CareCloud Bundle

What's the Story Behind CareCloud's Rise in Healthcare Tech?

CareCloud, a pivotal player in the CareCloud SWOT Analysis, has revolutionized the healthcare technology sector with its innovative cloud-based platform. Initially known as Medical Transcription Billing Corporation (MTBC) in 1999, the company set out to transform how medical practices manage their operations across the United States. This commitment has propelled CareCloud to the forefront of healthcare technology, reshaping operational and care delivery paradigms.

From its humble beginnings in New Jersey, focused on transcription and medical billing, CareCloud has evolved into a publicly traded entity. The company's journey highlights its adaptability and strategic vision in a rapidly changing market. Today, CareCloud serves a vast network of providers, demonstrating its significant impact on the healthcare landscape and its commitment to delivering advanced medical software solutions.

What is the CareCloud Founding Story?

The story of CareCloud begins in 1999, when Mahmud Haq established the company, initially known as Medical Transcription Billing Corporation (MTBC). Haq's inspiration came from the need to find a dependable and adaptable IT solution for medical practices, a need he recognized while searching for a solution for his wife's practice. MTBC's early operations focused on providing transcription and manual medical billing services, mainly to healthcare providers in New Jersey.

The initial business strategy involved using technology to simplify administrative tasks for medical practices. This aimed to improve patient care and outcomes. As the healthcare sector evolved, with the rise of electronic health records (EHR) and an increasing need for streamlined practice management solutions, CareCloud saw an opportunity to fill this gap. The company set out to offer a comprehensive, cloud-based platform to meet these new demands.

CareCloud's journey has been marked by strategic investments and a commitment to innovation in healthcare technology. The company's evolution reflects the changing needs of medical practices and the broader healthcare landscape.

CareCloud, originally MTBC, secured a Series B funding round in 2013, led by Tenaya Capital, which brought in $20 million. This, along with contributions from Intel Capital and Norwest Venture Partners, brought the total funding to $44 million at the time. In 2014, CareCloud also received a $25.5 million debt financing commitment from Hercules Technology Growth Capital. The company has raised a total of $159 million over 14 rounds from 14 institutional investors, including Intel, Tenaya Capital, and PNC.

- 1999: Mahmud Haq founds Medical Transcription Billing Corporation (MTBC).

- 2013: Series B funding round led by Tenaya Capital, raising $20 million.

- 2014: Receives $25.5 million in debt financing from Hercules Technology Growth Capital.

- Total funding of $159 million across 14 rounds.

The company's early focus on transcription and billing services evolved into a broader offering of cloud-based EHR and practice management solutions. This shift reflects CareCloud's response to the growing demand for integrated healthcare technology platforms. For more information on how CareCloud approaches the market, consider reading about the Marketing Strategy of CareCloud.

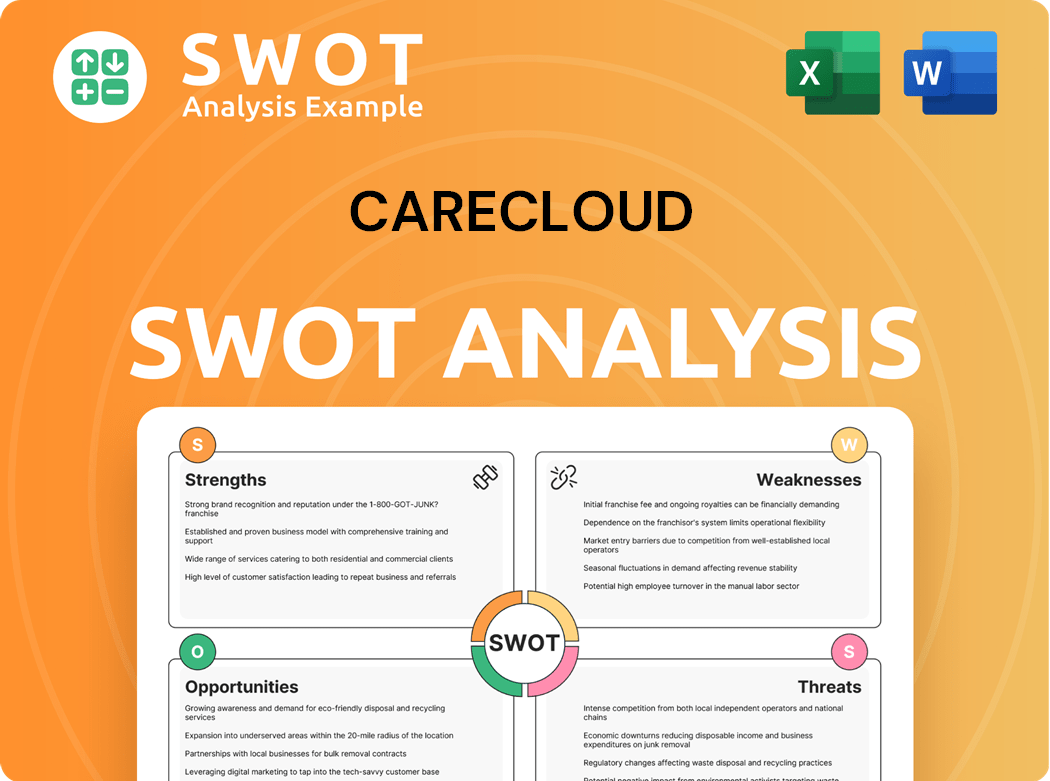

CareCloud SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of CareCloud?

The early growth and expansion of the company, formerly known as MTBC, marked a significant period of development. The company's journey began in 1999, evolving to offer a comprehensive suite of services. A pivotal moment came in 2012 when it rebranded as CareCloud, Inc., reflecting its focus on cloud-based solutions for healthcare.

In 2004, the company introduced a fully integrated service suite. This included a proprietary practice management platform and ONC-ACB, along with meaningful use stage 2 certified electronic health records software. Revenue cycle management services were added in 2015, enhancing the value proposition for medical practices.

By 2013, the cloud-based platform supported nearly 3,000 providers across 45 states. It managed over $2 billion in annualized accounts receivables for its clients. In Q1 2014, the company reported its 17th consecutive quarter of triple-digit revenue growth, adding over 170 new medical groups.

Ken Comée became CEO in 2015, succeeding founder Albert Santalo, who transitioned to chairman and chief strategy officer. The company expanded its team, reaching over 250 employees with offices in Miami and Boston by 2015.

The company's growth strategy emphasized innovation and customer satisfaction. It adapted its offerings to meet the evolving needs of medical practices. This focus helped shape its trajectory in the competitive healthcare technology market.

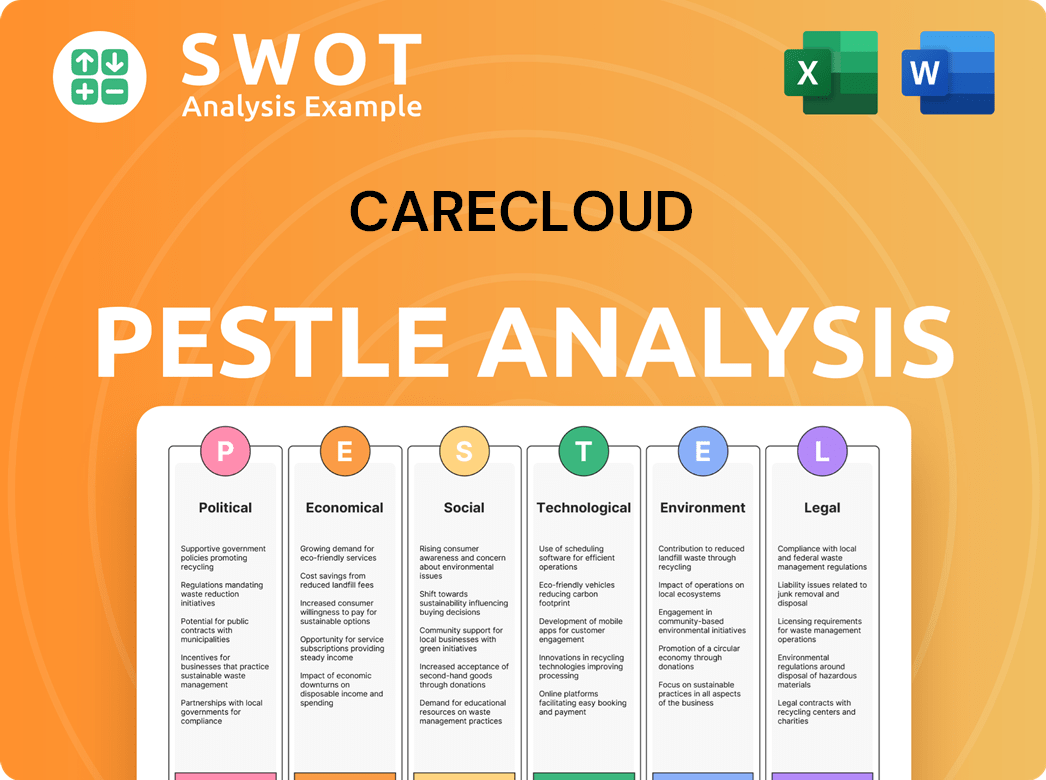

CareCloud PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in CareCloud history?

The CareCloud company has experienced several important milestones throughout its history, including significant shifts in focus and strategic acquisitions that have shaped its trajectory in the healthcare technology sector. These developments highlight the company's evolution and its adaptation to the changing demands of the industry.

| Year | Milestone |

|---|---|

| 2012 | Rebranding from MTBC to CareCloud, Inc., emphasizing cloud-based healthcare solutions. |

| 2015 | Expansion of product offerings to include revenue cycle management services. |

| 2018 | Introduction of new features and enhancements to the CareCloud platform. |

| January 2020 | MTBC acquired CareCloud Corporation, integrating CareCloud's EHR and practice management technologies. |

| 2024 | Achieved positive GAAP net income of $7.9 million and a substantial increase in adjusted EBITDA. |

| Q1 2025 | Launched the AI Center of Excellence, focusing on AI-driven innovation. |

CareCloud has consistently innovated to meet the evolving needs of the healthcare industry, particularly in the realm of medical software. The company's focus on cloud-based EHR solutions and revenue cycle management has allowed it to offer comprehensive services.

CareCloud provides cloud-based EHR solutions, enhancing accessibility and data management for healthcare providers.

Offers revenue cycle management services to improve financial performance for healthcare practices.

Regularly updates its platform with new features and enhancements to meet the changing needs of the healthcare technology landscape.

Launching an AI Center of Excellence to integrate AI into its services, aiming to scale to 500 AI specialists by Q4 2025.

Despite these advancements, CareCloud has faced significant challenges, including intense competition in the healthcare technology market and the need to adapt to evolving regulations. Cybersecurity threats also pose a constant risk to the company's operations and data security.

Faces strong competition from established players such as Epic Systems and Cerner, requiring continuous innovation and differentiation.

Healthcare regulations are constantly changing, requiring the company to adapt its services and maintain compliance, such as the new CMS regulations in March 2023.

The healthcare sector is a prime target for cybersecurity attacks, posing risks of data breaches, financial liabilities, and reputational damage.

Despite challenges, the company reported positive GAAP net income of $7.9 million in 2024, a significant recovery from a loss in 2023.

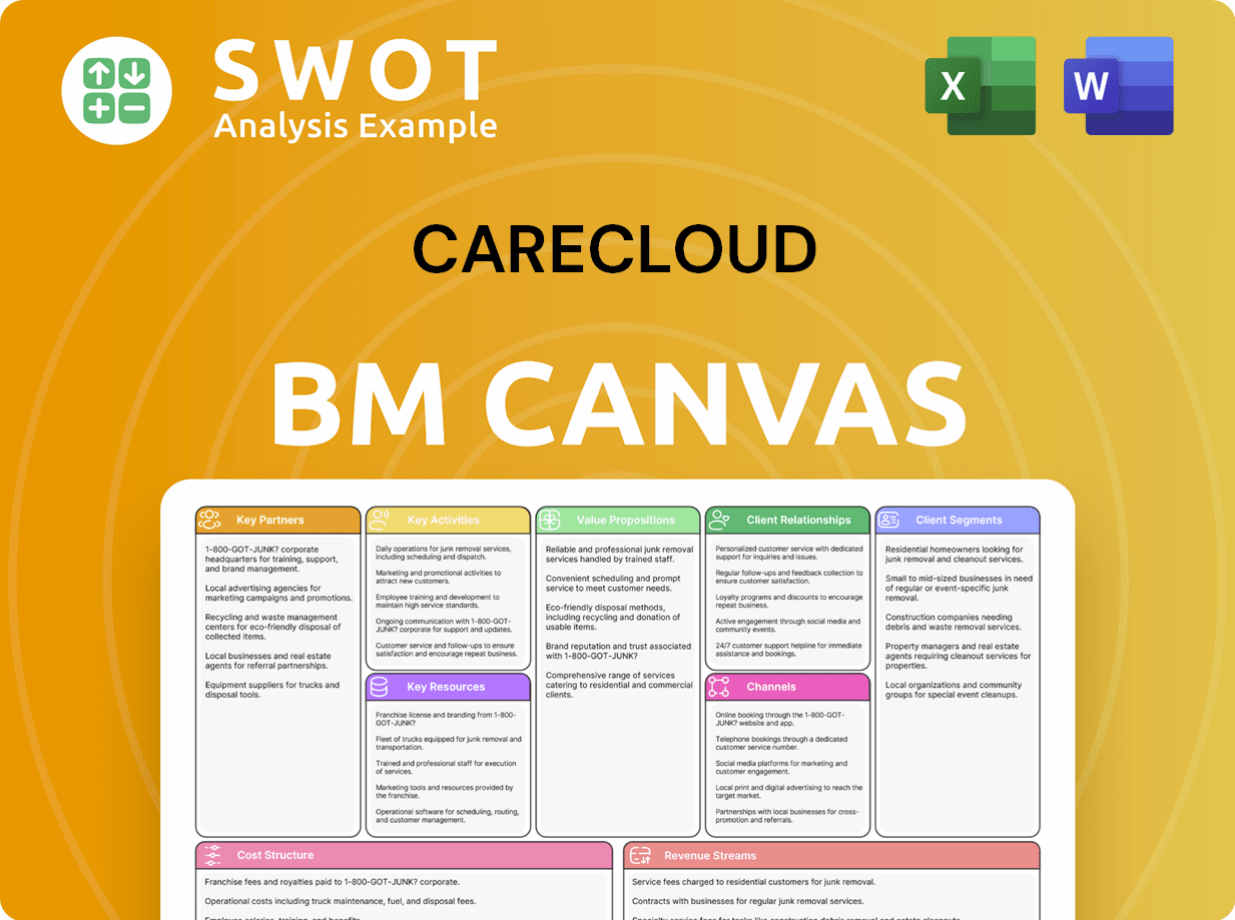

CareCloud Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for CareCloud?

The evolution of CareCloud's history reflects its journey in the healthcare technology sector. From its inception as Medical Transcription Billing Corporation (MTBC) in 1999 to its current status, the company has consistently adapted and expanded its offerings. Key milestones include the development of integrated services, rebranding as CareCloud, securing significant funding rounds, and strategic acquisitions. The company’s focus on innovation and strategic partnerships has positioned it for continued growth in the medical software market.

| Year | Key Event |

|---|---|

| 1999 | Founded as Medical Transcription Billing Corporation (MTBC) by Mahmud Haq. |

| 2004 | Developed a fully integrated suite of services, including practice management, EHR, and revenue cycle management. |

| 2012 | MTBC rebrands as CareCloud, Inc. |

| 2013 | Secures $20 million in Series B financing, bringing total funding to $44 million. |

| 2014 | Receives a $25.5 million debt financing commitment and reports its 17th consecutive quarter of triple-digit revenue growth. |

| 2015 | Expands product offerings to include revenue cycle management services and appoints Ken Comée as CEO. |

| 2018 | Introduces new features and enhancements to its platform. |

| January 2020 | MTBC acquires CareCloud Corporation, subsequently adopting the CareCloud name. |

| 2024 | Reports its most profitable year, with GAAP net income of $7.9 million and adjusted EBITDA of $24.1 million, and its common stock surges over 300%. |

| December 2024 | A. Hadi Chaudhry and Stephen Snyder are appointed Co-CEOs, with Crystal Williams as President, effective January 1, 2025. |

| February-April 2025 | Completes two strategic acquisitions, MesaBilling and Revenue Medical Management. |

| Q1 2025 | Launches its dedicated AI Center of Excellence and reports Q1 2025 revenue of $27.6 million and GAAP net income of $1.9 million. |

CareCloud is focusing on AI to enhance operational efficiency and drive healthcare transformation. The AI Center of Excellence aims to scale to 500 AI specialists by Q4 2025. This initiative is expected to accelerate the development of intelligent solutions, positioning CareCloud at the forefront of the industry.

The company is returning to M&A activity, as seen with the acquisitions of MesaBilling and Revenue Medical Management in early 2025. These acquisitions are part of a broader strategy to expand service offerings and market reach. This approach is designed to accelerate growth and enhance its capabilities in the healthcare technology sector.

CareCloud anticipates full-year 2025 revenue to be approximately $111 million to $114 million. The company projects adjusted EBITDA to be between $26 million and $28 million. Furthermore, a positive EPS of $0.10 to $0.13 is expected, marking the first positive EPS since 2014.

The company plans to continue enhancing its solutions with new functionality and features. This includes leveraging internal teams, partnerships, and future acquisitions. Analysts expect CareCloud to turn profitable in 2025, with statutory earnings of $0.11 per share. This strategy is rooted in the vision of revolutionizing healthcare operations through technology.

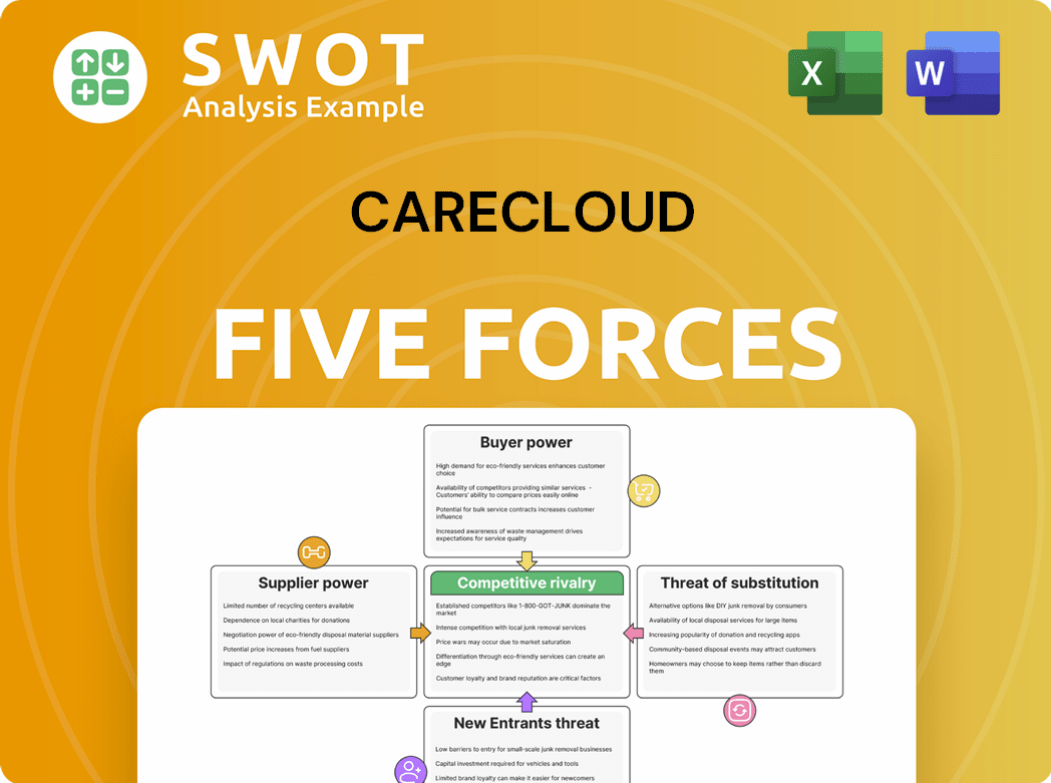

CareCloud Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of CareCloud Company?

- What is Growth Strategy and Future Prospects of CareCloud Company?

- How Does CareCloud Company Work?

- What is Sales and Marketing Strategy of CareCloud Company?

- What is Brief History of CareCloud Company?

- Who Owns CareCloud Company?

- What is Customer Demographics and Target Market of CareCloud Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.