Atos Bundle

Who Really Controls Atos Company?

Unraveling the Atos SWOT Analysis is key to understanding its future. The question of 'Who Owns Atos Company?' is more pertinent than ever, especially given its recent strategic shifts. Understanding the Atos owner is crucial for anyone tracking the IT sector's evolution.

Atos, a multinational IT giant, has seen significant changes since its founding in 1997. The current Atos ownership structure, including major investors and Atos shareholders, directly impacts its strategic decisions. This exploration will delve into the company's history, from its headquarters in Bezons, France, to the key players who shape its trajectory, providing insights into who controls Atos and its future outlook. This includes a look at Atos company stock information.

Who Founded Atos?

The formation of the Atos company in 1997 was a pivotal moment, resulting from the merger of Axime and Sligos. This consolidation fundamentally shaped the initial ownership structure, differing from a typical startup scenario with individual founders taking initial equity. Understanding the roots of Atos ownership requires examining the entities that converged to create it.

Axime, founded by Bernard Bourigeaud, played a crucial role, with Bourigeaud later becoming the first CEO of Atos. Sligos, a subsidiary of Crédit Lyonnais, also significantly influenced the early ownership dynamics. The merger involved integrating these companies, which included share exchange ratios and the establishment of a new board of directors.

Early agreements would have centered on the integration of these two companies, including the exchange ratios for their shares and the formation of a new board. The vision of creating a stronger, more competitive European IT services company was reflected in this consolidation of control, aiming for synergistic growth and market expansion.

Atos emerged from the merger of Axime and Sligos in 1997. Axime was founded by Bernard Bourigeaud. Sligos was a subsidiary of Crédit Lyonnais.

Crédit Lyonnais, through Sligos, held a significant early stake. The pre-existing shareholding structures of Axime and Sligos largely determined the initial ownership of Atos.

Bernard Bourigeaud became the first CEO of Atos. Early agreements focused on integrating the two companies and forming a new board.

The merger involved share exchange ratios and the establishment of a new board. This consolidation aimed for synergistic growth and market expansion.

The merger aimed to create a stronger European IT services company. The goal was to enhance competitiveness and expand market reach.

The initial ownership was shaped by the pre-existing structures of Axime and Sligos. The early agreements focused on the integration of these two companies.

The early stages of the Atos company were marked by a strategic consolidation, aiming to create a formidable player in the European IT services market. The initial ownership structure, influenced by the merger of Axime and Sligos, set the stage for the company's future. For more details, you can read a Brief History of Atos.

The merger of Axime and Sligos in 1997 formed Atos. Bernard Bourigeaud, founder of Axime, became the first CEO. Crédit Lyonnais, through Sligos, held a significant early stake.

- The merger was a consolidation of existing entities, not a startup.

- Early ownership was influenced by Axime and Sligos' pre-existing structures.

- The goal was to create a stronger, more competitive IT services company.

- The initial agreements included share exchange ratios and board formation.

Atos SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Atos’s Ownership Changed Over Time?

The ownership structure of the Atos company has seen considerable changes since its inception. A pivotal moment was the 2011 acquisition of Siemens IT Solutions and Services. This move significantly broadened Atos's global reach and capabilities. Siemens became a major shareholder, initially holding approximately 15% of Atos's shares. This strategic alliance aimed to establish a leading European IT services provider. Over time, Siemens decreased its stake, eventually selling off its remaining shares. The evolution of Atos's ownership has been marked by strategic acquisitions and shifts in major shareholdings, influencing the company's direction.

As of early 2024, the Atos owner structure is primarily dispersed among institutional investors and public shareholders. Major institutional investors typically include asset management firms, mutual funds, and hedge funds. For instance, as of early 2024, key institutional investors in Atos include EPF Partners, holding roughly 6.2% of the shares, and other investment funds such as Sycomore Asset Management and Amundi Asset Management, each holding smaller but significant percentages. The French state, through its investment arm, has also been identified as a potential strategic investor, especially given Atos's involvement in sensitive cybersecurity and supercomputing activities. These ownership shifts have directly influenced Atos's strategic focus on areas like cybersecurity and digital transformation services, and have been central to discussions about the potential sale of its business units.

| Shareholder | Approximate Shareholding (Early 2024) | Notes |

|---|---|---|

| EPF Partners | 6.2% | Major institutional investor |

| Sycomore Asset Management | Significant | Institutional investor |

| Amundi Asset Management | Significant | Institutional investor |

| Public Shareholders | Majority | Dispersed ownership |

Understanding the dynamics of Atos shareholders is crucial for assessing its strategic direction and financial health. The company's history, including its acquisitions and partnerships, has shaped its current ownership landscape. For more insights into the company's strategic positioning, consider exploring the Target Market of Atos.

The Atos company's ownership has evolved significantly, marked by strategic acquisitions and shifts in shareholdings.

- Siemens was once a major shareholder, but has since divested its stake.

- Ownership is now largely dispersed among institutional investors and public shareholders.

- Major institutional investors include firms like EPF Partners, Sycomore Asset Management, and Amundi Asset Management.

- The French state has a potential strategic interest.

Atos PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Atos’s Board?

The current Board of Directors of the Atos company is pivotal in its governance, representing various stakeholder interests. As of early 2024, the board includes a mix of independent directors and those representing significant shareholders. For example, Jean-Pierre Mustier holds the position of Chairman of the Board. Understanding the Atos ownership structure is key to grasping the company’s strategic direction.

The board's decisions are critical, especially given the strategic reorientation and financial performance challenges faced by the company. The ongoing discussions about the potential divestiture of Tech Foundations and Eviden highlight the board's decision-making and its relationship with major shareholders. The composition of the board and its decisions are essential in navigating these complex situations and shaping the future of the Atos company.

| Board Member | Role | Notes |

|---|---|---|

| Jean-Pierre Mustier | Chairman of the Board | Oversees board activities and strategic direction. |

| Caroline Ruellan | Director | Independent Director |

| Nourdine Bihmane | Director | CEO of Eviden |

The voting structure of Atos generally follows a one-share-one-vote principle for its ordinary shares. However, the influence of major institutional investors and the French state, particularly given the strategic importance of Atos's activities, can be significant. The question of who controls Atos is often influenced by these factors. The company’s Competitors Landscape of Atos provides further insights into the competitive environment.

The board's composition is crucial for navigating the company's strategic direction.

- The Chairman of the Board is Jean-Pierre Mustier.

- The voting structure is generally one-share-one-vote.

- Major institutional investors and the French state have significant influence.

- The board's decisions are critical for the future of the Atos company.

Atos Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Atos’s Ownership Landscape?

Over the past few years, the Atos company has been undergoing significant changes in its ownership and strategic direction. A major shift includes the company's efforts to sell off certain business units. For example, the Tech Foundations unit and Eviden, which focuses on cybersecurity and digital transformation, have been subjects of potential divestitures. These moves are part of a larger plan to streamline operations and concentrate on more profitable areas. These actions influence who owns Atos and how the company is structured.

The potential sales have drawn interest from various parties. Czech billionaire Daniel Křetínský's EPEI was in exclusive talks to acquire Tech Foundations. Also, there were discussions with Airbus regarding a possible stake in Eviden. These developments could significantly change the Atos ownership structure. The French state has also shown interest in Atos's strategic assets, especially those related to national security. This indicates potential government involvement in future ownership changes. These trends reflect a wider industry trend towards specialization and consolidation, as IT service providers adjust to market demands.

| Metric | Details | Data |

|---|---|---|

| Market Capitalization | Approximate value of a company's outstanding shares | As of early 2024, the market capitalization fluctuated, reflecting ongoing restructuring and market sentiment. |

| Revenue | Total income generated by the company | In 2023, revenue was reported, with figures varying based on the business units included due to ongoing divestitures. |

| Number of Employees | Total workforce | The employee count has changed due to divestitures and restructuring. |

These changes are part of a broader industry trend. To learn more about the company, check out the Revenue Streams & Business Model of Atos article.

The shareholder base of Atos company is diverse, including institutional investors and individual shareholders. Major investors and their stakes are subject to change due to ongoing restructuring and market activities. The company's stock is traded on the Euronext Paris exchange.

Atos owner is focusing on core businesses and streamlining operations. This involves divesting non-core assets and potentially acquiring new technologies. The company aims to strengthen its position in key markets. The strategy is driven by evolving market demands and technological advancements.

Divestitures significantly impact the company's financial performance and structure. They lead to changes in revenue streams and asset values. These changes influence the Atos ownership and the company's future strategic decisions. The restructuring aims to improve profitability and focus.

The French government's interest in Atos's strategic assets highlights the importance of national security. Government involvement can influence ownership changes and strategic decisions. This reflects the significance of the company's technology and services.

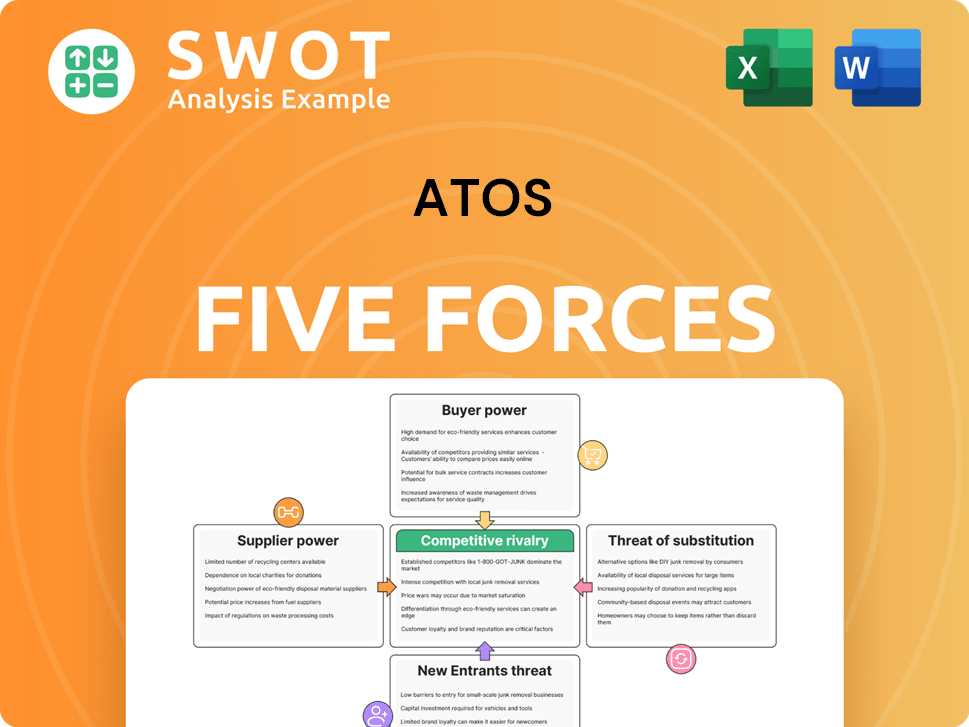

Atos Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Atos Company?

- What is Competitive Landscape of Atos Company?

- What is Growth Strategy and Future Prospects of Atos Company?

- How Does Atos Company Work?

- What is Sales and Marketing Strategy of Atos Company?

- What is Brief History of Atos Company?

- What is Customer Demographics and Target Market of Atos Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.