Carrols Bundle

How Did Carrols Company Become a Fast-Food Giant?

Ever wondered about the origins of one of the largest Burger King franchisees in the U.S.? Carrols Company, a significant player in the quick-service restaurant industry, boasts a fascinating Carrols SWOT Analysis that reveals its strategic evolution. From its humble beginnings in 1960, this fast food empire has charted an impressive course, marked by strategic expansion and operational prowess. Explore the brief history of Carrols restaurant chain and uncover the secrets behind its enduring success.

The journey of Carrols Corporation, from its Syracuse, New York, roots to its current status, is a compelling narrative of growth and adaptation. Understanding the Carrols history provides crucial insights into the dynamics of the fast-food industry. This exploration will uncover the key decisions that shaped Carrols locations and its relationship with Burger King, offering a comprehensive view of its rise to prominence.

What is the Carrols Founding Story?

The Carrols Company, a notable player in the fast-food industry, has a rich history. The story of this restaurant chain begins in Syracuse, New York, with its founding in 1960.

Herbert N. Slotnick established the company, recognizing the growing demand for quick and affordable dining options. His vision centered on a self-service model, offering a streamlined menu to ensure speed and value for customers.

Carrols Restaurant Group's origins trace back to July 19, 1960, in Syracuse, New York, marking the beginning of the Carrols history. Herbert N. Slotnick, the founder, used his restaurant industry experience to capitalize on the emerging fast-food trend.

- Slotnick's initial funding came from personal investment and local bank loans.

- The name 'Carrols' was selected to create a welcoming and family-oriented image.

- Early challenges included securing real estate, establishing supply chains, and standing out in a competitive market.

- The cultural context of the 1960s, with suburban growth and a need for convenience, played a key role in the company's initial success.

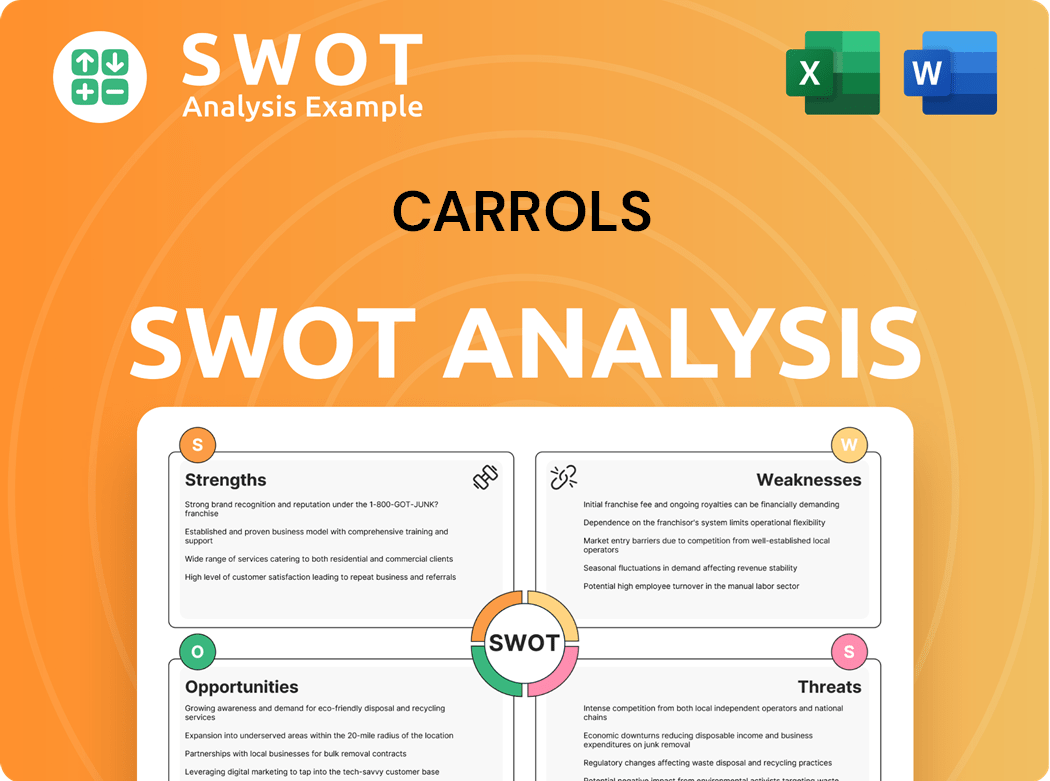

Carrols SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Carrols?

The early growth of the Carrols Company, a significant player in the quick-service restaurant (QSR) industry, was characterized by strategic expansion. Initially, the company focused on establishing standalone Carrols restaurants, building a regional presence. A pivotal moment arrived in 1967 when Carrols entered a franchise agreement with Burger King, marking a major shift in its business model. This move allowed Carrols to leverage the established brand and operational efficiency of Burger King, leading to rapid expansion.

The transition involved converting existing Carrols locations into Burger King restaurants and opening new units. This strategy was crucial for capitalizing on Burger King's marketing and operational systems. This partnership fundamentally reshaped the Carrols Company timeline, setting the stage for its future growth. The decision to become a Burger King franchisee was a turning point, enabling Carrols to scale its operations more effectively.

Throughout the 1970s and 1980s, Carrols aggressively acquired more Burger King franchises. This strategy led to a steady increase in its restaurant count and geographical reach. By the early 2000s, Carrols had become one of Burger King's largest franchisees, a testament to its successful expansion strategy. This growth was fueled by strategic acquisitions and operational efficiency, solidifying its position in the market. For more details, check out the Growth Strategy of Carrols.

Carrols expanded its footprint beyond New York, entering states like Pennsylvania and Ohio. This expansion was a key part of the company's growth. The company's acquisitions played a crucial role in its evolution, increasing its presence within the Burger King system. Carrols' ability to acquire and integrate new locations efficiently was a key driver of its success.

Carrols explored diversification by becoming a franchisee for Popeyes Louisiana Kitchen. This move demonstrated its ambition within the QSR sector. This strategic move highlighted Carrols' willingness to explore opportunities beyond its primary brand. The diversification efforts showed the company's adaptability and its pursuit of growth within the fast-food industry.

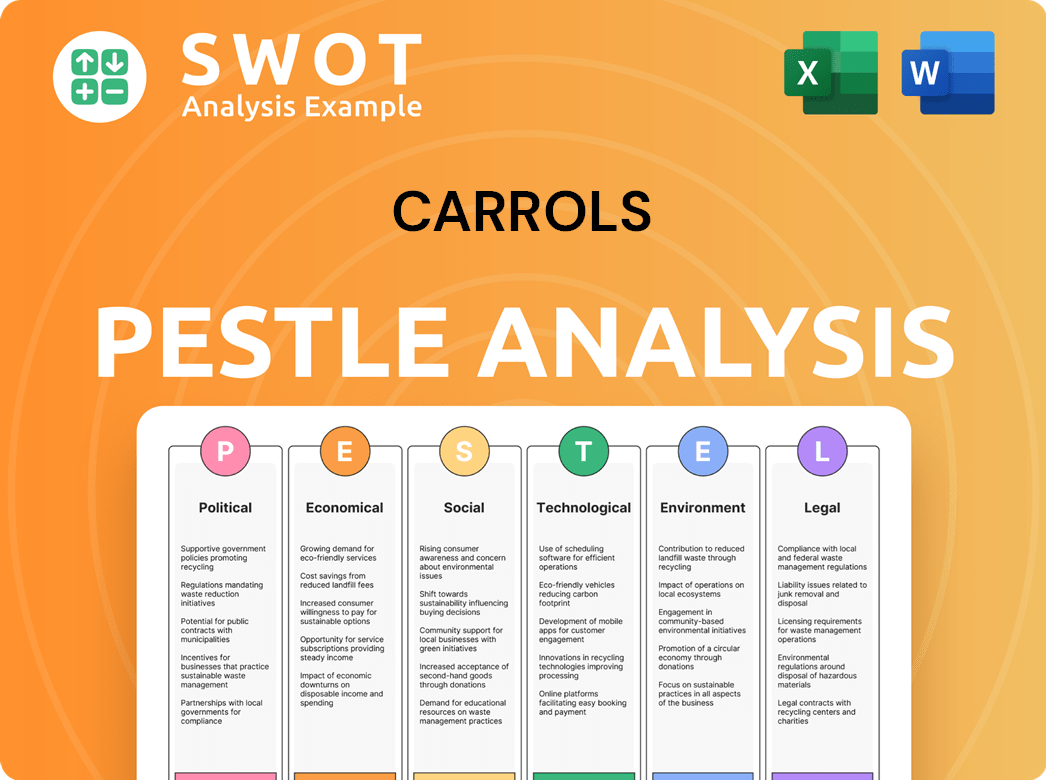

Carrols PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Carrols history?

The Carrols Company has a rich Carrols history, marked by significant strategic moves. A key aspect of the Carrols restaurant chain's evolution has been its focus on expanding its Burger King franchise, positioning it as a leading operator in the fast-food industry.

| Year | Milestone |

|---|---|

| Early 1960s | The Carrols Company was founded, marking the beginning of its journey in the fast-food industry. |

| 1970s | The company began its association with Burger King, laying the groundwork for its future expansion. |

| 2019 | Significant expansion occurred with the acquisition of 278 Burger King restaurants, enhancing its portfolio. |

| 2020 | The company adapted to the COVID-19 pandemic by focusing on drive-thru and digital ordering services. |

| 2023 | Carrols announced it would close approximately 60 restaurants, with the majority of these closures expected in the first half of 2024. |

| 2024 | Carrols is actively involved in Burger King's 'Reclaim the Flame' initiative, investing in remodels and technology. |

Innovation at Carrols Corporation includes adapting to digital ordering and drive-thru services, especially highlighted during the pandemic. The company continues to invest in technology to enhance customer experience and operational efficiency across its Carrols locations.

Implementation of online and mobile ordering platforms to improve customer convenience and order accuracy.

Optimizing drive-thru operations to increase speed of service and reduce wait times, especially crucial during peak hours.

Investing in restaurant renovations to modernize the dining experience and align with Burger King's brand standards.

Implementing strategies to improve efficiency, such as inventory management and labor scheduling, to reduce costs.

Introducing new menu items and promotions to attract customers and stay competitive within the Carrols fast food industry.

Utilizing technology for data analysis to improve decision-making and customer service, enhancing overall operational performance.

Challenges for Carrols Company include navigating economic downturns and intense competition within the fast-food sector. The company also faces rising operational costs, including labor and food expenses, which impact profitability.

Economic downturns can decrease consumer spending, affecting sales and profitability for Carrols restaurants.

Intense competition from other fast-food chains and quick-service restaurants requires constant innovation and strategic adjustments.

Increased labor costs, food prices, and other operational expenses can squeeze profit margins, requiring effective cost management.

Significant capital investments are needed for restaurant remodels and modernizations, which can strain financial resources.

Adapting to changing consumer tastes and preferences, including health-conscious options and digital ordering, is crucial.

Supply chain issues can affect the availability of ingredients and increase costs, requiring proactive supply chain management.

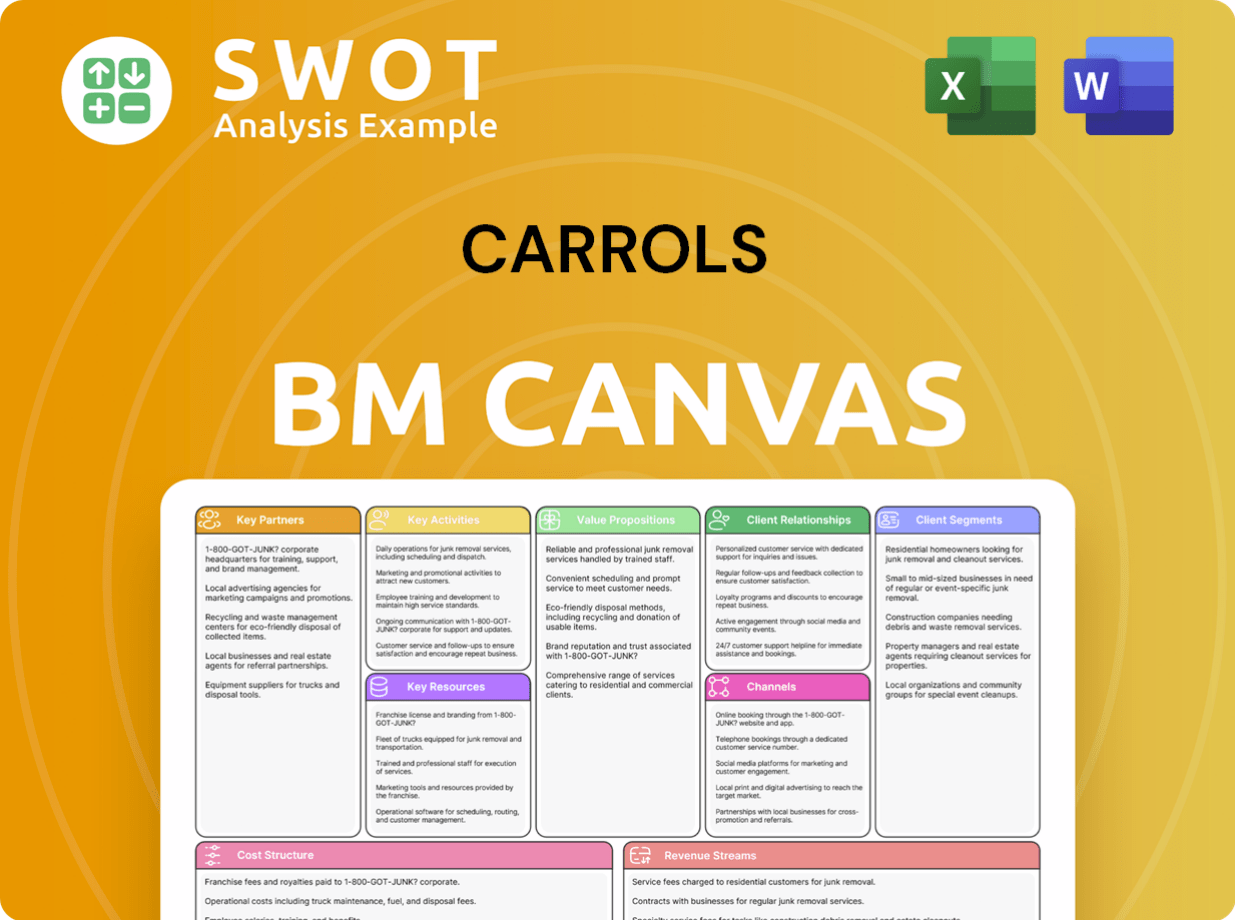

Carrols Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Carrols?

The Carrols Company, a significant player in the fast food industry, has a rich history marked by strategic decisions and operational growth. Founded in Syracuse, New York, the company's trajectory has been shaped by key acquisitions and adaptations to market trends. From its early days to its current status as a major Burger King franchisee, Carrols has demonstrated a commitment to expansion and operational efficiency.

| Year | Key Event |

|---|---|

| 1960 | Carrols Restaurant Group was founded in Syracuse, New York, marking the beginning of its journey in the fast-food sector. |

| 1967 | The company began franchising Burger King restaurants, a strategic shift that would define its future. |

| 1986 | Carrols became a publicly traded company, allowing for further expansion and investment opportunities. |

| Early 2000s | Carrols emerged as one of the largest Burger King franchisees in the U.S., solidifying its market position. |

| 2012 | The company completed a significant acquisition of 278 Burger King restaurants, boosting its portfolio. |

| 2019 | Carrols acquired additional Burger King restaurants, further establishing itself as the largest franchisee. |

| 2020-2022 | Carrols navigated operational challenges and adapted to changing consumer behaviors during the COVID-19 pandemic. |

| 2023 | Actively participated in Burger King's 'Reclaim the Flame' initiative, committing to restaurant remodels and technological upgrades. |

| 2024 | Continues strategic focus on operational efficiency and portfolio optimization. |

| 2025 | Expected to continue investing in restaurant modernization and digital initiatives, aligning with broader industry trends. |

Carrols is expected to continue investing in restaurant modernization, including digital platforms and drive-thru enhancements. This aligns with the broader industry trend of improving customer experience through technology. The 'Reclaim the Flame' initiative is a key part of this strategy, focusing on remodels and upgrades.

Emphasis on operational efficiency and cost management is predicted to continue to mitigate rising labor and food costs. This includes streamlining processes and leveraging technology to improve overall profitability. The company aims to maintain a competitive edge through efficient operations.

Carrols' long-term strategy involves optimizing its existing portfolio, which may include divesting underperforming assets. Strategic acquisitions of well-located restaurants could further consolidate its market position. The company aims for a balanced and profitable portfolio.

Leadership is committed to leveraging technology to improve customer engagement and streamline operations. This includes digital ordering, loyalty programs, and enhanced drive-thru experiences. The focus is on adapting to consumer preferences for convenience and digital integration.

Carrols Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Carrols Company?

- What is Growth Strategy and Future Prospects of Carrols Company?

- How Does Carrols Company Work?

- What is Sales and Marketing Strategy of Carrols Company?

- What is Brief History of Carrols Company?

- Who Owns Carrols Company?

- What is Customer Demographics and Target Market of Carrols Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.