Cadence Design Bundle

Who Really Calls the Shots at Cadence Design Systems?

Understanding the ownership of a company is paramount for investors and strategists alike, as it directly impacts its trajectory. Cadence Design Systems, a titan in the electronic design automation (EDA) industry, has a fascinating ownership story. From its inception in 1988 through the merger of SDA Systems and ECAD, Cadence has consistently been at the forefront of innovation.

This exploration into Cadence Design SWOT Analysis will reveal the evolution of the Cadence company's ownership, from its founders to the current landscape. With a market capitalization of approximately $83.9 billion as of June 2025, understanding the Cadence ownership structure is crucial for anyone invested in the Cadence Design Systems story, including its Cadence stock performance and the influence of its Cadence CEO and key stakeholders.

Who Founded Cadence Design?

The story of Cadence Design Systems begins in 1988, born from a strategic merger. This union brought together two key players in the Electronic Design Automation (EDA) sector: SDA Systems and ECAD. This merger was a pivotal moment, setting the stage for Cadence to become a dominant force in the industry.

SDA Systems, initially named Solomon Design Automation, was founded in 1983. ECAD, Inc. was co-founded in 1982. The merger was a stock swap valued at $72 million, allowing SDA to go public through ECAD's existing public status. This consolidation was a strategic move to create a powerful entity in the growing EDA market.

The formation of Cadence Design Systems marked a significant shift in the EDA landscape. The merger of SDA Systems and ECAD created a company with a broader range of capabilities. This strategic consolidation aimed to establish a leading position in the nascent EDA industry.

SDA Systems, later becoming part of Cadence Design Systems, was founded in 1983 in San Jose, California. The founders included James Solomon, Richard Newton, and Alberto Sangiovanni-Vincentelli. Solomon's background at National Semiconductor influenced the company's early direction.

ECAD, Inc. was established in 1982 by Glen Antle, Paul Huang, and Ping Chao. ECAD specialized in physical verification software. Their design rule checker, Dracula, gained widespread industry acceptance.

The merger of SDA and ECAD in February 1988 was a pivotal event. This merger, valued at $72 million, enabled SDA to go public. Joseph Costello became the first CEO of the newly formed Cadence Design Systems.

James Solomon initiated SDA with funding from venture capitalists and corporate entities. These corporate backers gained access to SDA's software. This early model of strategic client partnerships influenced initial ownership.

Joseph Costello, previously SDA's COO, was appointed as the first Cadence CEO. Glen Antle, initially slated for a leadership role, did not remain with the company post-merger. This transition marked a new phase for the company.

The founders' vision was to develop essential electronic design automation tools. This strategic consolidation aimed to create a dominant player in the then-nascent EDA industry. This vision drove the company's early development.

Understanding the history of Cadence Design Systems provides insight into its current market position. The company's early focus on EDA tools and strategic acquisitions has shaped its growth. For more information on the competitive landscape, you can read about the Competitors Landscape of Cadence Design.

The merger of SDA Systems and ECAD in 1988 was a defining moment for Cadence Design Systems.

- SDA Systems was founded in 1983 by James Solomon, Richard Newton, and Alberto Sangiovanni-Vincentelli.

- ECAD, Inc. was co-founded in 1982 by Glen Antle, Paul Huang, and Ping Chao.

- The merger was valued at $72 million, enabling SDA to go public.

- Joseph Costello became the first CEO of the newly formed Cadence.

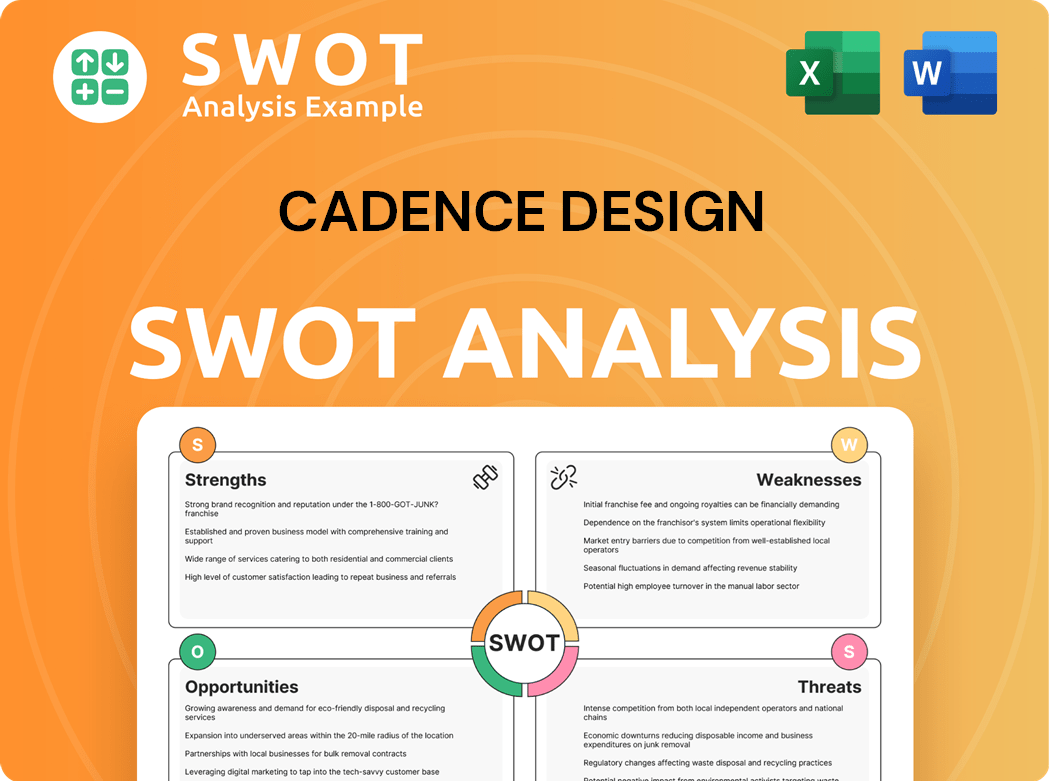

Cadence Design SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Cadence Design’s Ownership Changed Over Time?

The ownership structure of Cadence Design Systems has evolved significantly since its inception. Following the 1988 merger of SDA Systems and ECAD, with ECAD already being publicly traded, Cadence became a public company. This marked the beginning of its journey as a publicly traded entity, setting the stage for future ownership dynamics. The company's growth strategy, as detailed in Growth Strategy of Cadence Design, has been significantly impacted by strategic acquisitions.

Cadence's expansion through acquisitions played a crucial role in shaping its ownership landscape. Key acquisitions in the early years included Gateway Design Automation in 1989 for $72 million, which brought in Verilog, and Valid Logic Systems in 1991 for approximately $200 million. These strategic moves not only broadened its product portfolio but also solidified its position as an industry leader, influencing the distribution of its stock among various stakeholders.

| Key Acquisition | Year | Impact on Cadence |

|---|---|---|

| Gateway Design Automation | 1989 | Expanded product portfolio with Verilog. |

| Valid Logic Systems | 1991 | Made Cadence the EDA revenue leader. |

| Numerous others | 1990s onward | Expanded into system-level and PCB design. |

As of February 2025, Cadence Design Systems (NASDAQ: CDNS) is predominantly owned by institutional shareholders, holding approximately 84.23% of the company's shares. Major institutional investors include BlackRock, Inc. (holding 11% of shares outstanding), Vanguard Group Inc. (9.4%), and State Street Corp (4.3%). Individual insiders own a smaller percentage, approximately 6.23%, while retail investors account for about 9.54% of the ownership. The company had 271,973,000 shares outstanding as of June 2025. This ownership structure reflects the increasing interest from large investment funds in the technology sector, particularly in companies integral to the semiconductor and AI industries.

Cadence Design Systems is primarily owned by institutional investors, with a significant portion held by major firms like BlackRock and Vanguard. Individual insiders and retail investors hold smaller percentages of the company's stock.

- Institutional ownership accounts for approximately 84.23%.

- BlackRock, Inc. holds 11% of outstanding shares.

- The company had 271,973,000 shares outstanding as of June 2025.

- The ownership structure reflects interest in the semiconductor and AI industries.

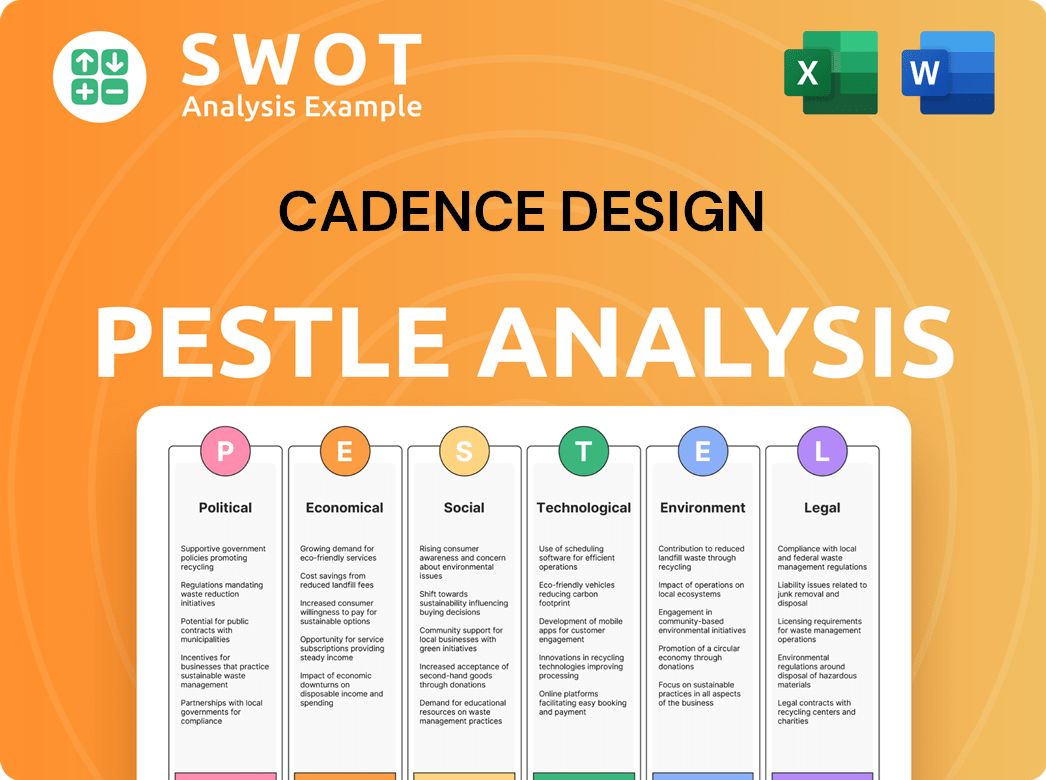

Cadence Design PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Cadence Design’s Board?

The current board of directors at Cadence Design Systems is pivotal in the company's governance and strategic direction. As of May 2025, the board consists of ten directors, elected at the Annual Meeting of Stockholders to serve until the 2026 Annual Meeting. Anirudh Devgan serves as the President and CEO of Cadence. In December 2024, Moshe Gavrielov joined the board, effective January 1, 2025, bringing significant industry expertise.

The board's composition reflects a blend of industry veterans and financial experts, likely influenced by the significant institutional ownership of the company. The presence of individuals with strong financial and industry backgrounds suggests alignment with the interests of major institutional investors, ensuring robust oversight and strategic decision-making for the Cadence company.

| Board Member | Title | Year Joined Board |

|---|---|---|

| Anirudh Devgan | President and CEO | N/A |

| Moshe Gavrielov | Director | 2025 |

| Other Directors | Directors | N/A |

Cadence operates with a voting structure where stockholders approve executive compensation and the selection of independent auditors. The substantial institutional ownership, approximately 87% as of January 2025, indicates that major institutional investors collectively hold considerable voting power. Shareholder engagement is evident, as a proposal concerning 'golden parachutes' did not pass in May 2024, highlighting the importance of shareholder influence on governance. For insights into the company's approach to reaching its target market, check out this article on the Marketing Strategy of Cadence Design.

The board of directors plays a crucial role in the governance of Cadence Design Systems.

- The board consists of ten directors as of May 2025.

- Anirudh Devgan is the President and CEO of Cadence stock.

- Moshe Gavrielov joined the board in January 2025.

- Institutional investors hold approximately 87% of the shares.

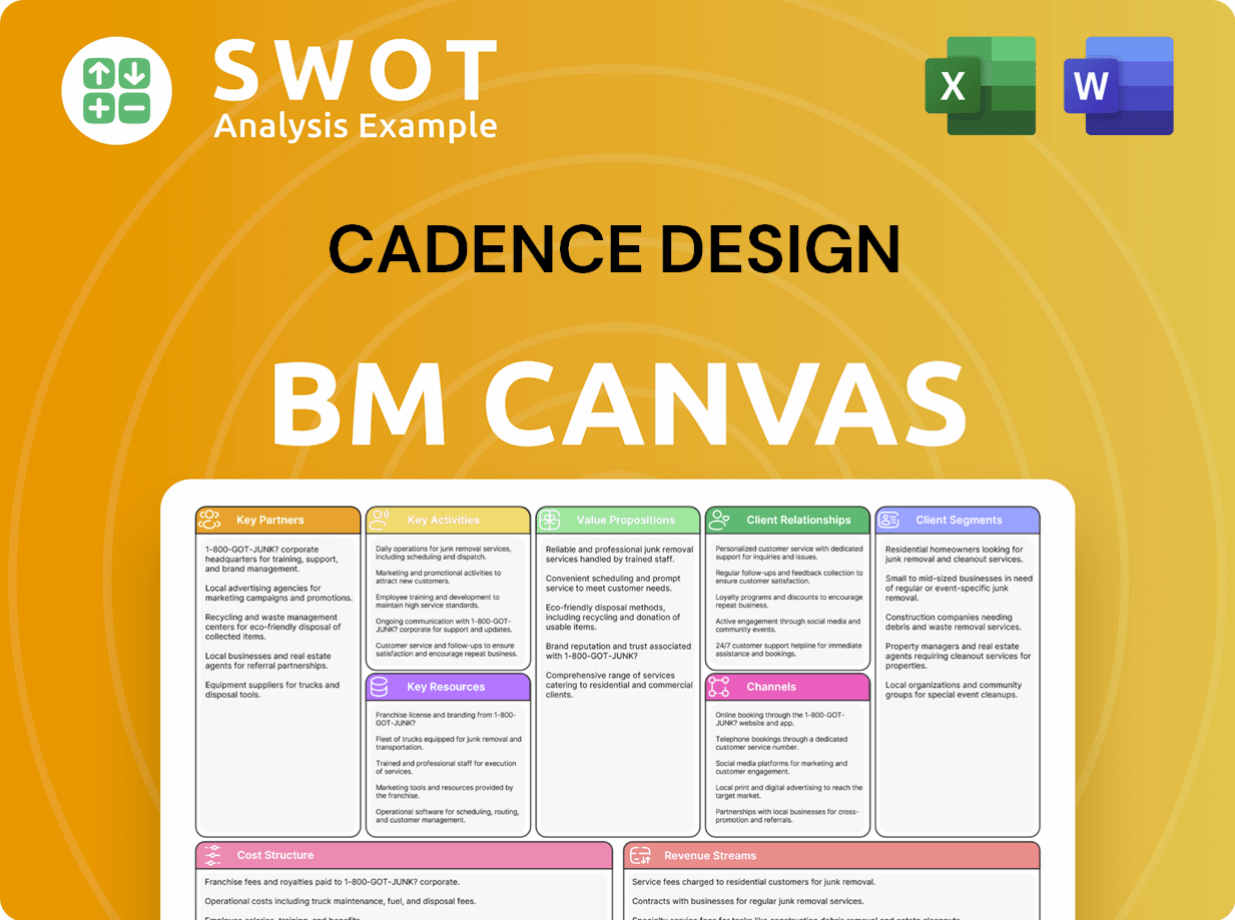

Cadence Design Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Cadence Design’s Ownership Landscape?

Over the past few years, Cadence Design Systems has shown strong growth, particularly in areas driven by AI and semiconductor innovation. For 2024, the company reported a total revenue of $4.641 billion, a 13.5% increase from the previous year. This positive trend continued into early 2025, with revenue reaching $1.242 billion in the first quarter, marking a 23% year-over-year increase. The company projects that its full-year 2025 revenue will be between $5.15 billion and $5.23 billion, reflecting strong demand in core segments.

Cadence's financial strategy includes significant capital management activities. In 2024, the company repurchased approximately $550 million of its common stock. This commitment to returning value to shareholders continued into 2025, with $350 million used for share repurchases in the first quarter alone. The board's authorization of an additional $1.5 billion for share repurchases in May 2025 further emphasizes this strategy. The non-GAAP EPS for fiscal year 2025 is projected to be between $6.73 and $6.83, a significant increase from $5.97 in 2024.

| Metric | 2024 | Q1 2025 | Projected FY 2025 |

|---|---|---|---|

| Revenue | $4.641 billion | $1.242 billion | $5.15 - $5.23 billion |

| Semiconductor IP Revenue Growth | 40% | ||

| System Design and Analysis Revenue Growth | Over 50% | ||

| Non-GAAP EPS | $5.97 | $6.73 - $6.83 |

The ownership structure of Cadence Design Systems reflects a trend of increasing institutional interest. As of January 2025, institutions owned 87% of the company. This high level of institutional ownership underscores the importance of Cadence in the AI and semiconductor sectors. The company's strategic focus on AI-driven solutions and acquisitions, such as BETA CAE Systems in June 2024 and Secure-IC in January 2025, supports its growth and market position. Furthermore, leadership changes, like Neil Zaman transitioning to a Senior Advisor role and Paul Scannell becoming Senior Vice President of Worldwide Field Operations, along with the appointment of former Cadence CEO Lip-Bu Tan as Intel's CEO, highlight the company's influence in the industry.

Cadence Design Systems has demonstrated strong financial performance, with significant revenue growth and a positive outlook for 2025. The company's strategic focus on AI and semiconductor solutions has contributed to its market position and investor interest.

Leadership transitions, including the appointment of Paul Scannell and the previous CEO's move to Intel, reflect the company's influence in the technology sector. These changes highlight the talent within Cadence and its impact on the industry.

Institutional ownership of Cadence Design Systems is high, with 87% held by institutions as of January 2025. This indicates strong confidence from major investors in the company's future prospects and its role in the AI and semiconductor industries.

Cadence continues to expand its offerings through strategic acquisitions, such as BETA CAE Systems and Secure-IC. These moves, along with its focus on AI-driven solutions, enhance its market reach and product portfolio, driving growth.

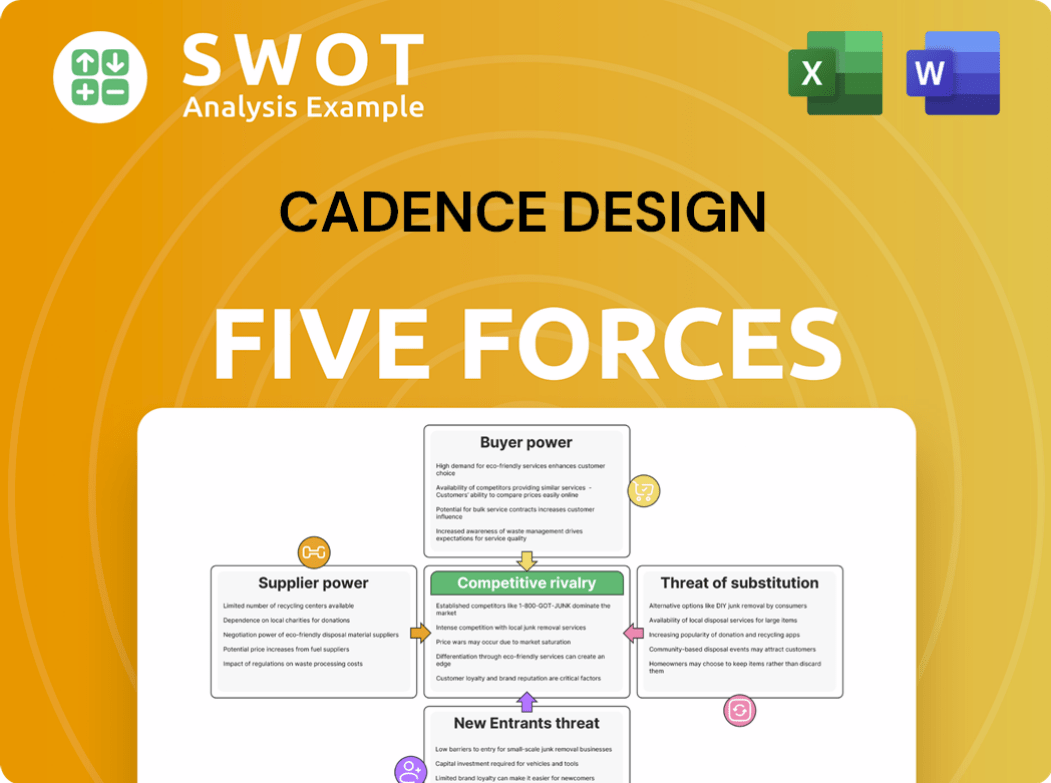

Cadence Design Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Cadence Design Company?

- What is Competitive Landscape of Cadence Design Company?

- What is Growth Strategy and Future Prospects of Cadence Design Company?

- How Does Cadence Design Company Work?

- What is Sales and Marketing Strategy of Cadence Design Company?

- What is Brief History of Cadence Design Company?

- What is Customer Demographics and Target Market of Cadence Design Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.