Cadence Design Bundle

How Does Cadence Design Systems Drive the Tech Revolution?

In an era defined by relentless technological advancement, Cadence Design Systems stands at the forefront, powering the creation of the sophisticated electronics that shape our world. With a stellar track record, including a 13% revenue increase in 2024 and a remarkable 23% surge in Q1 2025, Cadence is not just participating in the evolution; it's leading it. Its Cadence Design SWOT Analysis reveals the company's strategic position in the market.

This deep dive into Cadence's operations will illuminate how its Cadence EDA tools and Cadence software are indispensable for semiconductor design and beyond. We'll explore its vital role in the design of integrated circuits and systems-on-chips, examining its revenue streams, competitive advantages, and future prospects. Whether you're an investor, a tech enthusiast, or simply curious about the engine behind modern electronics, understanding Cadence Design Systems is key.

What Are the Key Operations Driving Cadence Design’s Success?

Cadence Design Systems provides essential electronic design automation (EDA) software, hardware, and IP solutions. These tools are crucial for designing and verifying complex electronic systems. Their offerings serve a specialized market, primarily semiconductor and electronics systems companies, as well as internet service and infrastructure companies.

The company's core products cover digital IC design and signoff, functional verification, custom IC design and simulation, IP, and system design and analysis. Cadence focuses on continuous technology development, investing heavily in research and development to stay competitive. This includes a robust sales and distribution network to reach a global customer base and strategic partnerships to enhance its offerings.

Cadence's 'Intelligent System Design' strategy, which integrates AI into its EDA tools, sets it apart. This approach helps customers tackle complex challenges like optimizing chiplet integration and reducing power consumption. The Cerebrus Intelligent Chip Explorer, an AI-driven tool, has significantly contributed to growth in its core EDA segment. Cadence also maintains a strong market position in analog design, with over 80% market share for more than two decades.

Cadence offers a comprehensive suite of Electronic design automation (EDA) tools. These tools are used for digital IC design, functional verification, and custom IC design. The company also provides IP solutions and system design and analysis tools.

Cadence primarily serves semiconductor and electronics systems companies. They also cater to internet service and infrastructure companies and other tech firms. These customers use Cadence EDA tools for various applications, including communications, consumer devices, and automotive systems.

Cadence focuses on continuous technology development and innovation through R&D investments. They have a robust sales and distribution network and strategic partnerships. The company's supply chain management, particularly for hardware components, is also a key operational strength.

Cadence helps customers reduce errors, accelerate validation speeds, and lower engineering costs. It enables quicker time-to-market for complex electronic designs. Their AI-driven tools, like Cerebrus, provide significant advantages in chip design.

Cadence's 'Intelligent System Design' strategy, using AI in EDA tools, is a key differentiator. This approach helps customers address complex design challenges. The company's strong market position in analog design, with over 80% market share, adds to the stickiness of its EDA portfolio.

- AI-driven tools for chip design optimization.

- Significant market share in analog design.

- Focus on reducing power consumption and accelerating time-to-market.

- Strategic partnerships to enhance offerings.

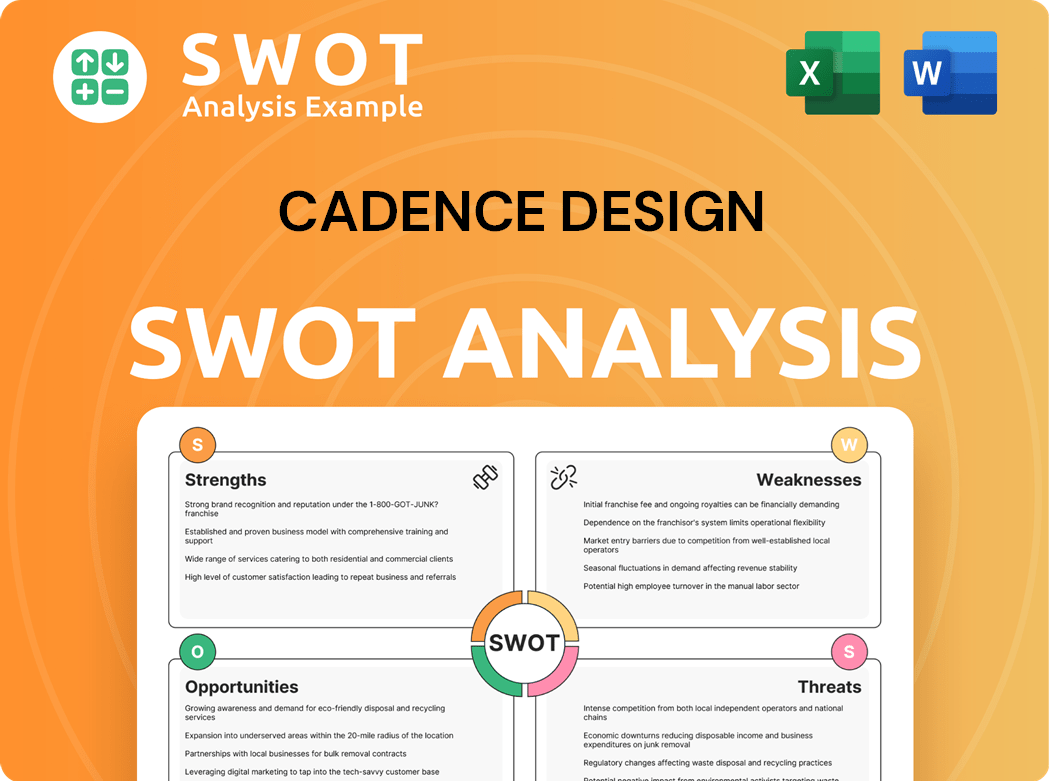

Cadence Design SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Cadence Design Make Money?

Cadence Design Systems generates revenue through multiple channels, primarily focusing on software and IP licensing, hardware sales, and services. This diversified approach allows the company to maintain a robust financial structure. A significant portion of its revenue is recurring, ensuring financial stability.

The company's revenue streams are categorized into Core EDA, IP, and System Design and Analysis. These segments contribute differently to the overall revenue, reflecting the company's diverse offerings in the electronic design automation (EDA) market. Cadence also earns royalties from IP usage, adding to its revenue base.

In fiscal year 2024, Cadence reported a total revenue of $4.641 billion. The company's financial performance shows strong growth, particularly in key areas such as Semiconductor IP and System Design and Analysis, as indicated by the Q1 2025 results.

Cadence Design Systems employs various monetization strategies, including tiered pricing for its software and bundled services. This approach allows the company to cater to different customer needs and complexity levels. The company's substantial backlog and current remaining performance obligations (cRPO) indicate strong future revenue potential.

- Cadence's Core EDA segment contributed 71% of the revenue in fiscal 2024.

- IP contributed 13%, and System Design and Analysis contributed 16% in fiscal 2024.

- In Q1 2025, Semiconductor IP segment soared 40% year-over-year.

- System Design and Analysis revenue surged over 50% in Q1 2025.

- Core EDA revenue increased by 16% year-over-year in Q1 2025.

- The company's quarter-end backlog was $6.4 billion at the end of Q1 2025.

- cRPO was $3.2 billion, expected to convert into revenue within 12 months.

- The Americas accounted for 43% of revenues in fiscal year 2023.

- APAC market accounted for approximately 41% of revenues in fiscal year 2023.

- EMEA accounted for about 16% of revenues in fiscal year 2023.

- Revenue from the United States increased by 27% in fiscal 2024.

- Revenue from China decreased by 16% in fiscal 2024.

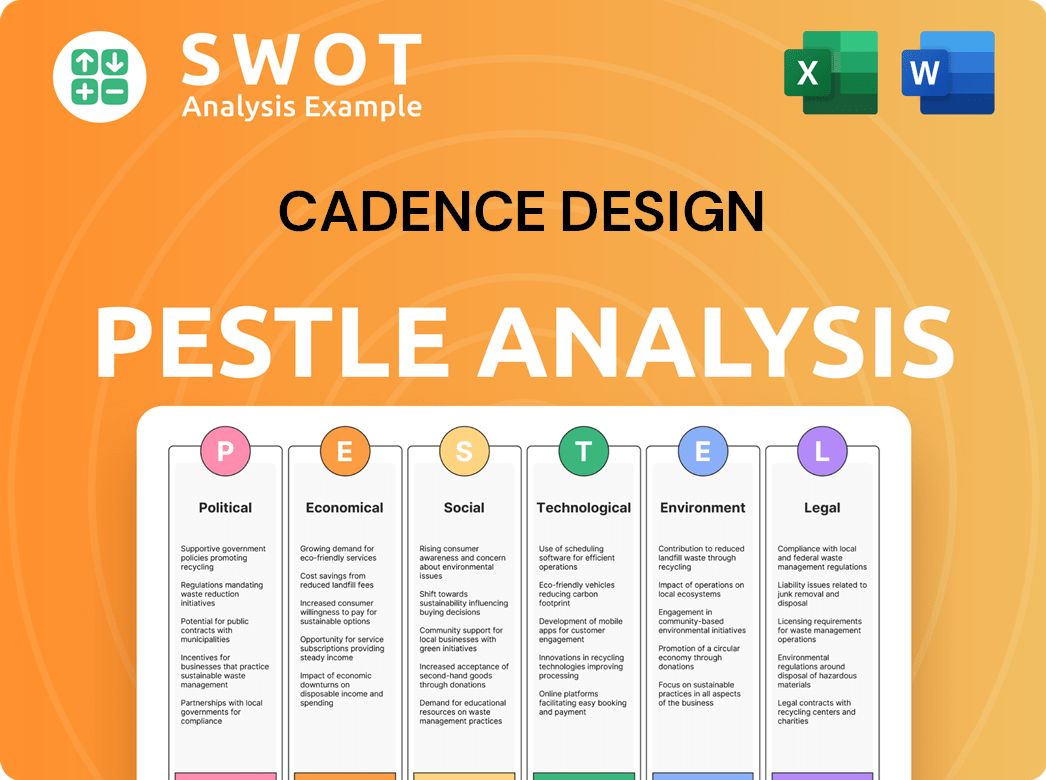

Cadence Design PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Cadence Design’s Business Model?

Cadence Design Systems, a prominent player in the electronic design automation (EDA) sector, has a rich history marked by strategic milestones and continuous adaptation. Founded in 1988 through the merger of SDA Systems and ECAD, the company quickly established itself as a leading provider of EDA tools. Its evolution reflects a commitment to innovation and a strategic response to market dynamics.

Cadence's journey is characterized by significant product launches and strategic moves. The introduction of tools like the Cerebrus Intelligent Chip Explorer, an AI-driven chip design automation tool, has been pivotal in driving growth in its core electronic design automation segment. Cadence also continually expands its IP portfolio, particularly in areas like AI and HPC protocols, demonstrating its focus on cutting-edge technologies. Strategic partnerships and acquisitions have further solidified its market position and expanded its capabilities.

The company's competitive edge is bolstered by its strong market position, extensive experience, and high barriers to entry within the EDA industry. Cadence's comprehensive product portfolio, offering end-to-end solutions, and its ability to adapt to emerging trends, such as AI and chiplet-based systems, further contribute to its sustained success. This includes its software-centric business model and its commitment to innovation in the face of challenges.

Cadence Design Systems was formed in 1988 through a merger. The company has consistently launched innovative products, including the Cerebrus Intelligent Chip Explorer. Cadence has expanded its IP portfolio, especially in AI and HPC protocols.

Cadence has formed strategic partnerships with industry leaders such as NVIDIA and Intel Foundry. The company has made strategic acquisitions, including Invecas and BETA CAE. Cadence adapts to market challenges by diversifying revenue streams and tailoring its EDA tools to comply with regulations.

Cadence holds a strong market position alongside competitors like Synopsys. The company has a dominant market share in analog design. High barriers to entry, including substantial R&D investments, sustain its business model.

Geopolitical tensions and export restrictions have impacted Cadence, leading to a decrease in revenue from China. The company anticipates flat revenue from China in 2025. Cadence responds by diversifying revenue streams and developing alternative technologies.

Cadence's competitive advantages are significant, stemming from its strong market position and extensive experience. Its dominance in analog design, with over 80% market share for more than two decades, creates significant customer stickiness. High barriers to entry, including substantial R&D investments (Cadence's R&D expenses were $843 million in 2023), and the need for deep technical expertise, further sustain its business model. For those interested in the financial aspects, a deeper dive into the company's ownership can be found in this article: Owners & Shareholders of Cadence Design.

- Strong market position in the EDA industry.

- Extensive experience and customer stickiness in analog design.

- High barriers to entry due to R&D investments and technical expertise.

- Comprehensive product portfolio offering end-to-end solutions.

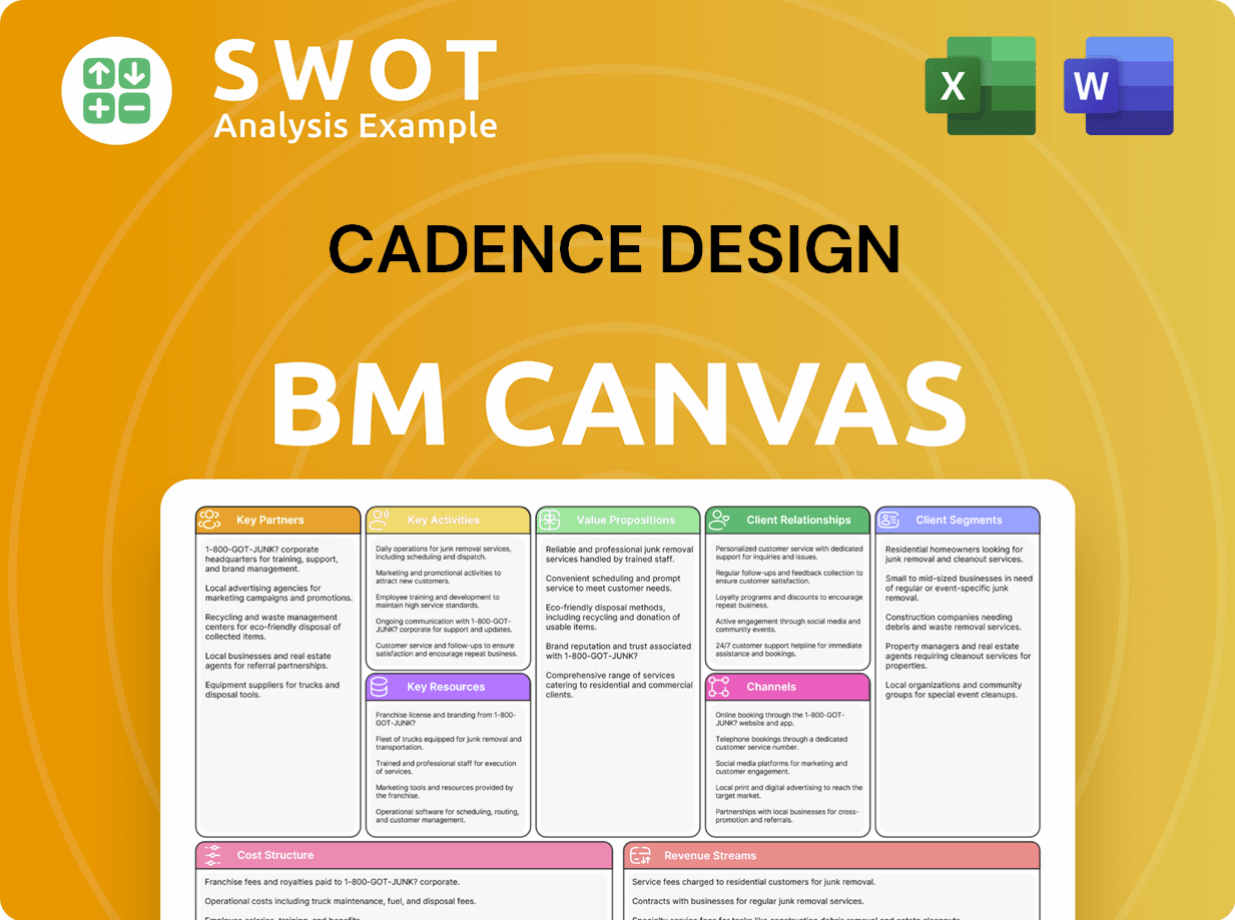

Cadence Design Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Cadence Design Positioning Itself for Continued Success?

Cadence Design Systems is a significant player in the electronic design automation (EDA) market. As the second-largest EDA vendor globally, trailing only Synopsys, Cadence holds a substantial market share and maintains strong customer loyalty due to the critical nature of its EDA tools and high switching costs. Cadence's revenue and outlook are closely tied to the semiconductor and electronics industries, making it sensitive to broader economic and geopolitical factors.

The company faces various risks, including market uncertainties and geopolitical tensions, particularly concerning China. Operational risks, such as revenue recognition timing and reliance on suppliers, also pose challenges. However, Cadence is strategically positioned to leverage its Intelligent System Design strategy and capitalize on the AI revolution and semiconductor innovation, aiming for sustained growth and profitability.

Cadence Design Systems is a leading vendor in the electronic design automation (EDA) market. In 2022, Cadence held a market share of 35.4% in the global EDA tool market, solidifying its position as a major player. The company's customer base spans various sectors and geographies, mitigating concentration risks.

Cadence faces market risks tied to global economic conditions and geopolitical tensions, especially regarding China. Operational risks include revenue recognition and reliance on suppliers. Emerging risks involve AI development and cybersecurity. Revenue from China decreased by 16% in fiscal year 2024, and flat revenue is anticipated for 2025.

Cadence is focused on enhancing its competitive position through increased R&D and strategic acquisitions, such as the 2025 acquisition of BETA CAE. The company's future is driven by its Intelligent System Design strategy and AI's transformative potential. Cadence raised its full-year 2025 revenue guidance to a range of $5.15 billion to $5.23 billion.

Cadence expects non-GAAP diluted net income per share to be between $6.73 and $6.83 for fiscal year 2025. The company anticipates an increase in up-front revenue in 2025. Cadence plans to maintain a robust cash position to support ongoing operations and strategic investments. For more insights, you can check the Competitors Landscape of Cadence Design.

Cadence is strategically focused on enhancing its competitive position through increased R&D investments to meet evolving technological requirements. The company is also pursuing strategic acquisitions to broaden its product offerings and market reach, exemplified by the BETA CAE acquisition in 2025.

- R&D Investments: Cadence continues to invest heavily in research and development to stay at the forefront of innovation in EDA tools and semiconductor design.

- Strategic Acquisitions: Acquisitions are a key part of Cadence's growth strategy, allowing it to integrate new technologies and expand its portfolio.

- Intelligent System Design: Cadence is leveraging its Intelligent System Design strategy to capitalize on the convergence of hardware and software, driven by AI and machine learning.

- AI and Semiconductor Innovation: Cadence is at the center of cutting-edge semiconductor innovation, poised to benefit from the AI revolution and its impact on chip design.

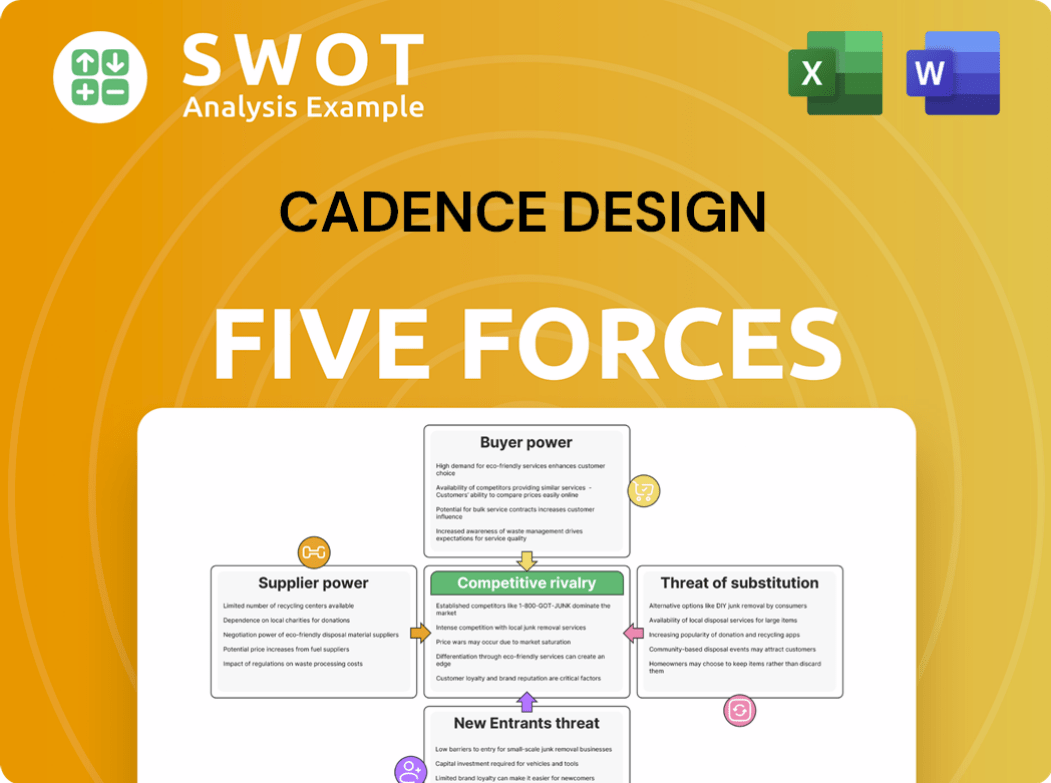

Cadence Design Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Cadence Design Company?

- What is Competitive Landscape of Cadence Design Company?

- What is Growth Strategy and Future Prospects of Cadence Design Company?

- What is Sales and Marketing Strategy of Cadence Design Company?

- What is Brief History of Cadence Design Company?

- Who Owns Cadence Design Company?

- What is Customer Demographics and Target Market of Cadence Design Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.