Attica Group Bundle

How Does Attica Group Dominate the Eastern Mediterranean Ferry Market?

Attica Group's recent financial results for 2024 reveal a thriving business, but what does this mean for its position in the competitive ferry industry? Founded in 1918, Attica Group has evolved into a major player, connecting mainland Greece with its islands and international destinations. This article explores the dynamic Attica Group SWOT Analysis, helping to understand its competitive landscape.

Attica Group's success, marked by impressive financial performance, necessitates a deep dive into its competitive environment. This Attica Group market analysis will identify key Attica Group competitors and dissect the strategies driving its sustained growth. Understanding the Attica Group competitive landscape is crucial for grasping its industry position, especially considering factors like Attica Group ferry routes and Attica Group financial performance, alongside Attica Group market share in Greece and its adaptation to challenges like the Attica Group impact of COVID-19.

Where Does Attica Group’ Stand in the Current Market?

Attica Group holds a leading market position within the Eastern Mediterranean passenger shipping industry. The company is a key player in the Greek domestic ferry market and also operates international routes, connecting Greece with Italy. Its core business revolves around providing conventional and high-speed ferry services for passengers and vehicles, meeting diverse travel needs.

The company's market presence is extensive, primarily serving Greek domestic routes, including the Cyclades, Dodecanese, North Aegean, and Crete. This strong geographic footprint allows it to cater to a broad customer base, including tourists, local residents, and commercial vehicle operators. Over time, Attica Group has strategically diversified its offerings, including moves towards more premium services on certain routes and significant investments in digital transformation to enhance customer experience and operational efficiency. For more insights, explore the Growth Strategy of Attica Group.

Attica Group's financial performance, as demonstrated by its strong 2024 results, positions it favorably compared to industry averages, showcasing its scale and resilience. While specific market share figures for 2024-2025 are still emerging, the company consistently ranks among the top operators in terms of passenger and vehicle traffic in Greece and the Aegean Sea. The company's success is also reflected in its ability to maintain a strong presence in key tourist destinations like the Cyclades and Dodecanese routes.

Attica Group consistently ranks among the top ferry operators in Greece and the Aegean Sea. Its strong presence in key routes, like the Cyclades and Dodecanese, highlights its market leadership. The company's competitive advantage is also supported by its diverse service offerings, including conventional and high-speed ferries.

The company's main focus is on Greek domestic routes, including the Cyclades, Dodecanese, North Aegean, and Crete. It also operates international routes connecting Greece with Italy. This strategic geographic presence allows it to capture a significant share of both domestic and international passenger traffic.

Attica Group serves a diverse customer base, including tourists, local residents, and commercial vehicle operators. It caters to various travel preferences by offering both conventional and high-speed ferry services. This diversified customer base supports its strong market position.

Attica Group's financial health is robust, as demonstrated by its strong 2024 financial results. This financial stability allows the company to invest in fleet upgrades, digital transformation, and premium services. The company's resilience is a key factor in maintaining its competitive edge.

Attica Group's competitive landscape includes both domestic and international rivals. The company faces intense competition on certain international routes, while maintaining a strong position in key domestic markets. Strategic investments in technology and premium services help it stay competitive.

- Market Share: Attica Group consistently ranks among the top operators in Greece.

- Route Focus: Strong presence in the Cyclades and Dodecanese.

- Financial Health: Strong 2024 financial results support its market position.

- Customer Base: Serves a diverse customer base, including tourists and locals.

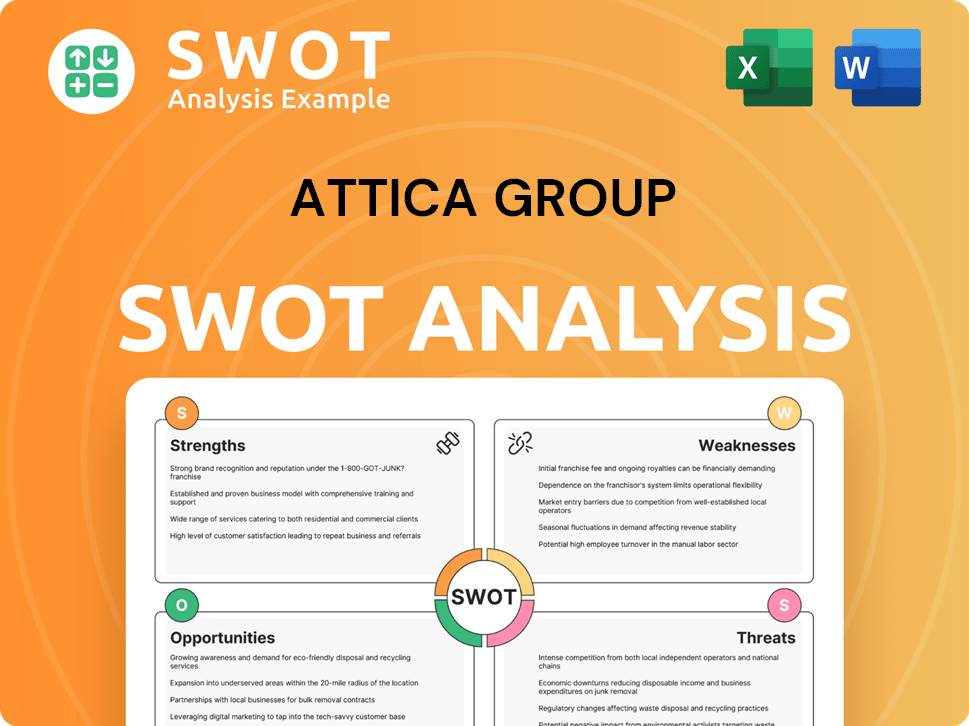

Attica Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Attica Group?

The Growth Strategy of Attica Group involves navigating a dynamic competitive landscape. Understanding the key players and their strategies is crucial for assessing its industry position and future growth prospects. This analysis is essential for stakeholders, including investors and business strategists, seeking to make informed decisions in the passenger shipping market.

Attica Group's financial performance is directly influenced by its ability to compete effectively. Analyzing its competitors and their strategies provides insights into the challenges and opportunities the company faces. This market analysis is vital for understanding the company's strengths, weaknesses, and potential for expansion.

Attica Group operates within a competitive environment, primarily in the Eastern Mediterranean passenger shipping market. The company's success hinges on its ability to differentiate itself and maintain a strong market share amidst intense rivalry. A detailed examination of its competitors is essential for a comprehensive understanding of its strategic position.

Minoan Lines, part of the Grimaldi Group, is a significant direct competitor. It challenges Attica Group on both domestic and international routes, particularly on the Greece-Italy routes. Competition often focuses on pricing and service quality.

ANEK Lines is another major direct competitor, especially on routes to Crete. Both companies have historically engaged in intense competition for market share in this area. The competitive dynamics between these two companies are a key factor in the market.

SeaJets, known for its high-speed vessels, provides competition, especially in the Cyclades. Its faster travel times appeal to tourists. This creates a need for Attica Group to innovate and improve its services to remain competitive.

Golden Star Ferries and Fast Ferries operate on various domestic routes. They often compete on frequency and pricing. These companies contribute to the overall competitive pressure within the Greek ferry market.

Indirect competition comes from the airline industry, especially for longer distances. Airlines are a major competitor for passengers prioritizing speed over cost. This forces Attica Group to consider its pricing and service offerings.

Smaller, regional ferry operators cater to niche local routes. These operators provide competition in specific geographic areas, influencing Attica Group's strategic decisions. Their presence adds to the complexity of the market.

The Greek ferry market has seen consolidation, with Attica Group acquiring a stake in ANEK Lines. This indicates a shifting competitive landscape, potentially leading to increased market concentration and reduced direct rivalry on certain routes. These changes impact the company's financial performance and strategic planning.

- Consolidation: Recent acquisitions and mergers are reshaping the industry.

- Competition: Intense rivalry exists on various routes.

- Pricing Strategies: Companies compete on both price and service quality.

- Market Share: The struggle for market share is a key driver of competition.

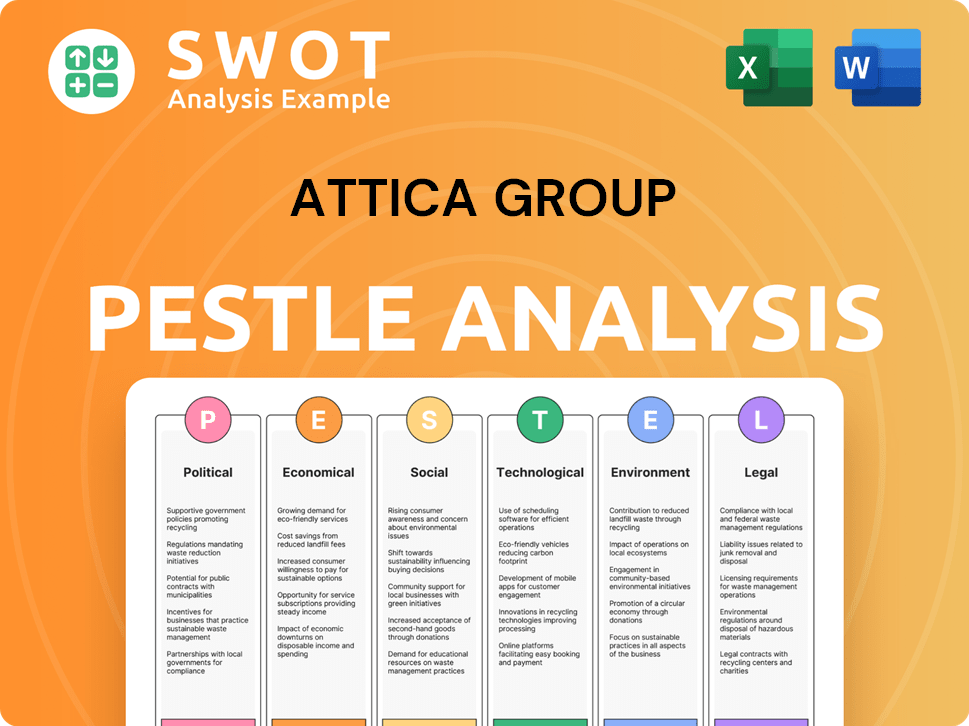

Attica Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Attica Group a Competitive Edge Over Its Rivals?

Understanding the competitive landscape of Attica Group involves analyzing its key strengths and how it positions itself against rivals. The company, a major player in the Eastern Mediterranean, benefits from a robust operational foundation and a well-established brand. This analysis is crucial for investors and stakeholders aiming to understand the firm's long-term viability and growth prospects, especially when considering factors like Brief History of Attica Group.

Attica Group's competitive advantages are multifaceted, encompassing its extensive fleet, strong brand recognition, and a comprehensive distribution network. These elements contribute to its ability to serve a wide range of routes and maintain customer loyalty. The company's continuous investment in technology and customer experience further enhances its market position, allowing it to adapt to evolving consumer preferences and industry trends.

Attica Group's strategic approach and operational capabilities are key to its success. The company's focus on fleet modernization, route optimization, and customer service has allowed it to maintain a competitive edge. This includes the development of digital booking systems and onboard amenities, which improve the overall customer experience. These factors are crucial in the context of Attica Group market analysis and its competitive standing.

Attica Group operates a fleet of over 30 vessels, including conventional ferries and high-speed crafts. This diverse fleet allows the company to serve a broad range of routes efficiently. The variety in vessel types also helps in catering to different passenger needs and preferences, enhancing its market reach.

The company's brands, such as Superfast Ferries, Blue Star Ferries, and Hellenic Seaways, are well-regarded in the Eastern Mediterranean. This strong brand recognition fosters significant customer loyalty. Brand strength allows the company to maintain a competitive edge in the market, ensuring repeat business.

Attica Group has an extensive distribution network, including online booking platforms, travel agencies, and port offices. This network ensures broad accessibility for its services. A wide distribution network is essential for capturing a significant share of the market.

The company consistently invests in technological advancements, such as digital booking systems and onboard amenities. These enhancements improve the customer experience and operational efficiency. Technology helps the company to stay competitive and meet the evolving needs of its customers.

Attica Group's competitive advantages are substantial, but it faces ongoing challenges. Competitors investing in fleet modernization pose a threat. Shifts in consumer preferences towards alternative transport options or budget-friendly choices also impact the company.

- Economies of Scale: The large fleet allows for cost efficiencies in fuel procurement, maintenance, and crew management.

- Strategic Marketing: The company leverages its brand strength in marketing campaigns and partnerships with tourism organizations.

- Operational Efficiency: Continuous investments in technology and fleet renewal enhance operational capabilities.

- Market Share: Attica Group maintains a significant market share in the Greek ferry market, supported by its strong brand and extensive network.

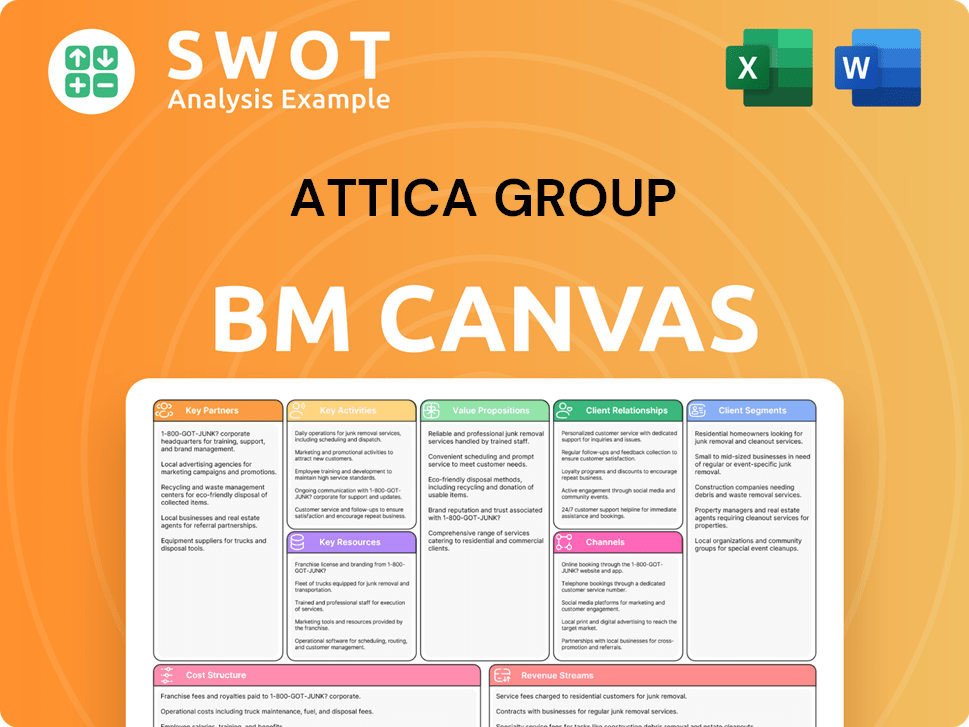

Attica Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Attica Group’s Competitive Landscape?

The Attica Group competitive landscape in the Eastern Mediterranean passenger shipping industry is shaped by ongoing shifts in environmental regulations, technological advancements, and evolving consumer preferences. This sector faces challenges from rising fuel costs and geopolitical instability, but also benefits from opportunities in route expansion and strategic partnerships. A thorough Attica Group market analysis reveals the need for continuous adaptation to maintain a strong Attica Group industry position.

Attica Group's future depends on its ability to navigate these complex dynamics effectively. The company must balance investments in sustainability and technology with efforts to manage operational costs and respond to market fluctuations. Understanding the competitive environment, including key Attica Group competitors, is crucial for making informed strategic decisions and achieving sustainable growth.

The passenger shipping industry is experiencing a strong push toward decarbonization, requiring significant investments in new vessels and greener fuels. Technological advancements in vessel design, digital connectivity, and smart port operations are offering opportunities for increased efficiency and enhanced customer experiences. Consumer demand is shifting towards more sustainable travel options and seamless digital interactions.

Rising fuel costs pose a constant threat to profitability, requiring careful cost management strategies. Geopolitical instability can significantly impact travel demand, especially in sensitive regions. Aggressive pricing strategies from competitors can put pressure on profit margins. Maintaining operational efficiency and adapting to changing regulations are also key challenges.

Expanding into new routes, particularly those with emerging tourism potential, presents a significant growth opportunity. Further developing cruise-ferry services can attract a broader customer base. Leveraging strategic partnerships with tour operators and other transport providers allows for integrated travel solutions. Investments in digitalization can improve customer service and operational efficiency.

Attica Group is focusing on fleet modernization programs to enhance energy efficiency and reduce emissions. Digitalization initiatives are being implemented to streamline operations and improve customer engagement. Exploring new market segments helps diversify revenue streams and reduce reliance on traditional routes. Strategic partnerships are key for expanding service offerings.

Attica Group is actively responding to industry trends by investing in eco-friendly practices and digital services. This includes fleet upgrades and online service enhancements to meet evolving customer expectations. The company is also exploring new revenue streams to mitigate risks.

- Fleet modernization focused on energy efficiency and alternative fuels.

- Digitalization of services to improve customer experience and streamline operations.

- Expansion into new routes and market segments, including cruise-ferry options.

- Strategic partnerships to offer integrated travel solutions and increase market reach.

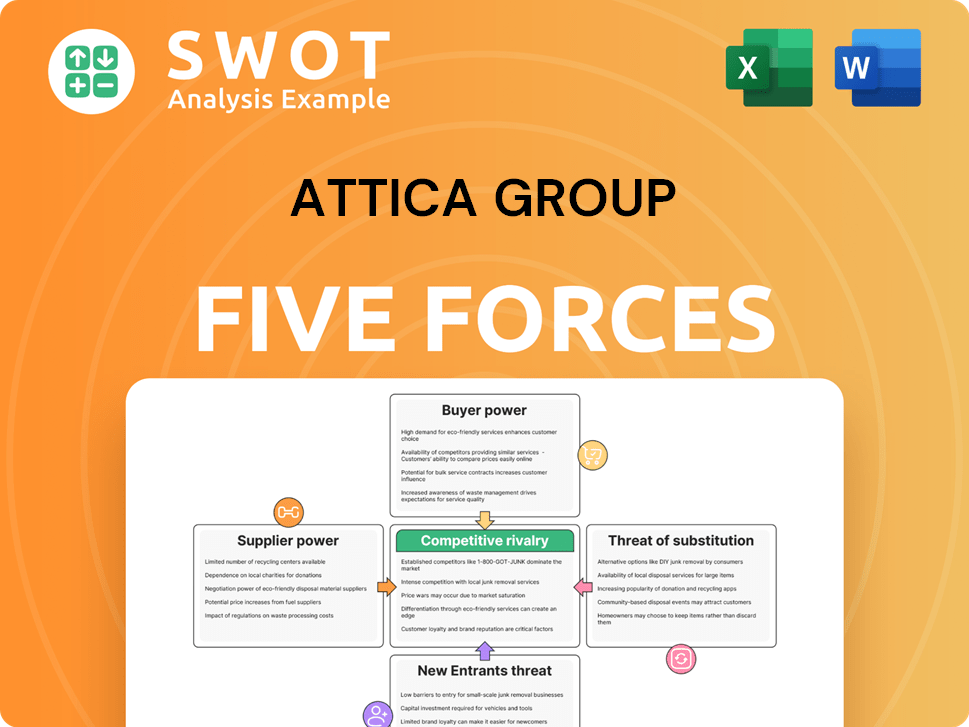

Attica Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Attica Group Company?

- What is Growth Strategy and Future Prospects of Attica Group Company?

- How Does Attica Group Company Work?

- What is Sales and Marketing Strategy of Attica Group Company?

- What is Brief History of Attica Group Company?

- Who Owns Attica Group Company?

- What is Customer Demographics and Target Market of Attica Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.