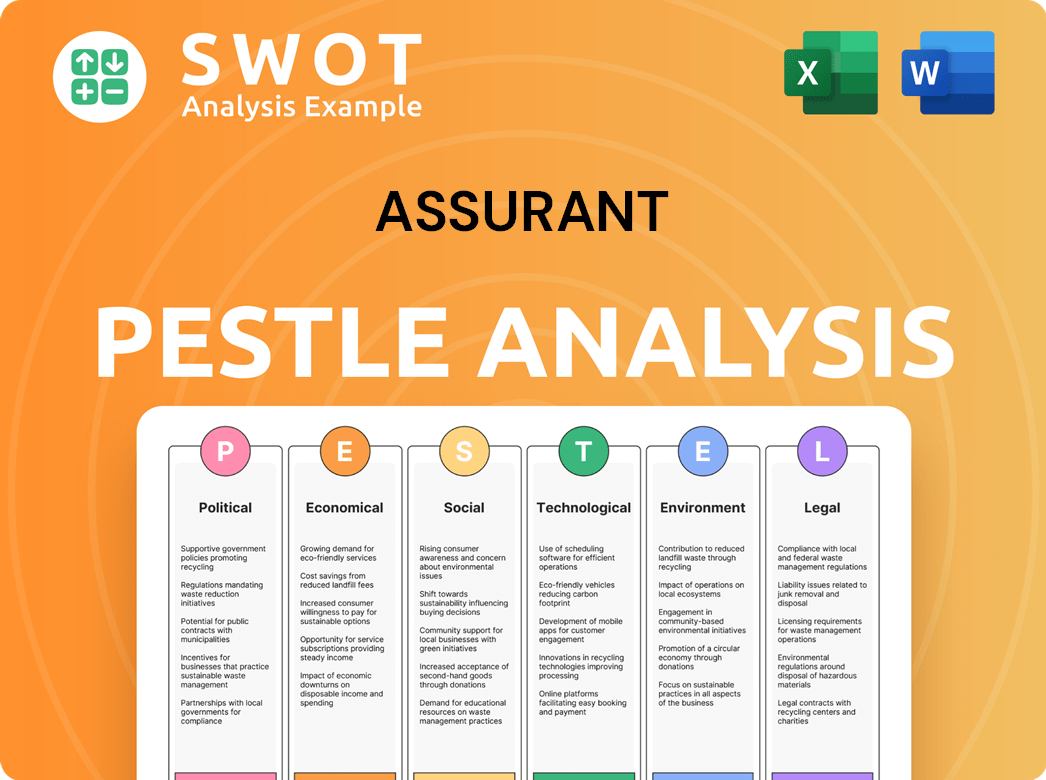

Assurant PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Assurant a Competitive Edge Over Its Rivals?

Understanding the Assurant competitive landscape involves analyzing its key strengths that allow it to maintain a strong position in the insurance market. These advantages are crucial for investors, financial analysts, and business strategists assessing the company's long-term viability. The company's strategic moves and operational efficiencies are key factors in its success.

Assurant's ability to navigate the complexities of the financial services sector is reflected in its strategic initiatives and market performance. This overview provides a detailed look at how Assurant differentiates itself from its competitors. The company's strategic approach, including its focus on innovation and customer service, is central to its competitive edge.

The company's performance and strategic direction are vital for understanding its competitive stance. This analysis highlights the key factors contributing to Assurant's success. For more insights into its growth strategy, you can refer to the Growth Strategy of Assurant.

Assurant operates in 21 countries, giving it a broad customer base. This global presence allows for efficient delivery of its diverse product portfolio, including mobile device protection and lender-placed insurance. The company's established relationships with leading mobile carriers and financial institutions strengthen its market position.

Assurant uses advanced analytics to improve risk assessment, pricing models, and claims processing. Digital platforms for mobile device claims streamline processes for consumers and partners. This technological advantage enhances operational efficiency and customer experience, providing a competitive edge.

Decades of experience in specialty protection products enable Assurant to understand niche markets and manage complex risks effectively. This expertise allows for tailored solutions, fostering strong customer loyalty. The company's ability to adapt and innovate in these areas sets it apart.

Assurant's reputation for reliable service and a customer-centric approach builds trust. Consistent performance and a focus on customer needs enhance its competitive edge. This brand equity supports customer retention and attracts new business.

Assurant leverages several key advantages to maintain its market position. These include a global presence, advanced technology, and specialized expertise. The company's focus on digital transformation and strategic partnerships supports its ongoing success.

- Extensive global reach with operations in 21 countries.

- Advanced data analytics for risk assessment and claims processing.

- Strong brand equity and a reputation for reliable service.

- Economies of scale, particularly in mobile protection.

Assurant Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Assurant’s Competitive Landscape?

The competitive landscape for Assurant is significantly shaped by industry trends, future challenges, and opportunities. The company operates within the insurance market, facing dynamics driven by technological advancements and evolving consumer preferences. Understanding these factors is crucial for assessing Assurant's position and potential for growth.

The company's position in the financial services sector is influenced by factors like regulatory changes and the rise of insurtech companies. Assessing the competitive landscape requires a look at the company's strategies, the market's innovations, and its financial performance. For more insights into the company, consider reading about Owners & Shareholders of Assurant.

Technological advancements are transforming the industry. The adoption of 5G and the Internet of Things (IoT) is creating new device categories and potential risks. Regulatory changes across different geographies impact product design and compliance.

Anticipated disruptions include the rise of embedded insurance and insurtech companies. These trends could impact traditional distribution channels, requiring further investment in digital capabilities. Adapting to consumer preferences for personalized solutions is crucial.

Significant growth opportunities exist in emerging markets. Product innovations, such as cyber protection, offer avenues for expansion. Strategic partnerships with technology companies and financial institutions will be crucial for growth.

Assurant's strategy likely involves continued investment in technology and strategic acquisitions. The company will focus on fostering a culture of innovation to remain resilient and capitalize on future growth. The competitive position will evolve towards a more digitally-driven model.

The insurance market is dynamic, with companies like Assurant facing constant change. Understanding the competitive landscape requires analyzing industry trends, challenges, and opportunities. Adaptability and innovation are essential for success.

- Focus on digital capabilities and data-centric models.

- Explore partnerships to expand reach and integrate offerings.

- Prioritize proactive risk management and customer experience.

- Invest in technology and strategic acquisitions.

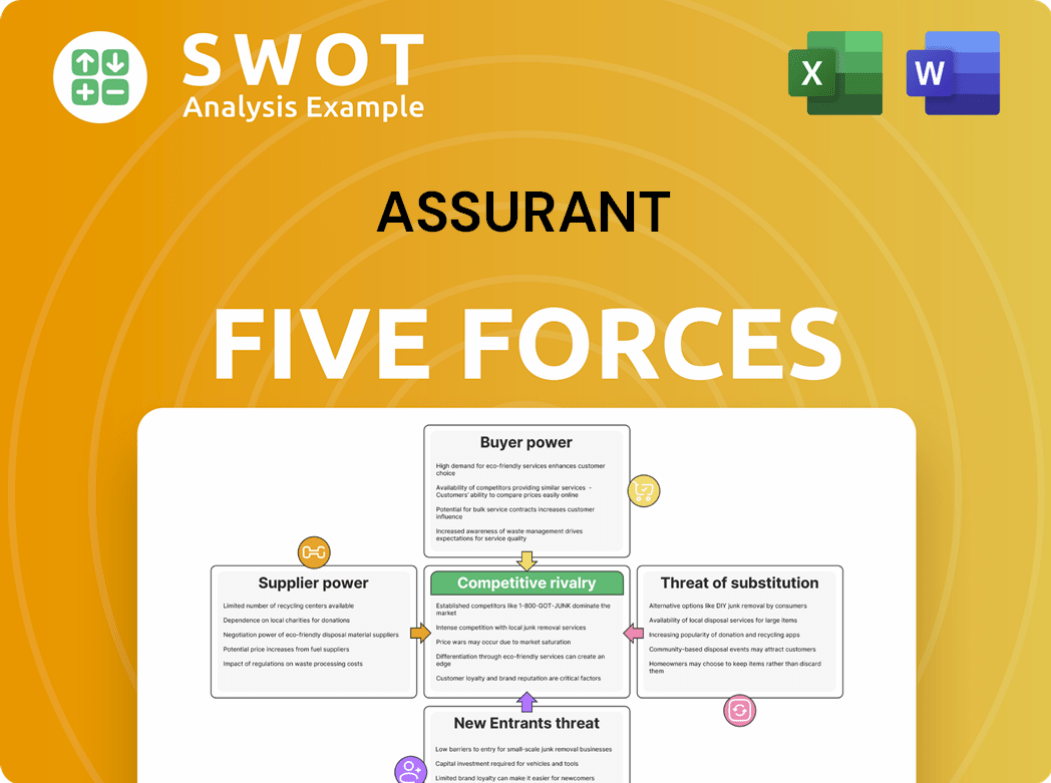

Assurant Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Assurant Company?

- What is Growth Strategy and Future Prospects of Assurant Company?

- How Does Assurant Company Work?

- What is Sales and Marketing Strategy of Assurant Company?

- What is Brief History of Assurant Company?

- Who Owns Assurant Company?

- What is Customer Demographics and Target Market of Assurant Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.