CACI Bundle

How has the CACI SWOT Analysis shaped CACI's success?

Embark on a journey through time to uncover the fascinating CACI history, a story of innovation and strategic evolution. From its inception in 1962, CACI company has transformed from a simulation technology pioneer to a leading force in government modernization and national security. This brief history of CACI company unveils the key milestones that have defined its trajectory.

Delving into the CACI story reveals a company that has consistently adapted and expanded, driven by a commitment to advanced computing and strategic acquisitions. Understanding the CACI International journey provides valuable insights into its significant role in the information technology industry and its impressive financial performance, including its current market capitalization and position in key financial indices. Explore the CACI services and how they have shaped its growth.

What is the CACI Founding Story?

The brief history of the CACI company begins in the early 1960s, a period marked by rapid advancements in computer science and a growing need for sophisticated data analysis. Founded on July 17, 1962, in Santa Monica, California, CACI International emerged from the vision of Herb Karr and Harry Markowitz, who saw an opportunity to commercialize the SIMSCRIPT simulation programming language.

Their initial focus was on providing support and training for SIMSCRIPT, a language they had previously helped develop at the RAND Corporation. This marked the beginning of CACI's journey into the world of advanced analytical capabilities and government contracting. The company's early years were characterized by a 'bootstrapping' approach, using funded contracts to develop new products and expand its services.

CACI's first project, secured in June 1963, was a $17,330 contract with the U.S. Navy. In 1964, a $30,000 contract with IBM to develop SIMSCRIPT I.5 solidified CACI's position as a pioneer in proprietary software development. The company's initial name was California Analysis Center, Inc., which later changed to Consolidated Analysis Centers Inc. in 1967, while retaining the familiar 'CACI' initials. This expansion reflects its growing influence and scope in the burgeoning field of data analysis and simulation.

CACI's founding story is a testament to entrepreneurial spirit and foresight in leveraging emerging technologies. The company's early success laid the groundwork for its future growth and expansion into various sectors.

- July 17, 1962: CACI International was founded in Santa Monica, California.

- June 1963: Secured its first contract with the U.S. Navy.

- 1964: Signed a contract with IBM to develop SIMSCRIPT I.5.

- 1967: Changed its name to Consolidated Analysis Centers Inc.

The early focus on SIMSCRIPT and simulation technology set the stage for CACI's evolution into a major player in the industry. The company's ability to secure contracts and develop proprietary software, like SIMSCRIPT I.5, was crucial. The Growth Strategy of CACI has been a key factor in its sustained success.

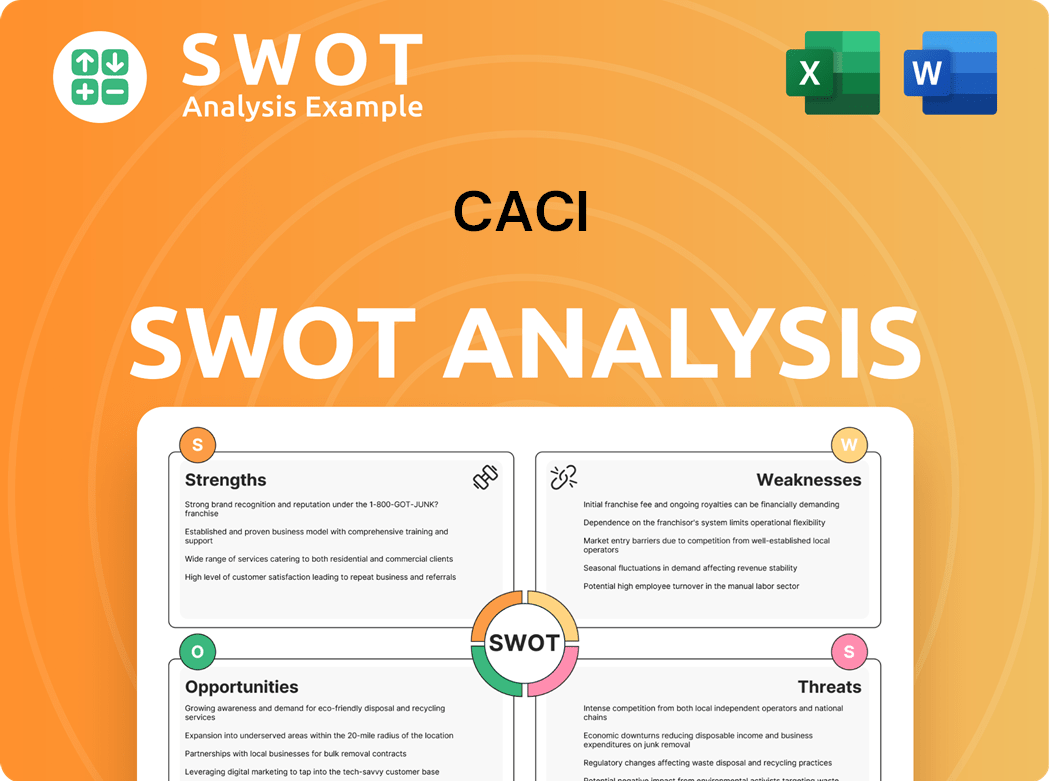

CACI SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of CACI?

The early years of the CACI company were marked by significant advancements in its product offerings and strategic expansion into new markets. This period saw the development of key technologies and the establishment of a strong foundation for future growth. These early initiatives set the stage for the company's evolution into a major player in its industry.

Following the success of SIMSCRIPT I.5, CACI released SIMSCRIPT II.5 in 1971, which became a leading simulation language. The company also developed QUICK QWERY, expanding its capabilities in information processing systems. These innovations helped CACI secure its position in the market.

CACI went public on August 15, 1968, a significant milestone that coincided with revenues exceeding $1 million for the first time. By this point, the company had grown to employ 40 people. This early success set the stage for future growth and expansion.

In 1972, CACI relocated its headquarters to a suburb of Washington, D.C., to be closer to its government clients. The company established a European headquarters in 1974, with its London offices housing the Marketing Systems Group. By 1977, European operations generated nearly $1 million in revenue.

The mid-1970s marked the beginning of CACI's contracting with the U.S. Department of Defense and, later, the U.S. Department of Justice. By 1980, revenues approached $35 million with a staff of 1,000. By 1983, revenues exceeded $100 million, demonstrating rapid growth.

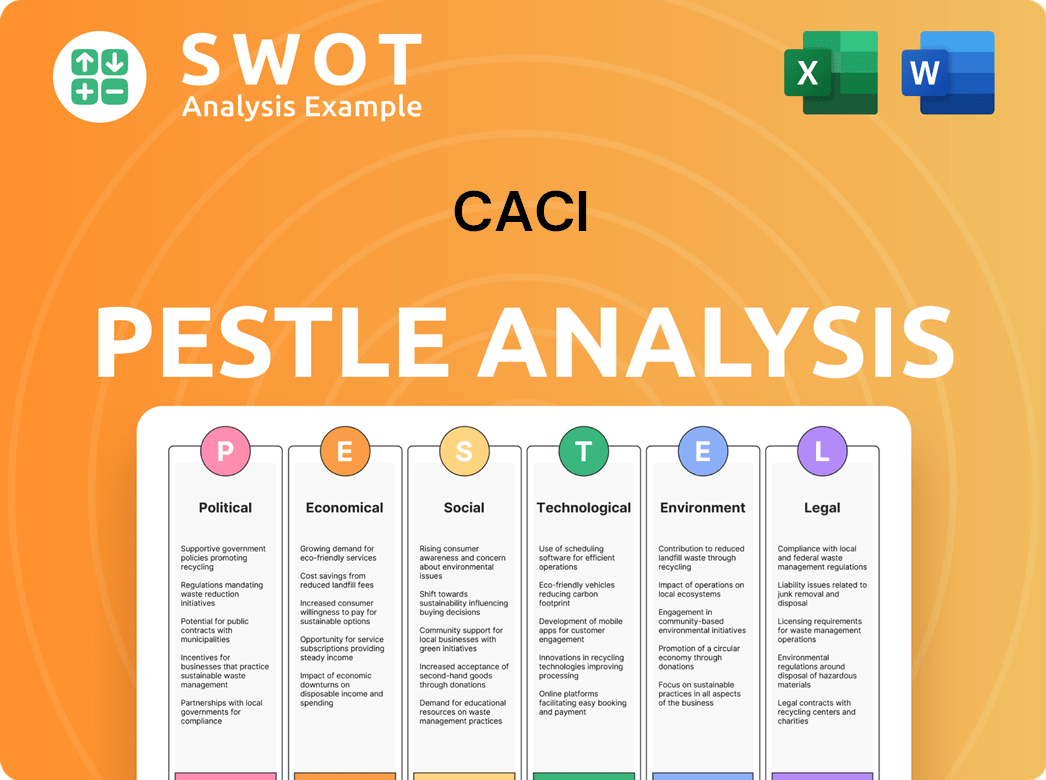

CACI PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in CACI history?

The CACI company has a rich history, marked by significant milestones in technology and strategic growth. From its early days, CACI has continually adapted and expanded its capabilities, establishing itself as a key player in the government contracting sector. The company's evolution reflects its commitment to innovation and its ability to respond to changing market demands.

| Year | Milestone |

|---|---|

| 1962 | Founded as a consulting and systems analysis company. |

| 1983 | Pioneered the incorporation of 1980 U.S. and 1981 British Census data into its systems. |

| 1980s | Launched NETWORK II.5®, a network simulation software. |

| 1998 | Acquired QuesTech, Inc., expanding into the intelligence community market. |

| 2000 | Acquired XEN Corp., further expanding its presence in the intelligence sector. |

| 2015-2025 | Achieved a revenue growth at a 9.7% CAGR and net profit at 14.2% CAGR. |

| April 2025 | Completed 24 acquisitions, expanding its expertise. |

CACI has consistently demonstrated innovation throughout its history, particularly in the development of advanced technological solutions. The company's focus on anticipating future needs and investing in differentiated capabilities has been a key driver of its success.

CACI developed SIMSCRIPT III, the latest version of its simulation programming language. This tool remains a leading solution in the industry.

CACI was the first company to incorporate 1980 U.S. and 1981 British Census data into its systems. This was a pioneering move in data analytics.

CACI launched NETWORK II.5®, a network simulation software in the late 1980s. This software anticipated the importance of networked applications.

CACI has strategically acquired companies to expand its expertise. These acquisitions have fueled the company's growth in key markets.

CACI has transitioned from a traditional services contractor to a mission-focused technology partner. This shift emphasizes software-defined solutions.

CACI continually invests in relevant and differentiated capabilities. This investment allows them to secure long-term contracts.

CACI has faced challenges, including controversies and market shifts, which it has addressed through strategic adjustments. The company's ability to adapt and innovate has been crucial to its sustained success in a competitive environment.

In 2004, CACI faced scrutiny related to prisoner abuse at Abu Ghraib prison. This led to civil litigation against the company.

CACI has adapted to market downturns and competitive threats. The company has demonstrated resilience through strategic pivots and acquisitions.

The shift from a traditional services contractor to a mission-focused technology partner required significant adaptation. This transition needed to be managed effectively.

The government contracting industry is highly competitive. CACI must continually differentiate itself to secure contracts.

Changes in government regulations can impact CACI's operations. The company must stay compliant with evolving requirements.

Economic downturns can affect government spending and, consequently, CACI's revenue. The company must be prepared for economic fluctuations.

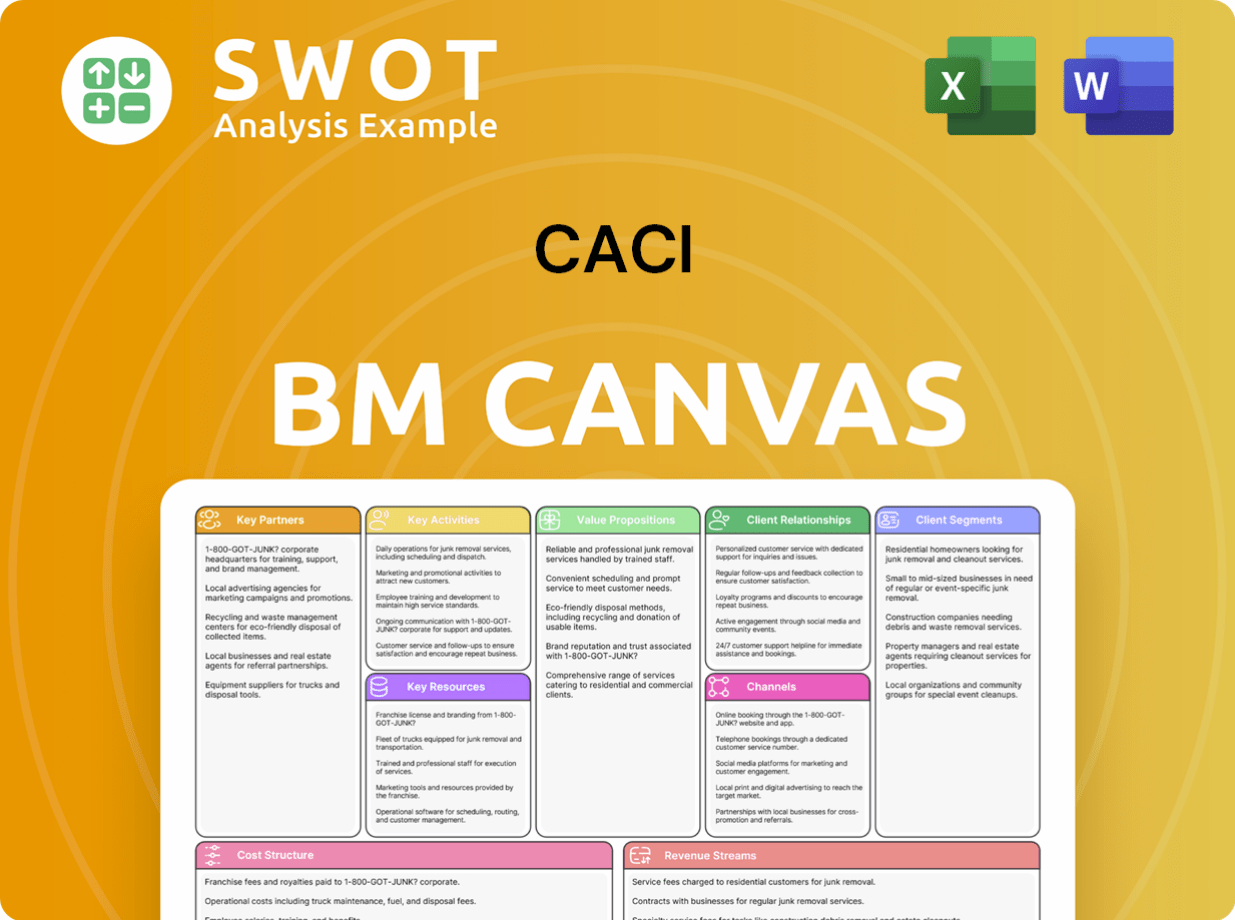

CACI Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for CACI?

The CACI history is marked by significant milestones, from its inception as California Analysis Center, Inc. in 1962 to its current status as a leading technology and professional services provider. Key events include pioneering software development, strategic acquisitions, and consistent revenue growth, reflecting its evolution and expansion within the government contracting sector. Here's a look at the

| Year | Key Event |

|---|---|

| 1962 | California Analysis Center, Inc. is founded in Santa Monica, California, by Herb Karr and Harry Markowitz. |

| 1963 | Wins its first contract with the U.S. Navy for inventory control simulation. |

| 1965 | Releases SIMSCRIPT I.5, becoming one of the first companies to sell proprietary software. |

| 1967 | Renamed Consolidated Analysis Centers Inc. and opens offices in Washington, D.C., and New York City. |

| 1968 | CACI goes public; revenues exceed $1 million. |

| 1974 | Establishes European headquarters. |

| 1983 | Revenues top $100 million; incorporates U.S. and British Census data into systems. |

| 1984 | Dr. J.P. 'Jack' London becomes President and CEO. |

| 1986 | Company is renamed CACI International Inc. |

| 1998 | Enters the intelligence community market with the acquisition of QuesTech, Inc. |

| 2002 | CACI's stock migrates from NASDAQ to the New York Stock Exchange. |

| 2004 | Revenues exceed $1 billion. |

| 2019 | Acquires LGS Innovations for $750 million, a major step in becoming more technology-centric. |

| 2024 | Reports fiscal year revenue of $7.6 billion. |

| 2024 (October) | Acquires Applied Insight and Azure Summit Technology, enhancing cloud and electronic warfare capabilities. |

| 2025 (January) | Reports Q2 FY25 revenues of $2.1 billion, an increase of 14.5% year-over-year. |

| 2025 (March) | Reports Q3 FY25 revenues of $2.167 billion, up 11.8% year-over-year. |

| 2025 (June) | Named a Fortune 500 company based on its 2024 fiscal year results, with $7.7 billion in revenue. |

CACI anticipates continued strong growth, particularly in national security and government modernization. For fiscal year 2025, revenue guidance is set between $8.55 billion and $8.65 billion, indicating a 14.5%–16% increase. This growth is supported by a robust backlog and a substantial pipeline of potential new business.

The company is focusing on software-defined capabilities and advanced technologies like AI and digital transformation. Key investments include the CrossBeam® Optical Communication Terminals. The company is well-positioned to capitalize on government demand for these advanced solutions.

CACI's adjusted EPS is expected to be between $24.24 and $24.87, representing 15%–18% growth. The company's backlog increased by 10% to $31 billion as of March 31, 2025, representing nearly four years of annual revenue. The company has a robust pipeline of $17 billion in bids under evaluation.

Analysts predict that CACI's revenue will grow by 6.6% per annum, with earnings expected to increase by 8.4% per annum over the next three years. This positive outlook reflects the company's strategic direction and its ability to secure and execute on government contracts.

CACI Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of CACI Company?

- What is Growth Strategy and Future Prospects of CACI Company?

- How Does CACI Company Work?

- What is Sales and Marketing Strategy of CACI Company?

- What is Brief History of CACI Company?

- Who Owns CACI Company?

- What is Customer Demographics and Target Market of CACI Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.