Assurant Bundle

Who Buys Insurance from Assurant?

In today's dynamic market, understanding the Assurant SWOT Analysis is key, but it starts with knowing your customer. For a company like Assurant, a global leader in risk management, identifying its customer demographics and target market is essential for success. This exploration dives into the core of Assurant's business strategy, revealing the intricate details of its clientele and how it adapts to their evolving needs.

From its origins as a regional insurer, Assurant company has evolved to serve a diverse array of insurance customers. This shift highlights the importance of detailed market segmentation to understand the specific needs of each customer group. This analysis will provide insights into Assurant's customer profile analysis, including Assurant's target audience demographics and Assurant insurance customer characteristics, and how the company tailors its offerings to meet their needs, including Assurant's customer acquisition strategies and Assurant's customer retention tactics.

Who Are Assurant’s Main Customers?

Understanding the customer demographics and target market of the Assurant company is crucial for assessing its business strategy. Assurant operates in both business-to-consumer (B2C) and business-to-business (B2B) segments, serving a diverse clientele. This dual approach allows Assurant to reach a broad audience and capitalize on various market opportunities. Analyzing the customer base reveals insights into the company's focus and growth areas.

In the B2C segment, Assurant primarily targets individuals seeking protection for their mobile devices, appliances, and vehicles. These customers are often tech-savvy and concerned about the longevity and repair costs of their devices. For extended service contracts, the target market includes homeowners and those looking to safeguard significant investments. This focus on protection products aligns with evolving consumer needs in a connected world.

The B2B segment is equally significant, involving partnerships with wireless carriers, retailers, financial institutions, and automotive dealerships. These businesses offer Assurant's protection products to their end-customers. Assurant's partnerships with major players like wireless carriers and retailers highlight its strong position in the market. The Global Lifestyle segment, particularly mobile protection and extended service contracts, has been the fastest-growing area for Assurant, with net earned premiums and fees increasing to $2.7 billion in the first quarter of 2024.

The B2C customer base includes individuals who seek protection for their mobile devices, appliances, and vehicles. These customers are often tech-savvy and concerned about device longevity and repair costs. Assurant focuses on providing solutions that meet the needs of these consumers.

The B2B segment includes partnerships with wireless carriers, retailers, financial institutions, and automotive dealerships. These businesses offer Assurant's protection products to their own end-customers. This segment is crucial for Assurant's market reach and revenue generation.

Assurant segments its market based on product type and distribution channels. This includes mobile device protection, extended service contracts, and other specialty protection products. The company's focus on these areas reflects market trends and consumer demand.

The growth of Assurant is driven by the increasing adoption of connected devices and the need for comprehensive protection plans. The Global Lifestyle segment, particularly mobile protection and extended service contracts, has seen significant growth. This focus on specialty protection products positions Assurant for continued success.

Assurant's customer demographics span a wide range, from individual consumers to large business partners. The company's strategic focus on specialty protection products, like mobile device protection and extended service contracts, has driven significant growth. To learn more about the financial health and strategies of Assurant, you can read about Owners & Shareholders of Assurant.

- B2C customers include tech-savvy individuals and homeowners.

- B2B partners are wireless carriers, retailers, and financial institutions.

- The Global Lifestyle segment is a major growth driver.

- Focus on specialty protection products aligns with market trends.

Assurant SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do Assurant’s Customers Want?

Understanding the customer needs and preferences is crucial for the success of any business, and this is especially true for a company like Assurant. The core of Assurant's customer value proposition revolves around providing peace of mind and financial protection. This is achieved through a variety of insurance products and services designed to mitigate risks associated with various assets.

For mobile device protection, customers are primarily driven by the need to safeguard their expensive devices from damage, loss, or theft. Extended service contracts for appliances and electronics also cater to this need, offering protection against unexpected breakdowns. These services are designed to alleviate financial burdens and reduce the stress associated with potential unexpected expenses.

The Marketing Strategy of Assurant is heavily influenced by customer feedback and market trends. This approach allows the company to adapt its products and services to meet evolving consumer needs. For instance, the increasing complexity of smart home devices and the growing demand for sustainable solutions have led Assurant to explore and offer relevant protection plans.

Customers seek security and a reduction of stress related to potential financial burdens. This is the primary psychological driver for choosing Assurant's offerings. The company's products and services are designed to provide a sense of safety and protection against unforeseen events.

Assurant offers various tiers of protection and flexible payment options. These options are tailored to specific customer segments. The goal is to provide financial security against potential losses and to make the protection plans accessible to a wide range of customers.

Streamlined claims processes and features like same-day repair or replacement are key. These features cater to the immediate needs of device-dependent consumers. Assurant focuses on making the claims process as easy and efficient as possible for its customers.

The perceived value of protection plans against potential future expenses is crucial. The ease of claims and the reputation of the provider influence purchasing decisions. Customers evaluate the long-term benefits of the protection plans.

Assurant tailors its marketing and product features to specific segments. This includes offering different tiers of protection and flexible payment options. This approach ensures that the company can meet the diverse needs of its customer base.

Customer feedback and market trends influence product development. The increasing complexity of smart home devices and the growing demand for sustainable solutions have led to the development of new protection plans. This ensures that Assurant remains relevant and competitive.

Assurant's success hinges on understanding and meeting the needs of its diverse customer base. The company focuses on delivering value through comprehensive protection plans and excellent service. This approach has allowed Assurant to maintain a strong position in the market.

- Financial Security: Customers seek protection against the high cost of device repairs and unexpected expenses.

- Convenience: The ease of finding reliable service and a streamlined claims process are highly valued.

- Peace of Mind: Customers desire a sense of security and reduced stress associated with potential financial burdens.

- Value: Customers assess the value of protection plans based on their perceived benefits and the provider's reputation.

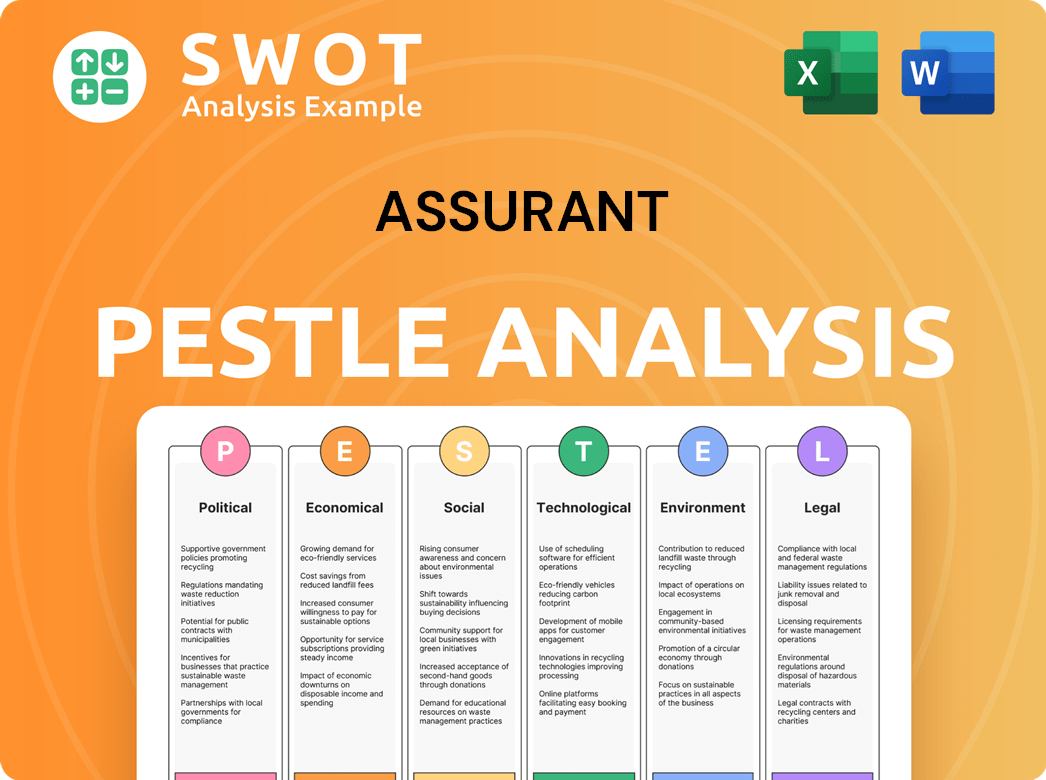

Assurant PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does Assurant operate?

The geographical market presence of Assurant is extensive, with significant operations across North America, Europe, Latin America, and the Asia-Pacific region. North America serves as a core market, where the company has a strong market share and brand recognition across various specialty protection lines. This wide distribution allows Assurant to serve a diverse range of insurance customers and adapt to varying regional demands.

Assurant's strategic approach involves tailoring its offerings to suit the specific needs of each region. This includes adjusting product features, marketing messages, and partnerships to align with local market conditions and regulatory environments. The company's ability to adapt its strategies across different geographical areas is a key factor in its sustained growth and market diversification.

In the first quarter of 2024, Assurant's Global Lifestyle segment, encompassing mobile and extended service contracts, reported net earned premiums and fees of $2.7 billion. This financial performance highlights the company's strong activity across its key regions and its ability to generate revenue from diverse markets. The company's diverse geographic distribution of sales contributes to its overall financial resilience and market diversification.

Assurant employs market segmentation strategies to cater to different customer demographics and preferences. This involves understanding the unique needs of customers in various regions and tailoring products and services accordingly. This approach ensures that Assurant's offerings remain relevant and competitive in diverse markets.

Customer demographics vary significantly across regions. In emerging markets, there might be a higher demand for affordable protection plans, while developed markets may seek premium features. Assurant adapts its offerings, including mobile protection plans, to suit local market conditions and regulatory requirements.

Assurant strategically expands into new markets and strengthens its presence in existing ones through partnerships with local businesses. While specific expansions are not always publicly detailed, the consistent growth in the Global Lifestyle segment indicates an ongoing focus on expanding its reach in key international markets. This expansion enhances the company's ability to serve its target market.

Assurant customizes its product features, marketing messages, and partnerships to meet regional nuances. For example, mobile protection plans may vary in coverage options or pricing based on local market conditions. This customization ensures that products resonate with the target audience in each region.

The diverse geographic distribution of sales contributes to Assurant's overall financial resilience and market diversification. This diversification helps to mitigate risks associated with economic fluctuations in any single region. This strategy supports the company's long-term financial stability.

Assurant's customer acquisition strategies are tailored to the specific characteristics of each regional market. This includes adapting marketing campaigns and distribution channels to effectively reach the target audience. This targeted approach enhances the company's ability to attract and retain customers.

Assurant Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does Assurant Win & Keep Customers?

The strategies employed by the Assurant company for customer acquisition and retention are multi-faceted, encompassing both digital and traditional channels. Their approach to attracting new customers often involves partnering with businesses like wireless carriers and retailers, where marketing efforts are concentrated at the point of sale. This includes in-store promotions and integrating protection plans into the purchase process for devices and appliances.

Digital marketing plays a crucial role in reaching potential customers, utilizing targeted online ads, social media campaigns, and search engine optimization to increase awareness and drive consideration. For their B2B partners, Assurant focuses on direct engagement, highlighting the value of their protection solutions in boosting customer loyalty and revenue. The use of customer data and CRM systems is also vital for segmenting the market and personalizing marketing campaigns.

Retention strategies emphasize providing seamless customer experiences, from the initial enrollment to claims processing. Efficient and user-friendly claims processes, such as digital submissions and quick resolutions, significantly contribute to customer satisfaction and loyalty. Loyalty programs, though often integrated into partner offerings, enhance the overall value proposition for the end-customer. Over time, Assurant has increasingly invested in digital transformation to improve customer journeys and operational efficiency, impacting customer lifetime value and reducing churn rates. Understanding the Revenue Streams & Business Model of Assurant is key to grasping how these strategies drive financial results.

Assurant partners with wireless carriers and retailers to offer protection plans at the point of sale. This strategy allows direct access to potential customers during their purchasing decisions. In-store promotions and online ads are key components of this approach.

Digital marketing efforts include targeted online ads, social media campaigns, and SEO. These initiatives aim to increase brand awareness and drive customer consideration. They are crucial for reaching a broad audience.

Direct engagement with B2B partners highlights the value of Assurant's protection solutions. These strategies aim to enhance customer loyalty and increase revenue streams for partners. They focus on building strong business relationships.

Assurant prioritizes seamless customer experiences, from enrollment to claims. Efficient claims processes, such as digital submissions, are essential for customer satisfaction. Loyalty programs, integrated into partner offerings, boost overall value.

Customer data and CRM systems are used to segment customers and personalize marketing. This approach allows for more targeted campaigns. This personalization enhances customer engagement and conversion rates.

Assurant invests in digital transformation to improve customer journeys and operational efficiency. These improvements impact customer lifetime value and reduce churn rates. This adaptation is key to staying competitive.

Efficient claims processing, including digital submissions and quick resolutions, is a key retention strategy. This focus on efficiency leads to higher customer satisfaction. Quick resolutions improve customer loyalty.

Loyalty programs are often integrated into partners' offerings, enhancing the value proposition. This collaborative approach strengthens customer relationships. It ensures a cohesive customer experience.

The company adapts its strategies to evolving technology and consumer behaviors. This adaptability is crucial for ongoing success in acquiring and retaining customers. This flexibility ensures long-term sustainability.

Assurant uses market segmentation to tailor marketing messages. This helps target specific customer demographics effectively. This targeted approach increases the chances of conversion.

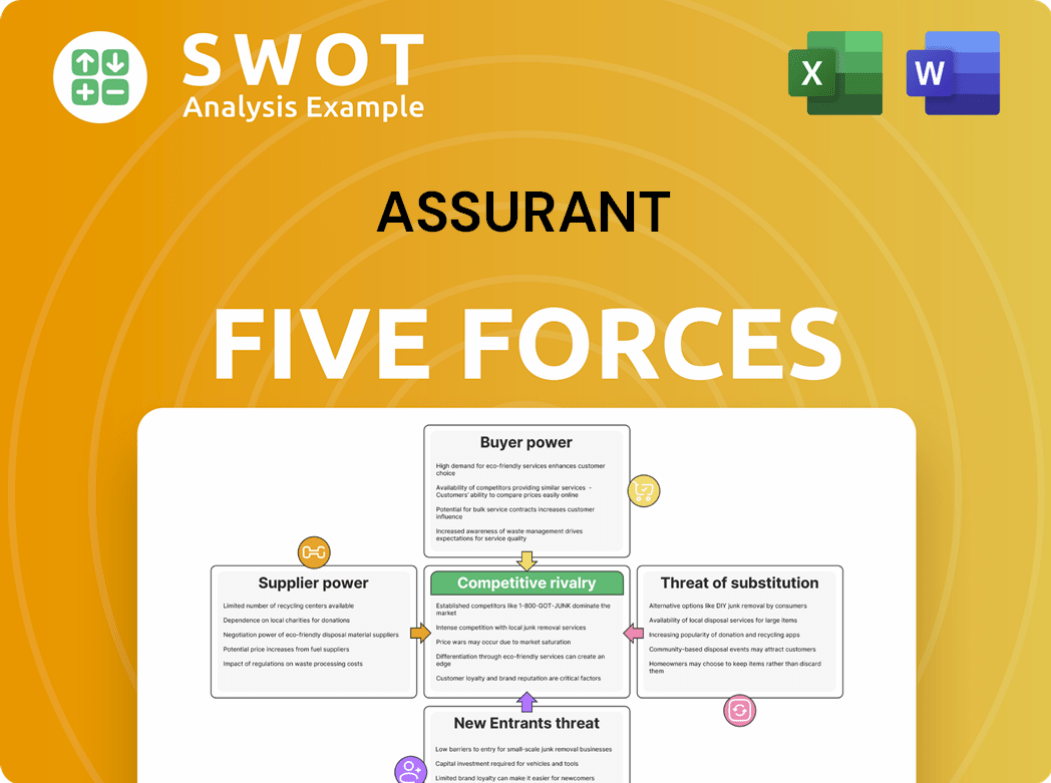

Assurant Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Assurant Company?

- What is Competitive Landscape of Assurant Company?

- What is Growth Strategy and Future Prospects of Assurant Company?

- How Does Assurant Company Work?

- What is Sales and Marketing Strategy of Assurant Company?

- What is Brief History of Assurant Company?

- Who Owns Assurant Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.