Bloomberg Bundle

Decoding the Empire: How Does the Bloomberg Company Thrive?

In the complex world of finance, Bloomberg SWOT Analysis reveals the inner workings of a financial powerhouse, but how does the Bloomberg company truly operate? This global leader, known for its indispensable Bloomberg Terminal, provides real-time financial data, news, and advanced analytics to professionals worldwide. From investors to analysts, understanding Bloomberg's structure and operations is key to navigating today's markets.

With a market presence built on the Bloomberg Terminal, the company has become synonymous with financial information. Exploring the Bloomberg business model, its extensive media operations like Bloomberg News, and its vast data offerings provides a comprehensive view of its influence. Whether you're curious about Bloomberg data analysis tools or Bloomberg terminal cost, this analysis will provide valuable insights.

What Are the Key Operations Driving Bloomberg’s Success?

The core of the Bloomberg business revolves around providing financial professionals with real-time data, news, and analytical tools, primarily through its flagship product, the Bloomberg Terminal. This platform caters to a wide range of users, including institutional investors, portfolio managers, and financial analysts. The value proposition of the Bloomberg company lies in offering a comprehensive, integrated solution for accessing and analyzing global financial information, which enables swift and informed decision-making.

Bloomberg's operational processes are extensive and technologically advanced. The company continually invests in research and development, with a budget reaching $2.4 billion in 2024, to maintain its competitive edge. This investment supports the development of new products and the refinement of data analysis tools, ensuring the platform remains at the forefront of market needs.

The company's operational effectiveness stems from its ability to provide an unparalleled breadth and depth of real-time data, particularly in fixed-income markets, combined with a robust communication network for traders. These core capabilities translate into significant customer benefits, such as enhanced decision-making, operational efficiency, and risk management, contributing to a sustained competitive advantage in the fast-paced financial world. For more insights into the company's growth, consider exploring the Growth Strategy of Bloomberg.

Bloomberg sources and aggregates data from a vast array of global financial markets, news wires, and proprietary sources. This comprehensive data collection is crucial for providing real-time market data and financial news to its users. The company's ability to gather and process this data efficiently is a key differentiator.

Bloomberg continuously develops and refines its technology, integrating AI and machine learning to enhance data analysis and personalize insights for users. This commitment to innovation ensures the platform remains relevant and effective in a rapidly evolving financial landscape. The company's investment in R&D is a testament to its focus on staying ahead.

The distribution network for the Bloomberg Terminal is primarily digital, centered around the secure and reliable delivery of the software and its associated data services. This digital infrastructure ensures that users worldwide can access the platform's features and data in real-time. The reliability of this distribution is critical to its value proposition.

The core capabilities of Bloomberg translate into significant customer benefits, including enhanced decision-making, operational efficiency, and risk management. Users gain a sustained competitive advantage in the fast-paced financial world. These benefits are central to the value that the Bloomberg company provides to its clients.

The Bloomberg Terminal offers a wide array of features designed to meet the diverse needs of financial professionals. These features include real-time market data, news, analytics, and communication tools, all integrated into a single platform. The terminal is a crucial tool for anyone needing access to Bloomberg data.

- Real-time Market Data: Provides up-to-the-minute information on stocks, bonds, currencies, and commodities.

- News and Analysis: Offers access to Bloomberg News and other financial news sources, along with in-depth analysis.

- Analytical Tools: Includes a suite of tools for financial modeling, risk management, and portfolio analysis.

- Communication Network: Enables users to communicate and share information securely with other professionals.

Bloomberg SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Bloomberg Make Money?

The core of the Bloomberg business model revolves around its subscription-based services, primarily the Bloomberg Terminal. This platform is the cornerstone of the company's revenue generation, offering real-time financial data, news, and analytical tools to a global clientele.

Bloomberg's monetization strategy extends beyond the Terminal, encompassing various other services and media assets. These include financial news publications, data licenses, and advertising revenue from its media outlets. The company's focus is on providing high-value, premium services to professionals in the financial industry.

The company's revenue streams are diversified across multiple channels, but the Bloomberg Terminal remains the most significant contributor. Bloomberg's ability to maintain a strong market position is linked to its continuous investment in technology and data accuracy.

The primary revenue stream for the Bloomberg company is the Bloomberg Terminal, a comprehensive platform for financial data and analytics. As of 2025, the annual subscription fee for a single terminal is just under $32,000, with a price of $28,320 for multiple units. This pricing reflects a 6.5% increase for 2025.

- Bloomberg Terminal: The primary source of revenue, offering real-time data, news, and analytics.

- Bloomberg News: Subscription-based financial news services.

- Advertising: Revenue from the company's global television network, radio stations, and magazines like Bloomberg Businessweek and Bloomberg Markets.

- Data Licenses and Services: Including the Bloomberg Market Data Feed (B-PIPE), also subject to the 6.5% price increase in 2025.

Bloomberg PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Bloomberg’s Business Model?

The evolution of the Bloomberg company has been marked by significant milestones and strategic moves that have shaped its operations and financial performance. The company's inception in 1981, with the release of the Bloomberg Terminal in December 1982, was a pivotal moment, establishing it as a vital tool for financial professionals. Since then, the company has continuously evolved, investing heavily in research and development to maintain its technological leadership and introduce new products.

Bloomberg has strategically expanded its offerings beyond the core Terminal, venturing into media with Bloomberg News, Television, and Radio, further diversifying its information delivery. The company has also actively engaged in strategic partnerships, such as its collaboration with the Financial Services and the Treasury Bureau (FSTB) in Hong Kong, announced in October 2024, to enhance the region's family office ecosystem. Furthermore, Bloomberg Philanthropies, founded by Michael Bloomberg, has undertaken significant initiatives, including a partnership with the COP30 Presidency in April 2025 to accelerate global climate progress.

Operational challenges include the increasing reliance on data-driven investment strategies, which has brought challenges related to data coverage, timeliness, and quality. Bloomberg has responded by emphasizing its commitment to building out its multi-asset Investment Research Data product suite, targeted at quantitative and quantamental research, systematic strategies, and AI workflows. The company's competitive advantages are deeply rooted in its vast fixed-income database, its robust communication network for traders, and the ability to access its platform remotely through Bloomberg Anywhere. Its strong brand recognition and global network also enhance its competitive position.

The launch of the Bloomberg Terminal in December 1982 was a foundational moment. The company has consistently invested in research and development, with a budget reaching $2.4 billion in 2024. This commitment to innovation is demonstrated by the launch of 12 new products in 2024.

Expansion into media with Bloomberg News, Television, and Radio has diversified its offerings. Strategic partnerships, such as the collaboration with the Financial Services and the Treasury Bureau (FSTB) in Hong Kong, enhance its global presence. Bloomberg Philanthropies continues to undertake significant initiatives, including a partnership with the COP30 Presidency in April 2025.

Its vast fixed-income database and robust communication network for traders provide a strong competitive advantage. Bloomberg Anywhere allows remote access to its platform. The company is adapting to new trends by leveraging AI and machine learning.

Bloomberg continues to enhance its data analysis tools. The company is focused on offering cost-effective software solutions. The company's strong brand recognition and global network also enhance its competitive position. Read more about the Marketing Strategy of Bloomberg.

The increasing reliance on data-driven investment strategies has brought challenges related to data coverage, timeliness, and quality. Bloomberg is addressing these challenges by building out its multi-asset Investment Research Data product suite.

- Emphasis on building out its multi-asset Investment Research Data product suite.

- Targeted at quantitative and quantamental research.

- Focus on systematic strategies and AI workflows.

- Commitment to building out its multi-asset Investment Research Data product suite.

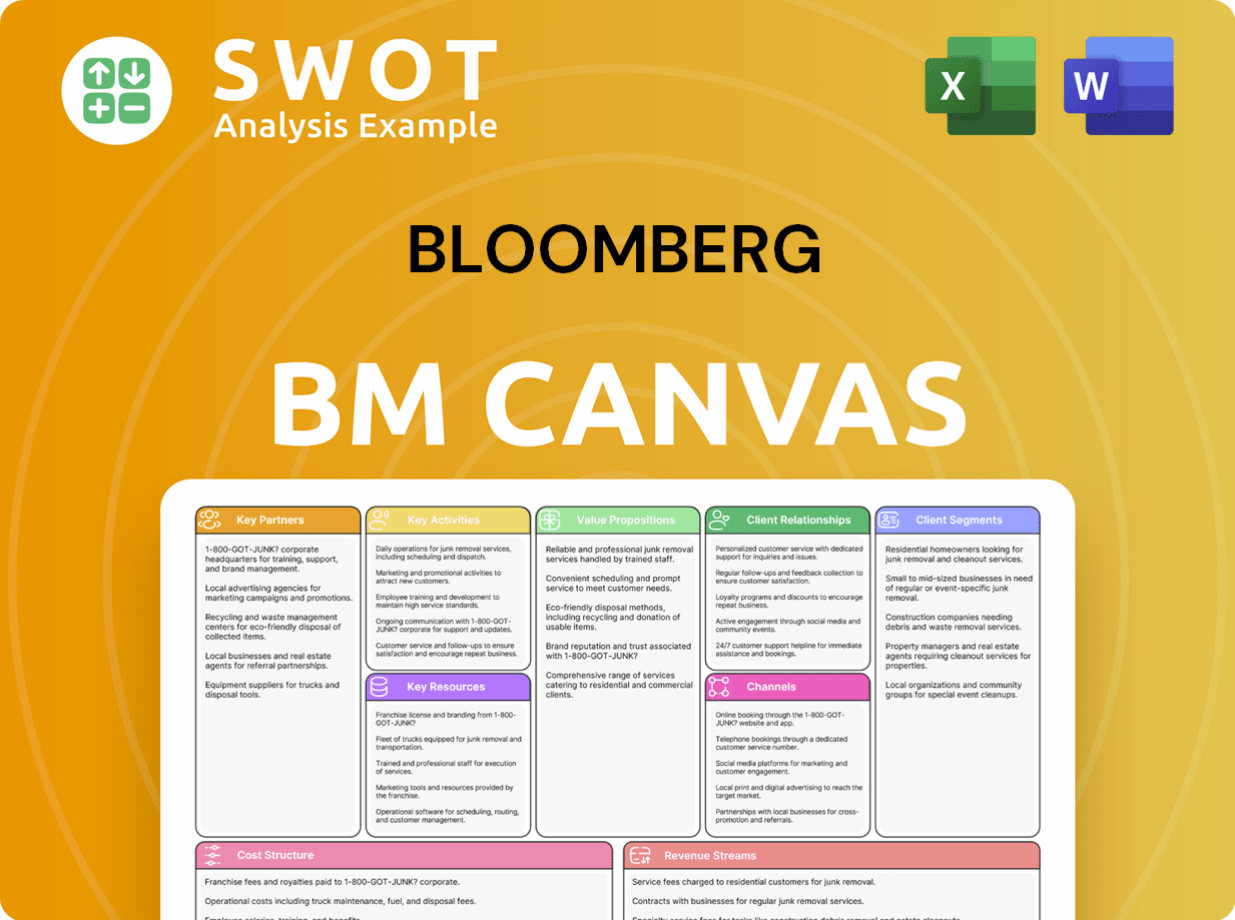

Bloomberg Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Bloomberg Positioning Itself for Continued Success?

The Bloomberg company holds a prominent position within the financial data and analytics sector. As of May 2025, the Bloomberg Terminal maintains a substantial market share, demonstrating its influence in the industry. Its robust brand recognition and global reach contribute significantly to customer loyalty, solidifying its position as a leading information provider.

Despite its strong market presence, the Bloomberg business faces various risks. Economic downturns and increased competition are potential challenges. Additionally, the company's profitability depends on its global services, which can be impacted by various operational risks. The future outlook involves strategic initiatives to sustain revenue generation and capitalize on market opportunities.

The Bloomberg Terminal leads the Financial Data Analysis Platforms category with a 35.4% market share as of May 2025, up from 32.4% the previous year. This places it ahead of competitors like Refinitiv Eikon (28.4% mindshare) and FactSet (20.3% mindshare) as of May 2025. The company's brand recognition and global reach are key strengths.

Economic crises and competition from new entrants pose risks to Bloomberg's operations. Profitability depends on global services, which can be affected by cultural and communication issues. Data challenges, such as ensuring data quality, and geopolitical uncertainties also present potential threats.

Bloomberg is increasing its AI integration, with a 35% increase in 2024 across its platforms, recognizing the projected $30.2 billion AI in financial services market by 2025. The company is also expanding its ESG data offerings, anticipating the ESG market to reach $36.4 billion by 2029. Strategic initiatives include expanding services to support M&A activity, which reached $2.9 trillion globally in 2024.

Bloomberg aims to achieve net-zero carbon emissions by 2025. The company is focused on leveraging AI, expanding ESG data, and supporting increased M&A activities. These efforts aim to navigate future challenges and maintain a profitable trajectory. Learn more about the Target Market of Bloomberg to understand its customer base.

Bloomberg Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Bloomberg Company?

- What is Competitive Landscape of Bloomberg Company?

- What is Growth Strategy and Future Prospects of Bloomberg Company?

- What is Sales and Marketing Strategy of Bloomberg Company?

- What is Brief History of Bloomberg Company?

- Who Owns Bloomberg Company?

- What is Customer Demographics and Target Market of Bloomberg Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.