CareCloud Bundle

Can CareCloud Revolutionize Healthcare in 2025?

CareCloud (Nasdaq: CCLD, CCLDO) is making waves in the healthcare technology sector, showcasing impressive financial gains and strategic moves as we head into 2025. This company specializes in cloud-based software and services, targeting medical practices with solutions designed to boost efficiency and patient care. With a focus on generative AI and strategic acquisitions, CareCloud is rapidly evolving.

CareCloud's CareCloud SWOT Analysis reveals a company leveraging its CareCloud platform to offer a comprehensive suite of services, including electronic health records (EHR) and practice management. Its recent performance, including a 6% revenue increase in Q1 2025, highlights its potential. This analysis will explore how CareCloud's cloud-based solutions and commitment to innovation are reshaping medical practice management and its impact on the future of healthcare technology, including examining the CareCloud EHR and its functionalities.

What Are the Key Operations Driving CareCloud’s Success?

The core of how CareCloud operates revolves around providing comprehensive, cloud-based software and technology-enabled services tailored for the healthcare sector. This includes electronic health records (EHR), practice management (PM), revenue cycle management (RCM), and patient engagement solutions. These offerings are designed to streamline operations, improve efficiency, and enhance patient care for a wide range of medical practices and healthcare systems.

The CareCloud platform supports approximately 40,000 providers across 2,600 independent medical practices and hospitals, spanning 80 specialties and subspecialties across all 50 states. Additionally, the company serves around 150 clients that are service organizations within the healthcare community. This extensive reach underscores the platform's adaptability and value within the healthcare landscape.

The operational processes are enabled by significant technology development and a dual-shore delivery model, providing 24/7 development and cost efficiency through U.S. and offshore teams. This global workforce contributes to a competitive cost structure. CareCloud's deep 'healthcare DNA' and over 20 years of clinical and operational data power its healthcare-specific large language models (LLMs) and real-world AI applications.

The platform offers a suite of features designed to optimize medical practice workflows. These include EHR, PM, RCM, and patient engagement tools. The solutions are tailored to meet the needs of various healthcare providers, from small practices to large healthcare systems.

CareCloud aims to improve operational efficiency and patient care. The platform helps alleviate staffing shortages, digitize workflows, and provide analytics for risk stratification. It also focuses on improving cash collections and reducing billing burdens for providers.

The CareCloud EHR is built with built-in compliance readiness. The company emphasizes HIPAA compliance from day one, making its solutions secure, audit-ready, and enterprise-deployable. This ensures data security and privacy for healthcare providers.

Strategic partnerships with major healthcare networks enhance service distribution and broaden the customer base. These collaborations are crucial for expanding the platform's reach and impact within the healthcare industry.

CareCloud offers several benefits to healthcare providers, including streamlined operations and improved patient care. The platform helps to automate workflows, reduce administrative burdens, and enhance financial performance.

- Improved efficiency through automation and digitization.

- Enhanced patient care with better access to health records.

- Better financial performance through improved revenue cycle management.

- Reduced administrative burdens and regulatory complexity.

For more insights, explore the Marketing Strategy of CareCloud. This provides additional context on how CareCloud positions itself in the market and its approach to customer acquisition and retention.

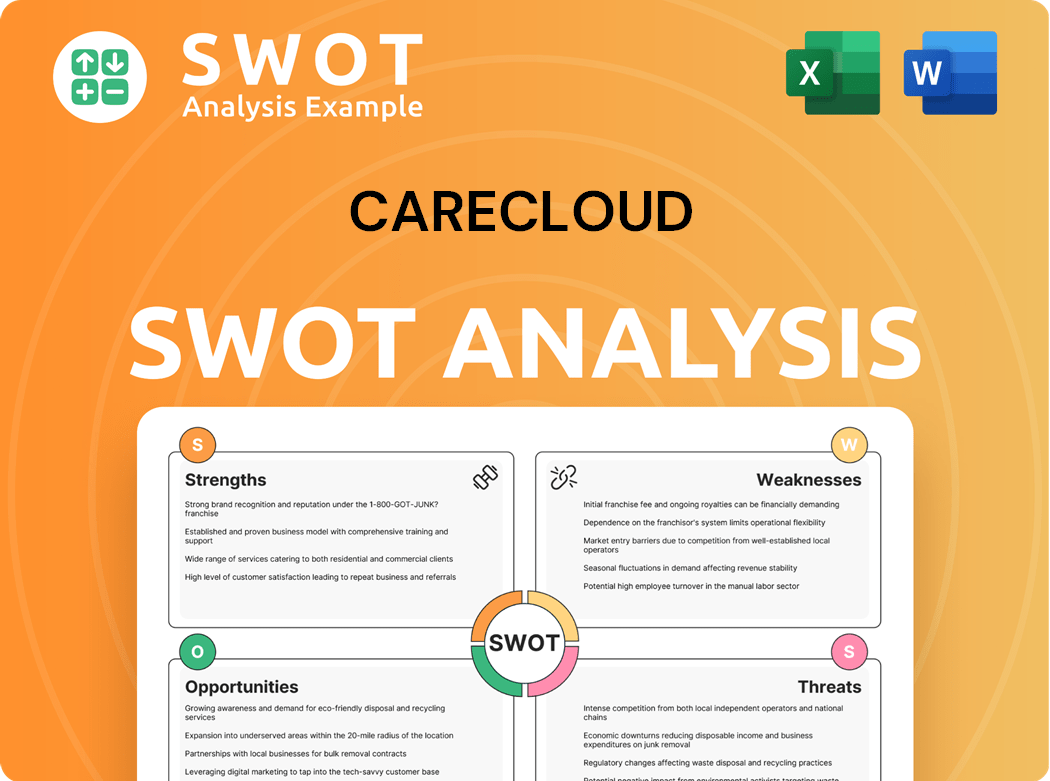

CareCloud SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does CareCloud Make Money?

The primary revenue streams and monetization strategies of CareCloud revolve around its technology-enabled business solutions. These solutions include revenue cycle management, electronic health records (EHR), and practice management systems, which are key components of the CareCloud platform.

In 2024, these technology-enabled solutions accounted for approximately 67% of the company's total revenue. CareCloud's approach involves subscription models for its cloud-based software and fees for services like revenue cycle management (RCM).

The company's focus on operational efficiencies and AI-driven innovation further supports its revenue generation and profitability. Discover more about the company's structure at Owners & Shareholders of CareCloud.

In Q1 2025, the Healthcare IT segment generated $24.64 million, with technology-enabled business solutions contributing $17.70 million. Professional services brought in $5.89 million, while other services added to the revenue. The company's cost reduction efforts, such as the $25 million reduction in recurring expenses in 2024, are expected to contribute to improved profitability.

- For the full year 2024, CareCloud reported total revenue of $110.8 million.

- The company anticipates full-year 2025 revenue to be approximately $111 million to $114 million.

- Medical practice management services contributed $2.99 million.

- Printing and mailing services contributed $879,000, and group purchasing services added $168,000.

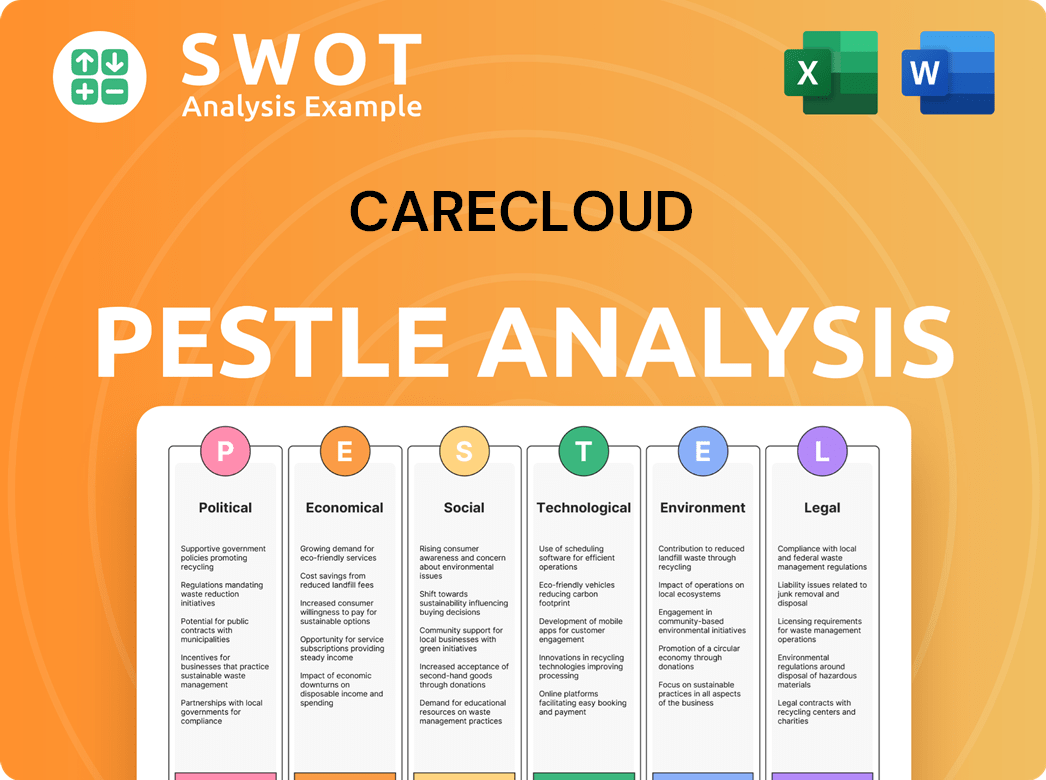

CareCloud PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped CareCloud’s Business Model?

The evolution of CareCloud reflects a strategic journey marked by significant milestones, strategic initiatives, and a focus on enhancing its competitive position within the healthcare technology sector. This transformation is evident in the company's financial performance and strategic decisions.

A key highlight is the company's return to profitability in 2024, achieving a GAAP net income of $7.9 million, a substantial improvement from the $48.7 million net loss in 2023. This financial turnaround underscores the effectiveness of its strategic adjustments and operational improvements. Furthermore, the company has implemented several strategic moves designed to strengthen its market position and drive future growth.

CareCloud's strategic moves and competitive advantages are critical to its success. The company has focused on cost management and operational efficiency, including a 14% reduction in direct operating costs and a 35% reduction in selling and marketing expenses in 2024.

CareCloud achieved GAAP profitability in 2024, reporting a net income of $7.9 million, a significant turnaround from the previous year. The company also saw a 56% increase in Adjusted EBITDA to $24.1 million for the full year 2024. Record free cash flow of $13.2 million in 2024, a 244% increase from the prior year, further solidified its financial health.

In March 2025, CareCloud completed the conversion of 3.5 million Series A preferred shares into common shares, reducing its dividend commitment by approximately $7.7 million. The company also fully repaid its Silicon Valley Bank credit line using internally generated cash flow. A major strategic initiative is the launch of its AI Center of Excellence, aiming to scale to 500 AI specialists by Q4 2025, self-funded through operating cash flows.

CareCloud has reignited its acquisition strategy, completing two strategic acquisitions in March and April 2025, with more opportunities under evaluation. These acquisitions, including MesaBilling LLC and RevNu Medical Management, are expected to be accretive within 90 days. This expansion strategy aims to broaden CareCloud's market reach and service offerings.

CareCloud's competitive advantages include diverse product offerings (EHR, billing, telehealth), strong regulatory compliance, and a scalable cloud-based technology platform. The company leverages its dual-shore engineering capabilities and deep healthcare expertise to develop AI-driven solutions like cirrusAI Notes, cirrusAI Appeals, and cirrusAI Voice, which are key differentiators. Learn more about the Target Market of CareCloud.

The conversion of preferred shares and repayment of the credit line have strengthened CareCloud's financial structure. The AI Center of Excellence is expected to drive innovation and enhance its product offerings. Strategic acquisitions are aimed at expanding the company's market share and service capabilities.

- The AI Center of Excellence is fully self-funded through operating cash flows.

- Acquisitions, such as MesaBilling LLC and RevNu Medical Management, are expected to be accretive within 90 days.

- Cost management and operational efficiency led to a 14% reduction in direct operating costs and a 35% reduction in selling and marketing expenses in 2024.

- Preferred dividends resumed in February 2025.

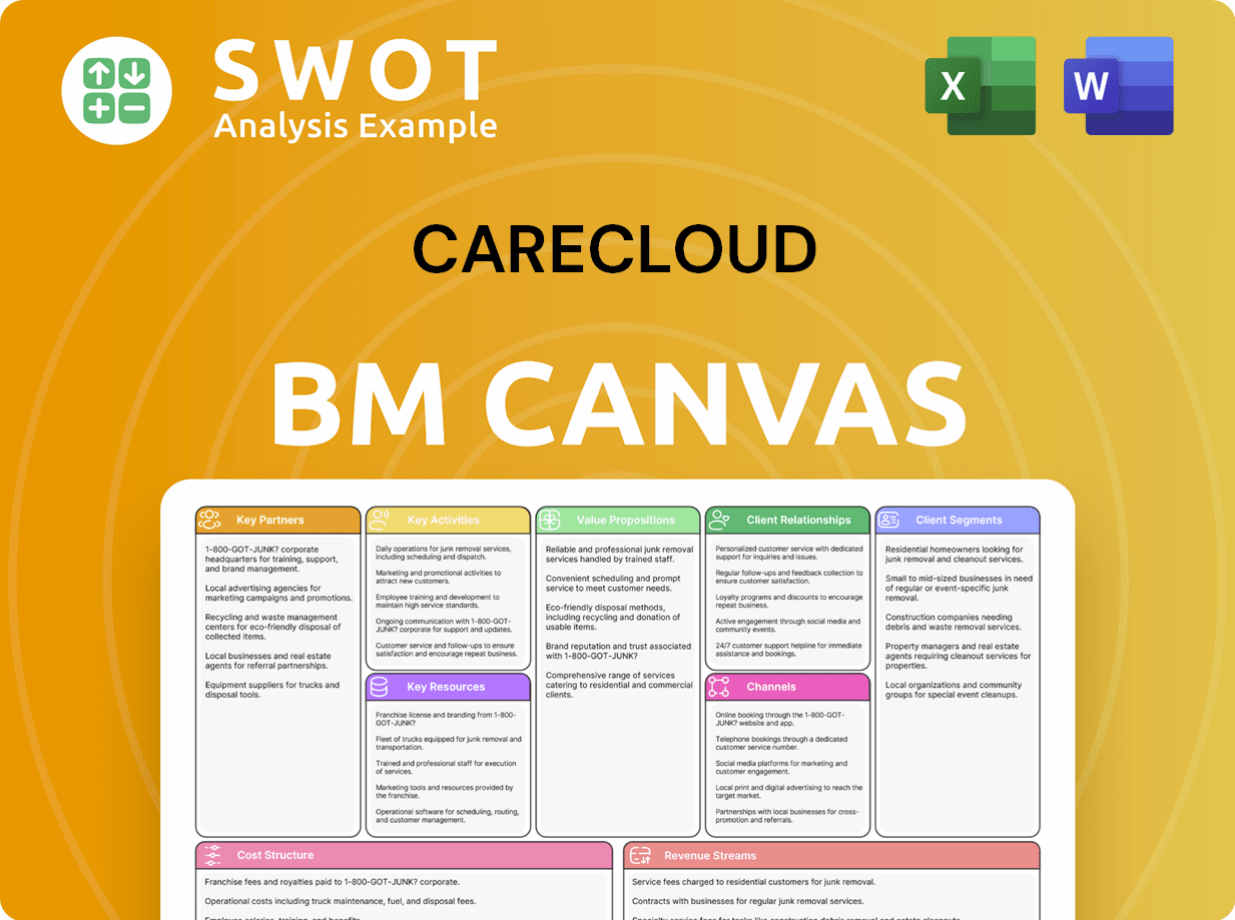

CareCloud Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is CareCloud Positioning Itself for Continued Success?

The company, a key player in the healthcare technology sector, serves a broad base of approximately 40,000 providers across 2,600 independent medical practices and hospitals. Despite strong performance in 2024 and Q1 2025, the company operates in a competitive market. The company faces competition from large healthcare IT companies, as well as smaller AI-focused startups.

Several factors pose risks to the company's operations. These include intense market competition, integration challenges from recent acquisitions, economic uncertainties affecting healthcare spending, and the need for continuous AI investment. Additional risks include regulatory changes, data privacy and security concerns, and reliance on offshore operations.

The company holds a significant position in the healthcare technology sector. It serves a broad base of providers, with a focus on cloud-based solutions. The company competes with both large and small healthcare IT companies.

Key risks include intense market competition, integration challenges, and economic uncertainties. Regulatory changes, data privacy concerns, and reliance on offshore operations also pose challenges. Dependence on AI advancements necessitates continuous investment and innovation.

The company is pursuing strategic initiatives to drive revenue growth. The company anticipates full-year 2025 revenue of approximately $111 million to $114 million. The company is focusing on AI innovation and strategic mergers and acquisitions to drive future growth.

The company plans to enhance its solutions and expand into new markets. The expansion of its AI Center of Excellence, aiming for 500 AI specialists by year-end 2025, is a key part of its innovation roadmap. Maxim Group has named the company its 'Top Healthcare IT Pick for 2025'.

The company projects full-year 2025 revenue between $111 million and $114 million, with adjusted EBITDA expected to be between $26 million and $28 million. The company also projects GAAP EPS of $0.10 to $0.13 for full year 2025. Strategic focus includes AI innovation, mergers and acquisitions, and expanding its AI Center of Excellence.

- The company is focused on expanding its AI capabilities.

- Strategic mergers and acquisitions are a key part of the growth strategy.

- The company plans to enhance its solutions with new features.

- The company aims to expand into new categories and markets.

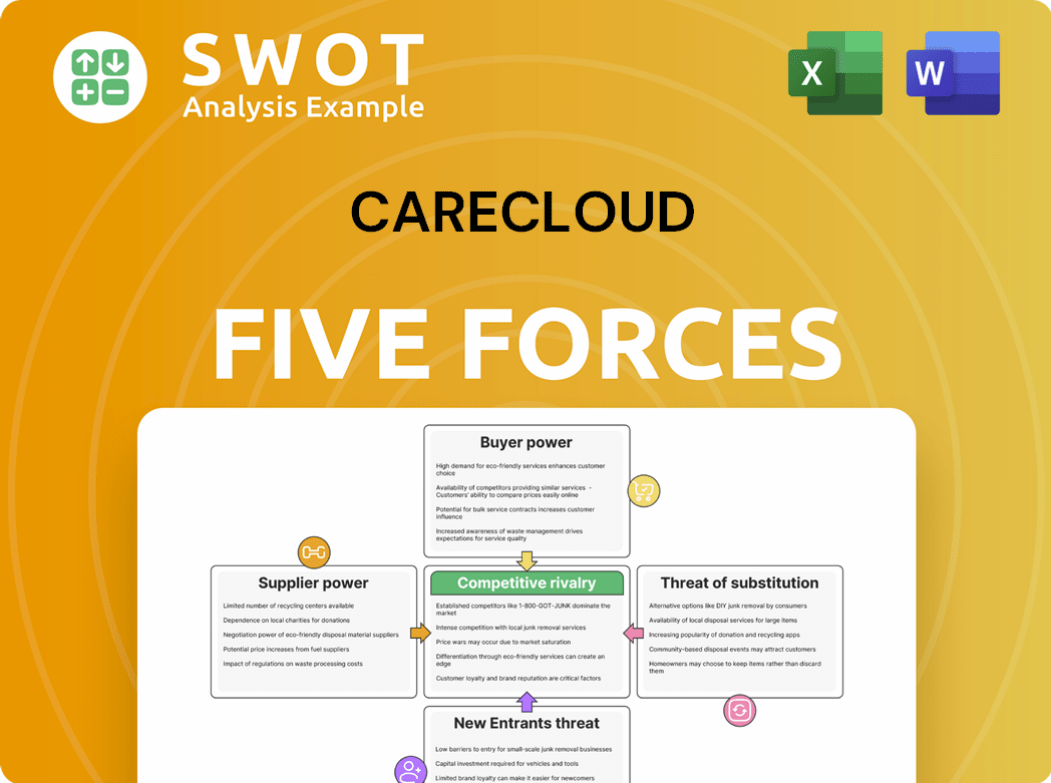

CareCloud Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of CareCloud Company?

- What is Competitive Landscape of CareCloud Company?

- What is Growth Strategy and Future Prospects of CareCloud Company?

- What is Sales and Marketing Strategy of CareCloud Company?

- What is Brief History of CareCloud Company?

- Who Owns CareCloud Company?

- What is Customer Demographics and Target Market of CareCloud Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.