CareCloud Bundle

Who Really Controls CareCloud?

Unraveling the ownership structure of a company is like peering into its very soul, revealing its strategic heart and future ambitions. A deep dive into CareCloud's ownership unveils crucial insights into its direction, influence, and accountability. Understanding who owns CareCloud is paramount for anyone seeking to make informed decisions about the company.

This exploration into CareCloud SWOT Analysis will examine the company's ownership, from its inception as Medical Transcription Billing, Corp. (MTBC) to its current status as a healthcare technology provider. We'll investigate the evolution of CareCloud ownership, the influence of its directors and executives, and how these factors impact the company's potential for growth. Knowing the CareCloud company ownership details is vital for investors, analysts, and anyone interested in the company's trajectory, including its management and investors.

Who Founded CareCloud?

The story of CareCloud's ownership begins with its founders. Understanding the initial ownership structure provides context for the company's evolution and its current standing in the healthcare technology sector. The founders and early investors played crucial roles in shaping the company's trajectory.

CareCloud, initially known as Medical Transcription Billing Corporation (MTBC), was founded in 1999 by Mahmud Haq. Another founder listed is Mahmud Ul Haq. The company's early focus was on providing transcription and manual medical billing services. Later, in 2009, Albert Santalo also founded CareCloud. The company has seen significant changes in its ownership structure since its inception.

The company secured approximately $102 million in funding since its founding in 2009. Early institutional investors included Norwest Venture Partners, Intel Capital, Tenaya Capital, and Adams Street Partners. In 2016, CareCloud secured an additional $31.5 million in Series C financing.

Mahmud Haq and Mahmud Ul Haq founded the company in 1999. Albert Santalo also founded CareCloud in 2009. These founders provided the initial vision and direction for the company.

The company's early services included transcription and manual medical billing. These services were primarily offered to healthcare providers, particularly in New Jersey. This focus laid the groundwork for future developments.

CareCloud raised a total of approximately $102 million in funding since its founding in 2009. In 2016, the company secured an additional $31.5 million in Series C financing. These funding rounds supported the company's growth and expansion.

Early institutional investors included Norwest Venture Partners, Intel Capital, Tenaya Capital, and Adams Street Partners. These investors played a key role in the company's early development. Blue Cloud Ventures also led a funding round.

Mahmud Haq, as the founder and Executive Chairman, has maintained a significant beneficial ownership. The leadership team played a crucial role in guiding the company. The current leadership continues to shape the company's direction.

Specific equity splits or shareholding percentages for the founders at inception are not publicly detailed. However, Mahmud Haq, as the founder and Executive Chairman, has maintained a significant beneficial ownership. The ownership structure has evolved over time with subsequent funding rounds.

Understanding the early ownership of CareCloud provides insight into its development. The founders, along with early investors, played a crucial role in shaping the company's trajectory. The company's focus on medical billing and transcription services marked its initial phase. Key investors and funding rounds supported its growth. The ownership structure has evolved over time.

- Mahmud Haq and Mahmud Ul Haq founded CareCloud in 1999.

- Albert Santalo also founded CareCloud in 2009.

- Early investors included Norwest Venture Partners and Intel Capital.

- The company raised approximately $102 million in funding since 2009.

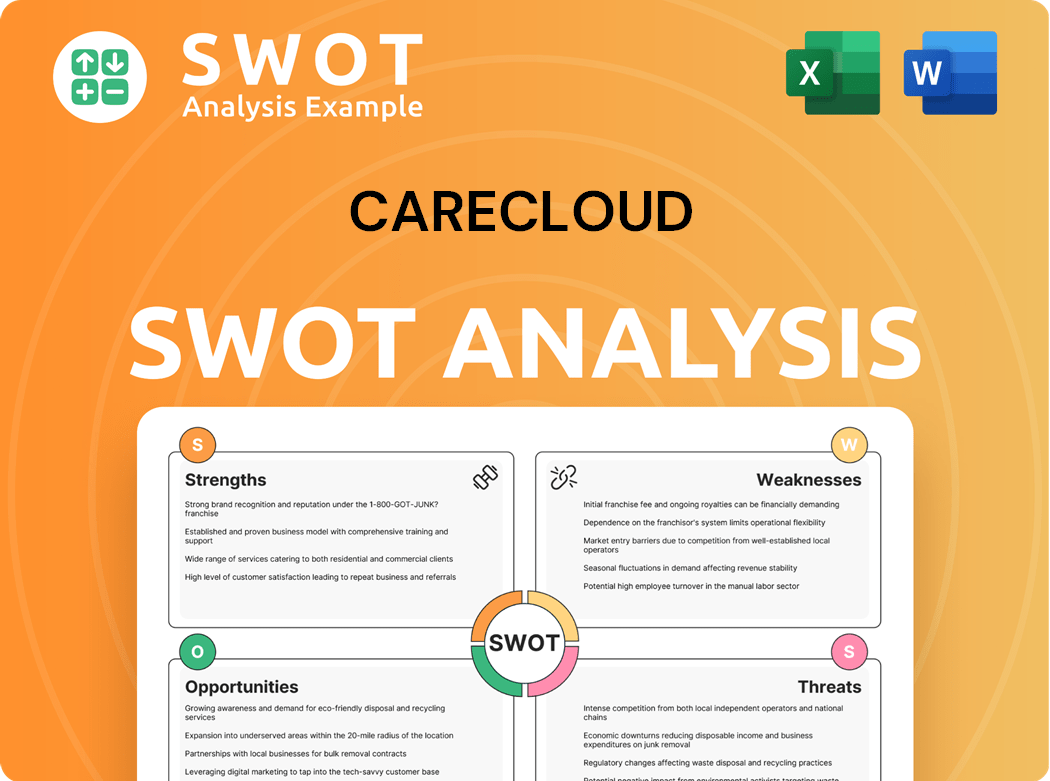

CareCloud SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has CareCloud’s Ownership Changed Over Time?

The evolution of ownership for CareCloud, formerly known as MTBC, Inc., reflects significant shifts. Initially, the company became publicly traded on the Nasdaq Global Market under the ticker 'CCLD'. As of March 19, 2025, the market capitalization was $0.05 billion, which increased to $94.8 million by June 11, 2025. The company's capital structure also includes Series A and Series B Preferred Stocks, traded under the symbols 'MTBCP' and 'CCLDO,' respectively.

Key events have significantly impacted the ownership structure of CareCloud. The conversion of Series A Preferred Stock has led to dilution, influencing the voting power of existing common shareholders. The ownership structure is also influenced by the holdings of institutional investors and the founder's stake. These factors have created a dynamic landscape for CareCloud's ownership.

| Date | Event | Impact |

|---|---|---|

| December 31, 2023 | Directors and Executive Officers held approximately 38% of common stock shares and voting power. | Provided substantial control over company matters. |

| December 31, 2024 | Mahmud Haq, the founder and Executive Chairman, owned 31% of the outstanding common stock. | Despite dilution, he controlled 12% of the outstanding common stock, allowing significant control over stockholder approvals. |

| June 5, 2025 | Institutional investors held 10.16% of CareCloud's stock. | Indicated a notable presence of institutional investors. |

CareCloud's ownership structure involves a mix of insider holdings, institutional investors, and mutual funds. As of March 2025, insider holdings were at 51.06%, while institutional investor holdings stood at 4.20%. Mutual funds decreased their holdings from 4.65% to 4.39%. The founder, Mahmud Haq, remains a significant shareholder, and the conversion of preferred stock has influenced voting power. Understanding the dynamics of CareCloud ownership is crucial for investors and stakeholders.

The ownership of CareCloud is a blend of insider control, institutional investments, and market dynamics. The founder and Executive Chairman, Mahmud Haq, holds a significant percentage of the common stock. Institutional investors, such as Ameriprise Financial Inc. and Vanguard Group Inc., also hold a notable portion of the stock.

- The company is publicly traded.

- Insider holdings remain significant.

- Institutional investors play a key role.

- The founder retains considerable influence.

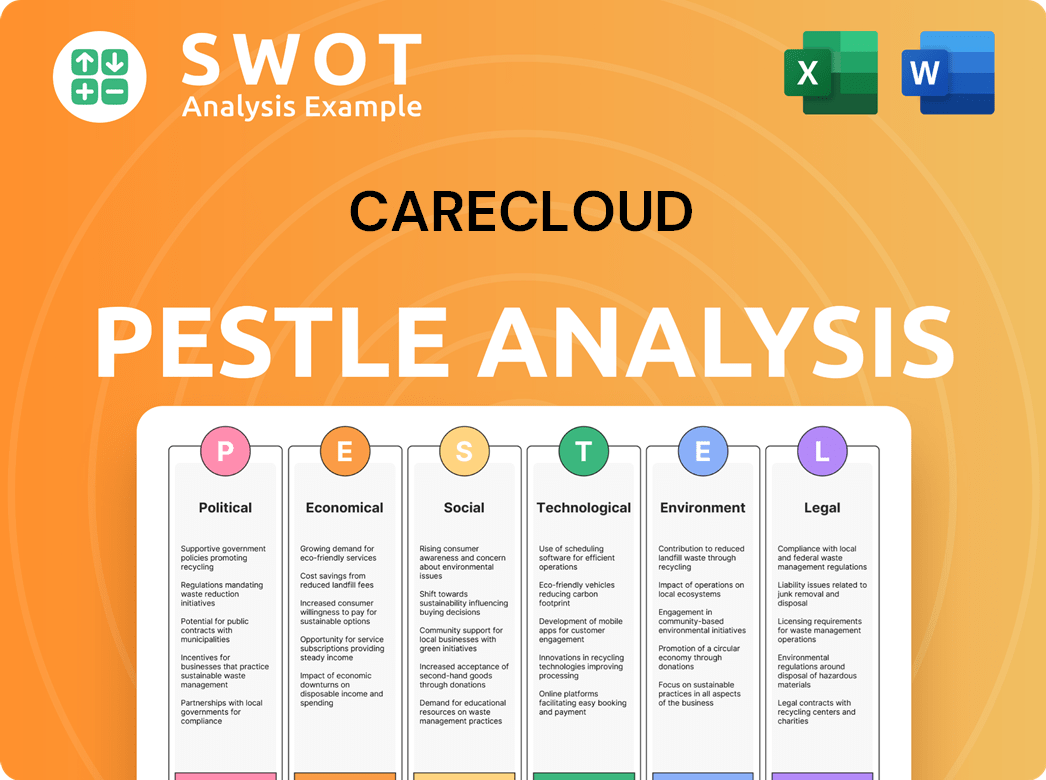

CareCloud PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on CareCloud’s Board?

The Board of Directors of the CareCloud company is responsible for overseeing the company's management and ensuring that the long-term interests of shareholders are met. As of January 1, 2025, CareCloud adopted a co-CEO structure. A. Hadi Chaudhry and Stephen Snyder serve as Co-CEOs. Crystal Williams was appointed President on the same date. Mahmud Haq continues to serve as the Founder and Executive Chairman of CareCloud's Board of Directors.

The Annual Meeting of Shareholders occurred on May 27, 2025. Shareholders approved the re-election of Anne Busquet, Bill Korn, and Lawrence Sharnak to the Board of Directors, each for two-year terms. They also approved the compensation package for named executive officers and the appointment of Rosenberg Rich Baker Berman, P.A. as the independent registered public accounting firm for fiscal year 2025.

| Board Member | Title | Date of Appointment |

|---|---|---|

| Mahmud Haq | Executive Chairman | Not Available |

| A. Hadi Chaudhry | Co-CEO | January 1, 2025 |

| Stephen Snyder | Co-CEO | January 1, 2025 |

| Crystal Williams | President | January 1, 2025 |

| Anne Busquet | Director | May 27, 2025 (Re-elected) |

| Bill Korn | Director | May 27, 2025 (Re-elected) |

| Lawrence Sharnak | Director | May 27, 2025 (Re-elected) |

Each share of CareCloud common stock has one vote. As of March 31, 2025, there were 42,321,129 shares of common stock outstanding. As of December 31, 2023, directors and executive officers collectively held approximately 38% of the common stock and voting power. As of December 31, 2024, Mahmud Haq, the Executive Chairman, beneficially owned 31% of the outstanding common stock and, after a conversion, still controls 12% of the outstanding common stock. This gives him significant influence over matters requiring stockholder approval. For more insights, you can explore the Marketing Strategy of CareCloud.

CareCloud's leadership structure includes a co-CEO model and a Board of Directors that oversees the company. The voting power is determined by the number of shares held, with each share having one vote.

- The company transitioned to a co-CEO structure with A. Hadi Chaudhry and Stephen Snyder as Co-CEOs.

- Mahmud Haq, as Executive Chairman, holds significant voting power.

- Shareholders re-elected directors and approved executive compensation at the May 2025 meeting.

- As of March 31, 2025, there were 42,321,129 shares of common stock outstanding.

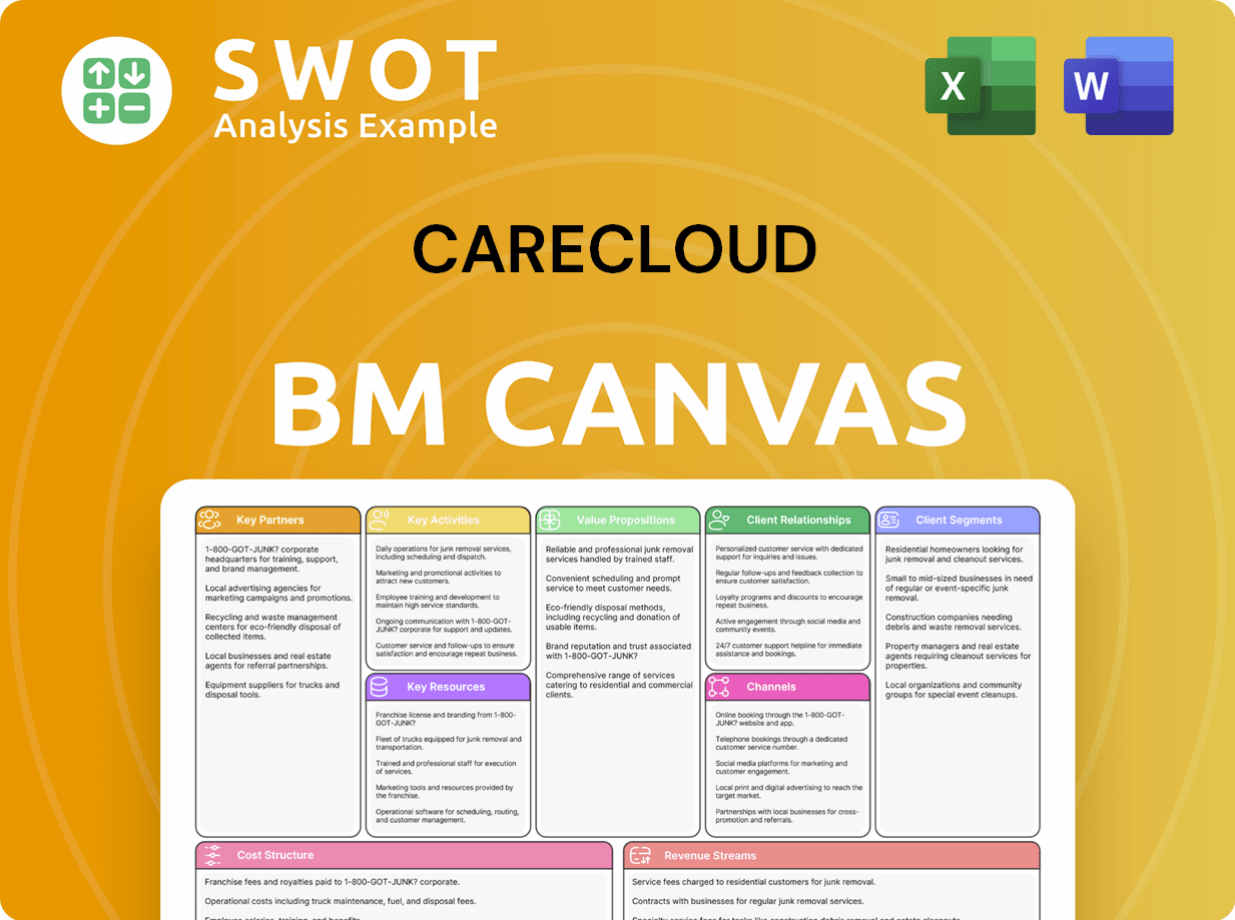

CareCloud Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped CareCloud’s Ownership Landscape?

Over the past few years, significant developments have reshaped the ownership and strategic direction of the CareCloud company. In 2024, the company demonstrated strong financial performance, returning to positive GAAP income and achieving a 50% year-over-year increase in adjusted EBITDA. This financial success allowed CareCloud to fully repay its $10 million credit line, contributing to a substantial increase in its common stock value, exceeding 300% over the past year.

A strategic leadership realignment, effective January 1, 2025, saw A. Hadi Chaudhry and Stephen Snyder appointed as Co-CEOs, with Crystal Williams as President. This move aims to accelerate technological innovation and revenue growth, particularly in generative AI solutions. Furthermore, CareCloud resumed preferred stock dividends in February 2025, with declared dividends for six months as of May 2025. In December 2024, a special meeting proxy was filed to increase authorized shares of common stock from 35 million to 85 million, approved in January 2025. This increase provides flexibility for future initiatives and the potential conversion of Series A Preferred Stock, which could reduce future dividend cash requirements by approximately $2.5 million annually.

Institutional ownership data as of May 21, 2025, reveals shifts among CareCloud investors. Acadian Asset Management LLC increased its holdings by 481.9%, while Goldman Sachs Group Inc. decreased its position by 13.6%. Hillsdale Investment Management Inc. added 68,900 shares in Q4 2024, and Johnson Investment Counsel Inc. reduced its holdings by 50,000 shares. Overall, 18 institutional investors added shares, while 14 decreased their positions in the most recent quarter, reflecting evolving perspectives on CareCloud ownership.

| Institutional Investor | Change in Holdings | Percentage Change |

|---|---|---|

| Acadian Asset Management LLC | Increased | 481.9% |

| Goldman Sachs Group Inc. | Decreased | 13.6% |

| Hillsdale Investment Management Inc. | Added 68,900 shares | N/A |

| Johnson Investment Counsel Inc. | Removed 50,000 shares | N/A |

CareCloud's ownership has seen shifts, with increases and decreases in institutional holdings.

The appointment of Co-CEOs and a President signals a focus on innovation and growth.

Strong financial results, including positive GAAP income and EBITDA growth, have boosted the company.

The increase in authorized shares and dividend resumption suggest confidence in future strategies.

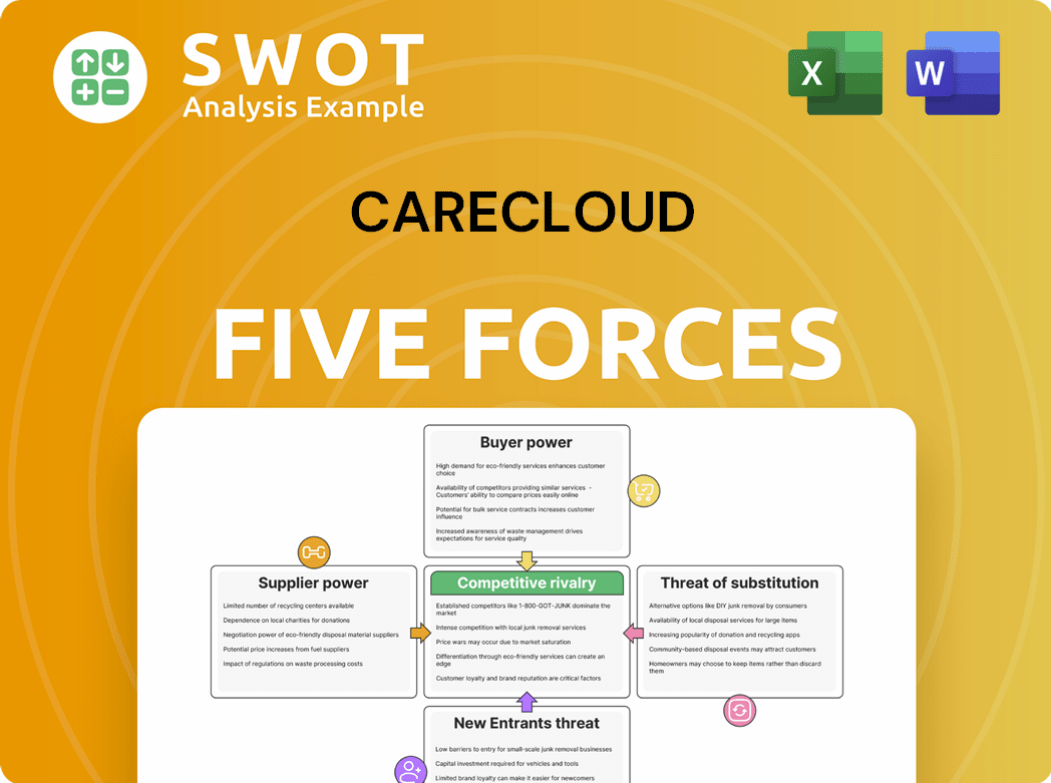

CareCloud Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of CareCloud Company?

- What is Competitive Landscape of CareCloud Company?

- What is Growth Strategy and Future Prospects of CareCloud Company?

- How Does CareCloud Company Work?

- What is Sales and Marketing Strategy of CareCloud Company?

- What is Brief History of CareCloud Company?

- What is Customer Demographics and Target Market of CareCloud Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.