Cadence Design Bundle

Can Cadence Design Systems Conquer the AI Era?

Cadence Design Systems, a titan in the Electronic Design Automation (EDA) software industry, is at the forefront of a technological revolution. Established in 1988, Cadence has evolved from a merger into a $71.2 billion powerhouse, enabling the design of cutting-edge electronics. But what does the future hold for this industry leader?

This analysis delves into the Cadence Design SWOT Analysis, exploring its growth strategy, market share, and future prospects within the rapidly evolving landscape. We'll examine the company's financial performance, competitive landscape, and expansion plans, providing actionable insights for investors and strategists alike. Understanding Cadence's position in the 'AI super cycle' is crucial for anyone looking to navigate the complexities of the EDA software market and identify potential investment opportunities.

How Is Cadence Design Expanding Its Reach?

Cadence Design Systems is executing a comprehensive Growth Strategy focused on both organic and inorganic initiatives to enhance its market position. The company is actively involved in product innovation, particularly in AI-driven solutions, and strategic mergers and acquisitions to expand its capabilities and reach. This approach is driven by the increasing demand for advanced design tools and the need to stay competitive in the rapidly evolving Electronic Design Automation (EDA) market.

The company's expansion efforts are geared towards capturing new market opportunities and strengthening its existing product offerings. Cadence aims to meet the rising demand for specialized AI hardware and faster design cycles by diversifying its revenue streams. Through these strategic moves, Cadence is positioning itself for sustained growth and enhanced value creation in the semiconductor ecosystem.

Cadence's expansion strategy includes both organic growth through product innovation and inorganic growth via strategic mergers and acquisitions. This strategy is aimed at enhancing capabilities and broadening market reach. The company is also focusing on geographical expansion, particularly in India, to support AI and GPU development.

Cadence is actively innovating and expanding its product portfolio to meet the evolving needs of the semiconductor industry. The launch of the Millennium M1 supercomputer in February 2024, designed for computational fluid dynamics (CFD) and leveraging AI, marked its entry into the supercomputer business. This demonstrates a commitment to providing cutting-edge solutions.

Strategic acquisitions play a crucial role in Cadence's expansion strategy, accelerating its ability to enhance capabilities and broaden market reach. The acquisition of BETA CAE Systems in March 2024 expanded its multiphysics system analysis offerings. The pending acquisition of Secure-IC in January 2025 will enhance its security solutions.

Cadence is expanding its workforce in India to support AI and GPU development. This expansion aims for an 8-10% compounded annual growth rate (CAGR) in headcount. The company is investing in key regions to support its global growth objectives and meet the increasing demand for its products and services.

The initiatives are driven by the increasing demand for specialized AI hardware, faster design cycles, and the need to diversify revenue streams. Cadence's expansion strategy is closely aligned with industry trends, such as the growing adoption of AI and the increasing complexity of semiconductor designs. These factors drive the company's growth.

Cadence's acquisition of BETA CAE Systems in March 2024 significantly expanded its multiphysics system analysis offerings. The acquisition of Invecas in January 2024 bolstered design engineering and system analysis capabilities, aligning with the Intelligent System Design strategy. The pending acquisition of Secure-IC in January 2025 enhances security solutions.

- Acquisition of BETA CAE Systems: Expanded multiphysics offerings, entry into structural analysis (automotive, aerospace).

- Acquisition of Invecas: Enhanced design engineering and system analysis capabilities, expanded presence in automotive, aerospace, industrial, and healthcare.

- Acquisition of Secure-IC (expected to close mid-2025): Enhanced security solutions for complex system-on-chips and silicon solutions.

- Acquisition of Arm's Artisan foundation IP business (April 2025): Strengthens IP portfolio and presence in the SoC design ecosystem.

Cadence's expansion plans are further supported by its commitment to innovation and its ability to adapt to changing market dynamics. This is evident in its recent acquisitions and product launches. For more insights into their strategic approach, consider reviewing the Marketing Strategy of Cadence Design.

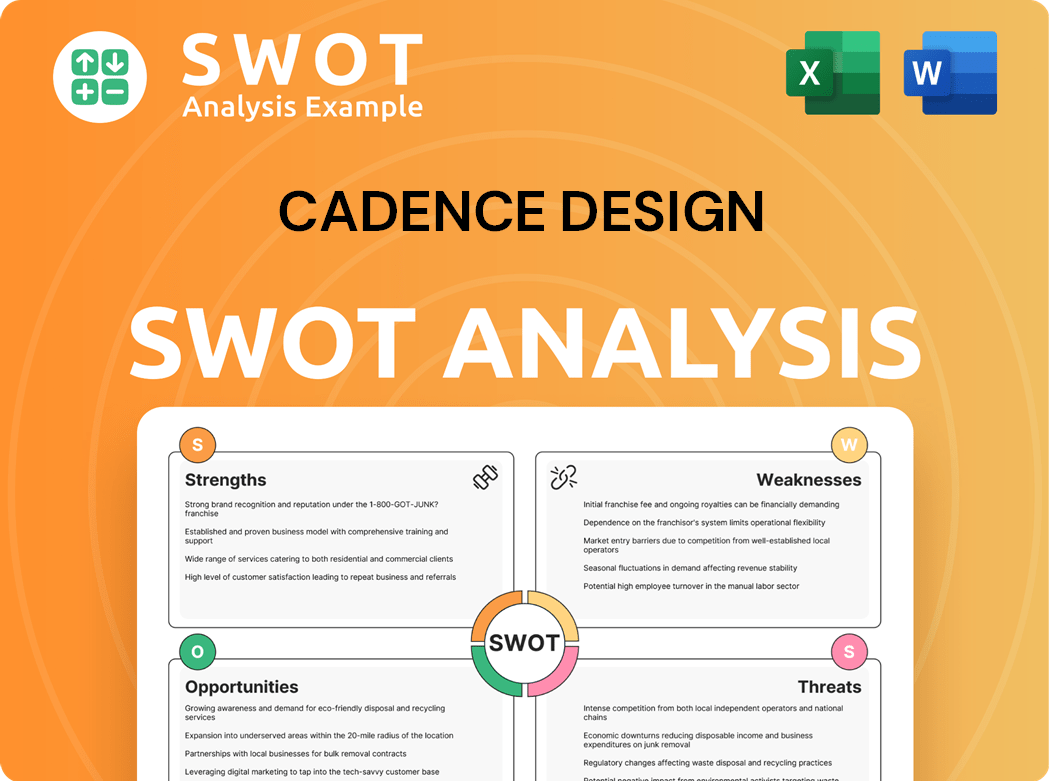

Cadence Design SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Cadence Design Invest in Innovation?

Cadence Design Systems' growth strategy is deeply rooted in its commitment to innovation and technological advancement, particularly within the Electronic Design Automation (EDA) sector. The company focuses on delivering sophisticated solutions that address the complex needs of its customers in the semiconductor and electronics industries. Their ability to anticipate and meet these evolving demands is crucial for maintaining a competitive edge in the market.

The company's approach involves a blend of cutting-edge software and hardware offerings, designed to enhance design efficiency and performance. By integrating advanced technologies like AI, Cadence aims to provide tools that not only streamline the design process but also improve the quality and reliability of the end products. This strategic focus ensures that Cadence remains at the forefront of the EDA industry, driving innovation and supporting the evolving needs of its diverse customer base.

Cadence Design Systems' innovation strategy centers on AI-driven solutions and advanced design platforms. This focus is crucial for tackling complex challenges in the EDA sector, such as optimizing chiplet integration and reducing power consumption. The company's substantial investment in research and development (R&D) underscores its commitment to technological advancement, which is critical in the fast-paced EDA industry.

Cadence invested $1.55 billion in R&D in 2024. This represents 33.01% of its trailing twelve-month (TTM) revenue.

Cadence integrates AI into its EDA tools, including Cadence Cerebrus for generative AI in IC design and Verisium for multi-run verification. Allegro X AI for PCB design enhances productivity and design quality.

Cadence Cerebrus alone added 50 new customers in Q1 2025. This highlights the growing adoption of AI in EDA.

The Cadence Millennium Enterprise Multiphysics Platform (Millennium M1) was unveiled in February 2024. The Palladium Z3 Emulation and Protium X3 FPGA Prototyping systems launched in April 2024.

Cadence has expanded its partnership with NVIDIA, particularly around the Grace Blackwell architecture. They also collaborate with Intel on the 18A node.

Cadence announced new IP optimized for Intel's 18A and 18A-P process technologies in late April 2025. This ensures compatibility for AI, HPC, and mobility applications.

Cadence's innovation strategy involves significant investments in AI, hardware, and strategic partnerships. These advancements are crucial for maintaining a competitive edge in the EDA market and driving future growth. The company's focus on AI-driven solutions, such as Cadence Cerebrus, enhances design efficiency and performance, attracting top-tier customers. Their collaboration with industry leaders like NVIDIA and Intel further solidifies their position at the forefront of semiconductor innovation.

- AI Integration: Cadence Cerebrus for generative AI in IC design, Verisium for multi-run verification, and Allegro X AI for PCB design.

- Hardware Innovation: Launch of the Cadence Millennium Enterprise Multiphysics Platform (Millennium M1) and Palladium Z3 Emulation and Protium X3 FPGA Prototyping systems.

- Strategic Partnerships: Expanded collaborations with NVIDIA and Intel, focusing on advanced architectures and process technologies.

- IP Development: New IP optimized for Intel's 18A and 18A-P process technologies.

- Customer Adoption: Cadence Cerebrus added 50 new customers in Q1 2025.

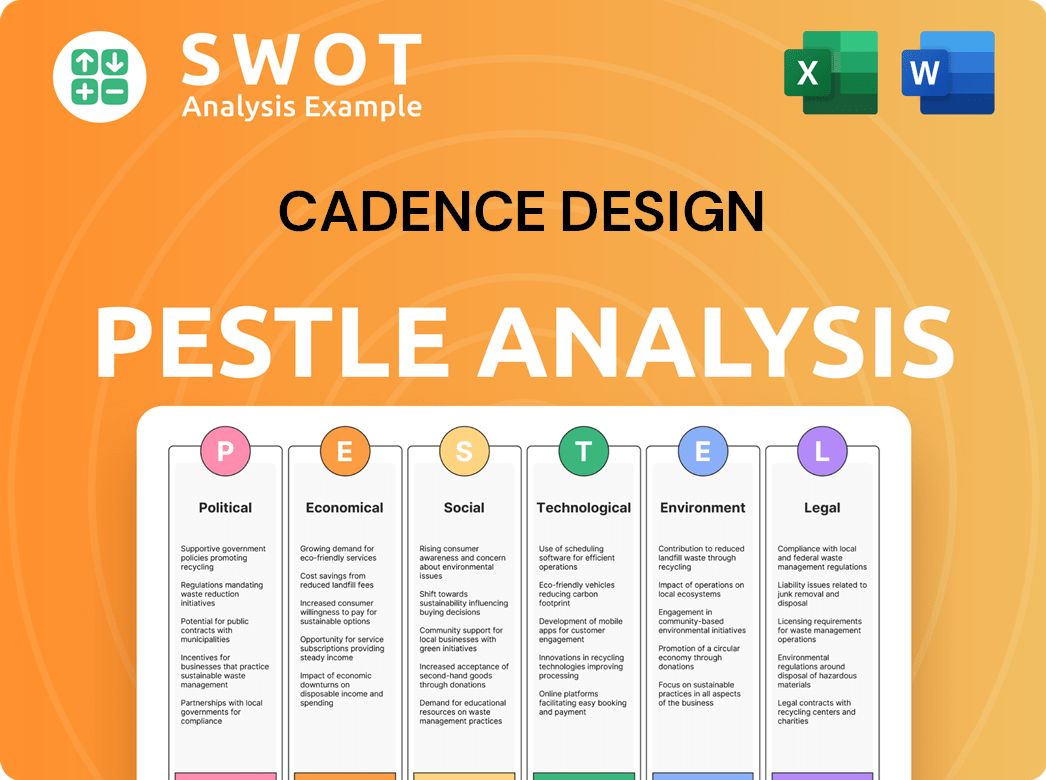

Cadence Design PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Cadence Design’s Growth Forecast?

The financial outlook for Cadence Design Systems is robust, driven by strong demand for its Electronic Design Automation (EDA) software and services, particularly in the AI and semiconductor sectors. Cadence has demonstrated consistent revenue growth, with a significant increase in its financial metrics. The company's strategic positioning in high-growth markets supports a positive trajectory for future expansion.

Cadence's financial performance reflects its strong position in the market and its ability to capitalize on industry trends. The company's commitment to innovation and strategic investments, including acquisitions, have contributed to its growth. This positive trend is further reinforced by its increasing backlog and strong recurring revenue streams.

Cadence Design Systems' revenue reached $4.641 billion for fiscal year 2024, marking a 13% increase from the previous year. Net income for 2024 was $1.06 billion, showing a modest increase. The company's financial health is further demonstrated by its substantial cash reserves and a significant increase in total assets.

For fiscal year 2024, Cadence Design Systems reported total revenue of $4.641 billion, a 13% increase compared to fiscal year 2023. This growth underscores the company's strong market position and the demand for its EDA software and services.

Net income for 2024 was $1.06 billion, a slight increase from $1.04 billion in 2023. The company's 3-year Net Income CAGR is 14.89%, reflecting consistent profitability. The gross profit margin was 86.05% in 2024, highlighting the profitability of its EDA and IP business model.

Cadence has raised its revenue and EPS outlook for fiscal year 2025. The company now projects revenue between $5.15 billion and $5.23 billion. Non-GAAP EPS for 2025 is expected to be between $6.73 and $6.83.

The company's Q1 2025 performance further reinforces this positive trajectory, with revenue reaching $1.242 billion, a 23% year-over-year jump from Q1 2024. Non-GAAP EPS increased by 34%.

As of December 31, 2024, Cadence held $2.64 billion in cash and cash equivalents, a significant increase from $1.01 billion at the end of 2023. Total assets grew to $8.97 billion in 2024 from $5.67 billion in 2023.

The company's backlog at the end of Q1 2025 stood at $6.4 billion, with $3.2 billion in current remaining performance obligations (cRPO) expected to convert into revenue within 12 months. In 2024, 83% of revenue came from software and services.

Cadence plans to use approximately 50% of its free cash flow for share repurchases in 2025, which will contribute to EPS growth. This strategy demonstrates confidence in the company's financial health and its ability to generate cash.

- The company's focus on share repurchases highlights its commitment to enhancing shareholder value.

- This financial strategy is supported by the company's strong cash position and robust free cash flow generation.

- Share repurchases are expected to positively impact earnings per share.

Cadence Design Systems demonstrates strong financial performance, and its future prospects are promising. The company's revenue growth, profitability, and strategic financial decisions position it well for continued success in the EDA software market. For a deeper understanding of the competitive landscape, consider exploring the Competitors Landscape of Cadence Design.

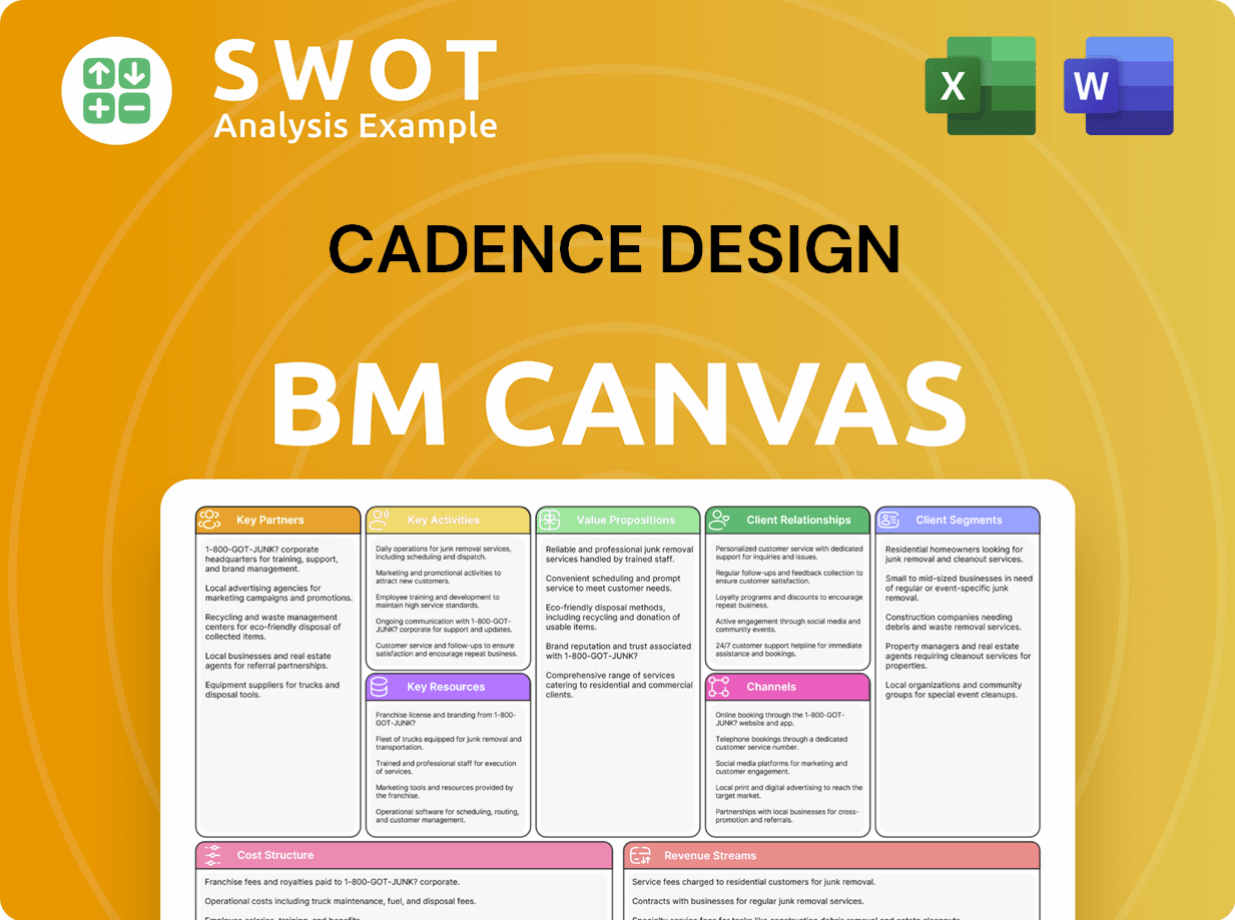

Cadence Design Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Cadence Design’s Growth?

While the future looks promising for Cadence Design Systems, several potential risks and obstacles could impact its trajectory. These challenges span geopolitical tensions, competitive pressures, operational complexities, and regulatory hurdles. Understanding these factors is crucial for assessing the company's long-term growth potential and making informed investment decisions.

The company's Growth Strategy is intertwined with its ability to navigate these risks effectively. The Electronic Design Automation (EDA) software market is dynamic, and Cadence Design Systems must continuously adapt to maintain its competitive edge. This chapter delves into the specific challenges the company faces and the strategies it employs to mitigate them.

The Market Analysis of Cadence Design Systems reveals a complex environment where success depends on managing various internal and external factors. From fluctuating market dynamics to geopolitical uncertainty, the company's ability to adapt will be critical for its Future Prospects.

Geopolitical tensions, particularly those involving China, pose a significant risk. The company's 2025 outlook anticipates flat revenue from China. Export control restrictions and geopolitical tensions have already caused a decline of over $100 million in revenue in 2024. Further escalation could lead to reduced market access.

The EDA sector is highly competitive, with Synopsys as a major rival. Maintaining a technological edge requires continuous and significant investment in research and development. While Cadence has increased its market share to 35.1% in 2024, the competition remains intense.

Operational risks include revenue recognition timing, particularly for hardware, IP, and certain software products. The sales cycle is often long. Dependency on a limited number of suppliers for hardware components also presents a risk. Dependence on key clients such as Intel is also a risk.

Evolving governmental export and import controls, along with new regulations like the EU AI Act, could impose significant compliance costs. Cybersecurity risks are also present, as the company is vulnerable to cyberattacks. Fluctuations in foreign exchange rates and significant cash holdings outside the U.S. could also impact financial condition.

A significant portion of Cadence's revenue is derived from a few key clients. A reduction in business from these major clients, such as Intel, could severely affect the company's financial stability and growth prospects. This concentration of revenue creates a vulnerability.

Cadence is exposed to cybersecurity risks, including cyberattacks that could compromise IT systems. Such attacks could lead to the theft of confidential information, operational disruptions, and reputational damage, potentially resulting in significant financial harm. The company must continually enhance its cybersecurity measures.

Cadence employs several strategies to mitigate these risks. These include enhancing its competitive position through increased R&D investment. Implementing risk-based policies is crucial to comply with trade restrictions. Strengthening cybersecurity measures is also a priority. Managing foreign exchange risks through hedging strategies is another key aspect.

Cadence has set an $8.5 billion revenue target for 2025. The achievement of this target hinges on the stability of trade policies and the company's ability to execute its strategic initiatives. The company's outlook is influenced by the evolving geopolitical and economic conditions.

For a deeper dive into the company's financial performance and ownership structure, consider reviewing the insights provided in Owners & Shareholders of Cadence Design.

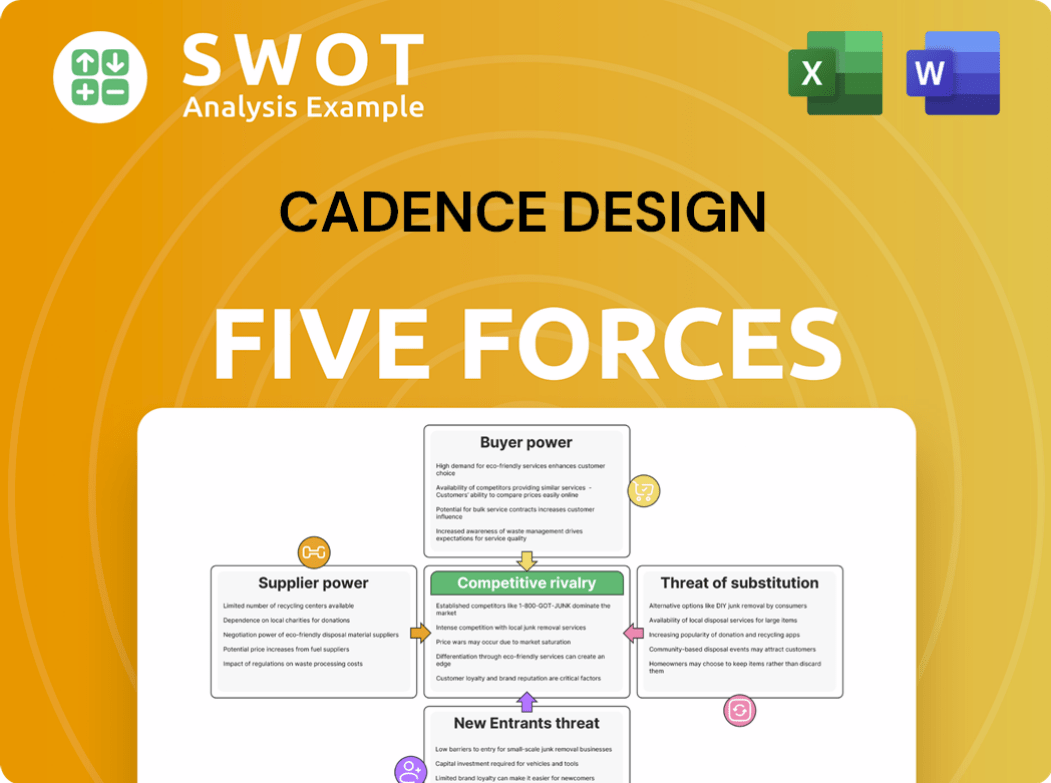

Cadence Design Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Cadence Design Company?

- What is Competitive Landscape of Cadence Design Company?

- How Does Cadence Design Company Work?

- What is Sales and Marketing Strategy of Cadence Design Company?

- What is Brief History of Cadence Design Company?

- Who Owns Cadence Design Company?

- What is Customer Demographics and Target Market of Cadence Design Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.