Atos Bundle

How Does the Atos Company Thrive in the Digital Age?

Atos, a global force in IT services and consulting, is deeply involved in digital transformation across various industries. With a significant restructuring plan announced in late 2023, understanding Atos SWOT Analysis is more critical than ever for anyone interested in the IT sector. This analysis will explore how Atos operates, offering essential insights for investors, clients, and industry watchers.

Atos provides a wide range of services, including consulting, systems integration, and managed services, supporting large enterprises and public sector organizations. Its global presence and diverse client base highlight its importance in enabling digital transformation. This examination of the Atos business model will provide a clear understanding of its value proposition and strategies for future growth, including its cloud computing offerings and cybersecurity solutions.

What Are the Key Operations Driving Atos’s Success?

The Atos company delivers value through a suite of IT services, focusing on digital transformation. Their core offerings include consulting, systems integration, managed services, and business process outsourcing. Atos serves a diverse customer base across sectors like manufacturing, financial services, and healthcare, providing them with tailored Atos solutions.

The operational backbone of How Atos works involves technology development, leveraging research and development in areas such as cybersecurity and cloud computing. It uses a global delivery model, including data centers and a skilled workforce, to ensure efficient service delivery. Strategic partnerships with major technology vendors enhance its market reach and solution portfolio, making Atos a significant player in the IT sector.

Atos's integrated approach provides clients with improved operational efficiency and accelerated digital transformation. This comprehensive approach translates into a competitive advantage, supporting clients in achieving their business goals. For more information about the company's target audience, check out the Target Market of Atos.

Atos offers consulting services, helping clients strategize their technology adoption. They also provide systems integration, designing and implementing complex IT solutions. Managed services and business process outsourcing are key components of their offerings, ensuring comprehensive support for clients.

Atos invests in technology development, particularly in cybersecurity and cloud computing. A global delivery model, supported by data centers and skilled professionals, ensures efficient service delivery. Strategic partnerships with major technology vendors enhance their market reach and solution portfolio.

Clients benefit from improved operational efficiency, enhanced cybersecurity, and accelerated digital transformation. Atos's integrated approach helps optimize business processes, providing a competitive edge in the market. These benefits are crucial for clients aiming to stay ahead.

Atos provides end-to-end services, addressing complex client needs comprehensively. Their deep industry expertise, combined with a robust service portfolio, sets them apart. This approach ensures that clients receive tailored, effective solutions.

Atos's operations are characterized by a strong focus on technology and a global delivery model. This allows them to offer a wide range of services and maintain a competitive edge in the market. Their ability to adapt to the changing needs of their clients is a key factor in their success.

- Deep industry expertise.

- End-to-end service offerings.

- Strategic partnerships with technology vendors.

- Focus on cybersecurity and cloud computing.

Atos SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Atos Make Money?

The Atos company generates revenue through its diverse IT services, focusing on managed services, consulting, systems integration, and specialized solutions. While specific financial breakdowns for 2024 and 2025 are pending, these core areas consistently drive its financial performance. Understanding how Atos works involves analyzing its revenue streams and the strategies it employs to monetize its offerings.

Managed services, which provide long-term IT infrastructure and application management, form a significant portion of its revenue, ensuring a steady income flow. Consulting and systems integration projects, often project-based, contribute through fees for designing, developing, and implementing IT solutions. The company's strategic restructuring is expected to reshape the revenue mix, emphasizing digital and cybersecurity offerings.

Atos employs several monetization strategies to maximize its revenue. Subscription-based models and consumption-based pricing are common for managed services, while consulting and integration projects often use time-and-materials or fixed-price contracts. The company also uses bundled services and cross-selling to provide comprehensive value to its clients. The company has a strong focus on digital transformation services.

Atos's revenue streams are diversified across IT services, with managed services, consulting, and cybersecurity solutions as key contributors. Monetization strategies include subscription-based models, time-and-materials billing, and bundled service offerings. Atos adapts its approach based on client needs and market dynamics. The company's focus on digital transformation services helps it to remain competitive.

- Managed Services: Recurring revenue through long-term contracts for IT infrastructure and application management.

- Consulting and Systems Integration: Project-based revenue from design, development, and implementation of IT solutions.

- Big Data and Cybersecurity: Revenue from specialized software, hardware, and expert services, particularly through the Eviden business line.

- Subscription-Based Models: Clients pay based on usage or agreed-upon service levels.

- Time-and-Materials or Fixed-Price Contracts: Used for consulting and integration projects.

- Bundled Services: Integrated solutions combining multiple service lines to provide comprehensive value.

- Cross-Selling: Offering additional services to existing clients as their digital transformation needs evolve.

Atos PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Atos’s Business Model?

The evolution of the Atos company has been marked by significant milestones and strategic shifts. A pivotal move is the proposed restructuring, announced in 2023, to split into two entities: Eviden and Tech Foundations. This aims to sharpen focus and unlock value within each segment. The Atos has also grown through strategic acquisitions, such as the 2011 acquisition of Siemens IT Solutions and Services, which expanded its global reach and service offerings.

Atos has faced challenges including intense competition and rapid technological advancements. The company has responded by divesting non-core assets and investing in key capabilities like AI and quantum computing. The company's ability to manage complex IT environments for large enterprises and public sector organizations provides a significant competitive edge. The company continues to adapt by focusing on innovation, strategic partnerships, and by aligning its offerings with the evolving digital transformation needs of its clients.

The Atos business model is designed to provide end-to-end IT services. This includes consulting, systems integration, managed services, and digital transformation solutions. The company's focus on research and development, particularly in emerging technologies through Eviden, positions it to adapt to new trends and competitive threats. For a deeper dive into how Atos has navigated its growth, consider exploring the Growth Strategy of Atos.

The acquisition of Siemens IT Solutions and Services in 2011 was a major expansion. The proposed restructuring into Eviden and Tech Foundations in 2023 is a strategic pivot. Acquisitions like Ipsotek in 2021 enhanced its cybersecurity portfolio.

Divesting non-core assets and streamlining operations are key strategies. Investing in AI and quantum computing demonstrates a forward-thinking approach. Forming strategic partnerships to enhance service offerings is also a priority.

A strong brand reputation and global presence are significant advantages. Deep industry expertise and a comprehensive service portfolio provide a competitive edge. Its ability to manage complex IT environments for large enterprises is a key differentiator.

Intense competition in the IT services sector is a constant challenge. The rapid pace of technological change requires continuous adaptation. Global economic uncertainties also impact operations and financial performance.

Atos leverages its strengths to navigate the competitive landscape. Its focus on digital transformation, cloud computing, and cybersecurity positions it for growth. The company is investing in areas like AI to enhance its service offerings and maintain its competitive edge.

- Strong global presence and brand recognition.

- Comprehensive portfolio of IT services.

- Focus on innovation and R&D in emerging technologies.

- Strategic partnerships to expand capabilities.

Atos Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Atos Positioning Itself for Continued Success?

Understanding the industry position, risks, and future outlook of the Atos company is crucial for anyone evaluating its potential. Atos operates within the competitive global IT services market, contending with industry giants. Its ability to adapt to market changes and execute its strategic initiatives will be key to its long-term success. The company's evolution and current strategies are closely watched by investors and industry analysts alike, making a comprehensive analysis essential.

The company’s journey, including its past and present strategies, provides insights into its future trajectory. The company's approach to digital transformation, cloud computing, and cybersecurity highlights its focus on innovation and client needs. Examining its market position in relation to competitors, its financial performance, and its strategic partnerships offers a complete view of how Atos works and its prospects.

Atos holds a significant position in the IT services market, competing with firms like Capgemini, Accenture, and DXC Technology. Its market share varies across service lines and regions. It benefits from an extensive client base, particularly within the public sector and large enterprises. The company has a strong presence across Europe, North America, South America, and Asia Pacific.

Atos faces risks including intense price competition, talent acquisition challenges, and rapid technological changes, such as generative AI. Regulatory changes, especially concerning data privacy and cybersecurity, pose compliance issues. Economic downturns and geopolitical instability can also affect client spending on Atos services.

The future outlook for Atos involves focusing on high-growth areas, improving operational efficiency, and strengthening its role as a digital transformation partner. The company is working to finalize its transformation plan, which includes potential capital increases and asset sales. The company's strategy includes continued investment in cybersecurity, cloud solutions, and advanced analytics, aligning with its goal of becoming a leader in secure and decarbonized digital services.

Atos is undertaking strategic initiatives, including the proposed separation of its businesses into Eviden and Tech Foundations, to create more focused and agile entities. These initiatives aim to mitigate risks and improve the company's strategic positioning. The company is focused on optimizing its operations and strengthening its position as a trusted partner for digital transformation.

Atos's financial performance and strategic direction are key factors influencing its future. The company's ability to adapt to market changes and execute its strategic plans will determine its success. Understanding the company's market position, risks, and future outlook provides a comprehensive perspective on its operations. For more details, consider exploring Owners & Shareholders of Atos.

- Atos's revenue in 2023 was approximately €10.6 billion.

- The company is undergoing a significant transformation, including the separation of its business units.

- Atos has a strong focus on cybersecurity, cloud solutions, and digital transformation services.

- The company aims to improve its operational efficiency and strengthen its market position.

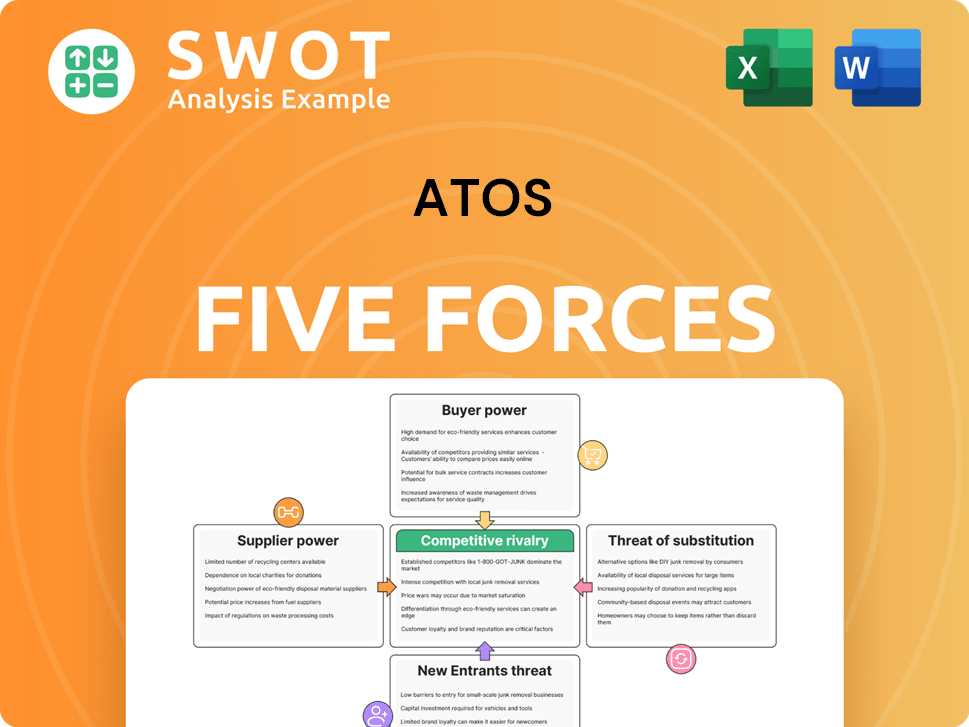

Atos Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Atos Company?

- What is Competitive Landscape of Atos Company?

- What is Growth Strategy and Future Prospects of Atos Company?

- What is Sales and Marketing Strategy of Atos Company?

- What is Brief History of Atos Company?

- Who Owns Atos Company?

- What is Customer Demographics and Target Market of Atos Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.