Atos Bundle

Can Atos Rebound and Thrive in the Digital Age?

Atos, a titan in the IT services sector, is undergoing a significant transformation. The company's recent restructuring, including the potential sale of its Tech Foundations business, signals a bold move to sharpen its focus on digital transformation and cybersecurity. This strategic pivot begs the question: how will Atos navigate the ever-evolving tech landscape and secure its future?

This Atos SWOT Analysis offers a deep dive into the company's strategic initiatives, exploring its Atos growth strategy and Atos future prospects. We will examine the Atos company analysis, including its Atos market position, Atos business model, and Atos financial performance, to understand how Atos plans to achieve its ambitious goals and adapt to market changes. Uncover Atos's strategic initiatives for growth and explore the potential impact of Atos's recent acquisitions and their impact.

How Is Atos Expanding Its Reach?

The expansion initiatives of Atos are primarily focused on bolstering its presence in high-growth sectors such as cybersecurity, cloud computing, and digital transformation. This strategic direction is a key component of the overall Atos growth strategy, aiming to capitalize on the increasing demand for advanced digital solutions. The company's approach involves significant strategic shifts, including portfolio streamlining and targeted investments to enhance its market position.

A core element of Atos's strategy involves the divestiture of its Tech Foundations business, which provides traditional IT infrastructure services. This move, slated for completion in 2024, is designed to enable greater focus and investment in its Eviden business. Eviden encompasses advanced computing, cybersecurity, and digital platforms, positioning Atos to capture new customer segments and diversify revenue streams.

Furthermore, Atos is actively fostering partnerships and collaborations to amplify its market reach and technological capabilities. These strategic alliances are crucial for driving innovation and expanding its service offerings. By concentrating on these key areas, Atos aims to achieve significant milestones in 2025, targeting an increased market share within its core strategic domains.

The planned sale of the Tech Foundations business is a pivotal move. This strategic divestiture, expected by the end of 2024, aims to streamline operations and concentrate resources on high-growth areas. This allows for greater investment in Eviden, which is focused on advanced computing, cybersecurity, and digital platforms.

Eviden is at the heart of Atos's expansion strategy. This segment encompasses advanced computing, cybersecurity, and digital platforms. The company is strategically positioning itself to meet the growing demand for cutting-edge digital solutions. This shift is crucial for driving future growth and enhancing the

Atos is actively pursuing partnerships to enhance its market reach and technological capabilities. A notable example is the continued collaboration with Google Cloud. These alliances are vital for expanding service offerings and driving innovation. The emphasis on partnerships is a key element of Atos's strategic initiatives for growth.

Atos is concentrating on key geographical markets, particularly in Europe and North America. Demand for digital and cybersecurity services remains robust in these regions. The company is aiming to strengthen its presence and capture a larger market share in these critical areas. This geographical focus is a key aspect of Atos's expansion plans and strategies.

Atos's expansion strategy centers on strategic divestitures and targeted investments in high-growth areas. The focus is on cybersecurity, cloud computing, and digital transformation. By streamlining its portfolio and fostering key partnerships, Atos aims to enhance its market position and drive sustainable growth.

- Divestiture of Tech Foundations to streamline operations.

- Focus on Eviden for advanced computing and cybersecurity solutions.

- Strategic alliances, such as the Google Cloud partnership, to enhance capabilities.

- Geographical expansion in Europe and North America to capitalize on market demand.

Atos SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Atos Invest in Innovation?

The innovation and technology strategy of the company is a cornerstone of its growth, particularly through its Eviden business. The company is heavily investing in research and development (R&D) across key areas such as artificial intelligence (AI), high-performance computing (HPC), quantum computing, and cybersecurity. This strategic focus is designed to drive sustained expansion and maintain a strong market position.

A key aspect of the company's strategy involves significant R&D investments. These investments are directed towards cutting-edge technologies, including AI, HPC, and quantum computing. For example, the company continues to develop and deploy its BullSequana X supercomputers, which are crucial for advanced scientific research and industrial applications. These initiatives support the company's future outlook and strategic initiatives for growth.

The company's approach to digital transformation involves leveraging its expertise in cloud orchestration, data analytics, and automation to help clients modernize their IT landscapes and improve operational efficiency. The company emphasizes the integration of AI into its service offerings, developing AI-powered solutions for cybersecurity threat detection, predictive maintenance, and customer experience enhancement.

The company is increasing its R&D investments to drive innovation. These investments are focused on AI, HPC, quantum computing, and cybersecurity. This approach strengthens its competitive advantages in the market.

The company is actively advancing its quantum computing capabilities. The goal is to deliver a fault-tolerant quantum computer by 2030. This positions the company at the forefront of technological innovation.

The company offers digital transformation services to help clients modernize their IT infrastructure. These services include cloud orchestration, data analytics, and automation. This supports the company's business model and expansion plans.

The company is integrating AI into its service offerings. This includes AI-powered solutions for cybersecurity, predictive maintenance, and customer experience. This enhances its ability to meet evolving market needs.

Sustainability is a key focus, with the company developing energy-efficient computing solutions. The company assists clients in reducing their carbon footprint through optimized IT infrastructure. This aligns with its sustainability initiatives and goals.

The company consistently files patents in areas like cybersecurity and advanced computing. This reinforces its leadership in critical technological domains. This strategy supports its financial performance and key metrics.

The company's technology strategy is centered around several key areas. These areas are critical for its future prospects and overall growth strategy. The company's focus on these areas supports its adaptation to market changes.

- Artificial Intelligence (AI): Developing AI-powered solutions for cybersecurity, predictive maintenance, and customer experience.

- High-Performance Computing (HPC): Continuing to develop and deploy BullSequana X supercomputers for advanced research and industrial applications.

- Quantum Computing: Aiming to deliver a fault-tolerant quantum computer by 2030.

- Cybersecurity: Strengthening cybersecurity solutions and services to protect clients' data and infrastructure.

- Cloud Computing: Providing cloud orchestration and services to help clients modernize their IT landscapes.

The company's commitment to innovation is evident through its consistent filing of patents in areas such as cybersecurity and advanced computing. This reinforces its leadership in these critical technological domains. For more details on the company's approach to marketing, see this article: Marketing Strategy of Atos.

Atos PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Atos’s Growth Forecast?

The financial outlook for Atos is shaped by its strategic shift towards high-growth sectors like digital and cybersecurity. The company's future prospects are closely tied to its ability to execute its restructuring plan and focus on its core Eviden business. This includes a divestment strategy aimed at streamlining operations and improving profitability.

Atos's financial performance is crucial for understanding its current position and future direction. For the full year 2023, the company reported revenue of €10.6 billion. The company's guidance for 2024 indicates a continued focus on improving its operating margin and free cash flow, particularly within the Eviden perimeter. Analyst forecasts for Atos in 2024 and 2025 generally reflect a cautious but optimistic view, anticipating stabilization and gradual improvement in financial performance as the restructuring takes hold.

Atos's financial strategy involves optimizing its capital structure and potentially leveraging new funding rounds or asset sales to support investments in its strategic growth areas. The company aims to demonstrate a clear path to enhanced shareholder value through its refocused portfolio and operational efficiencies, moving towards a more streamlined and profitable business model in the coming years. The Target Market of Atos is a key factor in its financial performance.

Atos's financial performance is a critical aspect of its company analysis. Recent reports show the company's focus on improving its operating margin and free cash flow. The company's revenue for 2023 was €10.6 billion, with expectations for improvement in the coming years.

Atos's growth strategy involves a strategic transformation and a focus on high-growth digital and cybersecurity markets. This strategic shift is a key element of Atos's future prospects. The company is also focused on optimizing its capital structure to support investments.

Atos's digital transformation strategy is a key driver for its future outlook. The company is investing in cloud computing services and cybersecurity to capitalize on market opportunities. This strategy is aimed at adapting to market changes and enhancing its competitive advantages.

Cybersecurity is a significant area of focus for Atos, contributing to its Atos growth strategy. The company aims to strengthen its market position through strategic initiatives and partnerships. This focus is crucial for its expansion plans and strategies.

Analyst forecasts for Atos in 2024 and 2025 anticipate stabilization and gradual improvement in financial performance. The company's refocused portfolio and operational efficiencies are expected to contribute to revenue growth. This is a key aspect of Atos's company future outlook.

Atos faces both challenges and opportunities in the market. The company is navigating a complex financial landscape with its divestment strategy playing a crucial role. Strategic initiatives and partnerships are important for addressing these challenges and capitalizing on opportunities.

Atos is adapting to market changes through its digital transformation strategy. The company's focus on high-growth digital and cybersecurity markets is a key element. This adaptation is essential for maintaining its Atos market position.

Atos's expansion plans and strategies include focusing on high-growth markets and optimizing its capital structure. The company aims to achieve improved profitability and sustainable growth in its core Eviden business. This is a key aspect of its Atos business model.

Atos's competitive advantages include its focus on digital transformation and cybersecurity. The company's strategic initiatives and partnerships are aimed at strengthening its position. This focus is crucial for its expansion plans and strategies.

Atos's partnerships and collaborations are essential for its growth strategy. The company leverages these relationships to enhance its market position and expand its service offerings. These collaborations support its strategic initiatives for growth.

Atos Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Atos’s Growth?

The company faces several potential risks and obstacles that could affect its ability to achieve its growth goals. These challenges include intense competition in the digital transformation, cloud, and cybersecurity markets, as well as the need to adapt to evolving regulations and technological advancements. Understanding these risks is crucial for assessing the Mission, Vision & Core Values of Atos and its future outlook.

Market dynamics and internal factors also present significant hurdles. Supply chain vulnerabilities and the need to attract and retain top talent pose ongoing challenges. The company’s ability to navigate geopolitical fragmentation and manage its internal restructuring effectively will be critical for future success. These risks must be carefully managed to ensure continued growth and market competitiveness.

A primary risk stems from the highly competitive nature of the digital transformation, cloud, and cybersecurity sectors. This market is crowded with both established players and innovative startups. The need to continuously innovate and adapt to emerging technologies at a pace that keeps up with, or surpasses, competitors is critical for maintaining market position. Regulatory changes, especially in data privacy and cybersecurity, pose ongoing challenges. These changes require constant adaptation of services and compliance frameworks.

The company operates in a highly competitive market, facing challenges from established firms and agile startups. Maintaining a strong competitive edge requires continuous innovation and strategic adaptation to emerging technologies. The company must stay ahead of market trends and customer demands to sustain its Atos market position.

Changes in regulations, particularly concerning data privacy and cybersecurity, pose significant challenges. Adapting services and compliance frameworks to meet evolving standards is crucial. Failure to comply with these regulations could lead to financial penalties and damage the company's reputation.

Vulnerabilities in the supply chain, particularly regarding hardware and software components, could impact service delivery and project timelines. The company needs to diversify its suppliers and implement robust risk management strategies to mitigate these risks. Delays in project completion and service disruptions can affect financial performance.

The rapid pace of technological change poses a risk if the company fails to innovate and adapt. Competitors are constantly introducing new technologies and services. Staying at the forefront of technological advancements is essential to maintain a competitive edge and capture market share.

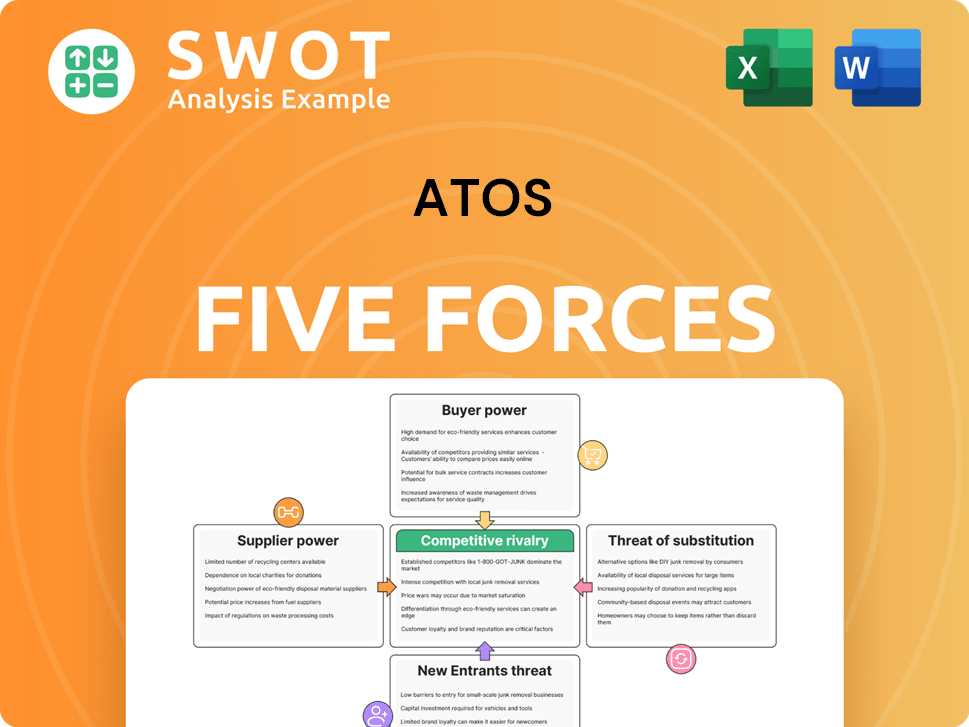

Atos Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Atos Company?

- What is Competitive Landscape of Atos Company?

- How Does Atos Company Work?

- What is Sales and Marketing Strategy of Atos Company?

- What is Brief History of Atos Company?

- Who Owns Atos Company?

- What is Customer Demographics and Target Market of Atos Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.