Attica Group Bundle

How Does Attica Group Navigate the Seas of Profit?

Attica Group, a dominant force in Eastern Mediterranean passenger shipping, has dramatically expanded its footprint, especially after absorbing ANEK LINES S.A. in late 2023. This strategic move has propelled Attica Group to the forefront of global Ro-Pax vessel operators by passenger capacity. Operating under renowned brands like Superfast Ferries and Blue Star Ferries, Attica Group ferries connect mainland Greece with numerous islands and international locations.

With a 27% revenue surge in 2024, reaching €747.8 million, and significant increases in passenger and vehicle traffic, Attica Group's financial performance reflects its operational prowess. To truly grasp its success, let's explore the core Attica Group SWOT Analysis, revenue streams, and strategic advantages that define its market leadership. Understanding Attica Group operations, including its Hellenic Seaways routes and ferry routes to the Greek islands, is key for anyone seeking to understand the passenger shipping industry.

What Are the Key Operations Driving Attica Group’s Success?

The core of Attica Group's operations revolves around providing ferry services. This involves connecting mainland Greece with numerous islands and international routes, including Greece-Italy. The company's primary offerings include transporting passengers, private vehicles, and freight units.

Their operational framework is supported by a modern and technologically advanced fleet. As of March 2025, the fleet comprises 42 vessels, including 27 conventional Ro-Pax vessels, 13 high-speed vessels, and 2 Ro-Ro carriers. The focus is on continuous investment in fleet renewal, environmental transition, and digitalization of operations.

Attica Group's value proposition lies in offering reliable, comfortable, and increasingly environmentally friendly travel options. Market differentiation is achieved through its broad service portfolio and strong brand recognition across its Superfast Ferries, Blue Star Ferries, Hellenic Seaways, and ANEK Lines brands.

Attica Group operates extensive ferry routes. These include connections between mainland Greece and various Greek islands, as well as international routes to Italy. The company's network is a key factor in its operational effectiveness.

The company's modern fleet supports its operations. This includes conventional Ro-Pax vessels, high-speed vessels, and Ro-Ro carriers. Attica Group invests in technology, such as advanced wireless communications, to improve passenger experience.

Attica Group emphasizes robust customer service. This includes digital platforms for bookings and information. The company aims to enhance the overall passenger experience through these channels.

Attica Group is committed to environmental upgrades. This includes scrubber installations on vessels and the adoption of energy-saving devices. These initiatives contribute to sustainability and cost efficiencies.

Attica Group's effectiveness comes from its comprehensive network, modern fleet, and strategic acquisitions. The merger with ANEK LINES S.A. significantly expanded its capacity and reach. The company's focus on environmental upgrades demonstrates a forward-looking strategy.

- Comprehensive ferry routes, including Greek islands and international destinations.

- Modern fleet with Ro-Pax, high-speed, and Ro-Ro vessels.

- Investment in technology and digital platforms for improved customer service.

- Commitment to environmental sustainability through various initiatives.

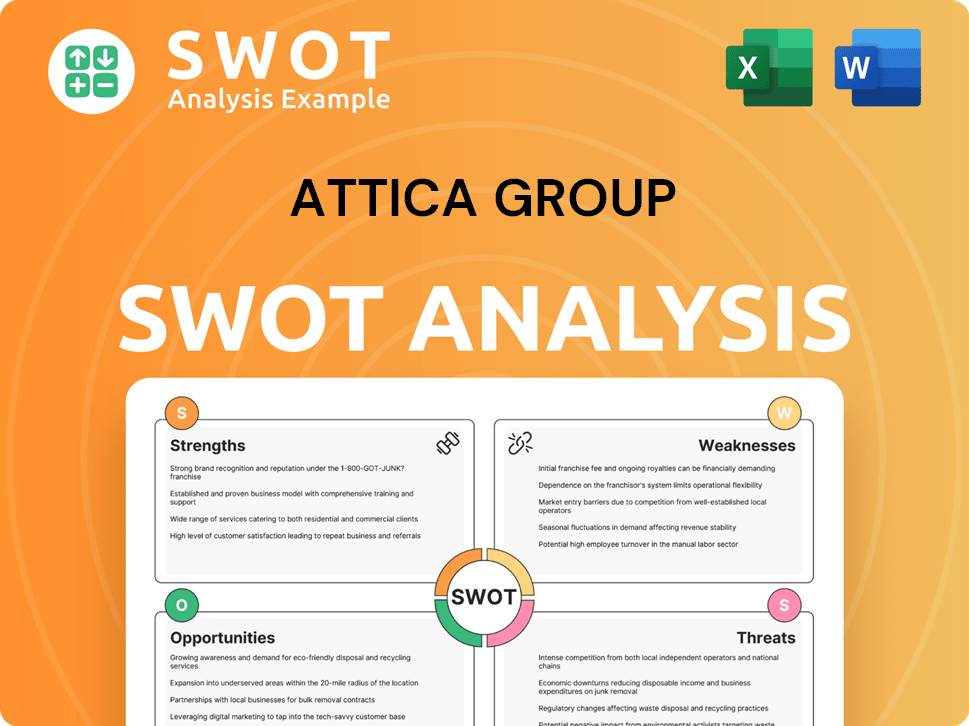

Attica Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Attica Group Make Money?

The primary revenue streams for Attica Group stem from passenger, private vehicle, and freight unit transportation, alongside onboard sales. Historically, the majority of the company's revenue has been generated from Greek domestic routes, with international routes also contributing to overall earnings. The company has strategically expanded into complementary sectors to diversify its revenue base.

In 2024, Attica Group demonstrated significant financial growth. The company's consolidated revenue increased substantially, reflecting both organic growth and strategic acquisitions. This expansion is supported by increased traffic volumes across various transportation segments.

Attica Group's monetization strategies involve a combination of core transportation services and strategic investments. The company focuses on enhancing operational efficiency through investments in areas like scrubber installations and energy-saving devices. These initiatives aim to improve profitability and reduce operational costs.

The consolidated revenue for Attica Group in 2024 surged by 27% to reach €747.8 million, compared to €588.3 million in 2023. For the nine-month period of 2024, revenue reached €593.4 million, a 27.4% increase from €465.6 million in the same period of 2023. This growth was driven by increased traffic across all categories.

- Passenger transport increased by 12.2%, with 6.1 million passengers transported in the first nine months of 2024.

- Private vehicle transport rose by 25.3%, with 1.1 million vehicles transported.

- Freight unit transport increased by 27.4%, totaling 407,000 units.

- The company invested €14 million in the first half of 2024 to acquire a second hotel complex in Naxos, expanding its presence in the tourism sector.

- Attica Group also benefits from fuel price hedging, impacting its earnings positively. For more details on the company's strategy, see Growth Strategy of Attica Group.

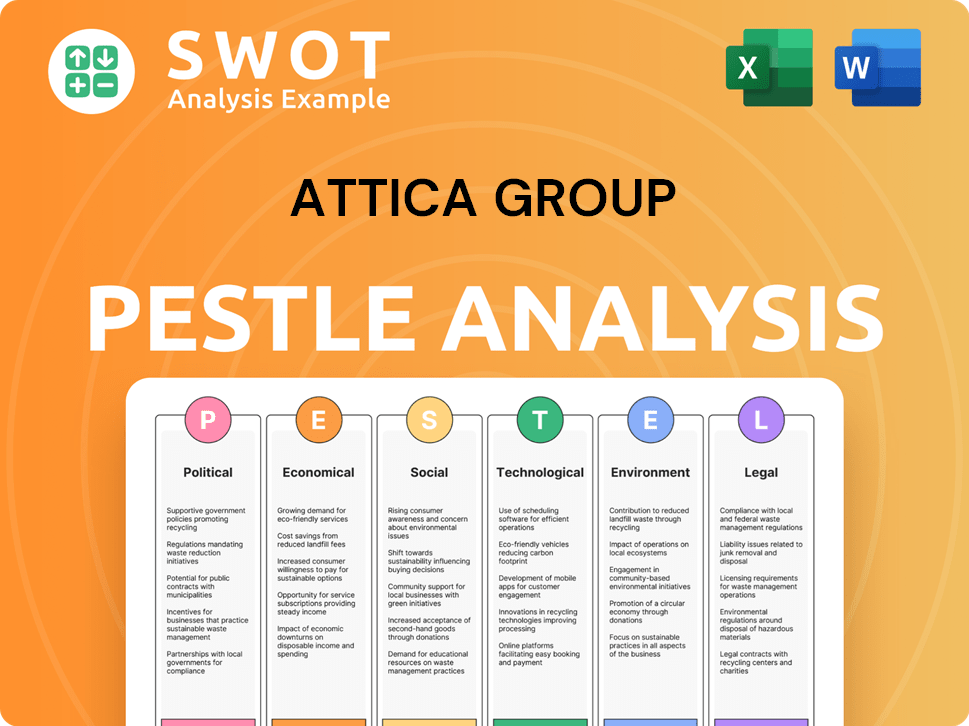

Attica Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Attica Group’s Business Model?

A significant milestone for Attica Group was the completion of its merger by absorption of ANEK LINES S.A. on December 4, 2023. This strategic move significantly expanded Attica Group's fleet and market reach, positioning it as one of the largest passenger and freight ferry operators globally. The merger directly contributed to a substantial increase in revenue, reflecting the company's growth trajectory.

Attica Group consistently invests in fleet renewal and modernization to maintain its competitive edge. Recent acquisitions and sales of vessels demonstrate the company's commitment to enhancing its services and adapting to market demands. These actions are part of a broader strategy to optimize its operations and meet evolving environmental standards.

Operational challenges, such as compliance with environmental regulations, are addressed through strategic investments and operational adjustments. Despite these costs, Attica Group maintains a competitive advantage through its strong brand recognition, extensive route network, and focus on innovation, including investments in digital transformation and sustainable practices. To learn more about the company's strategic direction, consider reading about the Growth Strategy of Attica Group.

The merger with ANEK LINES S.A. on December 4, 2023, was a pivotal moment, expanding the fleet and market presence. This strategic move resulted in a 27% increase in consolidated revenue in 2024, reaching €747.8 million. The integration, however, led to non-recurring expenses of €28.2 million in 2024.

Attica Group has focused on fleet renewal, acquiring new E-Flexer vessels and Ro-Pax vessels like 'Highspeed 3', 'KISSAMOS', and 'KYDON'. The company also sold the Ro-Pax vessels KRITI II and KRITI I in March and May 2025, respectively, for recycling. Total investment cash outflows in 2024 amounted to €162 million.

Attica Group benefits from strong brand recognition (Superfast Ferries, Blue Star Ferries, Hellenic Seaways, Anek Lines) and a comprehensive network of ferry routes in the Eastern Mediterranean. The company is investing in digital transformation, including €7 million for enhanced onboard connectivity. Additionally, it is focused on green transition with methanol and battery-ready vessels.

Compliance with the European Union Emissions Trading System, effective January 1, 2024, added to operating costs. The cost of emission allowances purchase in 2024 was €18.9 million. Despite these costs, Attica Group continues to adapt and innovate, maintaining its position in the market.

Attica Group's operations are centered around passenger and freight ferry services, primarily in the Eastern Mediterranean. The company's extensive route network connects various Greek islands and mainland ports, offering a wide range of ferry routes Greece. Attica Group ferries are known for their reliability and comprehensive onboard services.

- The fleet includes a mix of high-speed vessels and Ro-Pax ferries.

- The company continues to invest in modernizing its fleet and improving passenger experience.

- Attica Group destinations include popular Greek islands and strategic ports.

- The company's commitment to sustainability is evident in its fleet renewal and green initiatives.

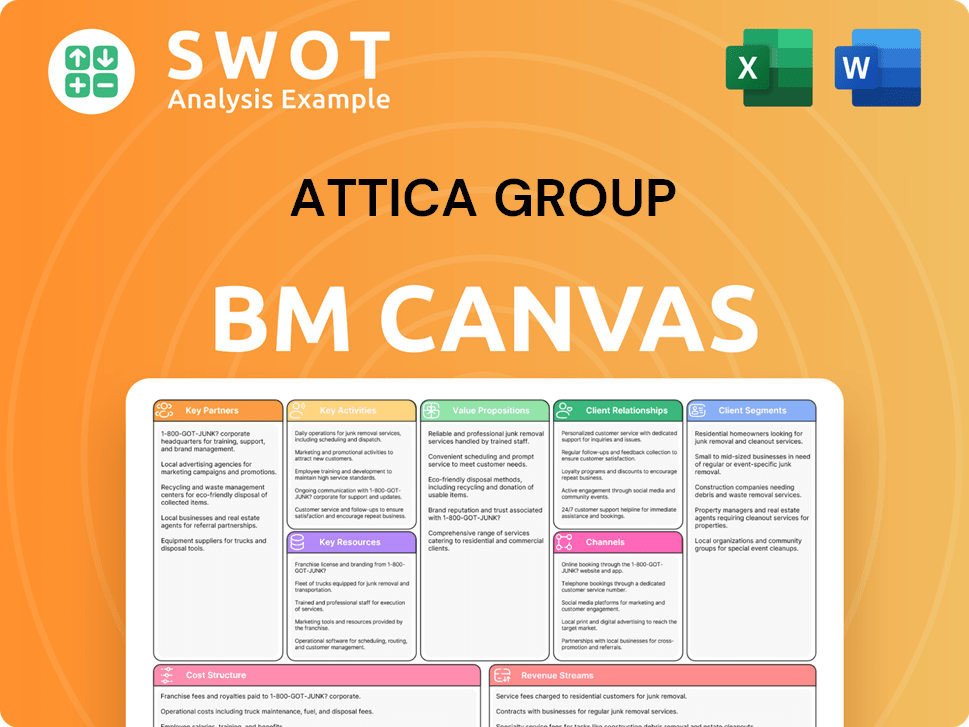

Attica Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Attica Group Positioning Itself for Continued Success?

Attica Group holds a leading market position in the Greek coastal passenger shipping sector. It is recognized among the largest ferry companies globally based on passenger capacity. With an extensive network of over 55 destinations, including routes within Greece and to Italy, the company has established a strong presence in the ferry industry.

Key risks include regulatory changes, especially those related to environmental compliance. The company is also navigating evolving consumer preferences and potential competition. Looking ahead, the company is focused on sustaining and expanding its profitability through strategic initiatives.

Attica Group's extensive network serves over 50 Greek islands and operates international routes. In 2024, the company transported 7.29 million passengers, 1.3 million private vehicles, and 0.53 million freight units. This strong performance reflects its significant market share and customer loyalty in the ferry industry.

Regulatory changes, particularly environmental compliance, pose a risk. The European Union Emissions Trading System added €18.9 million to operating costs in 2024. The company also faces risks from changing consumer preferences, new competitors, and technological disruptions.

Attica Group is focused on fleet renewal and environmental transition, including new Ro-Pax newbuildings. The company plans to digitize operations and expand into hospitality. Leadership emphasizes organic growth, green transition, and digital transformation to strengthen its competitive edge.

The company's investment plan led to €145.1 million in cash outflows during the first nine months of 2024 and €162 million for the full year 2024. Attica Group is committed to its Corporate Responsibility and Sustainability Strategy for 2024-2026, targeting a 13.6% improvement in responsible operation and ESG principles.

Attica Group is investing in fleet renewal and environmental upgrades, including new Ro-Pax vessels. The company is also focused on digital transformation and expanding into complementary sectors. These initiatives aim to optimize operations and strengthen its market position.

- Fleet renewal and environmental transition.

- Digitization of operations.

- Expansion into hospitality.

- Focus on organic growth and sustainability.

Attica Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Attica Group Company?

- What is Competitive Landscape of Attica Group Company?

- What is Growth Strategy and Future Prospects of Attica Group Company?

- What is Sales and Marketing Strategy of Attica Group Company?

- What is Brief History of Attica Group Company?

- Who Owns Attica Group Company?

- What is Customer Demographics and Target Market of Attica Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.