Bloomberg Bundle

Who Does Bloomberg Serve?

Delving into the Bloomberg SWOT Analysis reveals the critical importance of understanding its customer base. Knowing the customer demographics and Bloomberg target market is vital for any business, but especially for a financial data giant like Bloomberg. The evolution of the Bloomberg Terminal itself reflects the need to adapt to the ever-changing landscape of its Bloomberg audience and the broader financial sector.

From its inception, Bloomberg has strategically shifted its focus, expanding from bond traders to a global network of Bloomberg users and Bloomberg clients. This expansion highlights the company's ability to anticipate and respond to shifts in the financial industry. This analysis will explore the specifics of who uses Bloomberg, their needs, and how the company maintains its position as a leader in financial information, examining aspects like the age range of Bloomberg users, geographic locations of Bloomberg customers, and industries that use Bloomberg.

Who Are Bloomberg’s Main Customers?

Understanding the Customer demographics and Bloomberg target market is crucial for appreciating the company's strategic positioning and operational success. The primary focus of the company is on business-to-business (B2B) services, with a highly specialized clientele. This approach allows it to concentrate its resources on providing high-value financial data and tools to a specific, demanding audience.

The core of the Bloomberg company's customer base comprises financial professionals. This includes investment bankers, portfolio managers, traders, and analysts. These professionals are typically well-educated, often holding advanced degrees in finance or related fields. They work within financial institutions, corporations, and governmental bodies, making data-driven decisions daily.

The Bloomberg audience is defined not just by job title but also by the need for real-time, reliable financial information. The company's services are essential for making informed decisions in fast-paced financial markets. As the financial landscape evolves, so does the company's strategy, expanding its offerings to meet the changing needs of its Bloomberg users.

The largest portion of the company's revenue comes from institutional clients, which include major banks, asset management firms, and hedge funds. These entities rely heavily on the company's terminal for real-time data, analytics, and trading tools. The company's terminal is a critical resource for these organizations, supporting their daily operations and strategic decisions.

Recognizing the broader need for reliable financial information, the company has expanded its reach to include government agencies, central banks, and academic institutions. This diversification reflects a strategic response to market research indicating a broader demand for its comprehensive data and analytical capabilities beyond traditional financial trading desks. This expansion has allowed the company to broaden its reach and cater to a diverse group of users.

The company has expanded its offerings to include environmental, social, and governance (ESG) data and analytics. This expansion reflects a shift in target segments driven by growing investor interest and regulatory requirements in sustainable finance. This expansion demonstrates the company's responsiveness to the evolving needs of its Bloomberg clients and the broader financial market.

The company's customer base is global, with a significant presence in North America, Europe, and Asia-Pacific. This global footprint allows it to serve clients across various time zones and markets. The company’s ability to provide data and analytics in multiple languages further supports its global reach, enhancing its appeal to international clients.

The typical user profile includes experienced professionals in high-income brackets, often with advanced degrees. The company's focus on data-driven decision-making and real-time information has made it a critical tool for financial professionals worldwide. The company's commitment to providing comprehensive financial data and analytics continues to attract and retain a diverse and influential customer base. For a deeper dive into how the company competes, consider exploring the Competitors Landscape of Bloomberg.

- Job Titles: Investment bankers, portfolio managers, traders, analysts, corporate treasurers, and economists.

- Education: Advanced degrees in finance, economics, or business are common.

- Income Levels: High, reflecting the specialized nature of their roles.

- Industries: Financial institutions, corporations, government agencies, and academic institutions.

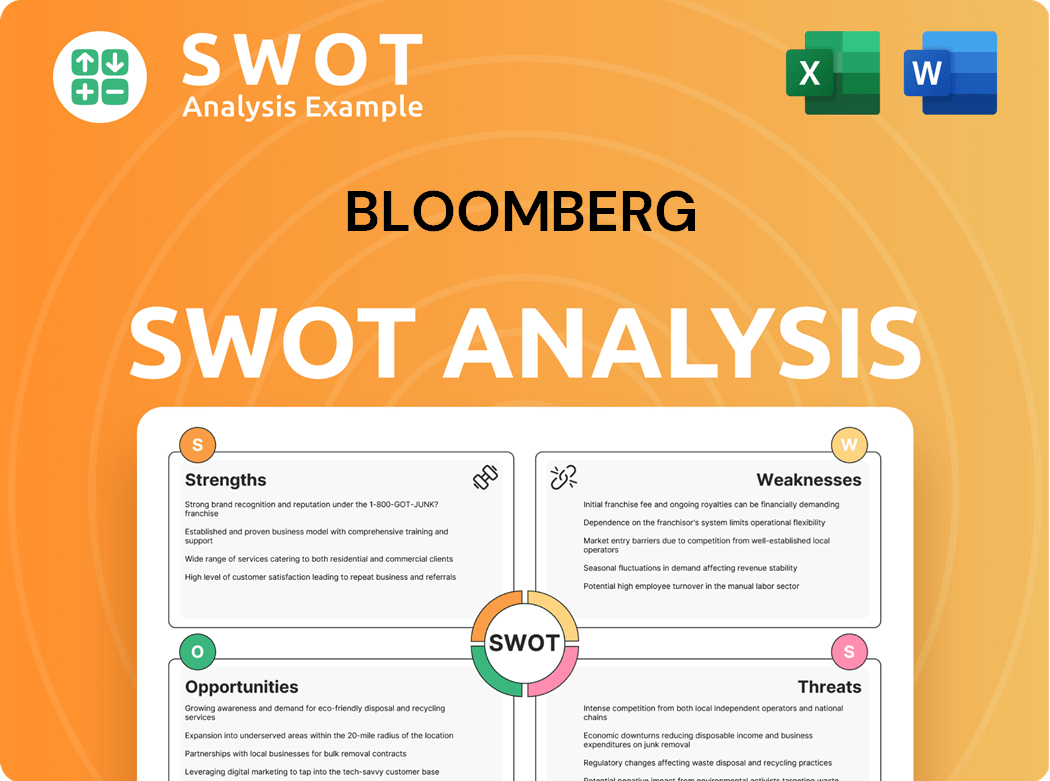

Bloomberg SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do Bloomberg’s Customers Want?

Understanding the customer needs and preferences is crucial for any business, and for the [Company Name], this involves a deep dive into the requirements of its sophisticated clientele. The core of [Company Name]'s success lies in its ability to meet the demanding needs of financial professionals globally. This includes providing timely, accurate, and comprehensive financial data and analytical tools.

The primary drivers for [Company Name]'s customers are the need to make informed decisions quickly, gain a competitive edge, and manage risk effectively. These professionals rely on the platform for real-time data, advanced analytics, and communication tools. The purchasing behavior of [Company Name]'s customers is characterized by a strong emphasis on reliability, speed, and the breadth of data available, which are critical for their day-to-day operations.

The [Company Name] platform is used intensively and continuously throughout the workday by professionals who need to monitor market movements, execute trades, and communicate with peers. The high loyalty among users is due to the platform's indispensable nature in their workflows, the significant learning curve involved in mastering its functionalities, and the high switching costs associated with moving to alternative platforms. The company addresses pain points such as information overload by providing customizable dashboards and filtering capabilities, and it tackles the need for speed through its real-time data feeds and instant messaging features.

Users seek to gain a competitive advantage by having access to the most current and accurate information. This includes real-time market data, news, and analytical tools. This is a key factor for the Bloomberg target market.

Risk management is another critical need. Access to sophisticated analytics and risk models helps users assess and mitigate financial risks effectively. The Bloomberg audience relies on these tools daily.

Identifying investment opportunities is a primary goal. The platform provides tools and data to analyze markets, identify trends, and make informed investment decisions. This is a core function for Bloomberg users.

Ensuring regulatory compliance is essential, especially in the financial sector. [Company Name] provides tools and data to help users meet regulatory requirements. This is a key consideration for Bloomberg clients.

The breadth and depth of available data sets are critical. Users require access to a wide range of financial data, including market prices, economic indicators, and company financials. This is a key factor in the customer demographics.

The sophistication of analytical tools is paramount. Users need advanced analytics, charting capabilities, and risk management tools to analyze data effectively. This is a critical aspect of the Bloomberg company.

Product development at [Company Name] is heavily influenced by feedback from its professional user base and market trends, leading to continuous enhancements in data coverage, analytical models, and user interface. For example, the integration of artificial intelligence and machine learning capabilities into the Terminal in recent years demonstrates how [Company Name] tailors its offerings to meet the evolving analytical needs of its sophisticated clientele. If you want to know more about the company's strategies, you can read about the Growth Strategy of Bloomberg.

The primary needs of [Company Name]'s customers revolve around access to real-time, accurate, and comprehensive financial information. Their preferences are shaped by the need for speed, reliability, and the depth of data available.

- Real-time Data: Immediate access to market data, news, and analytics.

- Advanced Analytics: Sophisticated tools for data analysis, charting, and risk management.

- Customization: Customizable dashboards and filtering options to manage information overload.

- Integration: Seamless integration of data, news, and communication tools within a single platform.

- Reliability: A dependable platform with minimal downtime and accurate data.

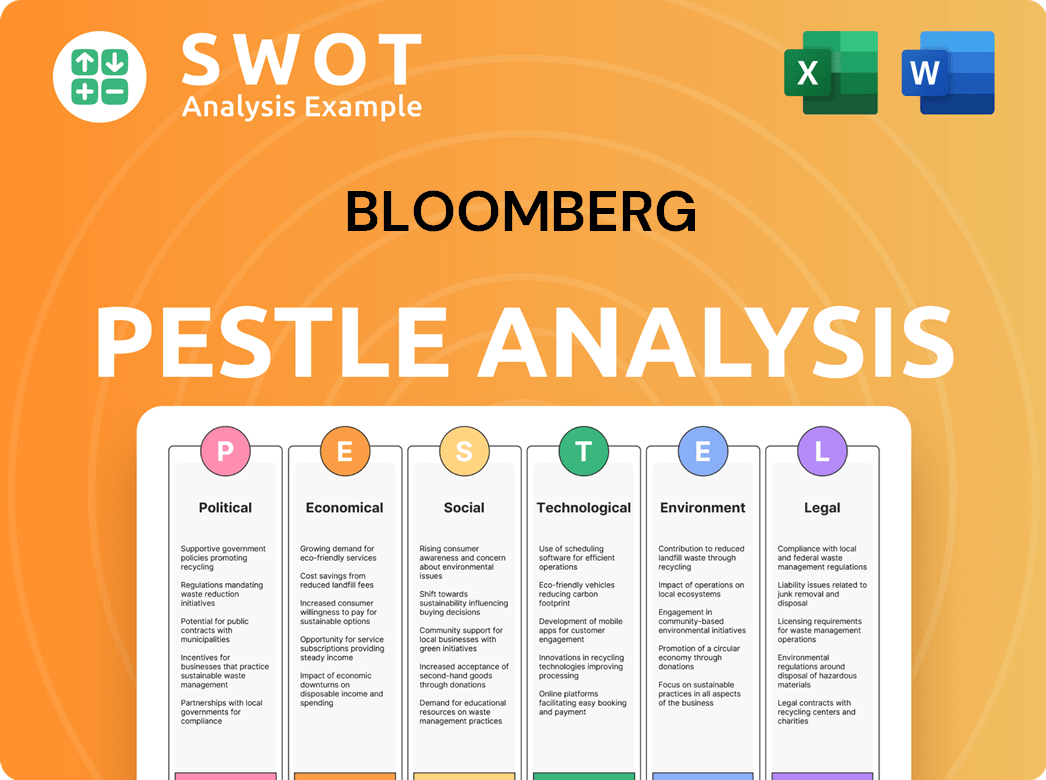

Bloomberg PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does Bloomberg operate?

The geographical market presence of the company is substantial, with a strategic focus on major financial hubs worldwide. Key regions include North America, Europe, and the Asia-Pacific, where the demand for sophisticated financial data and analytics is highest. The company's global footprint is a critical component of its business model, enabling it to serve a diverse clientele across various financial markets. Understanding the geographic location of Bloomberg customers is key to its market strategy.

The company has a strong presence in financial centers like New York, London, and Hong Kong. These locations are crucial for capturing a significant portion of its target market. The company's ability to provide real-time data and analysis is essential for financial professionals in these regions. This global reach is supported by a network of offices and data centers, ensuring reliable service and support.

The company tailors its offerings to meet the specific needs of each region, providing localized news feeds, market data, and customer support. This localization strategy is essential for maintaining a competitive edge. Recent expansions have focused on emerging markets, such as the Middle East and Latin America, where the financial sectors are growing. This expansion strategy is supported by localized sales teams and partnerships with regional financial institutions to ensure successful market penetration.

The United States represents a significant portion of the company's revenue. The demand for financial data and analytics services is high, with a large concentration of financial institutions. The company's services are essential for investment banks, hedge funds, and asset managers in this region.

Europe, particularly London and Frankfurt, is another key market. The regulatory environment and market structures differ from North America, requiring tailored offerings. The company provides region-specific news feeds and market data to cater to the needs of European clients.

The Asia-Pacific region, including Hong Kong, Singapore, Tokyo, and Sydney, is experiencing rapid growth. The company's presence in these financial centers is crucial for serving the increasing demand for financial data. The company's ability to provide services in multiple languages supports its growth in this region.

The company is expanding into emerging markets, such as the Middle East and Latin America. These regions offer significant growth potential as their financial sectors develop. The company's expansion strategy includes localized sales teams and partnerships with regional financial institutions.

The company localizes its offerings by providing region-specific news feeds, incorporating local market data, and offering customer support in multiple languages. This approach helps the company cater to the specific needs of its clients. This strategy is essential for maintaining a competitive edge in various markets.

The company holds a strong market share and brand recognition within these financial centers. This strong presence is a result of its comprehensive data and analytical tools. The company's reputation for providing reliable and timely information is a key factor in its success.

The company's target market includes a wide range of financial professionals, including investment bankers, portfolio managers, and traders. Its services are used by various industries, including finance, government, and media. Understanding the customer demographics is key to the company's strategy.

- Investment Professionals: Traders, portfolio managers, and analysts are key users.

- Financial Institutions: Investment banks, hedge funds, and asset management firms.

- Corporations: Treasury departments and financial planning teams.

- Government and Regulatory Bodies: Agencies that require financial data and analysis.

For more details, read about the Revenue Streams & Business Model of Bloomberg.

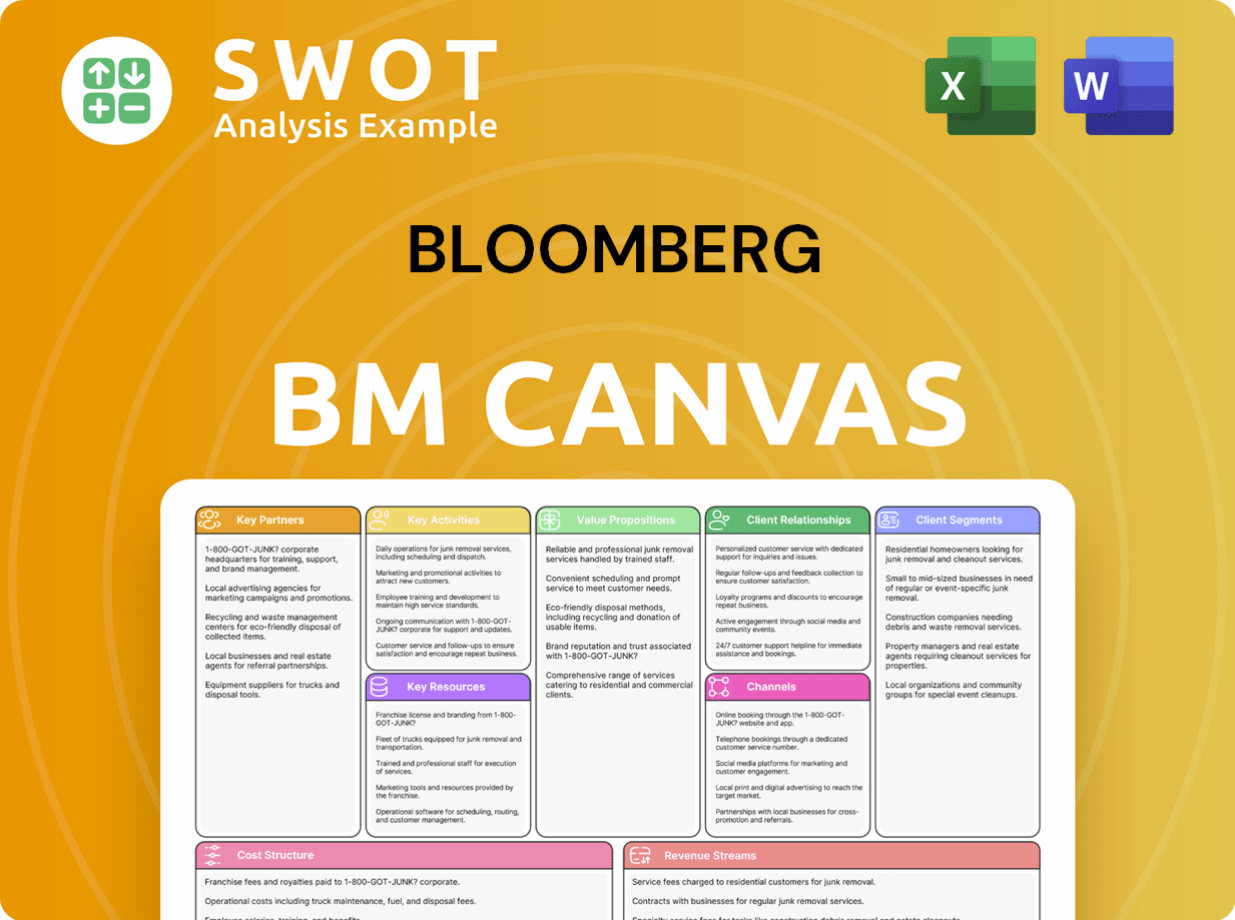

Bloomberg Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does Bloomberg Win & Keep Customers?

Understanding the customer acquisition and retention strategies of the [Company Name] is crucial, given its business-to-business (B2B) model and premium service offerings. The company focuses on a specific Bloomberg target market, primarily financial institutions and corporations. Their approach is highly specialized, emphasizing direct sales and relationship management to secure and maintain clients.

Customer acquisition at [Company Name] centers on direct sales efforts. Specialized sales teams engage directly with potential clients, emphasizing the indispensable nature of the Bloomberg Terminal. While traditional advertising is less common, the company leverages targeted marketing via industry events, financial publications, and thought leadership content. The company also benefits from referrals and word-of-mouth within the financial community, which are significant drivers of new business.

Retention is a critical aspect of [Company Name]'s strategy, particularly given its subscription-based model. The company focuses on providing exceptional customer service, continuous product enhancements, and fostering a strong user community. Customer data and CRM systems are crucial for understanding usage patterns and proactively addressing potential churn risks. Continuous development of new features and data sets keeps the Terminal at the forefront of financial technology.

The cornerstone of [Company Name]'s customer acquisition strategy is direct sales. Specialized teams engage directly with financial institutions, corporations, and other key players in the financial sector. This approach allows for personalized interactions and tailored solutions to meet specific client needs. Strong relationships are cultivated to ensure client satisfaction and retention.

While traditional advertising is limited, [Company Name] utilizes targeted marketing strategies. This includes participation in industry events, financial publications, and thought leadership content. The strong brand reputation of the company and the indispensable nature of the Bloomberg Terminal attract new clients. The content marketing strategy is key, as mentioned in the Marketing Strategy of Bloomberg.

Exceptional customer service is a key component of [Company Name]'s retention strategy. The company invests heavily in personalized support and training to ensure users maximize the value of their subscriptions. This proactive approach helps build strong client relationships and reduce churn, maintaining high customer satisfaction levels.

Continuous product enhancements are crucial for retaining customers. The constant addition of new data points, analytical models, and communication functionalities ensures the Terminal remains an essential tool. This ongoing innovation keeps the platform at the forefront of financial technology, meeting the evolving demands of its users.

The Bloomberg audience is primarily composed of financial professionals, including traders, analysts, portfolio managers, and other decision-makers within financial institutions. The Bloomberg users also include professionals in related sectors such as government, media, and legal fields. The company's focus is on providing tools and data that support critical financial decision-making. The geographic location of Bloomberg clients is global, with a strong presence in major financial centers worldwide. The company's services are tailored to meet the specific needs of different customer segments, ensuring high levels of customer satisfaction and retention. The company's market share by customer type and competitive analysis of its target market are key aspects of its strategic approach.

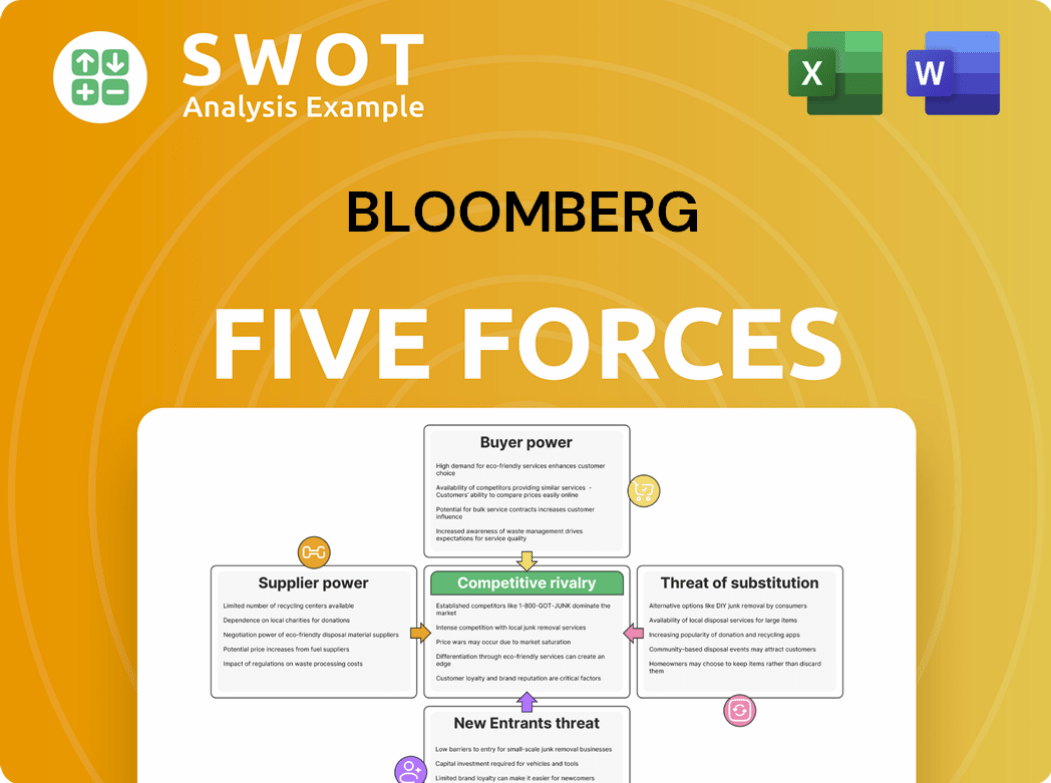

Bloomberg Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Bloomberg Company?

- What is Competitive Landscape of Bloomberg Company?

- What is Growth Strategy and Future Prospects of Bloomberg Company?

- How Does Bloomberg Company Work?

- What is Sales and Marketing Strategy of Bloomberg Company?

- What is Brief History of Bloomberg Company?

- Who Owns Bloomberg Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.