Assurant Bundle

Can Assurant Sustain Its Growth Trajectory?

Assurant, a global leader in risk management solutions, has strategically navigated the complex insurance landscape. Its journey, marked by the pivotal acquisition of The Warranty Group, showcases a commitment to expansion and diversification. This Assurant SWOT Analysis helps to understand its strengths and weaknesses.

This exploration delves into the

How Is Assurant Expanding Its Reach?

The growth strategy of the company is significantly shaped by its strategic expansion initiatives, which focus on both geographical reach and product diversification. This approach is crucial for maintaining and enhancing its market position. The company's ability to adapt and expand its offerings is a key factor in its long-term growth potential.

A primary focus area is the continued global expansion of its mobile device protection business. This includes targeting emerging markets where smartphone adoption is rising. The company aims to leverage existing partnerships with major carriers and retailers to introduce new protection plans and services, adapting offerings to local market needs.

The company is also keen on expanding its presence in the connected home ecosystem, offering protection for smart appliances and home systems. This involves developing new service contracts and exploring partnerships with smart home device manufacturers. These initiatives are driven by the need to access new customer bases and diversify revenue streams.

The company actively pursues opportunities in regions like Latin America and the Asia-Pacific. This expansion is part of its broader strategy to tap into emerging markets. These efforts are designed to increase its customer base and revenue streams.

The company is expanding into the connected home market, offering protection for smart devices. This diversification helps to reduce reliance on traditional insurance products. This strategy is designed to align with evolving consumer demands and technological advancements.

The company evaluates potential mergers and acquisitions that align with its core competencies. These actions aim to enhance technological capabilities and access new customer segments. This strategic approach supports long-term growth and market competitiveness.

Strategic partnerships with major carriers and retailers are crucial for expanding market reach. These collaborations enable the introduction of new protection plans and services. These partnerships are essential for accessing new customer bases.

The company's expansion plans are also supported by its risk management strategies, which are critical for sustainable growth. For a deeper understanding of the company's financial health and investor relations, you can find more information at Owners & Shareholders of Assurant.

The company's strategic initiatives focus on geographical expansion, particularly in emerging markets. Product diversification into the connected home ecosystem is also a key area of focus. These initiatives are designed to drive revenue growth and enhance market position.

- Expanding mobile device protection globally.

- Entering the connected home market.

- Evaluating strategic mergers and acquisitions.

- Leveraging partnerships for market access.

Assurant SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Assurant Invest in Innovation?

The company's growth strategy heavily relies on innovation and technology to enhance customer experience, boost operational efficiency, and develop new products. This approach is crucial for maintaining its competitive edge in the insurance market. The company's focus on digital transformation and the integration of cutting-edge technologies are key drivers of its future prospects.

Innovation at the company involves significant investment in research and development, both internally and through collaborations. This strategy aims to streamline processes, improve service delivery, and create new revenue streams. By embracing technological advancements, the company aims to strengthen its market position and meet evolving customer needs.

The company's commitment to digital transformation is evident in its use of AI-driven platforms for mobile device diagnostics and repair, which has significantly reduced processing times and improved customer satisfaction. Furthermore, the company is exploring the Internet of Things (IoT) to offer proactive protection services, shifting from reactive claims processing to preventative maintenance and support. These initiatives are part of the company's broader strategy to leverage technology for sustained growth.

The company is focused on streamlining claims processing and policy management through automation and AI-powered solutions. This includes the implementation of AI-driven platforms for mobile device diagnostics and repair. These efforts are designed to improve customer interactions and operational efficiency.

AI-driven platforms are used for mobile device diagnostics and repair, reducing processing times. Automation streamlines claims processing and policy management. These technologies are key to enhancing customer experience and operational efficiency.

Exploration of IoT to develop proactive protection services for connected devices. This shift moves from reactive claims processing to preventative maintenance and support. IoT integration aims to create new revenue streams and improve customer service.

Device lifecycle management, including repair and recycling programs, to minimize electronic waste. These efforts are part of the company's commitment to sustainability. Sustainability initiatives contribute to the company's long-term growth potential.

Significant investments in research and development, both internally and through collaborations. These investments are aimed at fostering innovation and developing new products. R&D is a cornerstone of the company's growth strategy.

Technological advancements contribute to growth objectives by improving service delivery. The company aims to create new revenue streams through innovative product offerings. These efforts strengthen the company's competitive position as a leader in tech-enabled protection solutions.

The company's innovation strategy also integrates sustainability initiatives, particularly in device lifecycle management. Repair and recycling programs are promoted to minimize electronic waste. These technological advancements contribute directly to the company's Assurant growth strategy by improving service delivery and creating new revenue streams. This approach strengthens the company's market position as a leader in tech-enabled protection solutions. The company's focus on digital transformation and technological innovation is critical for its

The company's technological strategies are focused on enhancing customer experience, improving operational efficiency, and developing new products. These strategies are central to the company's

- Digital Transformation: Streamlining claims processing, policy management, and customer interactions through automation and AI.

- AI-Driven Platforms: Implementing AI for mobile device diagnostics and repair to reduce processing times.

- IoT Integration: Exploring IoT to develop proactive protection services for connected devices.

- Sustainability Initiatives: Promoting repair and recycling programs to minimize electronic waste.

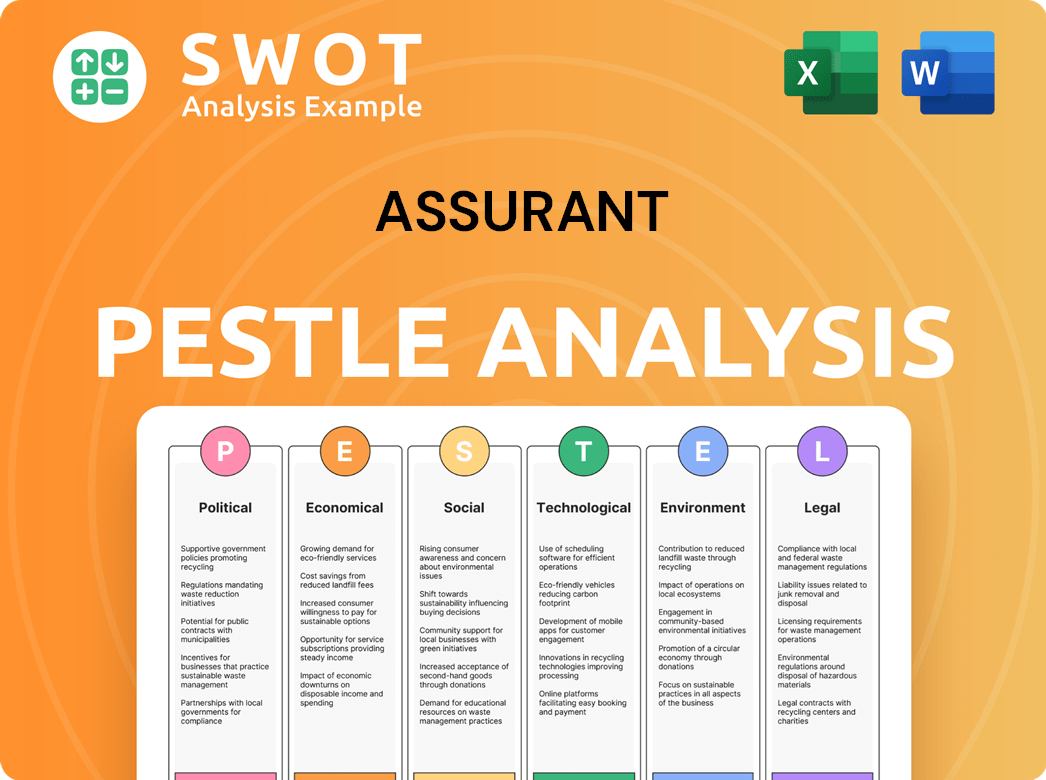

Assurant PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Assurant’s Growth Forecast?

The financial outlook for Assurant reflects a commitment to sustained growth, driven by strategic investments and a diversified business model. The company has demonstrated consistent financial performance, with reported net operating income per share often exceeding analyst expectations. This consistent performance contributes to a positive view of the Mission, Vision & Core Values of Assurant.

Assurant's strategic initiatives in 2024 are expected to drive further revenue growth and maintain healthy profit margins. The company's focus on higher-margin protection products and services supports this outlook. This strategic approach is designed to enhance shareholder value and maintain a strong financial position for future expansion.

Financial analysts generally maintain a positive outlook on Assurant, citing its resilient business model and its ability to adapt to market changes. The company's capital allocation strategy prioritizes investments in organic growth initiatives, strategic acquisitions, and returning capital to shareholders through dividends and share repurchases.

Assurant's growth strategy focuses on expanding its Global Lifestyle segment, particularly in mobile and extended protection services. This is supported by strategic acquisitions and investments in digital transformation. The company aims to capitalize on emerging market opportunities to drive revenue growth.

The Assurant business model is diversified, encompassing mobile protection, extended service contracts, and multi-family housing. This diversification helps to mitigate risks and ensures stability. The company's focus on customer acquisition strategies and innovation in insurance supports its long-term growth potential.

Assurant's financial performance is characterized by consistent revenue growth and healthy profit margins. The company's strong balance sheet and prudent risk management practices further bolster its financial health. The focus on higher-margin products contributes to sustained profitability.

Assurant holds a strong market position in the mobile protection and extended service contract sectors. The company's competitive landscape analysis reveals a focus on innovation and customer service. Assurant's expansion plans include targeting emerging markets.

Assurant's long-term financial goals are centered on delivering profitable growth, enhancing shareholder value, and maintaining a strong financial position. This includes strategic acquisitions and mergers to expand its market reach. The company is also focused on sustainability initiatives.

- Focus on profitable growth and margin expansion.

- Enhance shareholder value through dividends and share repurchases.

- Maintain a strong financial position for future expansion.

- Invest in digital transformation and innovation in insurance.

Assurant Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Assurant’s Growth?

The path to growth for the company, while promising, is not without its challenges. Several potential risks and obstacles could impact the company's strategic initiatives and future prospects. Understanding these challenges is crucial for a comprehensive company analysis.

Competition, regulatory changes, and technological disruption are among the key factors that could affect the company's trajectory. Additionally, internal resource constraints and supply chain vulnerabilities pose potential hurdles. A thorough examination of these risks is essential for assessing the company's long-term growth potential.

The company's ability to mitigate these risks through proactive strategies will be critical for achieving its objectives. The company's risk management strategies and its capacity to adapt to market shifts will play a significant role in shaping its future.

The protection products and services industry is highly competitive. Numerous established players and new entrants compete for market share, which could affect the company's market position. Competitive pressures can impact the company's financial performance and require continuous innovation.

The insurance sector is subject to regulatory changes across multiple jurisdictions. Adapting to new regulations and ensuring compliance requires significant resources and can pose operational challenges. These changes can influence the company's business model and strategic initiatives.

Supply chain disruptions, especially concerning mobile device repairs and parts, can affect service delivery. These vulnerabilities can impact customer satisfaction and operational efficiency. Building resilient supply chain networks is a key risk management strategy.

The rapid pace of technological change presents both opportunities and risks. Failure to adapt to emerging technologies or cybersecurity threats could undermine the company's competitive advantage. The company's digital transformation strategy is crucial for future success.

Attracting and retaining skilled talent in specialized areas can be challenging. Resource constraints can hinder innovation and operational efficiency. Investing in employee development and fostering a strong company culture are important.

Economic downturns and fluctuations can impact the demand for the company's products and services. Economic uncertainty can affect the company's financial performance. Diversifying its portfolio can help to mitigate this risk.

The company addresses these risks through a diversified portfolio and robust risk management. The company has invested in resilient supply chain networks and constantly updates its cybersecurity protocols. For further insights into the company's customer base, consider exploring the Target Market of Assurant.

The company employs a diversified portfolio of products and services to reduce risk. Robust risk management frameworks are in place to identify and address potential issues. Proactive scenario planning helps the company prepare for various market conditions.

The company's financial performance is subject to market conditions and regulatory changes. Economic downturns can impact revenue growth drivers. The company's ability to manage costs and maintain profitability is crucial for its long-term growth potential.

The competitive landscape includes established insurance providers and new entrants. The company must differentiate itself through innovation and customer service. Analyzing the competitive landscape is essential for strategic planning.

The company's future prospects depend on its ability to navigate these challenges. Adapting to market shifts and economic fluctuations is essential. The company's long-term growth potential hinges on its strategic initiatives and risk management.

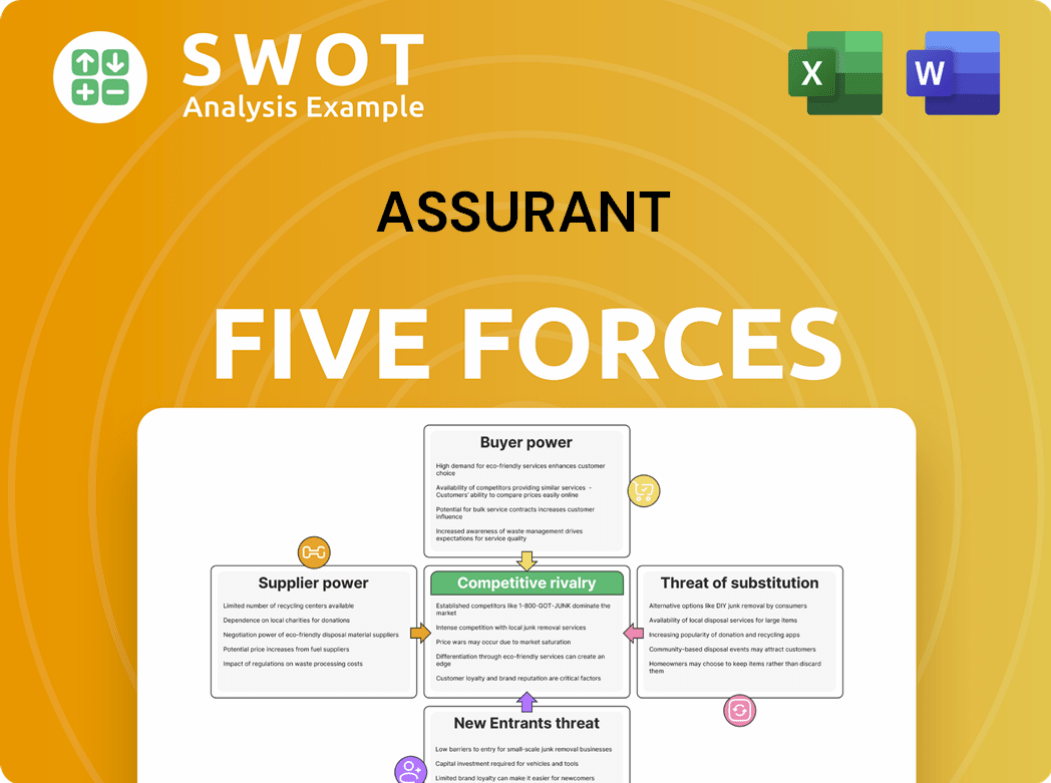

Assurant Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Assurant Company?

- What is Competitive Landscape of Assurant Company?

- How Does Assurant Company Work?

- What is Sales and Marketing Strategy of Assurant Company?

- What is Brief History of Assurant Company?

- Who Owns Assurant Company?

- What is Customer Demographics and Target Market of Assurant Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.