CACI Bundle

Can CACI Maintain Its Growth Trajectory?

Delve into the dynamic world of CACI International Inc., a leader in providing vital information solutions and services for national security and government modernization. This comprehensive analysis explores CACI's CACI SWOT Analysis, revealing the core strategies driving its success in the competitive government contracting sector. Discover how strategic acquisitions and innovative approaches are shaping the company's future.

With a focus on CACI's growth strategy and future prospects, this report examines its evolving business model and market position within the defense industry. We'll explore CACI's recent developments, including its strategic acquisitions and partnerships, and analyze its financial performance to assess its long-term growth strategy. Understand CACI's role in government contracting, its impact on national security, and the challenges and opportunities it faces in a rapidly changing landscape.

How Is CACI Expanding Its Reach?

The primary driver behind CACI's growth strategy is strategic expansion, primarily through acquisitions and a focus on high-demand areas within the government sector. This approach allows the company to access new customers, diversify its revenue streams, and stay ahead of industry changes by integrating complementary technologies. The company's market position is strengthened through these initiatives, which are crucial for long-term growth.

CACI's future prospects are closely tied to its ability to capitalize on opportunities within the defense and intelligence communities. The company's focus on areas such as cybersecurity, ISR, and electronic warfare positions it well to meet evolving government needs. CACI's business model is centered around providing technology and expertise to government clients, making it essential to adapt to changing technological landscapes and emerging threats.

CACI's financial performance reflects its successful expansion strategy and strong market position. The company's consistent contract wins and growing backlog indicate a healthy financial outlook and its ability to secure and execute significant government contracts. These factors contribute to CACI's overall growth and stability.

In fiscal year 2024, CACI acquired Azure Summit Technology for approximately $1.28 billion. This acquisition enhances capabilities in high-performance radio frequency technology, ISR, EW, and SIGINT. Applied Insight was acquired in October 2024, strengthening cloud migration and adoption expertise.

These acquisitions are designed to expand CACI's presence in both domestic and international markets. The 'Five Eyes' intelligence alliance and NATO countries are key areas of focus. This expansion is part of CACI's long-term growth strategy.

CACI secured $14.2 billion in contract awards in fiscal year 2024. The company's backlog reached $31.6 billion as of June 30, 2024, increasing to $32.4 billion by September 30, 2024. These wins highlight CACI's financial health and stability.

Recent contract awards include a $131 million sole-source contract for advanced data visualization for the DoD and Intelligence Community. A $238 million seven-year contract for space technology operations was also secured. Nearly $638 million in new Intelligence Community contracts were awarded.

CACI's expansion initiatives are significantly impacting its ability to secure substantial government contracts and increase its backlog. These strategic moves enhance its capabilities and market reach, contributing to sustained growth.

- Focus on strategic acquisitions to gain new capabilities and access new markets.

- Consistent contract wins, demonstrating strong performance and market demand.

- Significant backlog, providing a solid foundation for future revenue growth.

- Expansion into high-demand areas such as cybersecurity and ISR.

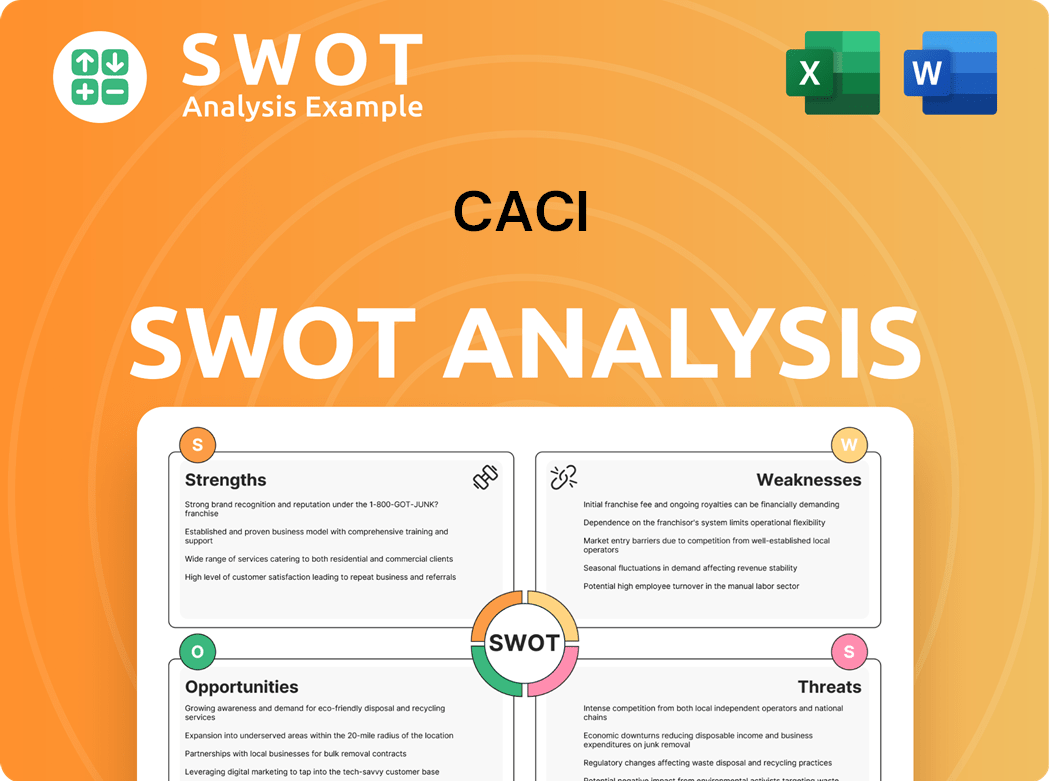

CACI SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does CACI Invest in Innovation?

CACI's growth strategy is heavily reliant on its innovation and technology initiatives, specifically focusing on software-defined solutions. This approach allows the company to rapidly adapt to evolving customer needs and maintain a competitive edge in the market. The company’s commitment to technological advancement is evident in its substantial investment in research and development.

The company's future prospects are closely tied to its ability to leverage cutting-edge technologies such as AI and IoT. These technologies are integrated into CACI's digital transformation strategy, enabling the delivery of advanced capabilities. CACI's focus on open architecture and software-defined technology is a key differentiator, allowing for faster and more efficient service delivery.

CACI's business model is centered around providing technology services and solutions to government clients. This model is enhanced by a strong emphasis on innovation, which supports its market position. The company's financial performance is directly influenced by its ability to win and execute contracts, with technology playing a crucial role in these endeavors.

In 2024, CACI invested $231.8 million in research and development. This investment underscores the company's dedication to innovation and enhancing its service offerings.

CACI's Chief Technology Officer, Glenn Kurowski, identifies software development as a core strength. This 'superpower' emphasizes speed, efficiency, and quality in delivering solutions.

CACI operates approximately 100 agile teams. These teams facilitate around 1,000 software releases annually, demonstrating a commitment to rapid development cycles.

The company's digital transformation strategy includes leveraging AI, IoT, and sustainability initiatives. This approach is enhanced by a focus on open architecture and software-defined technology.

CACI's optical communications technology was used in NASA's Deep Space Optical Communications (DSOC) experiment. This experiment successfully transmitted data over 200 million kilometers.

CACI develops and deploys advanced signals intelligence (SIGINT) and electronic warfare (EW) capabilities. The TLS BCT Manpack is an example of technology provided to warfighters.

CACI's strategic focus on innovation has positioned it well within the defense and government contracting sectors. This is evident in its continuous investment in R&D and its ability to rapidly deploy new technologies. For more details on the company's structure, you can read about Owners & Shareholders of CACI.

- Software-defined solutions are central to CACI's growth strategy.

- The company's commitment to agile development ensures rapid response to customer needs.

- CACI's technological advancements support its market position and financial performance.

- The company's focus on AI, IoT, and sustainability initiatives is key to its future prospects.

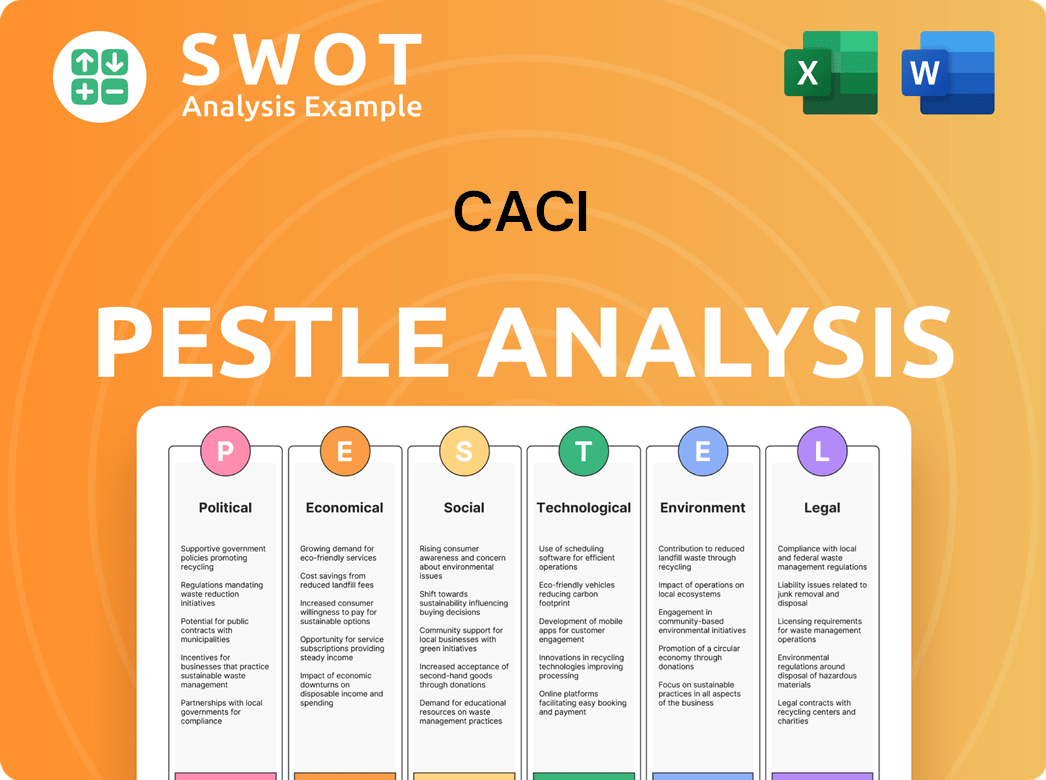

CACI PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is CACI’s Growth Forecast?

The financial outlook for CACI International is robust, underscored by strong performance in fiscal year 2024. CACI's CACI growth strategy has been effective, driving significant revenue increases and solidifying its CACI market position. The company's strategic initiatives and operational efficiency are key drivers of its financial success.

In fiscal year 2024, CACI reported revenues of $7.7 billion, marking a 14% year-over-year increase. This growth is a testament to the company's ability to secure and execute contracts effectively within the defense and government services sectors. The company's EBITDA margin of 10.4% reflects efficient cost management and strong profitability.

Looking ahead, CACI has consistently raised its financial guidance for fiscal year 2025, projecting revenues between $8.45 billion and $8.65 billion. This positive outlook is supported by a substantial backlog and strategic initiatives. To understand how CACI achieves its goals, check out the Marketing Strategy of CACI.

CACI's revenue for fiscal year 2024 reached $7.7 billion, demonstrating significant growth. This increase reflects successful contract execution and expansion within its core markets. The revenue growth is a critical component of the company's overall financial health.

CACI achieved an EBITDA of $798.0 million with a margin of 10.4% in fiscal year 2024. The EBITDA margin demonstrates efficient cost management and strong profitability. This profitability supports the company's investments in future growth.

Net income for fiscal year 2024 was $419.9 million, with diluted earnings per share (EPS) of $18.60. These figures highlight the company's profitability and its ability to generate value for shareholders. The EPS growth is a key indicator of financial success.

For fiscal year 2025, CACI projects revenues between $8.45 billion and $8.65 billion. This represents a significant increase from the initial estimates, reflecting confidence in the company's continued growth. This growth is supported by a strong backlog.

Adjusted net income for fiscal 2025 is projected in the range of $515 million to $535 million, with adjusted diluted EPS between $22.89 and $23.78. These projections indicate continued profitability and value creation. These numbers are key to understanding CACI future prospects.

CACI's backlog reached $32.4 billion as of September 30, 2024, with approximately 89% of fiscal year 2025 revenue expected from existing programs. This substantial backlog provides a strong foundation for future revenue. The backlog ensures revenue stability.

Free cash flow guidance for fiscal year 2025 has been raised to a minimum of $435 million. This reflects disciplined financial management and the company's ability to generate cash. This cash flow supports strategic initiatives.

In June 2025, CACI closed a $1.0 billion offering of 6.375% unsecured senior notes due in 2033. The offering was partially used to repay outstanding revolving credit facility debt. This financial strategy enhances financial flexibility.

CACI's financial strategy is supported by strategic capital allocation, ensuring resources are directed towards high-growth areas. Strategic capital allocation is crucial for long-term sustainability. This supports the company's CACI business model.

CACI's long-term growth strategy is focused on leveraging strong operational performance and strategic capital allocation. This strategy supports continued revenue growth and market expansion. The strategy drives value creation.

The company's financial health and stability are key factors in its ability to pursue strategic initiatives and maintain a competitive edge. Financial stability is essential for long-term success. This is crucial for CACI company analysis.

CACI's strong financial performance and positive outlook suggest significant investment potential. The company's consistent growth and strategic initiatives make it an attractive investment. This supports the CACI stock forecast and investment potential.

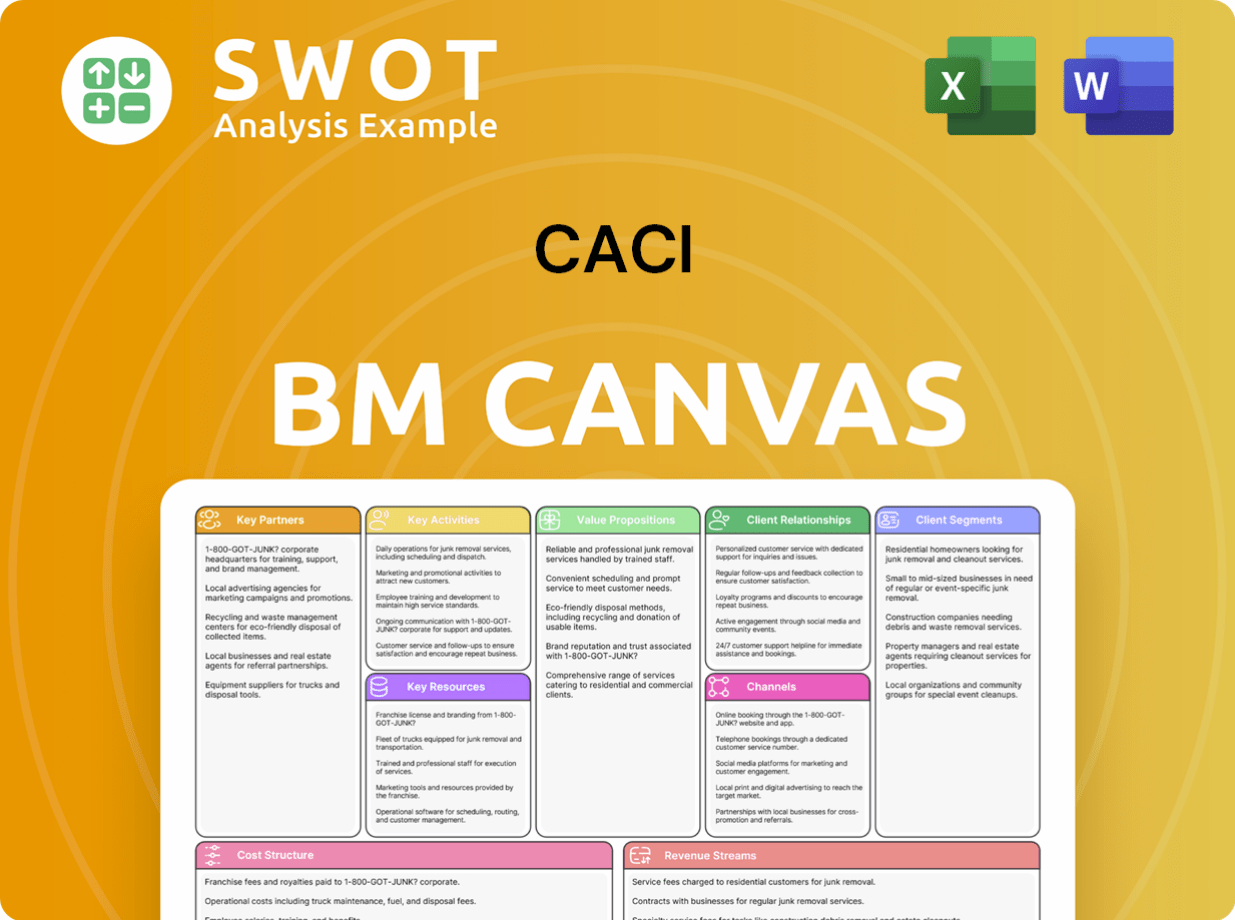

CACI Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow CACI’s Growth?

The CACI company analysis reveals several potential risks and obstacles that could impact its CACI future prospects. These challenges are primarily rooted in the government contracting sector, where the company operates. Understanding these risks is crucial for assessing the long-term viability of CACI's growth strategy.

One major risk is the reliance on U.S. government contracts, which are subject to funding fluctuations, delays, and potential terminations. The competitive landscape is also intense, with firms like Science Applications International (SAIC), Leidos Holdings (LDOS), and Booz Allen Hamilton (BAH) vying for similar contracts. This competition can lead to pricing pressures and affect profit margins. For a deeper dive into the company's origins, you can check out Brief History of CACI.

Furthermore, macroeconomic and geopolitical issues, as well as changes in political administrations, can introduce uncertainty. Supply chain vulnerabilities and technological disruptions also pose ongoing challenges. Despite these hurdles, CACI's business model includes strategies to mitigate these risks, such as diversifying offerings and making strategic acquisitions.

CACI's market position is significantly tied to U.S. government contracts, making it vulnerable to changes in government spending and priorities. Delays in appropriations or contract terminations can directly impact revenue. For example, in fiscal year 2023, the company's revenue was approximately $6.9 billion, with a substantial portion derived from government contracts. Any significant reduction in these contracts could affect CACI's financial performance.

The government contracting sector is highly competitive, with major players like SAIC, Leidos, and Booz Allen Hamilton. This intense competition can lead to pricing pressures and reduced profit margins. CACI's competitive landscape analysis must consider these factors. In 2024, the company's operating margin was around 10%, and maintaining this margin requires effective cost management and strategic bidding.

Global economic conditions and geopolitical tensions can influence government spending, potentially leading to reduced budgets for defense and other areas where CACI operates. Changes in political administrations can also create uncertainty, causing delays in contract awards and payments. The company's ability to navigate these uncertainties will be crucial for its CACI long-term growth strategy. The defense sector's growth rate in 2024 was approximately 3%, a rate that CACI aims to outperform.

Rapid technological advancements and supply chain disruptions can pose challenges. CACI's innovation in technology solutions must keep pace with evolving threats and requirements. Supply chain issues can affect the timely delivery of services and products. CACI's strategic acquisitions and partnerships play a key role in addressing these challenges. The cybersecurity market, a significant area for CACI, is expected to grow by 12% annually through 2025, presenting both opportunities and risks.

CACI Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of CACI Company?

- What is Competitive Landscape of CACI Company?

- How Does CACI Company Work?

- What is Sales and Marketing Strategy of CACI Company?

- What is Brief History of CACI Company?

- Who Owns CACI Company?

- What is Customer Demographics and Target Market of CACI Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.