Attica Group Bundle

Who Really Controls Attica Group?

Unraveling the ownership of Attica Group is crucial for understanding its strategic maneuvers and market dominance in the Eastern Mediterranean. From its inception as Stran S.A. in 1918 to its current status as a leading Attica Group SWOT Analysis powerhouse, the company's ownership has dramatically shaped its trajectory. This exploration will delve into the pivotal moments and key players that have defined Attica Group's evolution.

Understanding Attica Group ownership, including its parent company and key shareholders, provides critical context for its financial information and future prospects. The evolution of Attica Group, including the influence of entities like Grimaldi Group and the dynamics of Hellenic Seaways, is essential for anyone tracking this major shipping company. Discover how the decisions of Attica Group's shareholders and management team have shaped its ferry routes and overall market position.

Who Founded Attica Group?

Information regarding the specific equity split and shareholding of Attica Group's original founders at its inception in 1918, when it was known as Stran S.A., is not readily available in public records. The company underwent a significant transformation in 1993, when it was renamed Attica Enterprises S.A., marking a new era for the company. While the exact individual founders of Stran S.A. and their initial equity distribution are not widely publicized, the rebranding in 1993 under Attica Enterprises S.A. effectively established a new ownership and strategic direction.

Early backers and angel investors from the 1918 founding era are also not extensively documented. Similarly, specific details about early agreements such as vesting schedules, buy-sell clauses, or founder exits from the very early days are not publicly accessible. Any initial ownership disputes or buyouts from the Stran S.A. period are not prominent in public records. The vision of the founding team, though not explicitly detailed in terms of individual contributions, was to establish a leading passenger shipping company in the region.

The evolution of the company from its early days to the present involves significant changes in ownership and strategic direction. The focus has shifted from the initial founders to a more complex structure. Understanding the current ownership structure is key to assessing the company's present operations and future prospects. For more detailed information, you can explore the Revenue Streams & Business Model of Attica Group.

The original founders of Stran S.A. and their initial equity distribution are not widely publicized.

The renaming to Attica Enterprises S.A. in 1993 marked a new era.

Details about early backers and angel investors from 1918 are not extensively documented.

Specifics on early agreements like vesting schedules are not publicly accessible.

Initial ownership disputes or buyouts from the Stran S.A. period are not prominent in public records.

The founding team aimed to establish a leading passenger shipping company.

The early history of Attica Group, then known as Stran S.A., is characterized by a lack of publicly available information regarding its founders and their initial shareholdings. The company's transformation in 1993, with the renaming to Attica Enterprises S.A., marked a significant shift. The early ownership details and agreements, including any disputes or buyouts, remain largely undocumented. The primary focus of the founding team was to establish a prominent shipping company. Understanding the early structure of the company is crucial for analyzing its current ownership and strategic direction.

- The original founders' equity split is not publicly available.

- The 1993 rebranding signaled a new strategic direction.

- Details on early investors and agreements are limited.

- Early ownership disputes are not well-documented.

- The initial vision was to create a leading shipping company.

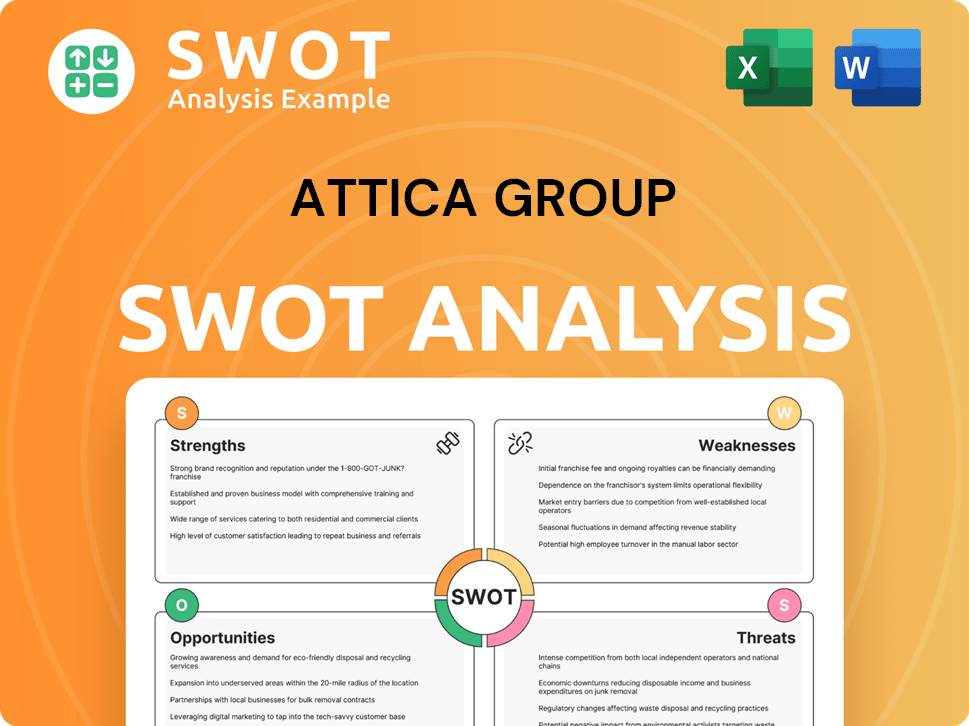

Attica Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Attica Group’s Ownership Changed Over Time?

The evolution of Attica Group's ownership has been marked by significant shifts, particularly after its transformation into Attica Enterprises S.A. in 1993. A key milestone in this journey was its initial public offering on the Athens Exchange, which opened the door for wider investor participation and set the stage for future ownership changes. This listing provided a platform for the company to raise capital and expand its operations, influencing its ownership structure over time.

Marfin Investment Group (MIG) has played a crucial role in shaping Attica Group's ownership landscape. MIG's strategic investments have made it a major stakeholder, significantly impacting the company's direction. As of early 2024, MIG holds a substantial percentage of Attica Group's shares, making it the largest shareholder and solidifying its control. This consolidation of ownership has likely influenced Attica Group's corporate strategy and governance, potentially leading to synergies and streamlined decision-making within MIG's broader portfolio.

| Ownership Timeline | Key Events | Impact on Ownership |

|---|---|---|

| 1993 | Attica Enterprises S.A. established | Set the stage for future ownership changes. |

| Early 2000s | Listing on the Athens Exchange | Opened the door for wider investor participation. |

| Ongoing | Marfin Investment Group (MIG) increases stake | MIG becomes the largest shareholder, influencing strategic direction. |

Other major stakeholders in Attica Group typically include institutional investors, mutual funds, and individual shareholders. The specific percentages held by these entities fluctuate based on market conditions and investment strategies. The relationship between Attica Group and the Grimaldi Group is also noteworthy, as it highlights the dynamics within the shipping industry. Understanding the interplay of these stakeholders provides a comprehensive view of who owns Attica Group and how their interests shape its future.

Attica Group's ownership has evolved significantly since 1993, with MIG emerging as the largest shareholder.

- Listing on the Athens Exchange was a pivotal moment.

- MIG's increased stake has solidified its control.

- Institutional investors and individual shareholders also play a role.

- Understanding the ownership structure is key to understanding the company's strategic direction.

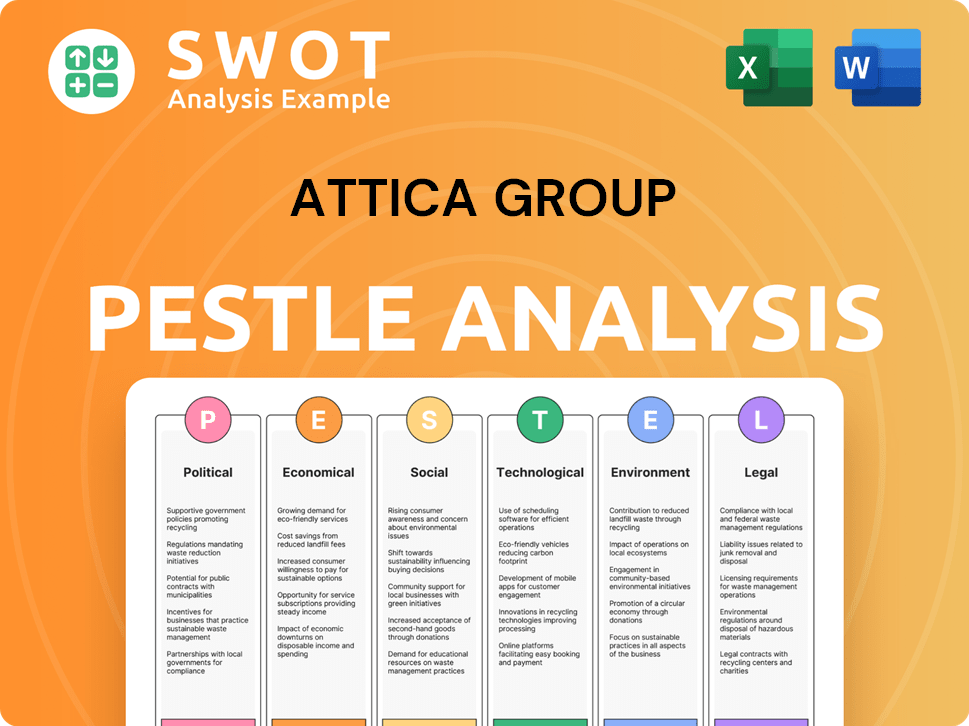

Attica Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Attica Group’s Board?

The current Board of Directors of Attica Group reflects its ownership structure, with representatives from major shareholders, independent members, and executive management. While a complete, real-time list of all board members and their specific affiliations to major shareholders would require access to the latest company filings (e.g., annual reports or shareholder meeting minutes from 2024 or 2025), it is common for the largest shareholder to have significant representation on the board. The composition of the board and the voting structure are crucial in shaping decision-making within the company, aligning it with the strategic interests of its major shareholders.

Information regarding the specific individuals on the board, their affiliations, and any changes in the board's composition would be detailed in the company's annual reports or filings with regulatory bodies. These documents would also provide insights into any committees within the board, such as audit, compensation, or nomination committees, and their respective members. Details on the board's activities, including meeting frequency, key decisions, and any related-party transactions, are typically disclosed in these reports as well. For the most current information, consulting Attica Group's official investor relations materials is recommended.

| Board Member Role | Typical Affiliation | Responsibilities |

|---|---|---|

| Chairman | Often a representative of a major shareholder or an independent director. | Oversees board meetings, sets agendas, and ensures effective governance. |

| CEO/Managing Director | Executive Management | Responsible for the day-to-day operations and strategic direction of the company. |

| Independent Directors | Unaffiliated with major shareholders | Provide an independent perspective, oversee management, and ensure shareholder interests are protected. |

The voting structure of Attica Group generally follows a one-share-one-vote principle for its common shares. There is no widely publicized information indicating the presence of dual-class shares, special voting rights, golden shares, or founder shares that would grant outsized control to specific individuals or entities beyond their direct shareholding. Recent proxy battles or activist investor campaigns involving Attica Group have not been prominently reported in public financial news, suggesting a relatively stable governance environment, at least in terms of public disputes. Understanding the voting rights is crucial for shareholders, as it directly impacts their ability to influence company decisions, such as electing board members or approving major corporate actions. For detailed information on voting rights, shareholders should consult the company's articles of association and any relevant regulatory filings.

The Board of Directors and the voting structure are key elements in understanding the company's governance. The board's composition, including representatives from major shareholders and independent directors, reflects the ownership structure. The voting rights, typically one-share-one-vote, empower shareholders to participate in decision-making.

- Board members represent major shareholders, ensuring their interests are considered.

- Independent directors provide an unbiased perspective.

- Voting rights enable shareholders to influence company decisions.

- Consulting the company's annual reports is crucial.

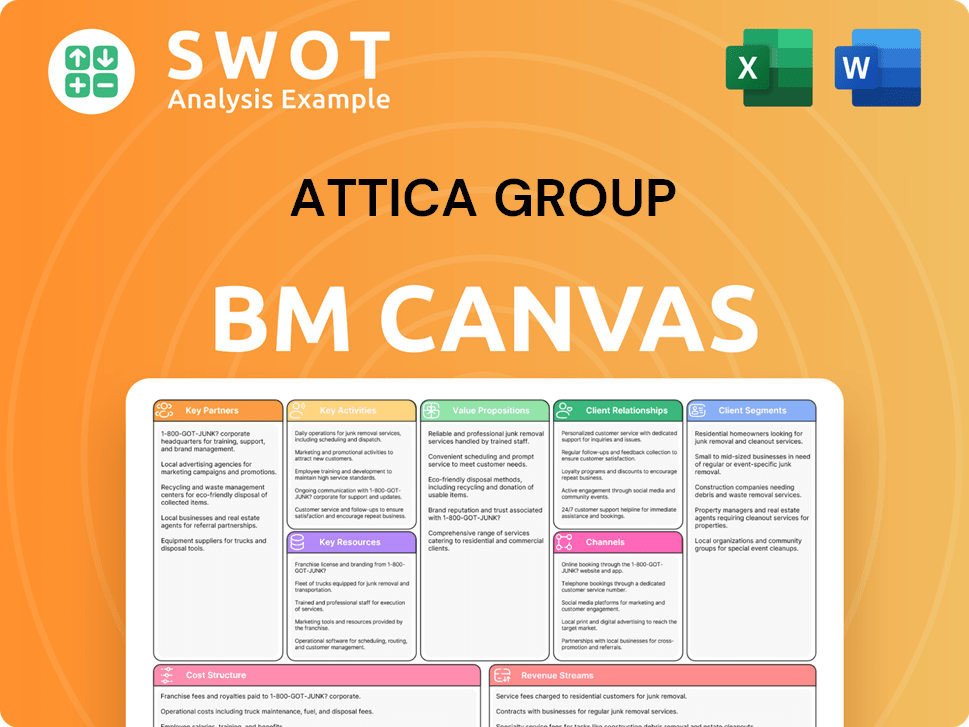

Attica Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Attica Group’s Ownership Landscape?

Over the past few years (2022-2025), the ownership of Attica Group has been significantly influenced by Marfin Investment Group (MIG). MIG's strategic moves to increase its stake have shaped the ownership structure, leading to a more concentrated profile. This trend reflects a broader consolidation within the Greek ferry industry, aiming for greater control and operational synergies. The Growth Strategy of Attica Group shows how these ownership dynamics affect the company's overall market position.

While there haven't been major public offerings or significant share buybacks by Attica Group itself, MIG's consistent accumulation of shares points to a strategic approach rather than a broad market offering. Mergers and acquisitions within the Greek shipping sector, such as Attica Group's involvement with ANEK Lines, indirectly affect the ownership dynamics by altering the competitive landscape. The industry is also seeing a move towards increased institutional ownership, often driven by strategic investors seeking to optimize operations and market share.

| Ownership Trend | Details | Impact |

|---|---|---|

| MIG's Increased Stake | Consistent accumulation of shares. | More concentrated ownership, potential for greater control. |

| Industry Consolidation | Mergers and acquisitions within the Greek shipping sector. | Altered competitive landscape, potential for further consolidation. |

| Institutional Ownership | Increasing presence of institutional investors. | Optimization of operations and market share. |

The current trajectory suggests continued strong influence from MIG, the major shareholder. While public statements about future ownership changes remain subject to market developments, the trend indicates a focus on strategic control and operational efficiency within the Attica Group and its subsidiaries, including Hellenic Seaways. The relationship between Attica Group and companies like the Grimaldi Group also affects the overall competitive environment.

MIG's consistent accumulation of shares reflects a strategic approach to increase its influence over Attica Group. This has led to a more concentrated ownership structure, enhancing its control. This strategic move within the Greek ferry industry aims for greater control and operational synergies.

The Greek shipping sector is experiencing increased consolidation, impacting Attica Group. Mergers and acquisitions alter the competitive landscape, potentially leading to further consolidation. This trend aligns with the strategic goals of major shareholders like MIG.

There's a growing trend towards institutional ownership in the Greek shipping sector. Strategic investors aim to optimize operations and market share. This trend is a key factor in Attica Group's recent ownership evolution.

The current trajectory suggests continued strong influence from MIG. Public statements about future ownership changes remain subject to market developments. This indicates a focus on strategic control and operational efficiency.

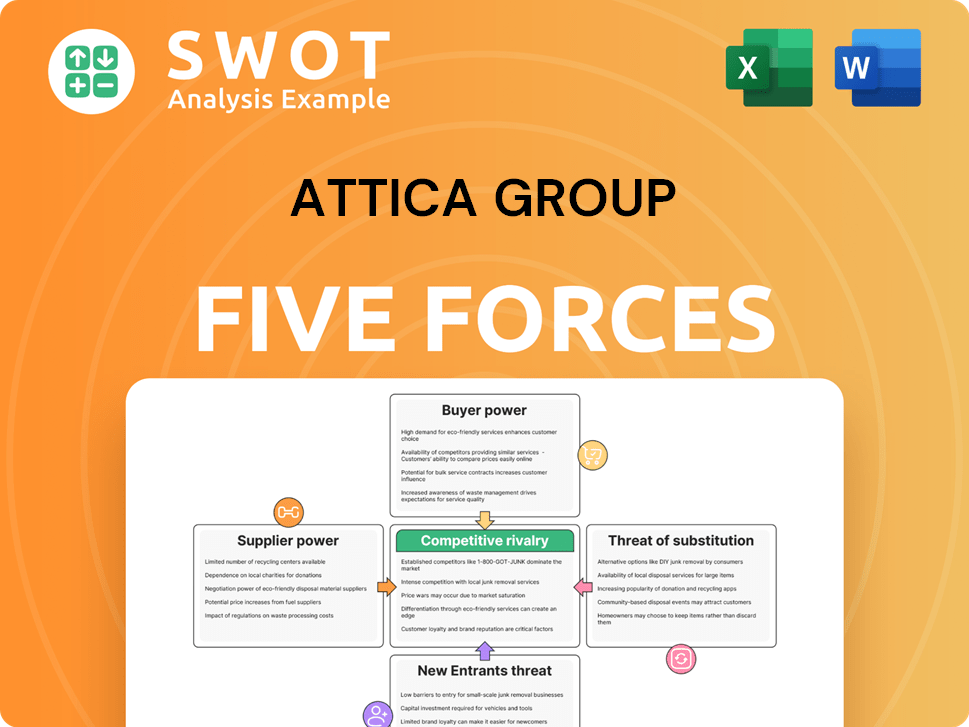

Attica Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Attica Group Company?

- What is Competitive Landscape of Attica Group Company?

- What is Growth Strategy and Future Prospects of Attica Group Company?

- How Does Attica Group Company Work?

- What is Sales and Marketing Strategy of Attica Group Company?

- What is Brief History of Attica Group Company?

- What is Customer Demographics and Target Market of Attica Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.