Carrols Bundle

Can Carrols Company Thrive Under RBI's Ownership?

The recent acquisition of Carrols Restaurant Group, the largest Burger King franchisee, by Restaurant Brands International (RBI) is reshaping the quick-service restaurant landscape. This pivotal move, valued at approximately $1 billion, marks a significant shift in Carrols' trajectory. The acquisition promises a new era of integration and strategic realignment, fundamentally altering the Carrols SWOT Analysis.

This report delves into the Carrols Company Growth Strategy and Future Prospects, particularly examining how the integration into RBI will redefine its operational framework. We'll analyze Carrols' expansion plans, innovation strategies, and strategic initiatives within this new corporate structure. Understanding the Burger King Carrols relationship is crucial for assessing the long-term growth potential and Carrols Market Analysis.

How Is Carrols Expanding Its Reach?

Following the acquisition by Restaurant Brands International (RBI), the expansion strategy for Carrols is closely aligned with RBI's broader vision for the Burger King brand in the United States. This collaboration is key to understanding the future prospects of the Carrols Restaurant Group. The focus is on leveraging Carrols' extensive network of over 1,000 Burger King restaurants to drive growth and enhance profitability.

A central component of this strategy is the 'Reclaim the Flame' plan, a significant investment by RBI. This multi-year initiative, involving $400 million, is designed to boost sales and improve franchisee profitability for Burger King in the U.S. This includes strategic investments in advertising, digital enhancements, restaurant remodels, and technology upgrades. The success of this plan is crucial for the future of Carrols and its ability to generate sustainable revenue.

The primary goal is to enhance the customer experience and drive sales through strategic closures of underperforming locations and targeted investments in high-potential restaurants. This operational focus, combined with RBI's financial backing and strategic direction, is expected to foster organic growth. The integration of Carrols into RBI's strategy allows for a more unified approach to product launches and marketing campaigns, ensuring consistent brand messaging and efficient execution across the Carrols-operated restaurants. For a deeper understanding of its origins, consider reading about the Brief History of Carrols.

Accelerating the pace of restaurant remodels is a key part of the expansion strategy. These upgrades aim to improve the customer experience and align with the latest brand standards. This involves significant investment in existing locations to enhance their appeal and operational efficiency.

Focusing on operational efficiency is crucial for optimizing the performance of Burger King locations. This includes streamlining processes, improving order accuracy, and reducing wait times. These improvements are designed to boost profitability and customer satisfaction.

Underperforming locations will be strategically closed to optimize the portfolio. Simultaneously, targeted investments will be made in high-potential restaurants to enhance the customer experience and drive sales. This approach aims to improve overall system health and future growth.

The integration with RBI allows for a more unified approach to product launches and marketing campaigns. This ensures consistent brand messaging and efficient execution across all Carrols-operated restaurants. This helps in reaching a wider audience and increasing brand awareness.

The primary drivers for growth include restaurant remodels, operational efficiency, strategic closures, and unified marketing efforts. These initiatives are designed to improve the customer experience and drive sales. The focus is on enhancing the brand's presence and profitability.

- Accelerated Remodels: Enhancing the customer experience.

- Operational Efficiency: Streamlining processes for better performance.

- Strategic Closures: Optimizing the restaurant portfolio.

- Unified Marketing: Consistent brand messaging.

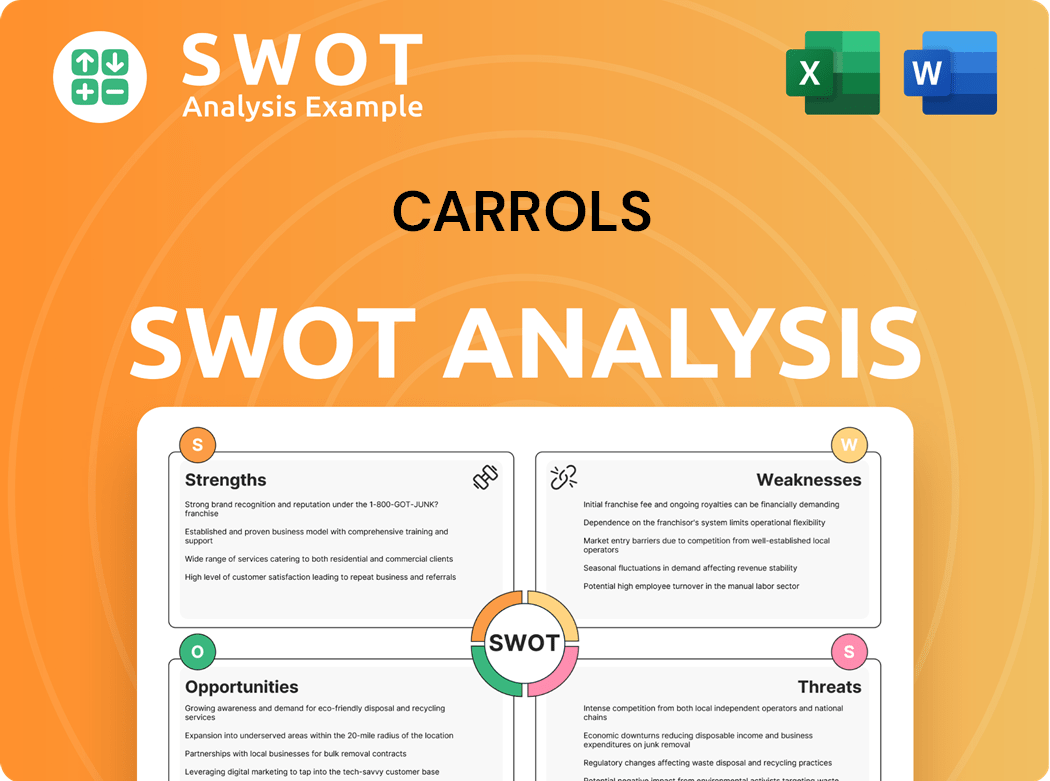

Carrols SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Carrols Invest in Innovation?

The innovation and technology strategy for Carrols, now integrated within Restaurant Brands International (RBI), is significantly influenced by RBI's 'Reclaim the Flame' plan. This strategic direction emphasizes digital transformation and the integration of advanced technologies to enhance both customer experience and operational efficiency. This approach is vital for the Carrols Company Growth Strategy.

A key aspect of this strategy involves substantial investment in digital platforms, including the Burger King app and loyalty programs. These digital tools are designed to boost customer engagement and increase order frequency. The focus is on creating a more seamless and personalized experience, from digital ordering and payment to optimizing drive-thru operations. This is a crucial element of the Carrols Company Future Prospects.

RBI's technological focus also extends to improving in-restaurant operations through automation and streamlined processes. This includes exploring technologies to optimize kitchen efficiency, reduce wait times, and enhance order accuracy. The integration with RBI allows Carrols to benefit from and contribute to broader technological advancements and sustainability goals.

The Burger King app and loyalty programs are central to driving customer engagement. These platforms offer personalized experiences and incentives, encouraging repeat business. Digital initiatives are designed to increase order frequency and enhance customer satisfaction.

Automation and streamlined processes are being implemented to improve in-restaurant operations. This includes technologies to optimize kitchen efficiency, reduce wait times, and enhance order accuracy. The goal is to create a more seamless and efficient experience for both customers and staff.

Sustainability is increasingly integrated into operational strategies. This includes efforts to reduce environmental impact, improve energy efficiency in restaurants, and explore sustainable sourcing practices. These initiatives contribute to long-term brand value and growth objectives.

The 'Reclaim the Flame' plan directs significant resources towards digital transformation and technology integration. This plan is a key driver for innovation within the company, influencing its strategic direction and operational improvements. The plan's investments are designed to improve customer experience and operational efficiency.

Drive-thru optimization is a key area of technological focus. This involves using technology to reduce wait times and improve order accuracy. The goal is to enhance the speed and efficiency of drive-thru services, improving customer satisfaction and throughput.

RBI leverages data analytics to inform decision-making across all aspects of the business. This includes analyzing customer behavior, optimizing marketing campaigns, and improving operational efficiency. Data-driven insights are used to enhance the overall performance and profitability of the business.

Carrols, as part of RBI, benefits from a broader technology and innovation strategy. This includes digital platforms, operational automation, and sustainability efforts. These initiatives are designed to enhance customer experience, improve efficiency, and contribute to long-term growth. For more insights, read about the Mission, Vision & Core Values of Carrols.

- Digital Ordering and Payment: Implementing and enhancing digital ordering and payment systems to provide convenience and speed for customers.

- Drive-Thru Optimization: Utilizing technology to improve drive-thru efficiency, reducing wait times and enhancing order accuracy.

- Kitchen Automation: Exploring technologies to automate kitchen processes, improving efficiency and consistency in food preparation.

- Sustainability Programs: Integrating sustainability initiatives to reduce environmental impact and promote responsible business practices.

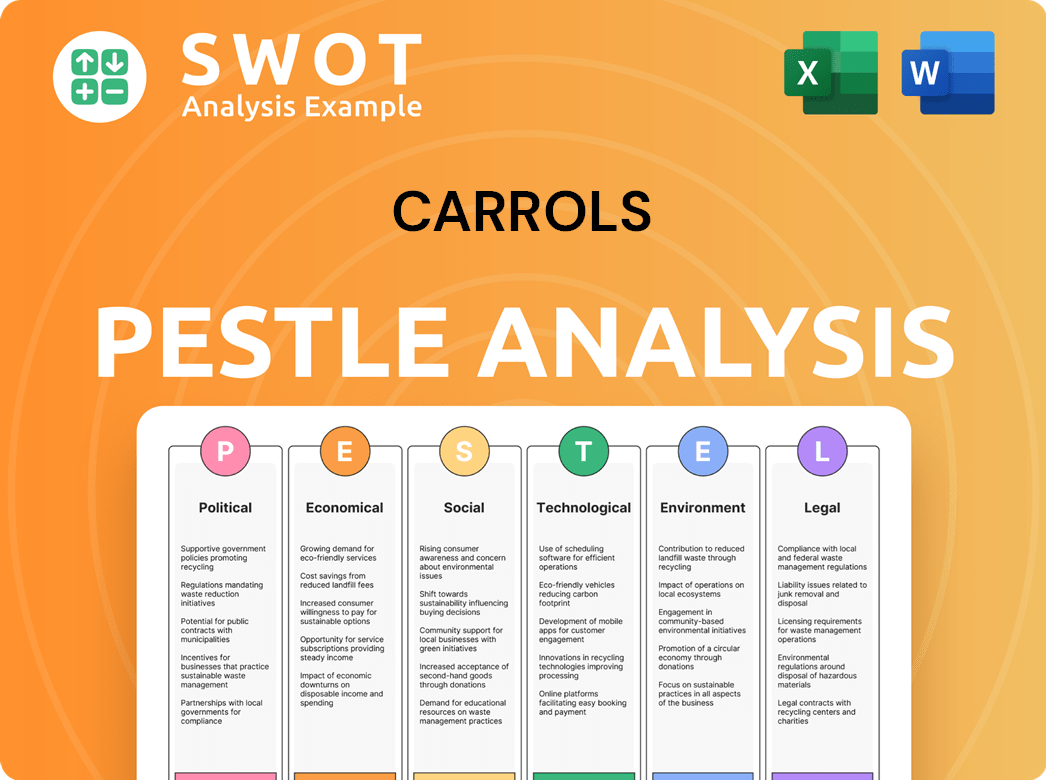

Carrols PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Carrols’s Growth Forecast?

The financial outlook for Carrols Company, now under Restaurant Brands International (RBI), is closely tied to RBI's strategic plans for the Burger King brand. The acquisition, finalized in the second quarter of 2024, represents a significant investment by RBI to bolster its presence in the U.S. fast-food market. This strategic move is designed to leverage Carrols' existing restaurant network to enhance Burger King's market position and drive future growth.

Before the acquisition, Carrols Restaurant Group demonstrated improving financial performance. For the fourth quarter of 2023, Carrols reported a net income of $12.3 million, a substantial turnaround from the $29.8 million net loss in the same period the previous year. The company's total revenues for the fourth quarter of 2023 reached $484.5 million, an increase from $461.3 million in the fourth quarter of 2022. For the entire year of 2023, Carrols' revenues totaled $1.92 billion, up from $1.81 billion in 2022, indicating a positive trajectory before the acquisition.

RBI's 'Reclaim the Flame' plan, involving a $400 million investment, is central to the future financial performance of the acquired Carrols restaurants. This investment is aimed at accelerating sales growth and improving franchisee profitability. The integration of Carrols is a key part of RBI's strategy to drive sustainable, long-term growth for the Burger King brand, focusing on restaurant-level profitability, same-store sales growth, and operational efficiency. To understand the competitive environment, consider the Competitors Landscape of Carrols.

The acquisition of Carrols by RBI is a strategic move to strengthen the Burger King system in the U.S. This integration is expected to streamline operations and improve overall efficiency. The focus is on leveraging Carrols' existing infrastructure to enhance Burger King's market presence.

Carrols demonstrated improved financial results before the acquisition. The company reported a net income of $12.3 million in Q4 2023. Total revenues for 2023 reached $1.92 billion, reflecting growth from the previous year.

RBI's 'Reclaim the Flame' plan includes a $400 million investment to boost sales and franchisee profitability. This investment will support marketing, remodels, and operational improvements. The goal is to drive sustainable growth for the Burger King brand.

The acquisition aims to enhance Burger King's market share in the competitive fast-food industry. The focus is on improving restaurant-level profitability and operational efficiency. The integration of Carrols is a key component of this strategy.

The future prospects for Carrols are now directly linked to RBI's overall performance and strategic initiatives. The focus will be on improving same-store sales growth and optimizing the acquired restaurants. The success of the 'Reclaim the Flame' plan will be crucial.

The growth strategy involves integrating Carrols into RBI's broader plan for Burger King. This includes investments in marketing, restaurant upgrades, and operational enhancements. The goal is to drive long-term, sustainable growth.

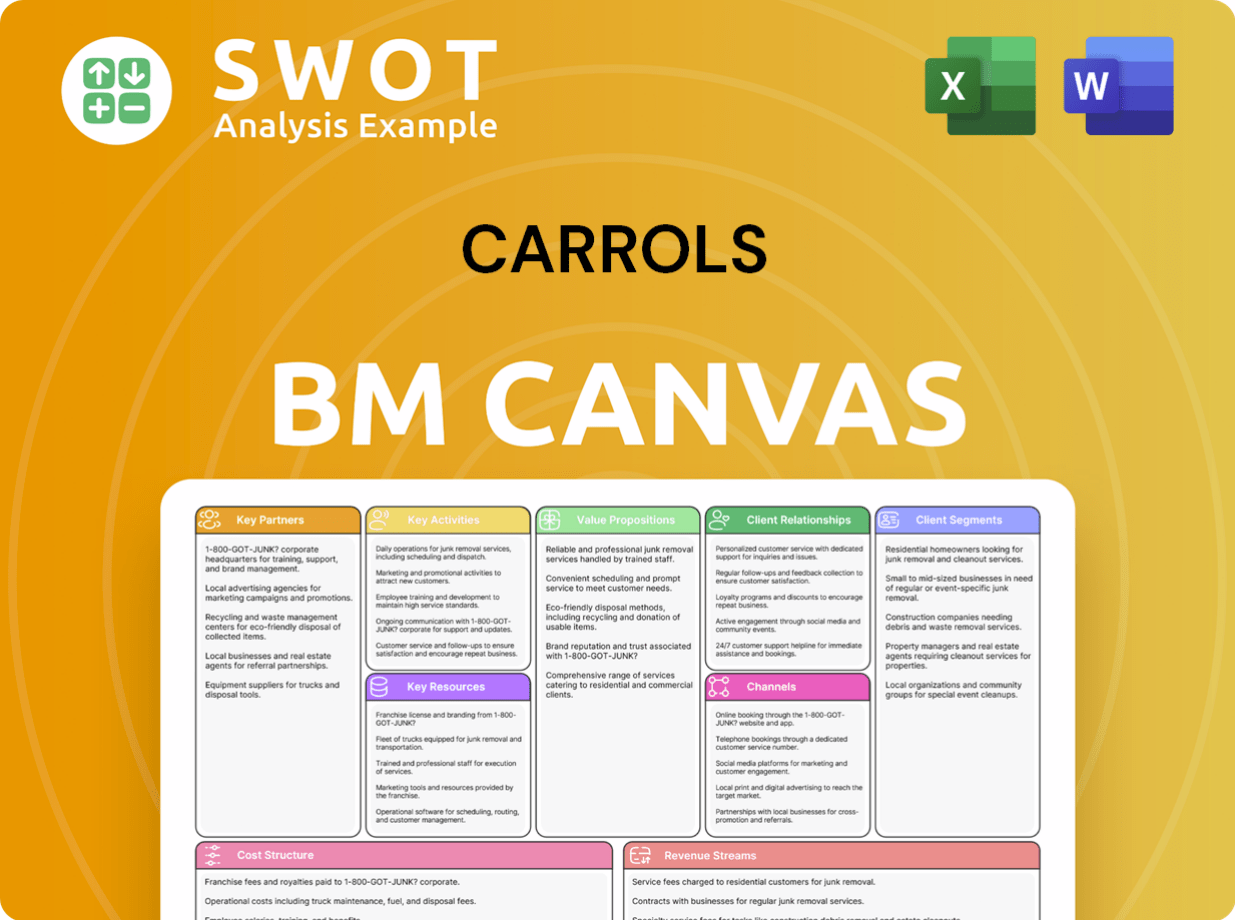

Carrols Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Carrols’s Growth?

The integration of Carrols into Restaurant Brands International (RBI) presents both opportunities and potential risks. While the acquisition may mitigate some standalone risks, new challenges arise from operational complexities and market dynamics within the quick-service restaurant (QSR) sector. Understanding these risks is crucial for evaluating the future prospects of Carrols and its role within RBI's broader strategy.

The fast-food industry is highly competitive, and Carrols faces constant pressure from rivals. Regulatory changes and supply chain issues further complicate operations. Moreover, technological advancements and internal resource constraints could hinder the effective implementation of strategic plans.

The 'Reclaim the Flame' plan is a key initiative to address some of these challenges, but its success hinges on effective execution and adaptation to market changes. A comprehensive Revenue Streams & Business Model of Carrols analysis can provide further insights into the financial health and strategic direction of the company.

The QSR industry is fiercely competitive, with major players like McDonald's and Wendy's continually innovating. These competitors invest heavily in their growth strategies, posing a constant challenge to the market position of Burger King and, by extension, Carrols.

Changes in labor laws, including minimum wage increases, and evolving food safety standards can significantly impact the profitability of Carrols' extensive network of restaurants. Compliance costs and operational adjustments can strain financial performance.

Global supply chain disruptions pose an ongoing risk, affecting the availability and cost of essential ingredients and supplies. These disruptions can lead to increased operational costs and potential disruptions in service, impacting customer satisfaction.

RBI's digital transformation efforts must keep pace with evolving consumer expectations and competitor advancements. Failure to adapt to new technologies and digital platforms could lead to a loss of market share and reduced customer engagement.

Internal resource constraints, including human capital and operational execution across a vast network of restaurants, can hinder the smooth implementation of RBI's strategic plans. Efficient management of a large workforce and consistent operational standards are critical.

The success of RBI's strategic initiatives, such as the 'Reclaim the Flame' plan, depends on effective execution and continuous adaptation to market dynamics. This includes adapting to changing consumer preferences and competitive pressures. The plan aims to revitalize the Burger King brand and improve its competitive standing.

Carrols Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Carrols Company?

- What is Competitive Landscape of Carrols Company?

- How Does Carrols Company Work?

- What is Sales and Marketing Strategy of Carrols Company?

- What is Brief History of Carrols Company?

- Who Owns Carrols Company?

- What is Customer Demographics and Target Market of Carrols Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.