CACI Bundle

Who Really Controls CACI International?

Ever wondered who's truly steering the ship at CACI International, a key player in government solutions? Understanding CACI SWOT Analysis is just the beginning. The ownership structure of a company like CACI, a major provider of services to the U.S. federal government, is a critical factor in its strategic direction. Uncover the key players shaping its future and the dynamics influencing its market influence.

This in-depth analysis of CACI ownership will explore the evolution of its shareholder base, from its founding in 1962 to its current status as a publicly traded company. We'll examine the influence of major CACI shareholders, the roles of CACI executives, and how these elements impact CACI's stock performance and its engagement in government contracts. Discover the answers to questions like "Who owns CACI?" and "What does CACI do?" to gain a comprehensive understanding of this significant company.

Who Founded CACI?

The genesis of CACI International Inc. traces back to 1962, when Herb Karr and Harry Markowitz joined forces to establish the company. Markowitz, a Nobel laureate in Economic Sciences, brought his expertise in portfolio theory to the table, while Karr focused on simulation technologies. Their initial aim was to commercialize SIMSCRIPT, a simulation programming language.

While specific details about the initial equity split or shareholding percentages are not readily available in public records, it is understood that Karr and Markowitz held the foundational ownership stakes. Early backers likely included individuals or small groups interested in the burgeoning field of computer simulation and analysis, setting the stage for what would become a major player in the industry. The company's early focus on simulation software for government and commercial applications was critical to its future growth.

Early agreements would have focused on establishing control and defining the path for future expansion, common for a technology-driven startup in the early 1960s. These early decisions helped shape the trajectory of CACI, influencing its growth and strategic direction in the decades that followed. Understanding the company's origins provides essential context for analyzing its evolution and current structure.

Herb Karr and Harry Markowitz founded CACI International Inc. in 1962.

The company's initial focus was commercializing SIMSCRIPT, a simulation programming language.

Early financial support likely came from individuals or small groups interested in computer simulation.

Karr and Markowitz held the initial ownership stakes, setting the stage for the company's trajectory.

Early agreements focused on establishing control and defining the path for future expansion.

Early applications included simulation software for government and commercial purposes.

Understanding the early ownership structure of CACI International is crucial for grasping its evolution. While specific details on the initial equity split are not readily available, the influence of founders Herb Karr and Harry Markowitz, as well as early investors, is undeniable. The company's initial focus on simulation software for government and commercial applications laid the groundwork for its future expansion. For those interested in understanding the company's operations, a deeper dive into the Target Market of CACI can provide additional insights. The company has grown significantly since its inception, with its stock symbol being CACI, and is a publicly traded company. As of the latest reports, CACI has a substantial employee count and continues to secure significant government contracts, contributing to its annual revenue. The company's leadership team guides its strategic direction.

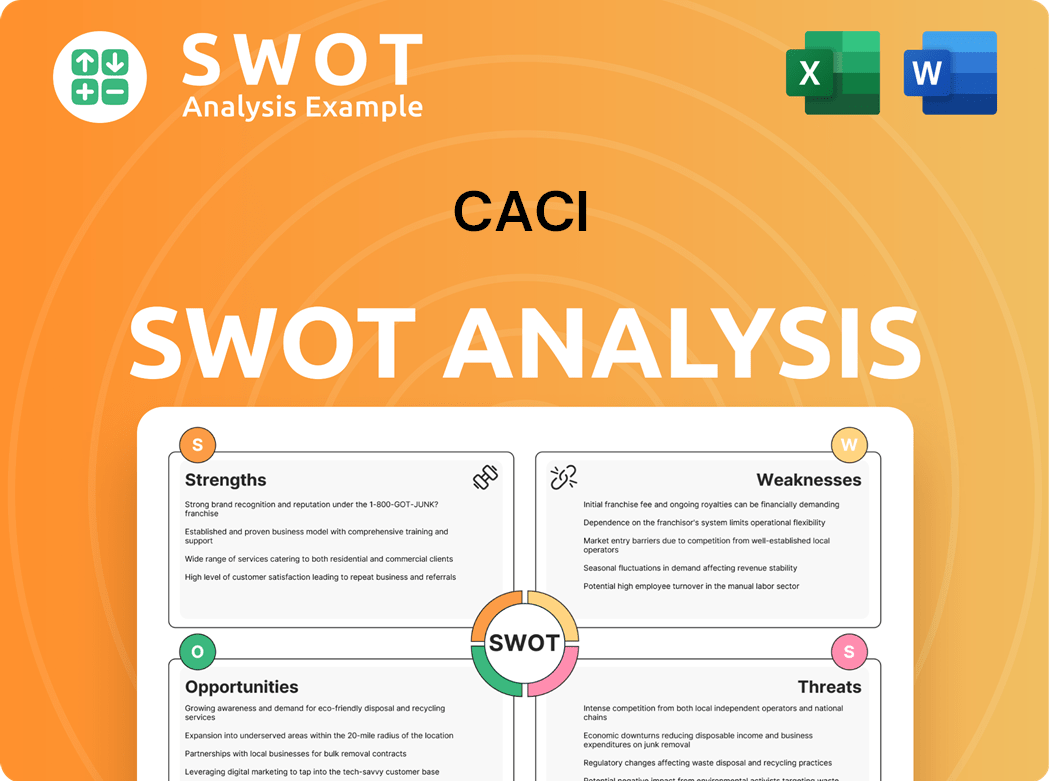

CACI SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has CACI’s Ownership Changed Over Time?

The transformation of CACI International Inc. into a publicly traded entity on September 17, 1968, was a pivotal moment, reshaping its ownership landscape. Before this, the company's ownership was likely concentrated among a smaller group. The move to go public opened the door for a more diverse shareholder base, a trend that has continued as the company has grown and evolved within the defense and government contracting sector. Understanding the evolution of CACI ownership provides insight into its strategic direction and financial stability.

As a publicly traded company, CACI's ownership structure has become increasingly diversified, with a significant portion of shares held by institutional investors. These investors often exert considerable influence on corporate strategy. The company's acquisitions, such as the purchase of LinQuest Corporation in April 2024 for approximately $1.6 billion, are often supported by the confidence of these institutional backers. This backing enables CACI to pursue significant growth initiatives and maintain its competitive edge in the market. The evolution of CACI ownership reflects its journey from a private entity to a major player in the government services market.

| Shareholder | Approximate Ownership (Early 2025) | Notes |

|---|---|---|

| The Vanguard Group, Inc. | Approximately 11.5% | A major institutional investor, indicating broad market confidence. |

| BlackRock, Inc. | Approximately 9.8% | Another significant institutional holder, influencing strategic decisions. |

| State Street Corporation | Approximately 4.5% | Holds a substantial portion of shares, reflecting investor trust. |

The presence of major institutional investors like The Vanguard Group, BlackRock, and State Street Corporation among CACI shareholders underscores the company's stability and potential for long-term growth. These institutions, representing a wide array of individual and fund investors, typically encourage a focus on stable financial performance and strategic acquisitions. For more insights into the company's strategic direction, consider reading about the Growth Strategy of CACI.

The ownership of CACI International has evolved significantly since its IPO in 1968, with a shift towards institutional investors.

- The Vanguard Group, BlackRock, and State Street Corporation are among the major shareholders.

- Institutional ownership influences company strategy, emphasizing long-term growth and stability.

- Strategic acquisitions, like the LinQuest purchase in April 2024, are supported by strong institutional backing.

- Understanding Who owns CACI provides insights into its financial health and strategic direction.

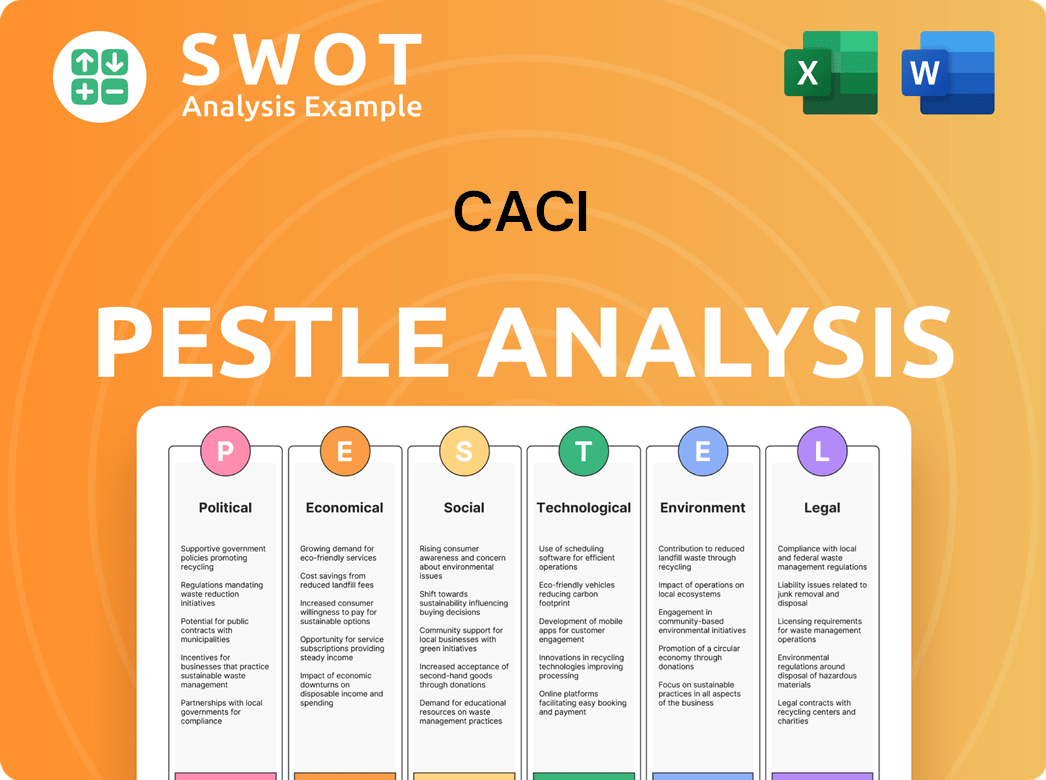

CACI PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on CACI’s Board?

The Board of Directors of CACI International Inc. includes a mix of independent directors and executives, ensuring robust corporate governance. As of early 2025, the board is led by Michael J. Dana, serving as Chairman, and John S. Mengucci as President and Chief Executive Officer. Other board members bring expertise from government, technology, and finance sectors. This structure supports strategic oversight and helps maintain investor confidence.

The board's role is crucial in guiding CACI's strategic initiatives, including acquisitions and technological advancements. This oversight is vital for the company's future and for aligning with shareholder interests. The composition of the board reflects CACI's commitment to strong governance and its focus on long-term value creation. The company's leadership team is dedicated to navigating the evolving landscape of the technology and government services sectors.

| Board Member | Title | Key Experience |

|---|---|---|

| Michael J. Dana | Chairman of the Board | Extensive experience in technology and government contracting. |

| John S. Mengucci | President and CEO | Deep understanding of CACI's operations and strategic direction. |

| Other Independent Directors | Various | Backgrounds in finance, technology, and government. |

CACI operates under a one-share-one-vote structure, ensuring equitable voting power among shareholders. This structure means each share of common stock entitles its holder to one vote on shareholder matters. There are no dual-class shares or special voting rights that would grant disproportionate control to any single entity. This approach promotes a more balanced distribution of voting power, which is essential for maintaining investor trust. For more information about the company, you can read a Brief History of CACI.

CACI's board comprises independent directors and executives, ensuring robust governance. The company operates under a one-share-one-vote system.

- Board members include Chairman Michael J. Dana and CEO John S. Mengucci.

- The board oversees strategic initiatives, including acquisitions.

- The voting structure promotes equitable shareholder power.

- The governance structure supports investor confidence.

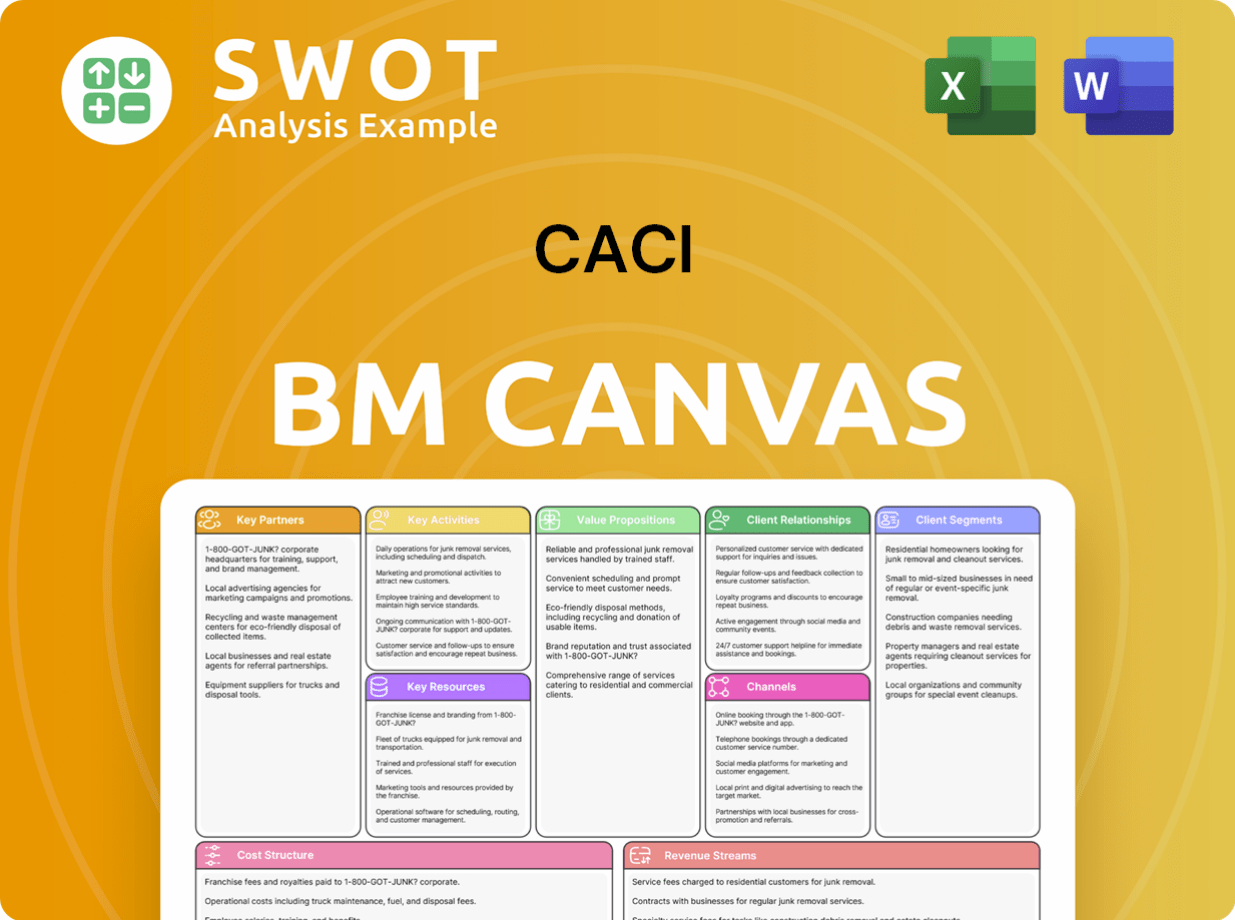

CACI Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped CACI’s Ownership Landscape?

Over the past few years, CACI International has shown steady activity in its ownership structure and strategic growth initiatives. A notable development was the acquisition of LinQuest Corporation in April 2024 for approximately $1.6 billion. This move aimed to bolster CACI's capabilities in space, national security, and technology solutions. Such acquisitions can slightly influence ownership as new shares are issued or capital is reallocated. This is a key aspect of understanding who owns CACI.

The overall trend in the defense and government contracting sector, where CACI operates, indicates sustained institutional ownership. Large institutional investors continue to hold significant stakes, reflecting the perceived stability and long-term growth potential in companies serving the U.S. federal government. While founder dilution is a natural progression for a company of CACI's age and public status, the focus remains on strategic expansion through organic growth and acquisitions. There have been no public statements suggesting privatization or major shifts in its public listing status. CACI continues to focus on leveraging its expertise in areas like artificial intelligence and cybersecurity to secure new contracts and expand its market presence, as highlighted in its recent financial reports and investor calls through early 2025.

CACI International is a publicly traded company, meaning its stock is available for purchase by the public. The company's stock symbol is CACI. Major shareholders typically include institutional investors. Understanding CACI shareholders is key to analyzing its ownership structure.

In April 2024, CACI acquired LinQuest Corporation for roughly $1.6 billion, expanding its footprint in the space and national security sectors. This acquisition is a significant move in CACI's growth strategy. These moves often influence the CACI stock performance and company profile.

CACI Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of CACI Company?

- What is Competitive Landscape of CACI Company?

- What is Growth Strategy and Future Prospects of CACI Company?

- How Does CACI Company Work?

- What is Sales and Marketing Strategy of CACI Company?

- What is Brief History of CACI Company?

- What is Customer Demographics and Target Market of CACI Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.