Bloomberg Bundle

How did a Wall Street exit birth a financial data empire?

In the early 1980s, a visionary named Michael Bloomberg saw an opportunity to transform the financial world. Leaving Salomon Brothers, he embarked on a mission to provide unparalleled access to Bloomberg SWOT Analysis and real-time market data. This bold move led to the creation of Bloomberg L.P., a company that would redefine how financial professionals operate.

The story of the Bloomberg company is a testament to innovation and a deep understanding of the needs of the financial industry. From its humble beginnings in New York City, Bloomberg quickly evolved, introducing the iconic Bloomberg Terminal and expanding its services to become a global leader in financial data and news. Understanding the Bloomberg history is crucial for anyone navigating today's complex financial landscape.

What is the Bloomberg Founding Story?

The story of the Bloomberg company began on October 1, 1981. It was founded by Michael Bloomberg, alongside Thomas Secunda, Duncan MacMillan, and Charles Zegar. This marked the start of what would become a major player in the financial world.

Michael Bloomberg's experience at Salomon Brothers shaped the company's initial direction. He identified the need for accessible, real-time financial data and analytical tools. This insight led to the creation of Innovative Market Systems (IMS), the precursor to Bloomberg L.P.

Leveraging a $10 million severance package, Bloomberg launched IMS. The goal was to develop a computerized system offering real-time market data and financial analysis. The company's early focus was on addressing a gap in the market for financial professionals.

The initial product, the 'Market Master terminal,' later known as the Bloomberg Terminal, was released in December 1982. This marked the first step in providing real-time financial information.

- In 1984, Merrill Lynch invested $30 million in IMS, becoming a crucial early client.

- Merrill Lynch's investment included purchasing 20 terminals and a 30% equity stake.

- The investment came with a five-year restriction on marketing the terminal to Merrill Lynch's competitors, which was lifted in 1984.

- The company was renamed Bloomberg L.P. in 1986.

Michael Bloomberg currently holds an 88% ownership stake in the company. This reflects his ongoing influence and vision for the future of Bloomberg.

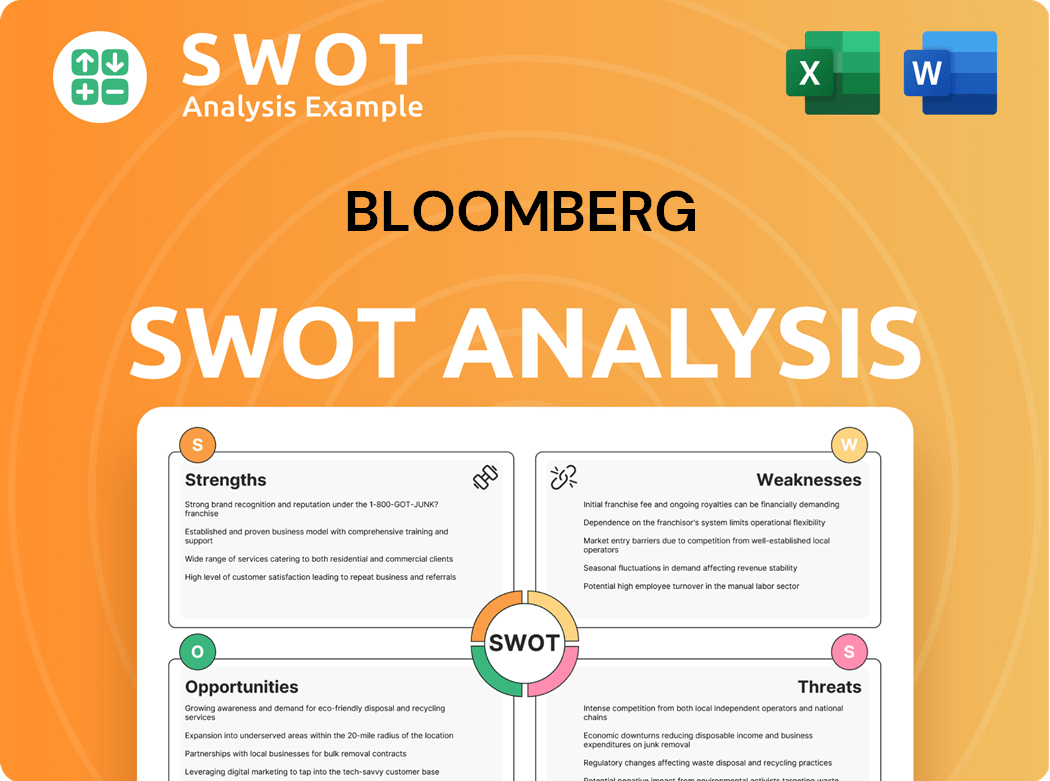

Bloomberg SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Bloomberg?

The early phase of the Bloomberg company, initially known as Innovative Market Systems (IMS), saw rapid growth in the financial market. This expansion was fueled by Merrill Lynch's substantial investment and the company's innovative approach to providing financial data. The company quickly established itself as a key player, evolving into Bloomberg L.P. and expanding its offerings.

In 1984, Merrill Lynch invested $30 million and purchased 20 terminals, a pivotal moment for the Bloomberg company. By 1986, the company had installed approximately 5,000 terminals. This early success laid the groundwork for future expansion and solidified its presence in the financial sector.

Bloomberg expanded beyond its core terminal with products such as Bloomberg Tradebook and the Bloomberg Messaging Service. The launch of Bloomberg Business News in 1990, with Matthew Winkler as editor-in-chief, marked a significant move into financial journalism. This diversification broadened its appeal and solidified its position in the market.

By 1991, Bloomberg had installed 10,000 terminals globally and established news bureaus in major financial centers. The company continued its geographical expansion, opening offices in London and Tokyo in 1987. The introduction of Bloomberg Television in 1994 further diversified its media presence.

Bloomberg's comprehensive approach to information and analytics positioned it as a strong competitor, outperforming rivals like Reuters and Dow Jones. The company's strategic decisions and innovative terminal significantly shaped its trajectory. For more details on how the company has evolved, check out the Marketing Strategy of Bloomberg.

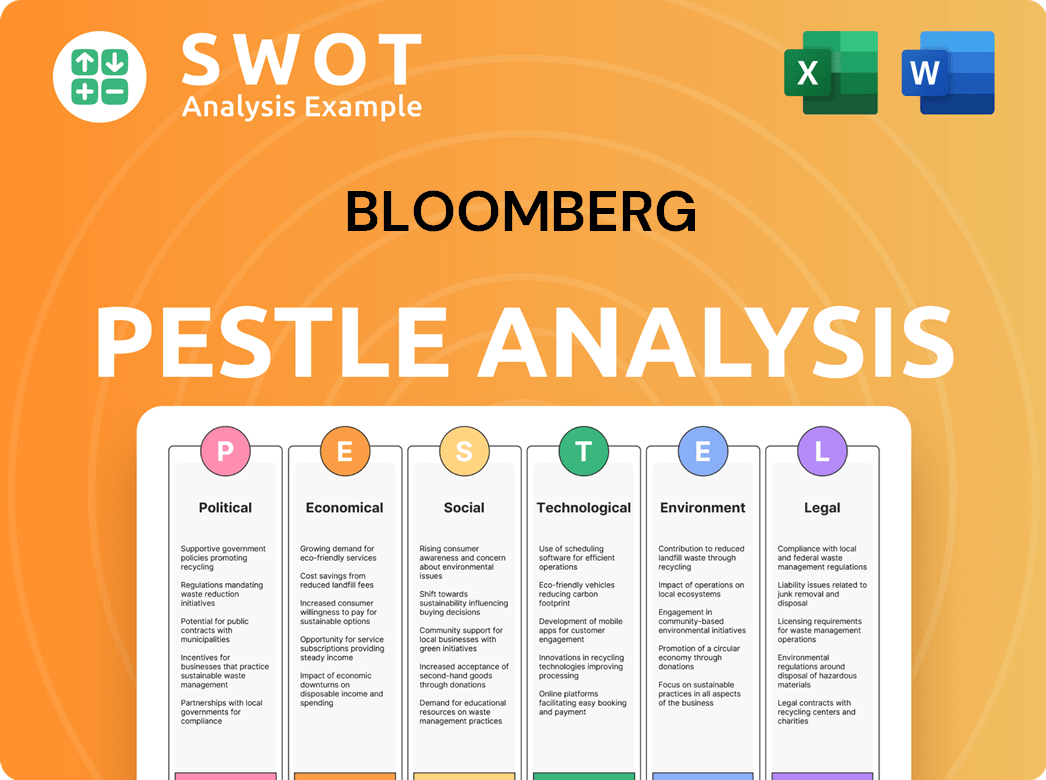

Bloomberg PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Bloomberg history?

The story of Bloomberg L.P. is marked by significant achievements and strategic shifts. From its inception, the company has consistently adapted to the changing financial landscape, establishing itself as a key player in the industry. This Bloomberg company timeline illustrates its growth and impact on the financial world.

| Year | Milestone |

|---|---|

| 1981 | Bloomberg was founded by Michael Bloomberg with the launch of the Bloomberg Terminal. |

| 1990 | Bloomberg Business News was launched, providing financial news directly to terminal subscribers. |

| 1994 | Bloomberg Television was launched, expanding its media presence in the financial world. |

| 2009 | Bloomberg acquired BusinessWeek magazine, further diversifying its media portfolio. |

| 2016 | Sales of the Bloomberg Terminal dropped for the second time, indicating challenges in the market. |

| 2025 | Bloomberg Law's reports on key legal industry trends for 2025 highlight its innovation in legal technology. |

Bloomberg has been a pioneer in providing real-time market data and financial analytics. The Bloomberg Terminal revolutionized Wall Street by offering an integrated system for data, calculations, and analytics. This innovative approach replaced manual processes, providing unprecedented access to data for traders and analysts.

The Bloomberg Terminal was a groundbreaking innovation, providing real-time market data and financial analysis. It replaced manual processes, offering unprecedented data access to traders and analysts, which transformed the financial industry.

Bloomberg expanded its offerings with the launch of Bloomberg Business News and Bloomberg Television. This strategic move established Bloomberg as a major media entity in the financial world, providing news directly to subscribers.

Further product diversification included Bloomberg Law and Bloomberg Government. This allowed the company to compete with existing services and provide updates on congressional and regulatory changes.

Bloomberg has been a trailblazer in the application of AI and machine learning in its legal technology offerings. This is evident in Bloomberg Law's reports on key legal industry trends for 2025.

The company has invested in industry-specific research products in areas like law, government, clean energy, and tax. This demonstrates Bloomberg's commitment to broader industry trends and its ability to adapt.

The BloombergNEF Pioneers award recognizes early-stage companies accelerating decarbonization and climate adaptation. This reflects a commitment to broader industry trends and sustainable innovation.

Despite its successes, Bloomberg has faced competitive pressures and market shifts. Competitors and the rise of social media and high-frequency trading have presented challenges. The company has also had to navigate scrutiny regarding market share and the evolving landscape of financial data.

Bloomberg has faced competition from other financial data providers, impacting its market share. The company lost market share in general spending on financial market data and analysis in 2017, even as the overall market grew to $28.5 billion.

Bloomberg has faced scrutiny regarding its market share and the evolving landscape of financial data. This has led to strategic pivots and investments in new areas to maintain its dominance.

The shift of live breaking news to social media platforms has diminished the advantage of human traders relying on the terminal for instantaneous news. This has forced Bloomberg to adapt its news delivery methods.

The rise of high-frequency trading has diminished the advantage of human traders relying on the terminal for instantaneous news. This has changed the way financial information is consumed and acted upon.

In 2016, sales of the Bloomberg Terminal dropped for the second time, indicating challenges in the market. This decline prompted the company to explore new strategies and product offerings.

The rapid evolution of the financial and technological landscape has posed challenges for Bloomberg. The company has responded by expanding its product ecosystem beyond the core terminal.

To learn more about the company's values and mission, read Mission, Vision & Core Values of Bloomberg.

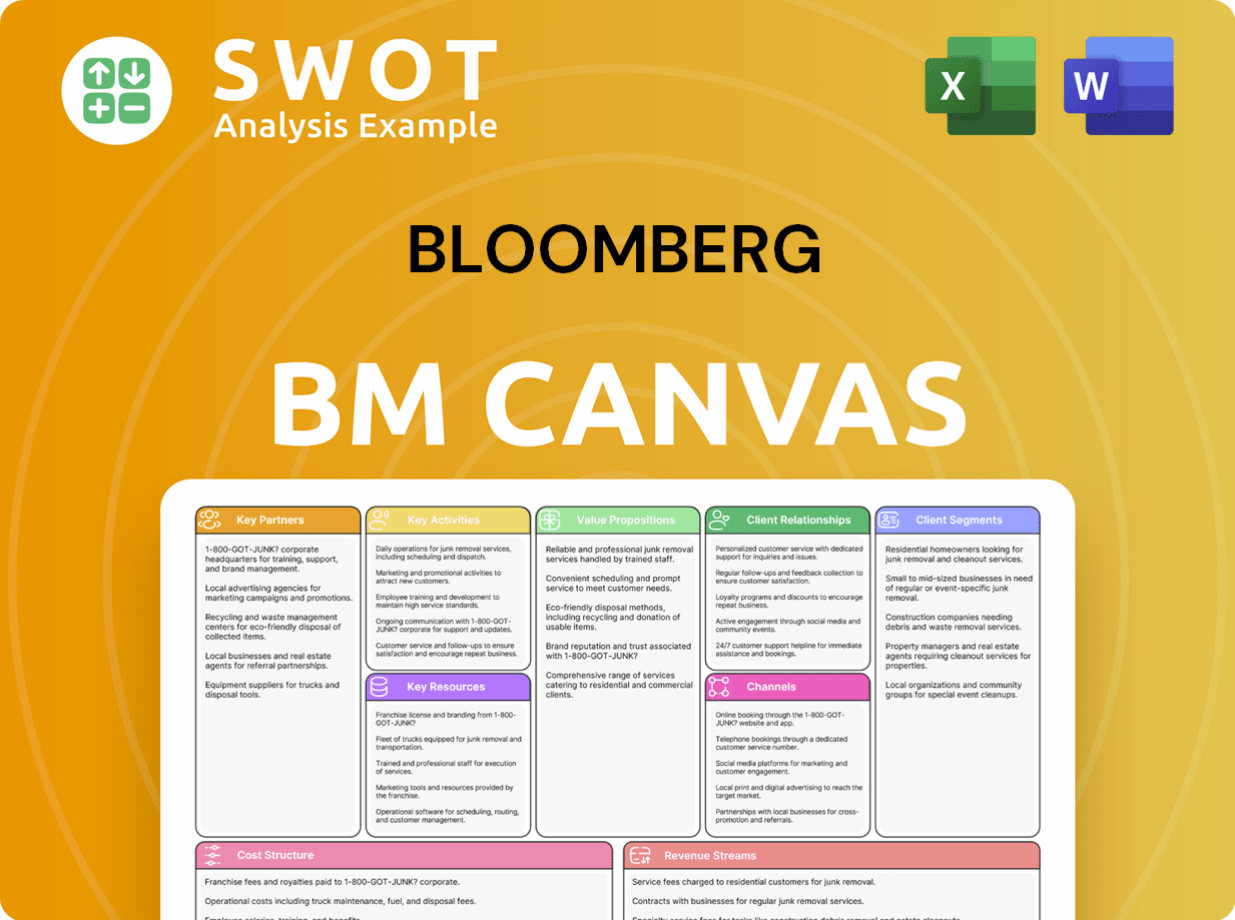

Bloomberg Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Bloomberg?

The journey of the Bloomberg company, from its inception to its current status as a financial data powerhouse, is marked by strategic innovations and expansions. Founded in 1981 by Michael Bloomberg, the company initially focused on providing real-time financial data to Wall Street. Over the years, it has evolved, integrating news, television, and various data services, significantly impacting the financial industry. This evolution reflects Bloomberg’s commitment to adapting and expanding its offerings to meet the changing needs of the global financial market. Read more about the Target Market of Bloomberg.

| Year | Key Event |

|---|---|

| 1981 | Michael Bloomberg founds Innovative Market Systems (IMS) in New York City. |

| 1982 | The 'Market Master terminal,' later known as the Bloomberg Terminal, is released. |

| 1984 | Merrill Lynch invests $30 million in IMS, becoming its first major client. |

| 1986 | The company is renamed Bloomberg L.P. |

| 1987 | Bloomberg expands internationally, opening offices in London and Tokyo. |

| 1990 | Bloomberg Business News (now Bloomberg News) is launched. |

| 1991 | 10,000 Bloomberg Terminals are installed worldwide. |

| 1993 | Bloomberg.com is established as a financial portal. |

| 1994 | Bloomberg Television, a 24-hour cable news network, is launched. |

| 1996 | Bloomberg L.P. buys back one-third of Merrill Lynch's stake for $200 million. |

| 2001 | Michael Bloomberg steps down as CEO to run for Mayor of New York City. |

| 2008 | Bloomberg Inc. buys Merrill Lynch's remaining stake for $4.43 billion. |

| 2009 | Bloomberg acquires BusinessWeek magazine, renaming it Bloomberg BusinessWeek. |

| 2015 | Michael Bloomberg returns as CEO. |

| 2024 | Bloomberg's estimated annual revenue reaches $13.3 billion. |

Bloomberg is integrating AI and machine learning across its products. This is particularly evident in Bloomberg Law, which is focusing on AI's impact on the legal industry in 2025. The company is investing in specialized research products and data solutions to enhance its offerings. These advancements are designed to improve efficiency and provide more insightful analysis.

The company is expanding its data solutions, with new investment research data products expected in 2025. This includes Geographic Segment Fundamentals Data and Pharma Products & Brands Data. This expansion is part of Bloomberg’s strategy to offer more comprehensive and specialized financial data to its clients.

Bloomberg is focused on adapting to evolving industry trends and leveraging its robust data and media platforms. The company is also keenly aware of the surging power demand from AI and data centers, and the ongoing energy transition, as highlighted by BloombergNEF's 2025 New Energy Outlook. The company is actively involved in discussions around these topics through events like Bloomberg New Economy 2025.

Bloomberg aims to maintain its position as a leading provider of financial information and analysis. The company is committed to quality journalism and data-driven insights. Bloomberg continually evolves to meet the complex demands of a dynamic global market, staying true to its founding vision of delivering transparency and on-demand information.

Bloomberg Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Bloomberg Company?

- What is Growth Strategy and Future Prospects of Bloomberg Company?

- How Does Bloomberg Company Work?

- What is Sales and Marketing Strategy of Bloomberg Company?

- What is Brief History of Bloomberg Company?

- Who Owns Bloomberg Company?

- What is Customer Demographics and Target Market of Bloomberg Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.