Atos Bundle

How Well Do You Know the Atos Company?

Embark on a journey through time to uncover the Atos SWOT Analysis and the fascinating story of Atos, a global powerhouse in IT services and consulting. From its humble beginnings to its current position as a leader in digital transformation, Atos has consistently adapted to the ever-changing technological landscape. Discover the key milestones and strategic decisions that have shaped the Atos history.

The Atos origins can be traced back to 1997, with the merger of Axime and Sligos, setting the stage for the Atos Group's global expansion. This brief history of Atos company reveals a narrative of strategic acquisitions and business transformation, reflecting the company's commitment to innovation and its ability to navigate market challenges. Understanding the Atos timeline and significant events provides valuable insights into its evolution and its current status in the industry.

What is the Atos Founding Story?

The Atos company, a significant player in the IT services sector, traces its origins back to 1997. This year marked the formal establishment of the company through a strategic merger. This consolidation was a pivotal moment in the company's history.

The formation of Atos was driven by the need to create a more robust IT service provider. The merging of Axime and Sligos, both French IT companies, was a key step. The goal was to combine their strengths to offer a wider array of IT solutions.

Before the official founding of Atos, a precursor company, Origin B.V., was formed in 1996. Origin B.V. was the result of a merger between BSO, a Dutch company, and the Philips C&P division. This entity would later merge with Atos. The initial vision was to build a stronger company capable of competing effectively in the evolving tech landscape.

The merger of Axime and Sligos in 1997 was a key event in the Atos history. This merger was a strategic move to combine the strengths of the two companies. The goal was to provide a broader range of IT solutions.

- The merger of Axime and Sligos in 1997 formed Atos.

- Origin B.V., formed in 1996, later merged with Atos.

- The initial business model focused on IT services.

- The early offerings combined the capabilities of Axime and Sligos.

Atos SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Atos?

The early growth of the Atos company was marked by strategic mergers and acquisitions that broadened its capabilities and global reach. This expansion included significant acquisitions that diversified its service offerings and strengthened its position in the market. These moves were crucial in shaping the company's trajectory, leading to its evolution into a major player in the IT services sector. To understand the competitive environment, it's helpful to look at the Competitors Landscape of Atos.

In 2000, Atos merged with Origin B.V. to form Atos Origin. Key acquisitions included KPMG Consulting in the United Kingdom and the Netherlands in 2002, and SchlumbergerSema in 2004. These acquisitions allowed Atos to diversify its service offerings and gain a stronger foothold in various markets.

In 2004, Atos created a subsidiary, Atos Worldline, focusing on transactional services. This strategic move highlighted the company's expansion into specialized areas within the IT sector. This division has played a crucial role in Atos's overall growth strategy.

A major milestone was the buyout of Siemens IT Solutions and Services, finalized in July 2011. This acquisition significantly boosted Atos's presence and capabilities in the IT services sector. Following this, the company reverted its name to Atos.

By 2023, Atos reported revenues of €10.69 billion. In 2024, the company's revenue was €9.577 billion, reflecting a 5.4% organic decline. As of December 2024, Atos had a total headcount of 78,112 employees.

Atos PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Atos history?

The Atos company has a rich history marked by significant achievements, particularly in the realm of IT services and digital transformation. The Atos Group has evolved considerably since its inception, becoming a key player in the European IT landscape. This Atos history showcases its ability to adapt and innovate within a rapidly changing technological environment.

| Year | Milestone |

|---|---|

| 1997 | Atos merges with the Dutch company, Origin B.V., marking a significant expansion in its global presence. |

| 2004 | Atos acquires SchlumbergerSema, significantly boosting its IT services capabilities and expanding its reach. |

| 2010 | Atos acquires Siemens IT Solutions and Services, becoming one of the largest IT service providers in Europe. |

| 2024 | Atos successfully completes a financial restructuring plan, reducing its gross debt by €2.1 billion. |

Atos has consistently pursued innovation, particularly in areas like high-performance computing and cybersecurity. The company has also explored advancements in generative AI and application management to stay ahead of the curve.

Atos has been a leader in providing supercomputing solutions, supporting scientific research and technological advancements. This includes supplying supercomputers for various research institutions and governmental organizations.

The company has invested heavily in cybersecurity, providing services to protect critical infrastructure and sensitive data. Atos managed 55 billion cybersecurity events during the Paris 2024 Olympic Games without major incidents.

Atos has been exploring and integrating generative AI solutions to improve operational efficiency and enhance its service offerings. This includes using AI for automation and data analysis.

The company provides comprehensive application management services, helping clients optimize their software applications. This includes application development, maintenance, and modernization.

Despite its achievements, Atos has faced considerable challenges in recent years, including financial difficulties and strategic setbacks. By early 2024, the company's market capitalization had fallen to €600 million, a significant drop from its previous valuation of €10 billion.

Atos initiated an accelerated financial safeguard plan, approved in October 2024, which included capital increases, asset sales, and debt issuances. The company successfully completed a financial restructuring in December 2024.

The company experienced frequent leadership changes, with six chief executives in two years by early 2025. This instability created challenges for long-term strategic planning and execution.

Negotiations to sell parts of the company, including its managed IT services division and cybersecurity expertise, were explored but ultimately failed in February 2024. These failed deals impacted the company's strategic direction.

Atos reported a net loss of €3.441 billion in 2023, largely due to impairment charges. However, the company reported a net income group share of €248 million in 2024, significantly influenced by a €3.520 million gain from financial restructuring.

By April 2024, Atos had reported debts of nearly €5 billion. The company's market capitalization significantly decreased, reflecting investor concerns about its financial health and strategic direction.

Atos has been undergoing a business transformation to adapt to the changing IT landscape. This includes focusing on key growth areas and streamlining operations. To learn more about Atos's strategic moves, check out this article on the Growth Strategy of Atos.

Atos Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Atos?

The Atos timeline reflects a series of strategic mergers, acquisitions, and transformations that have shaped the company into its current form. From its origins in the late 1990s to its recent financial restructuring and strategic shifts, Atos has consistently adapted to the evolving IT landscape. Understanding the Atos history is crucial for grasping the company's present and future trajectory. The Atos Group has undergone significant changes, particularly in the past few years, as it navigates the complexities of the technology sector. The Atos company evolution is a testament to its resilience and strategic vision.

| Year | Key Event |

|---|---|

| 1997 | Atos is formed through the merger of French IT companies Axime and Sligos. |

| 2000 | Merges with Dutch-based Origin B.V. to become Atos Origin. |

| 2002 | Acquires KPMG Consulting in the UK and Netherlands. |

| 2004 | Acquires SchlumbergerSema and creates Atos Worldline. |

| 2011 | Completes the acquisition of Siemens IT Solutions and Services, reverting the company name to Atos. |

| 2023 | Reports revenues of €10.69 billion. |

| October 2024 | Accelerated financial safeguard plan approved by the Nanterre Commercial Court. |

| November 2024 | Receives a non-binding offer from the French State to acquire its Advanced Computing activities for an enterprise value of €500 million, potentially rising to €625 million. |

| December 2024 | Successfully completes its financial restructuring, reducing gross debt by €2.1 billion. |

| March 2025 | Reports full-year 2024 revenue of €9.577 billion, down 5.4% organically, with an operating margin of 2.1% (€199 million). |

| April 2025 | Reports Q1 2025 revenue of €2.068 billion, a 15.9% organic decline compared to Q1 2024. |

| May 2025 | Unveils 'Genesis' strategic transformation plan, aiming for sustainable growth and improved profitability. |

The 'Genesis' plan aims to transform Atos into a global AI-powered technology partner. The plan includes targets of €9-10 billion in revenue and a 10% operating margin by 2028. It focuses on significant AI investments and a strategic focus on core countries. This strategic shift is vital for Atos to remain competitive.

Atos will streamline its operations into two main brands: Atos for services and Eviden for products. This reorganization aims to improve efficiency and focus on core competencies. The separation allows each brand to specialize and better serve its respective markets. The company's structure is designed to enhance focus and agility.

Atos anticipates approximately €8.5 billion in revenue for 2025, with an operating margin of around 4%. The company aims to achieve positive organic growth by 2026 and positive free cash flow by 2026. This financial outlook is crucial for assessing Atos's future performance.

Atos plans to invest €500 million in R&D over the next four years and €100 million in startups. A key goal is to have 100% of its workforce AI-certified by 2026. Under Philippe Salle, the focus is on debt reduction and operational efficiency. For more insights, consider reading about the Marketing Strategy of Atos.

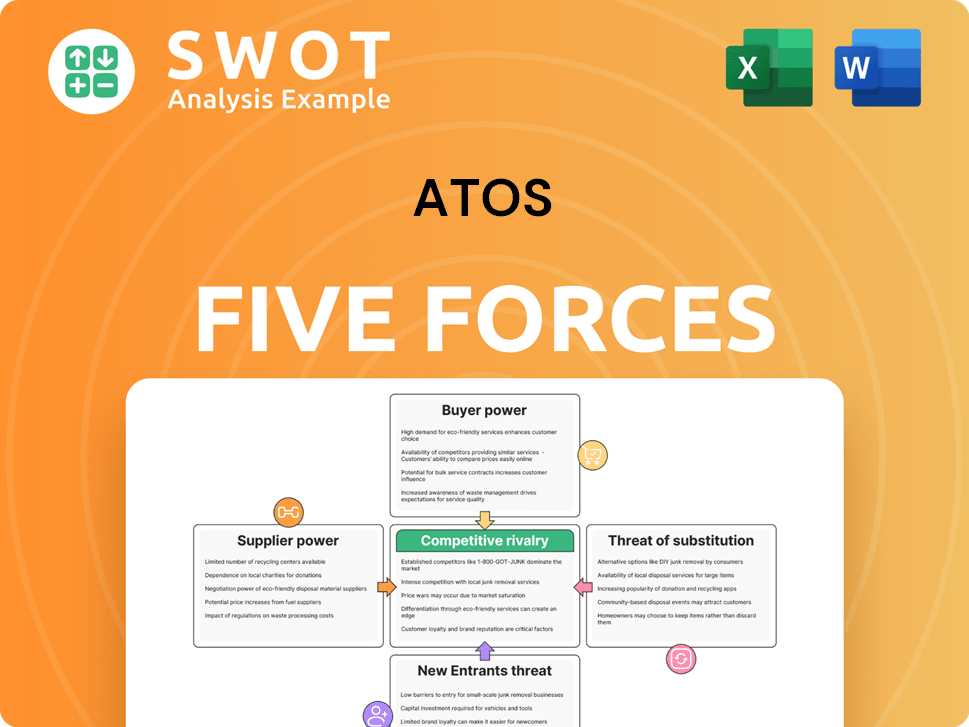

Atos Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Atos Company?

- What is Growth Strategy and Future Prospects of Atos Company?

- How Does Atos Company Work?

- What is Sales and Marketing Strategy of Atos Company?

- What is Brief History of Atos Company?

- Who Owns Atos Company?

- What is Customer Demographics and Target Market of Atos Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.