Bloomberg Bundle

How Does Bloomberg Dominate the Financial Data Arena?

Bloomberg L.P., a titan in the financial world, isn't just a data provider; it's a critical infrastructure for global markets. Founded in 1981, Bloomberg revolutionized financial information access, transforming how professionals make decisions. But in a sector teeming with rivals, how does Bloomberg maintain its dominance and what are its key differentiators?

This exploration delves into the Bloomberg SWOT Analysis, examining its position within the Bloomberg competitive landscape, and identifying its major competitors. Understanding Bloomberg's market share and how it competes with other financial data providers is crucial for anyone navigating the complexities of business intelligence and financial news. We'll dissect Bloomberg's key strengths and weaknesses, providing insights into its competitive strategy and its future in the financial industry.

Where Does Bloomberg’ Stand in the Current Market?

Bloomberg L.P. holds a significant position in the financial data and analytics sector. Its core operations revolve around providing real-time financial data, news, and analytical tools primarily through its flagship product, the Bloomberg Terminal. This comprehensive platform serves as a critical resource for financial professionals globally.

The value proposition of Bloomberg centers on delivering high-quality, instantaneous information and advanced analytical capabilities. This enables its clients to make informed decisions in fast-paced financial markets. The company's offerings extend beyond the Terminal to include financial news, professional services, and media content, creating a holistic ecosystem for financial professionals.

While precise market share figures for 2024-2025 are not publicly available, Bloomberg maintains a leading position in the financial data terminal market. The company's dominance is evident through its extensive client base and significant revenue generation. Bloomberg's market share is a key indicator of its competitive strength within the financial data providers landscape.

Bloomberg's primary product lines include the Bloomberg Terminal, Bloomberg News, Bloomberg Professional Services, and Bloomberg Media. The Bloomberg Terminal is the core offering, providing real-time data, analytics, and trading capabilities. Bloomberg News delivers financial news and insights, complementing the Terminal's data offerings. Bloomberg Professional Services offers expert consulting and support, enhancing client value.

Bloomberg has a robust global presence, serving a diverse customer base across North America, Europe, Asia, and other key financial hubs. This extensive geographic reach allows Bloomberg to cater to the needs of financial institutions, corporations, government agencies, and individual investors worldwide. Its global footprint supports its position in the financial data market.

Bloomberg's positioning is consistently at the premium end of the market, emphasizing high-quality, real-time data, and advanced analytical tools. This strategic focus caters to a sophisticated clientele willing to pay for superior information and functionality. The company's focus on premium services supports its strong financial health.

Bloomberg's financial health is characterized by strong revenues and profitability, although specific recent figures are not publicly available due to its private ownership. This financial strength enables significant investments in technology and content, further solidifying its market leadership. Bloomberg's competitive strategy is focused on maintaining its premium position and providing comprehensive financial solutions.

- Bloomberg's strong financial performance supports its ability to invest in new technologies and expand its offerings.

- The company's focus on innovation helps it maintain a competitive edge in the financial data industry.

- Bloomberg's premium pricing strategy reflects the value it provides to its clients.

- Its global presence and diverse product lines contribute to its overall market strength. For more insights, explore the Target Market of Bloomberg.

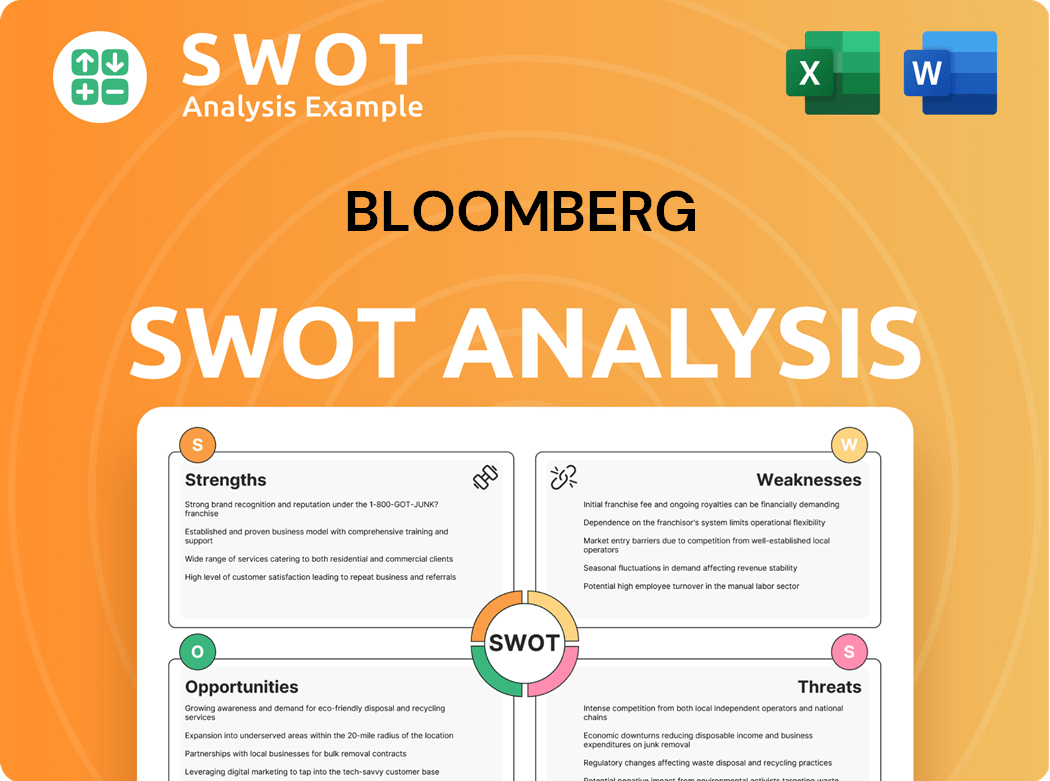

Bloomberg SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Bloomberg?

The competitive landscape for Bloomberg is multifaceted, encompassing both direct and indirect rivals. This environment is characterized by constant evolution, driven by technological advancements, strategic mergers, and shifting customer demands. Understanding these competitive dynamics is crucial for assessing Bloomberg's market position and future prospects.

Bloomberg's primary business segments, including financial data, analytics, and news, face challenges from various competitors. These rivals employ strategies such as competitive pricing, specialized tools, and strong client relationships to gain market share. The market is dynamic, with new entrants and evolving technologies continually changing traditional competitive dynamics.

The financial data and analytics sector is highly competitive, with several key players vying for market share. The competition is not only about providing data but also about offering sophisticated analytical tools, real-time news, and trading solutions. This competitive environment necessitates continuous innovation and adaptation to maintain a leading position. For a deeper understanding of the company's approach, you can explore the Marketing Strategy of Bloomberg.

Direct competitors offer similar products and services, competing head-to-head with Bloomberg. They focus on providing financial data, analytics, and news to the same customer base.

Refinitiv, now part of the London Stock Exchange Group (LSEG), is a major direct competitor. It offers the Eikon platform, which provides a wide array of financial data, analytics, and trading solutions.

FactSet specializes in providing integrated financial data and analytical applications. It is a key competitor, focusing on investment professionals and offering specialized analytical tools.

S&P Global Market Intelligence is another significant direct competitor. It is known for its extensive data, research, and analytics services, challenging Bloomberg's market share.

Indirect competitors offer alternative solutions or services that fulfill similar needs. These competitors may not directly offer the same products but still impact Bloomberg's market position.

News organizations, such as Reuters, provide real-time financial news. This content competes with Bloomberg News, attracting users seeking up-to-the-minute market information.

The competitive landscape of Bloomberg is shaped by various strategies and market dynamics. These include pricing strategies, technological advancements, and strategic partnerships.

- Pricing and Bundling: Competitors often use competitive pricing and bundled services to attract customers. This includes offering various packages tailored to different client needs.

- Technological Innovation: The rise of cloud-based data solutions and AI-driven analytics presents a challenge. These technologies provide more agile and cost-effective alternatives.

- Market Consolidation: Mergers and acquisitions, such as LSEG's acquisition of Refinitiv, create more formidable competitors. These consolidated entities can leverage broader resources and market reach.

- Customer Relationships: Strong relationships with specific customer segments are crucial. Understanding and catering to the unique needs of different client groups is a key competitive advantage.

- Market Share: While specific market share shifts for 2024-2025 are not publicly detailed, the competitive landscape remains dynamic. New entrants and evolving technologies continually disrupt traditional competitive dynamics.

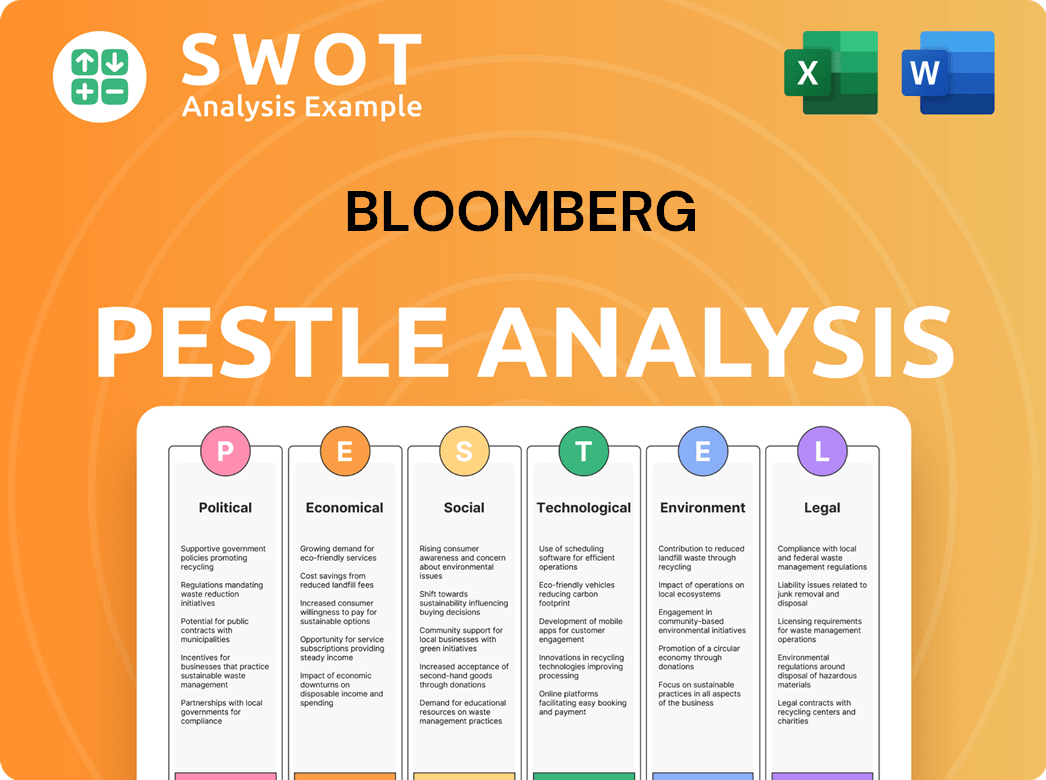

Bloomberg PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Bloomberg a Competitive Edge Over Its Rivals?

The competitive landscape for financial data providers is intense, with several key players vying for market share. Understanding the competitive advantages of each provider is crucial for making informed decisions. The company has established itself as a dominant force, but faces constant pressure from competitors and evolving market dynamics. A deep dive into its strengths, weaknesses, and strategies is essential for assessing its long-term viability.

The company's success is built on a foundation of proprietary technology, extensive data coverage, and a strong brand reputation. Its flagship product, the Bloomberg Terminal, is a critical tool for financial professionals worldwide. However, the market is dynamic, and the company must continuously innovate and adapt to maintain its competitive edge. The company's ability to navigate these challenges will determine its future success in the financial data market.

The company's competitive advantages are multifaceted, encompassing technological, brand, and operational strengths. These advantages have allowed it to maintain a leading position in the financial data industry. The company's strategic moves and continuous innovation are key to its ongoing success. Its ability to adapt to market changes and maintain a strong customer base is crucial for its long-term growth.

The Bloomberg Terminal offers an unmatched breadth and depth of real-time financial data, news, and analytical tools. This integrated platform provides a significant barrier to entry for competitors. Its continuous updates and vast data aggregation capabilities set it apart, making it an indispensable tool for financial professionals. The terminal's advanced features and functionalities ensure it remains a critical resource.

The company benefits from strong brand equity and a highly loyal customer base cultivated over decades. Consistent performance and exceptional service have solidified its reputation. This strong brand recognition translates into a competitive advantage, fostering trust and long-term relationships with clients. The company's commitment to quality enhances its market position.

Economies of scale allow the company to invest heavily in its global data collection infrastructure and advanced analytics. A vast network of journalists ensures timely and accurate information delivery worldwide. This extensive infrastructure supports its ability to provide comprehensive financial data and news. The company's global reach enhances its competitive position.

The company's unique culture, emphasizing innovation and client focus, attracts and retains top talent. This culture fosters a dynamic environment where employees are encouraged to excel. This focus on innovation and client needs contributes to its ability to maintain a competitive edge. The company's commitment to its employees strengthens its market position.

The company's competitive advantages are rooted in its proprietary technology, strong brand, and global infrastructure. These factors enable it to maintain a leading position in the financial data market. The company's ability to adapt to market changes and maintain a strong customer base is crucial for its long-term growth.

- Bloomberg Terminal: The core product offers unparalleled data and analytical tools, creating a significant barrier to entry.

- Brand Reputation: Decades of consistent performance and exceptional service have built a loyal customer base.

- Global Infrastructure: Extensive data collection and a vast journalist network ensure timely and accurate information delivery.

- Company Culture: Emphasis on innovation and client focus attracts and retains top talent.

The company's competitive advantages are substantial, but it faces threats from open-source data initiatives and evolving industry shifts. The financial data market is highly competitive, with rivals like Refinitiv, FactSet, and S&P Global vying for market share. The company's ability to innovate and adapt will be crucial for its future success. For more details, you can check out the Revenue Streams & Business Model of Bloomberg to understand its financial structure.

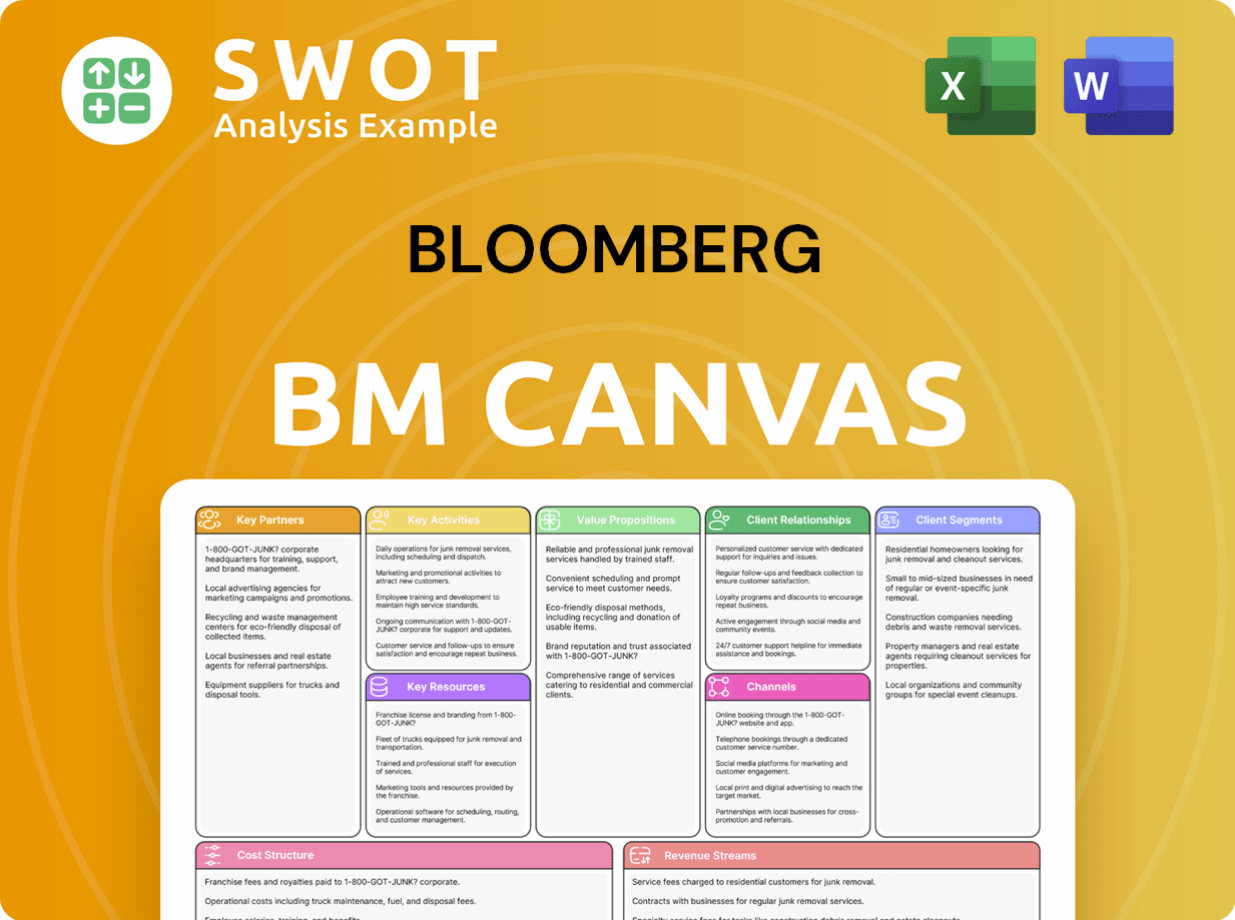

Bloomberg Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Bloomberg’s Competitive Landscape?

The financial data and analytics sector is undergoing significant transformation, driven by technological advancements and evolving market demands. This includes the integration of artificial intelligence (AI) and machine learning (ML), the growing importance of environmental, social, and governance (ESG) data, and the shift towards cloud-based solutions. These trends shape the Owners & Shareholders of Bloomberg, influencing its competitive landscape, risks, and future outlook.

Bloomberg faces both opportunities and challenges. The adoption of AI and ML offers avenues to enhance its analytical capabilities, while the rising demand for ESG data creates new market segments. However, it also contends with the rise of specialized data providers, regulatory scrutiny, and potential economic downturns. Bloomberg's strategic responses to these dynamics will determine its future success in the financial data market.

The financial data industry is seeing increased adoption of AI and machine learning for predictive analytics. There's a growing demand for ESG data, driven by investor interest in sustainable investments. Cloud-based solutions are becoming more prevalent, offering scalability and flexibility to financial institutions.

Increased competition from lower-cost, specialized data providers is a threat to established players. Regulatory scrutiny on data privacy and usage is intensifying globally. A potential global economic downturn could impact financial industry spending, affecting revenue streams.

Emerging markets offer growth potential as demand for sophisticated financial data rises. Product innovations, such as cryptocurrency analytics, can cater to new market segments. Strategic partnerships with fintech companies can expand reach and capabilities.

Bloomberg is likely to continue aggressive investment in technology, particularly AI and cloud infrastructure. The company will expand content offerings to meet evolving client needs. Exploration of new market verticals, such as private market data, will also be crucial.

The Bloomberg competitive landscape is significantly impacted by these trends. The firm needs to adapt to the changing market dynamics to maintain its Bloomberg market share. Key strategies include technological advancements and market diversification.

- Investment in AI and ML to enhance analytical tools.

- Expansion into ESG data and analytics services.

- Strategic partnerships to broaden market reach.

- Continuous innovation in Bloomberg terminal features and functionalities.

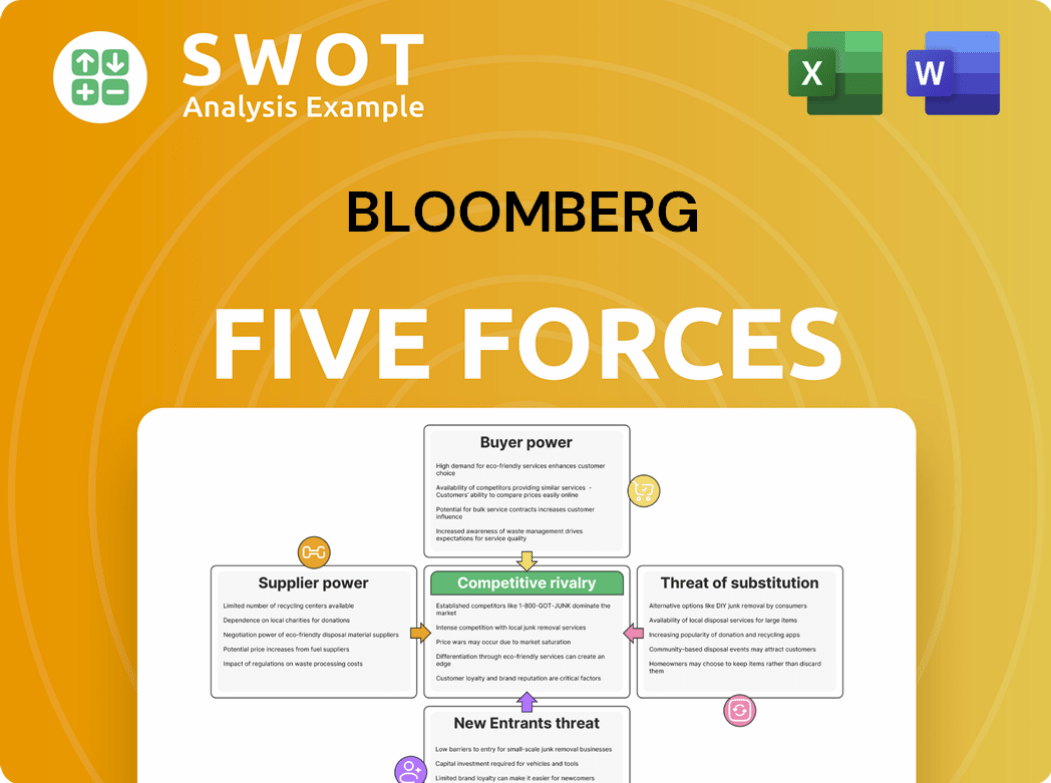

Bloomberg Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Bloomberg Company?

- What is Growth Strategy and Future Prospects of Bloomberg Company?

- How Does Bloomberg Company Work?

- What is Sales and Marketing Strategy of Bloomberg Company?

- What is Brief History of Bloomberg Company?

- Who Owns Bloomberg Company?

- What is Customer Demographics and Target Market of Bloomberg Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.