CareCloud Bundle

Can CareCloud Conquer the Healthcare IT Arena?

CareCloud, Inc. (Nasdaq: CCLD, CCLDO) is aggressively expanding its healthcare technology footprint, especially with a focus on generative AI. With plans to scale its AI Center of Excellence to 500 specialists by late 2025, the company is poised to reshape clinical and administrative workflows. This strategic move, funded entirely by operating cash flows, marks a critical phase in CareCloud's journey.

From its origins as Medical Transcription Billing Corporation (MTBC) in 1999, CareCloud has evolved into a comprehensive provider of cloud-based solutions. Its transition from billing services to a leader in healthcare technology showcases its adaptability. To understand its position, we delve into the CareCloud SWOT Analysis, exploring the CareCloud competitive landscape, identifying key CareCloud competitors, and analyzing the CareCloud market analysis to assess its potential for future growth, considering factors such as CareCloud's EHR features and benefits and how it compares against rivals like athenahealth and eClinicalWorks.

Where Does CareCloud’ Stand in the Current Market?

CareCloud's core operations center on providing cloud-based software and services tailored for medical practices and health systems. Their offerings encompass electronic health records (EHR), practice management, and revenue cycle management (RCM) solutions, alongside patient engagement tools. The company's focus on generative AI solutions is also growing, signaling an adaptation to emerging technological trends within the healthcare sector.

The value proposition of CareCloud lies in its comprehensive suite of services designed to streamline healthcare operations. By offering integrated solutions, the company aims to improve efficiency, enhance patient engagement, and optimize revenue cycles for its clients. This approach supports healthcare providers in managing their practices more effectively, ultimately contributing to better patient care and financial outcomes.

CareCloud serves approximately 40,000 providers across 2,600 independent medical practices and hospitals. Its services span 80 specialties and subspecialties across all 50 states. This broad geographic reach and diverse customer base indicates a strong market presence.

For the full year ended December 31, 2024, CareCloud reported a GAAP net income of $7.9 million, a significant improvement from a net loss in the prior year. Adjusted EBITDA for 2024 reached $24.1 million. In Q1 2025, revenue increased by 6% year-over-year to $27.6 million, with a GAAP net income of $1.9 million.

CareCloud reduced recurring expenses by $25 million in 2024 and fully repaid its $10 million line of credit with Silicon Valley Bank. The company completed two strategic acquisitions in March and April 2025. These actions reflect improved operational efficiency and financial stability.

CareCloud anticipates full-year 2025 revenue to be approximately $111 million to $114 million, with adjusted EBITDA projected between $26 million and $28 million. These projections indicate continued growth and profitability. This information is crucial for understanding the company's financial health.

CareCloud's market position is strengthened by its focus on AI-driven solutions and strategic acquisitions within the healthcare technology industry, which was valued at an estimated $150 billion in 2024. Its comprehensive suite of offerings caters to diverse client needs across various specialties, reinforcing its standing in the competitive market.

- The company's EHR, practice management, and RCM solutions are key components of its competitive strategy.

- Recent acquisitions and the integration of AI technologies are aimed at enhancing its market share.

- CareCloud's financial performance, including increased revenue and profitability, supports its competitive position.

- The company's ability to serve a wide range of medical practices across different specialties is a key differentiator.

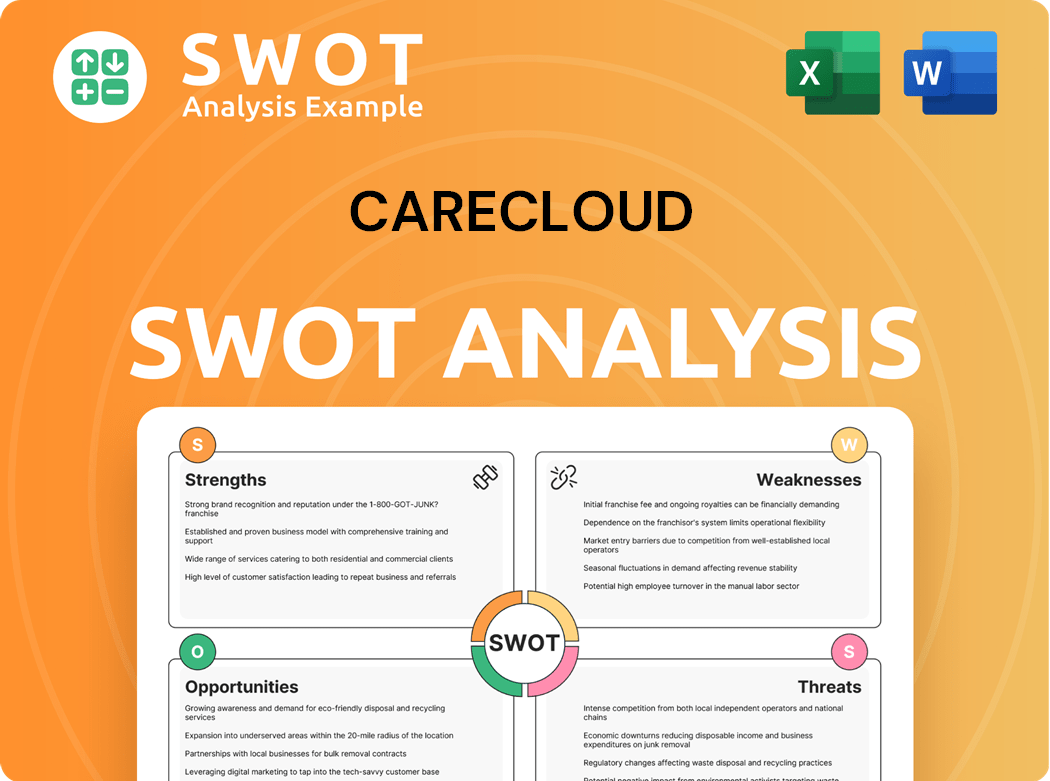

CareCloud SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging CareCloud?

The healthcare technology industry is fiercely competitive, and the CareCloud competitive landscape is shaped by a diverse set of rivals. These competitors offer a range of healthcare IT solutions, vying for market share and customer loyalty. Understanding the competitive dynamics is crucial for CareCloud to maintain its position and drive future growth.

Several established players pose significant challenges to CareCloud. These competitors provide comprehensive healthcare IT solutions, including cloud-based EHR systems, practice management tools, and patient communication platforms. The competitive environment also includes emerging players and diversified technology companies entering the healthcare space, intensifying the pressure to innovate and differentiate.

CareCloud's strategy includes strategic acquisitions to broaden its healthcare IT portfolio and enhance its service offerings. This approach reflects the dynamic nature of the market, where companies must continuously evolve to meet the changing needs of healthcare providers and maintain a competitive edge. This is a key element of the CareCloud market analysis.

athenahealth is a major CareCloud competitor, known for its comprehensive cloud-based services. It offers streamlined billing, practice management, and patient communication tools. This integrated approach challenges CareCloud.

eClinicalWorks is a strong contender with its comprehensive EHR system. It integrates telehealth solutions and offers AI-powered EHR capabilities. eClinicalWorks competes directly with CareCloud by providing a robust EHR platform.

NextGen Healthcare provides ambulatory practices with configurable clinical content and workflows. It offers an integrated patient experience platform, including telehealth. NextGen competes with its fully integrated solutions.

AdvancedMD offers a suite of solutions for practice management and EHR. It provides tools to streamline operations and improve financial performance. AdvancedMD is a direct competitor in the practice management space.

Smaller, emerging players are disrupting the traditional healthcare IT landscape. These companies often offer innovative solutions and competitive pricing. They challenge established companies like CareCloud.

Diversified technology companies are entering the healthcare space. These companies bring new technologies and business models. This increases the level of competition.

The competitive landscape is also influenced by mergers and acquisitions. Companies seek to expand their offerings and market reach. CareCloud's recent acquisitions in March and April 2025, as highlighted in a related article about CareCloud, demonstrate its commitment to growth and expansion. This dynamic environment requires continuous innovation and differentiation to maintain or gain market share. Key factors in CareCloud's market analysis include competitor pricing comparison, feature sets, and customer reviews.

Several factors drive competition in the healthcare technology market, influencing CareCloud's strategic decisions. These include the breadth and depth of product offerings, pricing models, and customer service. Understanding these factors is vital for CareCloud to succeed.

- Product Features: Comprehensive EHR, billing, and patient engagement tools.

- Pricing: Competitive pricing models tailored to different practice sizes.

- Customer Service: Reliable support and implementation services.

- Interoperability: Seamless integration with other healthcare systems.

- Innovation: Continuous development of new features and technologies.

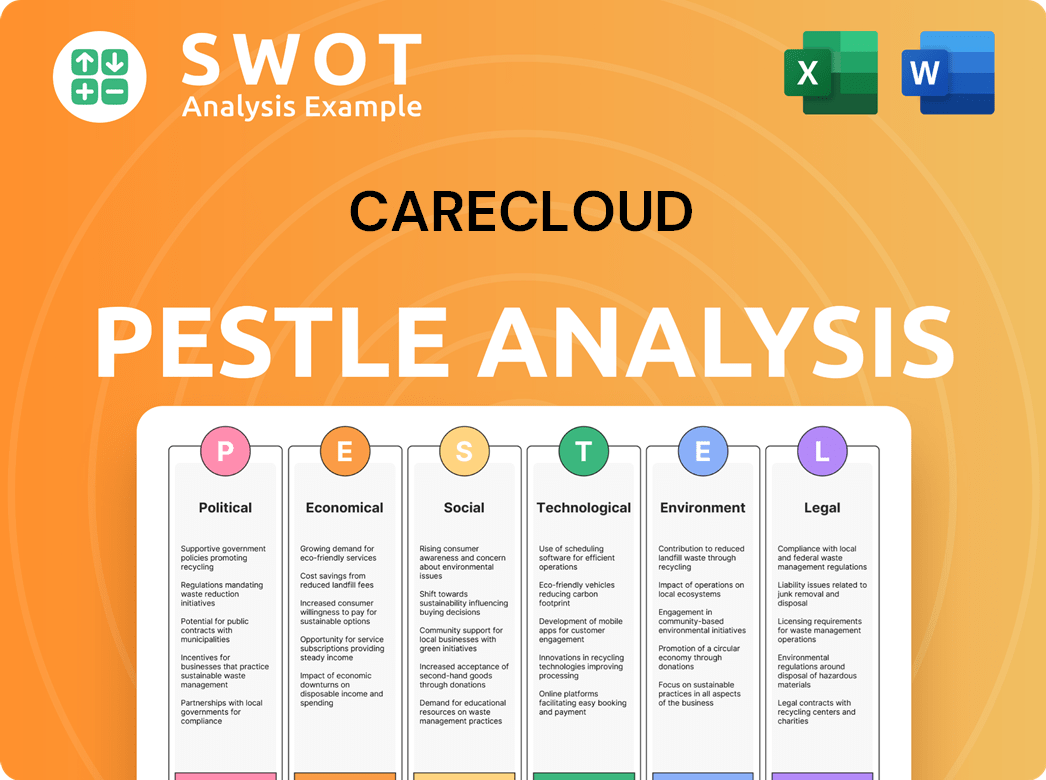

CareCloud PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives CareCloud a Competitive Edge Over Its Rivals?

The competitive landscape for healthcare technology is dynamic, with companies constantly vying for market share. Examining the CareCloud competitive landscape reveals a company that has strategically positioned itself through a combination of technological innovation, integrated solutions, and a strong focus on financial performance. This approach allows it to address the evolving needs of healthcare providers.

Key to understanding CareCloud competitors is recognizing its emphasis on cloud-based solutions and AI integration. The company's strategy includes a comprehensive suite of offerings, from electronic health records (EHR) to revenue cycle management (RCM), which aims to provide a streamlined, scalable, and accessible platform for healthcare practices. This integrated approach is designed to improve efficiency and reduce costs.

A deep dive into the CareCloud market analysis shows a company making significant strides. The company's commitment to AI, particularly its new 'cirrusAI' platform, is expected to increase operational efficiency by 15% within two years. This, combined with a focus on healthcare-specific large language models (LLMs) and real-world AI, gives it a unique edge in the market. Furthermore, the company's improved financial health, with record-breaking GAAP net income in 2024 and continued profitability into Q1 2025, strengthens its position for further growth and investment.

CareCloud's cloud-based platform offers scalability and accessibility, reducing on-site hardware expenses. The integrated suite includes EHR, practice management, and RCM solutions, streamlining patient data and billing processes. This comprehensive approach aims to meet the diverse needs of healthcare providers, enhancing operational efficiency.

The company has launched an AI Center of Excellence, planning to scale to 500 AI professionals by Q4 2025. AI tools like cirrusAI are designed to transform healthcare workflows, offering features such as automated clinical note-taking and real-time center intelligence. This strategic emphasis on AI is expected to boost operational efficiency and improve patient outcomes.

CareCloud reported record-breaking GAAP net income in full-year 2024 and maintained profitability into Q1 2025. This financial health provides the capital to invest in further innovation and acquisitions. Strategic cost reductions and debt repayment have further strengthened the company's financial position, enabling sustainable growth.

CareCloud's dual-shore engineering capabilities offer a cost-efficient model for 24/7 development without sacrificing quality. This approach enhances operational efficiencies and supports the company's commitment to providing high-quality solutions. This model contributes to the company's ability to innovate and adapt quickly to market demands.

The company’s competitive advantages are sustainable due to proprietary technology, a deep understanding of the healthcare sector, and a commitment to operational excellence. The strategic focus on AI and a robust financial foundation are key drivers of long-term success. To learn more about the company’s growth trajectory and strategic moves, consider reading the Growth Strategy of CareCloud.

- Cloud-based technology enables scalability and accessibility.

- AI-driven automation is expected to improve operational efficiency.

- Improved financial performance provides resources for innovation.

- Dual-shore engineering supports cost-effective development.

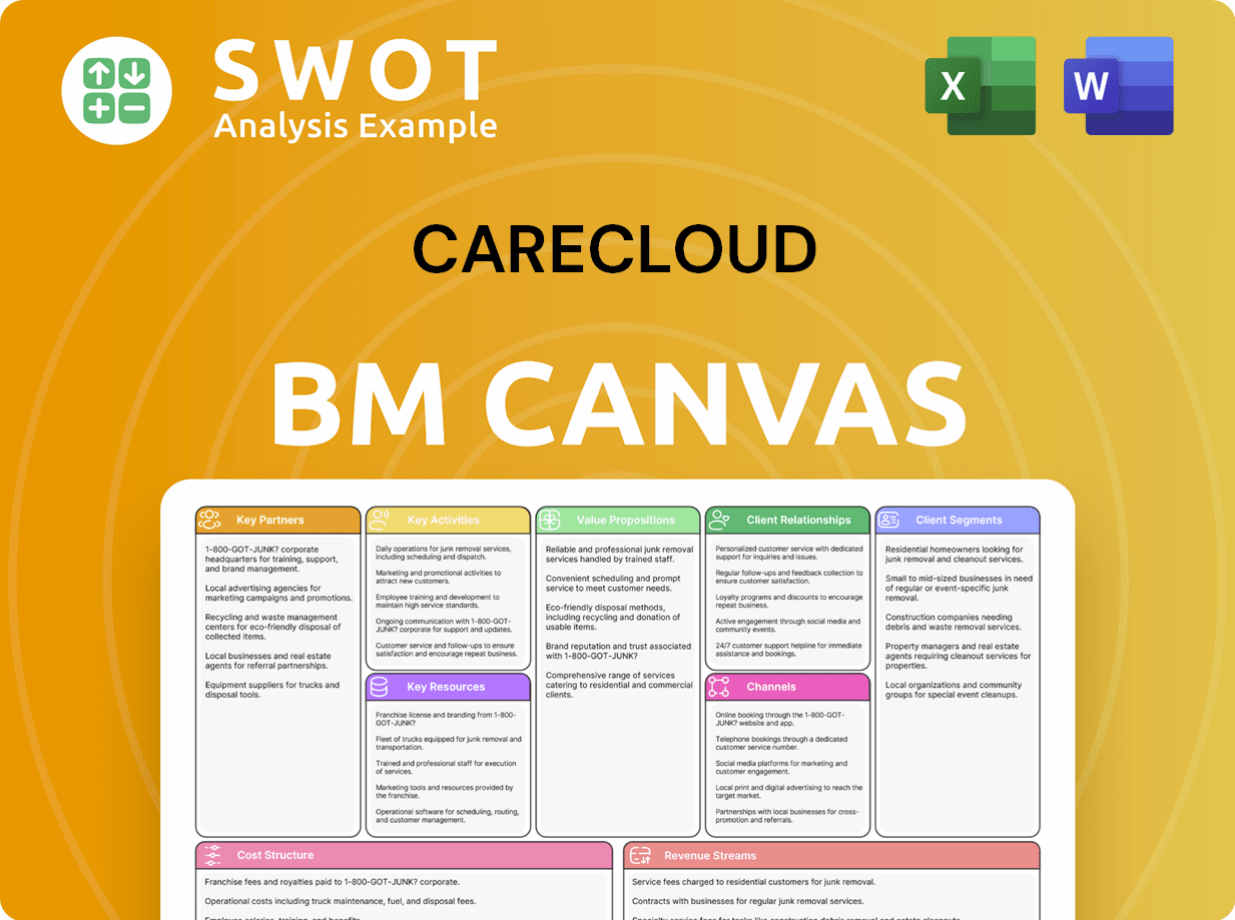

CareCloud Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping CareCloud’s Competitive Landscape?

The healthcare technology industry is experiencing significant shifts driven by technological advancements, regulatory changes, and evolving consumer preferences. These factors shape the CareCloud competitive landscape, presenting both challenges and opportunities for the company. Understanding these dynamics is crucial for evaluating its market position and future prospects.

The industry's risks include intense competition and the need for continuous innovation, while opportunities arise from the growing demand for cloud services, AI, and data applications. The company's strategic initiatives, such as its focus on AI and strategic acquisitions, are designed to capitalize on these opportunities and maintain its competitive edge. For a deeper dive into the company's target audience, consider exploring the Target Market of CareCloud.

The healthcare technology sector is currently influenced by rapid technological advancements, evolving regulatory landscapes, and shifting consumer preferences. Artificial intelligence (AI) is a key driver, with the global healthcare AI market projected to reach $61.3 billion by 2025. Regulatory changes, especially concerning data privacy like HIPAA compliance, continue to be significant.

Key challenges include intense competition from larger healthcare IT companies, potentially leading to pricing pressures and market share loss. Continuous innovation and adaptation to new technologies are also critical in this fast-paced sector. Managing the integration of strategic acquisitions, such as MesaBilling and RevNu Medical Management, while maintaining operational efficiency is also a challenge.

The growing adoption of cloud services, AI, and big data applications in healthcare boosts demand for core offerings. Specialty-specific EHR solutions and the M&A strategy provide avenues for market expansion and service diversification. Opportunities also include expansion into emerging markets and strategic partnerships.

The company is actively embracing AI, with plans to onboard 500 AI specialists by Q4 2025, aiming to lead market shifts. Leadership realignment, effective January 1, 2025, with co-CEOs focusing on technology/AI strategies and acquisitive/organic growth, indicates a clear strategy to capitalize on these opportunities. The company's outlook for 2025 projects continued revenue growth and improved profitability.

The CareCloud market analysis reveals a company navigating a dynamic industry. The company's ability to adapt to technological advancements and regulatory changes will be crucial for its long-term success. The company's strategic moves, including its AI initiatives and acquisitions, position it to capitalize on future opportunities.

- AI adoption and its potential to unlock new revenue streams.

- The importance of maintaining compliance in a changing regulatory environment.

- The role of strategic acquisitions in expanding market reach and services.

- The need for continuous innovation and adaptation to maintain a competitive edge.

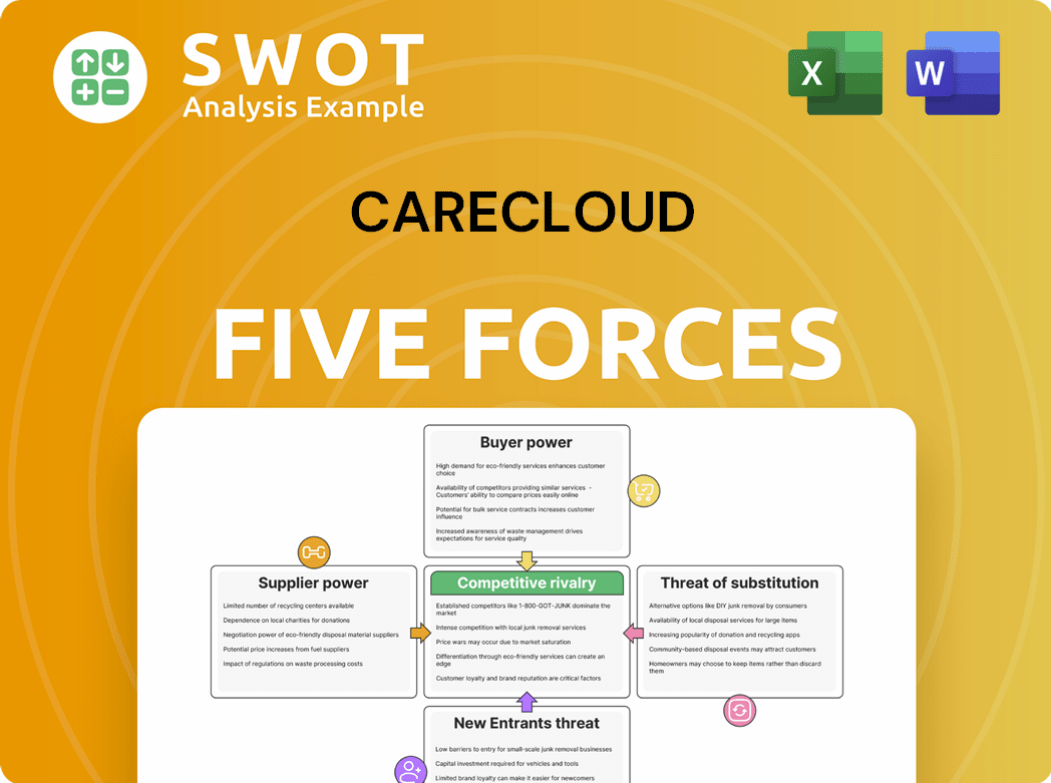

CareCloud Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of CareCloud Company?

- What is Growth Strategy and Future Prospects of CareCloud Company?

- How Does CareCloud Company Work?

- What is Sales and Marketing Strategy of CareCloud Company?

- What is Brief History of CareCloud Company?

- Who Owns CareCloud Company?

- What is Customer Demographics and Target Market of CareCloud Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.