Cadence Design Bundle

How Did Cadence Design Systems Become an EDA Powerhouse?

From its inception in 1988, Cadence Design Systems has revolutionized the Cadence Design SWOT Analysis industry. This EDA company, born from a merger, quickly became a cornerstone in electronic design automation. Its mission was to empower engineers with the tools to design the complex integrated circuits that power our modern world.

This brief history of Cadence Design Systems will explore its founding, early expansion, and key milestones. We'll examine how Cadence, with its innovative Cadence software, has shaped the chip design landscape and its impact on the semiconductor industry. Discover the journey of this influential company from its early years to its current market dominance, including its impressive revenue and market share.

What is the Cadence Design Founding Story?

The story of Cadence Design Systems, a prominent Electronic Design Automation (EDA) company, began with a strategic merger. This union of two pioneering startups laid the foundation for what would become a leader in the chip design industry. Understanding the Cadence history provides insight into its evolution and impact on the semiconductor world.

Cadence Design Systems officially emerged in 1988, born from the merger of SDA Systems and ECAD. This strategic move was pivotal in shaping the company's early trajectory and establishing its presence in the competitive EDA market. The merger allowed Cadence to leverage the strengths of both entities, accelerating its growth and innovation.

The founding of Cadence Design Systems is a story of innovation and strategic foresight. Let's delve into the details of how this major EDA company came to be.

SDA Systems, one of the key components of Cadence, was established in 1983 in San Jose, California. The founders had a vision to create integrated tools for IC physical design.

- SDA Systems was founded by James Solomon, Richard Newton, and Alberto Sangiovanni-Vincentelli.

- The company focused on providing IC physical design tools within an integrated 'framework'.

- Jim Solomon secured funding through venture capital and investments from companies like National Semiconductor.

- Joe Costello, who later became Cadence's first CEO, joined SDA Systems in 1984 and became its president in 1987.

ECAD, the other half of the Cadence story, was founded in 1982. ECAD specialized in commercializing physical verification tools, specifically the Dracula product.

- ECAD was co-founded by Ping Chao, Glen Antle, and Paul Huang.

- ECAD developed Dracula, an IC layout verification product.

- ECAD went public in 1987.

The merger of SDA Systems and ECAD in 1988 marked the official formation of Cadence Design Systems. This strategic move was crucial for the company's future.

- In February 1988, ECAD acquired SDA Systems for $72 million in a stock swap.

- The combined entity was incorporated as Cadence Design Systems on June 1, 1988.

- Joseph Costello was appointed as CEO and president.

- This merger set the stage for Cadence's rapid growth in the EDA market. For more insights into the company's core values, consider reading about the Mission, Vision & Core Values of Cadence Design.

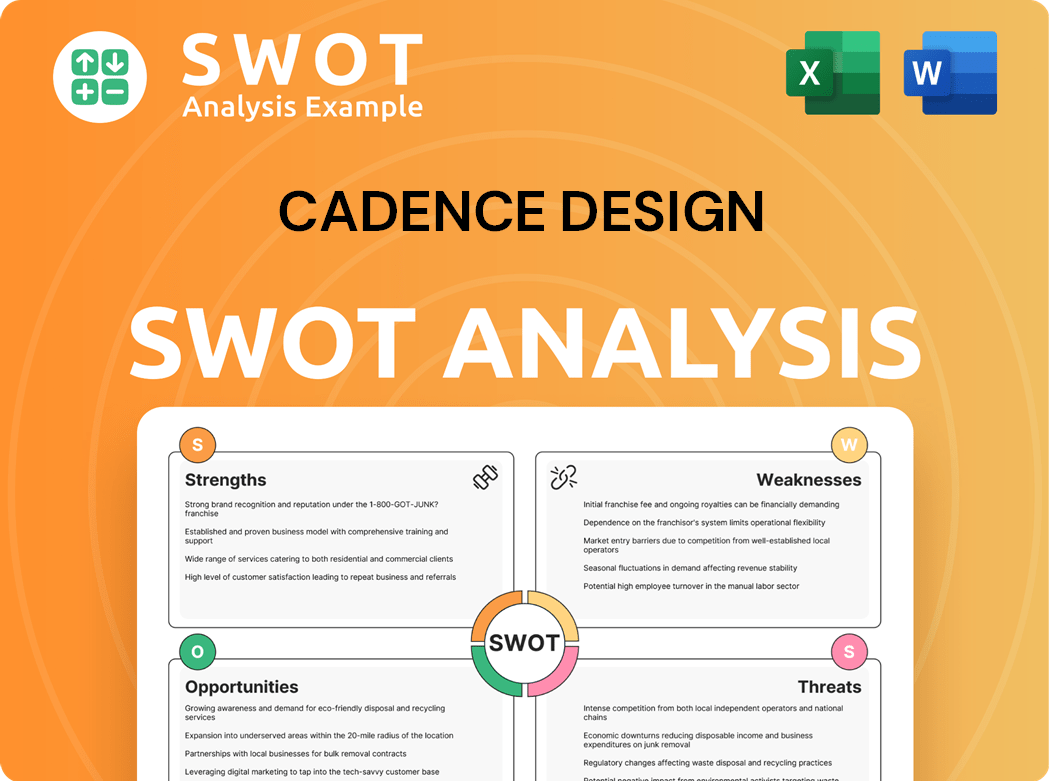

Cadence Design SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Cadence Design?

The early years of Cadence Design Systems were marked by rapid expansion and strategic moves that solidified its position in the Electronic design automation (EDA) market. This period saw significant acquisitions and a focus on developing widely-used product lines. Cadence's early success set the stage for its future as a leader in the chip design industry.

In its first year, Cadence Design Systems achieved impressive results, generating revenues of $78.6 million. The company also expanded its workforce to 433 employees, demonstrating its early growth trajectory.

A key strategy in its early phase was providing customized versions of its Cadence software for various computer platforms. This included support for Digital Equipment, Sun Microsystems, and Apollo computers. By its second year, Cadence extended its platform support to include Sony, NEC, and Hewlett-Packard computers.

A significant milestone in 1989 was the acquisition of Gateway Design Automation, the developer of the Verilog hardware description language. Cadence subsequently placed Verilog into the public domain a year later, which led to its widespread adoption. Jim Solomon initiated the Cadence Analog Division in 1989, which solidified Cadence's leadership in custom/analog design automation tools. The acquisition of Tangent Systems further boosted Cadence's capabilities in IC layout automation.

By 1990, Cadence's market share had surged to 44.2%, largely driven by its strong presence in Japan, where it served nine of the top ten Japanese chip makers. By 1997, Cadence had become the world's largest electronic design automation firm. The company's early growth was characterized by strategic acquisitions and a focus on building widely-used product lines, expanding into system-level and PCB design, and integrating design services into its core strategy.

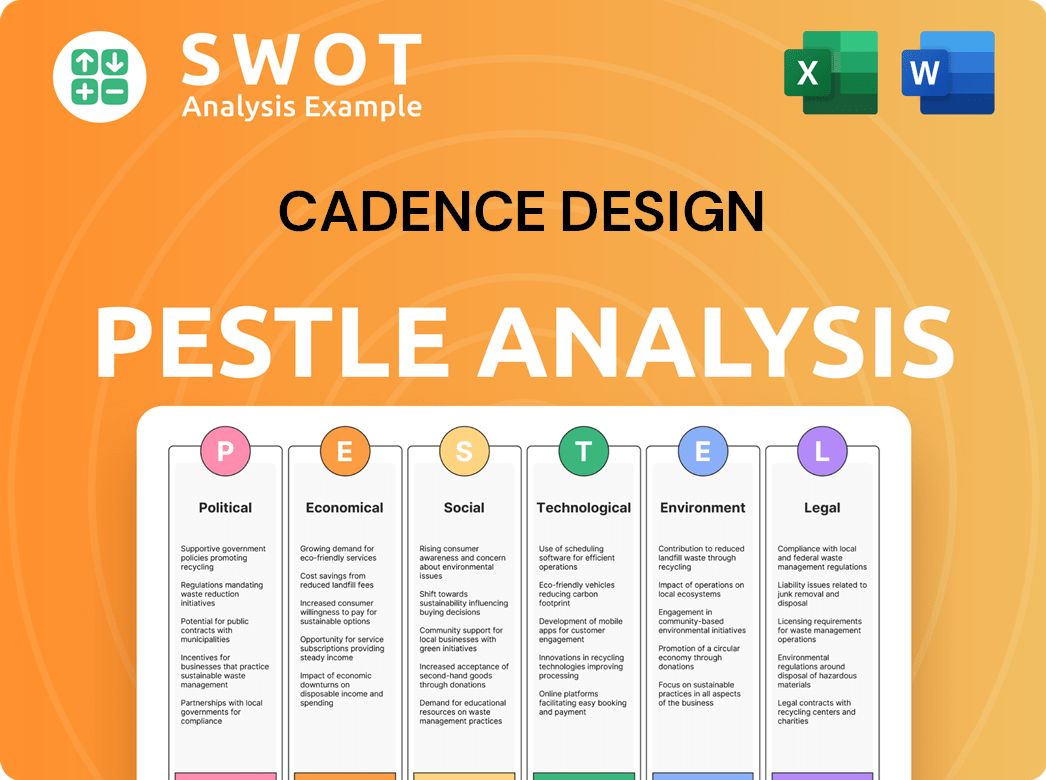

Cadence Design PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Cadence Design history?

The Cadence Design Systems has a rich Cadence history, marked by significant milestones in the Electronic design automation (EDA) industry. From its early years to its current position, the company has consistently pushed the boundaries of chip design and Cadence software, shaping the landscape of semiconductor and system design. The company's journey is a testament to its adaptability and commitment to innovation, reflecting its evolution as a leading EDA company.

| Year | Milestone |

|---|---|

| 1989 | Acquired Gateway Design Automation, placing the Verilog hardware description language into the public domain. |

| Early 2000s | Expanded implementation tools through acquisitions like Silicon Perspective, Verplex, and Celestry Design. |

| 2002 | Made its Genesis design database available as 'OpenAccess' to the EDA industry, fostering collaboration. |

| 2005 | Acquired Verisity, a pioneer in coverage-driven verification, strengthening verification capabilities. |

| 2010 | Proposed the EDA360 vision and acquired Denali Software to bolster its position in design and verification IP. |

| 2024 | Unveiled the Palladium Z3 Emulation and Protium X3 FPGA Prototyping systems, enhancing system and semiconductor design capabilities. |

Cadence Design Systems has consistently introduced groundbreaking innovations, particularly in AI-driven design optimization. The company's focus on advanced hardware and software solutions has enabled significant performance improvements and capacity enhancements for its customers, especially in the AI and hyperscale sectors.

The release of Verilog into the public domain and the introduction of OpenAccess were pivotal in promoting industry standards and collaboration. These initiatives significantly impacted the way chip design was approached, fostering a more open and collaborative environment.

Cadence established itself as a leader in custom/analog design automation tools, providing specialized solutions for complex designs. This focus allowed Cadence Design Systems to meet the unique needs of various design projects.

The acquisition of Verisity enhanced Cadence software's verification capabilities, providing advanced tools for coverage-driven verification. This strengthened the company's position in the verification market.

The EDA360 vision proposed an expanded role for Electronic design automation, shaping the future of the industry. This forward-thinking approach helped Cadence stay at the forefront of technological advancements.

Recent innovations include AI-driven design optimization tools, such as Cadence Cerebrus, Verisium SimAI, and Allegro X AI. These tools have seen significant adoption among top-tier customers in fiscal year 2024.

The introduction of the Palladium Z3 Emulation and Protium X3 FPGA Prototyping systems in April 2024, offering enhanced capacity and performance. These systems gained over 30 new customers and nearly 200 repeat customers in 2024.

Despite its successes, Cadence Design Systems faces several challenges, including intense competition within the EDA company market and economic fluctuations. Geopolitical tensions, particularly concerning China, have also impacted revenue, leading to a conservative growth outlook.

The EDA industry is highly competitive, with major players like Synopsys and Mentor Graphics vying for market share. Continuous innovation is crucial for Cadence Design Systems to maintain its competitive edge.

Economic downturns and market volatility in the semiconductor and technology sectors can significantly impact Cadence Design Systems' performance. These factors can affect investment in new projects and the demand for Cadence software.

Geopolitical tensions and trade sensitivities, especially concerning China, have presented challenges. The company experienced a decline in revenue from China by over $100 million from 2023 to 2024.

The decline in revenue from China has impacted the core EDA growth, leading to a conservative outlook for flat growth in China for fiscal year 2025. This highlights the importance of navigating international trade dynamics.

Despite these challenges, Cadence continues to invest heavily in research and development. Leadership expresses confidence in the company's ability to navigate dynamic situations and drive innovation for next-generation designs.

The Cadence history is marked by its ability to adapt to changing market dynamics and technological advancements. Understanding the Cadence Design Systems target market is crucial for sustained growth, as discussed in this article.

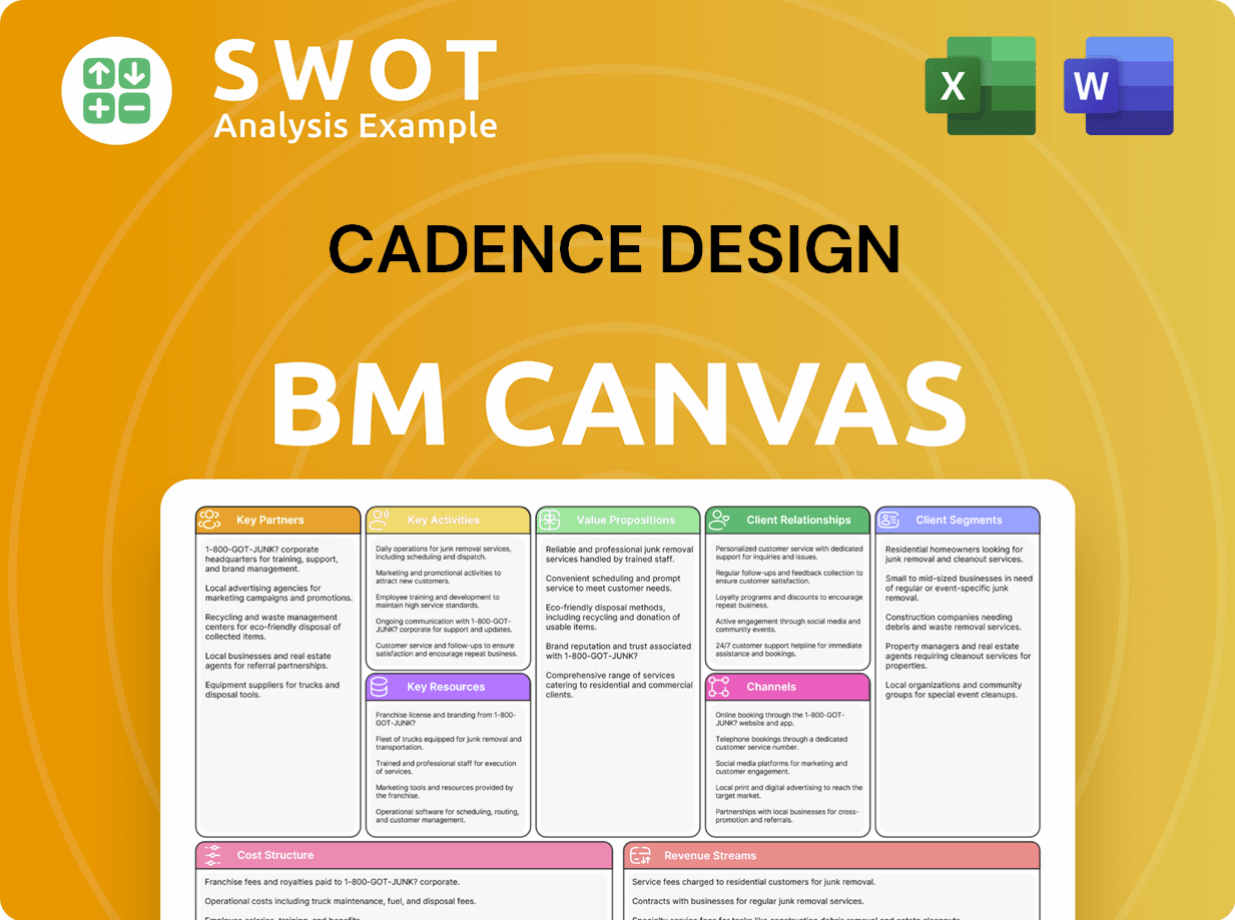

Cadence Design Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Cadence Design?

The EDA company, Cadence Design Systems, has a rich history marked by strategic acquisitions and innovations in electronic design automation. This Cadence history began with the founding of ECAD, Inc. in 1982 and SDA Systems in 1983, which later merged to form Cadence Design Systems in 1988. Over the years, the company expanded its capabilities through acquisitions like Gateway Design Automation, Verisity, and Denali Software, solidifying its position in the chip design market. Recent developments include the acquisition of BETA CAE Systems in June 2024 and the planned acquisition of Secure-IC in early 2025, demonstrating Cadence's commitment to expanding its offerings and securing its place in the industry.

| Year | Key Event |

|---|---|

| 1982 | ECAD, Inc. co-founded. |

| 1983 | SDA Systems founded. |

| 1988 | Cadence Design Systems officially formed through the merger of SDA Systems and ECAD. |

| 1989 | Acquired Gateway Design Automation and Tangent Systems. |

| 1990 | Cadence put Verilog into the public domain. |

| 1996 | Acquired High Level Design Systems, reaching 3,300 employees and $742 million in annual revenue. |

| 2001-2003 | Acquired implementation tools including Silicon Perspective, Verplex, and Celestry Design. |

| 2002 | Cadence Genesis design database offered as “OpenAccess”. |

| 2005 | Acquired Verisity, a pioneer in coverage-driven verification. |

| 2008 | Lip-Bu Tan became president and CEO. |

| 2010 | Proposed EDA360 vision and acquired Denali Software. |

| April 2024 | Unveiled the Palladium Z3 Emulation and Protium X3 FPGA Prototyping systems. |

| June 2024 | Purchased BETA CAE Systems. |

| February 2025 | Announced acquisition of Secure-IC, an embedded security IP platform provider, expected to close by mid-2025. |

| April 2025 | Signed a definitive agreement with Arm Holdings to acquire its Artisan foundation IP business. |

Cadence is focusing on the increasing demand for semiconductors driven by AI, IoT, and 5G. The company is well-positioned to provide sophisticated design tools for advanced manufacturing processes, such as 5nm and below. Cadence's 'Intelligent System Design' strategy, which integrates AI into its EDA tools, is key for future success.

Cadence has expanded its partnership with NVIDIA, particularly around the Grace Blackwell architecture and the Llama Nemotron Reasoning Model, highlighting its role in semiconductor innovation. Ongoing investment in R&D and strategic acquisitions are crucial for maintaining competitiveness in this rapidly evolving industry. The company's focus is on integrated solutions.

Cadence has raised its revenue and EPS outlook for fiscal year 2025, expecting revenue between $5.15 billion and $5.23 billion, and non-GAAP EPS between $6.73 and $6.83. The company ended Q1 2025 with a quarter-end backlog of $6.4 billion and cRPO of $3.2 billion, indicating strong future revenue potential.

Despite a cautious outlook for flat growth in the China market for 2025 due to geopolitical uncertainties, Cadence remains confident in its ability to navigate the macroeconomic environment. This confidence is driven by its resilient software business model and robust backlog. The company is focused on providing integrated solutions that address the entire design flow.

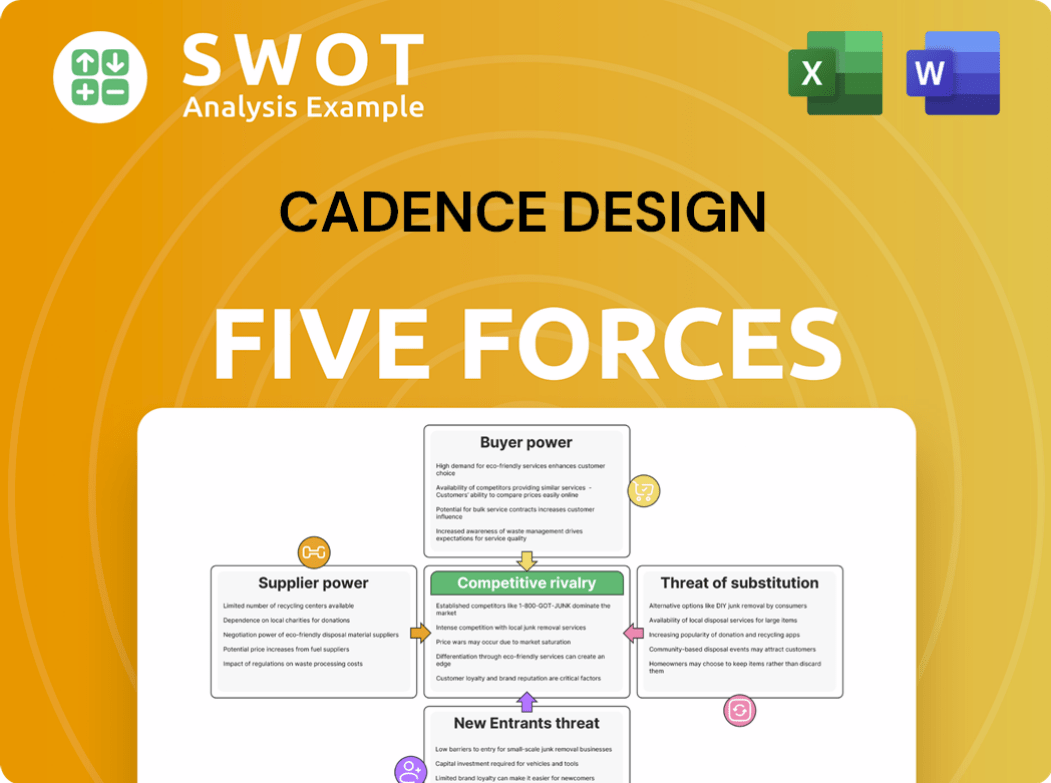

Cadence Design Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Cadence Design Company?

- What is Growth Strategy and Future Prospects of Cadence Design Company?

- How Does Cadence Design Company Work?

- What is Sales and Marketing Strategy of Cadence Design Company?

- What is Brief History of Cadence Design Company?

- Who Owns Cadence Design Company?

- What is Customer Demographics and Target Market of Cadence Design Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.