Assurant Bundle

How Does Assurant Thrive in Today's Market?

Assurant, a global powerhouse in risk management, shields consumers' cherished possessions, from smartphones to homes. With a substantial market footprint and a diverse array of specialty protection products, the Assurant SWOT Analysis reveals its strengths. Understanding the inner workings of Assurant is key for investors, customers, and industry watchers alike.

This article will illuminate the core of the Assurant company, exploring its value propositions and revenue streams. We'll dissect its competitive advantages and market position, providing a comprehensive view of how Assurant insurance continues to flourish. Whether you're curious about Assurant coverage, need to understand Assurant policies, or are looking for details on Assurant claims, this analysis is for you.

What Are the Key Operations Driving Assurant’s Success?

Assurant creates value by offering specialized protection products and services, addressing the evolving needs of consumers and businesses. Its core offerings include mobile device protection, extended service contracts for electronics and appliances, vehicle protection services, and lender-placed insurance. The company primarily serves major retailers, wireless carriers, financial institutions, and automotive dealerships, safeguarding millions of end-consumers globally.

Operational processes are streamlined to support these diverse offerings. For mobile device protection, this involves a sophisticated claims management system, repair and logistics networks, and customer support infrastructure. Extended service contracts encompass product development, underwriting, and a vast network of service providers. Lender-placed insurance involves data analytics, compliance management, and direct engagement with financial institutions.

Assurant leverages its proprietary technology platforms to enhance efficiency, personalize customer experiences, and manage risk effectively. The company's supply chain is characterized by strategic partnerships with device manufacturers, repair centers, and service networks, ensuring seamless delivery of its protection programs. Its distribution networks are extensive, leveraging strong relationships with its business clients to integrate its offerings directly into their sales processes. You can find more insights on the Growth Strategy of Assurant.

Offers protection against loss, theft, damage, and malfunction for smartphones and other mobile devices. This includes a streamlined claims process, repair services, and replacement options. The service is often bundled with wireless carrier plans or sold directly to consumers.

Provides coverage for electronics and appliances beyond the manufacturer's warranty. These contracts cover repair or replacement costs due to mechanical or electrical failures. They are offered through retailers and manufacturers to provide peace of mind.

Offers vehicle service contracts and other protection products for automobiles. These services cover mechanical breakdowns, tire and wheel protection, and other related services. They are sold through automotive dealerships.

Provides insurance coverage for properties when borrowers fail to maintain their own insurance. This protects the financial institution's investment. This service is crucial for financial institutions to mitigate risk.

Assurant's operational uniqueness lies in its deep industry expertise, data-driven insights for risk assessment, and its ability to scale complex protection programs globally. This translates into peace of mind and financial security for its customers. The company’s focus is on providing comprehensive insurance and service solutions.

- Claims Management: Efficient and streamlined processes for handling Assurant claims.

- Technology Platforms: Proprietary systems for enhanced efficiency and personalized customer experiences.

- Strategic Partnerships: Collaborations with device manufacturers and service networks.

- Distribution Networks: Strong relationships with business clients for direct integration of offerings.

Assurant SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Assurant Make Money?

Assurant, a global provider of risk management solutions, generates revenue primarily through premiums and fees derived from its diverse range of protection products and services. The company's business model is built on offering specialized insurance and related services across several key segments. Understanding Assurant's revenue streams and monetization strategies is crucial for assessing its financial health and growth potential.

The company's revenue is segmented into three primary areas: Global Lifestyle, Global Housing, and Global Automotive. These segments reflect Assurant's focus on providing protection solutions for mobile devices, housing, and vehicles. Each segment contributes differently to the company's overall financial performance, with Global Lifestyle being a significant revenue driver.

In 2023, Global Lifestyle, which includes mobile device protection and extended service contracts, was the largest segment, contributing substantially to the company's net operating income. The Global Housing segment, mainly driven by lender-placed insurance, also represents a significant portion of revenue. Global Automotive provides vehicle protection products and services, rounding out the company's revenue streams.

Assurant employs several innovative monetization strategies to maximize revenue and customer engagement. These strategies include bundling, tiered pricing, cross-selling, and fee-based services, all designed to create multiple revenue streams and enhance customer value. For more insights into the company's origins, consider reading Brief History of Assurant.

- Bundling: Assurant often bundles its protection plans with the sale of new devices or appliances through partnerships with wireless carriers and retailers. This strategy increases adoption rates and customer retention.

- Tiered Pricing: The company utilizes tiered pricing models, offering different levels of coverage and benefits to cater to various customer needs and price points.

- Cross-selling: Assurant leverages cross-selling opportunities, such as offering extended warranties to customers who have purchased mobile device protection.

- Fee-Based Services: The company generates revenue from fee-based services, including program administration and claims management for its business partners.

- Emerging Markets and Solutions: Assurant continues to explore new avenues for growth, including expanding into emerging markets and developing new protection solutions for connected living and the sharing economy.

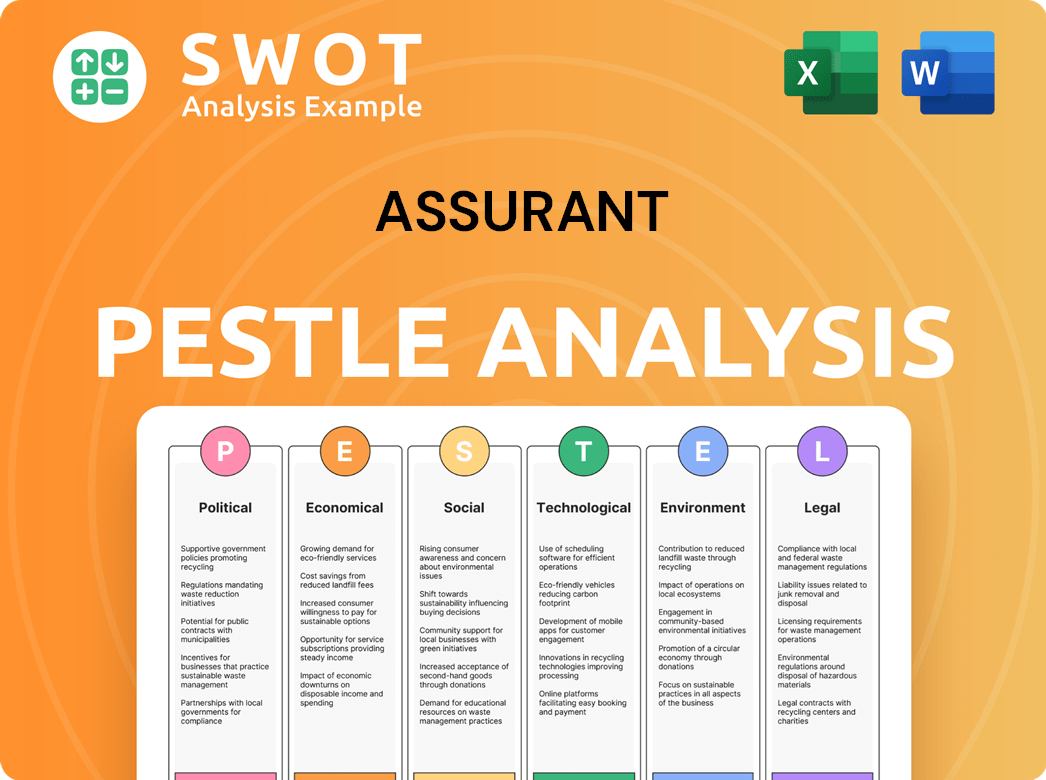

Assurant PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Assurant’s Business Model?

Assurant's journey has been marked by significant milestones and strategic moves that have shaped its operations and financial performance. A pivotal strategic move has been its focus on niche risk management solutions, particularly in the mobile and connected home ecosystems. The acquisition of The Warranty Group in 2018 was a transformative step, significantly expanding its global footprint in the vehicle protection and extended service contract markets. This acquisition not only diversified its product offerings but also strengthened its relationships with key clients worldwide.

The company has consistently invested in technology and analytics to enhance its claims processing, customer experience, and risk assessment capabilities, enabling it to adapt to evolving market demands. Operational challenges, such as navigating complex regulatory environments across different countries and managing the rapid pace of technological change in the mobile industry, have been met with agile responses, including strategic partnerships and continuous innovation in product development. Assurant's competitive advantages stem from its deep industry expertise, extensive global network of partners, and proprietary data and analytics capabilities that allow for precise risk underwriting.

Its strong brand reputation and long-standing relationships with major businesses further solidify its market position. The company continues to adapt to new trends, such as the increasing demand for sustainable and circular economy solutions in device lifecycle management, by offering trade-in and upgrade programs, thereby maintaining its competitive edge. For those looking into the Target Market of Assurant, understanding these strategic moves is key.

Significant milestones include the 2018 acquisition of The Warranty Group, which expanded its global reach. Consistent investment in technology and analytics has improved claims processing and customer experience. Assurant has adapted to market changes through strategic partnerships and product innovation.

Focus on niche risk management solutions, particularly in mobile and connected home ecosystems. The company has expanded its vehicle protection and extended service contract markets. Assurant has responded to operational challenges with agile strategies and continuous innovation.

Deep industry expertise and an extensive global network of partners. Proprietary data and analytics capabilities enable precise risk underwriting. Strong brand reputation and long-standing relationships with major businesses. Adapting to new trends, such as sustainable solutions, maintains its competitive edge.

In 2024, Assurant reported revenue of approximately $9.8 billion. The company's net income was around $400 million. Assurant's adjusted earnings per share (EPS) were approximately $13.50.

Assurant's strategic focus on mobile device protection and extended warranties has driven significant growth. The company's ability to manage risk effectively, supported by advanced analytics, is a key differentiator. Assurant's customer service is a critical component of its success, with multiple channels for Assurant insurance customers to seek assistance.

- Mobile Device Protection: Assurant is a major player in the mobile device protection market, providing coverage for smartphones and other devices.

- Extended Warranties: Assurant offers extended warranties for appliances, electronics, and other consumer goods.

- Renters Insurance: Assurant provides renters insurance, offering coverage for personal property and liability.

- Claims Process: The claims process is streamlined, with options for online filing and customer service support.

Assurant Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Assurant Positioning Itself for Continued Success?

In the competitive landscape of insurance and protection services, Assurant holds a significant position, particularly in the mobile device protection and lender-placed insurance sectors. The company's market share is supported by its partnerships with major wireless carriers, retailers, and financial institutions globally. Customer loyalty, driven by reliable service and comprehensive plans, is a key factor in maintaining its market presence. This has enabled Assurant company to become a key player in the industry, offering various Assurant coverage options.

However, Assurant faces several risks that could impact its operations. Regulatory changes within the insurance and financial services sectors across different jurisdictions pose a challenge. Competition from traditional insurance providers and tech-driven companies offering similar services also presents a continuous threat. Technological advancements, such as improved device durability, could also affect the demand for protection services. Furthermore, global economic downturns or catastrophic events can influence claims frequency and severity, impacting financial performance. Understanding these dynamics is crucial for assessing the future outlook of Assurant insurance.

Assurant maintains a strong presence in mobile device protection and lender-placed insurance. The company has a broad network of partnerships, enhancing its market reach. This allows Assurant to provide robust Assurant policies to a wide customer base, ensuring sustained market presence.

Regulatory changes and intense competition pose significant challenges to Assurant. Technological advancements and economic downturns can also affect its performance. These factors can influence Assurant claims and overall financial outcomes.

Assurant is investing in digital transformation to improve customer experience and operational efficiency. Expansion into new markets and the development of innovative solutions are key strategies. The company focuses on data analytics to refine its risk models and personalize offerings.

Assurant is focused on sustainable growth and maximizing shareholder value. The company aims to anticipate future consumer needs and stay at the forefront of protection solutions. For more insights, you can read about the Marketing Strategy of Assurant.

Assurant is expanding its digital capabilities to improve customer experience. They are also focusing on data analytics to refine risk models. The company aims to innovate in protection solutions.

- Investment in digital transformation.

- Expansion into new markets.

- Development of innovative protection solutions.

- Leveraging data analytics for risk management.

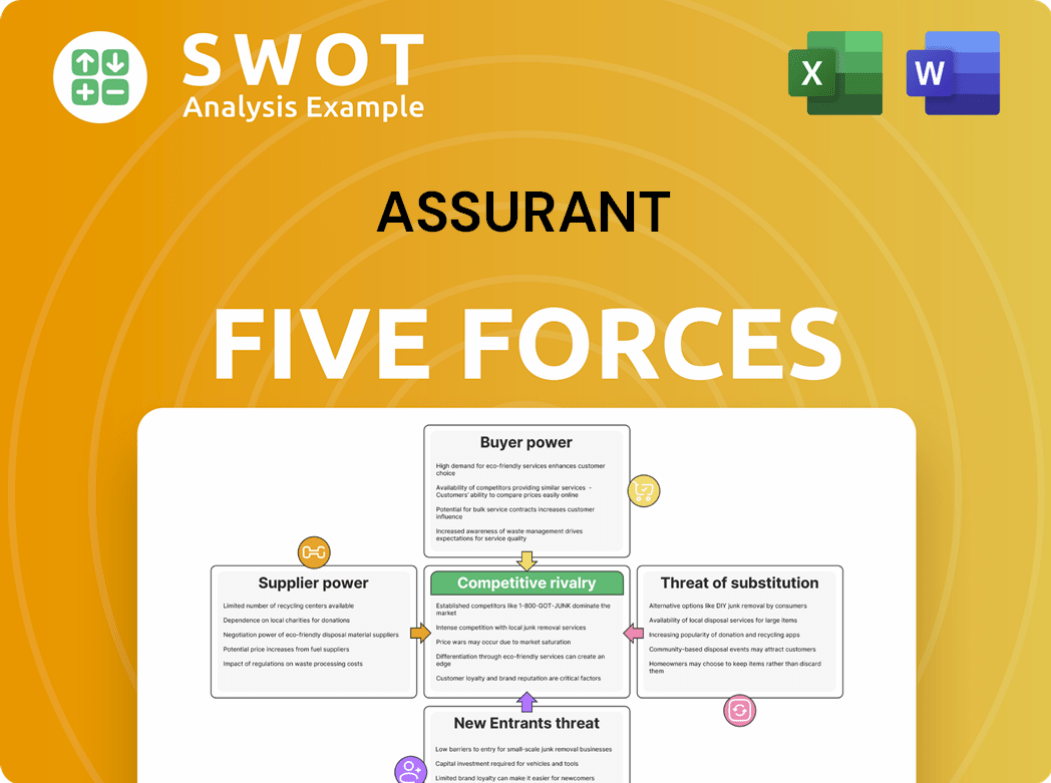

Assurant Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Assurant Company?

- What is Competitive Landscape of Assurant Company?

- What is Growth Strategy and Future Prospects of Assurant Company?

- What is Sales and Marketing Strategy of Assurant Company?

- What is Brief History of Assurant Company?

- Who Owns Assurant Company?

- What is Customer Demographics and Target Market of Assurant Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.