Carrols Bundle

How Does Carrols Company Stack Up in the Fast-Food Frenzy?

The quick-service restaurant (QSR) sector is a battleground of brands, constantly evolving with consumer demands and technological leaps. Carrols Restaurant Group, a major player in this arena, primarily operates as the largest Burger King franchisee in the U.S. Understanding the Carrols SWOT Analysis is key to grasping its position.

This analysis dives deep into the competitive landscape of Carrols Company, examining its market share, and identifying its main rivals within the fast food industry. We'll explore its business strategy, including its expansion plans and marketing strategies, to understand how Carrols navigates the challenges of the restaurant industry competition. This comprehensive Carrols market analysis will provide valuable insights into its financial performance and competitive advantages.

Where Does Carrols’ Stand in the Current Market?

Carrols Restaurant Group holds a significant market position as the largest franchisee of Burger King in the United States. As of the end of 2023, the company operated 1,023 Burger King restaurants, a substantial portion of the total Burger King locations in the U.S. This scale gives Carrols considerable influence within the Burger King system and a strong presence in the broader quick-service restaurant (QSR) market. Carrols' primary offerings are centered around Burger King's menu, including items like the Whopper sandwich and french fries.

Geographically, Carrols' operations span over 20 states, primarily in the Eastern, Midwestern, and Southern U.S. This wide footprint allows it to serve a broad customer base seeking convenient and affordable fast-food options. Historically, Carrols has focused on expanding its Burger King presence, often acquiring and revitalizing underperforming restaurants. This strategy has helped consolidate its market share within the Burger King segment. To learn more about the company's origins, see Brief History of Carrols.

Carrols' strategic focus has increasingly narrowed to Burger King, as demonstrated by its agreement in early 2024 to be acquired by a subsidiary of Restaurant Brands International (RBI), Burger King's parent company, for approximately $1 billion. This move further solidifies its alignment with the Burger King brand. The company's financial performance in 2023, with revenues of $1.81 billion, highlights its scale compared to many other multi-unit franchisees and regional QSR chains.

While specific market share figures for Carrols within the broader QSR industry are not publicly delineated, its dominant position within the Burger King brand implies a significant share of that brand's sales in the U.S. This is a key factor in the Carrols Company competitive landscape. The company's strong operational presence in key regions provides a solid foundation.

Carrols reported total revenues of $1.81 billion for the fiscal year ended December 31, 2023, showcasing its substantial financial strength within the fast food industry. This revenue, combined with its extensive restaurant count, highlights its scale. This performance is crucial when conducting a Carrols market analysis.

Carrols operates across more than 20 states, primarily in the Eastern, Midwestern, and Southern U.S. This geographic spread allows it to serve a wide customer base. Understanding this distribution is important for assessing Carrols restaurant competitors.

The acquisition agreement with RBI further solidifies Carrols' alignment with the Burger King brand. This strategic move underscores its commitment to the brand. This is a key element of Carrols business strategy.

Carrols' market position is defined by its size, brand association, and geographic reach. This position is constantly evolving within the restaurant industry competition.

- Largest Burger King Franchisee: Operates over 1,000 Burger King restaurants.

- Revenue: Generated $1.81 billion in revenue in 2023.

- Strategic Focus: Primarily focused on Burger King, with a recent acquisition agreement.

- Geographic Presence: Operates in over 20 states, primarily in the Eastern, Midwestern, and Southern U.S.

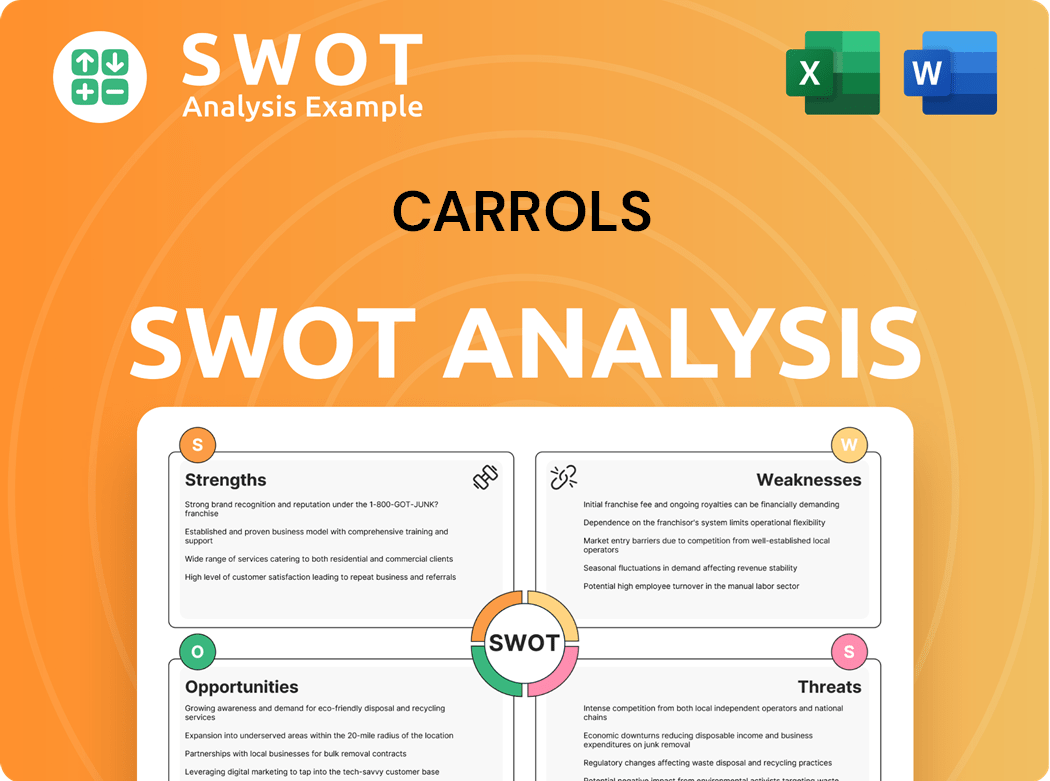

Carrols SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Carrols?

Understanding the Carrols Company competitive landscape is crucial for assessing its position within the fast-food industry. As a major Burger King franchisee, Carrols faces competition from various angles, including direct rivals and indirect threats. This analysis examines the key players and strategies shaping the competitive environment.

The fast-food industry is highly competitive, and Carrols, operating primarily as a Burger King franchisee, must navigate this complex environment to maintain and grow its market share. This involves understanding the strengths and weaknesses of its competitors and adapting its business strategy accordingly. A thorough Carrols market analysis is essential.

McDonald's is a primary competitor, holding a significant market share due to its brand recognition and global presence. Wendy's also competes directly, focusing on product innovation and value. These companies' strategies directly impact Carrols' performance.

Chick-fil-A, known for its customer service, and KFC, a long-standing player in the fried chicken market, compete for consumer spending. These chains have diversified menus, attracting customers who might otherwise choose Burger King.

Fast-casual restaurants like Chipotle offer perceived higher quality and healthier options. Convenience stores and supermarkets expanding ready-to-eat meals also pose indirect competition. The rise of food delivery platforms intensifies the competition.

McDonald's leverages its vast economies of scale, extensive menu, and digital innovation, including its highly successful mobile app and loyalty programs, to maintain market dominance. Their marketing budget is significantly higher than many competitors.

Wendy's often differentiates itself through product innovation and targeted promotions. Their focus on fresh ingredients and value-driven offers attracts a specific customer base. They regularly update their menu to stay competitive.

Chick-fil-A's competitive edge lies in its operational efficiency, premium perception, and exceptional customer experience, which can draw customers away from more traditional fast-food options. Their customer loyalty is a key strength.

The Carrols restaurant competitors are constantly evolving, with industry trends like plant-based options and delivery services reshaping the landscape. Mergers and acquisitions, such as those by Inspire Brands, create larger, more diversified restaurant groups with greater market power, affecting the Carrols Company competitive landscape. For example, in 2024, McDonald's reported global revenues of approximately $25.4 billion, highlighting the scale of competition Carrols faces. Wendy's reported revenues of approximately $2.1 billion in 2024. Chick-fil-A's estimated revenue for 2024 was around $18 billion. These figures underscore the need for Carrols to continually adapt its Carrols business strategy to remain competitive. Furthermore, understanding the fast food industry analysis is key to Carrols’ success.

Carrols must focus on several key areas to compete effectively within the fast-food sector. These factors are essential for success in a crowded market.

- Menu Innovation: Regularly updating menu offerings to appeal to changing consumer preferences.

- Operational Efficiency: Streamlining operations to reduce costs and improve customer service.

- Marketing and Branding: Developing strong marketing campaigns to build brand awareness and customer loyalty.

- Digital Presence: Enhancing online ordering, mobile apps, and delivery services to meet customer expectations.

- Value Proposition: Offering competitive pricing and promotions to attract and retain customers.

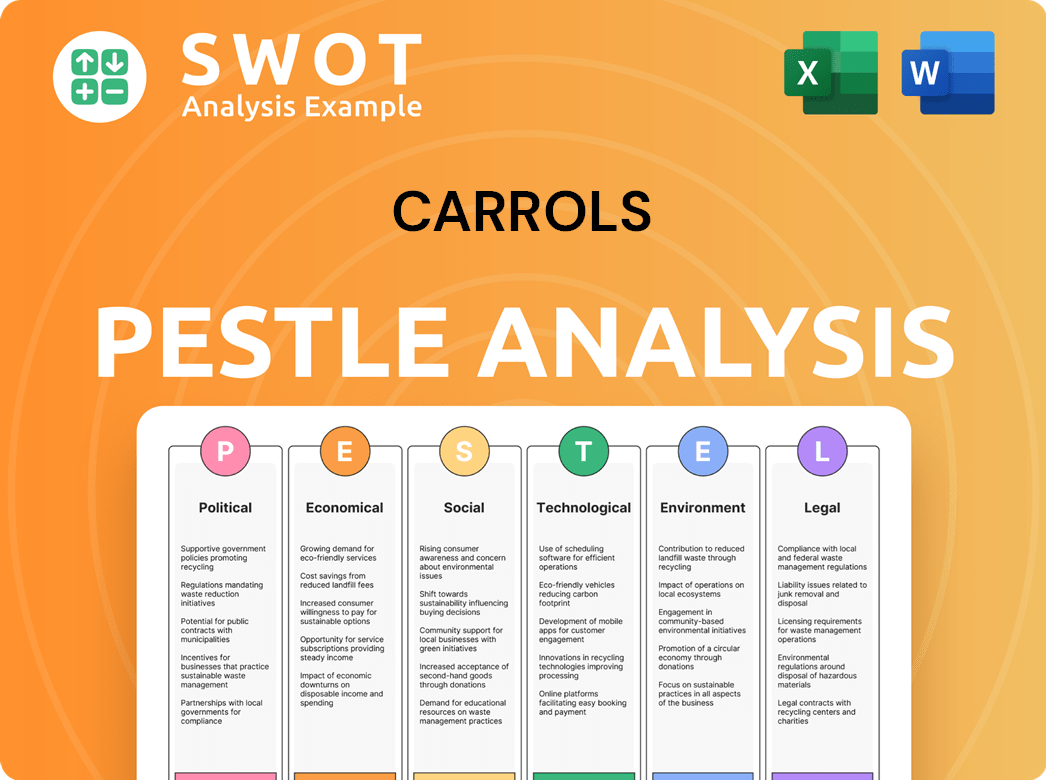

Carrols PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Carrols a Competitive Edge Over Its Rivals?

Understanding the competitive landscape of Carrols Company involves examining its key advantages within the fast-food industry. Carrols, as the largest Burger King franchisee, has built its strategy around operational expertise and economies of scale. This approach has allowed the company to navigate the competitive restaurant market effectively. The company's strategic moves and market positioning are crucial elements in its overall business strategy.

Carrols' success is significantly influenced by its relationship with Restaurant Brands International (RBI). This partnership provides a consistent product offering and leverages Burger King's established brand. Carrols' ability to adapt to industry trends and maintain customer loyalty is vital for its continued success. A detailed analysis of Carrols' owners and shareholders can provide additional insights into its market position.

The company’s competitive edge is further enhanced by its long-standing experience in managing quick-service restaurants (QSRs). This expertise includes site selection, construction, staff training, and efficient kitchen operations. These factors contribute to consistent service quality and operational efficiency across its restaurant portfolio. Carrols' operational strategies are key to its success in the fast-food industry.

Carrols benefits from significant economies of scale due to its large number of Burger King restaurants. This allows for favorable terms with suppliers, reducing costs and improving profit margins. The company's extensive geographic footprint provides strong brand presence and market penetration across various regions.

Carrols leverages the established brand equity of Burger King, including national marketing campaigns and menu innovations. This partnership reduces the need for independent brand building and provides a loyal customer base. The collaboration with RBI supports Carrols' competitive position.

Carrols' long-standing operational experience in managing QSRs is a key competitive advantage. This includes efficient site selection, construction, and staff training. The company's operational efficiency contributes to consistent service quality.

Carrols has grown through strategic acquisitions, integrating new restaurants into its existing operational framework. The planned acquisition by RBI, expected to close in Q2 2024, further strengthens this relationship. This integration can provide Carrols with additional resources.

Carrols Company's competitive advantages are multifaceted, including economies of scale, brand recognition, and operational efficiency. These factors position Carrols favorably within the fast-food industry. The company's ability to negotiate better supplier terms and maintain operational excellence are crucial.

- Economies of Scale: Carrols operates a large number of Burger King restaurants, allowing for cost efficiencies.

- Brand Recognition: Leveraging the Burger King brand provides a consistent product offering and customer base.

- Operational Efficiency: Expertise in site selection, construction, and staff training ensures consistent service quality.

- Strategic Partnerships: The relationship with RBI supports Carrols' business strategy and market position.

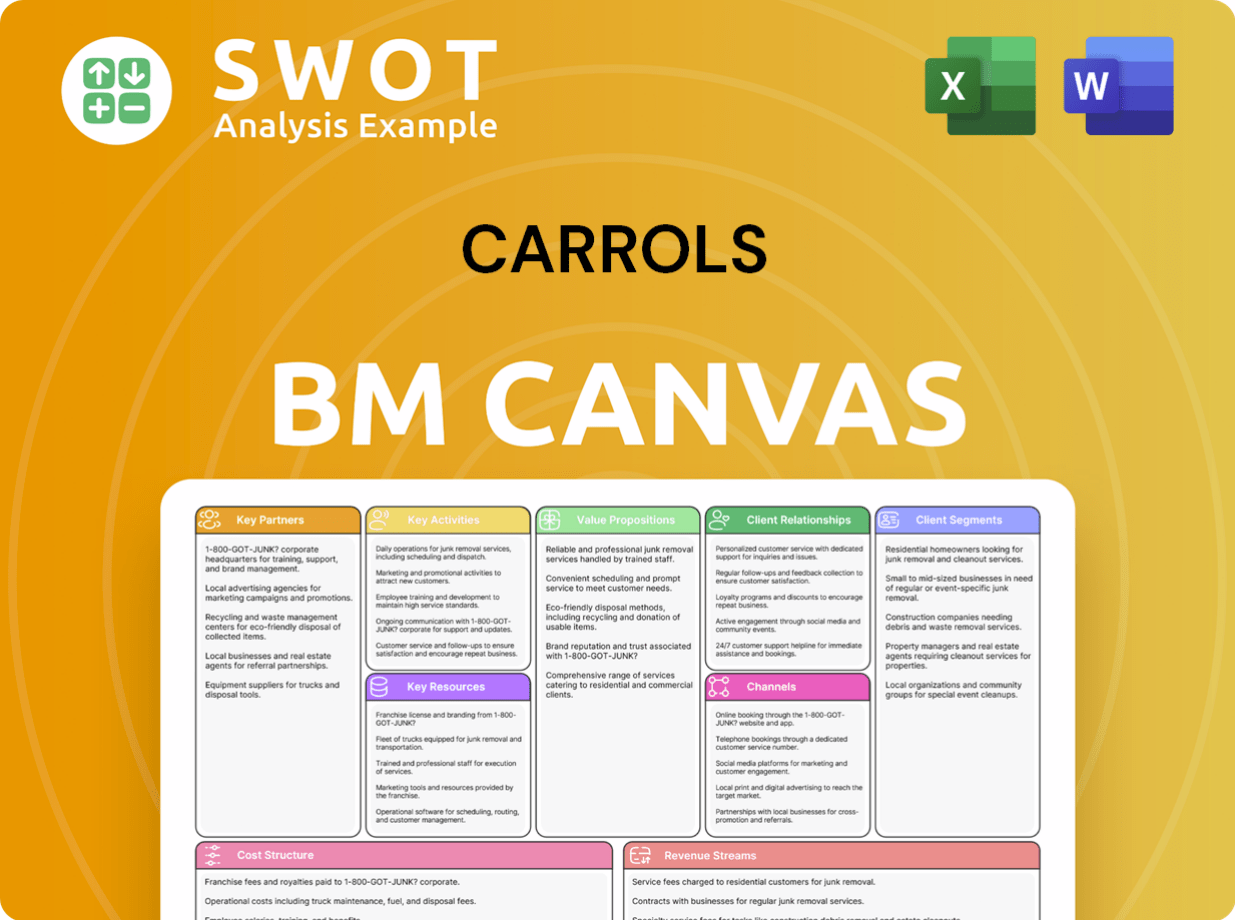

Carrols Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Carrols’s Competitive Landscape?

The quick-service restaurant (QSR) sector is experiencing significant transformations, influencing the competitive landscape for companies like Carrols Restaurant Group. Digital advancements, evolving consumer preferences, and economic shifts are key factors. Understanding these trends is essential for Carrols to maintain and enhance its market position. A detailed Carrols market analysis is crucial for strategic planning.

Carrols faces challenges from labor shortages and wage inflation. However, opportunities exist through integration with Restaurant Brands International and expansion strategies. The company's ability to adapt and leverage its operational expertise will determine its future growth. This analysis explores the Carrols Company competitive landscape, addressing industry trends, future challenges, and potential opportunities.

Technological integration is reshaping the fast food industry analysis. Digital ordering, mobile apps, and self-service kiosks are becoming standard. Third-party delivery services expand reach but alter cost structures. Carrols needs to invest in technology to meet customer expectations.

Consumer demand is shifting towards healthier options and plant-based alternatives. Regulatory changes, like those concerning labor costs and labeling, impact operations. Carrols must adapt its menu and sourcing to align with these trends. Addressing Carrols Company customer demographics and competitor analysis is key.

Labor shortages and wage inflation pose threats to operational efficiency and profit margins. Increased competition from emerging fast-casual concepts challenges market share. Global economic shifts, including inflationary pressures, affect ingredient costs and consumer spending. These factors influence Carrols Company financial performance compared to competitors.

Further integration with Restaurant Brands International can unlock synergies and streamline supply chains. Expanding into new markets represents a growth opportunity. Continued investment in digital transformation, including AI, can strengthen Carrols' competitive position. Carrols Company expansion plans vs competitors are crucial.

Carrols must focus on several key areas to navigate the competitive landscape effectively. This includes leveraging its relationship with Restaurant Brands International, adapting to evolving consumer preferences, and optimizing operational efficiencies. Understanding Carrols restaurant competitors is important.

- Enhance digital capabilities to meet consumer demand for convenience and personalized experiences.

- Adapt menu offerings to include healthier options and plant-based alternatives, like the Impossible Whopper.

- Explore opportunities for geographic expansion and market penetration, focusing on areas with strong growth potential.

- Invest in technologies like AI for personalized marketing and operational optimization.

Carrols Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Carrols Company?

- What is Growth Strategy and Future Prospects of Carrols Company?

- How Does Carrols Company Work?

- What is Sales and Marketing Strategy of Carrols Company?

- What is Brief History of Carrols Company?

- Who Owns Carrols Company?

- What is Customer Demographics and Target Market of Carrols Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.