CACI Bundle

Who Does CACI Serve? Unveiling the Customer Landscape

In the ever-evolving landscape of national security and government modernization, understanding a company's customer base is crucial. The success of any organization, including CACI International Inc, hinges on its ability to identify and serve its target market effectively. This analysis delves into the CACI SWOT Analysis, exploring the company's customer demographics and strategic approach to its client base.

CACI's sustained growth, highlighted by its impressive financial performance in Q3 2024, underscores the importance of a well-defined customer profile. This detailed examination will explore the specifics of CACI's CACI target market, including CACI's government customer base and their evolving needs. We'll also analyze CACI market analysis to understand how the company adapts to maintain its position within its core sectors, including CACI's customer acquisition strategies.

Who Are CACI’s Main Customers?

Understanding the primary customer segments is crucial for analyzing the business model of the company. The company's main focus is on serving the U.S. federal government. This customer base accounts for the vast majority of its revenue, making it a key factor in its market position.

The company's primary customers are concentrated within the U.S. federal government. These include the Department of Defense (DoD), the Intelligence Community (IC), and Federal Civilian Agencies. This focus shapes the company's strategic direction and service offerings.

The company's customer profile is heavily weighted towards government entities, with a substantial portion of its revenue derived from contracts with the DoD. This concentration highlights the importance of government contracts in its overall financial performance and growth strategy. Examining the company's customer demographics provides insights into its market positioning and potential for expansion.

The company's customer base is primarily composed of U.S. government entities. In fiscal year 2024, 95.1% of the company's revenue came from federal government contracts. A significant portion, 74.4%, was derived from contracts with DoD agencies, indicating a strong reliance on this segment.

The main customer segments include the Department of Defense (DoD), the Intelligence Community (IC), and Federal Civilian Agencies. These segments drive the demand for the company's services. The company's ability to secure and maintain contracts within these segments is critical to its success.

The company's market position is heavily influenced by its government contracts. The company's sustained growth in contract awards, with $14.2 billion in annual contract awards in fiscal year 2024, demonstrates a strong demand from its primary government segments. The company's backlog increased by 22% to $32 billion in fiscal year 2024, further solidifying its strong position within its target segments. For more insights, you can explore the Growth Strategy of CACI.

The company provides advanced solutions tailored to the needs of its government clients. Recent contracts highlight the company's capabilities in data visualization, space technology operations, and IT modernization. For example, the company secured a seven-year sole-source contract valued at over $131 million to provide advanced data visualization technology to support the DoD and the Intelligence Community.

The company's target market is primarily the U.S. federal government, with a strong emphasis on the DoD and IC. This focus is reflected in its revenue distribution and contract awards. The company's customer segmentation strategies are centered around providing specialized services to meet the unique needs of these government agencies.

- The DoD and IC require advanced solutions in areas like data visualization, space technology operations, and electronic warfare systems.

- Federal Civilian Agencies, such as NASA, require IT modernization and digital transformation services.

- The company's consistent growth in contract awards signifies a sustained demand from its primary government segments.

- The company also has a smaller presence in commercial and international markets, mainly in the U.K., accounting for 3.0% of total revenues in fiscal year 2024.

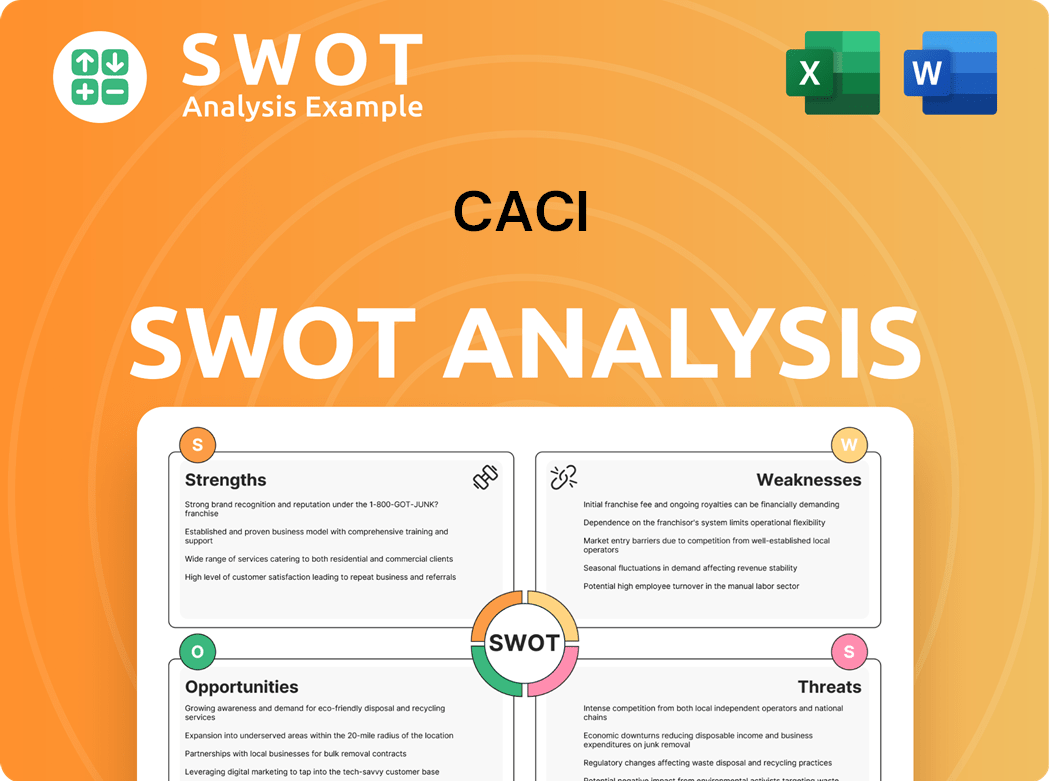

CACI SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do CACI’s Customers Want?

Understanding the customer needs and preferences is crucial for any business, and for the company, it is particularly important given its focus on government contracts. The company's customer base primarily consists of U.S. federal government agencies, demanding a deep understanding of their unique requirements and priorities. This analysis offers insights into the specific needs and purchasing behaviors of the company's clients, as well as the company's strategies to meet these needs effectively.

The company's customers, mainly U.S. federal government agencies, are driven by critical national security missions and the need for government modernization. Their key needs revolve around enhancing operational efficiency, securing sensitive data, leveraging advanced analytics for decision superiority, and modernizing legacy IT infrastructures. These needs shape the company's service offerings and strategic direction. The company's ability to align its expertise with these enduring priorities is key to winning and retaining contracts.

The company's commitment to innovation and customer satisfaction is evident in its financial investments and strategic partnerships. For example, its investment in research and development, with $231.8 million allocated in 2024, demonstrates its dedication to creating unique intellectual property and addressing critical national security needs. This commitment, along with its focus on agile software development and AI-augmented data platforms, directly addresses the demand for rapid, secure, and efficient technological solutions.

Customers require solutions that improve operational efficiency, secure sensitive data, and modernize legacy IT infrastructures. The Department of Defense and Intelligence Community prioritize data visualization and advanced electronic warfare capabilities.

Purchasing decisions are made through a rigorous contract award process. Expertise, differentiated technology, and a strong track record are essential for securing contracts. The company's investment in R&D, totaling $231.8 million in 2024, supports its ability to meet these requirements.

Customers value long-term partnerships and adaptability to evolving threats. The company's strategy involves aligning its expertise with enduring national security priorities to secure contracts and maintain relationships. The company's success in securing large contracts, such as the $805 million task order with the U.S. Navy, demonstrates its ability to meet complex and evolving customer requirements.

The company's success is closely tied to its ability to understand and meet the needs of its diverse government clients. To further understand the company's journey and how it has positioned itself to meet these needs, consider reading a Brief History of CACI.

- Department of Defense (DoD) and Intelligence Community (IC): Require solutions for data visualization, advanced electronic warfare, and decision superiority.

- Federal Government Agencies: Need enhanced operational efficiency, secure data management, and modernized IT infrastructures.

- NASA: Seeking modernization of SAP solutions to the S4/Hana platform and implementation of Agile SAFe® model.

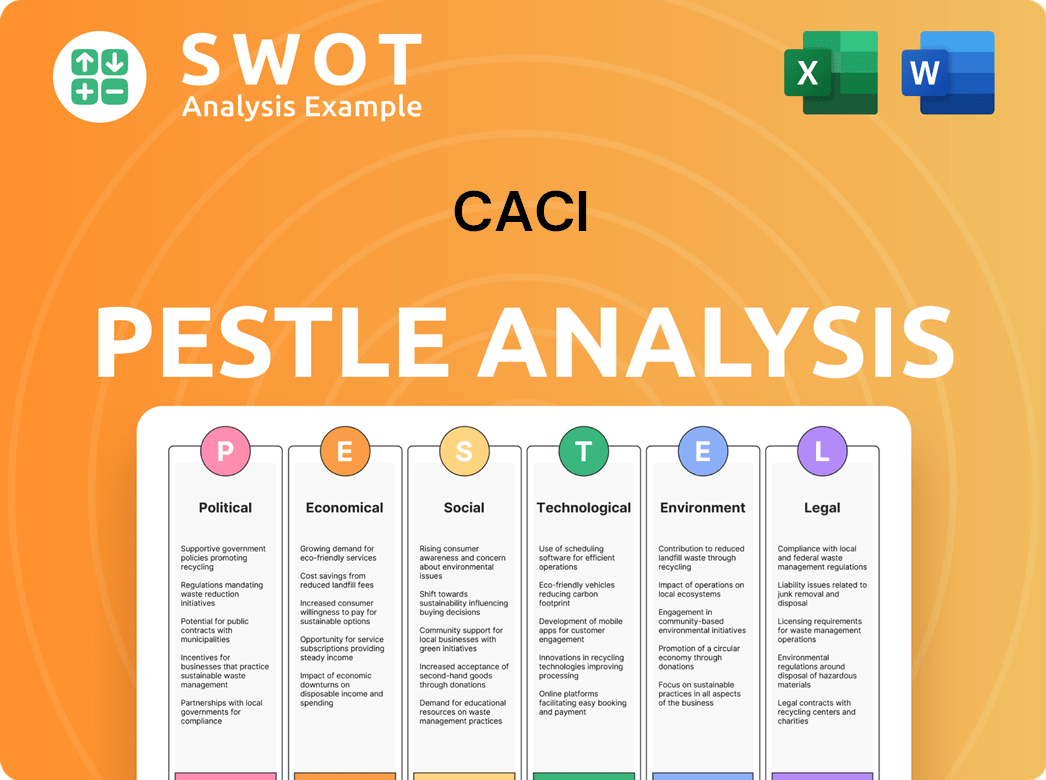

CACI PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does CACI operate?

The geographical market presence of CACI International Inc. is predominantly within the United States. The company's operations are heavily concentrated domestically, primarily serving the U.S. federal government. Understanding CACI's geographical footprint is crucial for analyzing its customer demographics and target market.

In fiscal year 2024, domestic operations accounted for a significant 97.0% of CACI's total revenues. This highlights the importance of the U.S. federal government as CACI's primary market. This includes agencies such as the Department of Defense, the Intelligence Community, and Federal Civilian Agencies.

While the U.S. market is central, CACI also maintains a limited international presence. This is primarily through its subsidiaries in Europe, specifically CACI Limited and CACI BV. These international operations contributed 3.0% of total revenues in fiscal year 2024.

CACI's primary customer base is the U.S. federal government. This includes various agencies and departments. The company's services are aligned with the specific needs and requirements of these government entities.

CACI has a presence in Europe, mainly through its subsidiaries. These operations cater to both commercial and government customers. The international market provides a smaller but still significant revenue stream.

CACI's customer base can be segmented into the U.S. federal government and international commercial and government entities. Each segment has distinct needs and requirements. This segmentation helps CACI tailor its offerings effectively.

CACI adapts its services to meet the specific needs of each region. This includes understanding agency policies and challenges within the U.S. government. It also involves tailoring IT consultancy services and proprietary data and software products for international customers.

The differences in customer demographics, preferences, and buying power between these regions are notable. The U.S. federal government market is characterized by large-scale, long-term contracts with strict security and compliance requirements, driven by national security and modernization mandates. In contrast, the international commercial and government enterprises in the U.K. likely have a more diverse mix of IT consultancy services and proprietary data and software product needs. CACI localizes its offerings by maintaining expert knowledge of agency policies, operations, and challenges within the U.S. government, and by adapting its IT consultancy services and proprietary data and software products for its international commercial customers. For more insights into CACI's financial structure, consider reading about the Revenue Streams & Business Model of CACI.

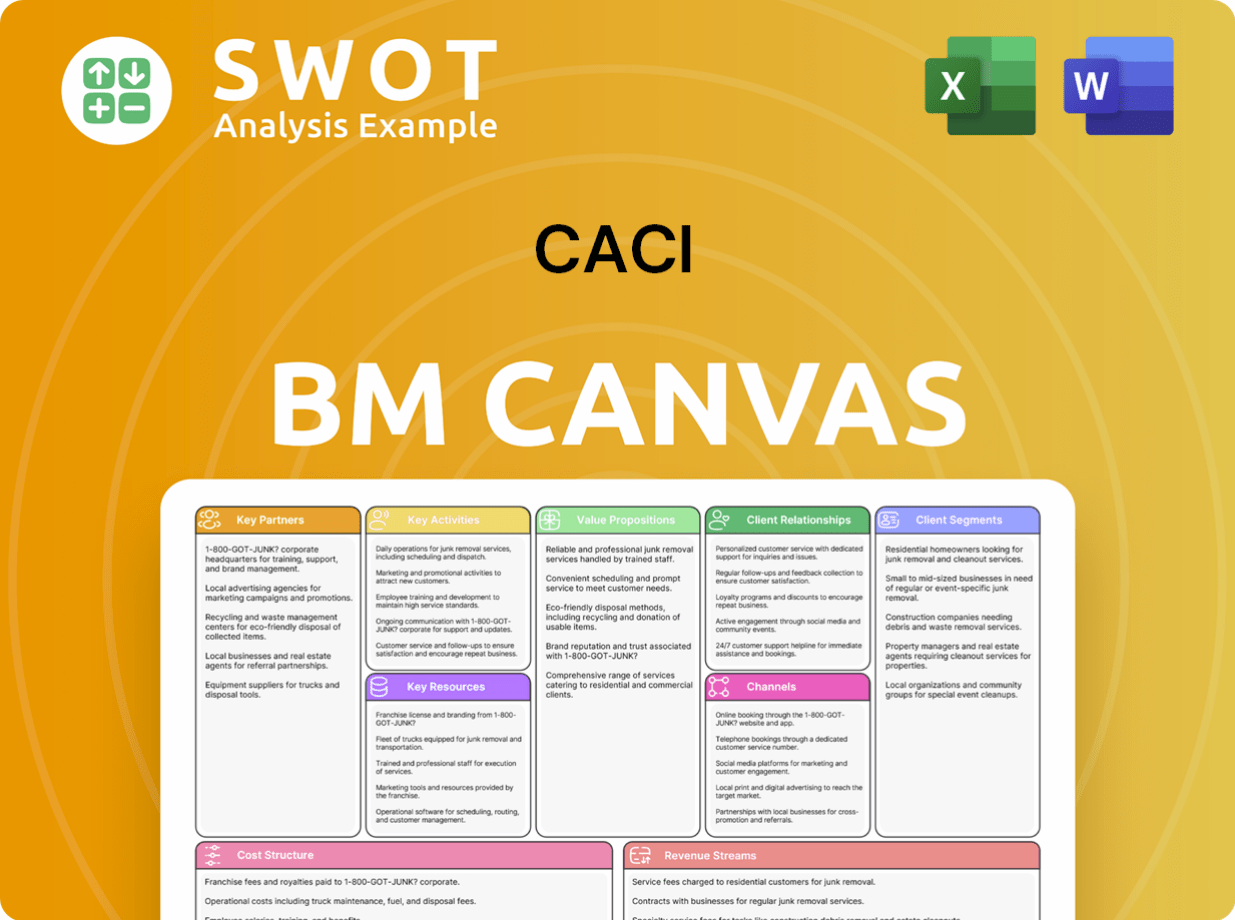

CACI Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does CACI Win & Keep Customers?

The customer acquisition and retention strategies of CACI International Inc. are primarily focused on the U.S. federal government. This business-to-business (B2B) approach is deeply ingrained in the company's mission of supporting national security and government modernization. CACI's success hinges on its ability to understand and meet the specific needs of its government clients, offering specialized expertise and advanced technological solutions.

CACI's approach to acquiring new contracts involves a robust business development organization. This team actively seeks out competitive business opportunities and maintains an expert understanding of agency policies, operations, and challenges. The company's ability to respond effectively to government solicitations and showcase its differentiated expertise is crucial for securing new business. For instance, CACI secured a $2 billion NASA IT modernization deal in June 2024, showcasing strong proposal development and solution delivery capabilities.

Retention strategies are built on consistent, high-quality program delivery and continuous innovation. CACI invests in research and development to generate unique intellectual property, ensuring its offerings stay relevant and cutting-edge. The company focuses on agile software development, AI-augmented data platforms, and enterprise IT systems to proactively address evolving government requirements. The company's backlog of $32.4 billion as of September 30, 2024, represents a 21.3% increase from the previous year, underscoring strong future revenue potential from existing contracts and successful retention efforts.

CACI's customer acquisition strategies focus on the U.S. federal government, leveraging a strong business development organization. They actively seek out competitive opportunities and maintain expertise in agency operations. A key tactic is responding to government solicitations, showcasing differentiated expertise.

Sales tactics revolve around responding to government solicitations, leveraging deep understanding of customer needs. CACI showcases differentiated expertise and technology. Securing large contracts, such as the $2 billion NASA IT deal, highlights proposal development and solution delivery capabilities.

Retention strategies are built on consistent, high-quality program delivery and continuous innovation. CACI invests ahead of customer needs through R&D to generate unique IP. They focus on agile software development and AI-augmented data platforms.

CACI's contract awards for fiscal year 2024 totaled $14.2 billion, with a book-to-bill ratio of 1.9x. Approximately 70% of these awards were for new business to CACI. The company's backlog of $32.4 billion as of September 30, 2024, represents a 21.3% increase from the previous year.

CACI's customer base primarily consists of various agencies within the U.S. federal government. This includes departments focused on defense, intelligence, and civilian sectors. The company tailors its services to meet the specific needs of these government entities, ensuring a strong alignment with their missions and objectives.

- Defense agencies

- Intelligence agencies

- Civilian government sectors

- NASA

Understanding the Growth Strategy of CACI is crucial for assessing its long-term potential. CACI’s focus on the U.S. federal government as its primary customer base, along with its commitment to innovation and high-quality service delivery, positions it well for continued success in the competitive government contracting market. The company’s customer acquisition and retention strategies are closely aligned with its core mission of supporting national security and government modernization.

CACI Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of CACI Company?

- What is Competitive Landscape of CACI Company?

- What is Growth Strategy and Future Prospects of CACI Company?

- How Does CACI Company Work?

- What is Sales and Marketing Strategy of CACI Company?

- What is Brief History of CACI Company?

- Who Owns CACI Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.