Attica Group Bundle

How did a Greek flour mill become a global ferry giant: The Attica Group story?

Journey back in time to uncover the remarkable Attica Group SWOT Analysis, a company that began its journey in 1918 in Piraeus, Greece. Initially focused on flour production, the company, then known as 'General Company of Commerce and Industry of Greece,' would undergo a transformative evolution. Witness how this early venture laid the groundwork for what would become a leading force in the Eastern Mediterranean's maritime industry.

From its humble beginnings as 'Attica Flour Mills SA,' Attica Group's story is one of strategic pivots and ambitious growth. Today, operating under brands like Superfast Ferries, Blue Star Ferries, and Hellenic Seaways, the Greek ferry company has become a vital part of Greek infrastructure. This evolution, including the significant addition of ANEK Lines in 2023, showcases the company's resilience and commitment to connecting people across the seas.

What is the Attica Group Founding Story?

The story of the Attica Group begins in the early 20th century. The Attica Group history is a tale of adaptation and expansion within the Greek business landscape.

Established on October 27, 1918, in Piraeus, Greece, the company initially operated as the 'General Company of Commerce and Industry of Greece'. Its primary focus was on producing and trading flour under the name 'Attica Flour Mills SA'.

The company's early focus was clearly on industrial production within the Greek economic context of the early 20th century. This early focus set the stage for its future in the shipping industry.

The early years of the Attica Group company saw significant changes in ownership and direction.

- In 1922, the company changed ownership and was renamed Attica Enterprises S.A.

- This name later evolved to Attica Enterprises Holding S.A. before settling on its current form, Attica Group.

- The company was listed on the Athens Stock Exchange in 1924, marking a significant step in its development.

- The company's evolution reflects a broader vision beyond its original flour milling activities.

The company's listing on the Athens Stock Exchange in 1924 was a pivotal moment. This event provided the company with access to capital and laid the groundwork for its future expansion. For a deeper dive into the company's strategic moves, you might find insights in the Growth Strategy of Attica Group.

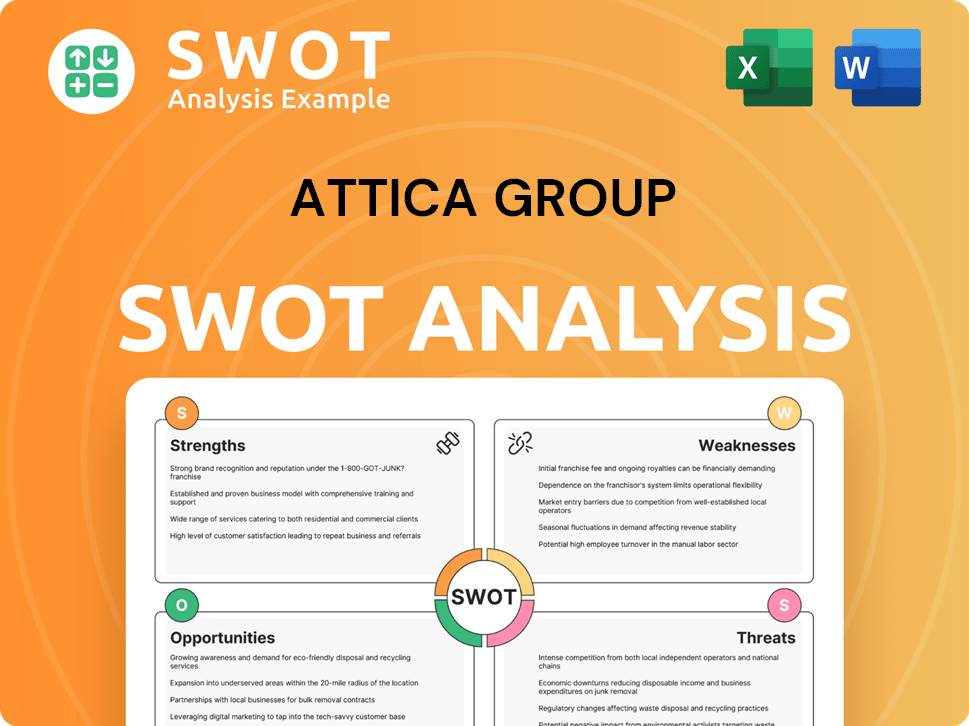

Attica Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Attica Group?

The early growth and expansion of the Attica Group company is a fascinating story of strategic moves and market dominance. The journey began with its listing on the Athens Stock Exchange in 1924. A pivotal moment arrived with the establishment of Superfast Ferries Maritime S.A. in 1993, marking its entry into the maritime sector and setting the stage for significant growth.

The company's decisive entry into the maritime sector came with the formation of Superfast Ferries Maritime S.A. This strategic move, spearheaded by Pericles S. Panagopulos, laid the groundwork for the launch of car-passenger ferries. The initial deployment on the Patras-Ancona-Patras route significantly reduced crossing times.

The launch of Superfast I and Superfast II in 1995 marked a crucial step in the Attica Group history. These ferries, deployed on the Patras-Ancona-Patras service, cut travel times by up to 40%. Further expansion included the addition of Superfast III and Superfast IV, and the opening of new routes.

Attica Group's growth strategy included strategic acquisitions. In May 2018, the company acquired a controlling interest in Hellenic Seaways, increasing its stake to 98.83% by June of the same year. This move significantly expanded its network within the Aegean Sea, making it a key player in the Greek ferry market.

A significant milestone was the acquisition of ANEK Lines in December 2023, positioning the company as the second-largest operator in passenger volume in Europe. This merger boosted the Group's revenue to €747.8 million in 2024, a 27% increase from €588.3 million in 2023. For more details on the company's business model, check out this article: Revenue Streams & Business Model of Attica Group.

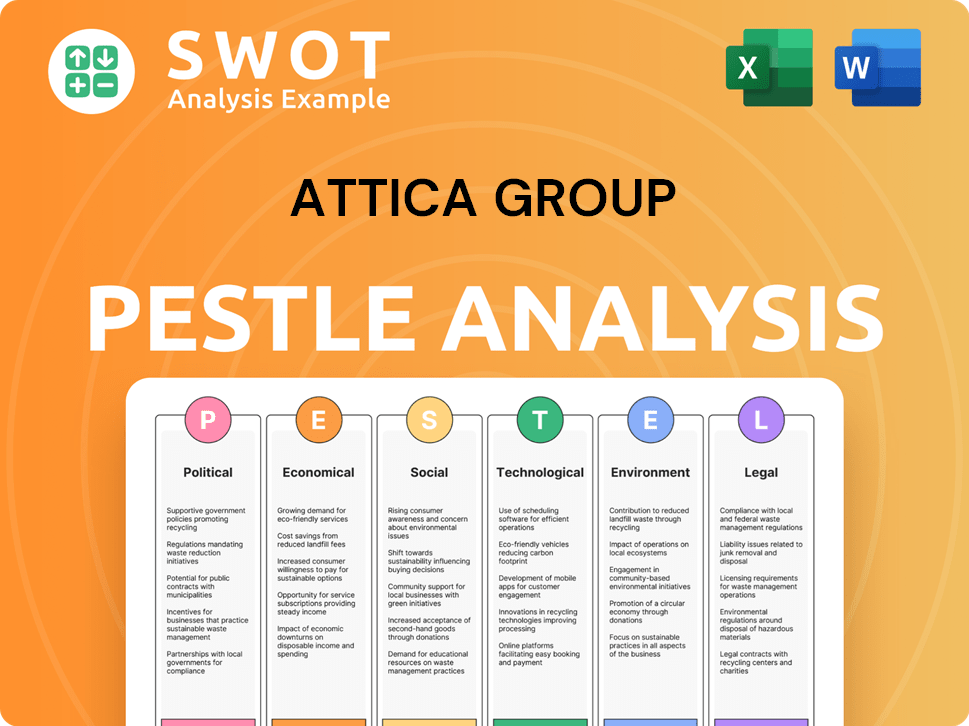

Attica Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Attica Group history?

The Attica Group has a rich history marked by significant milestones in the maritime sector. These achievements have shaped the company into a leading player in the ferry industry, demonstrating its commitment to growth and strategic acquisitions.

| Year | Milestone |

|---|---|

| 1995 | Introduction of Superfast Ferries, revolutionizing Adriatic sea travel with reduced travel times. |

| 2018 | Acquisition of Hellenic Seaways for €142.9 million, expanding the company's reach. |

| 2023 | Merger with ANEK Lines in December, making Attica Group one of the largest Ro-Pax vessel operators globally by passenger capacity. |

| 2025 | Sale of the Ro-Pax vessel KRITI II for environmentally sound recycling, showcasing commitment to green transition. |

Innovations have been central to the Attica Group's success. The introduction of Superfast Ferries in 1995, with their focus on speed and modern vessels, set a new standard for sea travel. The company continues to invest in fleet renewal and environmental upgrades, reflecting its dedication to sustainable practices.

The launch of Superfast Ferries in 1995 significantly reduced travel times in the Adriatic Sea, transforming the passenger experience. This innovation helped Attica Group establish a competitive advantage in the ferry market.

Ongoing investment in fleet renewal ensures that Attica Group maintains modern and efficient vessels. This commitment enhances operational performance and reduces environmental impact.

Attica Group consistently implements environmental upgrades to its vessels, supporting sustainable operations. These upgrades help the company meet evolving regulatory standards and reduce its carbon footprint.

The acquisition of Hellenic Seaways and the merger with ANEK Lines are examples of strategic moves to expand market presence. These acquisitions have strengthened Attica Group's position in the industry.

Attica Group is diversifying its investments by acquiring hotel complexes, such as the second hotel in Naxos for €14 million. This diversification strategy enhances revenue streams.

Attica Group continuously integrates technological advancements to improve operational efficiency. These advancements enhance passenger experience and streamline processes.

Attica Group has faced several challenges throughout its history. The integration of ANEK Lines resulted in non-recurring expenses of €28.2 million in 2024. Furthermore, the company's operating costs were burdened by €18.9 million for emission allowances in 2024, due to the EU Emissions Trading System.

The merger with ANEK Lines in 2023 led to non-recurring expenses of €28.2 million in 2024. These costs impacted the consolidated earnings after tax, reflecting the complexities of integrating operations.

The implementation of the EU Emissions Trading System on January 1, 2024, increased operating costs by €18.9 million. This regulatory change required significant investments in compliance.

Fluctuations in fuel prices and economic conditions pose ongoing challenges for the ferry industry. Attica Group must adapt to these changes to maintain profitability.

Competition from other ferry operators and alternative transportation modes requires continuous innovation. Attica Group must differentiate itself through service and efficiency.

Adhering to evolving maritime regulations, including environmental standards, demands ongoing investment. Attica Group is committed to meeting these requirements.

Economic downturns can reduce passenger traffic and impact revenues. Attica Group adapts its strategies to navigate challenging economic periods.

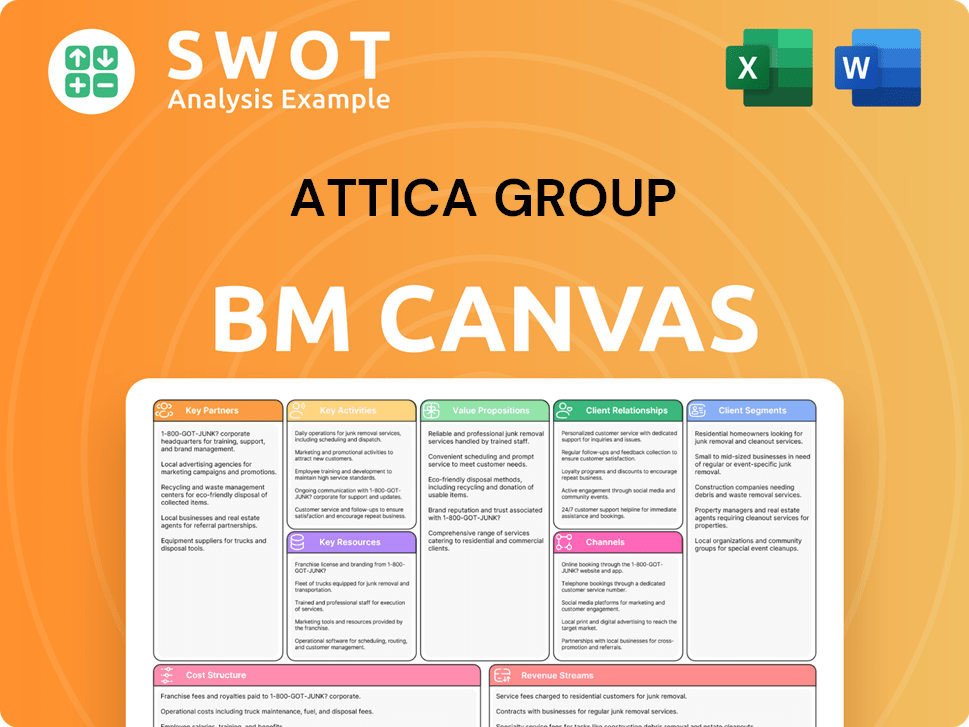

Attica Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Attica Group?

The Attica Group company has a rich history, starting as 'General Company of Commerce and Industry of Greece' in 1918 before evolving into a leading Greek ferry company. Key milestones include its listing on the Athens Stock Exchange in 1924, the introduction of Superfast Ferries in the 1990s, and the strategic acquisition of Hellenic Seaways. The recent merger with ANEK Lines in December 2023 significantly expanded its operational capacity, solidifying its position in the global passenger shipping market.

| Year | Key Event |

|---|---|

| 1918 | Founded in Piraeus, Greece, as 'General Company of Commerce and Industry of Greece,' initially operating as 'Attica Flour Mills SA.' |

| 1924 | Listed on the Athens Stock Exchange. |

| 1993 | New management team, chaired by Pericles S. Panagopulos, forms Attica Maritime S.A. (later Superfast Ferries Maritime S.A.). |

| 1995 | Delivery of Superfast I and Superfast II, revolutionizing Patras-Ancona route. |

| 1998 | Superfast III and Superfast IV delivered, expanding routes to include Igoumenitsa and Bari. |

| 2016 | Establishes Africa Morocco Link (AML) in a joint venture, operating ferry services from Morocco to Europe. |

| 2018 | Acquires a controlling interest in Hellenic Seaways, increasing its stake to 98.83%. |

| December 2023 | Completes merger by absorption of ANEK Lines, becoming one of the largest passenger shipping operators globally. |

| 2024 | Consolidated revenue reaches €747.8 million, a 27% increase, largely due to the ANEK merger. |

| March 2025 | Sells Ro-Pax vessel KRITI II for environmentally sound recycling. |

| May 2025 | Attica Holdings' market cap is reported as $0.59 Billion USD. |

Attica Group's strategic plan for 2025-2029 focuses on sustainable growth, with projected revenues of €915-€925 million and EBITDA of €238-€262 million by 2030. New investments for 2025-2029 are planned to range between €465 million and €515 million. This plan includes fleet renewal and expansion, digital transformation, and hospitality sector growth.

The Group plans to introduce two new E-Flexer vessels for the Adriatic market, expected in April and August 2027, which will be methanol-ready and have battery notation, aiming to reduce GHG emissions by 60%. Furthermore, two new catamarans are planned for the Saronic Gulf and one new vessel for the inland market. The Group is also focusing on green transition through the installation of scrubbers and energy-efficient systems.

Attica Group is committed to green initiatives, including installing scrubbers and energy-efficient systems. Additional installations are planned for two vessels, bringing the total to ten. These green investments are 80% funded through the Recovery and Resilience Facility (RRF). This demonstrates the company's dedication to sustainability.

Digital transformation is a key pillar, enhancing customer experience and operational efficiency. Attica Group is expanding its presence in the hospitality sector, acquiring a second hotel complex in Naxos for €14 million, with plans to develop one of the largest hospitality units on the island. The long-term vision includes a floating bridge connecting the mainland and the islands.

Attica Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Attica Group Company?

- What is Growth Strategy and Future Prospects of Attica Group Company?

- How Does Attica Group Company Work?

- What is Sales and Marketing Strategy of Attica Group Company?

- What is Brief History of Attica Group Company?

- Who Owns Attica Group Company?

- What is Customer Demographics and Target Market of Attica Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.